[ 2nd Quarter of fiscal 2017 Performance Briefing ]Consolidated Full Year Projections for FY March 2017

Mr. Shigenao Ishiguro

President and CEO

Thank you for coming today. My name is Shigenao Ishiguro. I will present our full year projections for the fiscal year ending March 2018.

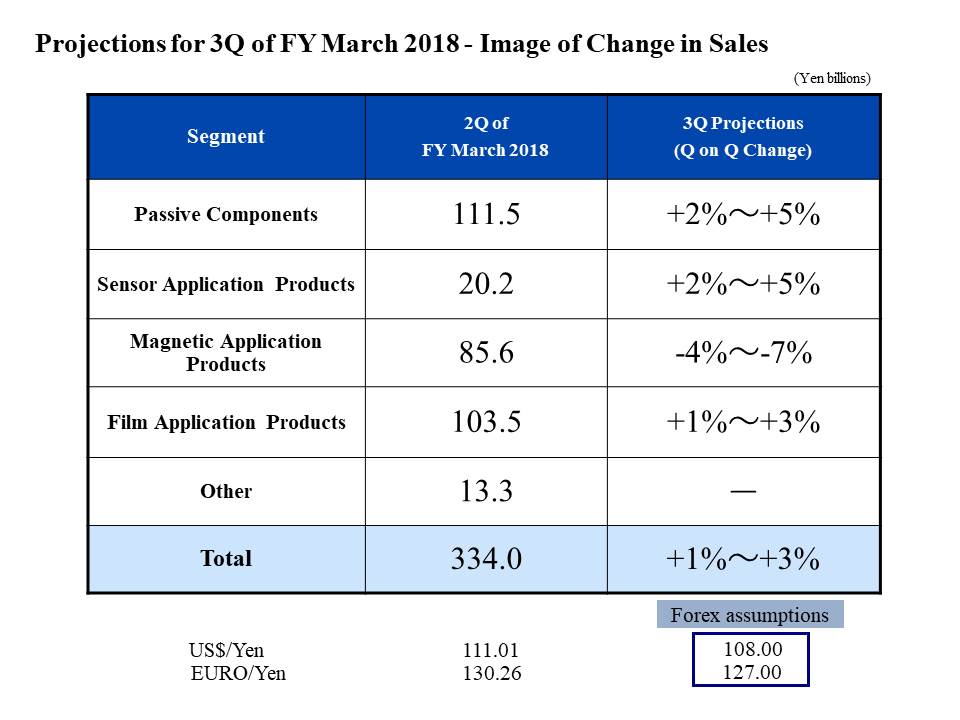

Projections for 3Q of FY March 2018 - Image of Change in Sales

First I will discuss our image of changes in sales for the third quarter of the fiscal year ending March 2018.

Looking at the Passive Components segment, we expect net sales to grow 2-5% overall. We anticipate ongoing strong sales to the automotive markets in Europe, China, and Japan, and solid sales to the industrial equipment market with momentum driven by Capacitors and Inductive Devices.

In the Sensor Application Products segment, we expect net sales growth of 2-5% overall. This outlook is based on solid sales of Temperature and Pressure Sensors as well as Magnetic Sensors to the automotive market, and sales of TMR Sensors increasing towards a peak for smartphones. Sales of MEMS Sensors are expected to be approximately level with the second quarter.

In the Magnetic Application Products segment, the total addressable market for HDDs has been revised down from the previous forecast of 400 million units per year to 390 million. The HDD head shipment index is expected to decrease by around 8% from 102 in the second quarter to 94 in the third quarter. We expect sales of HDD Suspension Assemblies to increase as volumes increase slightly while sales of microelectronic components for the ICT market move into full swing. Sales of Magnetic Products and Power Supplies to the industrial equipment market are projected to remain strong. A decline in HDD Head sales volume is expected to see overall Magnetic Application Products segment net sales contract by 4 to 7%.

In the Film Application Products segment, we expect third-quarter net sales to grow 1 to 3% over the second quarter. Rechargeable Battery shipments will ramp up in line with the launch of a new device by a major customer, and sale for Chinese customers should remain brisk. However, the growth will be muted by the impact of an order for around 7 billion yen recorded in the second quarter that was moved forward by a customer in anticipation of the China’s founding anniversary holiday. As a reference, if the order had not been moved forward, the projection for real third quarter growth would be approximately 16% over the second quarter.

As a result, third quarter net sales for the whole Company are expected to increase by 1 to 3% over the second quarter net sales of 334.0 billion yen.

FY March 2018 Full Year / Dividend Projections

Finally, we come to our consolidated full-year projections for the fiscal year ending March 2018. In light of our first-half performance and sales trends in the second half, compared to the previous consolidated full-year projection announced in July we have raised our projection for net sales to 1,250.0 billion yen, operating income to 85.0 billion yen, income before income taxes to 88.0 billion yen, and net income to 60.0 billion yen. Our dividend forecast remains unchanged from the initial announcement at 60 yen for the interim dividend and 70 yen for the year-end dividend, for an annual dividend of 130 yen. Regarding exchange rate assumptions, we are now assuming 127 yen against the euro, reflecting the euro’s appreciation, while we continue to assume 108 yen against the U.S. dollar.

In the second half of the fiscal year ending March 2018, we expect to continue seeing strong demand in the markets, mainly for automotive and industrial equipment. The smartphone market continues to present uncertainties in some aspects, but we do not envisage these having any major impact on the Company’s sales. We have therefore revised the full-year net sales projection upward by 60.0 billion yen. For operating income, in our previous forecast we had projected expenses of around 9.0 billion yen in relation to the acquisition of InvenSense; however, we are now anticipating expenses of around 10.0 billion after PPA amortization expenses related to inventory evaluations increased by around 1.0 billion yen in the second quarter. Our projection for net income has been revised up by 5.0 billion yen in step with increased profits due to higher net sales. We have also revised our expense estimates. Capital expenditure has been increased by 10.0 billion yen to 170.0 billion yen; depreciation and amortization has been increased by 2.0 billion yen to 90.0 billion yen; and research and development expenses have been increased by 5.0 billion yen to 99.0 billion yen.

That concludes my presentation. Thank you very much for your attention.