Remuneration for Directors and Audit & Supervisory Board Members

①Matters Concerning the Policy on Determining the Details or the amount of Remuneration for Individual Directors

(ⅰ) Policy on Determining the Details of Remuneration for Individual Directors

Regarding the Company’s policy on determining the details of remuneration for individual Directors (hereinafter, “Determining Policy”), the Board of Directors passed a resolution on the Determining Policy on April 26th 2024 after consulting the original proposal with and obtaining a report from the Compensation Advisory Committee, an advisory body to the Board of Directors. Outline of the Determining Policy is as follows.

<Basic Policy>

The Company designs its remuneration system through deliberation and examination of the Compensation Advisory Committee, an advisory body to the Board of Directors, for the following purposes.

To promote as much as possible behavior on the part of Directors geared towards enhancing corporate results and stock value and sustainably increase the corporate value of the overall TDK Group by constantly pursuing the formulation of a competitive remuneration system to secure diverse and excellent human resources that focuses on linkage with short- term as well as medium to long-term results.

<Policy, Etc. Concerning Determination of Each Remuneration>

The remuneration of Directors is comprised of basic remuneration, results-linked bonus and stock-linked compensation. The policy, etc. on determining the amounts or numbers for each type of the remuneration or the method of calculation thereof is described below.

| a. | Fixed compensation For fixed compensation, the Company pays basic remuneration on a monthly basis. Remuneration amounts for individual Directors are determined based on remuneration tables approved by the Board of Directors for each responsibility after consulting the original proposal with and obtaining a report from the Compensation Advisory Committee, while referring to studies, etc. on corporate management remuneration performed by third parties and comparisons of compensation levels at other companies of similar scale, mainly in the same business category. |

| b. | Results-linked compensation Results-linked compensation shall be results-linked bonuses (monetary compensation) and Performance Share Unit (PSU). The payment amounts of results-linked bonuses are linked to the degree of attainment of targets, using the consolidated results for the fiscal year and the indicators set for each division in charge, with an emphasis placed on short-term performance. The payment ratio of PSU is linked to the achievement ratio of the targets of the consolidated performance indicators in the Medium-Term Plan. Results-linked bonuses are paid out at a certain time each year, PSU is paid out after the Medium-Term as determined by the Board of Directors after consulting the original proposal with and obtaining a report from the Compensation Advisory Committee. |

| c. | Non-monetary compensation Non-monetary compensation shall be Restricted Stock Unit (RSU) and Performance Share Unit (PSU) and those are paid to Directors excluding Outside Directors. RSU shall be paid 50% by stock and the rest by cash, after the 3 years or longer period defined by the Board of Directors from the first year to the last year of the Medium-Term plan. The number of PSU to be vested for Directors who also serves as Corporate Officers shall be calculated based on the achievement ratio and paid 50% by stock and the rest by cash. Details are determined by the Board of Directors after consulting the original proposal with and obtaining a report from the Compensation Advisory Committee. |

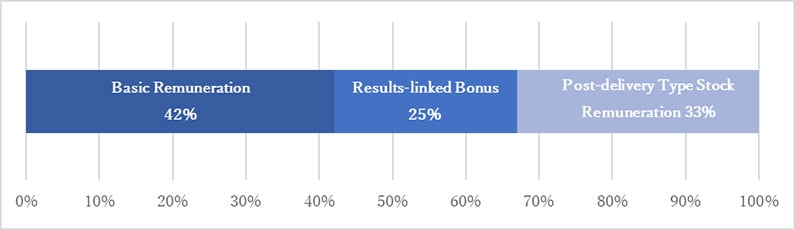

| d. | Ratio of remuneration Regarding the ratio of remuneration, by type, for Directors concurrently serving as Corporate Officers, the ratio of results-linked compensation is structured so that the higher the responsibility, the higher the ratio of performance- linked remuneration, based on comparisons of compensation levels at other companies of similar scale, mainly in the same business category, while referring to studies, etc. on corporate management remuneration performed by third parties, and is consulted with the Compensation Advisory Committee. While respecting the report from the Compensation Advisory Committee, the Board of Directors determines remuneration tables for each responsibility based on the ratio of remuneration by type indicated in the report. The guideline for the ratio of remuneration by type is basic remuneration : results-linked bonus : stock-linked compensation = 1 : approximately 0.6-1.0 : approximately 0.8-1.6 (assuming 100% achievement of performance targets). |

| e. | Return of remuneration, etc. (clawback and malus) In the event that the Company’s performance sharply and significantly deteriorates, or there are illegal activities or violations of laws and regulations, the right to the payment or delivery of remuneration may be forfeited or remuneration may be reduced or returned to the Company based on deliberations by the Compensation Advisory Committee and a resolution by the Board of Directors. |

(ⅱ) Remuneration Decision-making Process, Etc.

A majority of the members and the Chairman of the Compensation Advisory Committee are Independent Outside Directors. The Compensation Advisory Committee deliberates the framework and levels of remuneration for Directors and Corporate Officers and reports to the Board of Directors, thereby contributing to ensuring the transparency in the remuneration decision-making process and the appropriateness of individual remuneration.

As the Compensation Advisory Committee had conducted a multi-faceted examination of the original proposal, including from the viewpoint of accordance with the Determining Policy, the Board of Directors basically respected the Committee’s report and judged that the details of remuneration for individual Directors for the fiscal year under review are in accordance with the Determining Policy.

As explained above, at the Company, the Board of Directors determined the details of remuneration for individual Directors, and does not delegate this determination to a Director or other third party.

(ⅲ) Structure of Remuneration for Directors and Audit & Supervisory Board Members

| Type of Remuneration | Details of Remuneration | Fixed/Fluctuating | |

|---|---|---|---|

| Basic remuneration | Monetary compensation paid monthly | Fixed | |

| Results-linked bonus | Monetary compensation which is paid at predetermined times each year with an emphasis on the linkage with short-term performance. The amount of the bonus fluctuates within a range of 0% to 200% of the standard payment amount depending on the degree of attainment of the consolidated results for the fiscal year under review (operating income, ROE) and the targets set for each division. | Fluctuating (single fiscal year) | |

| Post-delivery type stock remuneration | Restricted Stock Unit (RSU) | RSU is a type of stock remuneration which is issued based on continuous service. In the case of RSU, subject to continuous service for a period of three years from the first day of the first year to the last day of the last year of the Medium-Term Plan (or a period of three years or more as determined by the Board of Directors of the Company, the "Target Period"), a predetermined amount of the Company’s shares and money is delivered after the end of the Target Period. | Fixed |

| Performance Share Unit (PSU) | PSU is a type of stock remuneration which is issued based on performance. In the case of PSU, an amount of the Company’s shares and money calculated in accordance with the degree of achievement of performance targets set by the Medium-Term Plan is delivered after the end of the Target Period. The degree of achievement of performance targets shall vary from 0% to 100% depending on the degree of achievement of consolidated performance targets (operating income, ROE) outlined in the Medium-Term Plan. | Fluctuating (medium- to long-term) | |

| Note: | Directors and Audit & Supervisory Board Members remuneration classification for results-linked compensation, non- monetary compensation and other remuneration is as follows. |

| Classification | Basic Remuneration | Results-linked Bonus | RSU** | PSU*** |

|---|---|---|---|---|

| Results-linked compensation | ― | ● | ― | ● |

| Non-monetary compensation | ― | ― | ● | ● |

| Compensation other than the above | ● | ― | ● | ― |

** PSU is classified as “results-linked compensation” and the stock remuneration portion is also classified as “non-monetary compensation.”

<Eligible for Payment>

| Classification | Basic Remuneration | Results-linked Bonus | Post-delivery Type Stock Remuneration | |

|---|---|---|---|---|

| RSU | PSU | |||

| Directors concurrently serving as Corporate Officers | ● | ● | ● | ● |

| Directors not concurrently serving as Corporate Officers | ● | ― | ● | ― |

| Outside Directors | ● | ― | ― | ― |

| Audit & Supervisory Board Members | ● | ― | ― | ― |

<Breakdown of Remuneration for Directors Concurrently Serving as Corporate Officers (for Standard Payments)>

<Dilution ratio of stock remuneration-type stock options and post-delivery type stock remuneration as of the end of fiscal year>

| Classification | Type and number of shares to be issued | Percentage in total shares issued |

|---|---|---|

| Shares subject to stock acquisition rights as stock remuneration-type stock options | 466,200 common shares | 0.12% |

| Shares to be delivered as post-delivery type stock remuneration | Equivalent to 196,400 common shares | 0.05% |

| Total | Equivalent to 662,600 common shares | 0.17% |

| 1. | With the introduction of the post-delivery stock renumeration plan approved at the 124th Ordinary General Meeting of Shareholders held on June 23, 2020, the stock remuneration-type stock option plan was abolished, except for those already granted. As a result, there were no stock acquisition rights newly issued as stock remuneration-type stock options in the current fiscal year. |

| 2. | In the fiscal year under review, 12,000 stocks were delivered to 6 Directors (excluding Outside Directors, including retired Directors) and 14,100 stocks were delivered to 14 Corporate Officers (including retired Corporate Officers) as RSU. PSUs are scheduled to be delivered in the fiscal year ending March 31, 2025 or later. |

(ⅳ) Indicators related to performance-linked remuneration, reasons for selecting the indicators, and methods for determining the amount of performance-linked remuneration

| a. | In calculating results-linked bonuses, the amount is designed to fluctuate within a range of 0% to 200% of the standard payment amount depending on the degree of attainment of targets, using the consolidated results for each fiscal year (operating income, ROE) and the indicators set for each division in charge. The reason for selecting these indicators is to use the same indicators as management targets with an emphasis on the linkage with short-term performance. The targets and results for the main indicators that relate to results-linked bonuses in the fiscal year under review are as follows.

|

| b. | The amount of the stock and cash delivered through PSU are calculated based on the achievement condition under the Medium-Team Plan. The results achievement condition takes consolidated results under the Medium-Term Plan (operating income, ROE) as an indicator, and varies the number of exercisable options within a range of 0% to 100% of the number of options granted, depending on the degree of attainment of targets. The reason for selecting this indicator is to use the same indicator as management targets under the Medium-Term Plan with an emphasis on the linkage with medium- to long-term performance and corporate value. The targets and results for the indicator that relate to stock-linked compensation stock options during the Medium-Term Plan, which ended in the fiscal year ended March 31, 2024, are as follows.

|

| c. | In the fiscal year under review, 12,000 stocks were delivered to 6 Directors (excluding Outside Directors, including retired Directors) as RSU. PSUs are scheduled to be delivered in the fiscal year ending March 31, 2025 or later. |

| d. | The types of remuneration in the table above are classified as Results-linked compensation, etc., Non-monetary compensation, etc., and Compensation other than above, as defined by the Company Law Enforcement Regulations. |

(ⅴ) Remuneration Scheme for Directors from next fiscal year

Partial revision of post-delivery type stock remuneration plan for Directors was approved in 128th General Shareholders Meeting on June 21st, 2024. This revision is intended to increase the willingness to contribute to the improvement in medium-term performance and corporate value and ensure a competitive remuneration level in the human capital market in the rapidly changing and difficult-to-predict global business environment. In addition, as evaluation indicators for PSUs, the Company proposes to introduce environmental and social indicators in order to increase the willingness to contribute to the realization of a sustainable society, and to introduce stock price indicators in order to further motivate management practices that are conscious of the cost of capital and stock price.

(ⅵ) Others

The Company has established Corporate Stock Ownership Guidelines. The Company makes an effort to ensure that eligible Directors and Corporate Officers hold at least a certain number of shares in the Company pursuant to their rank, including share-based compensation type stock options.

②Total amount of remuneration and other payments, total amount of remuneration and other payments by type and Number of eligible officers by officer category

| Officer category | Total amount of remuneration and other payments (Millions of yen) | Total amount of remuneration and other payments by type (Millions of yen) |

Number of eligible officers | |||

|---|---|---|---|---|---|---|

| Basic remuneration (Fixed remuneration) |

Results-linked bonus (Results-linked remuneration) |

Restricted Stock Units (RSU) |

Performance Share Units (PSU) |

|||

| Directors (Excluding Outside Directors) |

413 | 231 | 49 | 93 | 40 | 4 |

| Outside Directors | 58 | 58 | - | - | - | 3 |

| Audit & Supervisory Board Members (Excluding Outside Audit & Supervisory Board Members) |

62 | 62 | - | - | - | 3 |

| Outside Audit & Supervisory Board Members | 43 | 43 | - | - | - | 5 |

| 1. | Although there were four Directors (Excluding Outside Directors), three Outside Directors, two Audit & Supervisory Board Members and three Outside Audit & Supervisory Board Member as of March 31, 2024. the total number of payees, the total amount of remuneration and the basic remuneration in the breakdown thereof regarding Audit & Supervisory Board Members as shown above include one (1) Audit & Supervisory Board Member and two (2) Outside Audit & Supervisory Board Members who retired at the close of the 127th Ordinary General Meeting of Shareholders held on June 22, 2023, and the amount of remuneration paid to them. |

| 2. | For Result-linked bonuses, stock remuneration-type stock options, RSUs and PSUs for directors, the amounts recorded as expenses for the current fiscal year are shown. |

<Directors (Numbers as of the date of filing of this Annual Securities Report:7, numbers prescribed in the Articles of Incorporation of the Company: within 10)>

| (ⅰ) | Basic remuneration The amount of basic remuneration for Directors is ¥25 million or less per month, as approved by the 106th Ordinary General Meeting of Shareholders held on June 27, 2002. There were seven (7) Directors (including one (1) Outside Director) as of the close of the said Ordinary General Meeting of Shareholders. |

| (ⅱ) | Results-linked bonuses The amount of results-linked bonuses for Directors concurrently serving as Corporate Officers is ¥350 million or less per year, as approved by the 119th Ordinary General Meeting of Shareholders held on June 26, 2015. There were four (4) Directors concurrently serving as Corporate Officers as of the close of the said Ordinary General Meeting of Shareholders. |

| (ⅲ) | Post-delivery Type Stock Remuneration The amount of compensation as post-delivery type stock remuneration (RSU and PSU) is ¥457 million or less per year (as for the number of shares, 39,000 shares or less per year), as approved by the 124th Ordinary General Meeting of Shareholders held on June 23, 2020. RSU is granted to Directors, excluding Outside Directors, and there were four (4)Directors as of the close of the said Ordinary General Meeting of Shareholders. PSU is granted to Directors concurrently serving as Corporate Officers and there were three (3) Directors as of the close of the said Ordinary General Meeting of Shareholders. |

(Note)

1. The Company conducted a 3-for-1 stock division of common shares, effective October 1, 2021. As a result, the number of shares for post-delivery stock remuneration was adjusted to 117,000 shares per year.

2. The upper limit of the post-delivery stock remuneration was approved in 128th General Shareholders Meeting on June 21, 2024 as below.

| Item | Type | Before Revision | After Revision |

|---|---|---|---|

| Total amount of Monetary Remuneration Claims, Etc. to be paid to Eligible Directors | RSU | Up to 457 million yen per year | Up to the amount obtained by multiplying the upper limit of the number of Base Stock Units (*2) (40,000 shares) by the Stock Price at Delivery |

| PSU | Up to the amount obtained by multiplying the upper limit of the number of Base Stock Units (*2) by the Percentage of Payment (*3) (up to 200,000 shares) by the Stock Price at Delivery | ||

| Number of shares to be delivered to Eligible Directors | RSU | Up to 39,000 shares per year (up to 117,000 shares per year after the split) | Up to 20,000 shares per year |

| PSU | Up to 100,000 shares per year |

<Audit & Supervisory Board Members (Numbers as of the date of filing of this Annual Securities Report:5, numbers prescribed in the Articles of Incorporation of the Company: within 5 )>

The amount of basic remuneration for Audit & Supervisory Board Members is ¥120 million or less per year, as approved by the 124th Ordinary General Meeting of Shareholders held on June 23, 2020. There were five (5) Audit & Supervisory Board Members (including three (3) Outside Audit & Supervisory Board Members) as of the close of the said Ordinary General Meeting of Shareholders.

③Total amount of remuneration and other payments for individuals receiving a total of ¥100 million or more, etc.

| Name | Total amount of remuneration and other payments (Millions of yen) |

Officer category | Company category | Total amount of remuneration and other payments by type (Millions of yen) |

|||

|---|---|---|---|---|---|---|---|

| Basic remuneration (Fixed remuneration) |

Results-linked bonus (Results-linked remuneration) |

Restricted Stock Units (RSU) |

Performance Share Units (PSU) |

||||

| Shigeno Ishiguro | 145 | Director, Chairman | Filling company | 77 | - | 44 | 24 |

| Noboru Saito | 116 | Representa tive Director, President & CEO | Filling company | 77 | 17 | 16 | 6 |

*The Officer categories of Shigenao Ishiguro and Noboru Saito are as of the end of the fiscal year.