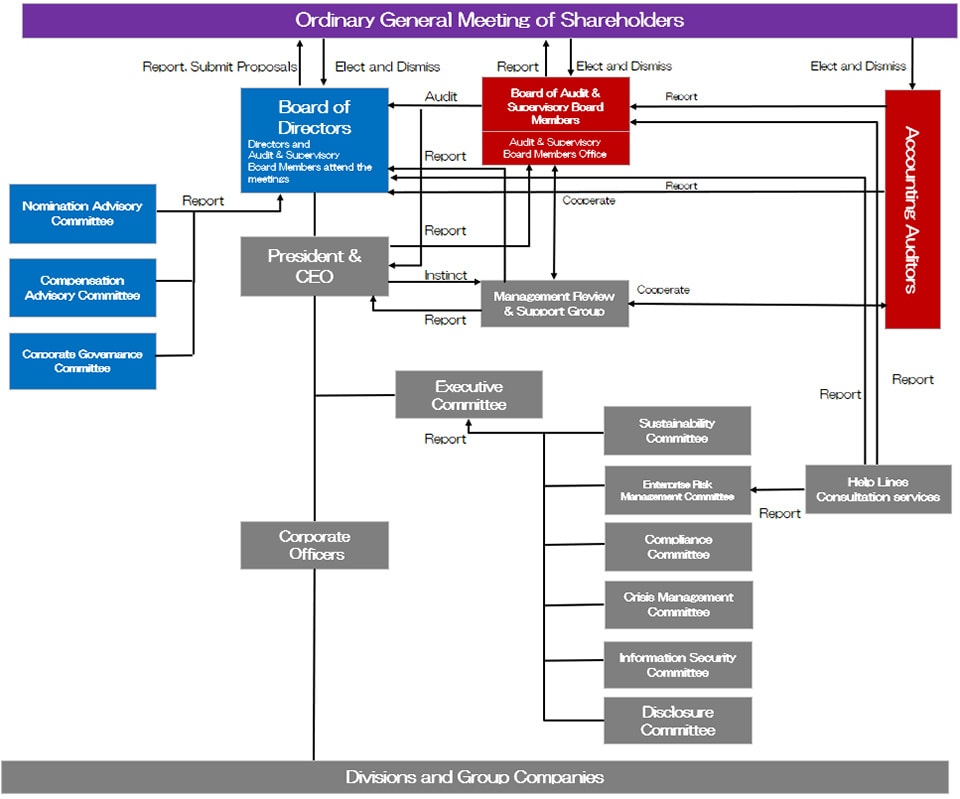

Management and Execution Structure and Audit System

- Organization Chart

- Overview of Current System and Reason for adoption

- Skills Matrix

- Status of audit by Audit & Supervisory Board Members

- Status of internal audit

- Status of accounting audit

- Audit fees, etc.

Last-update:April 1, 2025

Organization Chart

Overview of current system and reason for adoption

The Company is a company with an Audit & Supervisory Board and has implemented various measures to strengthen its corporate governance. In 2002, efforts to reform governance included the introduction of a Corporate Officer system along with a significant reduction in the number of Directors for the purpose of clearly separating management’s monitoring and execution functions. In addition, to fortify the system for boosting shareholders’ confidence, we shortened the term of office of Directors from 2 years to 1 year and actively invited the participation of Outside Directors.

In addition, the Company has established 3 committees acting as advisory organizations to the Board of Directors (the Nomination Advisory Committee, the Compensation Advisory Committee, the Corporate Governance Committee) to strengthen our management supervision functions.

Further, TDK established “TDK Basic Policy on Corporate Governance”. The policy request to elect Independent Outside Directors which account for half or more of the Directors and to assign an Independent Outside Director as the chair of the Board of Directors in principle. TDK complies them.

In short, the Company has always believed it can realize a system to continuously ensure sound, compliant and transparent management through the introduction of a new framework that strengthens corporate governance based on its Audit & Supervisory Board System.

-

a. Organization of the Board of Directors

The Company has a small number of Directors to expedite the management decision-making process. At the same time, the Company appoints disinterested, independent Outside Directors in order to enhance the supervision of the Company’s management. In addition, the Company’s basic policy is to elect independent Outside Directors which account for half or more of the Directors and from the perspective of ensuring clear separation between management oversight and business execution, an independent Outside Director serves as the Chair of the Board of Directors in principle. Furthermore, the Directors’ terms of office are set at one year to give shareholders an opportunity to cast votes of confidence regarding Directors’ performance every fiscal year.

- Organization of the Board of Directors(June 21. 2024):

Position and Duties, etc. at the Company Name Representative Director, President & CEO

General Manager of Humidifier Countermeasures HQNoboru Saito Representative Director & Senior Executive Vice President

Chief Financial OfficerTetsuji Yamanishi Director & Senior Vice President

Chief Technology Officer

General Manager of Technology and Intellectual Property HQShigeki Sato Outside Director Kozue Nakayama Chair of the board Outside Director Mutsuo Iwai Outside Director Shoei Yamana Outside Director Toru Katsumoto - Number of the Board of Directors meetings and attendance status (FY 2024):

-

Position at the Company Name Attendance Status Representative Director Noboru Saito 14 out of 14 meetings Representative Director Tetsuji Yamanishi 14 out of 14 meetings Director Shigenao Ishiguro 14 out of 14 meetings Director Shigeki Sato 14 out of 14 meetings Outside Director Kozue Nakayama 14 out of 14 meetings Chair of the board Outside Director Mutsuo Iwai 14 out of 14 meetings Outside Director Shoei Yamana 14 out of 14 meetings - Operating Policy of the Board of Directors (FY 2024):

-

T128

Basic PolicyDirectors and Audit & Supervisory Board Members and the executive side endeavor toward the common purpose of achieving sustainable corporate growth and increasing the medium- to long-term corporate value of the TDK Group. T128 represents the final year of the current medium-term management plan and the year for formulating a new medium-term plan starting from T129. Therefore, the Board of Directors will provide supervision and advice from various perspectives to ensure the formulation of a plan that is highly feasible and compelling to stakeholders.

T128

Key Discussion Items- 1. Review of the long-term plan and discussion on the new medium-term management plan.

- 2. Discussion on strengthening stakeholder engagement.

- 3. Discussion on the next management structure.

- Main agenda items in the Board of Directors (FY 2024):

-

Management Strategy - ・Formulation of long-term vision and new medium-term plan

- ・Progress/validation of medium-term and current-term management plan (Company-wide and major business units)

- ・Financial strategy, fund plan

Governance - ・Effectiveness evaluation of the Board of Directors

- ・Group governance, Group risk management, Compliance management

- ・Internal audit report

- ・Internal control system and state of operation

Headquarters functions - ・Sustainability

- ・Global human resource strategy

- ・Technology development strategy, Production engineering strategy, Intellectual property strategy, Quality assurance

- ・Management system, Supply chain management

- ・Branding / PR

As well as the above, the Board of Directors discussed business matters, capital investment, business tie-up, etc.

-

b. Organization of the Audit & Supervisory Board

The Company has adopted the Audit & Supervisory Board Member System pursuant to the Companies Act of Japan and has appointed independent Outside Audit & Supervisory Board Members who are disinterested in the Company to strengthen the supervision of the Company’s management.

(The status of audit by Audit & Supervisory Board Members is as described in (3) [Status of Audit].)- Organization of the Audit & Supervisory Board(June 21. 2024):

Position at the Company Name Chairperson Full-time Audit & Supervisory Board Member Masato Ishikawa Full-time Audit & Supervisory Board Member Takakazu Momozuka Outside Audit & Supervisory Board Member Douglas K. Freeman Outside Audit & Supervisory Board Member Chizuko Yamamoto Outside Audit & Supervisory Board Member Takashi Fujino -

c. Overview of advisory organizations to the Board of Directors

〈The Nomination Advisory Committee〉

The Nomination Advisory Committee is chaired by an Outside Director of the Company and a majority of the members are Outside Directors. The said Committee reviews the conditions expected for the post of Director, Audit & Supervisory Board Member, and Corporate Officer and makes nominations. In this way, the Nomination Advisory Committee ensures the appropriate election of Directors, Audit & Supervisory Board Members and Corporate Officers and provides transparency in the decision-making process. In addition, the said Committee confirms the positions of Outside Directors and Outside Audit & Supervisory Board Members held at other companies every term, and investigates and examines the independence of candidates of Directors and Outside Audit & Supervisory Board Members (including cases where the status of independence changes during the term of office). After deliberating and comprehensively judging the content, the said Committee report the deliberation results to the Board of Directors.

- Organization of the Nomination Advisory Committee(June 21. 2024):

Position and Duties, etc. at the Company Name Chair of the committee Outside Director Kozue Nakayama Outside Director Mutsuo Iwai Outside Director Shoei Yamana Outside Director Toru Katsumoto Representative Director, President & CEO

General Manager of Humidifier Countermeasures HQNoboru Saito - Number of the Nomination Advisory Committee and attendance status (FY 2024):

-

Position at the Company Name Attendance Status Chair of the committee Outside Director Kozue Nakayama 10 out of 10 meetings Outside Director Mutsuo Iwai 10 out of 10 meetings Outside Director Shoei Yamana 10 out of 10 meetings Director Shigenao Ishiguro 10 out of 10 meetings Representative Director Noboru Saito 10 out of 10 meetings - Main agenda items in the Nomination Advisory Committee (FY 2024):

-

Officer structure - ・Selection of director candidates

- ・Organization of Board Advisory committees for the next term

- ・Organization of Corporate Officers for the next term

Governance - ・Appointment Policy and Procedure for Directors

- ・Succession planning

- ・Skill matrix

〈The Compensation Advisory Committee〉

The Compensation Advisory Committee is chaired by an Outside Director of the Company and a majority of the members are Outside Directors. The said Committee contributes to the securement of the transparency of remuneration decision-making process and the reasonableness of individual remunerations in light of corporate business performance, individual performance and general industry standards by deliberating and reporting to the Board of Directors on the remuneration system and the level of remuneration pertaining to Directors and Corporate Officers.

- Organization of the Compensation Advisory Committee(June 21. 2024):

Position and Duties, etc. at the Company Name Chair of the committee Outside Director Shoei Yamana Outside Director Kozue Nakayama Outside Director Mutsuo Iwai Outside Director Toru Katsumoto Representative Director & Senior Executive Vice President

Chief Financial OfficerTetsuji Yamanishi - Number of the Compensation Advisory Committee and attendance status (FY 2024):

-

Position at the Company Name Attendance Status Chair of the committee Outside Director Shoei Yamana 9 out of 9 meetings Outside Director Kozue Nakayama 9 out of 9 meetings Outside Director Mutsuo Iwai 9 out of 9 meetings Director Shigenao Ishiguro 9 out of 9 meetings Representative Director Tetsuji Yamanishi 9 out of 9 meetings - Main agenda items in the Compensation Advisory Committee (FY 2024):

-

Remuneration of Directors and Corporate Officers - ・Revision of Executive Compensation System (Introduction of Pre-Financial Performance-Based Compensation)

- ・Corporate Officer performance-linked bonuses for the current term

- ・Executive compensation table for the next term

- ・Corporate Officer performance-linked bonus target value for the next term

Executive remuneration of major subsidiaries ・Executive remuneration of overseas subsidiaries

〈The Corporate Governance Committee〉

The Corporate Governance Committee conducts deliberations on TDK's medium- to long- term corporate governance way and system, policy for TDK's corporate governance and matters to be consulted by the Board of Directors, etc. and continuously strives to enhance corporate governance for TDK’s sustainable growth and increase of its corporate value over the mid- to long-term.

- Organization of the Corporate Governance Committee(June 21. 2024):

Position and Duties, etc. at the Company Name Chair of the committee Representative Director & Senior Executive Vice President

Chief Financial OfficerTetsuji Yamanishi Outside Director Kozue Nakayama Outside Director Mutsuo Iwai Outside Director Shoei Yamana Outside Director Toru Katsumoto Representative Director, President & CEO

General Manager of Humidifier Countermeasures HQNoboru Saito Corporate Officer, GM, Corporate Strategy HQ Shuichi Hashiyama - Number of the Corporate Governance Committee and attendance status (FY 2024):

-

Position at the Company Name Attendance Status Chair of the committee Director Shigenao Ishiguro 4 out of 4 meetings Outside Director Kozue Nakayama 4 out of 4 meetings Outside Director Mutsuo Iwai 4 out of 4 meetings Outside Director Shoei Yamana 4 out of 4 meetings Representative Director Noboru Saito 4 out of 4 meetings Corporate Officer Shuichi Hashiyama 4 out of 4 meetings - Main agenda items in the Corporate Governance Committee (FY 2024):

-

Governance - ・TDK's corporate governance ideals and policies

- ・Operating Policy of the Board of Directors

- ・Annual agenda for the Board of Directors meetings

- ・Board of Directors’ Deliberation Criteria (Delegation of Authority)

- ・Evaluation of the effectiveness of the Board of Directors

- ・Internal control system and its operational status

- ・Compliance status with Corporate Governance Codes

Skills Matrix

| Name | Position | Corporate Management |

Global Business Experience |

Sales/ Marketing |

ESG/ Sustainability |

Technology/ Research & Development |

Manufacture/ Production Technology |

Finance/ Accounting |

Legal/ Compliance/Risk Management |

|

|---|---|---|---|---|---|---|---|---|---|---|

| Directors | Noboru Saito | Representative Director, President & CEO |

● | ● | ● | ● | ||||

| Tetsuji Yamanishi | Representative Director, Senior Executive Vice President |

● | ● | ● | ● | |||||

| Shigeki Sato | Director, Senior Vice President |

● | ● | ● | ● | |||||

| Kozue Nakayama | Outside Director | ● | ● | ● | ● | |||||

| Mutsuo Iwai | Outside Director | ● | ● | ● | ||||||

| Shoei Yamana | Outside Director | ● | ● | ● | ● | |||||

| Toru Katsumoto | Outside Director | ● | ● | ● | ● | |||||

| Audit & Supervisory Board Members |

Masato Ishikawa | Full-time Audit & Supervisory Board Member |

● | ● | ● | |||||

| Takakazu Momozuka | Full-time Audit & Supervisory Board Member |

● | ● | ● | ● | |||||

| Douglas K. Freeman | Outside Audit & Supervisory Board Member |

● | ● | |||||||

| Chizuko Yamamoto | Outside Audit & Supervisory Board Member |

● | ● | ● | ||||||

| Takashi Fujino | Outside Audit & Supervisory Board Member |

● | ● | ● | ● | |||||

| Skills the Company expect | Reasons for selecting the skills in question |

|---|---|

| Corporate Management | To contribute to a sustainable society and enhance corporate value, the capability to perform in corporate management and to manage and supervise executive divisions is required. |

| Global Business Experience | Experience and knowledge in global business are essential in TDK where over 90% of net sales is recorded outside of Japan. |

| Sales/Marketing | Sales and marketing skills are necessary to understand market demands and create new business opportunities from the conception of both technology-out and market-in. |

| ESG/Sustainability | An adequate understanding of ESG and sustainability, one of the most crucial issues in present-day society, is an important capability to supervise the corporate management. |

| Technology/Research & Development | As under the Corporate Motto “Contribute to culture and industry through creativity,” the Company aims to be a company that contributes to the realization of a sustainable future by accelerating the advancements in technology and the transformation of society. |

| Manufacture/Production Technology | An adequate understanding and passion for Monozukuri (manufacturing experience) is required as quality and reliability of products are the foundation of TDK’s business. |

| Finance/Accounting | To aim for sustainable growth and carry out necessary investments, knowledge in finance and accounting, which supports a sound and solid financial basis, is required. |

| Legal/Compliance/Risk Management | Legal, compliance and risk management skills are necessary to respond to the trust of all stakeholders and to enhance corporate value in a sound and sustainable manner. |

Status of audit by Audit & Supervisory Board Members

The Audit & Supervisory Board is comprised of 2 full-time Audit & Supervisory Board Member and 3 Outside Audit & Supervisory Board Member, and audits business execution by Corporate Officers and operations and financial status of both domestic and overseas subsidiaries. Out of these members, full-time Audit & Supervisory Board Member Mr.Takakazu Momozuka has the experience of serving for many years in the field of financing and accounting of the Company, Outside Audit & Supervisory Board Member Ms. Chizuko Yamamoto is a certified public accountant. Outside Audit & Supervisory Board Member Mr. Takashi Fujino has knowledge concerning accounting and finance in companies with global operations. Thus, they have considerable knowledge in the field of financing and accounting.

During the fiscal year under review, the Company has held Board of Directors meetings once a month (total of 15 times). The details of attendance for each Audit & Supervisory Board members is as follows. Note that the attendance records of Mr. Masato Ishikawa, Ms. Chizuko Yamamoto, and Mr. Takashi Fujino are listed for the Audit & Supervisory Board meetings held after June 22, 2023 (the date of the regular shareholders' meeting).

| Position | Name | Attendance (Attendance ratio) |

|---|---|---|

| Full-Time Audit & Supervisory Board Member | Takakazu Momozuka | 15 of the 15 meetings (Attendance ratio: 100%) |

| Full-Time Audit & Supervisory Board Member | Masato Ishikawa | 10 of the 10 meetings (Attendance ratio: 100%) |

| Outside Audit & Supervisory Board Member | Douglas K. Freeman | 14 of the 15 meetings (Attendance ratio: 93%) |

| Outside Audit & Supervisory Board Member | Chizuko Yamamto | 10 of the 10 meetings (Attendance ratio: 100%) |

| Outside Audit & Supervisory Board Member | Takashi Fujino | 10 of the 10 meetings (Attendance ratio: 100%) |

The Audit & Supervisory Board Members timely collect information regarding management policies of TDK and conditions of business execution by Corporate Officers, etc. by attending the Board of Directors meetings as well as through regular attendance at the Executive Committee meetings, business plan review meetings and other important meetings and inspection of management reports and applications for internal decision-making. The Audit & Supervisory Board Members share and deliberate such information among themselves. The full-time Audit & Supervisory Board Members conducted hearings from operating department managers and headquarter function managers regarding the conditions of business execution and conducted audit of the Company’s operating departments and headquarters and the subsidiaries selected according to importance based on the audit policy setting forth the priority audit items in the fiscal year under review. The full-time Audit & Supervisory Board Members share the issues identified through such hearings and audit and confirm the countermeasures therefor with the relevant operating departments and headquarters, etc. Furthermore, the full-time Audit & Supervisory Board Members regularly had meetings and shared information with the Audit & Supervisory Board Members of the company’s subsidiaries and exchanged opinions with them on important issues and findings for auditing the entire TDK Group. The Outside Audit & Supervisory Board Members held regular meetings for information sharing with the Outside Directors to exchange opinions, and received briefings from relevant operating departments and headquarters, etc. to confirm the status of responses to major issues, etc.

The Audit & Supervisory Board establishes the Company’s audit policy and annual audit plan, confirms the Company’s business conditions through regular meetings with the Board of Directors and Representative Director, etc., and expresses opinions and provides recommendations from time to time regarding tasks to be addressed by TDK (including matters concerning corporate governance and compliance), development and operation status of internal control, risks surrounding TDK, important issues in the Audit & Supervisory Board Members’ audit and other issues. Also, the Audit & Supervisory Board receives the internal audit report from the internal audit department and promote information sharing and collaboration with them through establishing regular meetings. A summary of These audit results, identified issues and risks, confirmed countermeasures and internal audit status are shared among all Audit & Supervisory Board Members at the Audit & Supervisory Board meetings, and the issues are deliberated at the Audit & Supervisory Board meetings and reported to the Directors when appropriate. The Audit & Supervisory Board Members have meetings from time to time with an attorney with whom it has entered into an advisory contract and receive legal advice regarding Audit & Supervisory Board Members’ duties timely, and thereby improve the effectiveness of Audit & Supervisory Board Members’ duties.

On the other hand, the Audit & Supervisory Board promotes collaboration with the Accounting Auditor by discussing about audit plan with the Accounting Auditor, holding multiple meetings (including audit results report meeting and liaison meeting), and exchanging opinions regarding key audit matters (KAM) such as the valuation of goodwill and tangible fixed assets. To support the Audit & Supervisory Board, TDK has set an Audit & Supervisory Board Members Office, separate from the operational function to support the administration of Audit & Supervisory Board and to support each member’s operation.

Status of internal audit

The Management Review & Support Group, an internal audit department of the Company, is organized by 15 members.

In this fiscal year, The Management Review & Support Group conducted hearings from the four committees under the direct control of the Executive Committee regarding their activities and verified compliance with relevant laws and regulations, internal regulations, etc. and the efficiency and effectiveness of the operation at operating departments and principal subsidiaries. Also, the Management Review & Support Group conducted the evaluation of the “effectiveness of internal controls over financial reporting” in accordance with the Financial Instruments and Exchange Act of Japan at important locations and important subsidiaries in Japan and overseas. The Management Review & Support Group regularly reports about the results thereof to the President, the Board of Directors and the Audit & Supervisory Board Members.

The Management Review & Support Group and full-time Audit & Supervisory Board Members share information. The Management Review & Support Group submits internal audit reports to full-time Audit & Supervisory Board Members, receives results of the Audit & Supervisory Board Members’ audit from full-time Audit & Supervisory Board Members and seeks to conduct effective internal audits.

The Management Review & Support Group regularly confirms the Accounting Auditor’s audit activities through quarterly financial statements, etc. and regularly exchanges opinions with the Accounting Auditor regarding the status of evaluation of the “effectiveness of internal controls over financial reporting” in accordance with the Financial Instruments and Exchange Act of Japan.

Status of accounting audit

- Name of auditor

KPMG AZSA LLC - Continuing Auditing Period

21 years - Certified public accountants who conducted the accounting audit

Mr. Michitaka Shishido

Mr. Michiaki Yamabe

Mr. Ryoma Dodo - Constitution of assistant in conducting the accounting audit

Working to assist the above accountants in conducting the accounting audit of the Company were 14 certified public accountants, 9 assistant certified public accountants, and 72 other people. - Select standard and reason of auditor

The Audit & Supervisory Board prescribes procedures and standards for Appointment, Dismissal, and Reappointment of Accounting Auditors in the Regulations of the Audit & Supervisory Board and Standards for Appointment, Dismissal, and Reappointment of Accounting Auditors and selects the Company’s Accounting Auditor based on these procedures and standards. When judging selection, the Audit & Supervisory Board evaluates appropriateness of the quality control organization of the audit firm to be accounting auditor, rationality and validity of conducting the audit by the audit team and judges comprehensively considering the validity of the audit fee as well. In addition, the accounting auditor could be non-reappointed in a case where there is any item that does not meet the standard of Reappointment.

If all of the Audit & Supervisory Board Members acknowledge that the Company’s Accounting Auditor falls under any of the conditions set forth in Article 340 paragraph 1 of the Companies Act of Japan and it is difficult for the Accounting Auditor to properly execute auditing, the Company shall dismiss the Accounting Auditor by a unanimous resolution of the Audit & Supervisory Board. In addition to cases falling under any of the statutory reasons for dismissal of accounting auditors, if any fact occurs that is recognized as casting doubt upon important factors relating to the Accounting Auditor’s execution of duties, such as the Accounting Auditor’s qualifications, independency and ethics, the Audit & Supervisory Board will, in accordance with the Regulations of the Audit & Supervisory Board and Standards for Appointment, Dismissal, and Reappointment of Accounting Auditors, decide as to whether the Accounting Auditor shall be dismissed or shall not be re-appointed, comprehensively taking the facts into account. - Evaluation of auditor by the Audit & Supervisory Board Members and the Audit & Supervisory Board

The Audit & Supervisory Board evaluated the status of audit activity of the accounting auditor for the previous fiscal year. The objects of evaluation are appropriateness of the quality control organization of the accounting auditor and rationality and validity of conducting the audit by the audit team, mentioned above. The Audit & Supervisory Board has decided to reappoint KPMG AZSA LLC as accounting auditor for FY2024 based on these results of evaluation for the fiscal year under review.

Audit fees, etc.

- Details of fees to auditors

Category Fiscal 2023 Fiscal 2024 Audit fees Fees for non-attest service Audit fees Fees for non-attest service Filing company 394 - 399 5 Consolidated subsidiaries 46 - 47 - Total 440 - 446 5 In fiscal 2024, the content of non-attest service that TDK Corporation will pay to KPMG AZSA LLC, TDK Corporation’s auditors, is for the production of comfort letters related to the issue of bonds.

-

Details of fees to member firms to which auditors belong (member firms of KPMG) (excluding a.)

Category Fiscal 2023 Fiscal 2024 Audit fees Fees for non-attest service Audit fees Fees for non-attest service Filing company - 66 - 66 Consolidated subsidiaries 807 204 872 207 Total 807 270 872 273 In fiscal 2023 and fiscal 2024, the content of non-attest service that TDK Corporation and consolidated subsidiaries will pay to member firms of KPMG is mainly tax related.

- Details of other material audit fees

(Fiscal 2023)

TDK Electronics AG, consolidated subsidiary of TDK Corporation, has paid ¥235 million to Ernst & Young as audit fees.

(Fiscal 2024)

TDK Electronics AG, consolidated subsidiary of TDK Corporation, has paid ¥259 million to Ernst & Young as audit fees. - Policy of deciding audit fees

TDK Corporation carefully considers the independence of auditors and decides the audit fees by resolution of the Board of Directors. - Reason of agreeing audit fees by the Audit & Supervisory Board

Audit & Supervisory Board consented to audit fees for fiscal 2024, after examining the Accounting Auditor’s audit plan, the status of duties conducted in previous fiscal years, and the basis for calculation of the remuneration estimate by receiving the necessary materials and hearing reports from Directors, relevant in-house departments, and the Accounting Auditor.