[ 2nd Quarter of fiscal 2017 Performance Briefing ]Consolidated Results for First Half of FY March 2017

Mr. Tetsuji Yamanishi

Corporate Officer

I'm Tetsuji Yamanishi, Corporate Officer at TDK. Thank you for taking the time to attend TDK's performance briefing for the first half (April to September) of the fiscal year ending March 2017. I will be presenting an overview of our consolidated results.

Key points concerning earnings for First Half of FY March 2017

First, let's take a look at the key points concerning earnings for the first half. Net sales decreased by 1.4% and operating income decreased by 2.9% year on year. This was in line with the yen’s sharp appreciation since the beginning of the fiscal year. However, we managed to achieve a year-on-year increase of 3.8% in net income.

Looking at year-on-year comparison, TDK was strongly affected by the appreciation of the yen, which rose 16 yen against the U.S. dollar and 17 yen against the euro. Amid an emergent deceleration in the growth of our mainstay smartphone market as a whole, we sold passive components and film application products to customers in North America and made steady gains on capturing demand from customers in China. As a result, passive components absorbed the foreign exchange impact to set a new record high for both quarterly and half-yearly operating income, while rechargeable batteries also set a new record high for half-yearly operating income.

In the Passive Components segment, sales of high-frequency components expanded on sales promotion activities for discreet products and diversity modules. Productivity improvements also contributed to a major step forward in improving profitability. As a result, sales and income both increased year on year, driving earnings of the Passive Components segment as a whole.

In rechargeable batteries, we achieved both higher sales and income year on year. The main contributing factors were continued strong sales to winning Chinese customers, reducing dependence on North American customers. In addition to the expanded and more stable customer portfolio, another major contributor was growing sales for use in new applications such as drones.

In HDD heads, the initial expectation was for a year-on-year decline in demand of 10%, or around 400 million units. Recently, however, HDD demand has risen slightly, and the projection has been revised to 410 million units. Shipments of HDD heads for Japanese customer continued to move strongly, driving a 10% year-on-year increase in overall shipments, beating our initial estimation by around 20%, with HDD head sales increasing 7% year on year.

Consolidated Results for First Half of FY March 2017

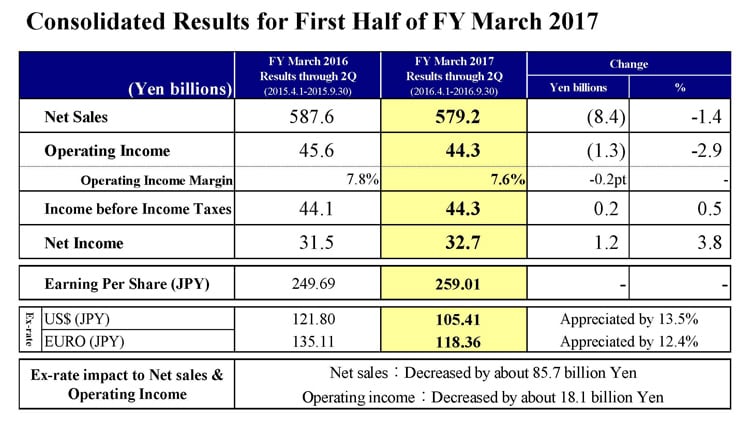

Next, let's take a look at our results for the first half. Net sales were 579.2 billion yen, down 8.4 billion yen, or 1.4% year on year. Operating income decreased 1.3 billion yen, or 2.9%, to 44.3 billion yen. The operating income margin was 7.6%, down 0.2 of a percentage point.

Income before income taxes was 44.3 billion, up 0.2 billion yen. Net income declined by 1.2 billion yen, or 3.8%, to 32.7 billion yen. Consequently, earning per share was 259.01 yen.

The average exchange rate for the first half of fiscal 2017 was 105.41 yen against the US dollar, an appreciation of 13.5%, and 118.36 yen against the euro, an appreciation of 12.4%. In terms of the impact of these exchange rate movements, exchange rates pushed down net sales and operating income by around 85.7 billion yen and 18.1 billion yen, respectively.

As for the exchange rate sensitivity, due to changes in the composition of foreign currency-denominated profits, there has been a slight fluctuation in the impact on operating income of a change of 1 yen in the exchange rate versus the U.S. dollar and the euro.

We estimate that a change of 1 yen against the U.S. dollar will have an impact of approximately 1.2 billion yen, while a change against the euro will have an impact of approximately 0.7 billion yen.

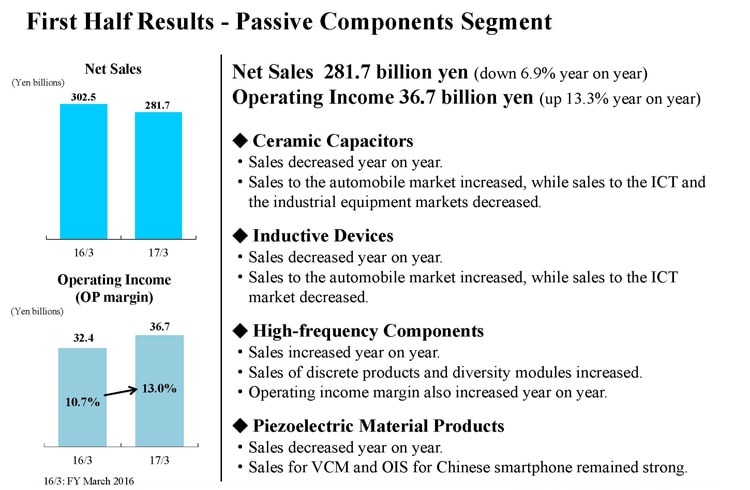

First Half Results - Passive Components Segment

Next, I would like to explain our business segment performance.

First, in the Passive Components segment, net sales were 281.7 billion yen, down 6.9% year on year, and operating income was 36.7 billion yen, up 13.3% year on year. The operating income margin was 13.0%. Profitability improved sharply, absorbing the impact of the yen’s appreciation and expanding earnings.

In ceramic capacitors and inductive devices, both sales and profits decreased year on year. This was mainly owing to a decrease in sales to the ICT market, particularly sales for use in smartphones, while sales to the automobile market were solid, particularly in North America, Europe and China. Sales of ceramic capacitors and inductive devices in the automotive market account for around half of the overall sales for both products.

High-frequency components continued to see favorable sales of discrete products for smartphones to major customer in North America, as well as in China and South Korea. Wi-Fi module sales volume declined. On the other hand, the increase in diversity module sales absorbed the impact of foreign exchange to achieve an increase in sales overall. Earnings saw a significant increase, reflecting the increase in sales, utilization gain from an increase in production in the run up to the third-quarter production peak, and an increase in the number of products incorporated in devices. As a result, high frequency products drove not only the earnings of the Passive Components segment, but also that of the Company as a whole.

In piezoelectric material products, we saw strong sales of VCM and OIS for camera modules to smartphone manufacturers in China.

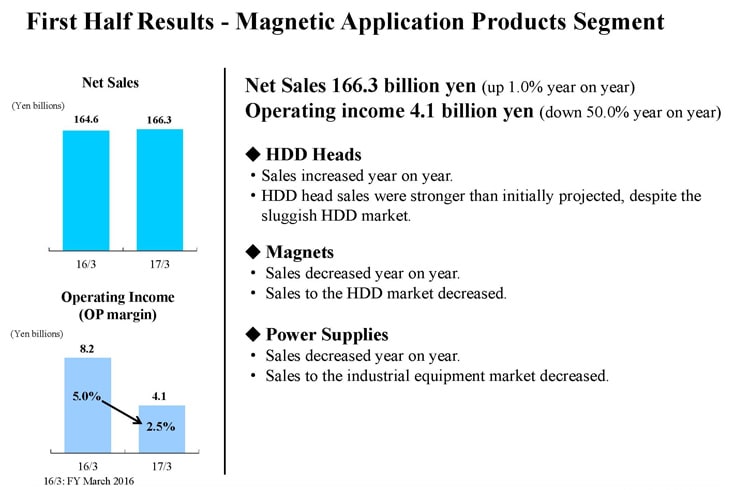

First Half Results - Magnetic Application Products Segment

Turning to the Magnetic Application Products segment, net sales were 166.3 billion yen, an increase of 1.0% year on year. Operating income decreased by around 50% year on year to 4.1 billion yen, with an operating income margin of 2.5%.

In HDD heads, shipments of 2.5-inch HDD heads for Japanese customer continued to show strong activity. In addition, due to a 30% year-on-year increase in sales of 3.5-inch HDDs following a switch to full-turnkey sales, sales increased by 7%. With the HDD shipments of the first quarter indexed as 100, the second-quarter shipment index came in at 124 – a significant increase over the previous estimation of 111, increasing 11% year on year. In terms of profitability, earnings declined, mainly due to sales price reductions for new products and an end to HDD assembly sales to U.S. customers.

In magnets, conditions remained difficult, mainly due to a decline in HDD magnet sales in line with a drop in HDD demand, although sales of motors for wind power generation have been ramped up.

In power supplies, sales declined year on year with a decline in sales for the semiconductor manufacturing equipment and measuring equipment markets. However, profits increased owing to a steady improvement in profitability.

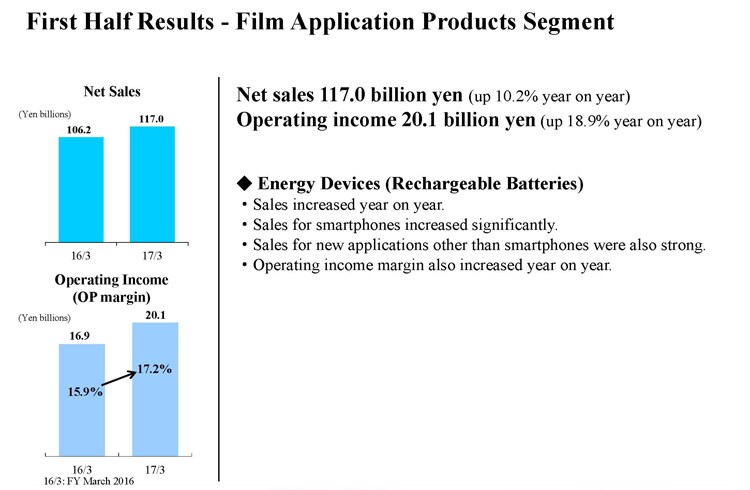

First Half Results - Film Application Products Segment

Next is the Film Application Products segment. In this segment, net sales were 117.0 billion yen and operating income was 20.1 billion yen. Sales rose by 10.2% and profits increased significantly by around 18.9%. The segment has maintained high profitability with an operating income margin of 17.2% amid increasing price pressure due to competition.

In rechargeable batteries, sales to North American customer outperformed initial expectations, and there were increases in sales to winning customers in China and in sales for use in new applications such as drones. TDK achieved much higher sales and profits as a result of meeting increased demand by executing timely investments to boost production capacity in conjunction with increasing productivity.

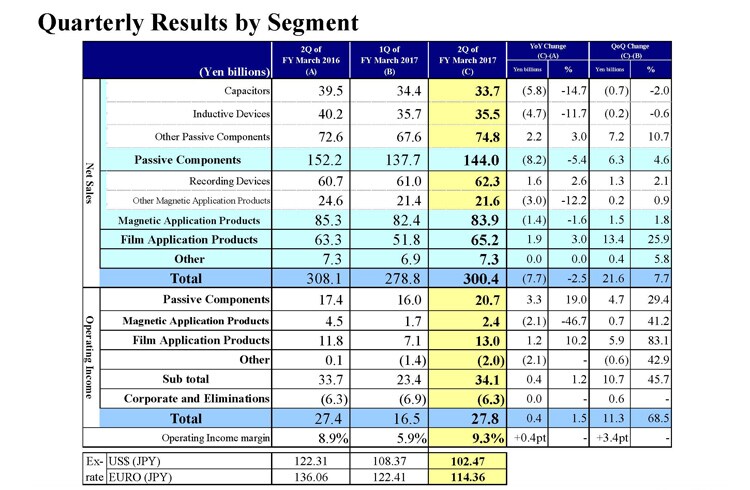

Quarterly Results by Segment

Next, I would like to explain the factors behind the changes in segment net sales and operating income from the first quarter to the second quarter. First, certain products have been reclassified between segments again in the fiscal year ending March 2017. Certain products in the Film Application Products segment have been reclassified to the Other segment. The impact of this change was to increase net sales of the Other segment by 0.8 billion yen in the second quarter of the previous fiscal year. Also, certain products in the Other segment have been reclassified to the Passive Components segment. The impact of this change was to increase net sales of the Passive Components segment by 2.1 billion yen in the second quarter of the previous fiscal year. These reclassifications had virtually no impact on operating income.

Let’s now look at the changes in each segment, beginning with the Passive Components segment. In this segment, net sales increased by 6.3 billion yen, or 4.6%, from the first quarter. Capacitor sales were strong to the automotive market but declined for use in ICT. In aluminum electrolytic capacitors and film capacitors, sales declined slightly from the first quarter due to lackluster sales for use in industrial equipment owing to the continuing impacts of decelerating economies, particularly China, and low crude oil prices. However, excluding the impact of the yen’s appreciation, sales rose slightly. Sales of inductive devices declined by 0.2 billion yen, or 0.6% from the first quarter. Sales to the automotive market remained strong from the first quarter. Excluding the impact of the yen’s appreciation, sales increased slightly. In other passive components, sales increase by 7.2 billion yen, or 10.7%. Sales of high-frequency components expanded significantly driven by expanded sales to smartphone manufacturers in China as well as strong sales to North American customers, including sales to PA manufacturers. Sales of camera models increased, absorbing the impact of foreign exchange, thanks to steady sales of VCM and OIS to Chinese customers.

Operating income in the Passive Components segment increased by 4.7 billion yen, or 29.4%, from the first quarter, setting a new record high for quarterly performance. Profitability also improved markedly, with the operating margin reaching around 15%.

Next is the Magnetic Application Products segment. In this segment, net sales increased by 1.5 billion yen, or 1.8%, from the first quarter. In sales of recording devices, the HDD head shipment index rose by around 11% to 124 in the second quarter, up from 112 in the first quarter, and net sales were up 1.3 billion yen, or 2.1%. Operating income in the Magnetic Application Products segment increased by 0.7 billion yen from the first quarter. In HDD heads, operating profit increased as sales and profit both rose due to growth in shipment volume of 2.5-inch heads, while utilization gain in the front-end process also contributed.

Moving on to the Film Application Products segment, net sales increased significantly by 13.4 billion yen, or 25.9%, from the first quarter. Sales grew substantially owing to a major contribution from sales to winning Chinese customers. In addition, strong sales to North American smartphone customer were posted in line with initial forecasts. Operating income rose by 5.9 billion yen to 13.0 billion yen, from 7.1 billion yen in the first quarter. We achieved significant earnings growth as an increase in marginal profit due to higher sales volume, and the pursuit of cost improvements absorbed the impact of severe sales price reductions.

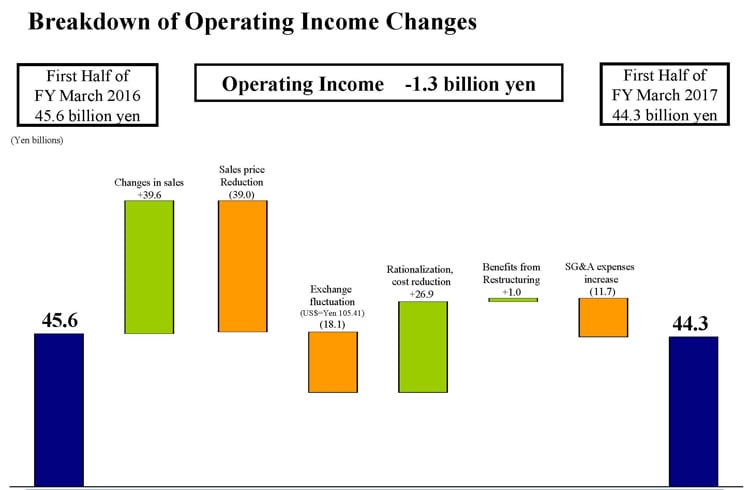

Breakdown of Operating Income Changes

Next is the breakdown of changes in operating income. Looking at the factors behind the 1.3 billion yen decrease in operating income, the first factor, changes in sales, had a positive impact of approximately 39.6 billion yen, reflecting sales increases attributable to factors including capacity utilization and product mix. The main contributor here was continued strong sales of high-frequency components and rechargeable batteries for use in smartphones.

The next factor, sales price reduction, had a negative impact of approximately 39.0 billion yen. Exchange fluctuation, specifically the stronger yen, had a negative impact of approximately 18.1 billion yen on operating income. Rationalization and cost reduction, in combination with progress on boosting efficiency and improving production yields, as well as discounts on raw materials, had a positive impact of 26.9 billion yen on operating income. Benefits from restructuring lifted operating income by 1.0 billion yen. An increase in SG&A expenses had a negative impact of 11.7 billion yen on operating income. The main contributors to this increase were an increase in expenses associated with the consolidation of Micronas and an increase in costs related primarily to preparations for establishing a joint venture with Qualcomm. Another main contributor was an increase in research and development expenses for strengthening new product development and process development in connection with the expansion in high-frequency components and rechargeable batteries, and for promoting the TDK Monozukuri revolution.

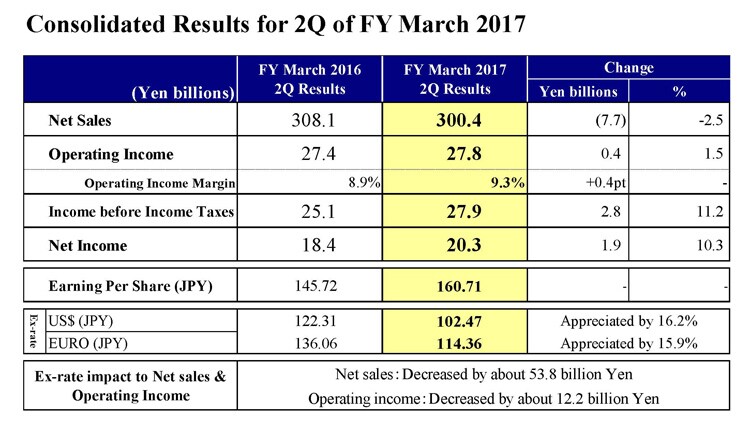

Consolidated Results for 2Q of FY March 2017

Next, let’s take a look at consolidated results for the second quarter of the fiscal year ending March 2017.

For the second quarter, net sales were 300.4 billion yen, a decrease of 2.5% year on year. Operating income was 27.8 billion yen, up 1.5% year on year. The yen appreciated by about 20 yen against the U.S. dollar, and about 22 yen against the euro, producing a negative impact of around 12.2 billion yen on operating income attributable to foreign exchange impacts. Nevertheless, overall operating income increased owing to strong performances in high-frequency components and rechargeable batteries, which absorbed the foreign exchange impact. Net income was 20.2 billion yen, up 9.8% year on year.

That concludes my presentation. Thank you for your attention today.