[ Financial Results for Fiscal 2017 Performance Briefing ]Consolidated Results for FY March 2017

Mr. Tetsuji Yamanishi

Corporate Officer

I'm Tetsuji Yamanishi, Corporate Officer at TDK. Thank you for taking the time to attend TDK's performance briefing for the fiscal year ended March 2017. I will be presenting an overview of our consolidated results.

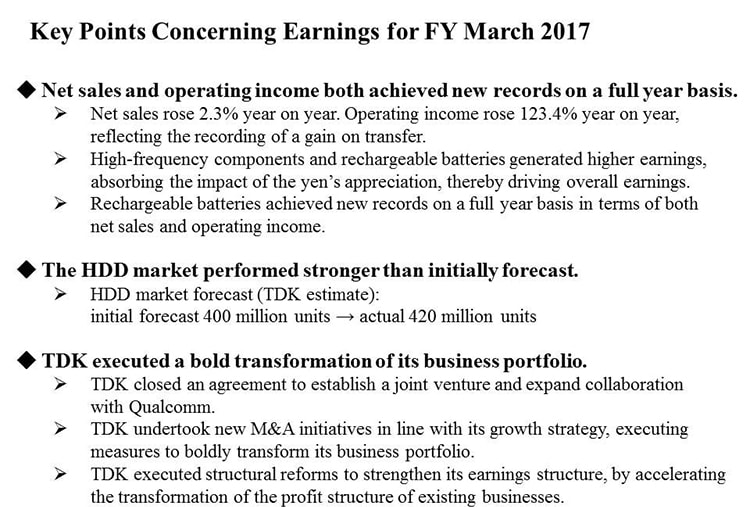

Key Points Concerning Earnings for FY March 2017

First, let's take a look at the key points concerning earnings for the fiscal year ended March 2107. Sales and profits both recorded historical highs for full-year results, with net sales up by 2.3% year on year and operating income increasing 2.2 times, including gain on sale of business associated with the transfer of part of the High-Frequency Components business. These results were achieved despite a sizable impact from the yen’s appreciation, as the yen-U.S. dollar pair decreased by around 12 yen, or approximately 10% and the yen-euro retreated by around 14 yen or approximately 10%.

Now let’s look at the market environments that affected TDK’s consolidated performance in the fiscal year ended March 2017. In the ICT market, which accounts for nearly 60% of TDK’s sales, the smartphone market overall decelerated; however, a few specific smartphone manufacturers in the biggest market of China gained momentum to grow sharply and are increasingly driving growth?not just in China but in the market overall. In the hard disk drive (HDD) market, we initially forecast the total addressable market (TAM) for HDDs at 400 million units, assuming lower PC demand and a faster switch from HDDs to solid state drives (SSDs). However, SSD supply and demand conditions and PC demand positively affected the HDD market, which has outperformed our projection with the TAM for HDDs coming to 420 million units. In the automotive market, which accounts for nearly 20% of TDK’s sales, sales stayed strong in the U.S. and Europe and rose sharply in China, where subsidies helped. Also, the automotive market overall remained robust, with demand for electric vehicles, hybrid electric vehicles, and plug-in hybrids (xEVs) really gearing up in anticipation of the tightening of environmental regulations, and steps to bring automated driving into the mainstream accelerating globally. Turning to the industrial equipment and energy markets, demand overall was weak, partially due to slow global economic recovery and restrained infrastructure investment. However, demand grew in some markets like semiconductor manufacturing equipment and renewable energy.

Against this market backdrop, Passive Components saw sales of High-Frequency Components grow with the expanding share of module products in the smartphone market. Coupled with a major improvement in profitability from better productivity, the effect offset impact from a stronger yen to secure profit growth and drive overall Passive Components earnings. In addition, sales to the automotive market, which account for roughly half of sales of products such as Capacitors and Inductors, rose year on year, absorbing the impact from a stronger yen. Providing products matching market needs is steadily leading to sales growth.

In Rechargeable Batteries, we achieved both higher sales and operating income year on year. The main contributing factors were an expanded and more stable customer portfolio with reduced dependence on a North American customer, reflecting steady expansion in sales to Chinese customers and growing sales for use in new applications such as drones and game consoles. With the addition of productivity improvements, we brushed off the impact of the stronger yen and pressure to discount sales prices to achieve new records in both sales and operating income.

As for HDD Heads, brisk shipments to a major Japanese customer from the start of the fiscal year drove shipments up about 13% year on year, outpacing our initial projection by about 25%. Sales grew 6% year on year, despite the impact of the stronger yen.

The agreement with Qualcomm regarding a business alliance and establishment of a joint venture was formalized in February 2017 as planned, and a \144.4 billion gain on sale of business associated with the agreement was posted in the fourth quarter. We have been leveraging funds received as consideration for the sale of business to execute M&As in line with our growth strategy since the previous fiscal year. Meanwhile, we are decisively restructuring as we transform earnings structures in the HDD Heads, Metal Magnets, and Aluminum Electrolytic Capacitors businesses in light of changing market climates, and we are further bolstering our earnings base. Along with shoring up our earnings foundation by reworking the earning structures of these existing businesses, we aim to grow further by rapidly realizing results from the organic integration of existing operations and business bases acquired through M&As.

Consolidated Full Year Results for FY March 2017

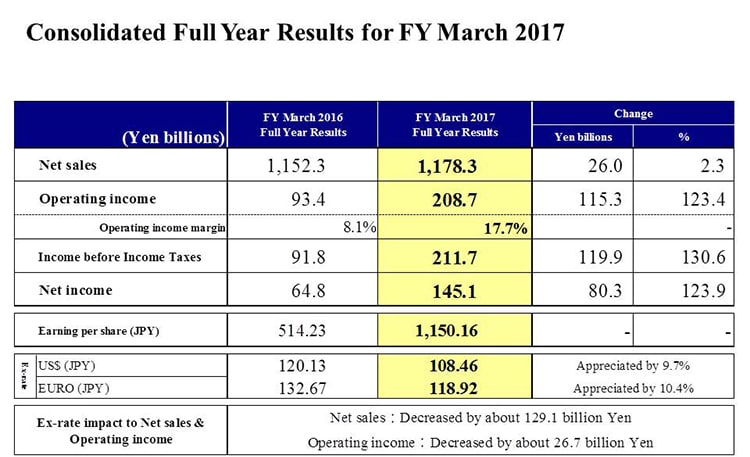

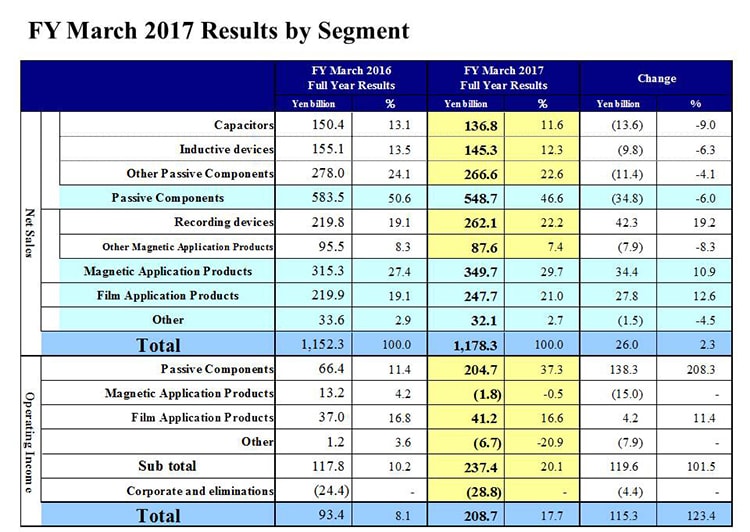

Moving along, I would like to present an overview of our results. Net sales were 1,178.3 billion yen, an increase of 26 billion yen, or 2.3%, year on year. Operating income was 208.7 billion yen, up 115.3 billion yen, or 2.2 times the figure a year ago. Operating income includes a 144.4 billion yen gain on sale of business and 21.2 billion yen in restructuring costs, mainly impairment losses. Excluding those one-time gains and costs, operating income on a real basis was 85.5 billion yen and the operating income margin was 7.3%.

Income before income taxes was 211.7 billion, up 119.9 billion yen. Net income increased by 80.3 billion yen to 145.1 billion yen. Consequently, earning per share was 1,150.16 yen.

The average exchange rate for the fiscal year ended March 2017 was 108.46 yen against the U.S. dollar, an appreciation of 9.7%, and 118.92 yen against the euro, an appreciation of 10.4%. In terms of the impact of these exchange rate movements, exchange rates pushed down net sales and operating income by around 129.1 billion yen and 26.7 billion yen, respectively.

With regard to exchange-rate sensitivity, as with our previous estimate, we estimate that a change of 1 yen against the U.S. dollar will have an impact of approximately 1.2 billion yen, while a change against the euro will have an impact of approximately 0.7 billion yen.

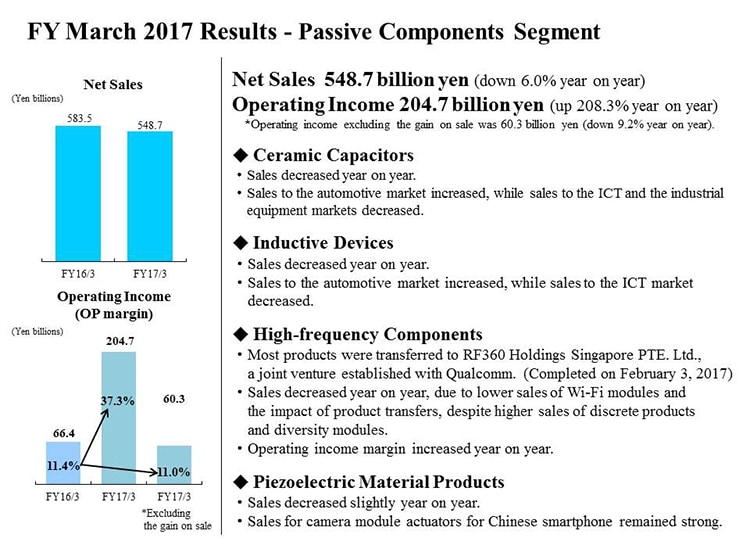

FY March 2017 Results - Passive Components Segment

Next, I would like to explain our business segment performance.

First, in the Passive Components segment, net sales were 548.7 billion yen, down 6% year on year, and operating income was 204.7 billion yen, 3.1 times the year-ago figure. Excluding the 144.4 billion yen gain on sale of business included in operating income puts operating income at 60.3 billion yen, down 9.2% year on year. However, the operating income margin remains on par with a year ago at 11%. Total restructuring costs of 9.8 billion yen were posted for the Passive Components segment overall. In Aluminum Electrolytic Capacitors business, a 9 billion yen one-time cost for impairment of long-lived assets and goodwill was recorded stemming from the shift in earnings structure. Specifically, we shifted our focus to products for the automotive market, where we have competitive advantages, and away from products for the infrastructure market, which is heavily influenced by economic factors. Meanwhile in the Other business, overseas workforce reductions were made.

Sales in both Ceramic Capacitors and Inductive Devices increased year on year as the impact of the stronger yen was absorbed by solid sales for the automotive market, which accounts for around half of the sales of each of the two categories, particularly in North America, Europe, and China, On the other hand, sales for the ICT sector centered on smartphones and for industrial devices declined.

In High-Frequency Components, sales of Discrete Products for smartphones remained strong to major customers in North America, China, and South Korea. In addition, sales of Diversity Modules to major North American customers grew, absorbing the impact from a stronger yen and lower sales volumes of modules for Wi-Fi. However, removal of the bulk of High-Frequency Components from consolidation due to the sale of business in February 2017 resulted in an overall sales decline. On the other hand, an increase in operating income from higher volumes combined with better Module Product earnings translated to major profit growth, and much higher margins than in the previous fiscal year.

In Piezoelectric Material Products, sales of actuators for camera modules continued to trend firmly for Chinese smartphone manufacturers.

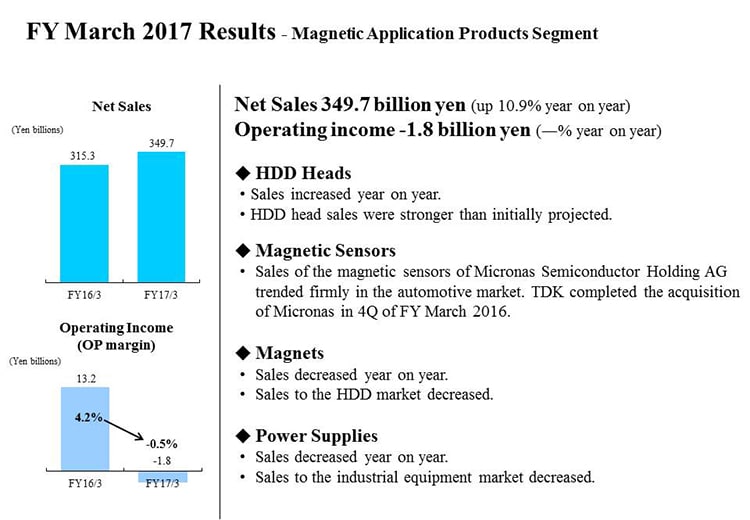

FY March 2017 Results - Magnetic Application Products Segment

Turning to the Magnetic Application Products segment, net sales were 349.7 billion yen, an increase of 10.9% year on year. Operating loss was 1.8 billion yen.

In HDD Heads, restructuring expenses of 7.6 billion were recorded, including costs for overseas workforce reductions, the impairment of long-lived assets associated with the concentration of wafer production bases to one site in the U.S. and the conversion of domestic wafer production sites to the TMR sensor business as steps towards rightsizing HDD head capacity. In Metal Magnets, a 3.7 billion yen cost for impairment of long-lived assets was recorded in connection with the goal of transforming the essential earnings structure by shifting to a product portfolio focused on automotive and industrial equipment rather than past dependence on HDD earnings. In Power Systems, we recorded 0.1 billion yen in expenses associated with domestic site relocation. As a result, total restructuring expenses of 11.4 billion yen were booked in the Magnetic Application Products segment. Excluding those restructuring expenses, operating income on a real basis was 9.6 billion yen and the operating income margin was 2.7%.

HDD heads saw sales grow on brisk shipments of 2.5-inch HDD heads to a major Japanese customer from the start of the fiscal year, in addition to higher sales from a switch to 3.5-inch HDD full-turnkey sales. Overall sales of recording devices also rose about 19% as a rise in sales from the acquisitions of Micronas and Hutchinson absorbed the impact of the stronger yen. With HDD head shipments in the first quarter of the previous fiscal year indexed at 100, the HDD head shipment index for the fourth quarter was 114 compared with our prior projection of 108. In terms of profitability, we delivered a double-digit operating income margin and slightly higher profits for HDD heads excluding one-time costs, despite the impact of the stronger yen. A key factor was an increase in a utilization gain from wafer site integration, which offset lower earnings from sales price reductions mainly for new products and an end to HDD assembly sales to a North American customer. The asset valuation for goodwill related to the acquisitions of Micronas and Hutchinson has been completed, and an amortization expense of 3.3 billion yen was booked in the fiscal year ended March 2017.

Sales of Magnets declined slightly year on year, even in real terms discounting the impact of the yen’s appreciation. Sales of magnets for HDDs continue to struggle in the face of declining HDD demand, although there was an increase in sales of motors for wind power generation as part of a drive to strengthen the business for industrial equipment.

In Power Supplies, sales rose slightly on a real basis excluding impact from foreign exchange rates. Sales of Power Supplies for medical equipment and measuring equipment in Europe and the U.S. were strong. In addition to higher overseas earnings, domestic manufacturing process reforms and development efficiency gains also contributed to a large increase in profitability.

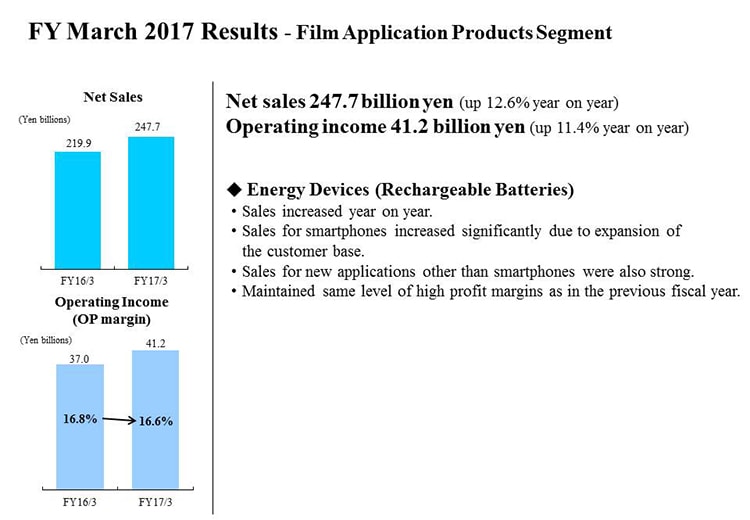

FY March 2017 Results - Film Application Products Segment

Next is the Film Application Products segment. In this segment, net sales were 247.7 billion yen and operating income was 41.2 billion yen. Sales rose by 12.6% and profits increased by 11.4%. The segment has maintained high profitability in conjunction with growth in the size of business. It has achieved a high operating income margin of over 16%, the same level as in the previous fiscal year.

In rechargeable batteries, TDK achieved much higher sales and profits. Sales increased sharply to smartphone manufacturers in China, despite declining to a North American customer. Moreover, sales increased for new applications other than smartphones, such as drones and game consoles. Furthermore, we met increased demand by executing timely investments to boost production capacity in conjunction with increasing productivity.

FY March 2017 Results by Segment

Moving on to full-year performance by segment, I have already provided explanations for Passive Components, Magnetic Application Products, and Film Application Products, so I will now cover the Other segment and corporate and eliminations.

Net sales in Other came to 32.1 billion yen, down 4.5% and operating loss was 6.7 billion yen, a deterioration of 7.9 billion year on year.

Sales of Semiconductor Manufacturing Equipment were strong. However, segment earnings were depressed mainly by a decline in income due to the absence of the sale of a major anechoic chamber facility recorded in the previous fiscal year and up-front expenses associated with new product launches.

The operating loss under corporate and eliminations increased by 4.4 billion yen, mainly due to development expenses related to the TDK Monozukuri revolution and a rise in expenses associated with new business development.

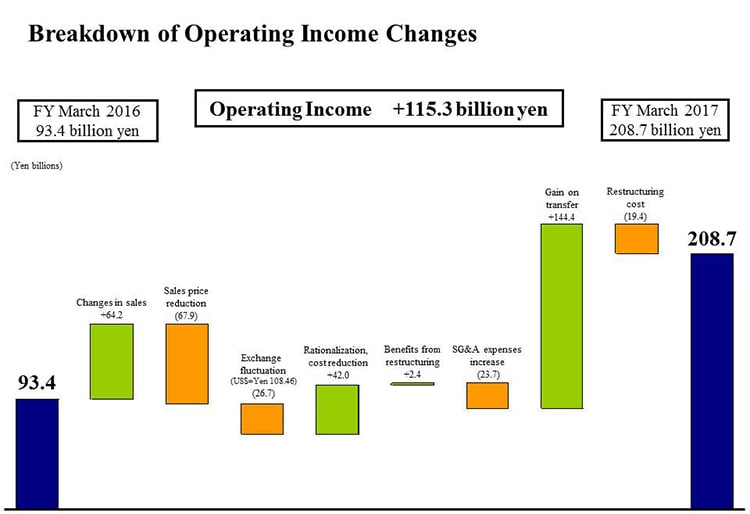

Breakdown of Operating Income Changes

Next is the breakdown of change in operating income. Operating income rose 115.3 billion yen but fell 9.7 billion yen if we exclude the 144.4 billion yen gain on sale of business and the negative impact of 19.4 billion yen from higher restructuring costs.

Firstly, sales growth, including from capacity utilization and the product mix, lifted operating income by about 64.2 billion yen. A key factor was brisk sales of High-Frequency Components and Rechargeable Batteries.

Next, sales price reductions with discounts averaging about 5% depressed operating income by roughly 67.9 billion yen. The stronger yen had a negative impact of about 26.7 billion yen on operating income. In rationalization and cost reductions, highly efficient processes boosted efficiency and improved yields which, in combination with discounts on raw materials, lifted operating income by 42 billion yen. Benefits from restructuring were 2.4 billion yen, reflecting overseas workforce reductions in HDD Head business implemented in the previous fiscal year.

SG&A expenses had a negative impact of 23.7 billion yen on operating income. Increases in SG&A expenses include about 9 billion yen stems from consolidation of the acquired companies Micronas and Hutchinson. The remaining roughly 15 billion yen reflects increases of about 9 billion yen in development expenses and roughly 6 billion yen in selling expenses. The rise in development expenses primarily reflects increases in development expenses related to the TDK Monozukuri revolution, headquarter R&D expenses related to new business development, and development expenses for growth businesses such as Rechargeable Batteries. The rise in selling expenses mainly owes to higher selling expenses from sales growth as well as M&A-related expenses and a rise in goodwill amortization after acquisitions.

FY March 2017 Quarterly Results by Segment

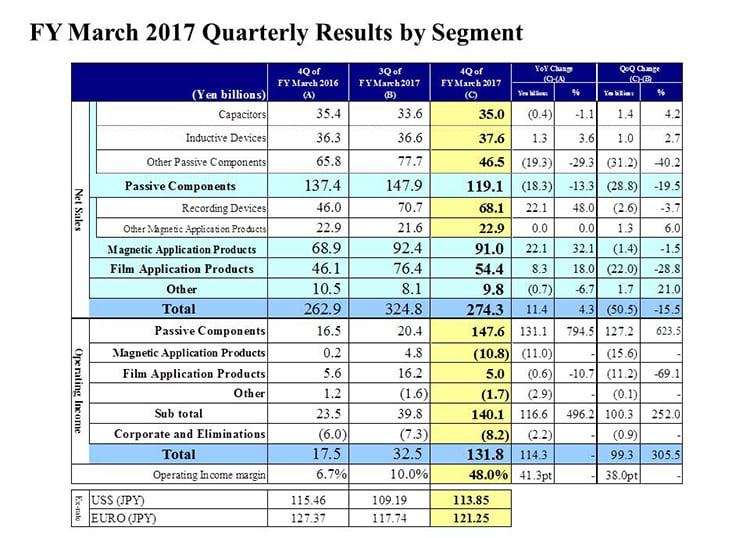

Next, I would like to explain the factors behind the changes in segment net sales and operating income from the third quarter to the fourth quarter. First, as was done previously, certain products have been reclassified between segments. Certain products in the Film Application Products segment have been reclassified to the Other segment from the fiscal year under review. This change had the impact of increasing net sales of the Other segment by 0.5 billion yen in the fourth quarter of the previous fiscal year. Also, certain products in the Other segment have been reclassified to the Passive Components segment from the fiscal year under review. This change had the impact of increasing net sales of the Passive Components segment by 1.2 billion yen in the fourth quarter of the previous fiscal year. These reclassifications had virtually no impact on operating income.

Let’s now look at the changes in each segment, beginning with the Passive Components segment. In this segment, net sales in the fourth quarter were 28.8 billion yen or 19.5% lower than in the third quarter. Sales of Capacitors were up by 1.4 billion yen, or 4.2%, from the third quarter. Sales of Ceramic Capacitors were brisk for automotive applications but declined for ICT applications, partially due to seasonality. Sales of Aluminum Electrolytic Capacitors and Film Capacitors were strong to the automotive market and grew for renewable energy applications. Sales of Inductive Devices were up by 1.0 billion yen, or 2.7%, from the third quarter. The slight increase reflects ongoing strong sales to the automotive market that offset weaker sales for ICT. In Other Passive Components, sales declined by a substantial 31.2 billion yen, or 40.2%. This largely reflects impact from High-Frequency Components being removed from consolidation as of February 2017 due to the sale of the business.

Operating income in the Passive Components segment increased by 127.2 billion yen from the third quarter. However, if the 144.4 billion yen gain on sale of business is excluded, operating income declined by 17.2 billion yen. Even if the 9.8 billion yen in restructuring costs are also excluded, operating income declined by 7.4 billion yen. However, that is mostly attributable to the sale of the High-Frequency Components business.

Next is the Magnetic Application Products segment. In this segment, net sales decreased by 1.4 billion yen, or 1.5%, from the third quarter. Sales of Recording Devices fell 2.6 billion yen, or 3.7%. This is mainly because our HDD Heads shipment volume index fell roughly 10% to 114 in the fourth quarter from 126 in the third quarter, and full-turnkey sales in 3.5-inch HDDs were slightly lower. Sales of Other Magnetic Application Products grew by 1.3 billion yen, or 6%, driven by strong sales of power supply for measurement instruments. Operating income in the Magnetic Application Products segment declined by 15.6 billion yen from the third quarter. Excluding restructuring costs of 11.4 billion yen, operating income fell by 4.2 billion yen. In addition to lower sales and income from a decline in HDD Head shipment volumes, this mainly reflects a reduction in capacity utilization due to the Lunar New Year holidays and the posting of goodwill amortization associated with the acquisition of Hutchinson.

Moving on to the Film Application Products segment, net sales decreased by 22 billion yen, or 28.8%, from the third quarter. Sales rose to major South Korean customers but fell to major North American customers due to seasonality, and there was an impact from lower sales to major Chinese customers as some of them made inventory adjustments. Operating income was 5 billion yen, down 11.2 billion yen, or 69.1%, from the third quarter. The significant decrease was due to lower marginal profit from lower sales volumes, reduced capacity utilization due to the Lunar New Year holidays, and higher materials prices.