[ Financial Results for Fiscal 2018 Performance Briefing ]Consolidated Full Year Projections for FY March 2019

Mr. Shigenao Ishiguro

President & CEO

Hello, I’m Shigenao Ishiguro, President & CEO of TDK. Today, I’d like to go over our consolidated earnings projections for the fiscal year ending March 31, 2019.

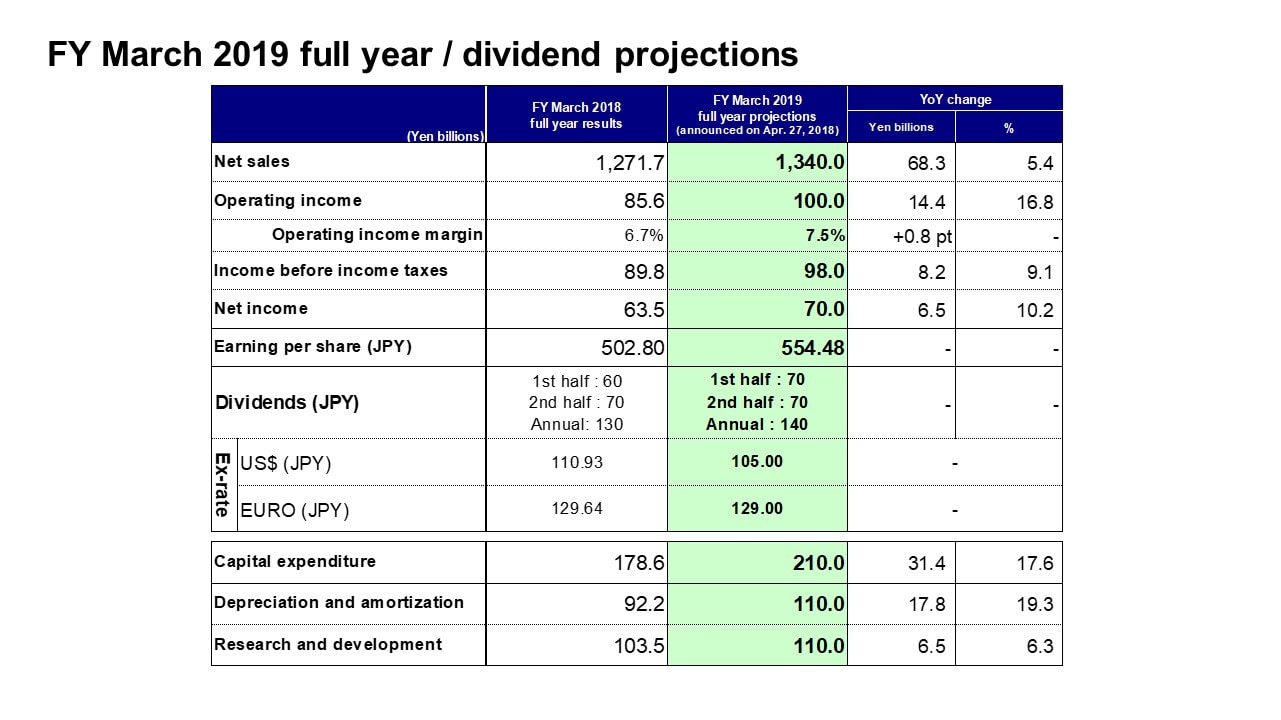

FY March 2019 full year / dividend projections

First, our earnings projections assume an average exchange rate of 105 yen against the U.S. dollar and 129 yen against the euro.

Assuming an appreciation in the yen of roughly 5% against the U.S. dollar, we are targeting net sales of 1,340.0 billion yen. This would be a record-high result for a sixth consecutive year. We are also projecting operating income of 100.0 billion yen. This means we will be targeting record-high operating income at the 100.0 billion yen level for the first time in real terms.

We are projecting income before income taxes of 98.0 billion yen, net income of 70.0 billion yen, and earnings per share of 554.48 yen. As for dividends, the interim dividend and year-end dividend are both projected at 70 yen per share, bringing the annual dividend to 140 yen per share, an increase of 10 yen from the previous fiscal year.

We are projecting capital expenditure of 210.0 billion yen, depreciation and amortization of 110.0 billion yen and research and development expenses of 110.0 billion yen. We plan to increase capital expenditure by around 30.0 billion yen from our actual capital expenditure of 178.6 billion yen in the fiscal year ended March 2018.

Under TDK’s new Medium-Term Plan, which begins in the fiscal year ending March 2019, we will implement the strategic investments needed to build production systems for the core businesses and technologies that will be key to achieving the targets for the plan’s final year. To this end, we will advance a wide range of initiatives. In the Passive Components segment, we will establish model lines primarily for capacitors. In the Sensor Application Products segment, we will execute investments to ramp up production of MEMS and TMR sensors. In the Magnetic Application Products segment, we will increase production of next-generation Heads and micro Dual-stage Actuators, along with establishing sites for Magnetic Products. In the Energy Application Products segment, we will invest in quality and safety, in addition to ramping up production capacity. Through these capital expenditures, we will address market needs appropriately to pave the way for expanding sales, with the aim of enhancing earnings.

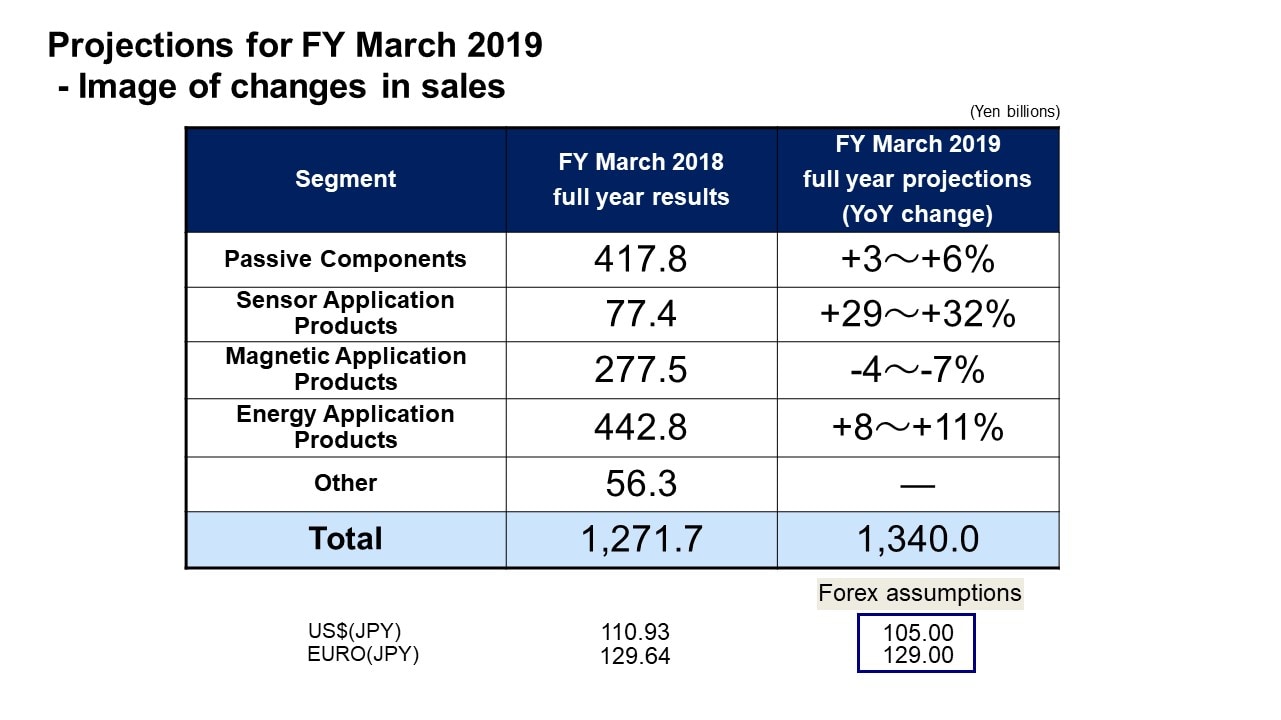

Projections for FY March 2019 - Image of changes in sales

I’d now like to present an image of changes in consolidated sales in each segment, which underlie our full-year projections for the fiscal year ending March 2019. It is based on a reclassification of sales for the fiscal year ended March 2018 into the new reporting segment framework I previously explained.

First, for the Passive Components segment, we are projecting a net sales increase of 3-6%. In the automotive market, we expect surging demand to increase even further with expansion in the adoption of xEVs (HEV, PHEV, EV, etc.), advanced driver assistance systems (ADAS), automated driving and other developments. Based on this outlook, we anticipate that Capacitors and Inductors will drive sales growth.

In the Sensor Application Products segment, we are projecting net sales growth of 29-32%. Having positioned MEMS Sensors as a major growth driver, we anticipate growth in motion sensors and ultrasonic fingerprint sensors. In addition, sales of Magnetic Sensors to the ICT market are also forecast to increase.

In the Magnetic Application Products segment, we are projecting a net sales decline of 4-7%. We envision HDD Head shipment volumes falling about 6%. Meanwhile, we expect increased sales in new businesses leveraging Hutchison’s additive metal deposition and etching technologies. In addition, sales of Magnetic Products for the automotive and industrial equipment markets are expected to trend firmly.

In the Energy Application Products segment, we are projecting net sales growth of 8-11%. We plan to further increase production capacity by around 15%, including the production capacity of batteries for mini cell and high-power applications. By doing so, we plan to steadily capture demand in the smartphone market, while proactively advancing the development of new applications.

We would like you to picture Company-wide sales steadily growing in line with expanding demand for a variety of Electronic Components. We expect market-beating growth for the Passive Components segment, our core business. The Sensor Application Products segment will start to contribute to sales growth as it advances to a stage where acquisitions start to deliver benefits. The Energy Application Products segment is expected to continue delivering firm growth.

That concludes my presentation. Thank you very much for your attention.