[ 2nd Quarter of fiscal 2019 Performance Briefing ]Consolidated Results for 2Q of FY March 2019

Mr. Tetsuji Yamanishi

Senior Vice President

Hello, I’m Tetsuji Yamanishi, Senior Vice President of TDK. Thank you for taking the time to attend TDK’s performance briefing for the first half (April to September) of the fiscal year ending March 2019. I will be presenting an overview of our consolidated results.

Key points concerning earnings for first half of FY March 2019

First, let’s take a look at the key points concerning earnings. Net sales rose 15.8% year on year, and operating

income increased sharply by 40.7%. Net sales and operating income both achieved new records on a half-year

and a quarterly basis.

In the Passive Components segment, sales of Capacitors and Inductive Devices continued to increase steadily in

the automotive market, where demand has remained strong. Notably, in MLCCs, TDK saw continuous expansion in

both net sales and operating income as it steadily captured demand for application products with high reliability and

redundancy characteristics for automotive use. This contributed immensely to enhancing the profitability of the

Passive Components segment as a whole.

In the Energy Application Products segment, in Rechargeable Batteries, we posted sharp increases in both sales

and operating income. This result reflected further expansion of sales to major Chinese customers and a continued

favorable trend in sales for applications other than smartphones such as tablets, laptops, and game consoles,

coupled with the benefits of higher capacity utilization due to increased production and continuous cost saving

efforts.

In the Magnetic Application Products segment, HDD Head sales volume decreased by around 6% year on year.

Meanwhile, sales of Nearline HDD Heads increased, boosted by a tailwind of higher demand from data centers.

With the added impact of reorganizing our production bases, both sales and operating income increased, with a

marked increase in profitability.

In Magnets, TDK has been strengthening its business through product development and process innovation, aiming

for business expansion in the automotive market, where demand is increasing. For Ferrite Magnets, we judged the

situation too difficult to effect a major recovery in earnings in the short term, and recorded impairment losses on

long-lived assets in the second quarter of the fiscal year ending March 2019, with a view to revitalizing the Magnet

business.

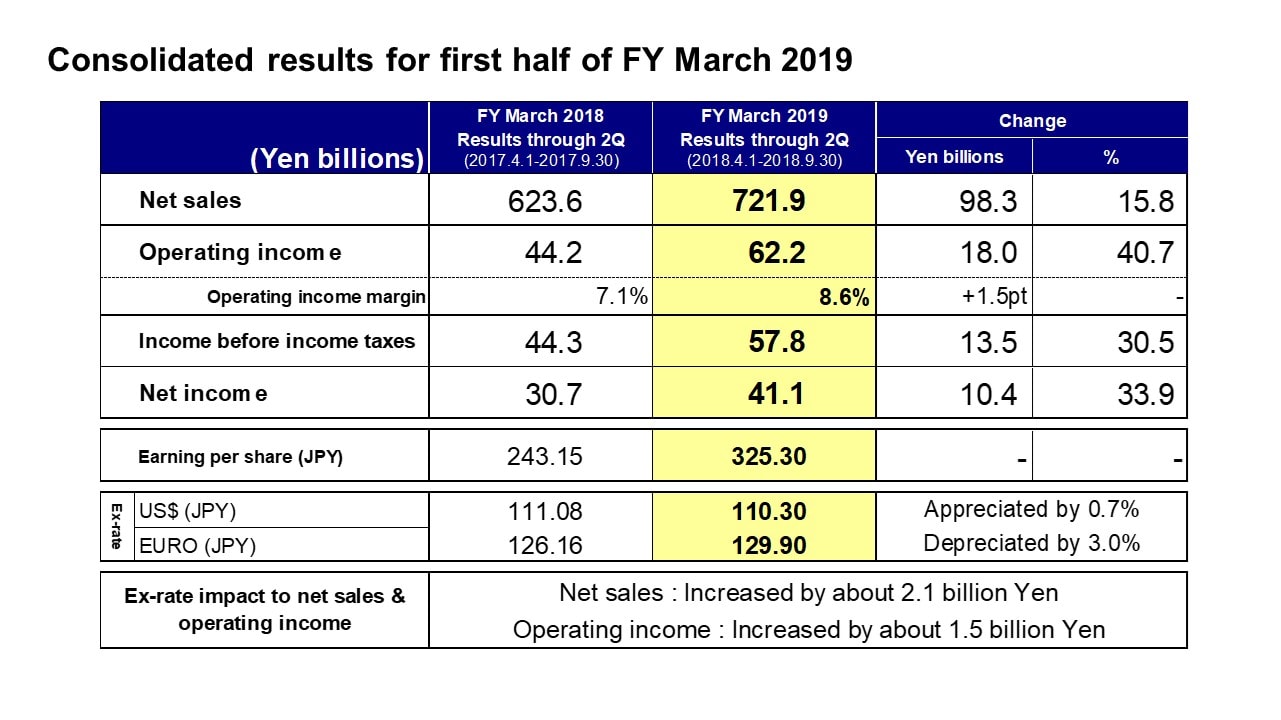

Consolidated results for first half of FY March 2019

Moving along, I would like to present an overview of our results. Net sales were 721.9 billion yen, an increase of

98.3 billion yen, or 15.8%, year on year. Operating income, including impairment losses of around 4.7 billion yen,

was 62.2 billion yen, up 18.0 billion yen, or 40.7%, year on year. Income before income taxes was 57.8 billion yen,

net income was 41.1 billion yen, and earnings per share were 325.30 yen. In accordance with changes in U.S.

accounting standards related to retirement benefit cost, a 1.9 billion yen portion of the net benefit cost included in

operating expense in profit/loss in the previous fiscal year was reclassified to other deductions. From the first

quarter of the fiscal year ending March 2019, the amounts pertaining to the change in accounting standards have

been recorded as other deductions.

The average exchange rates for the first half of the fiscal year ending March 2019 were 110.30 yen against the U.S.

dollar, an appreciation of 0.7%, and 129.90 yen against the euro, a depreciation of 3.0%. In terms of the impact of

these exchange rate movements, net sales and operating income were pushed up by around 2.1 billion yen and

around 1.5 billion yen, respectively.

With regard to exchange rate sensitivity, as with our previous estimate, we estimate that a change of 1 yen against

the U.S. dollar would have an impact of around 1.2 billion yen on full-year operating income, while a change against

the euro would have an impact of around 0.2 billion yen.

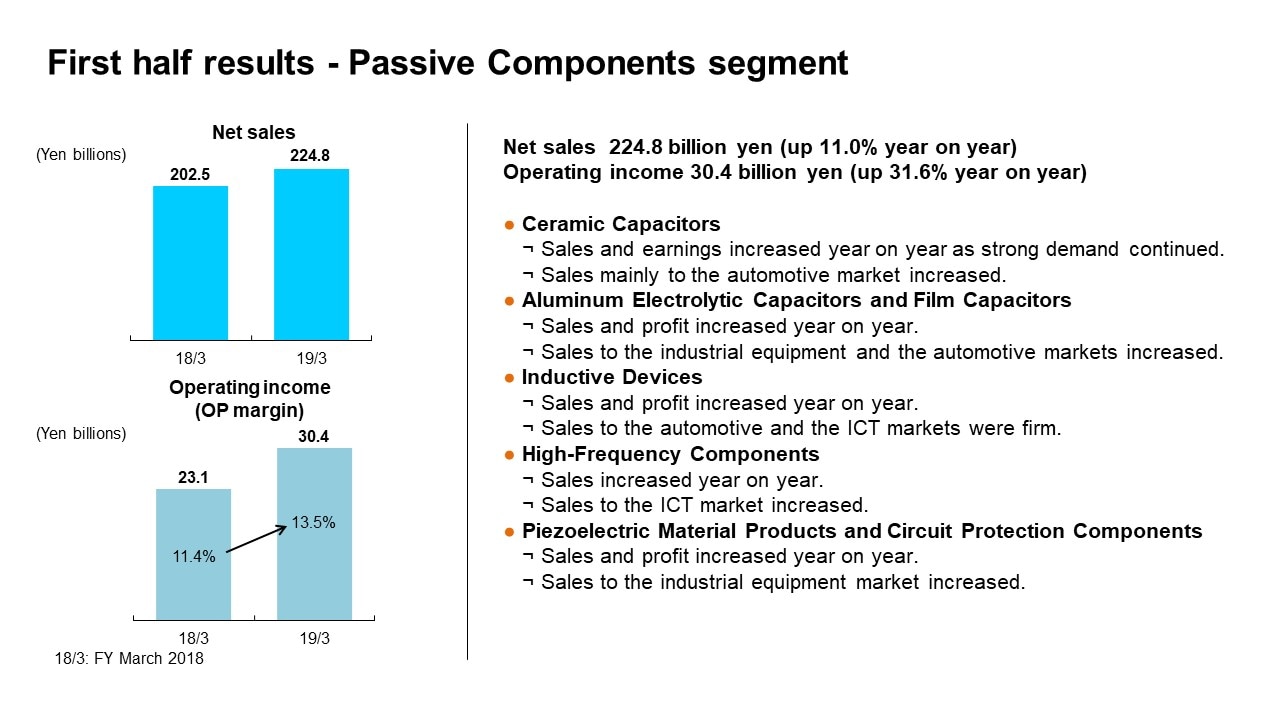

First half results - Passive Components segment

Next, I would like to explain our business segment performance.

From the fiscal year ending March 2019, we reclassified certain products such as Camera Module Actuators and

therefore we have regrouped results for the previous fiscal year. In the Passive Components segment, this change

reduced net sales for the first half of the fiscal year ended March 2018 by 12.4 billion yen and decreased operating

income by 0.8 billion yen.

In the first half of the fiscal year ending March 2019, net sales were 224.8 billion yen, an increase of 11.0% year on

year, and operating income was 30.4 billion yen, an increase of 31.6% year on year. The operating income margin

was 13.5%. We made progress on expanding sales and improving profitability. In Ceramic Capacitors, sales rose

as we leveraged products with high reliability and redundancy characteristics to firmly capture surging demand in

the automotive market. Substantial profit growth resulted from marked improvements in profitability driven by

contributions from an improved product mix and productivity enhancements. In Aluminum Electrolytic Capacitors

and Film Capacitors, sales and profit increased year on year, underpinned by growth in sales to the industrial

equipment market as well as solid sales to the automotive market. In Inductive Devices, sales to the automotive

market continued to increase firmly, along with sales for smartphones, to achieve steady earnings growth. In High-

Frequency Components, sales increased year on year atop favorable sales of Ceramic Filters for use in Chinese

smartphones. In Piezoelectric Material Products and Circuit Protection Components, sales to the automotive and

the industrial equipment markets trended favorably, leading to higher sales and profits with improved profitability.

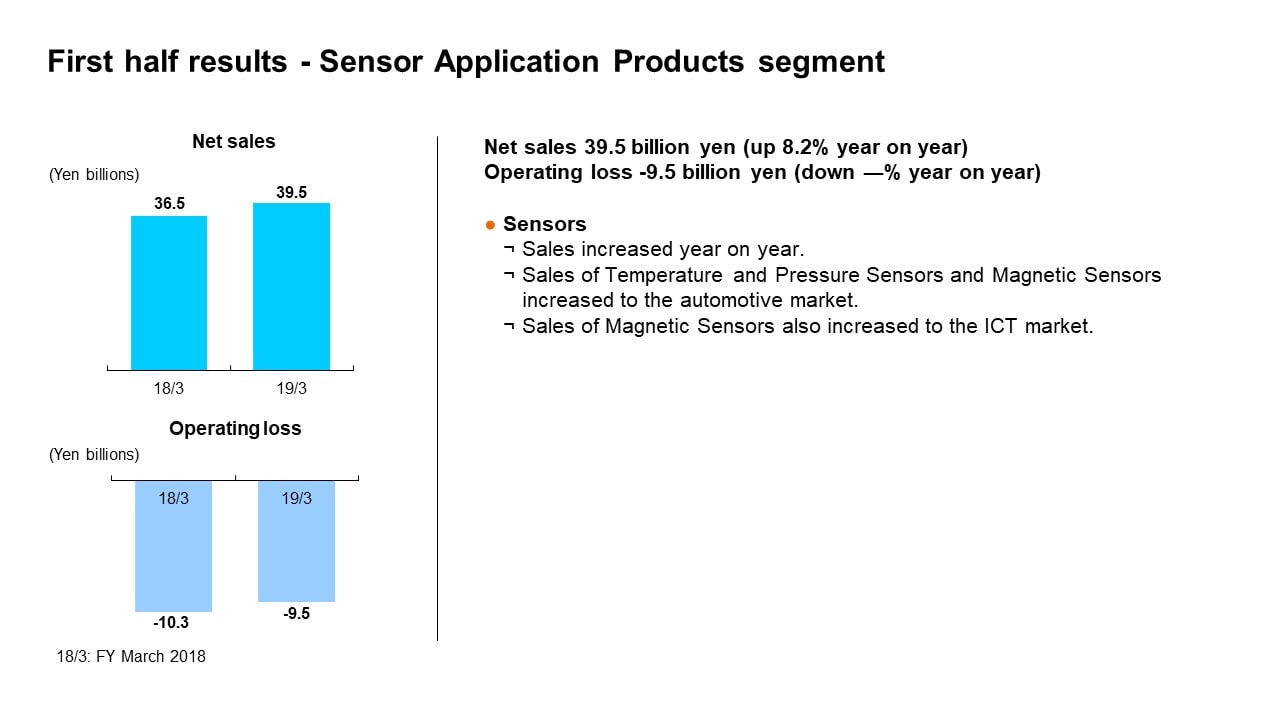

First half results - Sensor Application Products segment

In the Sensor Application Products segment, the reclassification of certain products reduced net sales for the first

half of the fiscal year ended March 2018 by 0.1 billion yen and increased operating income by 0.1 billion yen.

In the first half of the fiscal year ending March 2019, net sales were 39.5 billion yen, up 8.2% year on year.

Operating loss was 9.5 billion yen, including 2.8 billion yen in acquisition-related costs for InvenSense.

Sales to the automotive market trended firmly, rising around 16% centered on sales of Temperature and Pressure

Sensors and Magnetic Sensors to the European and Japanese markets. Sales of Magnetic Sensors to the ICT

market increased steadily driving significant growth in net sales and improved profitability. MEMS Motion Sensors

saw a larger operating loss, reflecting the impact of a decline in demand on sales for game consoles, an anticipated

decline in sales to core customers in the ICT market, and cost burdens such as for development resources to

accelerate commercialization of new models and initiatives to expand the customer base.

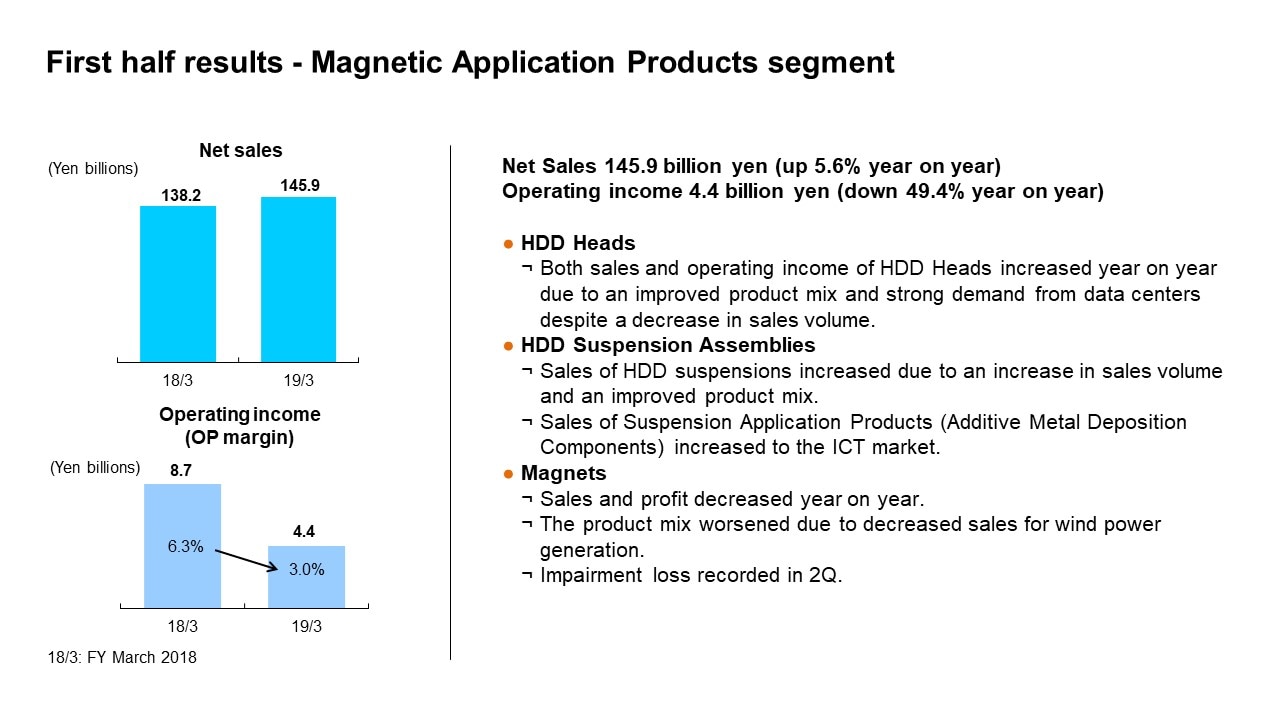

First half results - Magnetic Application Products segment

In the Magnetic Application Products segment, the reclassification of businesses in connection with a

reorganization reduced net sales and operating income for the first half of the fiscal year ended March 2018 by 24.5

billion yen and 2.4 billion yen, respectively.

In the first half of the fiscal year ending March 2019, net sales rose 5.6% year on year to 145.9 billion yen, operating

income decreased by 49.4% to 4.4 billion yen, and the operating income margin was 3.0%. In the second quarter,

TDK recorded impairment losses of around 4.7 billion yen in Ferrite Magnets, weighing heavily on profits. On a real

basis excluding one-time losses, operating income increased by 0.4 billion yen, or 4.6%.

Sales volume of HDD Heads decreased by around 6%. However, sales of Nearline HDD Heads increased due to

higher HDD demand from data centers. As a result, sales increased by around 6%, along with an improvement in

profitability, owing to the benefits of higher average sales prices in line with an improved product mix. Sales volume

of HDD Suspensions increased, and the product mix improved with an increase in compact, high-value-added

products, raising the average sale price. Moreover, sales of Suspension Application Products increased due to

higher sales to the ICT market, leading to an increase in operating income as well.

In Magnets, sales and profits decreased, partly reflecting a worsening product mix due to decreased sales to the

industrial equipment market, such as for wind power generation. Moreover, the Ferrite Magnet business saw losses

worsen significantly due to the recording of impairment losses during the second quarter ahead of revitalizing the

Magnet business amid short-term adversity for improving earnings.

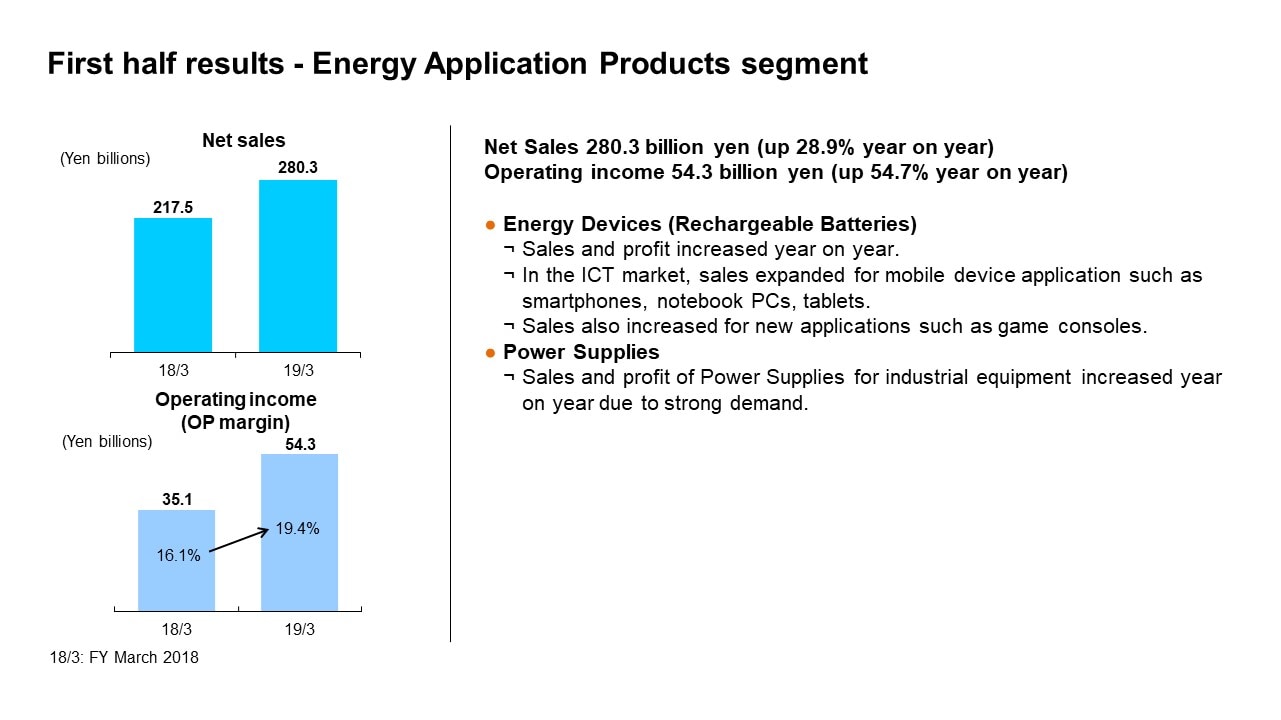

First half results - Energy Application Products segment

In the Energy Application Products segment, a reorganization saw the businesses of Power Supplies for industrial

equipment and Power Supplies for automobiles join the existing Rechargeable Battery business, causing net sales

to increase by 34.2 billion yen and operating income to increase by 1.1 billion yen for the first half of the fiscal year

ended March 2018.

In the first half of the fiscal year ending March 2019, net sales rose 28.9% year on year to 280.3 billion yen and

operating income surged 54.7% to 54.3 billion yen. Profitability also improved significantly together with profit

growth, with the operating income margin at 19.4%.

In Rechargeable Batteries, sales to the Chinese smartphone market increased sharply, and sales also increased

steadily for applications other than smartphones, such as tablets, laptops, and game consoles. By capturing

synergies between growth in sales volume and increased productivity, we have effectively enhanced profits. Power

Supplies for industrial equipment achieved growth in sales and profits due to strong demand.

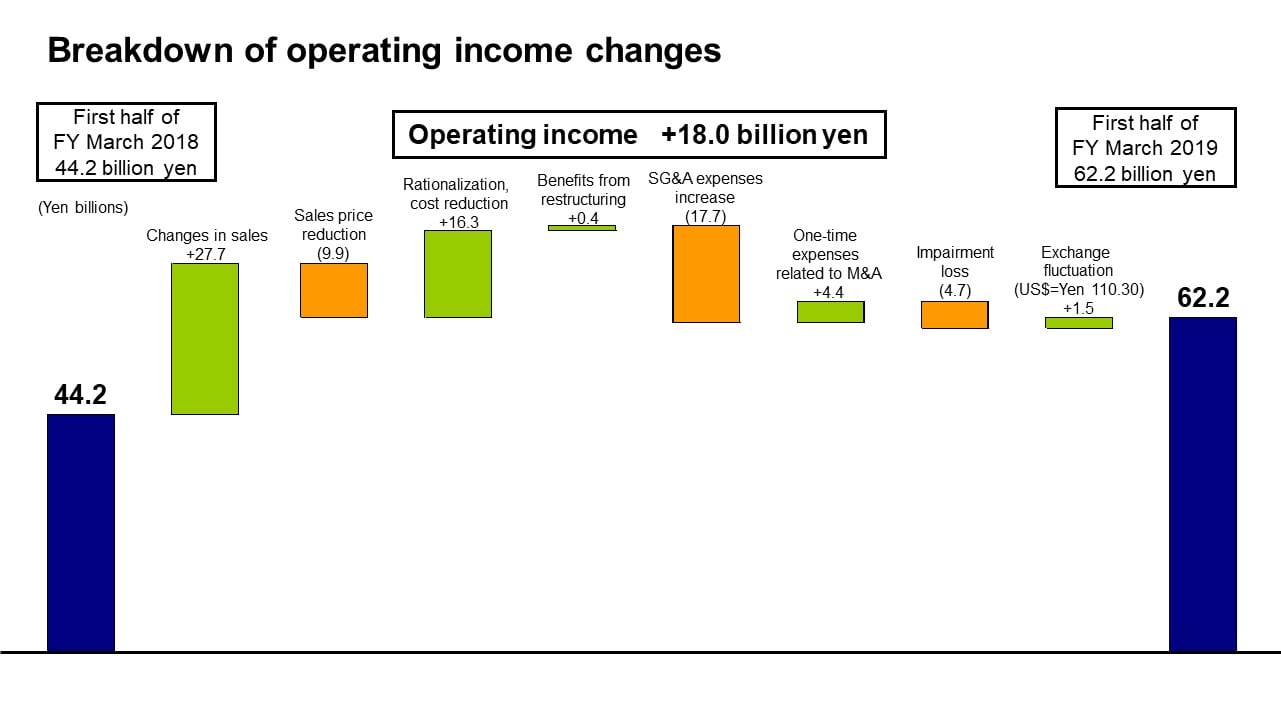

Breakdown of operating income changes

Next is the breakdown of the change in operating income. Let’s take a look at the main factors behind the increase of 18.0 billion yen in operating income. First, there was a positive impact of around 27.7 billion yen from an increase in net sales centered on Capacitors, HDD Heads, and Rechargeable Batteries. Reductions in sales prices had a negative impact of around 9.9 billion yen, but this was absorbed by the positive impact of 16.3 billion yen from rationalization and cost reductions and around 0.4 billion yen in benefits from restructuring implemented in the fourth quarter of the previous fiscal year. However, SG&A expenses increased by 17.7 billion yen due to increases in administration and development expenses in connection with business expansion in Rechargeable Batteries, as well as higher costs arising from strengthening the development framework in the Sensor business. Excluding the impacts of exchange rate fluctuations and one-time changes in expenses, operating income on a real basis increased by 16.8 billion yen. The overall increase of 18.0 billion yen includes a decrease of 4.4 billion yen in onetime M&A-related expenses, impairment losses of 4.7 billion yen, and an increase of 1.5 billion yen from exchange rate fluctuations.

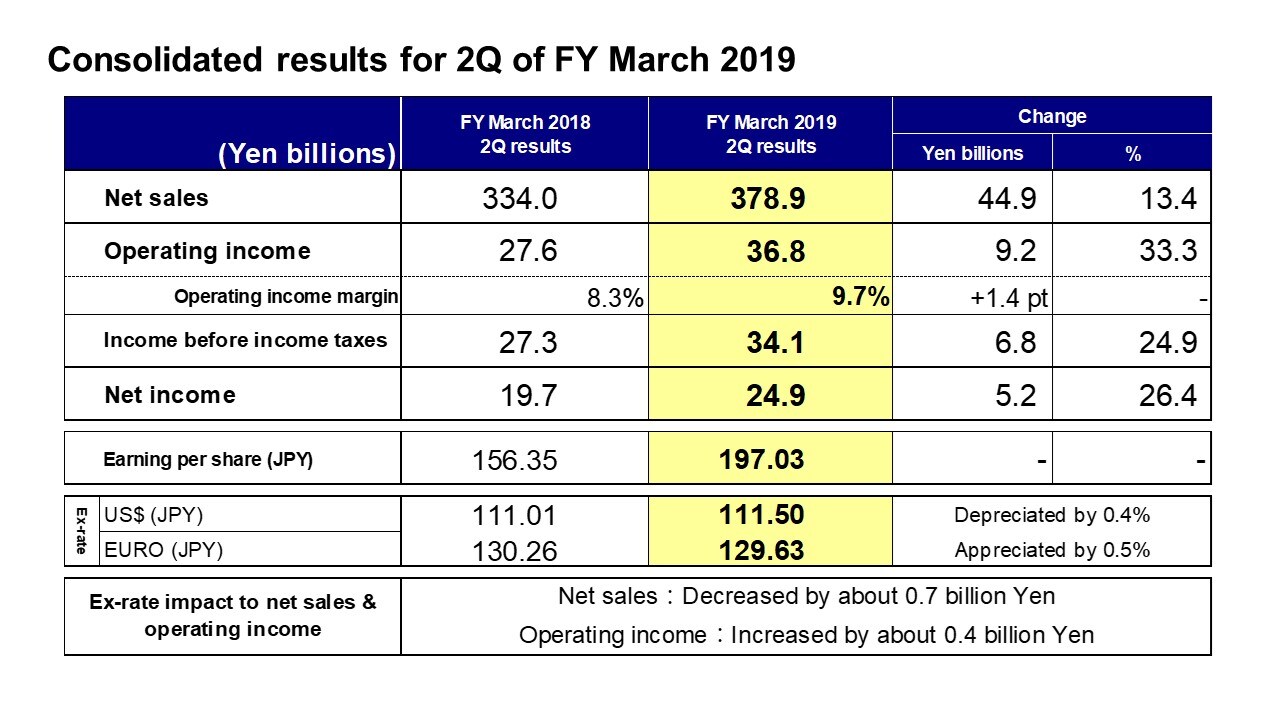

Consolidated results for 2Q of FY March 2019

Next, let’s look at consolidated results for the second quarter of the fiscal year ending March 2019. In the second quarter of the fiscal year ending March 2019, net sales rose 13.4% year on year to 378.9 billion yen and operating income increased by 33.3% to 36.8 billion yen, setting new record highs for both net sales and operating income on a quarterly basis. This result includes impairment losses of 4.7 billion yen recorded in the second quarter, and on a real basis, operating income was 41.5 billion yen, and the earnings structure improved markedly with an operating income margin of around 11%. Net income was 24.9 billion yen, up 26.4%.

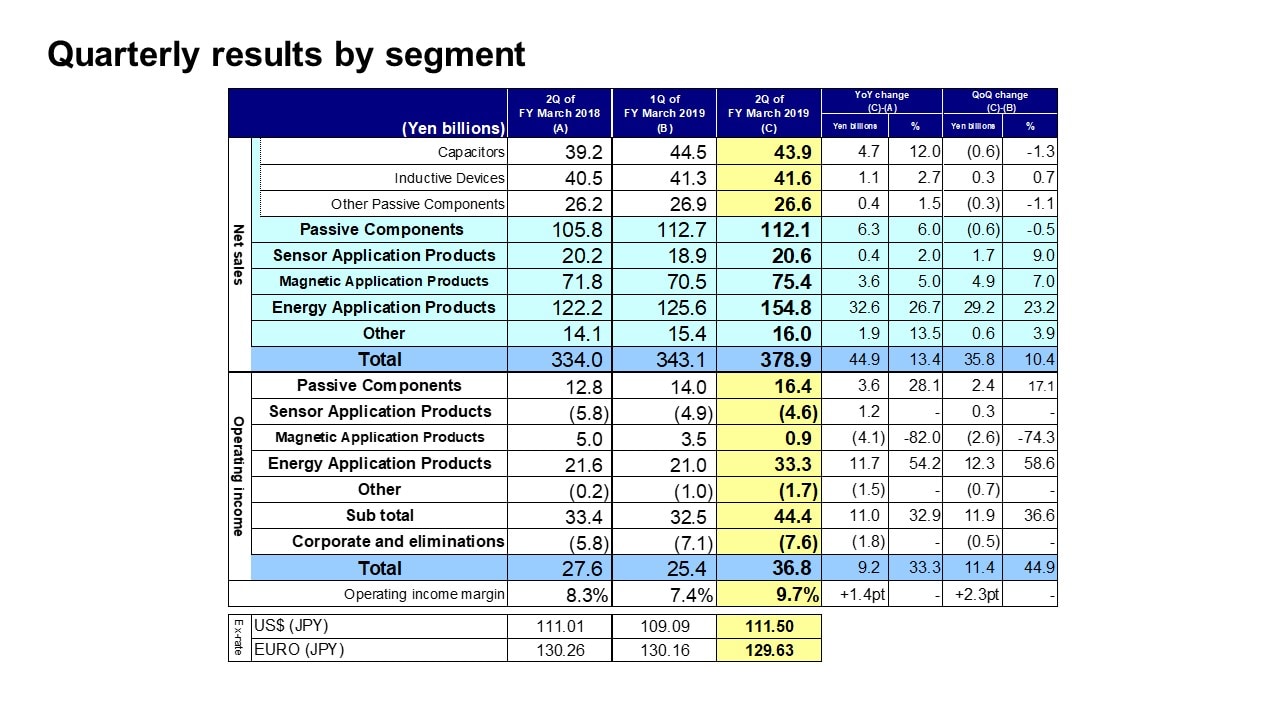

Quarterly results by segment

Next, I would like to explain the factors behind the changes in segment net sales and operating income from the first quarter to the second quarter of the fiscal year ending March 2019.

Let’s begin with net sales in the Passive Components segment. Net sales in this segment decreased by 0.6 billion yen, or 0.5%, from the first quarter. Ceramic Capacitor sales were strong to the automotive market. On the other hand, sales of Aluminum Electrolytic Capacitors and Film Capacitors slipped by 0.6 billion yen, or 1.3%, from the first quarter as sales for use in renewable energy declined heavily due to changes in China’s feed-in tariff (FIT) system. Net sales of Inductive Devices increased by 0.3 billion yen, or 0.7%, from the first quarter. Sales to the automotive market were firm, as with Ceramic Capacitors. In Other Passive Components, net sales declined by 0.3 billion yen, or 1.1%. In High Frequency Components, sales of Ceramic Filters for Chinese smartphones increased. Sales of Piezoelectric Material Products and

Circuit Protection Components declined for the automotive market due to a temporary lull in orders in Europe due to the enactment of common global exhaust emissions testing legislation. Operating income in the Passive Components segment increased by 2.4 billion yen, or 17.1%, from the first quarter. The main factors were higher profits from improvements in the product mix and productivity in Ceramic Capacitors and the impact of higher sales and profits from Inductors and High Frequency Components.

In the Sensor Application Products segment, net sales rose by 1.7 billion yen, or 9.0%, from the first quarter. Sales of Temperature and Pressure Sensors were mainly level, affected by the aforementioned enactment of exhaust emissions testing legislation. Sales of Magnetic Sensors to the ICT market increased significantly, while sales of MEMS Sensors to the same market declined but increased for drones and game consoles. Operating income returned to profit due to higher profits atop the increase in sales of Magnetic Sensors. In MEMS Sensors, the acquisition-related costs for InvenSense remained the same as the first quarter at 1.4 billion yen; however, operating loss widened slightly as we increased development resources from the first quarter in a bid to accelerate new product development. Overall operating loss for the Sensor Application Products segment decreased by about 0.3 billion yen.

In the Magnetic Application Products segment, net sales increased by 4.9 billion yen, or 7.0%, from the first quarter. HDD Head sales rose by 5% as the shipment index increased by 4% from the first quarter, from 93 to 97. HDD Suspension Assembly sales increased significantly due to an increase in sales volume of Suspension Assemblies and the peak season for customers in Suspension Application Product sales.

Overall, HDD Heads and HDD Suspension Assemblies recorded a marked increase in sales. Sales of Magnets increased slightly overall as sales of Metal Magnets to the automotive market grew, despite a drop in sales for the industrial equipment market led by a decline in sales of magnets for wind power generation. Operating income in the Magnetic Application Products segment declined by 2.6 billion yen from the first quarter, but increased by 2.1 billion yen on a real basis excluding impairment losses of 4.7 billion yen recorded in the second quarter. Both HDD Heads and HDD Suspension Assemblies saw growth in profit, while Magnets saw losses worsen on a real basis, reflecting a deterioration in the mix of products sold and a slide in productivity.

In the Energy Application Products segment, net sales increased by 29.2 billion yen, or 23.2%, from the first quarter. In Rechargeable Batteries, sales increased as sales for use in Chinese smartphones grew steadily, and sales increased in North America and for tablets, laptops and other products. Sales of Power Supplies for industrial equipment were steady. Operating income in the Energy Application Products segment was 33.3 billion yen, an increase of 12.3 billion yen from 21.0 billion yen in the first quarter. In Rechargeable Batteries, an increase in marginal profit due to an increase in sales volume and progress in cost improvement contributed significantly. Profitability also increased for Power Supplies for industrial equipment following progress in rationalization.

That concludes my presentation. Thank you very much for your attention.