Management Policy

- (1)Fundamental Management Policy

- (2)Medium- and Long-Term Management Strategy and Pressing Issues of TDK

(1)Fundamental Management Policy

TDK was founded as a venture enterprise in 1935 for the purpose of industrializing a magnetic material called ferrite, which was invented at the Tokyo Institute of Technology. TDK’s corporate motto is “Contribute to culture and industry through creativity,” a message that embodies the company’s founding spirit. Guided by this spirit, in the ensuing years TDK has continuously pursued originality and enhanced enterprise value through offering the creation of new value (products/services) by promotion of innovation. In addition, TDK has advanced globalization and diversification of its business operations while actively pursuing M&As, collaboration with external partners and other initiatives. As a result, TDK today is engaged in four main businesses: Passive Components, Sensor Application Products, Magnetic Application Products, and Energy Application Products.

Looking ahead, TDK brings together the entire TDK Group’s strengths while taking full advantage of the strengths of each TDK group company, and constantly drawing on innovative thinking and a willingness to tackle new challenges. By this, TDK aims to achieve satisfaction, trust, and support of all stakeholders, including shareholders, customers, suppliers, employees and local communities. Additionally, we strive to contribute to the resolution of social issues through our business and remain a socially beneficial entity, thereby contributing to the development of a sustainable society.

(2)Medium- and Long-Term Management Strategy and Pressing Issues of TDK

①Long-Term Vision

The global economy is facing a crisis of fragmentation due to the ongoing opposition between the U.S. and China against a backdrop of a struggle for hegemony in economic security, including technology. However, even in the face of this crisis, the shift to renewable energy and the transition to decarbonization are expected to continue from the perspective of countermeasures against global warming, energy security, and other issues. Moreover, the sophistication and permeation of technologies such as AI, the metaverse (virtual online space), robotics, and ADAS (Advanced Driver Assistance System) have led to major social changes such as labor savings and greater efficiency in industry, as well as advancement of urban functions. This transformation of society, including GX and DX, is expected to further accelerate in the future.

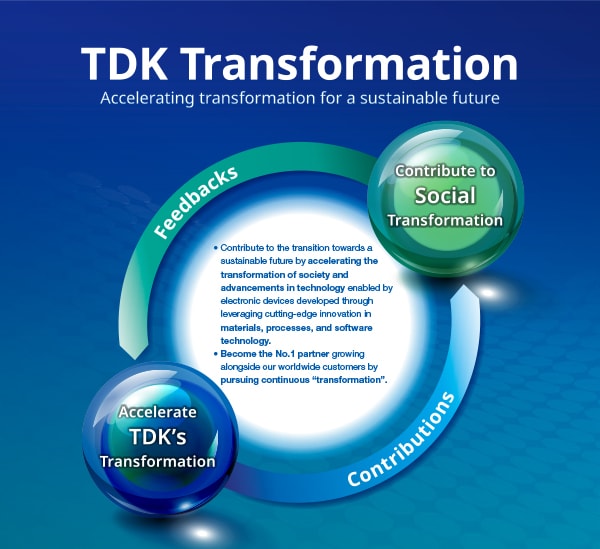

Amid such circumstances, TDK has formulated its new long-term vision to contribute to the transformation of society through business based on the Corporate Motto to “Contribute to culture and industry through creativity.”

<Long-Term Vision>

TDK will strive to “capture a position that can detect change ahead of time” and “establish and operate a system that can respond rapidly to change” to realize the long-term vision. In the aim to “capture a position that can detect change ahead of time”, TDK will further auger the strengths it has already cultivated in domains such as materials, processes and software technology (Intellectual capital・Manufactured capital・Natural capital), and seek out new strengths as well as carry out various initiatives to establish a leading position in the electronic device domain (Social and relationship capital・Intellectual capital). In the aim to “establish and operate a system that can respond quickly to change”, TDK will leverage having captured“ a position of being able to detect change ahead of time” and strengthen its capability to envision the future and focus on acquiring and training diverse and outstanding human resources, thus reinforcing the ability to execute the envisioned future in a speedy and efficient manner (Human capital・Intellectual capital). Through these initiatives, TDK will secure permanent investment capacity (Financial capital) and realize optimal investments to aim for further enhancement in its position to detect change ahead of time.

②Key issues (Materiality)

The global energy situation has become increasingly uncertain due to a sharp rise in energy prices, led by a combination of factors such as a lack of investment in fossil fuels, Russia's invasion of Ukraine, and tensions in the Middle East. In addition, political tensions between the United States and China have led to economic decoupling, with the United States restricting exports of semiconductor manufacturing equipment and relevant technologies to China. As this economic decoupling can make the fight for critical minerals fierce, the supply chain relating TDK could also be affected significantly.

However, even amid these changes in the social and industrial landscape, the trends of GX and DX should continue to grow in the electronics market. These trends are expected to bring about the creation of new markets in TDK’s business fields.

Significant growth opportunities will be presented to TDK by trends that include the widespread adoption of renewable energy and electric vehicles towards the realization of a decarbonized society in GX, and transition to upgraded current 5G i.e. new cellular technology (beyond 5G), the practical use of ADAS in automobiles, the growing use of IoT (Internet of Things) products and AI, and cloud services in DX. It is imperative for TDK to steadily capture these growth opportunities without falling behind these major changes. To this end, TDK will actively conduct research and technological development focused on launching competitive new products in a timely manner and expanding production capacity in line with demand.

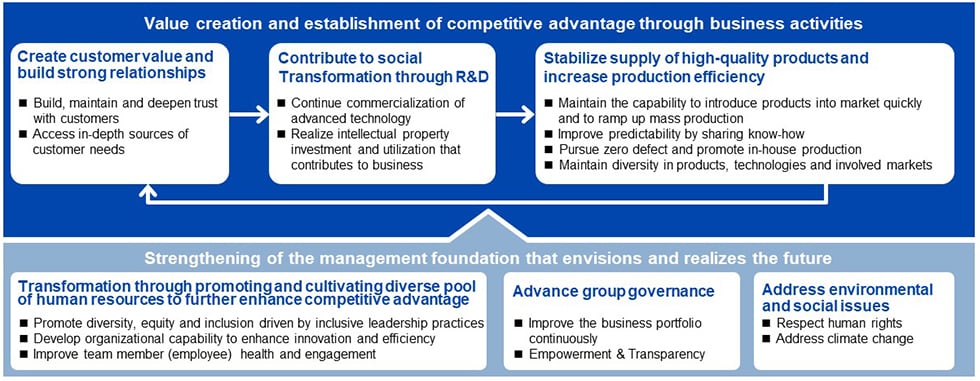

TDK has reidentified materiality as key issues that should be addressed based on the long-term vision to further improve enterprise value. TDK identified the following three areas for “value creation and establishment of competitive advantage through business activities”: “create customer value and build strong relationships”, “contribute to social transformation through R&D”, “stabilize supply of high-quality products and increase production efficiency”. Then, TDK identified the following three areas to support “strengthening of the management foundation that envisions and realizes future”: “transformation through promoting and cultivating a diverse pool of human resources to further enhance competitive advantage”; “advance group governance”; and “address environmental and social issues”. For example, to “advance corporate governance” TDK defined the following two themes: evaluate the business portfolio continuously and Empowerment & Transparency. Under the theme of evaluate the business portfolio continuously, TDK will establish a business portfolio management system and operate it continuously. In this way, TDK aims to achieve sustainable growth and increase enterprise value by advancing initiatives to address key issues and continuously operating a cycle of creating value through business activities.

From a financial aspect, TDK will allocate management resources and expand free cash flow while paying due consideration to business risks, and by maintaining an appropriate balance between capital efficiency, shareholder returns, and financial soundness, aims to build a strong financial foundation that will support TDK's sustainable growth and improve enterprise value.

<Key issues (Materiality)>

*Materiality is identified aiming to enhance enterprise value. The concept of synchronizing the sustainability of both society and the company is adopted and it consists of financial materiality (important matters for TDK) and impact materiality (important matters for stakeholders). After deriving financial materiality and impact materiality, we carefully examined both and selected the key issues (materiality).

Chart: Examples of opportunities brought forth by GX and DX within TDK operations

| GX | DX | |

|---|---|---|

| Passive Components | <Industrial Equipment> Widespread adoption of renewable energy Aluminum Electrolytic Capacitors, Film Capacitors, Piezoelectric Material Products, Circuit Protection Components, Inductive Devices |

<ICT> Growing use of 5G High-Frequency Devices, Inductive Devices, Ceramic capacitors Growing use of IoT High-Frequency Devices, Inductive Devices, Piezoelectric Material Products, Circuit Protection Components |

| <Automotive> Widespread adoption of electric vehicles Inductive devices, Ceramic capacitors, Aluminum Electrolytic Capacitors, Film Capacitors |

<Automotive> Growing use of ADAS Ceramic capacitors, Inductive Devices |

|

| Sensor Application Products | <Automotive> Widespread adoption of electric vehicles Temperature and Pressure Sensors, Magnetic Sensors |

<ICT> Growing use of 5G, Growing use of IoT All Sensor Application Products |

| <Automotive> Growing use of ADAS Magnetic Sensors, MEMS Sensors |

||

| Magnetic Application Products | <Automotive> Widespread adoption of electric vehicles Magnets |

<ICT> Growing use of cloud services HDD Heads, HDD Suspension Assemblies |

| <Industrial Equipment> Widespread adoption of renewable energy Magnets |

||

| Energy Application Products | <Automotive> Widespread adoption of electric vehicles Power Supplies |

<ICT> Growing use of 5G Rechargeable Batteries Growing use of IoT Rechargeable Batteries |

| <Industrial Equipment> Widespread adoption of renewable energy Rechargeable Batteries, Power Supplies |