1st Quarter of FY March 2026 Performance Briefing (Speech Text)

1st Quarter Fiscal 2026 Results Highlights

Tetsuji Yamanishi

Senior Executive Vice President & CFO

Hello, I am Tetsuji Yamanishi. Thank you for taking the time to attend TDK’s performance briefing for Q1 of FY March 2026. I would like to explain the highlights of our consolidated business results.

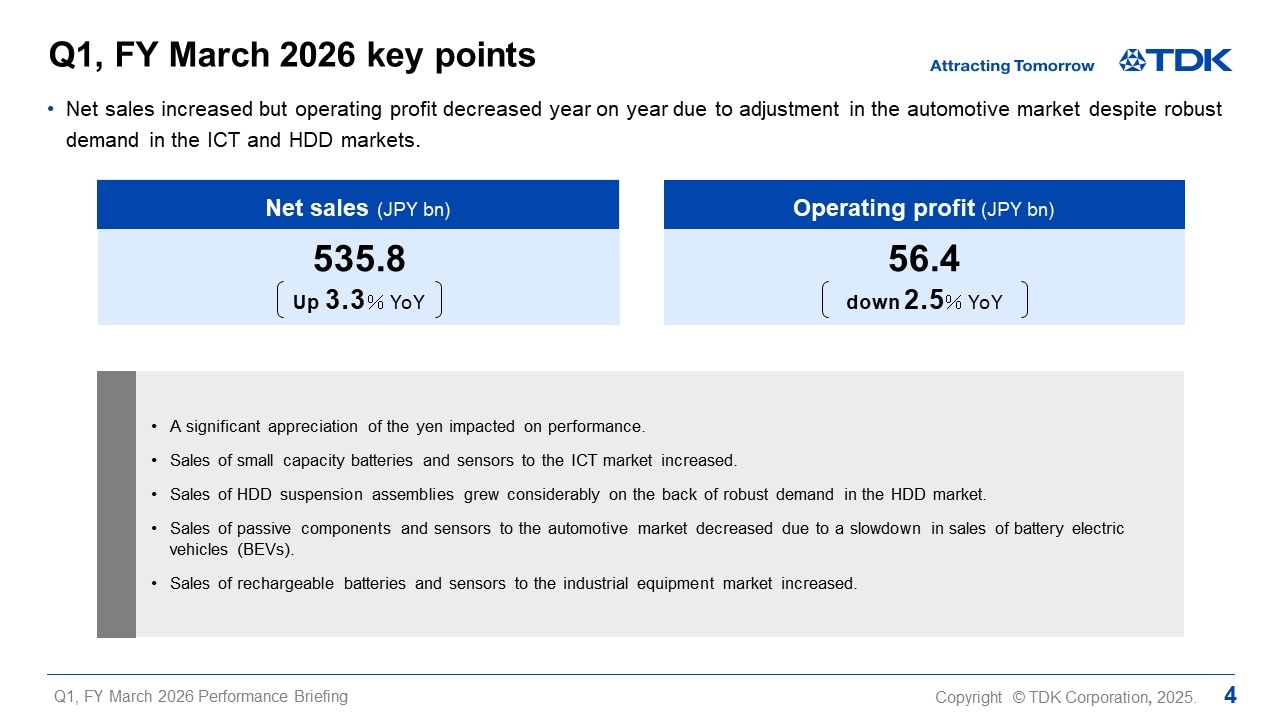

Q1, FY March 2026 key points

I would like to start with the key points of Q1 of FY March 2026. The global economy remained significantly unstable due to intensifying trade friction, growing uncertainty regarding tariff policies, and rising geopolitical risks in the Middle East. Exchange rates showed a significant appreciation of the yen against both the dollar and the euro year on year.

Looking at the electronics market, which has a large bearing on TDK’s consolidated business results, the production of smartphones among the ICT-related products remained strong on a year-on-year basis, and demand related to nearline HDDs for data centers also remained robust. On the other hand, in the industrial equipment market, capital investment demand remained sluggish in general. In the automotive market, demand for battery electric vehicles (BEVs) has continued to decline, resulting in lower component demand than we had expected at the beginning of the period.

In this business environment, segment sales by market were as follows: In the ICT market, sales of small capacity batteries and sensors increased, and reflecting robust demand in the HDD market, sales of HDD suspension assemblies rose significantly. On the other hand, sales of passive components and sensors to the automotive market decreased owing to the slowdown of demand for BEVs, while sales of rechargeable batteries and sensors increased on the back of demand recovery related to components for gaming applications which are categorized in the industrial equipment market. Consequently, net sales for Q1 were up 3.3% year on year.

Operating profit was down 2.5% year on year due to the sharp appreciation of the yen and the effect of a decline in shipments of products for the automotive market.

Q1, FY March 2026 results

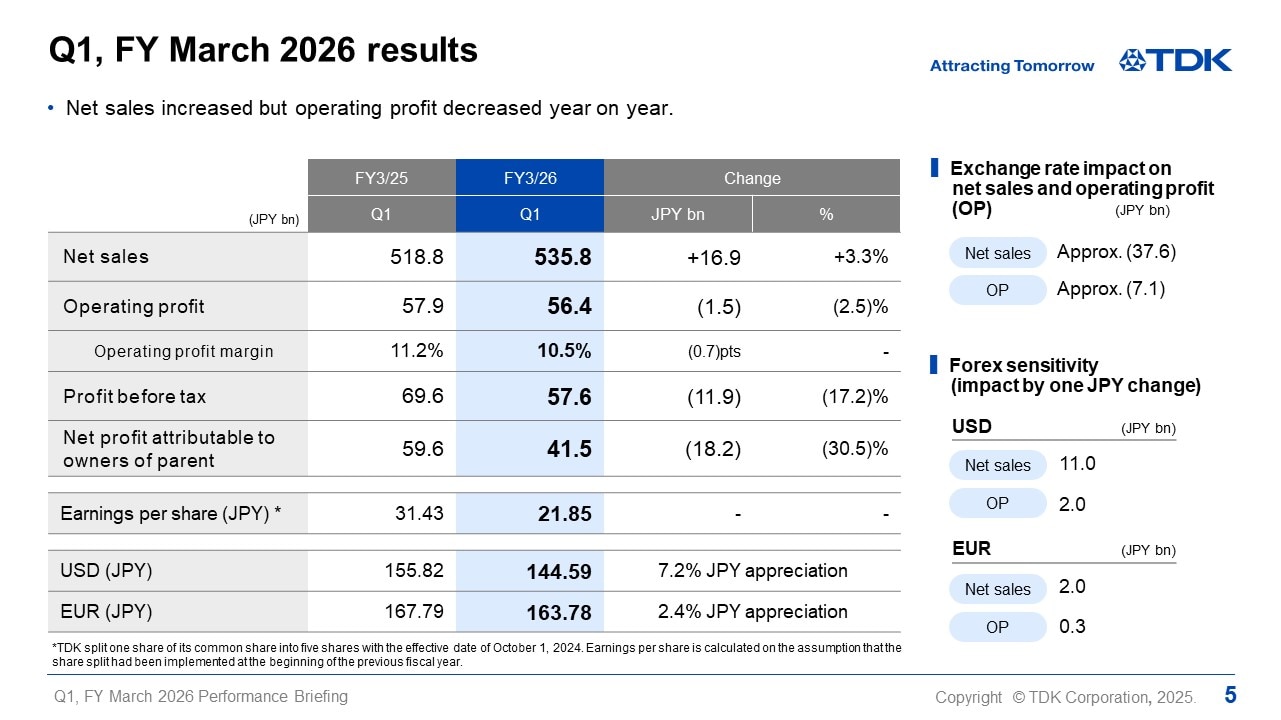

I would like to present an overview of our results for Q1.

There was a decrease of about ¥37.6 billion in net sales and a decrease of about ¥7.1 billion in operating profit due to exchange rate fluctuations against the U.S. dollar and other currencies. Including this impact, net sales were ¥535.8 billion, an increase of ¥16.9 billion, or 3.3%, year on year, and operating profit was ¥56.4 billion, a decrease of ¥1.5 billion, or 2.5%, year on year. Profit before tax was ¥57.6 billion, a decrease of ¥11.9 billion, or 17.2%, year on year, due partly to the effect of foreign exchange losses reflecting the appreciation of the yen during Q1. Net profit attributable to owners of parent was ¥41.5 billion, a decrease of ¥18.2 billion, or 30.5 %, year on year, reflecting the effect of a return of tax expenses in the previous fiscal year on top of foreign exchange losses.

Earnings per share amounted to ¥21.85. In terms of exchange rate sensitivity, we estimate that a change of ¥1 against the U.S. dollar will affect operating profit by about ¥2 billion a year, the same as our previous estimate, while a ¥1 change against the euro will have an impact of about ¥0.3 billion a year.

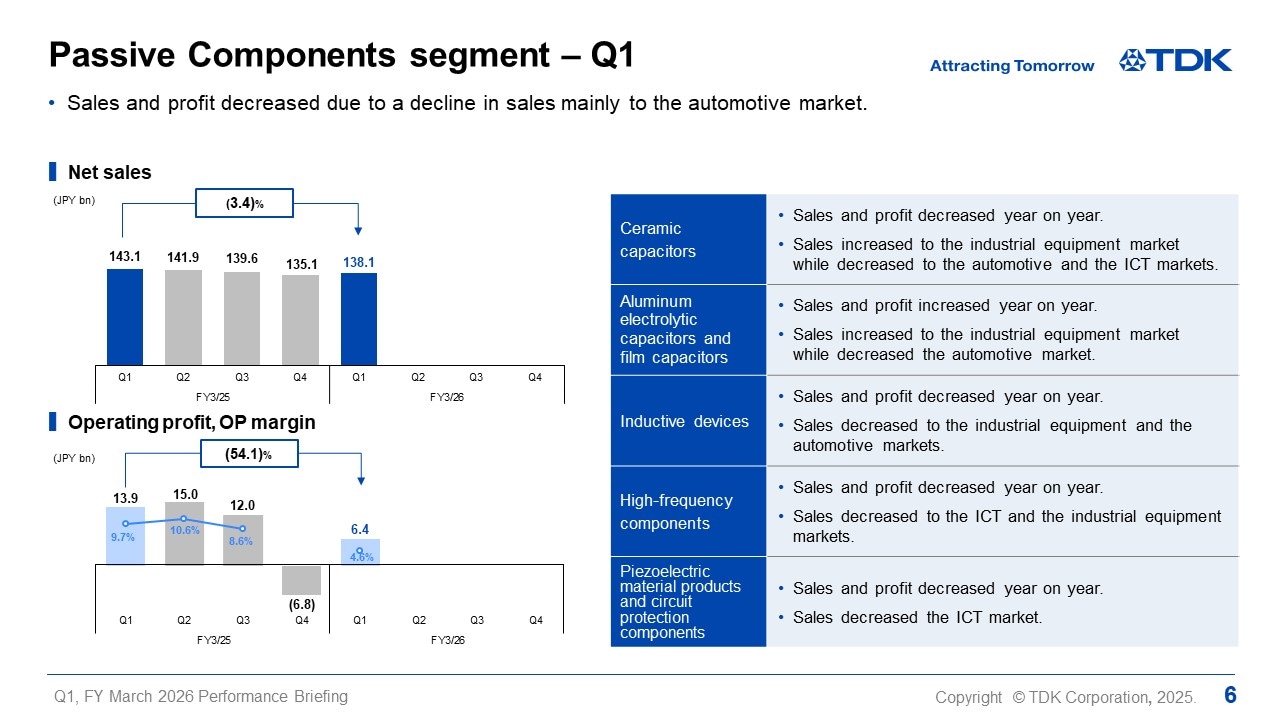

Passive Components segment - Q1

I will now move on to Q1 segment results.

In the Passive Components segment, as sales, primarily to the automotive market, declined, net sales decreased by 3.4% year on year to ¥138.1 billion and operating profit dropped by 54.1% year on year to ¥6.4 billion.

Sales and profit decreased year on year for ceramic capacitors and of inductive devices, which have a high ratio of sales to the automotive market. Sales and profit increased year on year for aluminum electrolytic capacitors and film capacitors on the back of a rise of sales related to renewable energy, despite a drop in sales to the automotive market.

Sales and profit decreased year on year for high-frequency components as sales to the ICT and industrial equipment markets declined, and sales and profit of piezoelectric material products and circuit protection components also decreased year on year reflecting a drop in sales to the ICT market.

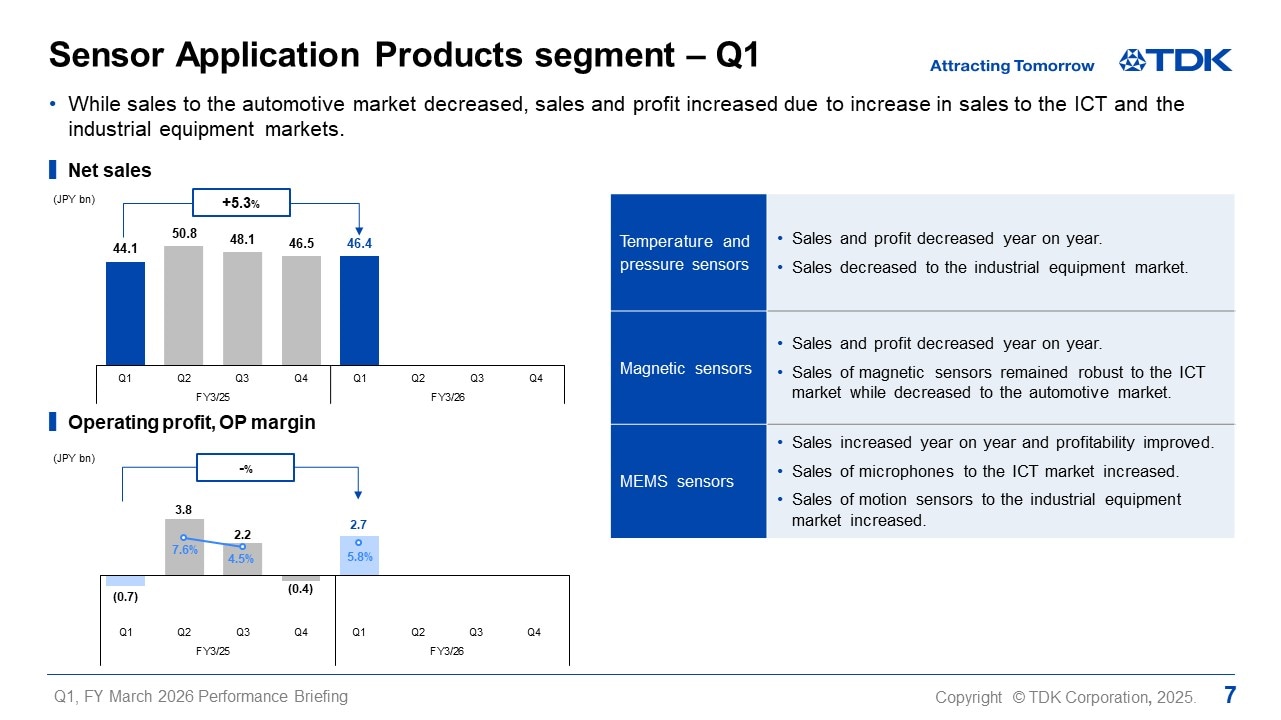

Sensor Application Products segment - Q1

In the Sensor Application Products segment, net sales increased 5.3% year on year to ¥46.4 billion, and operating profit stood at ¥2.7 billion, turning profitable after posting a loss in the previous fiscal year.

Sales and profit of temperature and pressure sensors decreased year on year reflecting a drop in sales to the industrial equipment market. In magnetic sensors, while sales of TMR sensors for smartphone applications rose, sales of Hall sensors declined to the automotive market. This resulted in year-on-year decreases in sales and profit of magnetic sensors on the whole. In MEMS sensors, sales of motion sensors increased to the industrial equipment market, on top of a rise in sales of microphones to the ICT market. Consequently, sales of MEMS sensors on the whole increased year on year and profitability improved significantly.

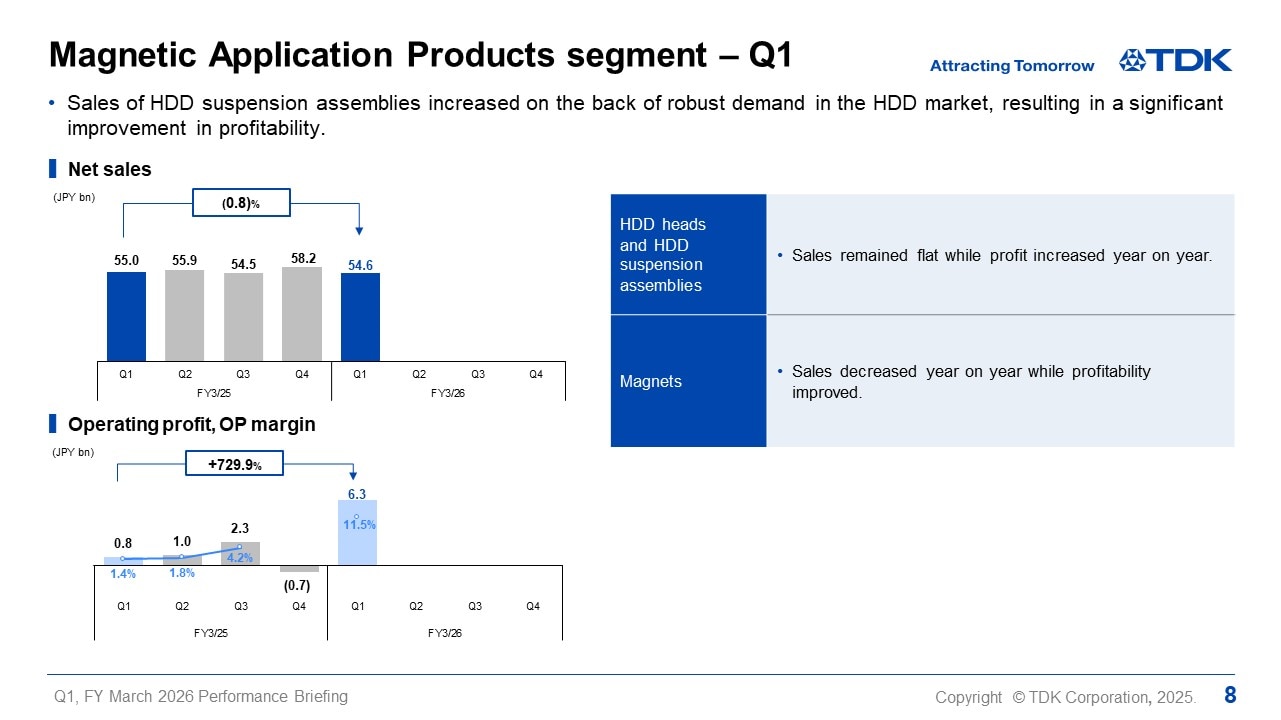

Magnetic Application Products segment - Q1

In the Magnetic Application Products segment, net sales remained virtually unchanged year on year at ¥54.6 billion, while operating profit rose significantly year on year to ¥6.3 billion.

In HDD heads and HDD suspension assemblies, profit increased considerably as profitability improved reflecting a favorable change in product mix, while overall sales of HDD heads remained virtually unchanged due to a decline in demand for PC applications, despite a rise in sales related to nearline HDDs. While sales of magnets decreased year on year due to lower sales to the automotive market, profitability improved on the back of cost reduction effects such as quality enhancement.

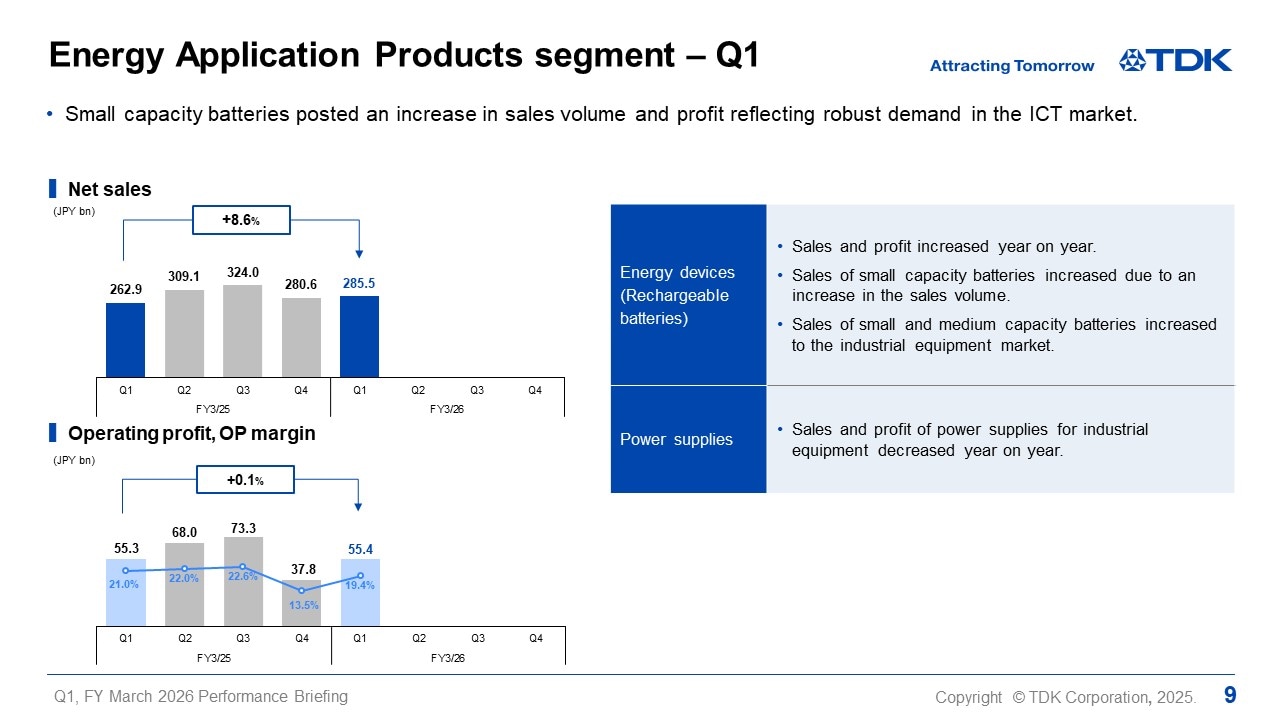

Energy Application Products segment - Q1

In the Energy Application Products segment, net sales amounted to ¥ 285.5 billion, up 8.6% year on year, and operating profit rose slightly year on year to ¥55.4 billion.

Sales and profit of rechargeable batteries increased year on year due to a rise in sales volume of small capacity batteries to the ICT market and growth in sales of small and medium capacity batteries to the industrial equipment market.

Power supplies for industrial equipment saw a year-on-year decline in terms of both sales and profit as demand for industrial equipment applications failed to recover significantly.

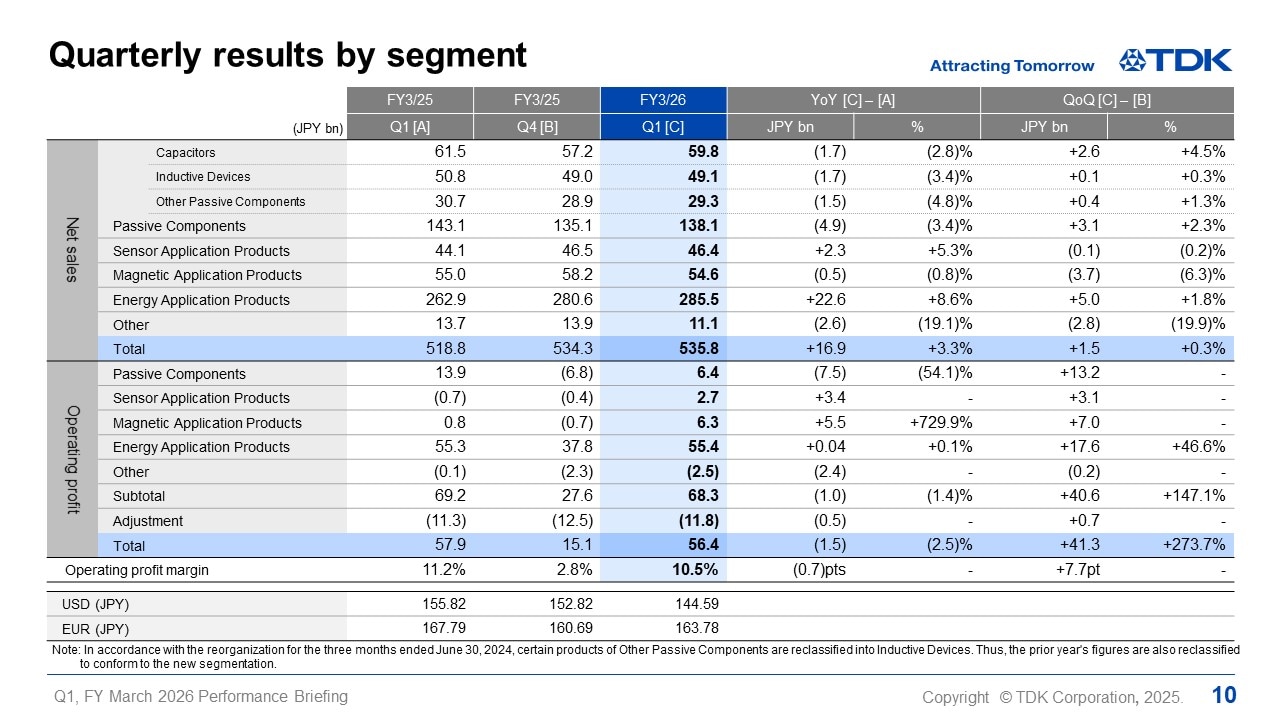

Quarterly results by segment

I will explain some of the factors behind the changes in segment sales and operating profit from the fourth quarter of FY March 2025 (Q4) to the first quarter of FY March 2026 (Q1).

In the Passive Components segment, net sales increased by ¥3.1 billion, or 2.3%, from Q4, and operating profit increased by ¥1.9 billion from Q4, when excluding one-time expenses of ¥11.3 billion recorded in Q4. Sales of ceramic capacitors increased reflecting a rise in sales to the automotive market. Sales of aluminum electrolytic capacitors and film capacitors increased due to growth in sales for renewable energy applications, despite a fall in sales to the automotive market. Sales of inductive devices remained virtually unchanged due to a decline in sales to the ICT market, despite an increase in sales to the automotive and industrial equipment markets. Sales of high-frequency components increased as sales to the ICT market recovered from seasonality. Sales of piezoelectric material products and circuit protection components increased driven by higher sales to the industrial equipment market. Operating profit increased by ¥1.9 billion from Q4 in real terms reflecting growth in profit on the back of the benefits from restructuring of high-frequency components as well as an overall rise in sales, despite a decline in profit due to the negative impact of the appreciation of the yen and the deterioration in product mix for ceramic capacitors.

In the Sensor Application Products segment, net sales remained virtually unchanged, down by ¥0.1 billion, or 0.2%, from Q4, and operating profit increased by ¥2.5 billion from Q4, when excluding one-time expenses of ¥0.6 billion recorded in Q4. Profit of temperature and pressure sensors decreased due to the deterioration of product mix, despite a slight increase in sales. Magnetic sensors saw a decrease in sales and profit of Hall sensors reflecting a decline in sales to the automotive market, while sales of TMR sensors for smartphone applications increased. As a result, profit of magnetic sensors on the whole increased from Q4, while sales remained virtually flat. MEMS sensors saw an increase in sales, and a significant improvement in profitability, of MEMS microphones reflecting brisk sales, and profit of MEMS motion sensors increased due to the effect of restructuring conducted in Q4 of the previous fiscal year, despite a decline in sales. As a result, profitability of MEMS sensors on the whole significantly improved, resulting in a diminished loss.

In the Magnetic Application Products segment, net sales decreased by ¥3.7 billion, or 6.3%, from Q4, while operating profit grew by ¥7.0 billion from Q4. As for HDD heads, while sales declined as the sales volume of nearline HDD heads decreased about 12% due to the transition period for demand related to mainstay products, profit increased on the back of the favorable change in product mix as well as the streamlining of fixed costs and other cost improvement efforts, which has helped to maintain a stable profit. HDD suspension assemblies saw a rise in both sales and profit as the sales volume increased 25% reflecting a growth in demand for nearline HDDs. As for magnets, while sales increased slightly, profitability improved on the back of the cost improvement effects and the recording of proceeds from the sale of employee welfare facilities.

In the Energy Application Products segment, net sales increased by ¥5.0 billion, or 1.8%, from Q4, and operating profit grew by ¥17.6 billion, or 46.6%, from Q4. Rechargeable batteries saw a rise in sales reflecting a growth in the sales volume of small capacity batteries to the ICT market, posting a significant increase in profit. Power supplies for industrial equipment saw a decrease in terms of both sales and profit due to the delay in demand recovery, and sales and profit of power supplies for EVs declined reflecting lower demand for BEVs.

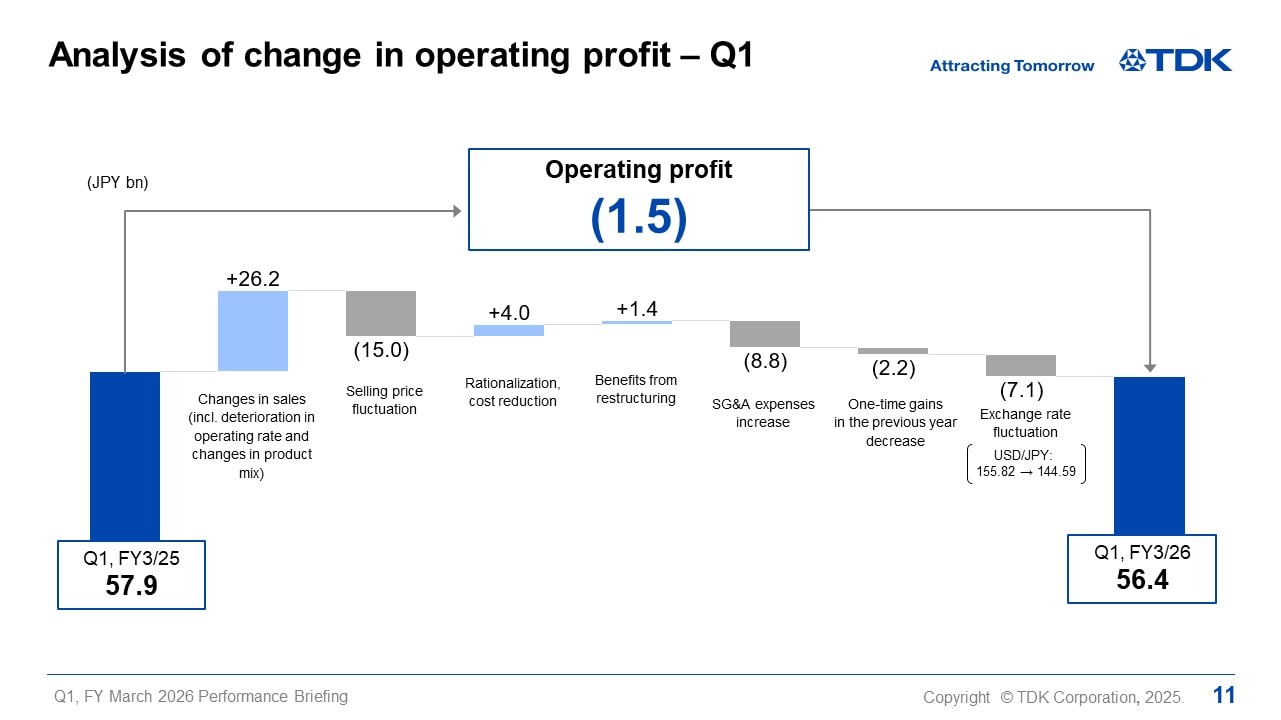

Analysis of change in operating profit - Q1

Next is an analysis of the ¥1.5 billion year-on-year decrease in operating profit for Q1. Changes in sales increased by ¥26.2 billion due to an increase in the sales volume of rechargeable batteries, HDD heads and HDD suspension assemblies, and sensors. While there were positive effects on operating profit including rationalization and cost reduction of ¥4.0 billion and benefits from restructuring carried out in the previous fiscal year of ¥1.4 billion, operating profit declined by ¥15.0 billion due to selling price fluctuation reflecting intensifying pressure to discount selling prices. SG&A expenses increased by ¥8.8 billion reflecting an increase in R&D expenses related to rechargeable batteries, for which TDK has been accelerating the development of new technologies and products. There was also ¥2.2 billion decrease in one-time gains recorded in the previous fiscal year. These factors, including the negative effect of the stronger yen amounting to ¥7.1 billion, contributed to the ¥1.5 billion decrease in operating profit on the whole.

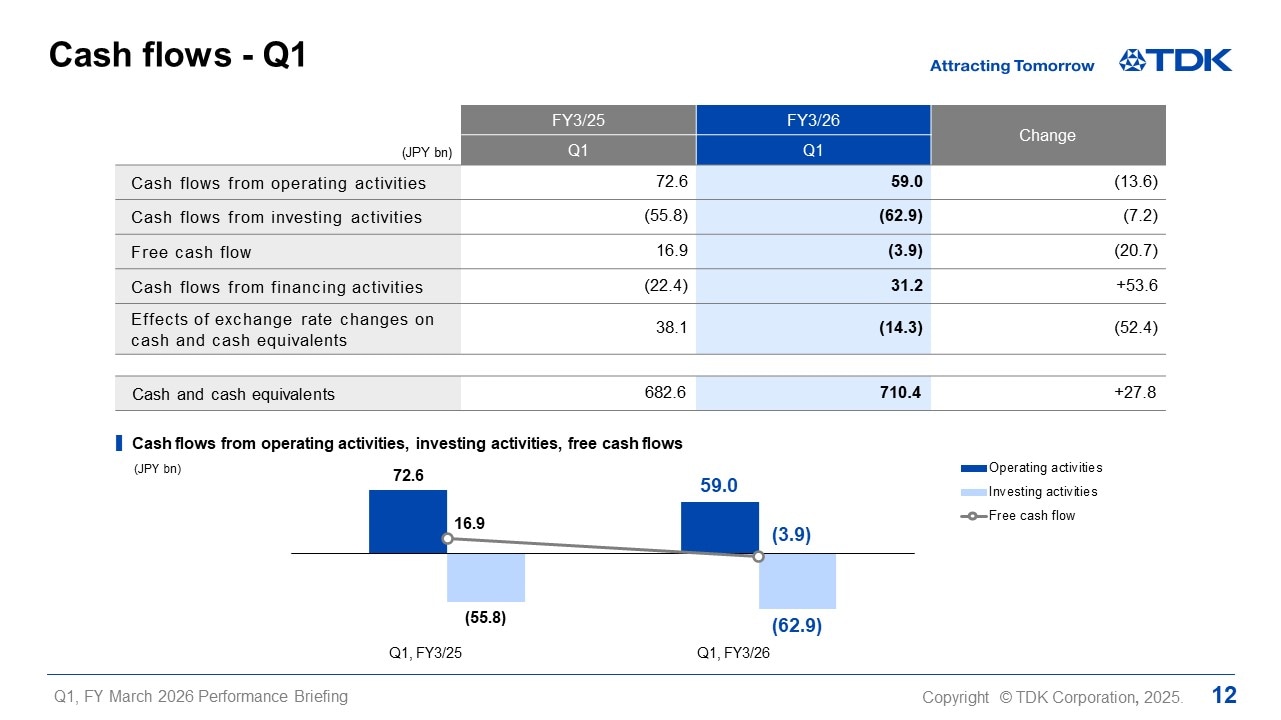

Cash flows - Q1

I would like to present an overview of cash flows.

Cash flows in Q1 remained at the projected level. Operating cash flow amounted to ¥59.0 billion and investing cash flow amounted to ¥62.9 billion including the acquisition of a company related to AI ecosystem, resulting in free cash outflow of ¥3.9 billion.

FY March 2026 Projections

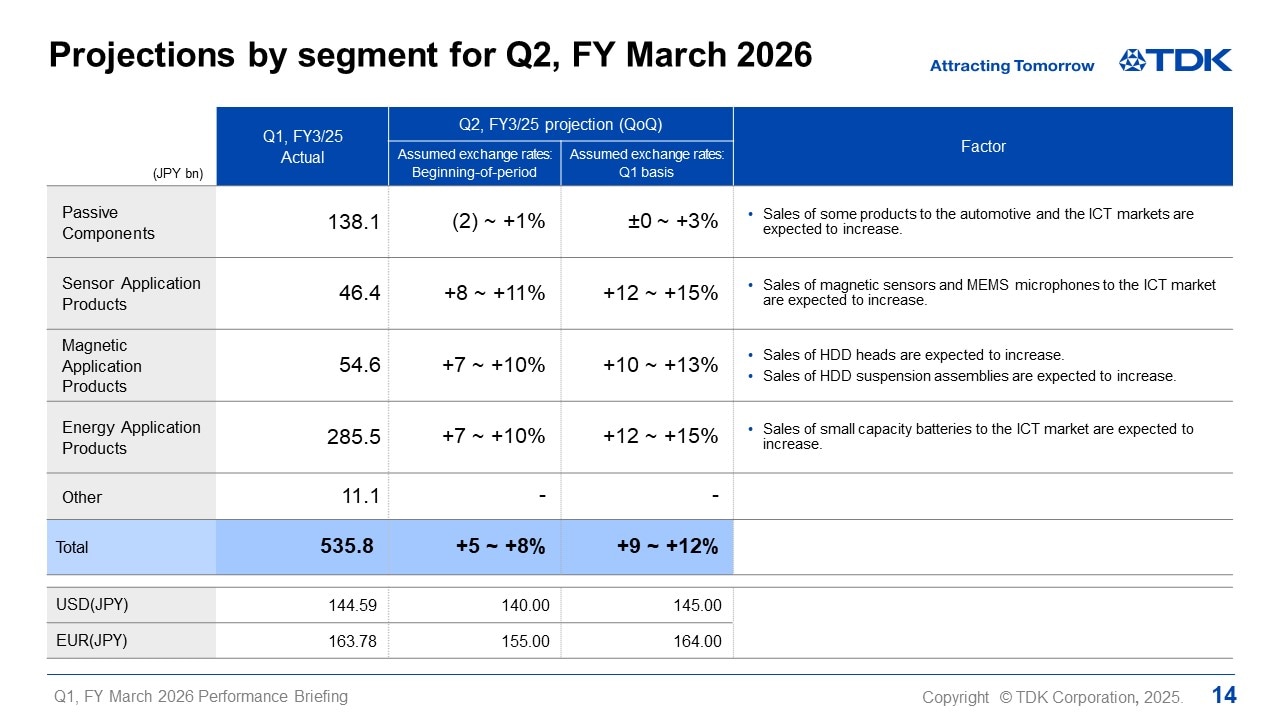

Projections by segment for Q2, FY March 2026

I would now like to discuss our projections regarding changes in segment net sales for Q2 in comparison with Q1.

While our exchange rate assumption for Q2 is ¥140 to the U.S. dollar, I will provide explanations by adjusting this to the actual exchange rate for Q1 for easier comparison.

In the Passive Components segment, we expect overall sales growth of ±0-+3% year on year, as demand is expected to increase in the automotive and ICT markets and sales are projected to grow mainly for MLCC.

In the Sensor Application Products segment, we expect overall sales growth of 12-15% year on year, driven by expected increases in sales of magnetic sensors and MEMS microphones to the ICT market due to seasonality, temperature and pressure sensors and magnetic sensors to the automotive market, and MEMS motion sensors to the industrial equipment market.

In the Magnetic Application Products segment, we expect overall sales growth of 10-13% year on year, as the sales volume of HDD heads is projected to increase by about 20% and the sales volume of HDD suspension assemblies is also anticipated to grow, based on the prediction that nearline HDD production will increase by about 8%.

In the Energy Application Products segment, we expect overall sales growth of 12-15% year on year, as demand related to smartphones is projected to remain robust due partly to seasonality.

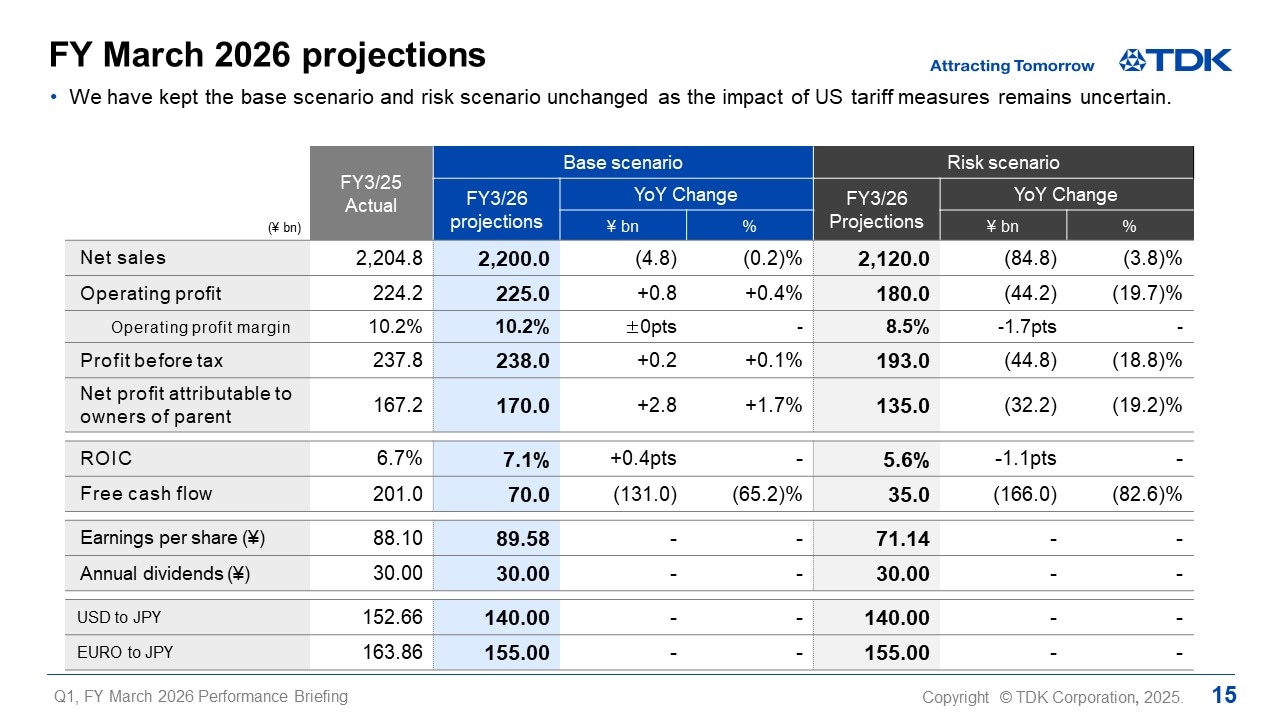

FY March 2026 projections

I would like to go over our full-year projections for FY March 2026.

At the time when our full-year projections were announced at the beginning of the current fiscal year, it was extremely difficult to forecast demand due to tariffs by the U.S. administration and the outlook was highly uncertain. Therefore, with regard to the production volume for key devices as a basis for our projections, we have formulated a risk scenario in which demand for key devices will decline in the U.S. due to tariffs, along with a base scenario based on initial expectations prior to the announcement of tariffs. Our projections based on these scenarios have a range.

As a result of the review of our full-year projections on production volume for key devices, there were no significant changes from the base scenario formulated at the beginning of the current fiscal year. Thus, our projections based on the base scenario will be kept unchanged from those initially announced.

As of August 1, as the tariff negotiations with various countries are still ongoing and the future demand trend remains uncertain, we will also maintain the risk scenario as initially announced. However, there is no change that we regard the base scenario as the minimum level to be achieved.

Our exchange rate assumptions for Q2 and thereafter remain the same as initially announced at ¥140 to the dollar and ¥155 to the euro. We have not modified our projections for ROIC, free cash flow and annual dividend.

Our projections for CAPEX, depreciation, and R&D expenses will also remain the same.

This concludes my presentation today. Thank you for your attention.