[ 2nd Quarter of fiscal 2019 Performance Briefing ]Consolidated Results for 2Q of FY March 2019

Mr. Shigenao Ishiguro

President & CEO

Hello, I’m Shigenao Ishiguro, President & CEO of TDK. Today, I’d like to go over our consolidated earnings forecast for the fiscal year ending March 2019.

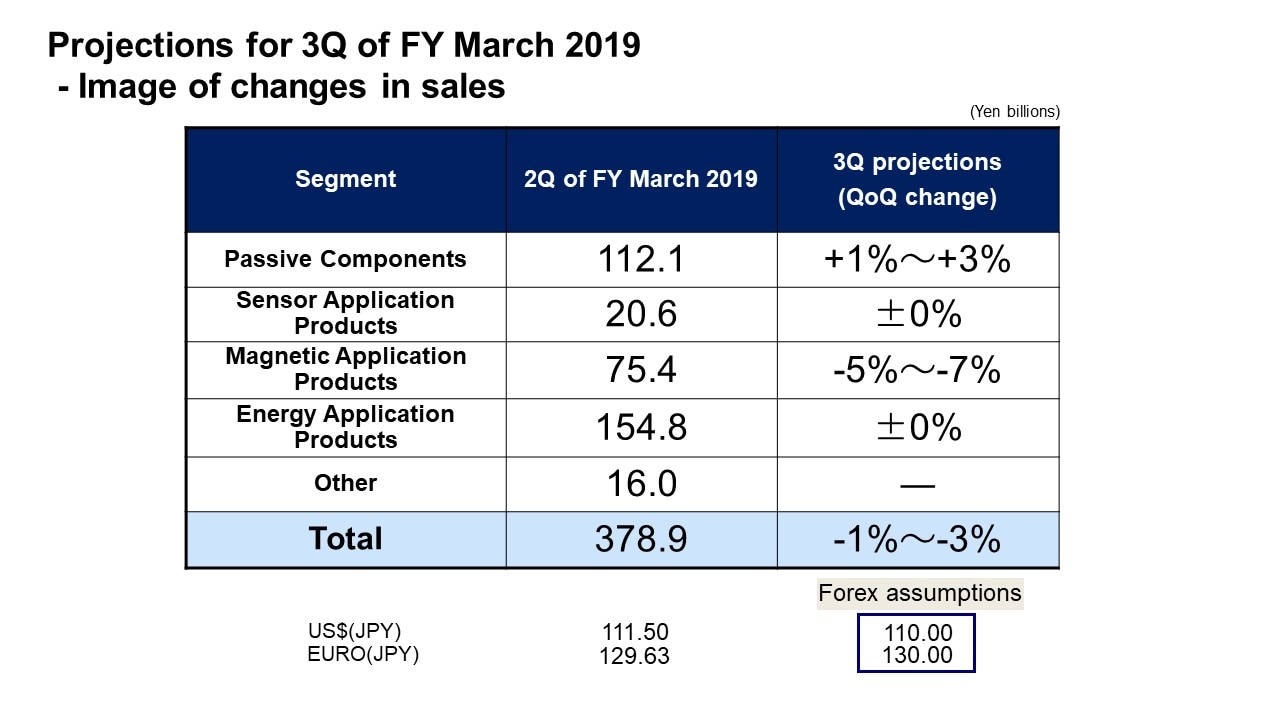

Projections for 3Q of FY March 2019 - Image of changes in sales

First, I will discuss our expectations for changes in sales for the third quarter of the fiscal year ending March 2019.

In the Passive Components segment, strong overall demand is expected to continue in our areas of expertise in

Powertrains and ADAS, despite emerging variation in regional market trends for automobile sales. Meanwhile,

Capacitors are projected to perform stably, with sales increases mainly led by Inductive Devices. We are expecting

an overall increase in sales of 1-3% for the Passive Components segment.

In the Sensor Application Products segment, we expect sales to remain level overall from the second quarter. Sales

of Temperature and Pressure Sensors are expected to recover from a temporary decline in orders due to the

impact of the enactment of exhaust emissions testing legislation. Meanwhile, Magnetic Sensors are expected to

see a slight decline in sales to the ICT market due to seasonal factors, while MEMS Sensor sales are anticipated to

increase only slightly from the second quarter. Initially, we stated our objective of achieving 30% year-on-year

growth over the full year, but the market launch of new products planned for the second half is now expected to

require more time, making it difficult to achieve significant growth this year.

In the Magnetic Application Sensors segment, the HDD Head shipment index is projected to decline around 10%

from 97 in the second quarter to 87 in the third quarter, while HDD Suspension Assembly sales remain substantially

flat and Suspension Application Product sales ramp up and drive overall sales growth for Suspension Assemblies.

Magnet sales are expected to remain about level, and the Magnetic Application Sensors segment is expected to

see overall sales decline by 5-7%.

In the Energy Application Products segment, sales of Rechargeable Batteries to a customer in North America are

expected to increase, and sales to customers in China are expected to decrease slightly while sales for applications

other than smartphones, such as game consoles, also decrease. Moreover, sales of Power Supplies for industrial

equipment are expected to decrease slightly, leading overall sales for the Energy Application Products segment to

remain mostly flat from the second quarter.

As a result, consolidated net sales for the third quarter are expected to decline by 1-3% from 378.9 billion yen in the

second quarter.

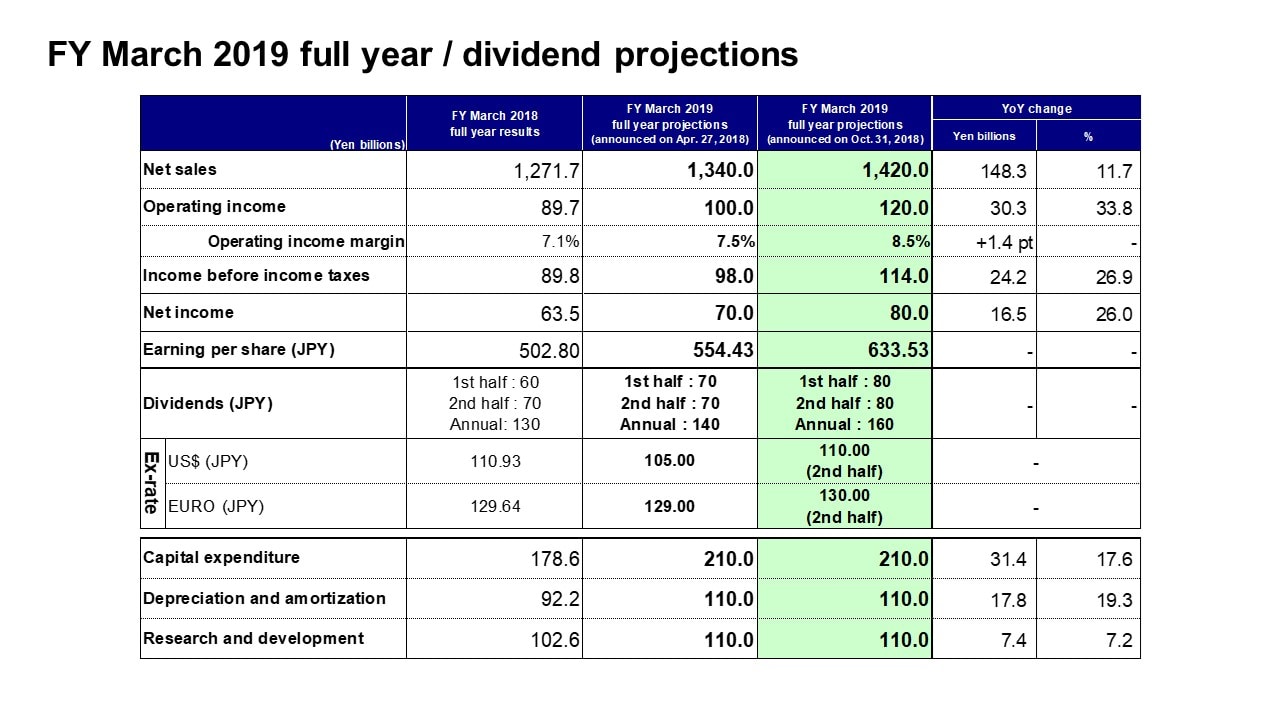

FY March 2019 full year / dividend projections

Finally, we come to our consolidated full-year earnings forecast for the fiscal year ending March 2019.

In light of our first-half performance and sales trends in the second half, we have revised our initial consolidated fullyear

earnings forecast and raised our projections for net sales to 1,420.0 billion yen, operating income to 120.0

billion yen, income before income taxes to 114.0 billion yen, and net income to 80.0 billion yen. We plan to increase

interim and year-end dividends per share by 10 yen from the initial announcement of 70 yen to 80 yen for an annual

dividend of 160 yen, an increase of 20 yen from the initially announced annual dividend of 140 yen.

Regarding exchange rate assumptions, we have revised our expectation to a level that remains close to the current

rate, and we are now assuming 110 yen against the U.S. dollar and 130 yen against the euro.

We have revised our full-year earnings forecast upward. This reflects stronger performance in the first half than we

had expected in our initial forecast, however we expect net sales and operating income in the second half to be in

line with our initial expectations, despite some variation between each business.

That concludes my presentation. Thank you for your attention.