[ 2nd Quarter of fiscal 2017 Performance Briefing ]Consolidated Full Year Projections for FY March 2017

Mr. Shigenao Ishiguro

President and CEO

My name is Shigenao Ishiguro.

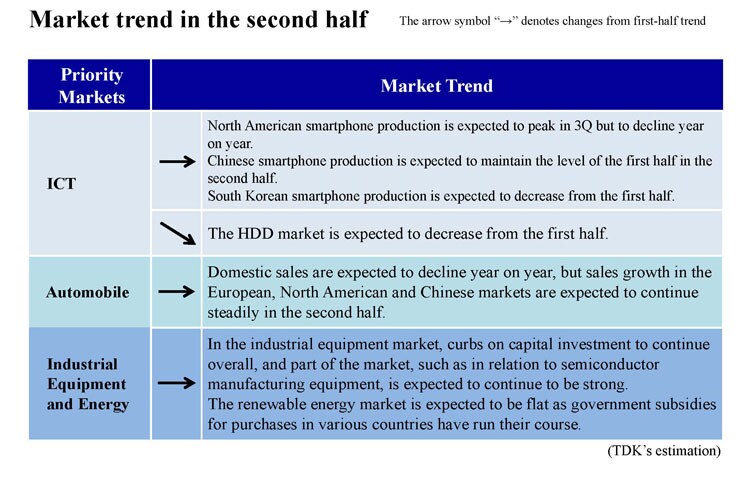

Market trend in the second half

First, let’s review market trends. As we have explained already, the smartphone and HDD markets in the first half performed more strongly than initially expected, driving earnings. In the second half, we expect the tone in the third quarter to remain largely the same as in the second quarter, and we anticipate a correction to come in the fourth quarter.

(1) ICT Market

Within the ICT market, the market trend in smartphones for the second half should see production levels somewhere between flat and slightly up.

Major North American smartphone manufacturer is again expected to hit peak production in the third quarter this year, with a heavy correction in the fourth quarter. We therefore expect second half production levels to be down year on year.

Chinese major smartphone manufacturers’ trends have been benchmarked, and although second-half production levels are slightly unclear for the fourth quarter, they are expected to continue at the same level as the first half.

South Korean smartphone manufacturers should see production levels drop in the second half compared to the first half.

In the HDD market, as we explained before, the HDD market projection (TAM) has been revised upward from the initial 400 million unit-level to the 410 million level. In the second half, we expect a correction in the fourth quarter, with the demand falling compared to the first half.

(2) Automobile Market

Automobile sales for consumers in Japan are expected to decline year on year. However, overall demand is projected to remain firm in the second half, led by the European and U.S. markets, and the Chinese market.

(3) Industrial Equipment Market

In the industrial equipment market, curbs on capital expenditures are expected to continue overall, while certain markets are expected to continue performing strongly, such as semiconductor manufacturing equipment and robot-related markets.

The renewable energy market is expected to be flat in the second half as government subsidies in various countries around the world have run their course.

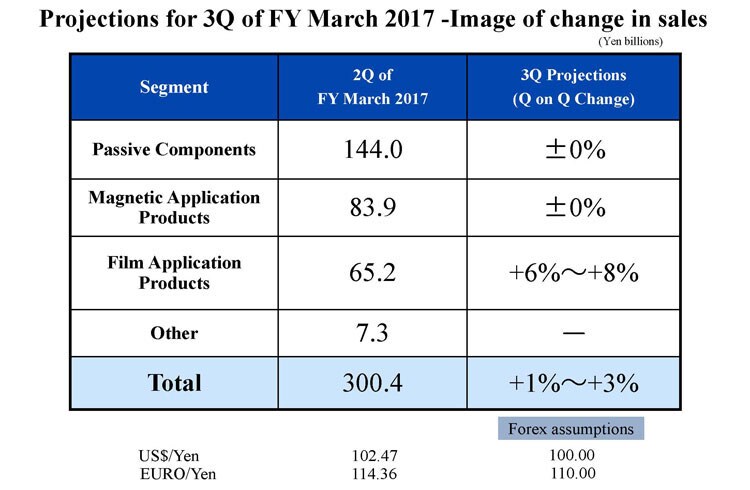

Projections for 3Q of FY March 2017 -Image of change in sales

Let me now discuss our image of changes in sales for the third quarter of the fiscal year ending March 2017.

Looking first at Passive Components, we expect the market to remain flat overall. We expect steady growth in sales of products centered on capacitors and inductive devices. This outlook is based on expectations of continued strong sales of automobiles in the North American, European and the Chinese markets. In the smartphone market, we expect strong sales of products centered on high-frequency components. This outlook is mainly based on expectations of continued brisk sales to Chinese customers and the production peak for new devices of North American customer. However, overall we expect sales to be level as sales of Wi-Fi modules to North American customer have dropped sharply, while in sales to PA manufacturers, the incorporation of components by some customers was brought forward slightly into the second quarter, pushing second quarter sales to a high level.

In Magnetic Application Products, as we explained before, the HDD market projection has been revised upward from the initial 400 million unit-level to the 410 million level. In the second half, we expect buoyant sales to Japanese customers to continue. However, the impact of halting sales of models for U.S. customer from the third quarter onward is starting to increase, while assembled sales of 2.5-inch HDDs to U.S. customer remained more-or-less level in 2Q. As a result, the sales index is projected to slide by around 4% from 124 in the second quarter to 119 in the third quarter. On the other hand, having completed the acquisition of Hutchinson Technology Inc. on October 5, we will include its net sales, equivalent to around 5% over our overall Magnetic Application Products in 2Q, in our consolidated results from the third quarter onwards. As a result, overall sales are expected to be flat quarter on quarter.

Film Application Products sales are expected to increase by 6% to 8% year on year overall as North American customer ramps up production of new devices and sales to China remain strong.

As a result, we expect an increase of between 1% and 3% over the second-quarter sales of 300.4 billion yen.

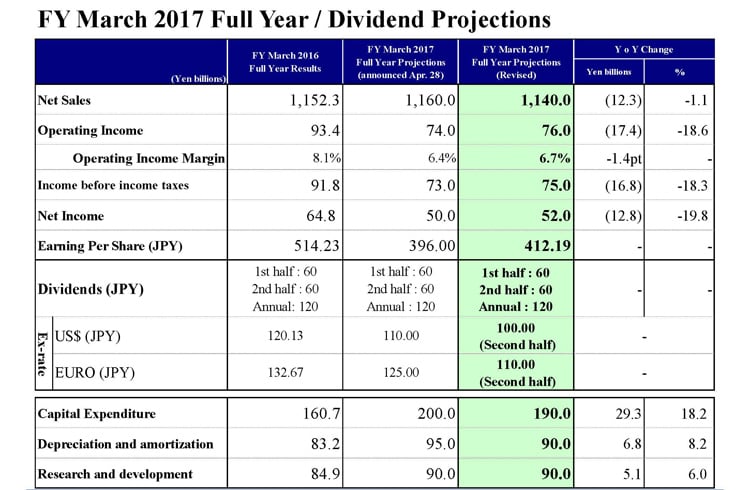

FY March 2017 Full Year / Dividend Projections

Finally, I will explain our full-year consolidated earnings projections.

The assumed average foreign exchange rate of the initial announcement has changed. For the second half, the exchange rate assumption has been revised to 100 yen to the U.S. dollar and 110 yen to the euro.

As a result, partly due to the impact of the yen’s appreciation, we have revised our projection for net sales downward by 20.0 billion yen to 1,140.0 billion yen. On the other hand, our projections for operating income, income before income taxes, and net income have each been revised upward by 2.0 billion yen, with operating income up from 74.0 billion yen to 76.0 billion yen, net income from 50.0 billion yen to 52.0 billion yen, and the projection for earnings per share at 412.19 yen. Our dividend outlook is for interim and final dividends of 60 yen per share, for an annual dividend of 120 yen per share.

For the second half, as I explained before, in the third quarter we are expected sales growth of around 2% compared to the second quarter, taking account of foreign exchange rate effects. However, in the fourth quarter, the demand trends have become unclear for the smartphone market and HDD head market, and we have revised our full-year forecast down by 20.0 billion yen.

On the other hand, we expect operating income to absorb the impact of the yen’s appreciation and we have revised the projection upward from the initial announcement. Since first-half operating income absorbed foreign exchange impacts to beat our initial projection, we have assumed that it will be able to absorb further the foreign exchange impacts expected in the second half, and so we have revised the full-year operating income projection up by 2.0 billion yen to 76.0 billion yen. This revision incorporates the earnings of Hutchison from the third quarter, which I mentioned before, as well as the current loss-making status and expenses arising in connection with the acquisition.

In line with the revision of our foreign exchange rate assumption, we have revised our plan for capital expenditures downward by 10.0 billion yen to 190.0 billion yen, and our depreciation and amortization expense down by 5.0 billion yen to 90.0 billion yen.

That concludes my presentation. Thank you for your attention.