Business Risks

In aiming for sustainable growth, the TDK Group promotes company-wide measures against factors (risks) that hinder the achievement of organizational goals and implements company-wide risk management (ERM) activities to appropriately manage them. TDK's basic policy for risk management is to ensure that each organization within the TDK Group takes appropriate risks in order to create corporate value and prevent damage to corporate value by appropriately identifying and responding to opportunities and risks.

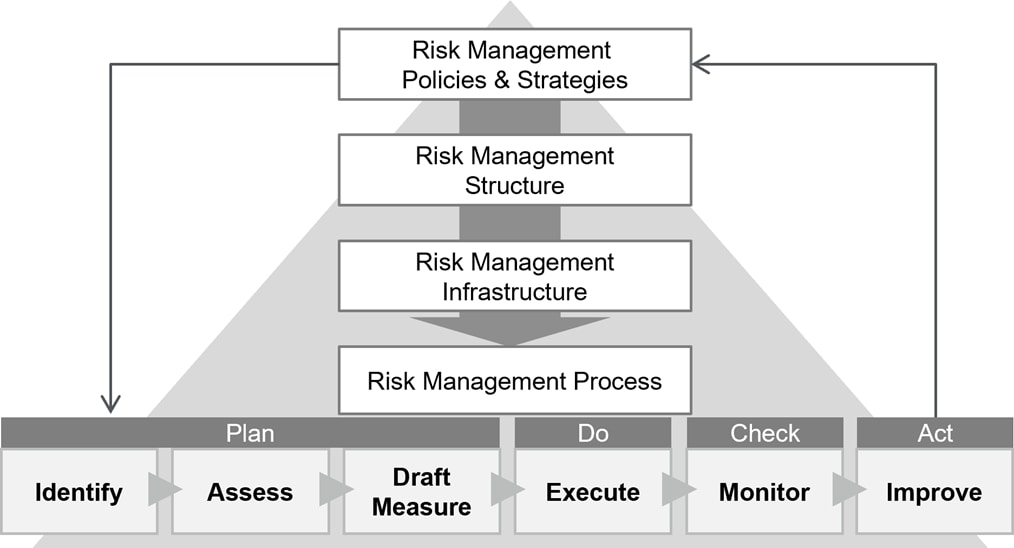

In order to consider and implement measures related to ERM activities and strengthen risk management activities, we have established an ERM Committee under the direct control of the Executive Committee, which is chaired by a corporate officer appointed by the president. The ERM Committee clarifies the role of each organization in risk management activities and promotes the PDCA cycle of a series of risk management activities, from identification of risks to evaluation, consideration of countermeasures, implementation, monitoring, and improvement. The appropriateness of these risk management activities is confirmed through oversight by the Board of Directors and the Executive Committee, as well as through the participation of the Management Audit group as an observer in ERM Committee meetings and audits by Full-time Corporate Auditors.

| Step | Purpose of activity |

|---|---|

| Identify | Identifying risks surrounding the TDK Group |

| Assess | Among the identified risks, from the perspective of the magnitude of the impact on the TDK Group if they occur, narrow down and prioritize the risks that should be strengthened from the perspective of both management (top-down) and on-site (bottom-up) |

| Draft Measure | To prevent risks from materializing, consider measures from the perspective of avoidance, transfer, reduction, acceptance, etc. |

| Execute | Implement measures to prevent risks from materializing |

| Monitor | Monitor whether the measures are functioning properly and whether there are any signs of manifestation |

| Improve | Review the results of risk management activities and consider improvements |

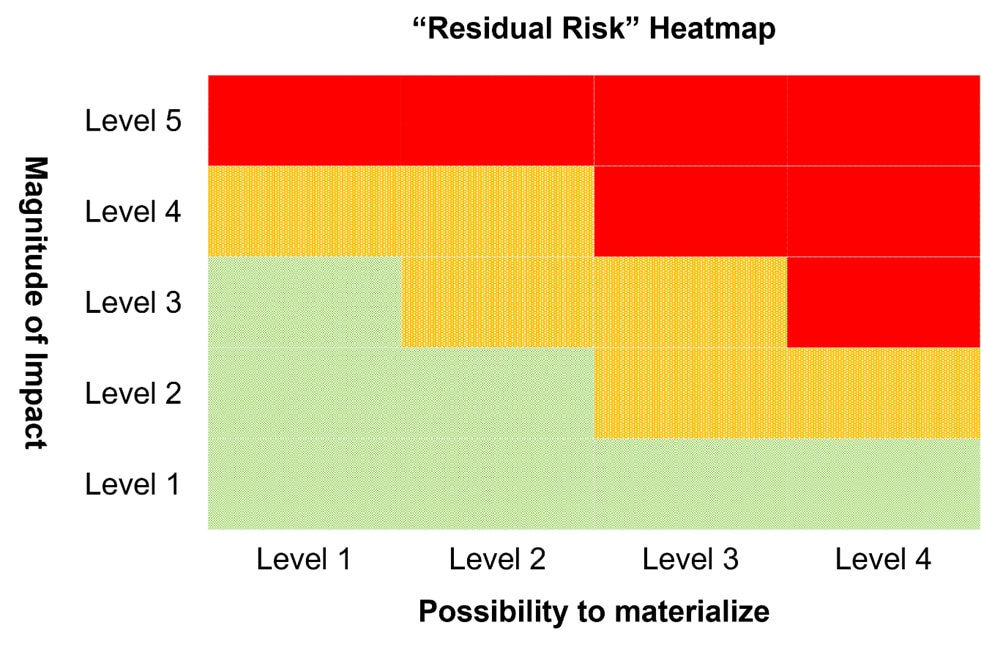

As a risk assessment, each term the residual risk (i.e., after control by the measures taken so far) is estimated from the perspective of the three elements of management resources (people, goods, and money), relationships with internal and external stakeholders, reputation, and BCP. We calculate the magnitude of the impact on the TDK Group from the above and combine it with the possibility of the risk materializing to create a residual risk heat map to identify critical risks. In addition, we have identified risks that may hinder the implementation of measures to achieve the TDK Group’s important issues (Materiality) set for this fiscal year and have designated these as critical risks as well. Among these critical risks, those for which it is considered possible to reduce the likelihood of occurrence or mitigate the impact in the event they materialize through the enhancement of our internal control systems are evaluated by each risk owner and the ERM Committee to determine whether the risk management systems are sufficient. The results of these risk assessments and the status of countermeasures are deliberated at the Executive Committee and reported to the Board of Directors. In addition, the validity of the heat map is verified at least once during the period, and the assessment of residual risk is reviewed if necessary.

Listed below are items that, among those relating to “Review of operations” and “Consolidated Financial Statements and Notes to Consolidated Financial Statements” stated in the Annual Securities Report, may significantly influence investor decisions. The following risks include forward-looking statements based on judgments current as of the filing date of the Annual Securities Report on June 19, 2025. However, it is difficult to reasonably predict when each risk will materialize if at all.

- (1) Risks concerning changes in economic trends

- (2) Risks concerning fluctuations in currency exchange

- (3) Risks concerning interest rate fluctuation

- (4) Risks concerning natural disasters and pandemics

- (5) Risks in international business activities

- (6) Risks concerning human rights

- (7) Risks concerning the environment including climate change

- (8) Risks of taxation

- (9) Risks concerning technological innovation and new product development

- (10) Risks concerning price competition

- (11) Risks concerning raw material procurement

- (12) Risks concerning customer performance and management policy changes

- (13) Risks concerning compliance

- (14) Risks concerning product quality

- (15) Risks concerning intellectual property

- (16) Risks concerning information security

- (17) Risks concerning securing personnel and training personnel

- (18) Risks concerning entry into new markets/businesses and M&A

- (19) Risks of impairment of non-financial assets

(1) Risks concerning changes in economic trends

The electronics industry, TDK’s field of operations, is highly susceptible to social and economic trends in the U.S., Europe, Asia, and particularly China and Japan, which are the main markets for end products. In addition, markets in these countries and regions are constantly exposed to various risk factors such as political issues, international issues, and economic fluctuations. Although TDK monitors such world risk trends and takes timely measures in response to them, there is no guarantee that adequate and timely measures can always be taken. And, if changes beyond our expectations occur in such business environments, such changes could significantly affect business results.

(Major Countermeasures)

In order to minimize the negative impact on TDK's business performance caused by economic trend changes, we are conducting several measures to improve our management structure, such as optimization of manufacturing sites, examination of capital investment plan, improvement of business efficiency in headquarters, etc.

(2) Risks concerning fluctuations in currency exchange

TDK conducts business activities globally. Indeed, 92% of net consolidated sales are accounted for by overseas sales, and many transactions are conducted in currencies other than the yen, such as the U.S. dollar or euro. A sudden appreciation of the yen against these currencies could affect earnings such as by reducing net sales and operating income. In order to mitigate these risks, TDK is working to purchase more raw materials in foreign currencies and increase the local procurement of supplies consumed overseas. Foreign currency fluctuations also give rise to conversion differences with respect to our investments in overseas assets and liabilities, which are converted into yen in our consolidated financial statements. We estimate that appreciation of one yen against the U.S. dollar and euro would push down TDK Group’s annual operating profit by about 2 billion yen and 300 million yen respectively. Measures are taken against fluctuations in foreign currency exchange rates, including procuring foreign currency-denominated funds and concluding forward foreign exchange contracts; however, sudden or significant fluctuations in exchange rates could have a significant adverse effect on TDK's financial position and business results.

(Major Countermeasures)

Transactions between overseas subsidiaries and the headquarters (Japan) are carried out in the local currency as much as possible to reduce the risk of foreign currency exchange fluctuations of overseas subsidiaries. The risk is consolidated at the headquarters and comprehensive exchange contracts are made from Japan to reduce the risk of overall currency exchange fluctuations. Overseas subsidiaries also use foreign exchange contracts, etc., as necessary to mitigate that risk. In order to reduce the impact of foreign currency fluctuations at the operating income stage, we are promoting U.S. dollar-based purchasing and Japanese yen-based sales or Chinese yuan-based sales.

(3) Risks concerning interest rate fluctuation

TDK, as necessary, has financial assets, such as cash deposits and government bonds, and financial liabilities such as loans from banks, corporate bonds, and lease obligations. Fluctuations in interest rates over such assets and debts could affect the interest income, and interest expense, and the value of financial assets and liabilities, which could have a significant effect on TDK’s financial position and business results.

(Major Countermeasures)

Regarding the risk of rising interest rates, we are working to reduce the risk of interest rate fluctuations by raising low-interest and fixed-rate funds through corporate bonds and bank loans. With regard to the risk of declining interest rates, we focus on guaranteeing principal and invest mainly in time deposits. While watching interest rate trends, we control the risk by investing for a relatively short period of time when interest rates are rising and a relatively long period of time when interest rates are falling.

(4) Risks concerning natural disasters and pandemics

TDK has many production factories and research and development facilities in Japan and overseas. These facilities and plants have taken disaster-protection and infection-control measures and purchased their own power generation facilities to cope with electricity shortages in preparation for unexpected natural disasters and infection outbreaks. However, significant damage could be incurred at these facilities and plants due to an event beyond assumptions, such as a large earthquake, tsunami, typhoon, flood, or volcanic eruption, or a large-scale blackout or electricity shortages caused by them. In the event of interruption to manufacturing, disruption of transportation routes, damage to or disconnection of information and communications infrastructure, impairment of central functions, or significant damage to our customers themselves due to the impact of such occurrences, orders and supply could be affected for a long period of time. This situation could have a significant effect on business results.

Furthermore, if the economy deteriorates, our offices are closed, or the supply chain is disrupted due to spread of the COVID-19 or other infections, it may have a significant impact on our business performance.

(Major Countermeasures)

TDK is formulating BCP (Business Continuity Planning) for each major business and promoting BCM (Business Continuity Management) activities so that production at the manufacturing site can be resumed as soon as possible in the event of an emergency. In the same way, the sales and headquarters staff functions also have a BCP to prepare for emergencies so that the entire functions of the company will not be suspended. In terms of securing the supply chain in the event of a disaster, even if business cannot be continued due to a large-scale disaster, we will follow the procedures stipulated in the BCP and establish alternative bases for priority operations in emergency such as payment to suppliers and continuation of the supply of materials. Furthermore, regarding initial response, TDK has globally introduced a system that enables rapid information sharing between our overseas subsidiaries and the headquarters to quickly grasp the damage situation in the event of an emergency.

Regarding infectious diseases, each of the TDK Group's business sites will maintain the usual infection control system, and in the event of an outbreak or cluster outbreak, we will implement the infection prevention system developed through our experience with COVID-19 countermeasures.

(5) Risks in international business activities

TDK conducts operations globally, and its overseas sales account for 92% of total sales on a consolidated basis.

In many of our target markets and emerging countries that are expected to see economic development going forward, TDK may be exposed to international political risks such as war, terrorism or other events, domestic political and economic risks such as fluctuations in currency exchange, tariff raising, import/export restrictions, and social risks including labor problems stemming from differences in cultures and customs, and diseases. There may be unknown risks in building relationships with trading partners due to differences in commercial and business customs. If these risks materialize, they could reduce or halt manufacturing activities, force the stagnation of sales activities and in turn have a significant adverse effect on business results.

In particular, TDK Group's sales to China account for 54% of total sales on a consolidated basis. In order to establish a system for supplying both local customers and foreign-owned companies that have been setting up operations in China, we have many factories in China. As a result, the amount of production at our Chinese factories is approximately 59% of the total amount of production of the entire the TDK Group. If problematic events occur in China due to above-mentioned political factors (such as changes in laws and regulations), economic factors (such as the continuity of high growth and status of infrastructure development such as electric power supply) or social environment factors, there could be a significant effect on business results.

(Major Countermeasures)

To deal with risks in international business activities, the government relations function established in the headquarters and the regional headquarters in the Americas, Europe, and China are used to grasp and analyze risk-related information in each region and changes in laws and regulations in each country. In particular, we recognize that global geopolitical risks, such as the recent conflict between the United States and China, are critical risks, and are working on taking appropriate measures. Furthermore, while most production is in the areas of demand, we are appropriately reviewing the location of factories, considering country risks and other factors. Although we continue implementing our site optimization strategy with regard to our dependence on China, the tangible fixed assets held by the TDK Group in China have slightly increased from 381.2 billion yen in the fiscal year ending March 31, 2024 to 391.1 billion yen in the fiscal year ending March 31, 2025.

In response to Russia's invasion of Ukraine, we have continued to freeze business activities in Russia and Belarus since the incident happened.

(6) Risks concerning human rights

TDK has, for the sustainable development of society and SDGs as an indicator, recognized corporate social responsibility, such as improvement of the working environment and respect for human rights, as important management issues. Also, TDK has been working to understand and continuously improve issues through self-assessment, auditing, training, and dialogue according to the action standards of RBA (Responsible Business Alliance) in all business operations including supply chain management. However, in case there are problems related to industrial health and safety such as industrial accident, child labor, forced labor, or human rights such as discrimination to foreign workers, despite of our efforts, decline of social trust in TDK, suspension of business transactions, or withdrawal of partial business may have a significant effect on our business results.

In case related laws, regulations, or international initiatives’ standards, etc., are materially tightened, expenses to adapt to such tightening may become unexpectedly high, or a part of business may be withdrawn. This could have a significant effect on our business results.

(Major Countermeasures)

We remain committed to respecting human rights in the TDK Code of Conduct, and explicitly prohibit any form of forced labor. In addition, the TDK Group Human Rights Policy clarifies our approach to respecting human rights, conducting various surveys and audits in the supply chain and communication with stakeholders in accordance with this policy. In the process, if we determine that there is an act that deviates from the Code of Conduct, we will take necessary measures to correct it.

We have listed “Progress in solving social and environmental issues” as one of "TDK Group Critical Issues (Materiality)," set "respect for human rights" as the themes, and are developing these themes globally. For our own manufacturing sites, the Sustainability Promotion Group takes the lead in conducting CSR self-checks, labor and business ethics risk assessments on an annual basis and conducts internal CSR audits and CSR audits by third-party auditing firms periodically for each production site. Especially as efforts to prevent child labor, in addition to the above, we conduct additional self-assessment with respect to our own manufacturing sites and contract manufacturing sites located in a high-risk area. Furthermore, Human Resources HQ promotes the management of working hours on a global basis to prevent forced labor.

Regarding changes and tightening of laws and regulations, we closely monitor each country’s laws, social conditions, and customer trends, etc., and are trying to reduce the risk by quickly responding to these changes.

(7) Risks concerning the environment including climate change

The emission of greenhouse gases that are contributing to global warming has been increasing. As represented by the "Paris Agreement" adopted in COP 21 in Dec 2015, a sense of crisis for Climate Change has been increasing. Since Climate change is an important issue for TDK, based on the recommendations of TCFD (Climate-related Financial Information Disclosure Task Force) which was announced in May 2019, we promote disclosure of information related to climate change and prepare analysis and countermeasures led by the Corporate Officer in charge of the environment.

In addition, the TDK Group is subject to various environmental laws and regulations, including those governing air pollution, water pollution, soil and groundwater contamination, waste disposal, and chemical substances contained in products. The TDK Group complies with these laws and regulations as it conducts its business activities, but environmental regulations are likely to become stronger, and the costs of complying with them are expected to increase, which could have an adverse effect on the TDK Group's financial position.

(Major Countermeasures)

In recent years, the TDK Group has become increasingly aware of the importance of harmonizing climate change and resource circulation with our business activities. We view these issues as both opportunities and risks for our business and are actively working on various initiatives. In addition, we are grasping the issues that have arisen or may arise in the fields of science, regulations, and society surrounding global efforts to prevent air, water, and soil pollution. Led by the Sustainability Promotion Group, we identify risks and opportunities, prioritize important issues, and continuously implement the PDCA cycle to drive ongoing improvement.

Details regarding climate change-related risks, opportunities, and main countermeasures are provided in Section 2, “Business Overview,” Subsection 2, “Approach and Initiatives for Sustainability,” under “Climate Change.”

(8) Risks of taxation

TDK has manufacturing bases and sales entities throughout the world, and we conduct a lot of international transactions between group companies. We pay close attention to make transaction prices appropriate from the perspective of transfer pricing taxation and customs laws in each applicable country. However, due to differences of opinions with tax authorities or customs authorities, we may incur additional tax burden as a result of indication that the transaction prices are inappropriate. And, due to the enforcement, introduction, amendment or abolition of tax laws or their interpretations and operations around the world, we may incur an increase of tax burden.

With respect to deferred tax assets, we have periodically evaluated their collectability according to the prospect of future taxable income and the profit plan to be realizable by tax. When the future profit plan cannot be realized, or when the evaluation of collectability is reviewed due to the enforcement, introduction, amendment or abolition of tax laws or their interpretations and operations, corporate income tax costs may increase by reducing the portion that is no longer likely to be collected.

When such events occur, that could have a significant effect on business results.

(Major Countermeasures)

For risks in international transactions among TDK group companies, we conduct transfer price monitoring within TDK Group and take measures to reduce the risk if it is judged to be high. In addition, taxation risk analysis is conducted at the time of changing business flow or starting new transactions, and measures are taken as needed.

About the risk concerning effect, enforcement, or introduction of tax law or its interpretation, we exchange information between the headquarters and each regional headquarters and try to grasp the information on tax revisions of each country in advance and identify the impact on the TDK group.

(9) Risks concerning technological innovation and new product development

In TDK, the launch of new products imbuing value on a timely basis helps boost our profitability. We also believe ongoing new product development is key to our survival. We believe that our ability to increase sales by developing appealing, innovative products has an important role to play in our growth. We are therefore engaged in new product development as an important element of our management strategies. However, it is extremely difficult to precisely predict future demand in the rapidly changing electronics industry. TDK may fail to continue to develop and supply, in a timely manner, attractive and new products with innovative technologies for this industry and our markets. Research and development divisions in TDK continuously reshape the framework based on analysis of market trends, along with conducting development management to promote the prioritization of development themes. Nevertheless, there is a risk that a loss of sales opportunities could result in the loss of future markets, as well as existing markets.

In addition, TDK develops, produces, and sells a wide variety of products in countries and regions around the world, and the data obtained through these business activities can be regarded as our assets. However, if these data could not be properly accumulated and utilized in the development and sales of attractive products in collaboration with the development, sales and marketing departments, it may have a significant adverse effect on business results and growth prospects.

(Major Countermeasures)

In new product development, all relevant functions are involved in reviewing and evaluating each development theme from start to end, judging marketability of new products and promoting productization by utilizing accumulated data. We conduct rigorous risk assessments through design reviews at each stage of product planning, design, prototyping, and manufacturing. Also, with Corporate Marketing & Incubation HQ at the center, we make quick feedback to new product development through the company-wide cross-functional system. It helps to respond to changes in the market in a timely manner.

Furthermore, by collaboration with venture companies that were invested in through TDK Ventures, which was established in 2019, we can quickly detect new technology trends, reinforce technology roadmaps, and work on entering new markets.

(10) Risks concerning price competition

TDK supplies electronic components in a broad range of fields in an electronics industry where competition is intensifying. These fields include ICT represented by smartphones, the automotive field, where use of onboard electronics is increasing, and energy related fields such as solar and wind power generation. Price is one of the main competitive factors differentiating us from other companies in the industry in which leading Japanese companies and international companies in South Korea, Taiwan and China have fueled intense price competition.

TDK is working to promote ongoing cost-cutting initiatives and increase profitability to counter this market competition. However, such price trends could have a significant effect on business results.

(Major Countermeasures)

In each business of TDK, we strive to avoid price competition by creating high value-added products, and continuously promote cost reduction measures. Also, we are working to improve capital efficiency and profitability company-wide and strive to minimize the negative impact of lowering price on our business performance.

(11) Risks concerning raw material procurement

TDK’s manufacturing system is premised on securing raw materials and other supplies in adequate quality and quantity in a timely manner from multiple external suppliers. However, for major raw materials, we may rely on a limited number of difficult-to-replace suppliers. Because of this, there may be cases where supplies of raw materials and other products to us are interrupted by a disaster, an accident or some other event at a supplier, supply is suspended due to quality or other issues, or there is a shortage of supply due to an increase in demand for finished products. Moreover, there may be cases where local procurement necessitated by increased overseas production is negatively affected by overseas circumstances. If any of these situations becomes protracted, it could have a significant, adverse effect on production and prevent us from fulfilling our responsibilities to supply products to our customers. If the supply-demand balance in the market is disrupted, it may considerably increase costs of manufacturing through run-ups in the prices we pay for raw materials and rises in fuel prices, including oil. When such cases occur, there could be a significant effect on business results.

(Major Countermeasures)

The procurement risk of raw materials (suspension, stop, or shortage of supply) is monitored continuously and shared with the related business division, while working on risk avoidance by multi-sourcing and long-term supply agreements.

As for materials, devices, and parts which are being procured from local sources, the possibilities of alternative procurement from other countries are being investigated for risk avoidance while understanding the material supply situation in other countries using a network of trading companies that could be known in the process of material source survey.

For conflict minerals, we investigate smelters according to the framework of the "Responsible Minerals Initiative." In addition, we have properly identified the CSR compliance status on the supplier side, such as working environment.

(12) Risks concerning customer performance and management policy changes

TDK is developing business-to-business transactions on a global scale, whereby we supply electronic components to customers in the electronics and automotive markets.

We work to reduce risk by conducting transactions with a variety of customers and take measures such as setting transaction terms and conditions based on our evaluation of a customer’s credit risk.

However, our business may be significantly affected by various factors that are beyond our control, such as changes in each customer’s business results and management strategies. In addition, a decline in purchasing demand due to customers’ poor business performance, strong discounting request from customers due to changes in their purchasing policies and practices, the unexpected termination of contracts or other occurrences could result in excess inventory or a reduction in profit margins.

In the event that our customers go through reorganizations caused by mergers and acquisitions effected by enterprises of different business types or by competitors domestically or abroad, this situation could have a significant effect on TDK’s business results, including a marked decline in orders or the cancellation of all business transactions.

There was one customer group that accounted for more than 10 percent of the consolidated net sales for the year ended March 31, 2025. The sales to the customer group were approximately 391.9 billion yen (18% of the consolidated net sales). These sales were mainly booked in the Energy Application Products segment.

(Major Countermeasures)

When investing in the equipment dedicated to a specific customer, we try to reduce the risk of investment by concluding a contract that imposes on the customer a certain amount of guaranteed product purchase.

We always try to collect information about the movement of industry reorganization with high sensitivity. When an important customer is involved in industry reorganization, we assume multiple scenarios and try to reduce or avoid risks.

(13) Risks concerning compliance

TDK is subject to and required to comply with various regulations in Japan and other countries where we conduct business. These regulations are related to business and investments, the safety of electric and electronic products, national security between nations, export/import, commercial, antitrust, patents, product liability, the environment and taxation.

TDK has appointed a Global Chief Compliance Officer and Regional Chief Compliance Officers for Japan and four other regions to oversee compliance-related initiatives including risk assessment and mitigation, education, and training in order to minimize the risk of non-compliance throughout the TDK Group including its corporate officers and employees. And, we have established a Corporate Code of Ethics and have been striving to foster a sincere, fair, and transparent corporate culture. Furthermore, we ensure that our corporate officers and employees comply with the internal regulations established by our group and the procedures and processes based on those regulations. Based on our governance policy of "Empowerment & Transparency" (delegation of authority and ensuring transparency), our group has compiled the minimum rules that group members must follow, so that each group company can make use of its individuality. We have developed and operate "Global Common Regulations," and the compliance status is monitored by the headquarters departments. However, despite of above measures, conflict with these related regulations and rules and wrongdoing by corporate officers or employees may not be avoidable.

In the event of such, the social credibility of the TDK Group may decline, and customers may cease business with TDK or large amounts of fines and compensation for damages may be imposed. This could have a significant adverse effect on business results.

In the event that laws and regulations become more stringent in the future, a large charge related to such regulations or a partial withdrawal from the particular business when compliance with the regulation is difficult could have a significant adverse effect on business results.

(Major Countermeasures)

TDK is implementing the following activities to reduce compliance risks and foster a compliance culture in TDK Group:

- - enforcement of "Global common regulations" based on the TDK Group's basic governance policy, and monitoring of compliance status of each group company by the headquarters departments;

- - internal investigation utilizing outside experts;

- - announcement of a thorough compliance directive from the TDK president and the head of each group company;

- - employee education and enlightenment of compliance through lecture and e-learning; and formulation and enforcement of internal rules based on the standards required by the US Department of Justice.

(14) Risks concerning product quality

TDK conducts quality management of various products at domestic and overseas manufacturing bases in accordance with International Quality Management Standards (valid version of ISO 9001, IATF16949, and/or other applicable standards) and the standards required by customers in the technologically innovative electronics industry. Furthermore, TDK utilizes proprietary quality technologies and past data concerning quality issues to create a quality assurance system for building in quality from the earliest development stage so as to ensure reliability and safety. This is achieved through design inspections, internal quality audits, supplier surveys and guidance, process management and in other ways at each product stage including planning, design, prototyping and manufacturing. We are also promoting the active use of digital technology at each production site.

However, TDK cannot be fully certain that faults in quality (including cases where products contain substances that may be prohibited by applicable regulations) and recalls due to those faults will not occur. Should a recall or a product liability claim against us occur, it could result in recall costs or damage claims and lower sales. Furthermore, it is assumed that a defect in quality in one of TDK’s name-bearing products would have a negative impact on our reputation and brand and endanger the continued existence of the company. In such a way, a major quality problem could have a significant effect on business results.

(Major Countermeasures)

TDK is implementing various measures from the perspectives of design, materials, processes, and management in order to reduce the risk of quality defects (including the inclusion of regulated substances). In particular, as the number of products incorporating ICs and software is increasing, we are also working to strengthen IC analysis technology and software vulnerability countermeasures.

(15) Risks concerning intellectual property

TDK is working hard to strengthen and utilize its patent portfolio by managing and acquiring new patents, licenses and other intellectual property rights covering TDK’s products’ functions, designs and so forth (hereinafter “intellectual property rights”), as a strategic intellectual property activity that contributes to business earnings.

However, there are cases where our intellectual property rights cannot be fully protected in a particular region for reasons unique to that region. We may suffer damages resulting from the manufacture by a third party of similar products to our own with the unauthorized use of our intellectual property rights.

There may be cases where it is alleged that our products or processes infringe on the intellectual property rights of third parties that may sue for damages as a result of such alleged infringement. This would require either legal processes or settlement negotiations and expenses as a part of that activity. If our defenses against such claims are not accepted in such disputes, we may have to pay damages and royalties and suffer losses such as the loss of markets.

Such disputes over intellectual property rights could have a significant effect on business development and business results.

(Major Countermeasures)

In cases where a third party uses TDK’s intellectual property without permission, we have established and enforced a system to monitor the unauthorized use of our brand and the sale of counterfeit products on a commercial transaction website.

On the other hand, TDK has a corporate policy to respect for the intellectual property rights owned by others and is working on reducing the risk of infringing intellectual property rights by taking investigation, prevention measures, and solutions in advance of product development.

(16) Risks concerning information security

As part of its business operations, TDK holds confidential information and personal information relating to customers and trading partners as well as confidential information of the TDK Group, including technical information and personal information. We have constructed a group-wide control system to prevent this information from being leaked to outside parties, falsified, otherwise manipulated, or destroyed. Moreover, we execute measures to ensure thorough management and IT security, improved facility security and employee training. However, there are still risks that such information could be leaked, destroyed, or falsified or that information systems are shut down through hacking, internal negligence, theft, intentional actions of officers and employees or other causes.

In such an event, TDK could suffer a lowering of credibility and perceived superiority of TDK products, be liable for costs relating to the compensation payments to the parties suffering damage, and potentially suspend affected operations. That could also have an effect on business results.

(Major Countermeasures)

TDK implements a vulnerability diagnosis on the information system by information security specialists and improves it if any problem is recognized. As for information security management, we are working on strengthening information security systems across TDK group companies based on the framework of NIST (National Institute of Standards and Technology, USA).

As measures to prevent information leakage from the TDK group companies, TDK restricts access to sensitive data by employing folder access controls, detects suspicious data transmission/reception using AI, restricts usage of devices with high risk of information leakage such as a USB memory, SD card, etc., implements measures to prevent employees planning to retire or otherwise leave the company from taking confidential information from TDK, and thoroughly implements information security education for employees. In case TDK suffers damage related to information security, we have globally enhanced the system to recover quickly. Furthermore, we have procured cyber-attack insurance for the entire TDK group. In addition to initiatives within the TDK group, in order to prevent information leaks from business partners such as suppliers, we will support the improvement of information security management for business partners and efforts to improve the management level of information security throughout the supply chain.

(17) Risks concerning securing personnel and training personnel

TDK pursues business operations in more than 30 countries and regions around the world, and around 90% of TDK employees are based outside of Japan. In order to continuously develop business in the fast-changing electronics industry, we believe that we must continuously promote efforts to acquire and develop various personnel who possess advanced technical skills and personnel with excellent management capabilities such as those necessary for formulating strategy and managing organizations globally.

However, competition to continuously recruit the necessary employees is intense. Moreover, in Japan, the employment environment is changing rapidly because of the falling birthrate, the aging population, and the declining workforce. A similar change is occurring at our overseas bases in China and other countries. The inability to recruit and train personnel as planned could have a significant effect on business development, business results and growth from a long-term perspective.

(Major Countermeasures)

TDK actively hires university graduates and employs experienced people throughout the year. Especially in Japan, our recruiting team was working to implement a virtual interviewing scheme to increase the contact opportunities and reach to various students and experienced persons even before the COVID-19 situation. As a result, we could smoothly transform the recruiting method to cope with the current COVID-19 related challenges.

Moreover, we are working to retain and develop personnel by putting in place frameworks for increasing their motivation. This includes enhancing fair evaluation and remuneration systems based on a target-based management system. We improve and extend various training programs to develop employees who can act independently and globally, and to pass on the “DNA” of our manufacturing as well as values and knowledge of the TDK Group. These include different management training tailored to our hierarchy levels, so we develop our future management talents as well as our existing global key personnel.

(18) Risks concerning entry into new markets/businesses and M&A

In the increasingly competitive electronics field, to achieve sustainable growth, we are actively working to enter new markets (geographically and by application) within our existing businesses and enter new businesses. We also actively utilize M&A when it is an effective means to acquire the technology and customer assets necessary to enter new markets and businesses, and to strengthen the competitiveness of our businesses.

When entering new markets/businesses or utilizing M&A, we strive to fully consider in advance the relevance to our group's business portfolio, relevant legal and regulatory trends in each country, and the results of risk analysis associated with M&A.

However, even in case there is prior research or prior consideration, due to significant changes in market, technology, legal and regulatory trends, etc., TDK’s business results, growth and business development among others could be significantly affected.

(Major Countermeasures)

When entering a new market or business, or making an M&A, we ask whether the business plan is consistent with our group's vision and growth strategy, whether it is a viable business plan, and where the legal risks are in each country and how they are being handled. Verification is conducted not only by business divisions and headquarters functions, but also by outside experts when necessary. Besides, in case of M&A, in order to smoothly proceed with post-merger integration (PMI) and maximize integration synergies, we have defined a standard target of the matters to be implemented and its achievement timing in the PMI.

(19) Risks of impairment of non-financial assets

In order to secure and establish a competitive advantage in the electronics industry, where competition is intensifying, TDK has enriched its business portfolio which is based on the material and process technology obtained through the production of ferrite (which was the initial business at the time of foundation) and also carried out M&A in some cases to accelerate the growth of its business. Also, TDK has continuously invested on capital expenses such as manufacturing facilities to improve production capacity, quality, or productivity. As a result, we have a large amount of non-financial assets, such as tangible fixed assets, right-of-use assets, goodwill, and intangible assets. While having a wide variety of businesses and assets helps to diversify risk, if we are unable to continuously improve the efficiency of our business and asset portfolio, it may have a significant impact on the TDK's earnings. As of March 31, 2025, the total amount of tangible fixed assets, right-of-use assets, goodwill and intangible assets of the TDK Group is 1,317 billion yen, of which 126.7 billion yen is tangible fixed assets of the HDD head business, 27.6 billion yen is tangible fixed assets of the High-frequency components business, 92.3 billion yen is allocated to goodwill of the MEMS sensor business, and 20.1 billion yen is allocated to goodwill of the HDD head business.

For property, plant and equipment, right-of-use assets, and intangible assets that are identifiable and have a fixed useful life, we determine whether there is any sign of impairment at the end of each fiscal year. If there is an indication of impairment, an impairment test is conducted based on the recoverable amount of the asset. Goodwill and intangible assets with undetermined useful lives are tested for impairment at the same time each year, regardless of whether there are any signs of impairment, and if there are any signs of impairment an impairment test is conducted each time.

As a result of such a test, if the carrying amount of an asset, cash-generating unit or cash-generating unit group exceeds the recoverable amount, the carrying amount is reduced to the recoverable amount and an impairment loss is recognized. When we recognize a large amount of impairment, it could have a significant effect on business results.

(Major Countermeasures)

TDK introduced a business portfolio management system which considers business profitability and growth potential. With this management system, we make investment decisions by “selection and concentration” and try to avoid future impairment risk.

In addition, for a business at higher risk of impairment, we monitor its performance and progress against an improvement plan from the beginning of the fiscal year. Business division and headquarters functions work together to consider the possibility to recover business profitability.