Medium-term Plan

Below is an outline of new Medium-term Plan(FY3/25 - FY3/27)

- My commitment as President & CEO

- Long-term Vision and Key Issues (Materiality)

- Positioning of the new Medium-term Plan

- New Medium-term Plan: Key points

- Financial/Pre-financial KPIs

- ROIC by segment

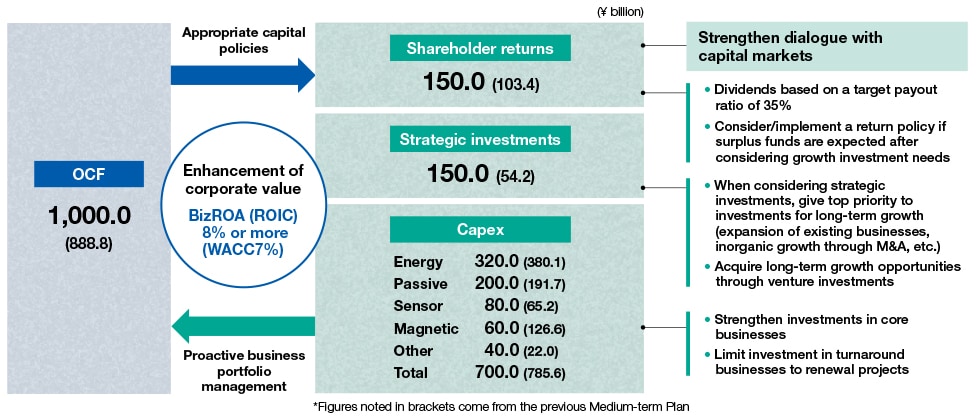

- Business portfolio map Capital allocation plan

- Pre-financial Capital that backs TDK’s Value Creation

- Presentation materials and Integrated Report

My commitment as President & CEO

- We have formulated our vision of what we want to be 10 years from now (Long-term Vision). We have back-casted from our vision for 10 years to identify the path to enhancing our corporate value.

- Based on our materials × processes × software technologies, we will become the No.1 partner for our world-wide customers and accelerate social transformation for a sustainable future.

- We will enhance our business portfolio management, increase the spread between ROIC and WACC, increase cash flows, improve capital efficiency, and strengthen business management to increase financial capital.

- We will evolve the Ferrite Tree and reinforce business management to increase pre-financial capital, which is the source of future cash flows.

- We will focus more on investor dialogue and investor relations.

May 2024

Noboru Saito

President & CEO

Long-term Vision and Key Issues (Materiality)

Please refer to the link below

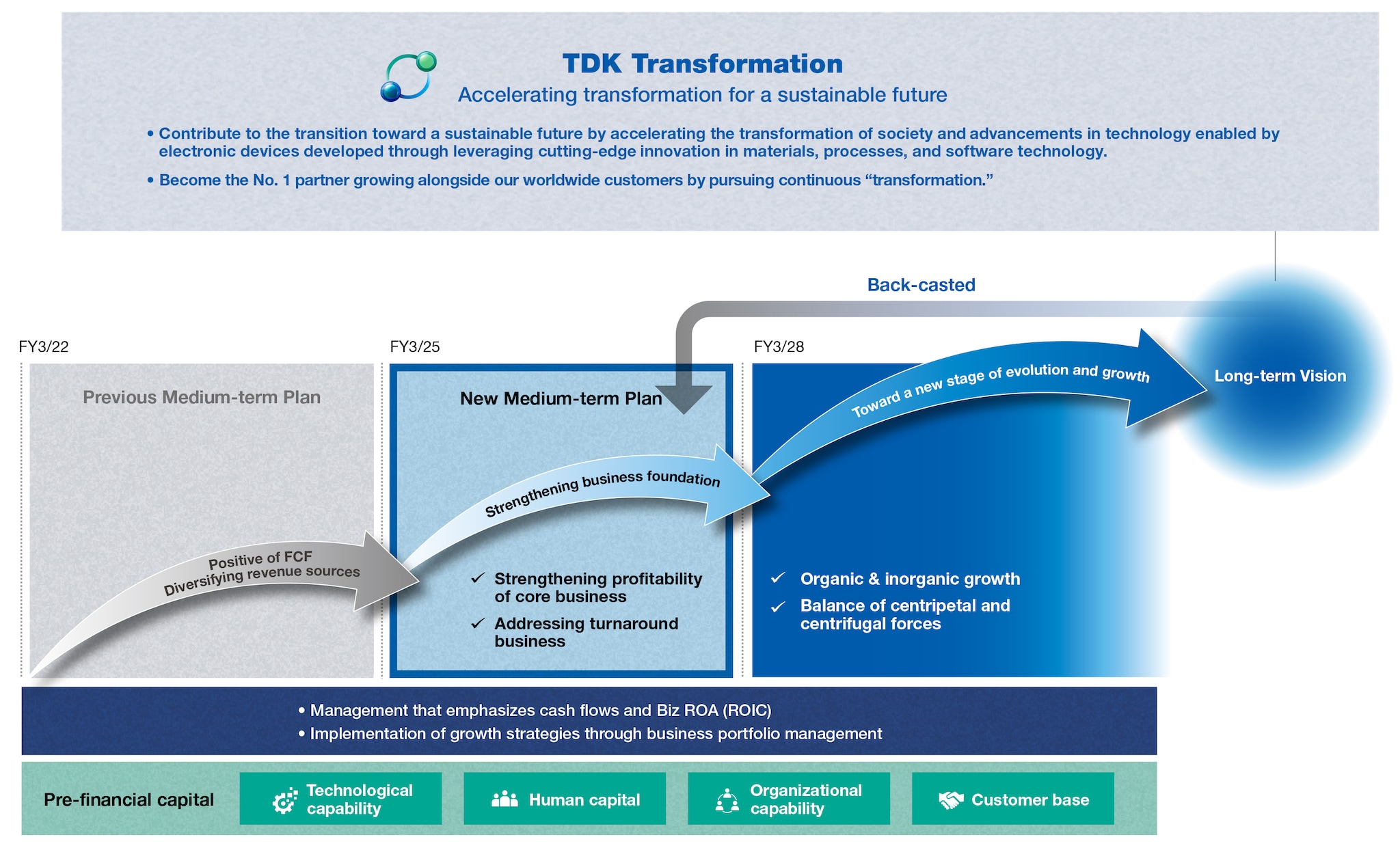

Positioning of the new Medium-term Plan

This new Medium-term Plan from the FY March 2025 was formulated by outlining what we want to be and future vision in light of the long-term social transformation ahead, and bask-casting from that point.

As we work towards achieving our Long-term Vision, we view the period of this Medium-term Plan as a time to strengthen our business foundation. We believe that issues that need to be addressed during this period include strengthening profitability of core businesses and addressing turnaround businesses.

New Medium-term Plan: Key points

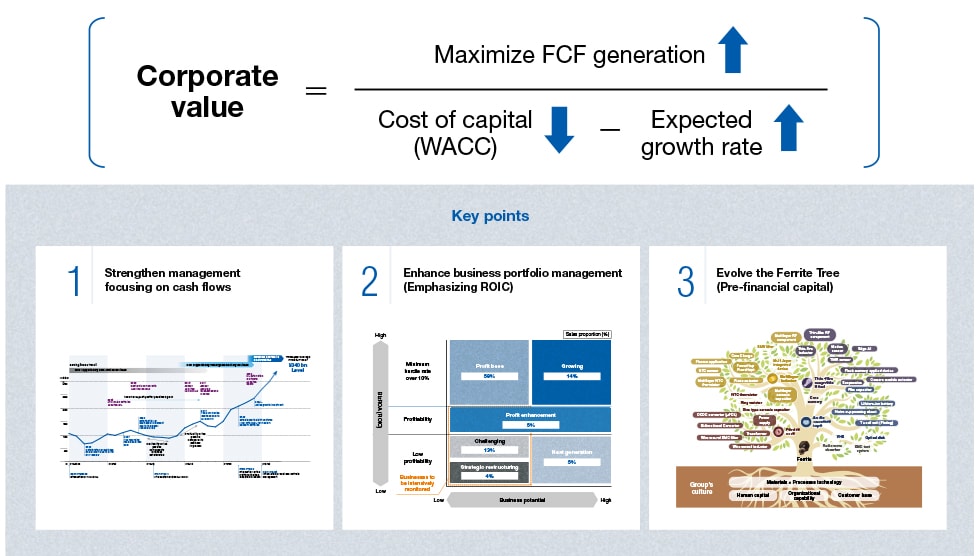

It is vital for enhancing our corporate value to maximize free cash flow (FCF) generation, reduce the cost of capital, and increase the expected growth rate.

Based on this thinking, the new Medium-term Plan, which is positioned as a period for strengthen business foundations, has three pillars.

1. Strengthen management focusing on cash flows

2. Enhance business portfolio management (Emphasizing ROIC)

3. Evolve the Ferrite Tree (Pre-financial capital)

Financial/Pre-financial KPIs

| FY3/24 | FY3/27 | How we want to be in the medium-to long-term |

|||

|---|---|---|---|---|---|

| Financial indicator |

Growth | Net sales [¥ billion] (CAGR) | 21,039 | 2,500.0 (approx. 5%) |

(10% or more) |

| Efficiency | ROE | 7.9% | 10% or more | 15% or more | |

| BizROA (ROIC) (>WACC) | 5.3%(<7.0%) | 8% or more | 12% or more | ||

| Operating profit margin | 8.2% | 11% or more | 15% or more | ||

| Financial soundness |

Shareholders’ equity ratio | 50% | 50% level | ||

| D/E ratio | 0.4x | 0.3–0.4x | |||

| Pre-financial indicator |

KPIs | Team member engagement survey | |||

| Communication score | 67 pts. | 75 pts. or more | |||

| Response rate | 80% | 80% or more | |||

| CO2 emission reductions* (SBTi Scope1+2, vs. FY3/22) |

42.9% | 23.3% | 42.0% | ||

| Exchange rate assumptions | ¥144/US$ | ¥135/US$ | ¥135/US$ | ||

* SBTi is an initiative that supports companies in setting scientifically based environmental goals. In order to achieve the goal stated in the Paris Agreement of limiting the rise in global average temperature to within 1.5˚C compared to pre-industrial levels, SBTi provides companies with criteria that can be used in goal setting. We have set the gradually required CO2 emission reduction rate calculated based on these criteria as the target for FY March 2027 Plan. However, it is expected that this target will be achieved ahead of schedule in FY March 2024. This is because of the proactive introduction and promotion of renewable energy (Scope 2). We are currently planning significant production increases and expansion of sites in our Medium-term Plan, and at this point, we consider the target to be reasonable. Please note that FY March 2024 Result is estimate amount. Furthermore, TDK has submitted a commitment letter to SBTi and is currently work-ing towards obtaining certification for our reduction targets.

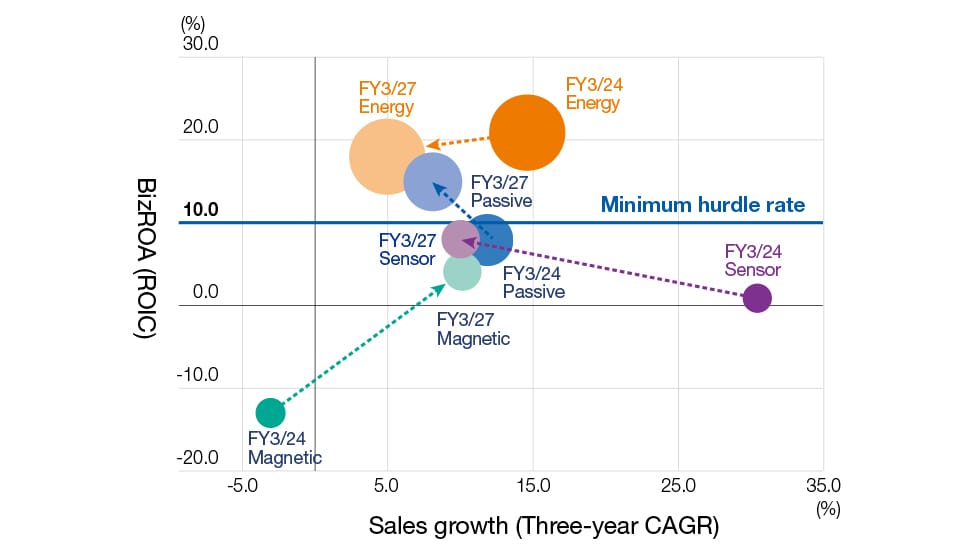

ROIC by segment

We will disclose target figures and actual figures for segment-specific ROIC(*1) to increase our focus on asset profitability. At the same time, in our dialogue with investors, we will seek to engage in more detailed discussions based on asset profitability for each business.

It should be noted that the Magnetic Application Products and the Sensor Application Products businesses have set these targets in this medium-term plan, although in the medium-to long-term they will aim to exceed the minimum hurdle rate 10%(*2) through further restructuring

ROIC(BizROA)by segment

| FY3/21 | FY3/24 | FY3/27 (target) |

|

|---|---|---|---|

| Company-wide | 5.2% | 5.3% | 8.0% |

| Passive Components | ― | 7.7% | 15.0% |

| Sensor Application Products | ― | 1.2% | 8.0% |

| Magnetic Application Products | ― | -12.2% | 4.0% |

| Energy Application Products | ― | 21.5% | 18.0% |

Chart for growth and capital efficiency by segment

Business portfolio map Capital allocation plan (FY3/25 to FY3/27 accumulated)

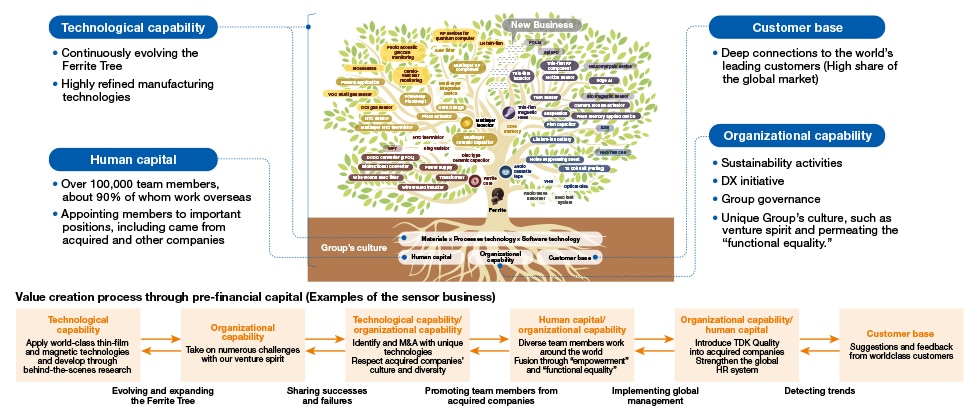

Pre-financial Capital that backs TDK’s Value Creation

Just as its roots below the ground are vital for a tree to grow, so the enhancement of pre-financial capital, such as technological capability, human capital, organizational capability, and customer base, are important for the further substantial evolution and growth of . The technological capability, organizational capability, and customer base we cultivate for the success of a single business, including some failures, are shared across the company and inherited for the next opportunities.

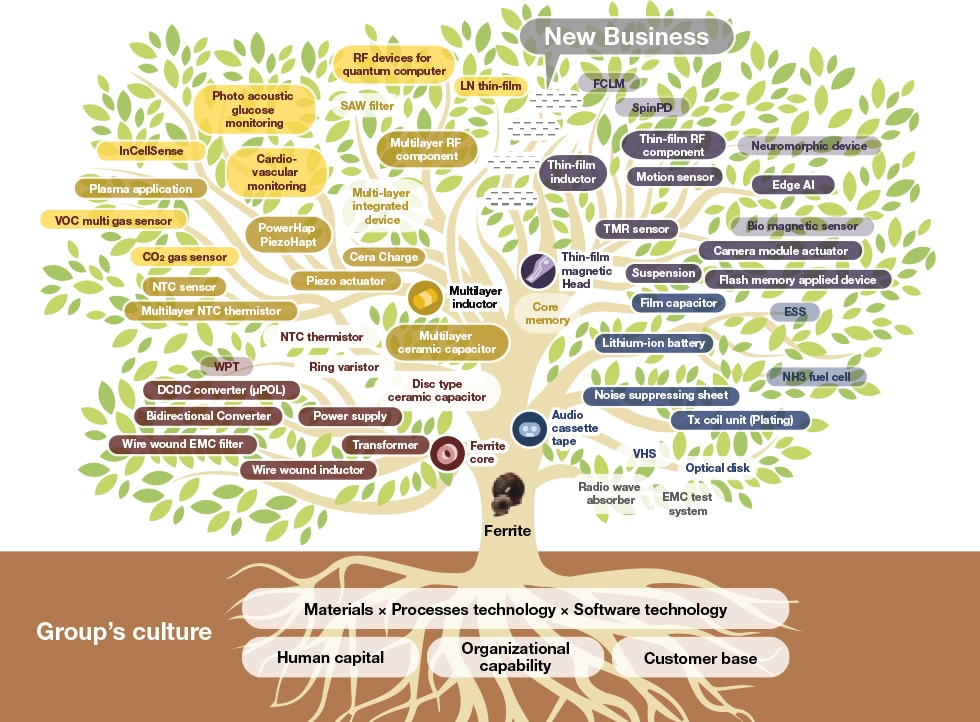

What is the Ferrite Tree ?

The Ferrite Tree is a concept that expresses the history and transitions that TDK’s business has continuously undergone since its establishment with ferrite as its founding business, in other words, the Ferrite Tree represents TDK’s growth trajectory. TDK’s generations of products are shown linked by the technology connections of its four major innovations—ferrite, audio cassette tapes, fine multilayering technology, and thin-film head technology. Since the commercialization of ferrite, TDK’s founding business, the Ferrite Tree has grown technology branches and leaves through the development of materials, processes, and derivative technologies and the expansion of TDK’s business portfolio through M&A.

Future Ferrite Tree

Four Great World-Class Innovations by TDK

Presentation materials and Integrated Report

Investor Day 2024

- Speech Text

- Recorded Video ver. * Link to third-party site

- Q & A

- Recorded Video ver. * Link to third-party site