[Financial Results for Fiscal 2017 Performance Briefing]Consolidated Full Year Projections for FY March 2018

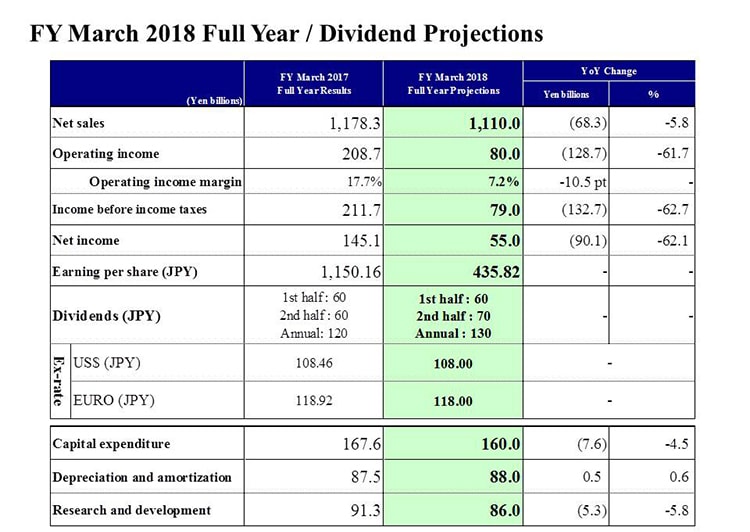

FY March 2018 Full Year / Dividend Projections

Next, let’s take a look at consolidated earnings projections for the fiscal year ending March 31, 2018.

TDK is projecting net sales of 1,110.0 billion yen, operating income of 80.0 billion yen, and an operating income margin of 7.2%. We are forecasting income before income taxes of 79.0 billion yen, net income of 55.0 billion yen, and earnings per share of 435.82 yen. Looking at our dividend projections, TDK plans to pay an interim dividend of 60 yen and raise the year-end dividend by 10 yen to 70 yen for an annual dividend of 130 yen per share. Our exchange rate assumptions are 108 yen against the U.S dollar and 118 yen against the euro. We are projecting capital expenditure of 160.0 billion yen, depreciation and amortization of 88.0 billion yen, and research and development (R&D) expenses of 86.0 billion yen.

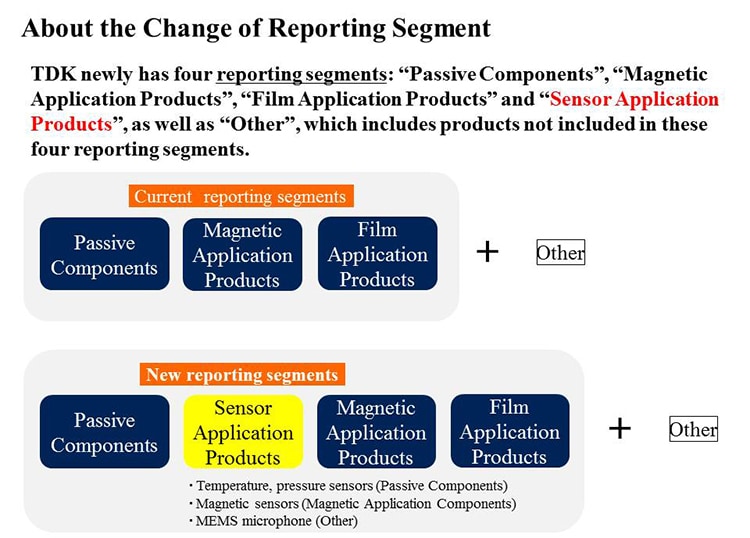

About the Change of Reporting Segment

Next, I will explain changes in segment classifications effective from the fiscal year ending March 2018.

On April 1, 2017, TDK established the Sensor Systems Business Company. The electronics market affects our consolidated performance. Within it, the market for sensors is expected to expand sharply moving ahead. In response, we have set up the new organization for several key reasons. Firstly, to speed up the integration of our pre-existing sensor operations with those of sensor-related companies we have already acquired and those of InvenSense, which we plan to finish acquiring soon. Secondly, to establish lateral frameworks for marketing, R&D, and other aspects. Ultimately, the new company is to offer sophisticated, high added-value sensing solutions. Based on this organization change, we established Sensor Application Products as a new reporting segment effective from the fiscal year ending March 2018, in addition to the existing reporting segments of Passive Components, Magnetic Application Products, and Film Application Products. The Sensor Application Products segment comprises businesses moved to it from pre-existing segments. Specifically, it includes Temperature and Pressure Sensors previously grouped into the Passive Components segment, Magnetic Sensors previously in the Magnetic Application Products segment, and MEMS Microphones previously in the Other segment.

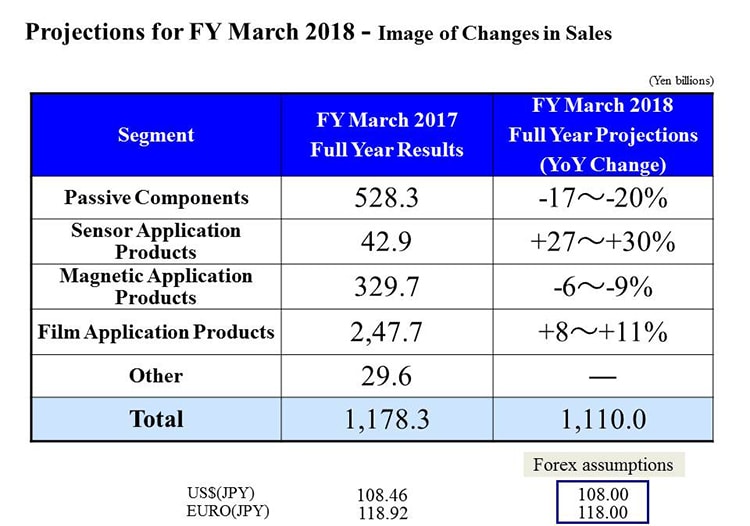

Projections for FY March 2018 - Image of Changes in Sales

Lastly, we present an image of changes in consolidated full-year sales in each segment. It is based on sales for the fiscal year ended March 2017 reclassified into the new reporting segment framework I previously explained. Also, we expect almost no change from foreign exchange rates because our assumptions for the fiscal year ending March 2018 are nearly the same as for the fiscal year ended March 2017.

First for the Passive Components segment, we are projecting a net sales decline of 17-20%. However, segment sales in the previous fiscal year included roughly 130 billion yen from the sale of business. Excluding the negative impact from that, we are projecting growth of 8-11%. In the smartphone market, strong growth is unlikely but an increase in the number of components in line with increasing sophistication of handsets is expected. In the automotive market, we expect robust demand growth with the expansion of advanced driving assistance systems (ADAS), automated driving and other developments.

In the Sensor Application Products segment, we are projecting net sales growth of 27-30%. Our projection does not factor in benefits from the acquisition of InvenSense. We expect expansion of Magnetic Sensor sales to the automotive market as well as the ICT market.

In the Magnetic Application Products segment, we are projecting a net sales decline of 6-9%. We envision HDD Head shipment volumes falling about 10%, but on the other hand, we expect a full-year contribution from Hutchinson’s sales in the HDD Suspension business, as well as sales growth in new business leveraging Hutchinson’s metal microfabrication and etching technology. For Other Magnetic Application Products, we anticipate basically flat growth.

In the Film Application Products segment, we are projecting net sales growth of 8-11%.

We would like you to picture Company-wide sales steadily growing as expanding demand for a variety of Electronic Components drives market-beating growth for Passive Components, which account for roughly half of Company-wide sales, while sales of Sensor Application Products expand steadily, and solid growth continues for Film Application Products. These growth factors should more than offset the impact of lower sales of HDD Heads and the decline in sales due to the sale of business.

That concludes my presentation. Thank you for your attention.