[ 2nd Quarter of fiscal 2018 Performance Briefing ]Consolidated Results for First Half of FY March 2018

Mr. Tetsuji Yamanishi

Corporate Officer

I'm Tetsuji Yamanishi, Corporate Officer at TDK. Thank you for taking the time to attend TDK's performance briefing for the first half of the fiscal year ending March 2018. I will be presenting an overview of our consolidated results.

Key Points Concerning Earnings for First Half of FY March 2018

First, let’s take a look at the key points concerning earnings for the first half. Net sales achieved new records both on a quarterly and a half-yearly basis, increasing 7.7% year on year.Operating income was level with the previous year, despite one-time expenses of 7.2 billion yen associated with the acquisition of InvenSense. Earnings expansion in existing businesses offset the impact of the transfer of part of the High-Frequency Components business.

Excluding one-time earnings and expenses associated with M&As, operating income achieved a record level on a half yearly basis.

In Passive Components, we steadily captured increasing demand in the automotive and industrial equipment markets, and steadily strengthened our earnings base by increasing sales volumes and expanding sales of high functional components. We secured an operating income margin of 10% or more even after transferring part of the highly profitable High-Frequency Components business.

The Magnetic Application Products segment secured stable earnings. This reflected strong sales of HDD Heads as overall demand in the HDD market trended in line with our initial expectations for the first half, while sales volumes of HDD Suspension Assemblies grew due to the acquisition of Hutchinson. Magnets and Power Supplies saw both sales and operating income grow as sales expanded and profitability rose with an increase in demand related to semiconductor manufacturing equipment and robotics-related applications in the industrial equipment market, as well as renewable energy.

Rechargeable Batteries saw brisk sales for smartphones and tablets. Sales for new applications such as drones and game consoles kept expanding, and penetration of polymer batteries for use in PCs is accelerating. As a result, sales volume increased dramatically with sales and operating income both achieving new record highs on a quarterly and half-yearly basis.

The Sensor business is a key pillar of our growth strategy based on shifting to a new business portfolio. Under Sensor Systems Business Company, which we established in April, leveraging the acquisitions of InvenSense and other sensor companies, we will expand our business while fusing materials technology and core technology in sensing with IC technology and packaging technology, and providing sophisticated, high added-value sensing solutions.

Consolidated Results for First Half of FY March 2018

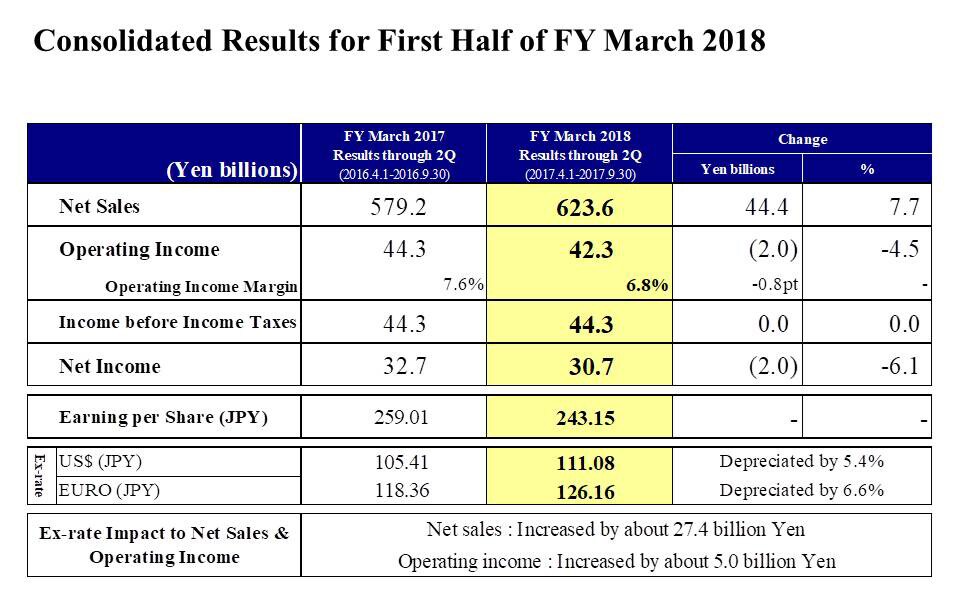

Next, let's take a look at our results for the first half. Net sales were 623.6 billion yen, up 44.4 billion yen, or 7.7% year on year. Operating income decreased slightly by 2.0 billion yen, or 4.5%, to 42.3 billion yen, including one-time expenses of roughly 7.2 billion yen associated with the acquisition. In real terms, we secured a higher level of profit than in the same period of the previous fiscal year. The operating income margin was 6.8%, but on a real basis excluding one-time expenses, profitability increased with the operating income margin at 7.9%.

Income before income taxes was 44.3 billion, level year on year. Net income followed operating income to decline slightly by 2.0 billion yen, or 6.1%. However, the level of income achieved substantially absorbed the impact of transferring the High-Frequency Components business while recording one-time expenses associated with the acquisition. Consequently, earnings per share were 243.15 yen.

The average exchange rate for the first half of fiscal 2018 was 111.08 yen against the U.S. dollar, a depreciation of 5.4%, and 126.16 yen against the euro, a depreciation of 6.6%. In terms of the impact of these exchange rate movements, exchange rates pushed up net sales and operating income by around 27.4 billion yen and 5.0 billion yen, respectively.

With regard to exchange rate sensitivity, we maintain our estimate that a change of 1 yen against the U.S. dollar will affect annual operating income by about 1.2 billion yen, while a change against the euro will have an impact of about 0.2 billion yen.

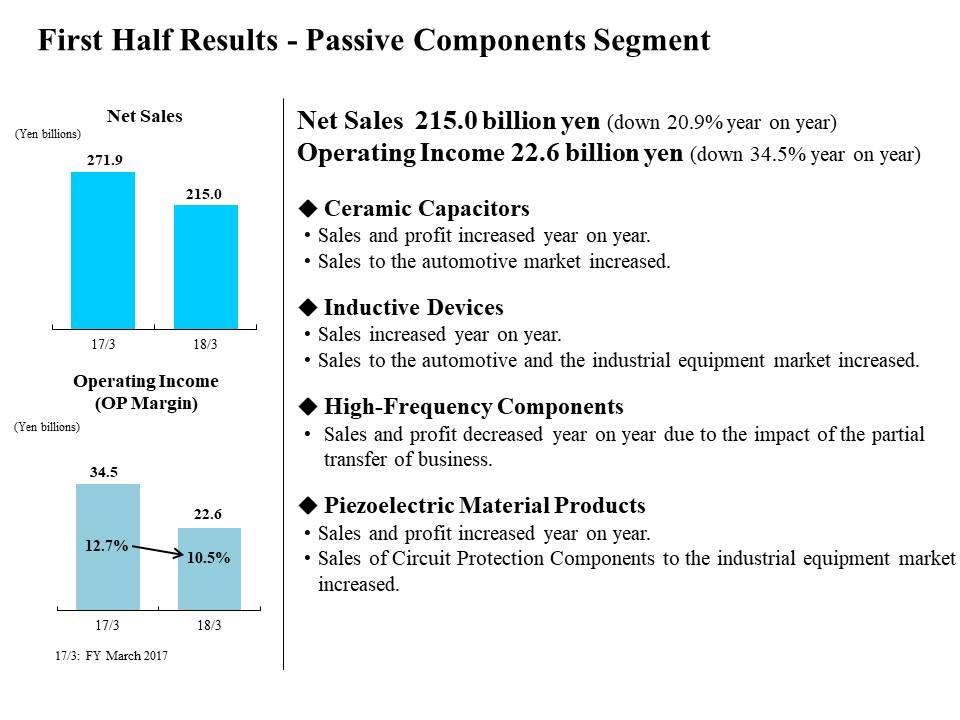

First Half Results - Passive Components Segment

Next, I would like to explain our business segment performance.

We newly established Sensor Application Products as a reporting segment from the fiscal year ending March 2018. As that resulted in certain products being reclassified, we have regrouped results for the fiscal year ended March 2017 into the new reporting segment framework. In the Passive Components segment, the product reclassifications reduced net sales for the first half of the previous fiscal year by 4.7 billion yen and operating income by 1.0 billion yen.

In the first half of the fiscal year ending March 2018, net sales declined 20.9% year on year to 215.0 billion yen, operating income decreased 34.5% to 22.6 billion yen, and the operating income margin was 10.5%.

For Ceramic Capacitors, sales and profits grew on continued strong sales to the automotive market driven by strong demand, and profitability improved markedly. In Inductive Devices, sales continued to grow. While sales for the ICT sector declined year on year due to the impact from inventory adjustments at major Chinese smartphone manufacturers, sales were solid to the automotive market as for Ceramic Capacitors. Sales also expanded overall to the industrial equipment market, which includes applications for industrial robots, measuring equipment, medicine, and renewable energy. In High-Frequency Components, sales and profits declined substantially due to the transfer of a part of the business. In the existing business sales fell sharply due to the absence of sales of Wi-Fi modules recorded in the previous fiscal year. However, Ceramic Filters recorded higher sales and have maintained high profitability. For Piezoelectric Material Products, sales and profits rose on higher sales of Circuit Protection Components for industrial equipment and household appliances.

While the Passive Components segment overall could not absorb all of the negative impact from the partial transfer of High-Frequency Components business, which caused net sales to decline by just over 70.0 billion yen and the operating income margin to decline by just over 20% from the first half of the previous fiscal year, earnings are steadily heading up in existing businesses.

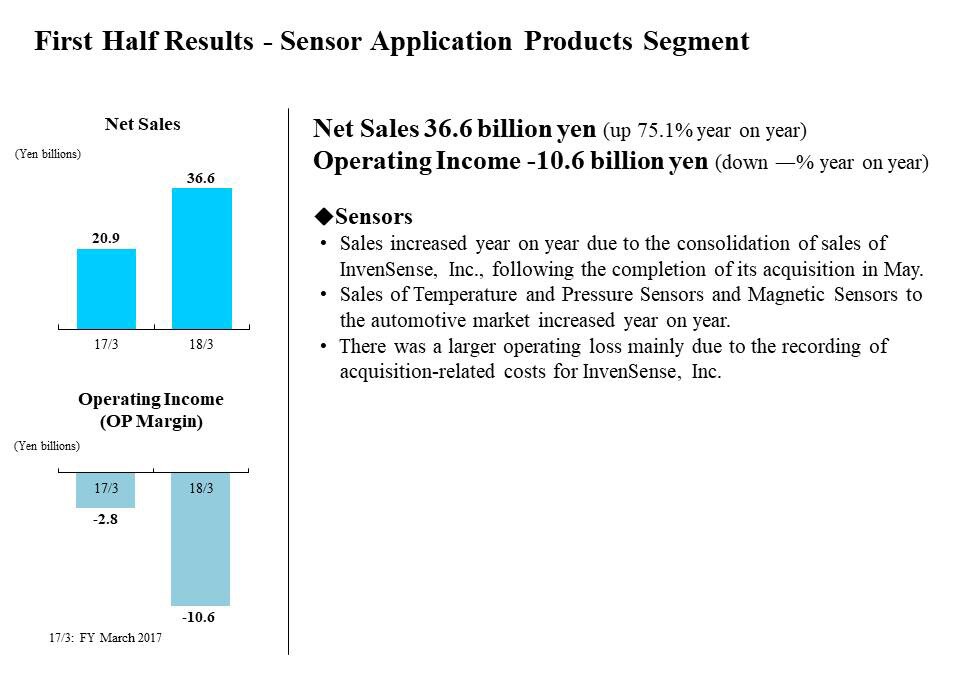

First Half Results - Sensor Application Products Segment

The Sensor Application Products segment includes Temperature and Pressure Sensors, Magnetic Sensors, and MEMS Sensors. Due to the reclassification of products into the new segment, net sales in the first half of the fiscal year ended March 2017 were 20.9 billion yen and operating losses totaled 2.8 billion yen.

In the first half of the fiscal year ending March 2018, net sales rose about 80% year on year to 36.6 billion yen, while operating losses totaled 10.6 billion yen.

Consolidation of sales of InvenSense lifted overall sales by 12.0 billion yen. We are currently calculating goodwill from the acquisition, but figures for the first half include one-time expenses totaling about 7.2 billion yen from the recording of amortization costs related to reevaluation of inventories and other acquisition-related costs.

Sales to the automotive market account for a large share of sales for both Temperature and Pressure Sensors and Magnetic Sensors, which rose about 17% driven by the European and Japanese markets. In addition, full-scale shipments of TMR Sensors to the ICT market began, and are making a strong contribution to sales expansion. Sales of MEMS Sensors accounted for about one third of total sales in the Sensor Application Products segment. Of that, roughly just over 60% of sales were to the ICT market and just under 40% for drones and other industrial equipment applications.

Excluding the roughly 7.2 billion yen in acquisition-related costs, operating income in the Sensor Application Products segment was flat year on year.

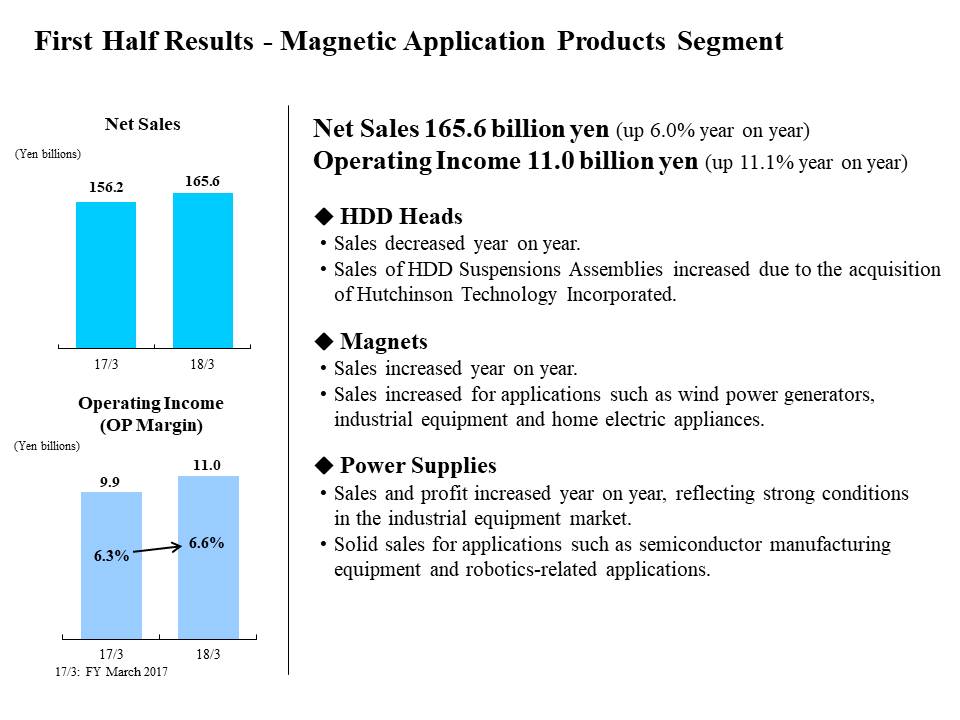

First Half Results - Magnetic Application Products Segment

In the Magnetic Application Products segment, the reclassification of certain products reduced net sales for the first half of the previous fiscal year by 10.1 billion yen and lifted operating income by 5.8 billion yen.

In the first half of the fiscal year ending March 2018, net sales rose 6.0% year on year to 165.6 billion yen, operating income increased 11.1% to 11.0 billion yen, and the operating income margin was 6.6%.

Sales of HDD Heads decreased reflecting a slight decrease in volumes year on year and the absence of HDD assembly sales to North American customers recorded in the first half of the previous fiscal year. However, profitability increased, reflecting benefits from wafer site integration and cost improvements focusing on HDD full-turnkey products. HDD Suspension Assembly sales rose 50% on volume growth from the consolidation of Hutchinson.

Sales of Magnets rose as higher sales for industrial equipment motor applications such as wind power generation and industrial robots offset lower sales of Magnets for HDDs due to a decline in HDD demand. While losses remain, they have halved, and earnings are steadily improving. In Power Supplies, sales and profits grew and profitability rose markedly on brisk sales related to robotics as well as the semiconductor manufacturing equipment and measuring equipment markets driven by strong demand.

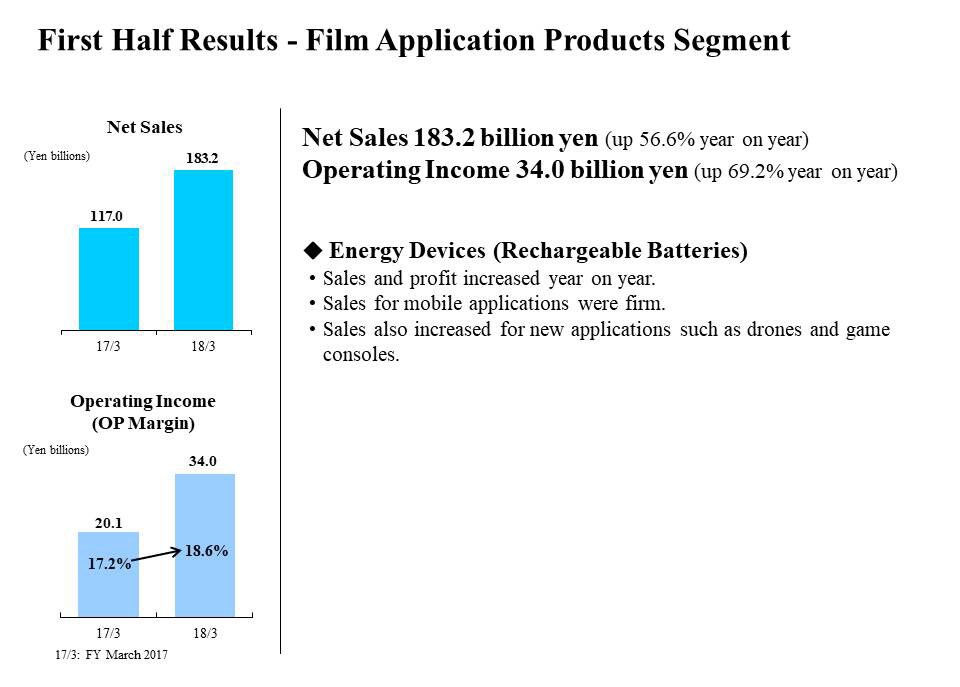

First Half Results - Film Application Products Segment

In the Film Application Products segment, net sales rose 56.6% year on year to 183.2 billion yen and operating income surged 69.2% to 34.0 billion yen. Profitability also stayed strong, with the operating income margin at 18.6%.

Overall sales for mobile devices outgrew initial expectations, and sales expansion to Chinese customers for a wide range of device types also contributed. In addition, the spread of polymer batteries as a replacement for use in PCs accelerated, while expanded sales for drones and game consoles also helped to drive significant increases in sales and profit.

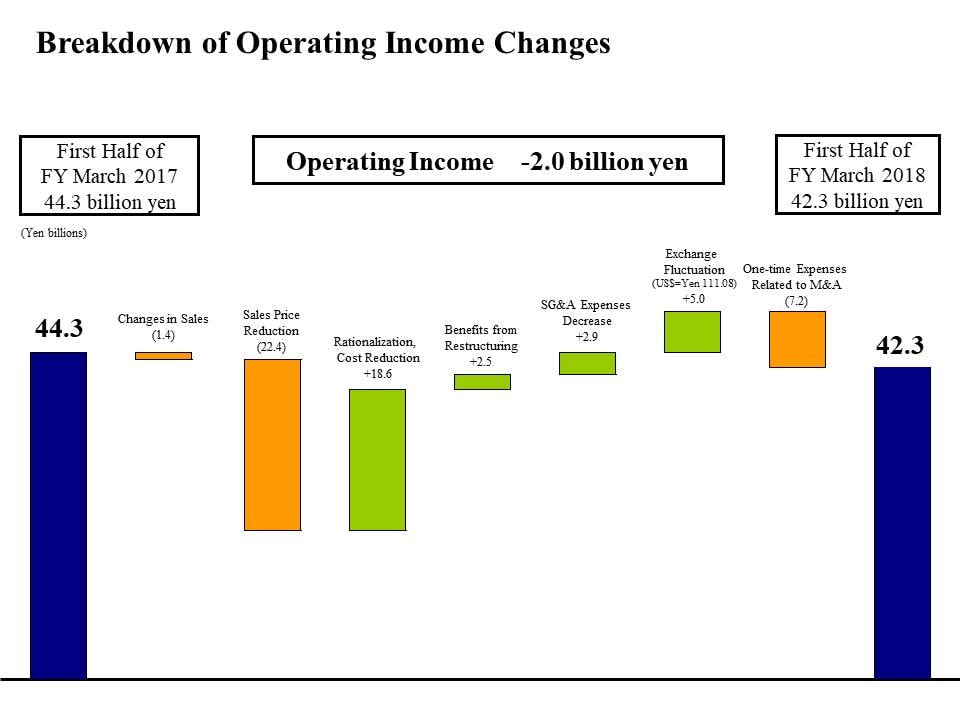

Breakdown of Operating Income Changes

Next is the breakdown of the 0.2 billion yen year-on-year decrease in operating income. First, there was negative impact of roughly 1.4 billion yen from changes in net sales, including capacity utilization and the product mix. Sales growth in Passive Components, Rechargeable Batteries and other existing businesses absorbed most of the negative impact from the transfer of part of the High-Frequency Components business.

Sales price reduction had a negative impact of about 22.4 billion yen. However, that was offset by a positive impact of roughly 18.6 billion yen from rationalization and cost reductions, approximately 2.5 billion yen from benefits from restructuring, and 2.9 billion yen from a decrease in SG&A expenses.

Excluding one-time expenses related to M&A and impact from the yen’s depreciation against the U.S. dollar, operating income was 44.5 billion yen, approximately level with the result of 44.3 billion yen in the same period of the previous fiscal year. Including the positive impact of about 5.0 billion yen from the yen’s depreciation against the U.S. dollar and the 7.2 billion yen in one-time expenses related to M&A, operating income declined 2.0 billion yen year on year.

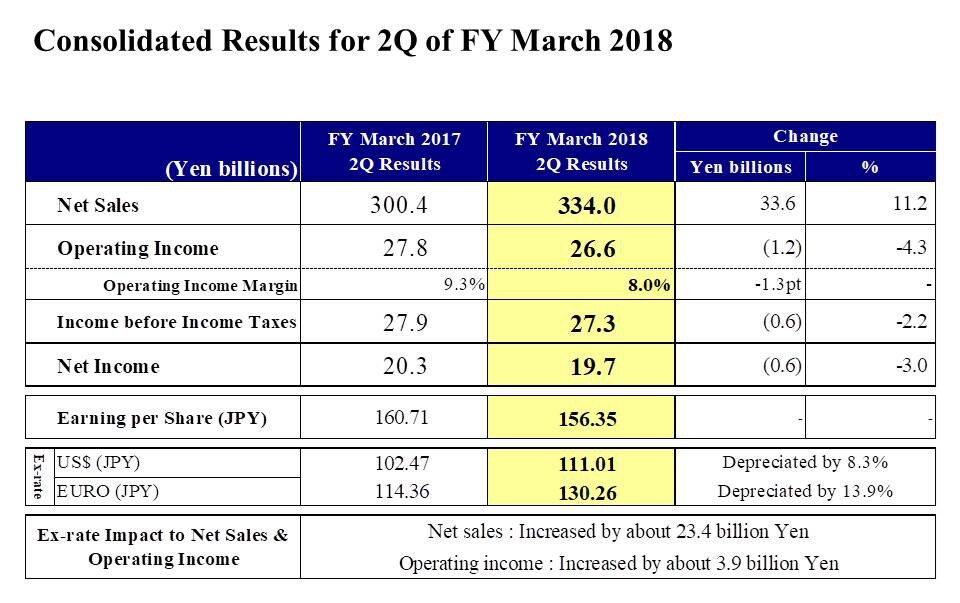

Consolidated Results for 2Q of FY March 2018

Next, let’s look at consolidated results for the second quarter of the fiscal year ending March 2018.

For the second quarter, net sales were 334.0 billion yen, up 11.2% year on year and a new record high on a quarterly basis.

Operating income was 26.6 billion yen, down 4.3% year on year. The second quarter included one-time expenses of 3.7 billion yen related to M&A, and in real terms we secured a higher level of profit than in the same period of the previous fiscal year. The operating income margin was 8.0%, but on a real basis excluding one-term expenses, it was 9.1%. The impact on profitability of transferring the highly profitable High-Frequency Components business was also absorbed. Net income was 19.7 billion yen, down 3.0%.

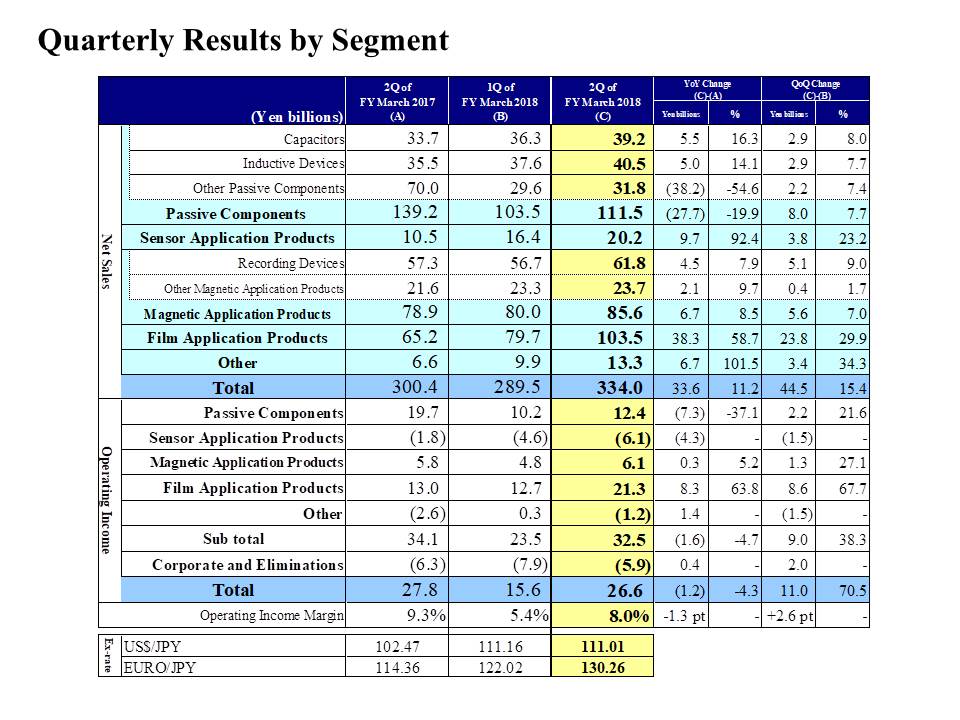

Quarterly Results by Segment

Next, I would like to explain the factors behind the changes in segment net sales and operating income from the first quarter to the second quarter.

First, net sales in the Passive Components segment increased by 8.0 billion yen, or 7.7%, from the first quarter. Ceramic Capacitor sales were strong to the automotive market. Also, Aluminum Electrolytic Capacitors and Film Capacitors drove sales for use in the renewable energy market and industrial robots.

Inductive Device sales rose 7.7% from the first quarter. As with Ceramic Capacitors, sales to the automotive market were strong and sales to the industrial equipment market also rose sharply. Sales for smartphones also found momentum and sales have generally increased for the automotive, industrial equipment and ICT fields.

Other Passive Component sales increased 2.2 billion yen, or 7.4% from the first quarter. Sales of Ceramic Filters and SESUB products for smartphones have increased.

Operating income in the Passive Components segment increased by 2.2 billion yen, or 21.6%, from the first quarter. The profitability of Capacitors has improved substantially due to an increase in sales volume and better production efficiency.

Turning to the Sensor Application Products segment, net sales rose by 3.8 billion yen, or 23.2%, from the first quarter. The growth mainly reflects increasing sales of TMR Sensors for smartphones and full consolidation of InvenSense in the second quarter.

Operating income declined by 1.5 billion yen from the first quarter. This resulted mainly from a 0.2 billion yen increase in one-time expenses related to M&A, advance payment of development expenses in MEMS sensors, and slight increase in losses due to full consolidation from the second quarter.

In the Magnetic Application Products segment, net sales increased by 5.6 billion yen, or 7%, from the first quarter. Sales of Recording Devices increased by 5.1 billion yen, or 9%, owing to slightly higher HDD Head shipments and an increase in HDD full-turnkey shipments. Sales of Other Magnetic Application Products increased by 0.4 billion yen, or 1.7%, from the first quarter. Sales to the industrial equipment market, including for industrial robots and measuring equipment, were brisk for both Magnetic Products and Power Supplies.

Operating income in the Magnetic Application Products segment increased by 1.3 billion yen from the first quarter. The main factors in the rise were an increase in marginal profit on HDD Heads due to volume growth, better Ferrite Magnet earnings in Magnetic Products, and volume growth in Power Supplies.

Finally, in the Film Application Products segment, net sales grew by 23.8 billion yen, or 29.9%, from the first quarter. Sales grew significantly driven by overall volume growth in sales for smartphones and tablets, expanded replacement of PC batteries with polymer batteries, and growth in sales for game consoles.

Operating income was 21.3 billion yen, up 8.6 billion yen from 12.7 billion yen in the first quarter. Increases in marginal profit atop higher sales volumes and progress on cost improvements have secured a significant increase in profit.

That concludes my presentation. Thank you very much for your attention.