[ Financial Results for Fiscal 2018 Performance Briefing ]Consolidated Results for FY March 2018

Mr. Tetsuji Yamanishi

Senior Vice President

Hello, I’m Tetsuji Yamanishi, Senior Vice President of TDK. Thank you for taking the time to attend TDK’s performance briefing for the fiscal year ended March 2018. I will be presenting an overview of our consolidated results.

Key points concerning earnings for FY March 2018

First, let’s take a look at the key points concerning earnings. We proactively pushed ahead with the transformation of our business portfolio, with a major turning point in this effort being the partial transfer of the High-Frequency Components business undertaken in the previous year. Even in this business environment, net sales rose 7.9% year on year, achieving a new record for a fifth consecutive fiscal year. Operating income decreased sharply by 59.0% year on year, because the previous year’s operating income included a gain on sale of business of 144.4 billion yen. However, operating income rose in real terms as earnings growth in existing businesses absorbed the impact of lower earnings in the High-Frequency Components business due to the partial transfer of business.

In the Passive Components segment, sales of Capacitors increased favorably in the automotive and industrial equipment markets, where demand has remained strong. Notably, in MLCCs, TDK benefited from growth in application products with high reliability and redundancy characteristics for automotive use. This contributed immensely to enhancing the profitability of the Passive Components segment as a whole.

In the Sensor Application Products segment, net sales expanded significantly year on year due to acquisitions. Due in part to acquisition-related costs, the acquisitions have not yet started to contribute to earnings. Nevertheless, we have expanded our product portfolio through the acquisition of InvenSense, Chirp Microsystems and other companies, with a view to widening the target applications, such as the IoT market, which are expected to grow. These acquisitions have also enabled us to steadily strengthen the foundation to expand our solutions business.

In the Magnetic Application Products segment, total HDD market demand was basically in line with our initial projection. Under these conditions, despite a declining trend in sales volumes of HDD Heads centered on core products, HDD Head sales trended slightly above initial projections, allowing us to generate stable profit, partly due to improvement of the product mix. In Power Supplies, we posted higher sales and profit by steadily capturing strong demand in the industrial equipment market, in addition to benefiting from growing sales of new products. In Magnets, we have concentrated management resources on products for the industrial equipment and automotive markets, shifting away from magnets for HDDs. As a result, there has been a large reduction in losses, despite a decrease in net sales. We have made steady strides toward building a foundation for restoring profitability.

In Rechargeable Batteries, we dramatically increased sales for smartphone applications by firmly addressing market needs amid major volatility in demand trends in the smartphone market. Together with steady growth in sales for applications other than smartphones, we posted record-high net sales and operating income for a third consecutive year.

Consolidated full year results for FY March 2018

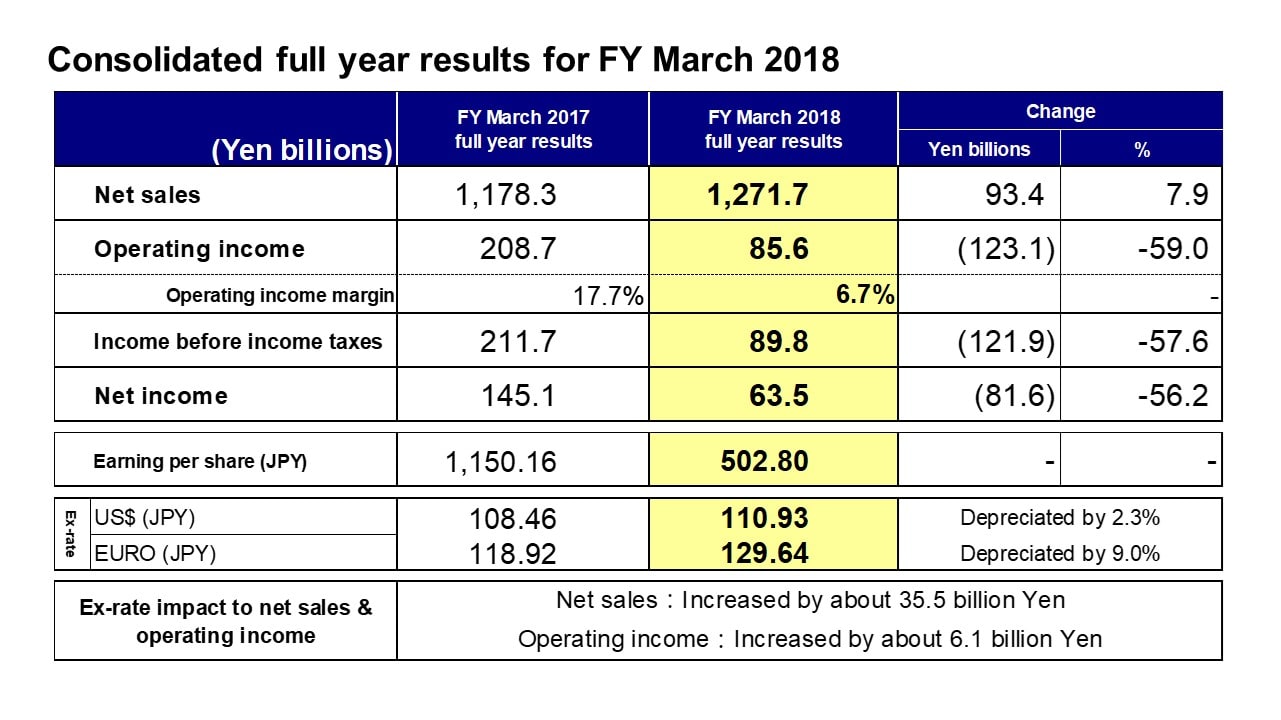

Moving along, I would like to present an overview of our results. Net sales were 1,271.7 billion yen, an increase of 93.4 billion yen, or 7.9%, year on year. Operating income was 85.6 billion yen, down 123.1 billion yen, or 59.0%, year on year. In the previous fiscal year, operating income included a gain on sale of business of 144.4 billion yen and restructuring costs of 21.2 billion yen, mainly impairment losses. Excluding those one-time gains and costs, operating income in the previous fiscal year was 85.5 billion yen in real terms. In the current fiscal year, operating income rose in real terms, even when including 10.9 billion yen in acquisition-related costs for InvenSense.

Income before income taxes was 89.8 billion yen, net income was 63.5 billion yen and earnings per share was 502.80 yen.

The average exchange rates for the fiscal year ended March 2018 were 110.93 yen against the U.S. dollar, a depreciation of 2.3%, and 129.64 yen against the euro, a depreciation of 9.0%. In terms of the impact of these exchange rate movements, net sales and operating income were pushed up by around 35.5 billion yen and 6.1 billion yen, respectively.

With regard to exchange rate sensitivity, as with our previous estimate, we estimate that a change of 1 yen against the U.S. dollar would have an impact of approximately 1.2 billion yen, while a change against the euro would have an impact of approximately 0.2 billion yen.

FY March 2018 results - Passive Components segment

Next, I would like to explain our business segment performance.

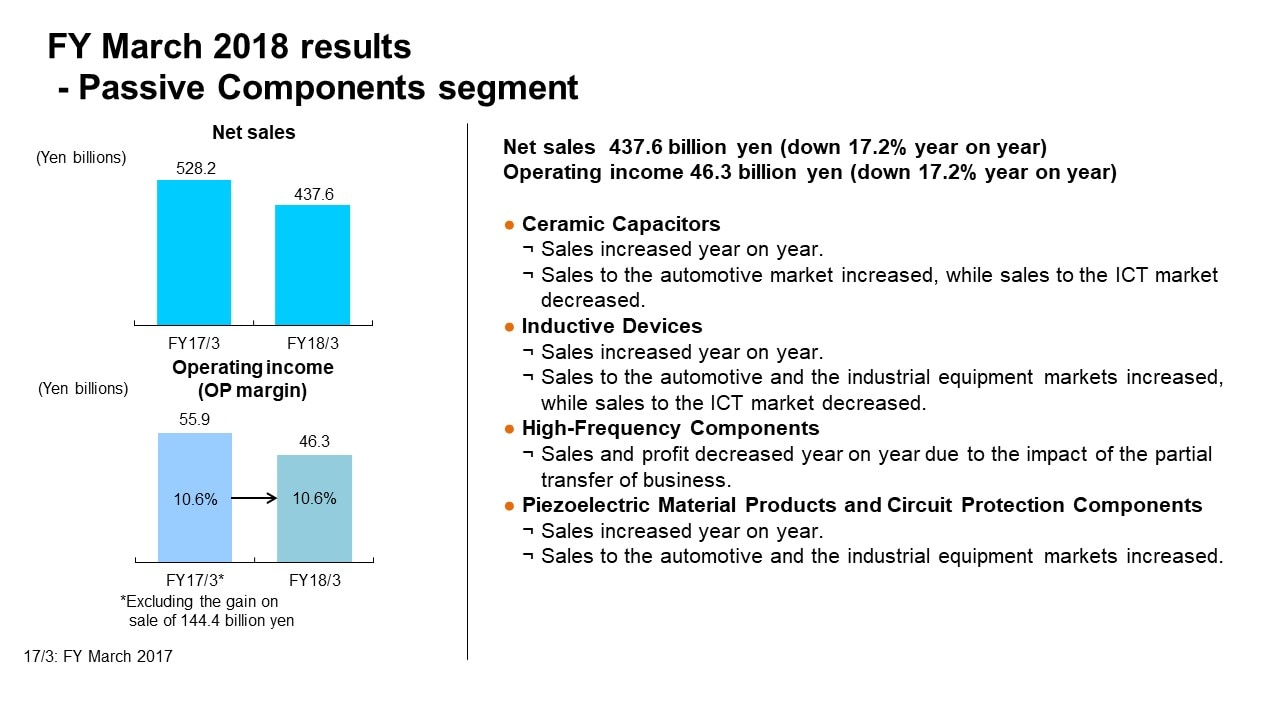

We have newly established the Sensor Application Products segment as a reporting segment from the fiscal year ended March 2018. As that resulted in certain products being reclassified, we have regrouped results for the fiscal year ended March 2017 into the new reporting segment framework. In the Passive Components segment, this change reduced net sales for the fiscal year ended March 2017 by 20.5 billion yen and reduced operating income by 4.5 billion yen.

In the Passive Components segment, net sales were 437.6 billion yen, a decrease of 17.2% year on year, and operating income was 46.3 billion yen, a decrease of 17.2%. The operating profit margin was 10.6%. Following the partial transfer of the High-Frequency Components business, we have not yet achieved a recovery in terms of the absolute amount of profit. However, our business structure is capable of generating the same level of profitability as in the previous fiscal year.

In Ceramic Capacitors, against the backdrop of surging demand in the automotive market, sales to the automotive market remained solid, increasing year on year. Substantial sales growth was driven by contributions from an improved product mix, including products with high reliability and redundancy characteristics, and from productivity enhancements. Profitability surpassed the 10% level. In Inductive Devices, sales to the ICT market decreased year on year, in response to the impact of a decline in the production volume of smartphone manufacturers. Meanwhile, net sales increased owing to growth in sales to the automotive and industrial equipment markets, including for use in applications for industrial robots and measuring equipment, and in sales for use in home electric appliances. In High-Frequency Components, specifically continuing operations excluding transferred businesses, overall sales decreased due to the discontinuation of sales of Wi-Fi modules, which were present in the previous fiscal year, although ceramic filters maintained high profitability, supported by growth in sales and earnings. In Piezoelectric Material Products, sales to the automotive and industrial equipment markets trended favorably, whereas sales of Camera Module Actuators to Chinese smartphone manufacturers decreased sharply. Overall, there was a decline in earnings on higher net sales.

FY March 2018 results - Sensor Application segment

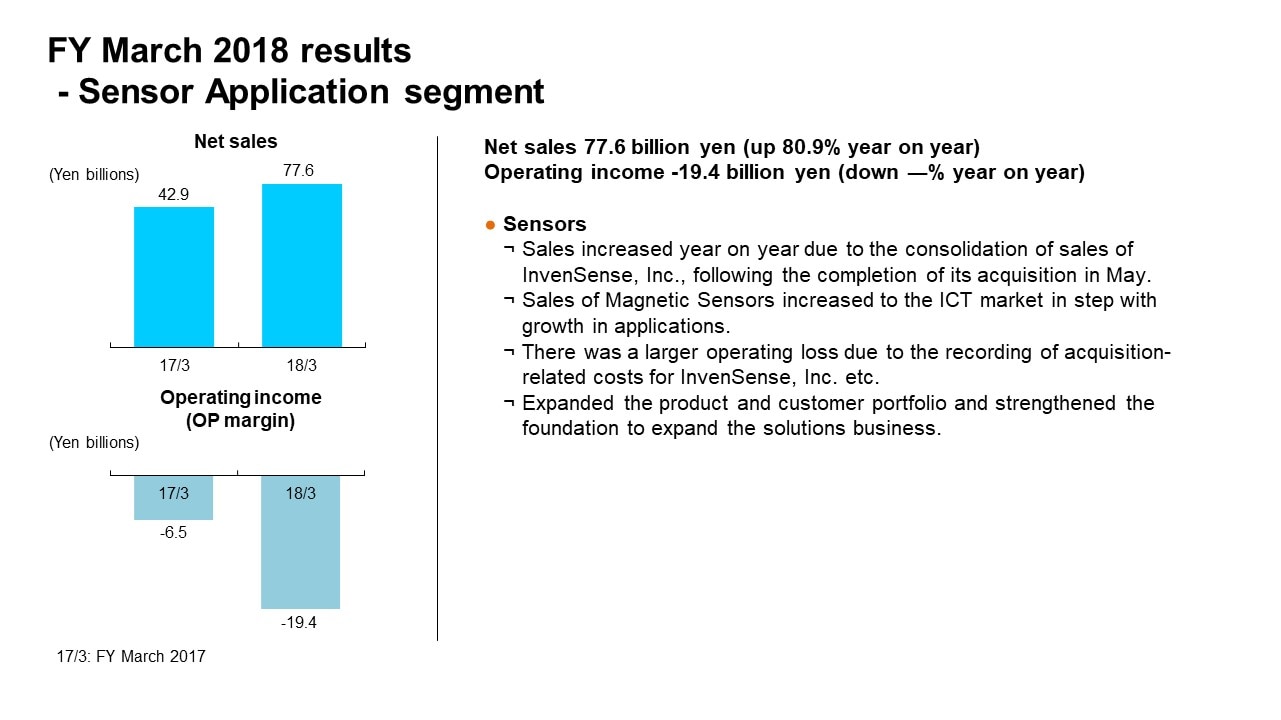

In the Sensor Application Products segment, net sales were 77.6 billion yen, up roughly 1.8 times year on year due partly to the acquisition of InvenSense. There was an operating loss of 19.4 billion yen, including 10.9 billion yen in acquisition-related costs for InvenSense.

Sales to the automotive market rose around 21% centered on sales of temperature and pressure sensors as well as magnetic sensors to the European and Japanese markets. In addition, sales of TMR sensors to the ICT market, as well as sales of InvenSense’s MEMS sensors, rose sharply. As a result, relative to the overall sales of the Sensor Application Products segment, the ratio of sales to the ICT market was just over 20%, the automotive market was nearly 50% and the industrial equipment market was just under 30%. This has created a well-balanced composition of sales in this segment. We have expanded the product portfolio through the acquisition of InvenSense, Chirp Microsystems and others. Synergies have also emerged from the expansion of the customer portfolio after the acquired companies joined the TDK Group. In these and other ways, we are making progress on strengthening the earnings foundation.

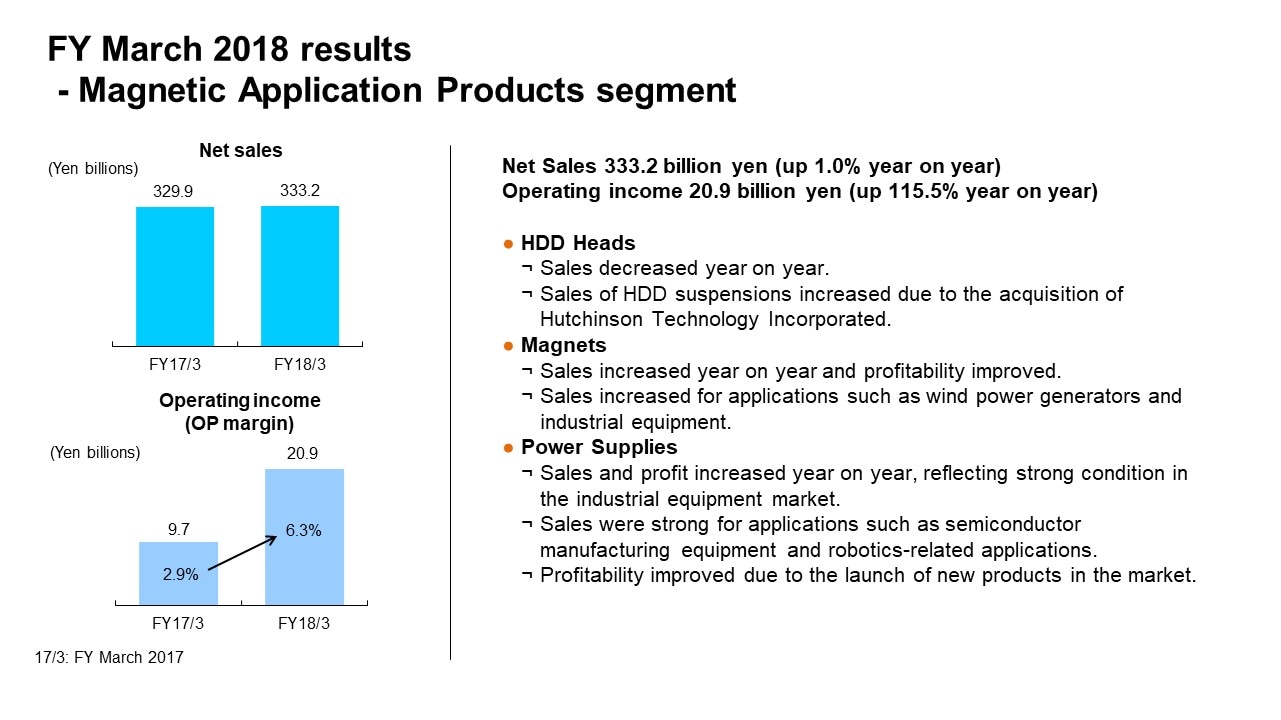

FY March 2018 results - Magnetic Application Products segment

In the Magnetic Application Products segment, the reclassification of certain products reduced net sales for the previous fiscal year by 19.8 billion yen and lifted operating income by 5.3 billion yen.

Looking at business performance, net sales were 333.2 billion yen, up 1.0% year on year, and operating income was 20.9 billion yen, up 2.2 times year on year, with an operating profit margin of 6.3%. That said, we posted 10.0 billion yen in restructuring costs, mainly impairment losses, in the previous fiscal year. Therefore, operating income in real terms rose 1.2 billion yen, or 6.1%, year on year.

Sales volume of HDD Heads decreased by around 12%. However, overall sales of recording devices were held to a decrease of only around 2%, owing to a higher average sales price in line with an improved sales mix, including a higher sales mix of nearline HDD Heads. Combined with the positive impact of the streamlining of fixed costs, such as the benefits of an improved product mix and the integration of wafer sites, we maintained a double-digit operating profit margin, and profitability has remained steady. Excluding restructuring costs of around 6.0 billion yen recorded in the previous fiscal year, operating income declined slightly.

In magnets, sales increased for industrial equipment motors for wind power generation and industrial robots, despite a decline in sales of magnets for HDDs. Earnings have steadily improved as losses have been reduced to around half in real terms, discounting the impact of around 4.0 billion yen in restructuring costs recorded in the previous fiscal year.

In Power Supplies, sales were strong, supported by surging demand from the semiconductor manufacturing equipment, measuring equipment, and robotics-related markets. In addition, the launch of new products has adroitly led to sales growth. Consequently, sales and profit increased year on year, and we have a business structure capable of targeting a double-digit operating profit margin on a full-year basis.

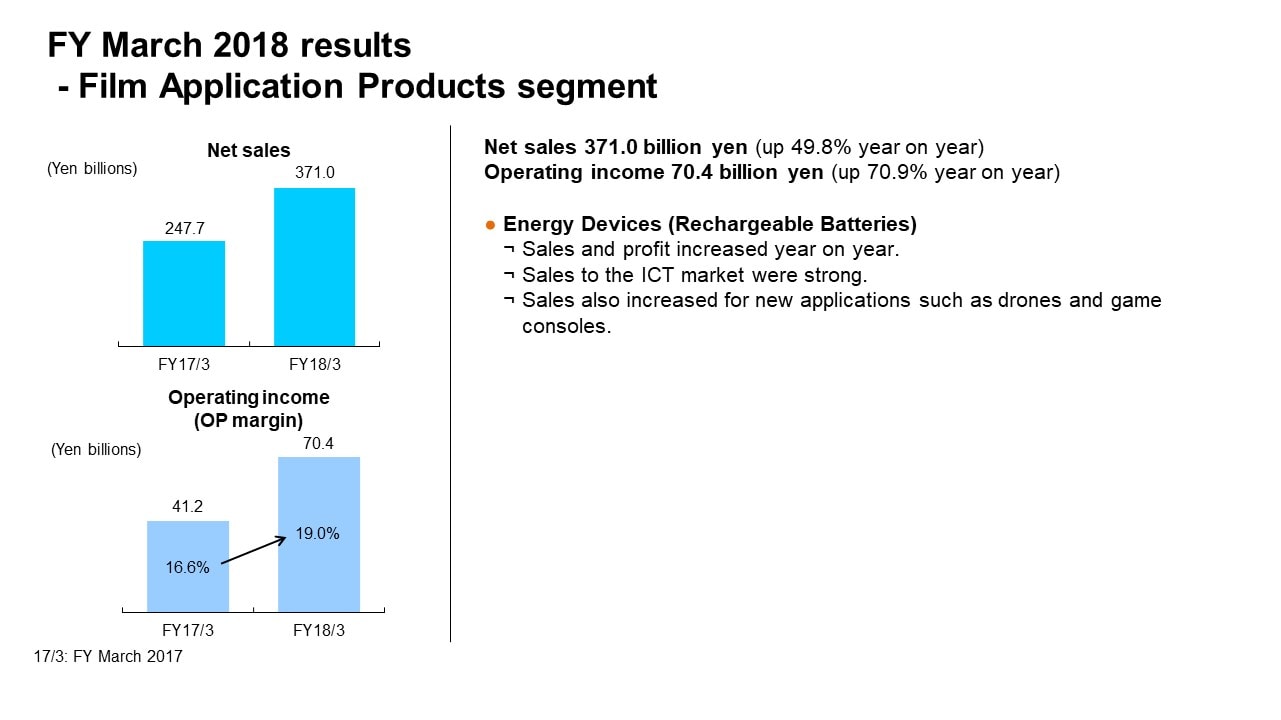

FY March 2018 results - Film Application Products segment

In the Film Application Products segment, net sales were 371.0 billion yen and operating income was 70.4 billion yen. Net sales increased 1.5 times year on year, operating income was up sharply by 1.7 times year on year. Both record-high net sales and operating income were recorded for a third consecutive year. Profitability has improved significantly, with the operating profit margin reaching 19%.

Despite large fluctuations in demand trends throughout the year in the smartphone market, sales for smartphone applications rose dramatically because we steadily captured market needs by optimizing production capacity as needed. Sales also steadily increased for applications other than smartphones. By capturing synergies between growth in sales volume and increased productivity, we have effectively enhanced profits.

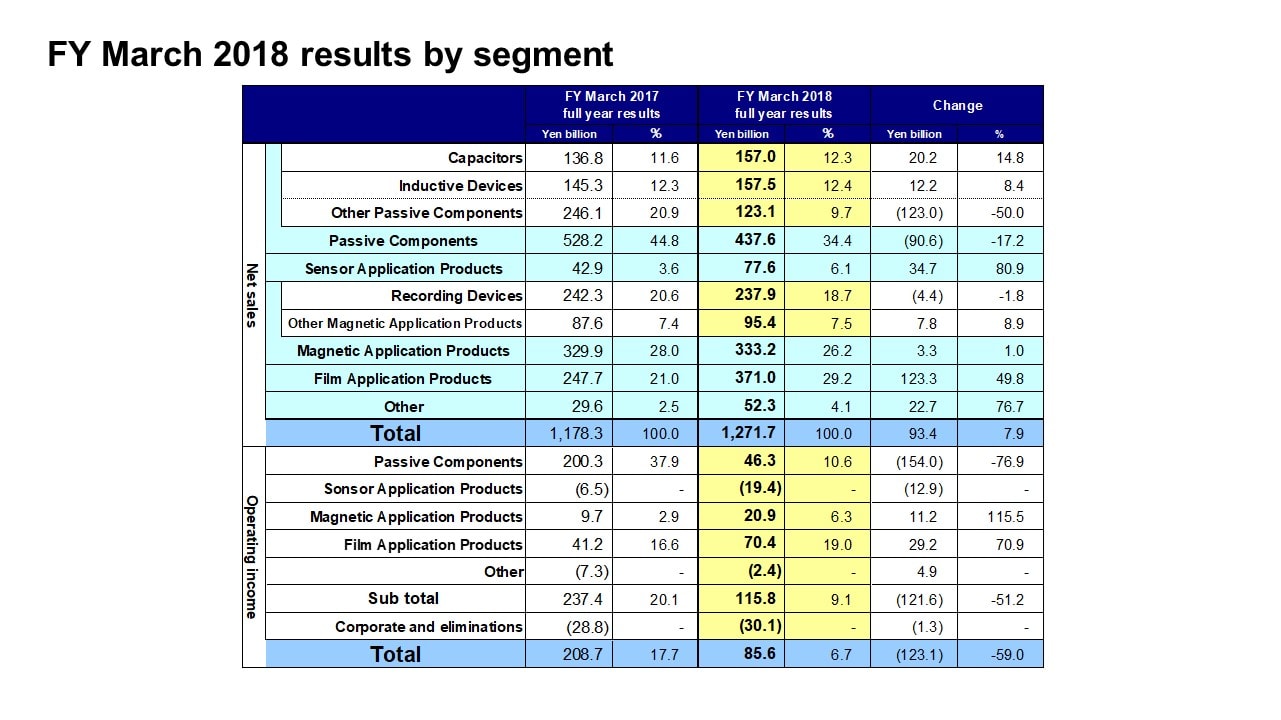

FY March 2018 results by segment

Moving on to full-year performance by segment, I have already provided explanations for the Passive Components, Sensor Application Products, Magnetic Application Products, and Film Application Products segments, so I will now cover the Other segment and corporate and eliminations.

Net sales in the Other segment amounted to 52.3 billion yen, down 76.7% year on year, and the operating loss was 2.4 billion yen, an improvement of 4.9 billion yen from the operating loss posted in the previous fiscal year.

Against the backdrop of continuing growth in demand in the industrial equipment market, the main factors behind the improvement were a large increase in profits owing to increased sales of semiconductor manufacturing equipment and improved profits related to new businesses.

In corporate and eliminations, operating income deteriorated slightly due to an increase in development expenses.

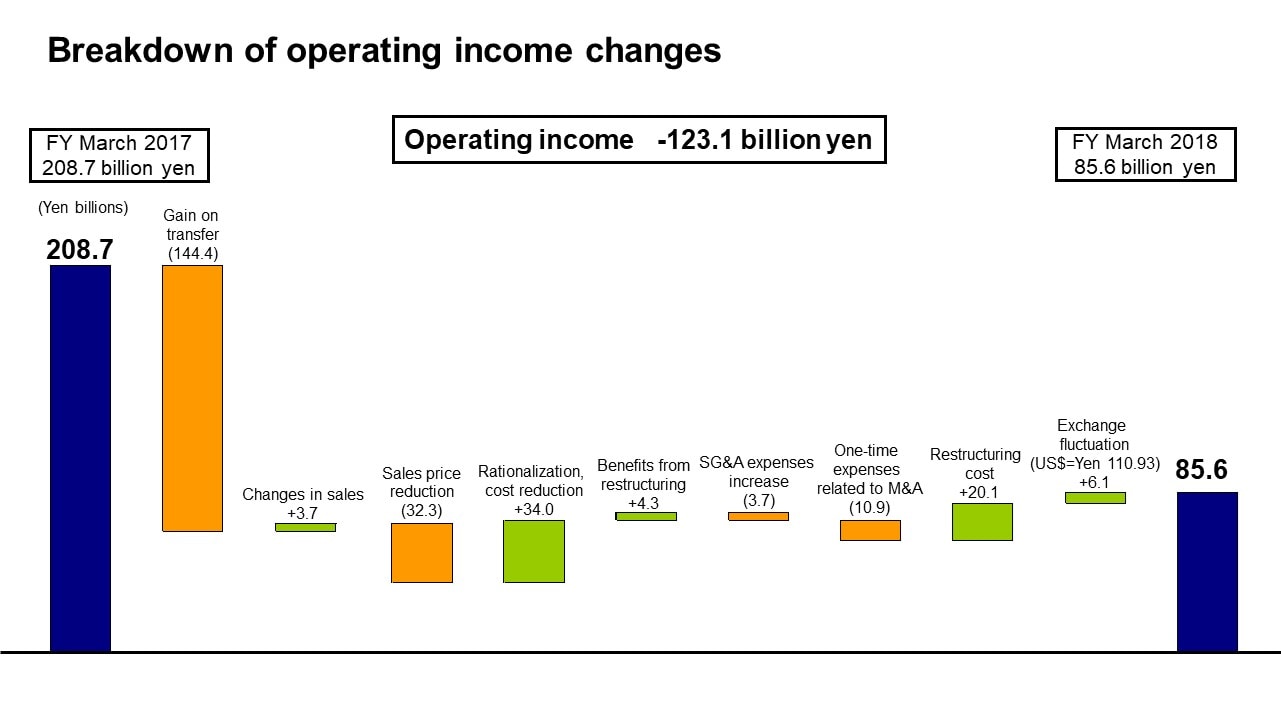

Breakdown of operating income changes

Next is the breakdown of the change in operating income. Let’s take a look at the main factors behind the decrease of 123.1 billion yen in operating income. If we exclude the 144.4 billion yen gain on sale of business recorded in the previous fiscal year, operating income would have been 64.3 billion yen in the previous fiscal year. That means operating income increased by 21.3 billion yen in real terms.

Let’s go over the main components of this increase of 21.3 billion yen. First, there was a positive impact of roughly 3.7 billion yen from an increase in net sales. Earnings growth in existing businesses absorbed the full-year negative impact of just over 30.0 billion yen from the transfer of part of the High-Frequency Components business, and this led to further profit growth. There was a combined negative impact of approximately 36.0 billion yen from the negative impacts of roughly 32.3 billion yen from reductions in sales prices and around 3.7 billion yen from increases in SG&A expenses. The combined negative impact of 36.0 billion yen was absorbed by the combined positive impact of roughly 38.3 billion yen comprising the positive impacts of roughly 34.0 billion yen from rationalization and cost reduction and around 4.3 billion yen from restructuring benefits. In addition, restructuring costs decreased by around 20.1 billion yen from the previous fiscal year. Including 10.9 billion yen in acquisition-related costs for InvenSense, operating income rose 21.3 billion yen in real terms.

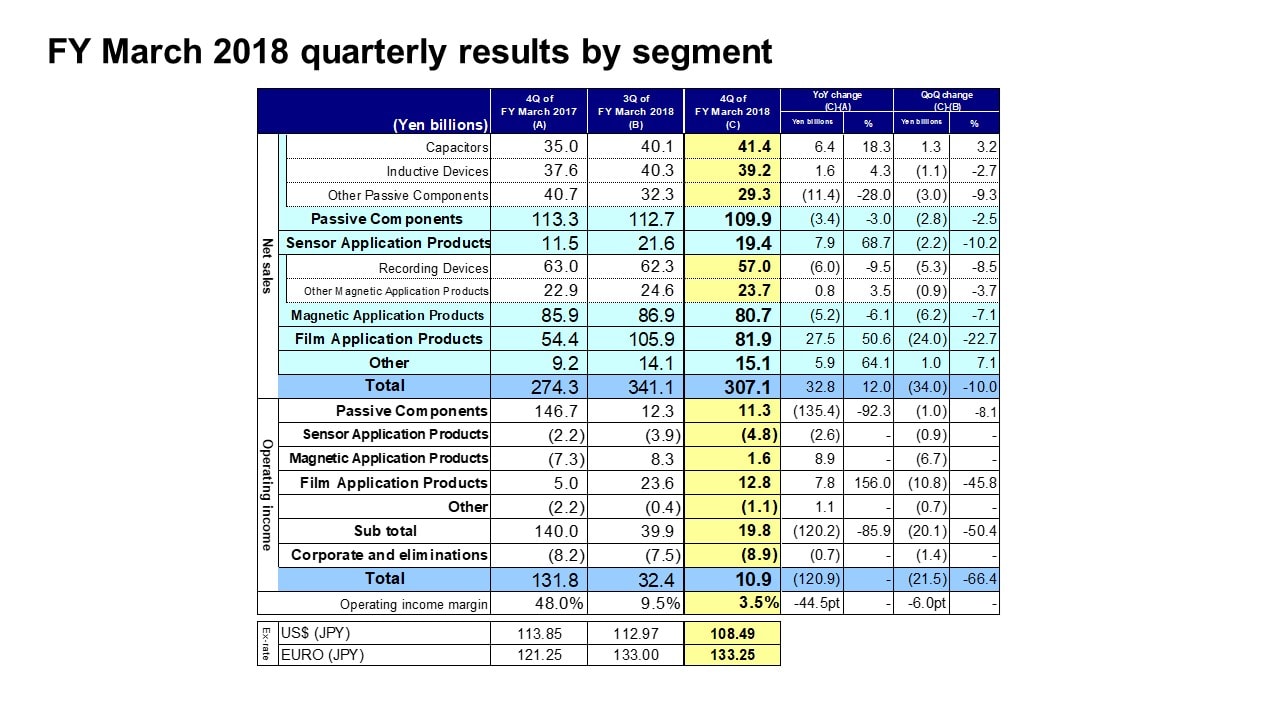

FY March 2018 quarterly results by segment

Next, I would like to explain the factors behind the changes in segment net sales and operating income from the third quarter to the fourth quarter.

Let’s begin with the Passive Components segment. In this segment, net sales in the fourth quarter decreased by 2.8 billion yen, or 2.5%, from the third quarter. Sales of Capacitors to the automotive and industrial equipment markets were strong, while sales of inductive devices were down 2.7% from the third quarter. Overall sales of Inductive Devices were down slightly due to the impact of lower smartphone production volume, despite firm sales to the automotive market. In Other Passive Components, sales decreased by 3.0 billion yen, or 9.3%, from the third quarter. Sales of SESUB products and Camera Module Actuators declined for smartphone applications.

Operating income in the Passive Components segment decreased by 1.0 billion yen, or 8.1%, from the third quarter. In Capacitors, earnings rose substantially atop higher net sales. In contrast, Inductive Devices posted a decline in earnings due to lower net sales. Camera Module Actuators were impacted significantly by production losses arising from the rapid start of production for the new models of Chinese smartphone manufacturers, leading to an overall decrease in earnings.

In the Sensor Application Products segment, net sales decreased by 2.2 billion yen, or 10.2%, from the third quarter. This decrease was mainly due to a large decline in sales of TMR sensors to the ICT market. In this segment, we posted an operating loss of 4.8 billion yen, mainly reflecting the sizable impact of a drop in production of TMR sensors, despite a decrease of 0.7 billion yen in acquisition-related costs.

In the Magnetic Application Products segment, net sales decreased by 6.2 billion yen, or 7.1%, from the third quarter. Sales of Recording Devices declined by 5.3 billion yen, or 8.5%, from the third quarter, mainly due to the impact of a 5% decrease in the HDD Head shipment index from 89 in the third quarter to 84 in the fourth quarter, which was still higher than our previous forecast of 77 for the fourth quarter. Sales of Other Magnetic Application Products decreased by 0.9 billion yen, or 3.7%, from the third quarter. In Magnetic Products, sales for industrial equipment applications were solid, while sales of magnets for HDDs declined. Sales of Power Supplies declined slightly due to the impact of fewer operational days because of the Lunar New Year holidays.

In the Magnetic Application Products segment, operating income decreased by 6.7 billion yen from the third quarter. The main factors were the recording of restructuring expenses of 1.1 billion yen mainly for the reorganization of overseas sites in the fourth quarter and lower sales and earnings, in addition to a loss on a reduction in capacity utilization due to the Lunar New Year holidays and the recording of a devaluation on HDD Head wafers for EOL products.

In the Film Application Products segment, net sales decreased by 24.0 billion yen, or 22.7%, from the third quarter. Sales for smartphone applications declined by 26% as fluctuations in demand had a major impact on sales. In addition, sales for applications other than smartphones were slightly soft.

Operating income in the Film Application Products segment was 12.8 billion yen, down 20.1 billion yen from 39.9 billion yen in the third quarter. This large decrease in earnings partly reflected the loss on reduced capacity utilization due to the Lunar New Year holidays and the impact of rising materials prices, as well as the impact of lower sales and earnings.

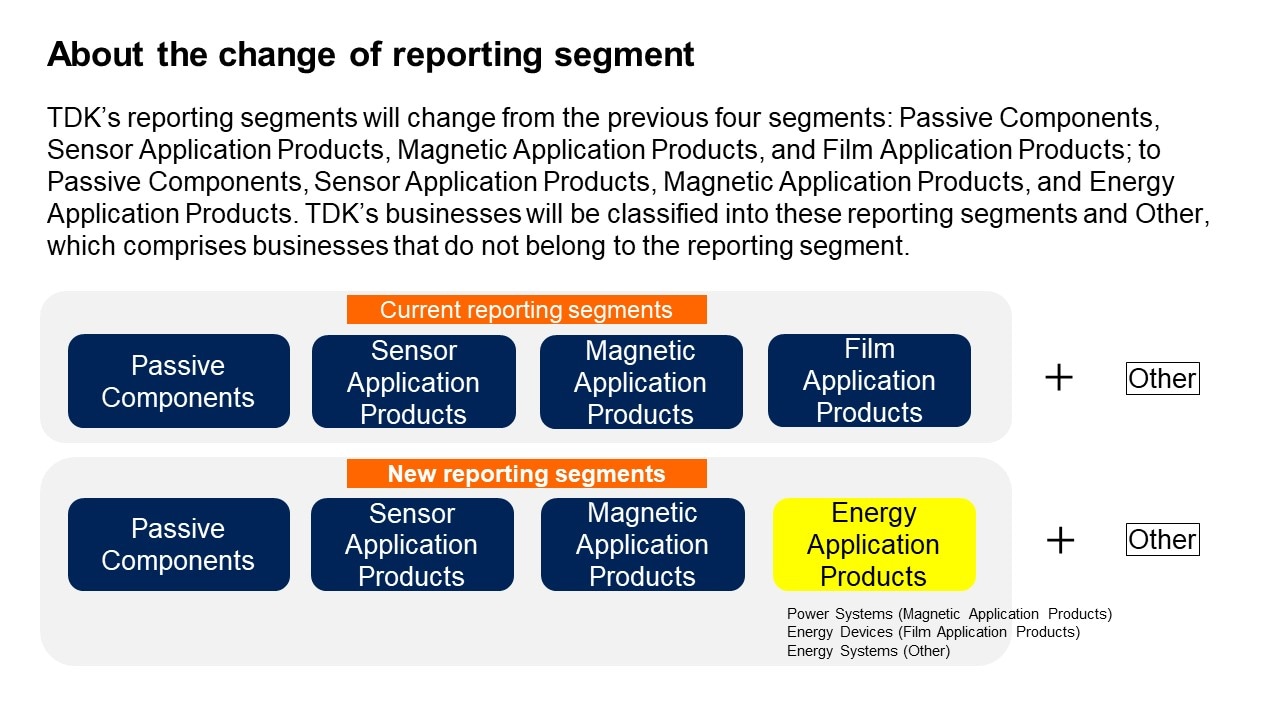

About the change of reporting segment

The president will later explain our full year projections for the fiscal year ending March 2019. For now, I would like to explain the changes in segment classifications effective from the fiscal year ending March 2019.

In order to generate synergies and enhance operations in TDK’s energy-related businesses, we established the Energy Solutions Business Company on April 1, 2018, thereby integrating the Rechargeable Battery business included in the existing Film Application Products segment, the Power Supplies business for industrial equipment included in the Magnetic Application Products segment and the automotive Power Supplies business in the Other segment. Based on this reorganization, we have renamed the existing Film Application Products segment as the Energy Application Products segment. TDK will provide reporting by regrouping these businesses from the previous segment to the new segment, along with reclassifying the financial results for the previous fiscal year based on the new reporting segment framework.

That concludes my presentation. Thank you for your attention.