2nd Quarter of FY March 2026 Performance Briefing (Speech Text)

H1, FY March 2026 Results Highlights

Tetsuji Yamanishi

Senior Executive Vice President & CFO

Hello, I am Tetsuji Yamanishi. Thank you for taking the time to attend TDK’s performance briefing for the first half of FY March 2026. I would like to explain the highlights of our consolidated results.

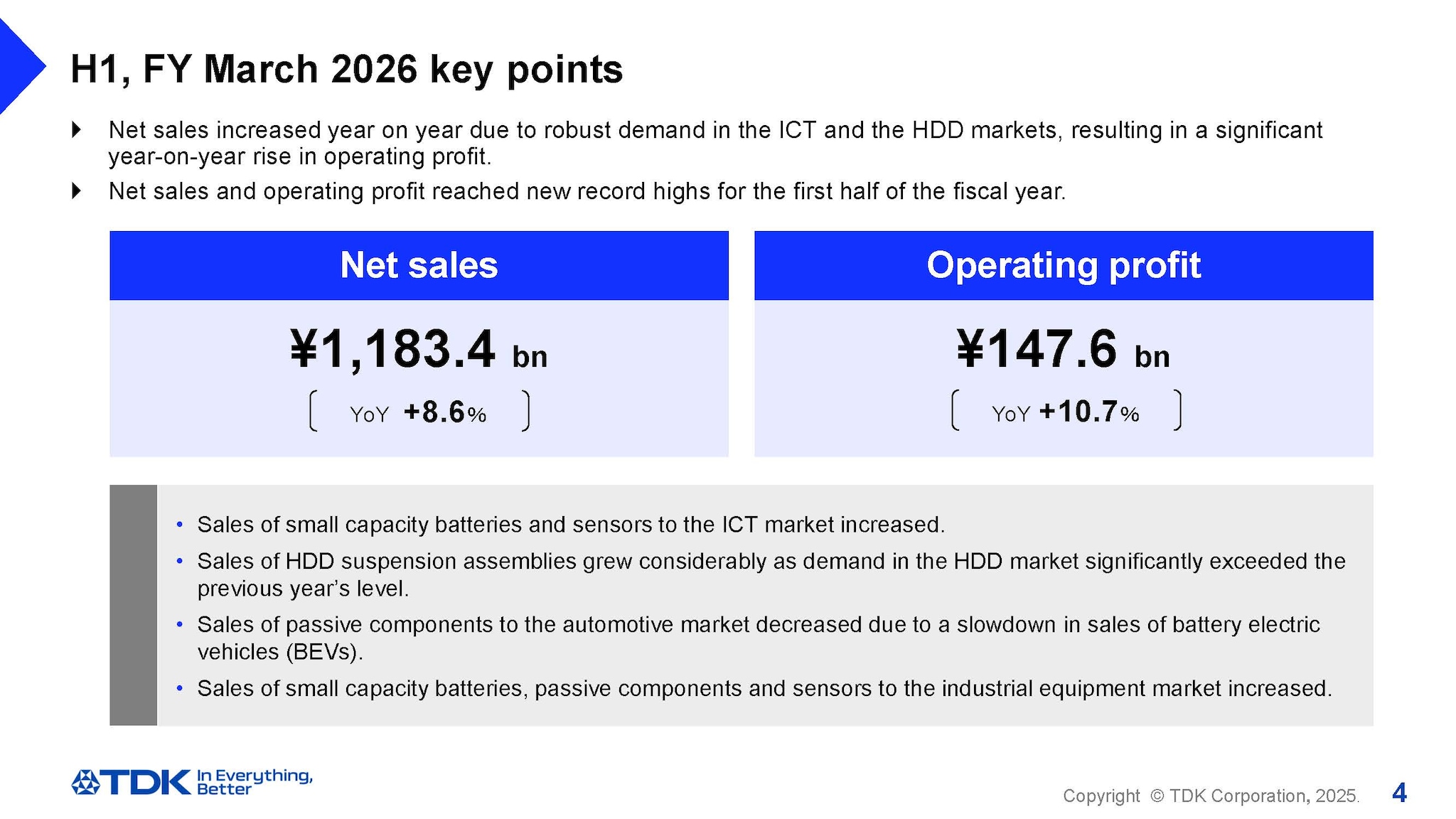

H1, FY March 2026 key points

I would like to start with the key points of the first half of FY March 2026 (H1). In the electronic components market, which has a significant impact on TDK’s consolidated business results, the production of ICT-related products remained strong on a year-on-year basis. The demand for nearline HDDs for data centers also remained robust. Meanwhile, in the industrial equipment market, demand related to renewable energy remained brisk. On the other hand, in the automotive market, the demand for battery electric vehicles (BEVs) has continued to decline, resulting in lower parts demand than forecasted at the beginning of the current fiscal year.

In this business environment, during H1, the Sensor Application Products, Magnetic Application Products, and Energy Application Products segments experienced an 8.6% increase in sales year on year and a 10.7% increase in profit year on year, mainly driven by robust demand for components in the ICT market and the industrial equipment market and front-loaded demand due to tariffs. As a result, net sales and operating profit reached new record highs for the first half of the fiscal year.

Segment sales by market were as follows: In the ICT market, sales of small capacity batteries and sensors increased, and reflecting a significant year-on-year growth in demand in the HDD market, sales of HDD suspension assemblies rose considerably. On the other hand, sales of passive components to the automotive market decreased owing to the slowdown of sales of BEVs. In the industrial equipment market, sales of small capacity batteries, passive components, and sensors increased.

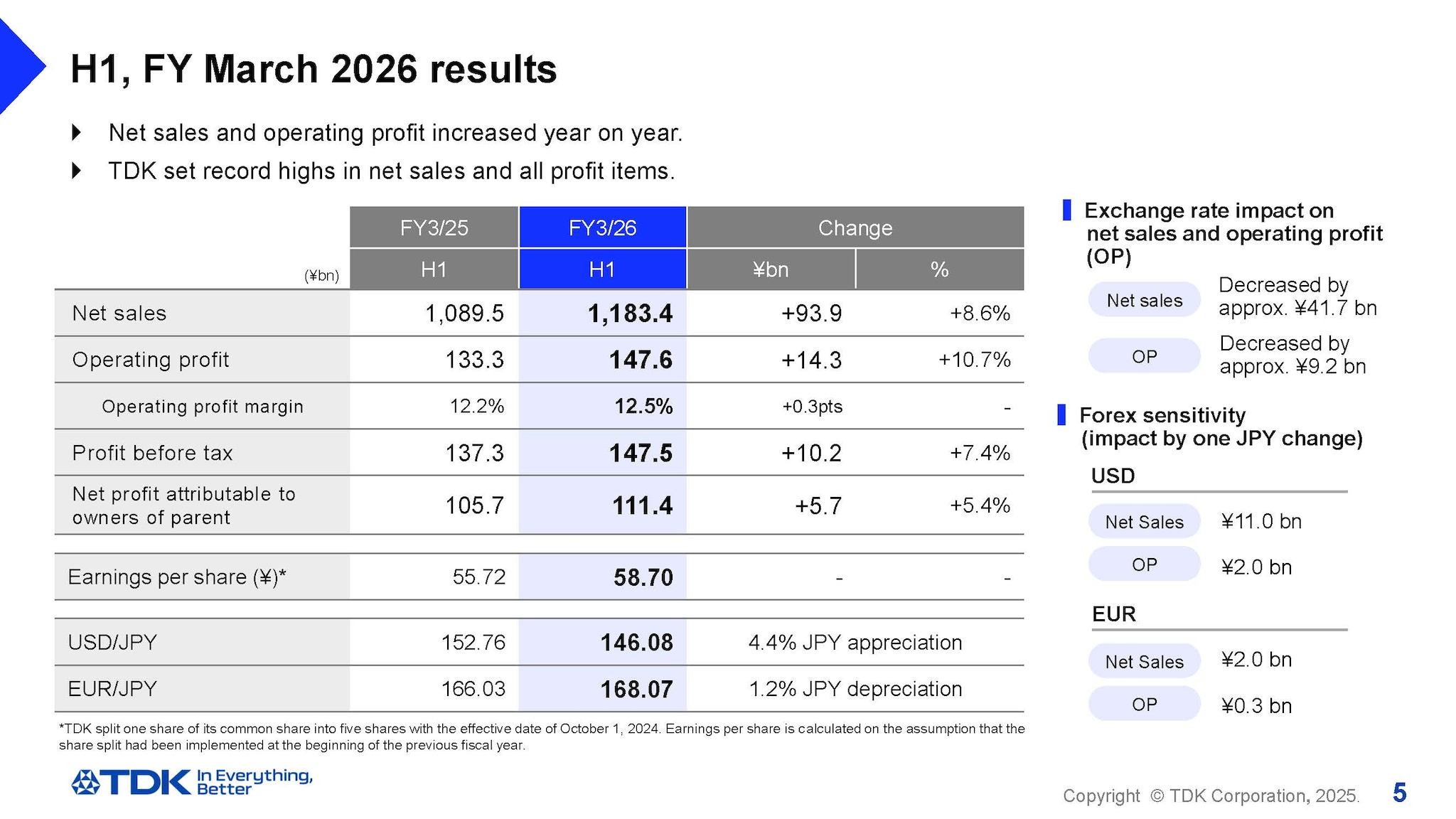

H1, FY March 2026 results

I would like to present an overview of our results for H1.

There was a decrease of about ¥41.7 billion in net sales and a decrease of about ¥9.2 billion in operating profit due to exchange rate fluctuations against the U.S. dollar and other currencies. Including this impact, net sales were ¥11,834 billion, an increase of ¥93.9 billion, or 8.6%, year on year, and operating profit was ¥147.6 billion, an increase of ¥14.3 billion, or 10.7%, year on year. Profit before tax was ¥147.5 billion, an increase of ¥10.2 billion, or 7.4%, year on year. Net profit attributable to owners of parent was ¥111.4 billion, an increase of ¥5.7 billion, or 5.4%, year on year, setting record highs in net sales and all profit items.

Earnings per share amounted to ¥58.70. In terms of exchange rate sensitivity, we estimate that a change of ¥1 against the U.S. dollar will affect operating profit by about ¥2 billion a year, the same as our previous estimate, while a ¥1 change against the euro will have an impact of about ¥0.3 billion a year.

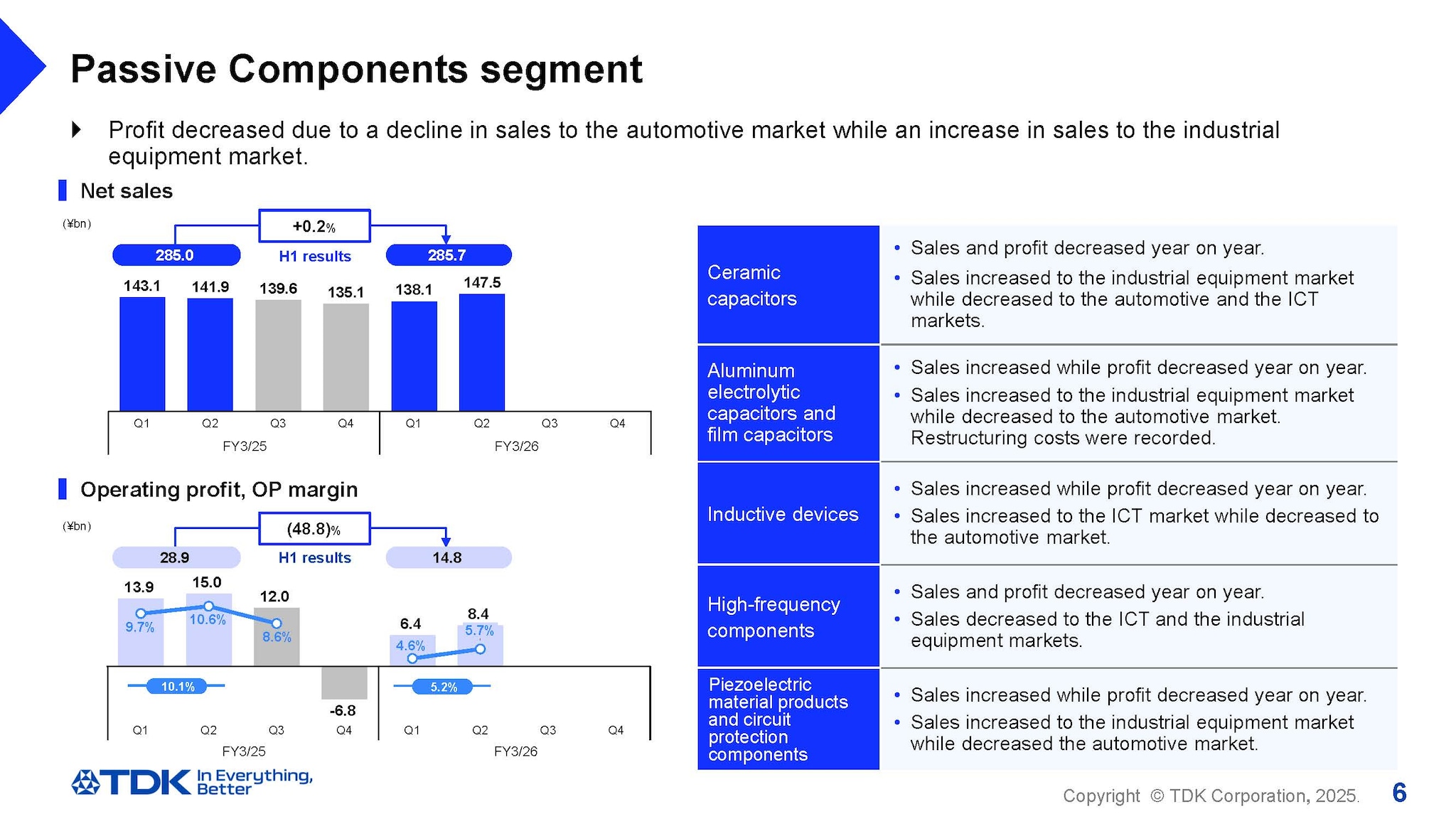

Passive Components segment

I will now move on to segment results for H1.

In the Passive Components segment, sales to the industrial equipment market increased, whereas sales to the automotive market declined. As a result, net sales amounted to ¥285.7 billion, a slight increase of 0.2% year on year, while operating profit stood at ¥14.8 billion, a drop of 48.8% year on year, including the impact of restructuring costs amounting to ¥2.7 billion.

Sales and profit decreased year on year for ceramic capacitors, which have a high ratio of sales to the automotive market. In aluminum electrolytic capacitors and film capacitors, sales increased year on year on the back of a rise of sales related to renewable energy, despite a drop in sales to the automotive market. However, profit decreased year on year owning to the recording of restructuring costs amounting to ¥2.7 billion as part of business portfolio management.

Inductive devices saw an increase in sales and a decrease in profit on a year-on-year basis, reflecting a rise in sales to the ICT market and a decline in sales to the automotive market. Sales and profit decreased year on year for high-frequency components as sales to the ICT and industrial equipment markets declined. Piezoelectric material products and circuit protection components saw an increase in sales and a decrease in profit on a year-on-year basis, reflecting a rise in sales to the industrial equipment market and a decline in sales to the automotive market.

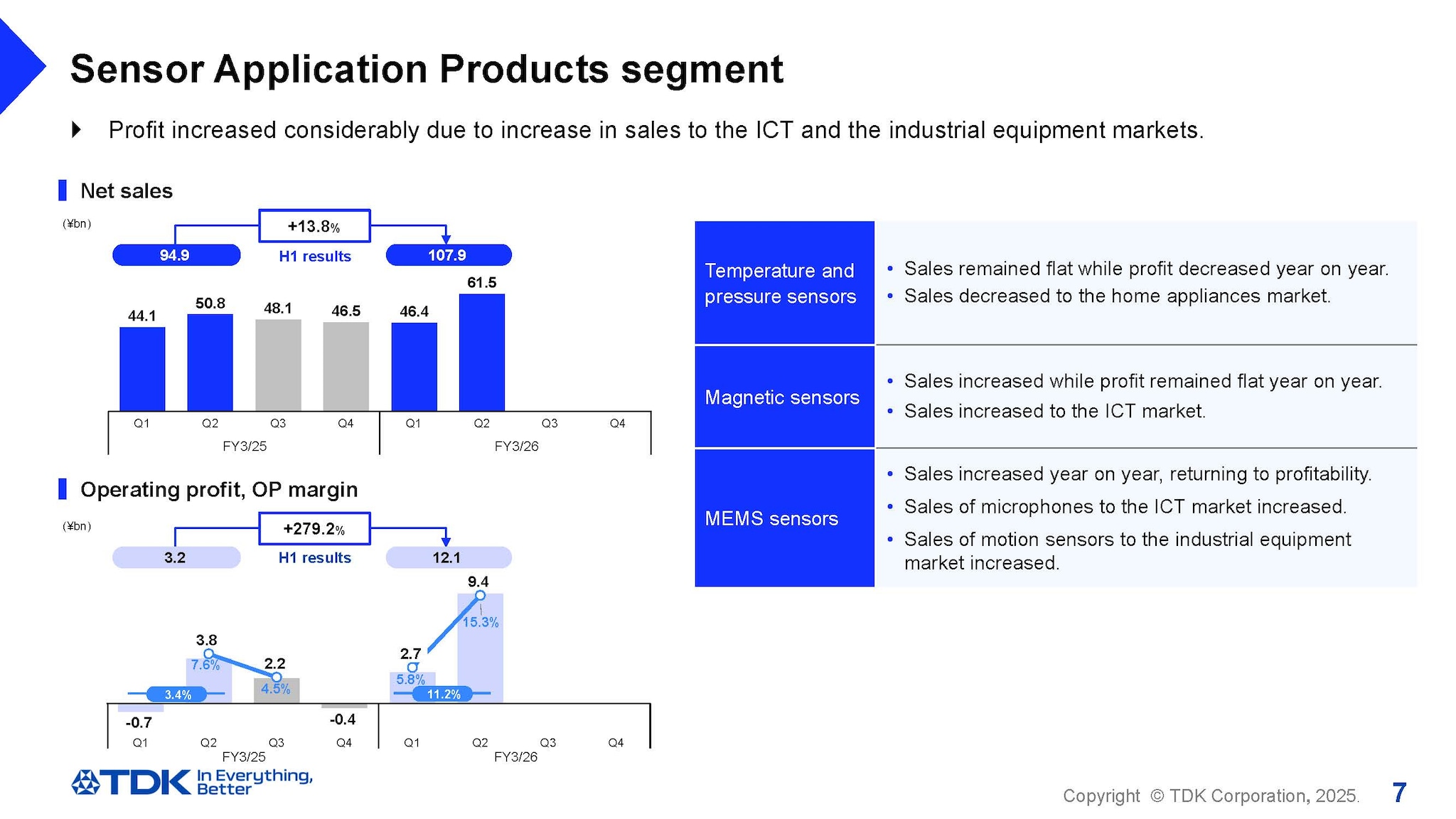

Sensor Application Products segment

In the Sensor Application Products segment, net sales increased 13.8% year on year to ¥107.9 billion, and operating profit stood at ¥12.1 billion, posting a significant rise in profit year on year.

In temperature and pressure sensors, sales remained flat year on year, while profit decreased year on year reflecting a drop in sales to the home appliances market. In magnetic sensors, while, sales of Hall sensors declined to the automotive market, sales of TMR sensors for smartphone applications rose due to peak season demand. This resulted in year-on-year increases in sales of magnetic sensors on the whole, while profit remained flat year on year due to the stronger yen. In MEMS sensors, sales of motion sensors increased to the industrial equipment market, on top of a rise in sales of microphones to the ICT market. Consequently, sales of MEMS sensors on the whole increased year on year, returning to profitability.

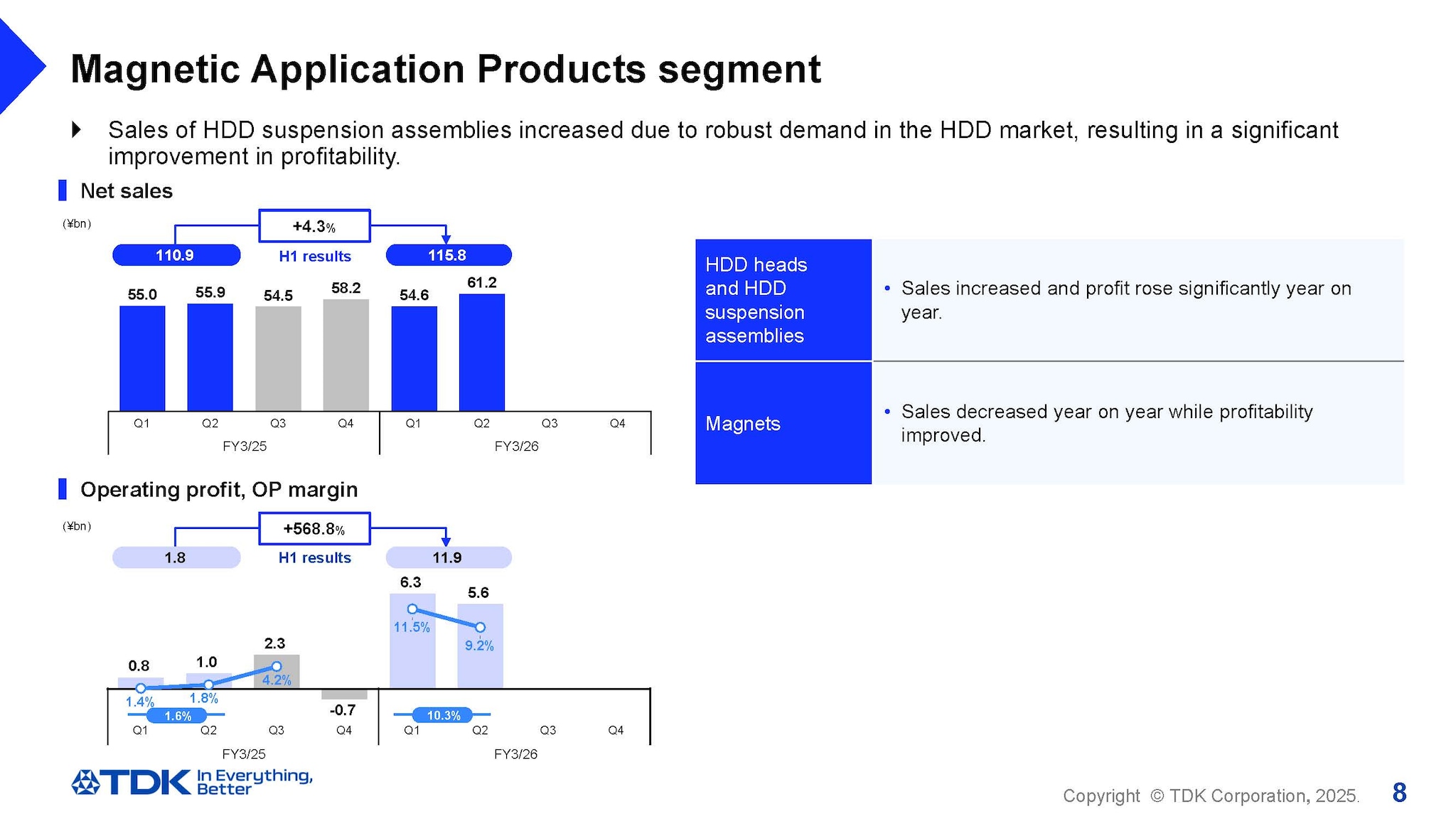

Magnetic Application Products segment

In the Magnetic Application Products segment, net sales increased 4.3% year on year to ¥115.8 billion, and operating profit rose significantly year on year to ¥11.9 billion.

In HDD heads and HDD suspension assemblies, profit increased considerably reflecting a rise in sales related to nearline HDDs. While sales of magnets decreased year on year due to lower sales to the automotive market, profitability improved on the back of cost reduction effects such as quality enhancement.

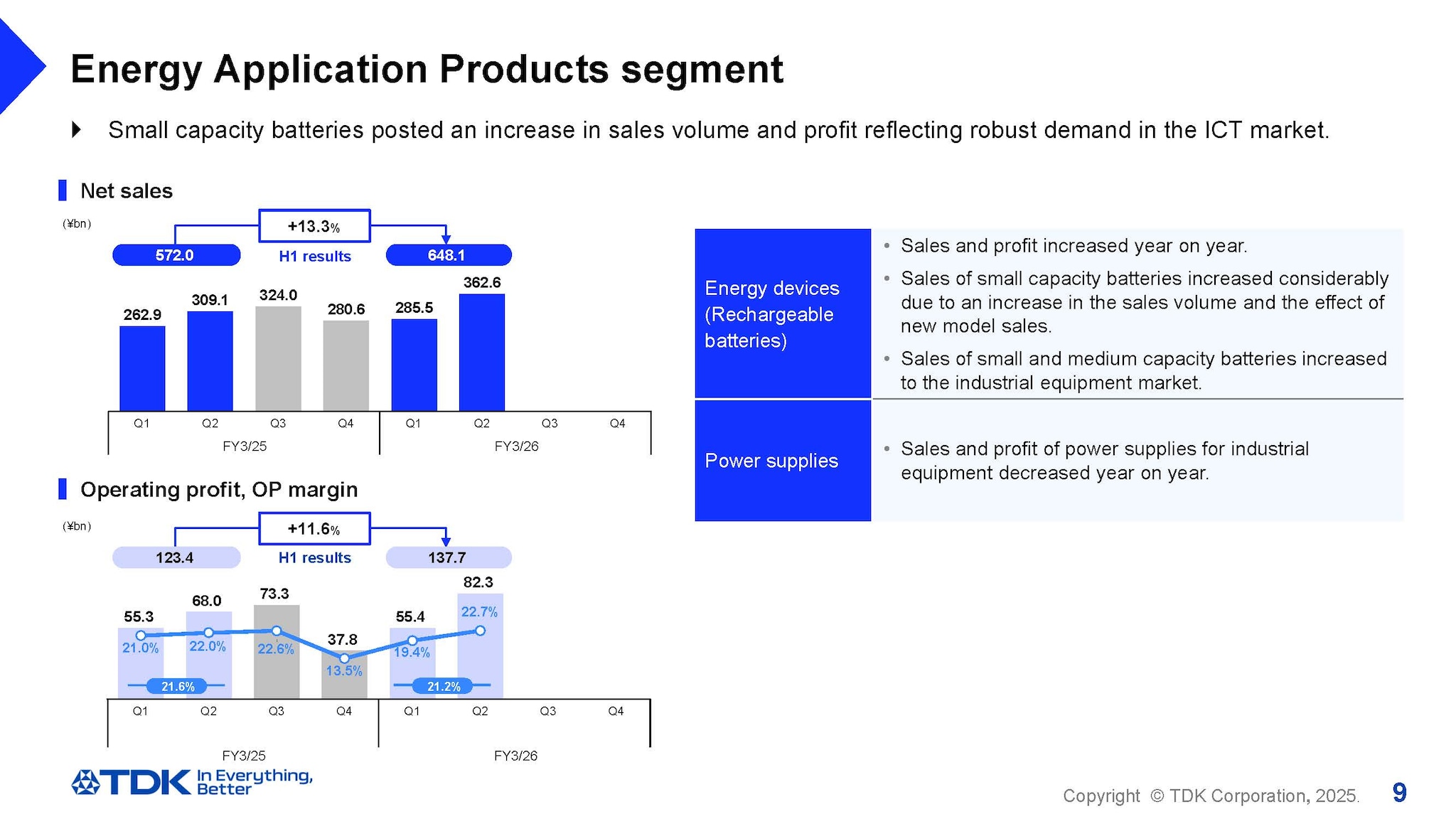

Energy Application Products segment

In the Energy Application Products segment, net sales amounted to ¥648.1 billion, up 13.3% year on year, and operating profit rose 11.6% year on year to ¥137.7 billion.

In rechargeable batteries, sales increased year on year on the back of a rise in sales volume of small capacity batteries for smartphone applications and the effect of new model sales as well as spot orders received, resulting in a significant increase in profit. Sales of medium capacity batteries also increased to the industrial equipment market. Power supplies for industrial equipment saw a year-on-year decline in terms of both sales and profit as demand for industrial equipment applications failed to recover significantly.

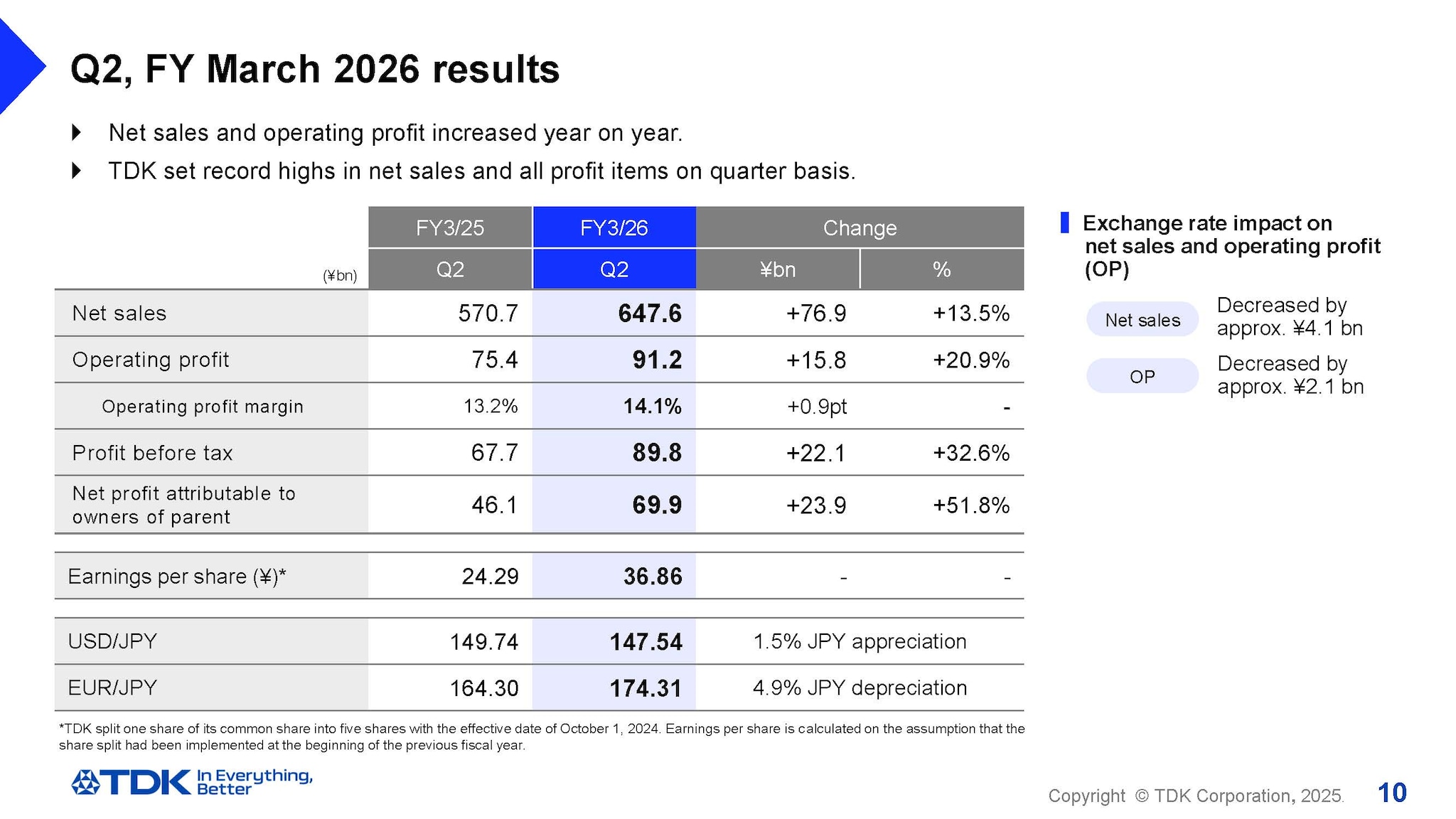

Q2, FY March 2026 results

I would like to present an overview of our results for Q2.

There was a decrease of about ¥4.1 billion in net sales and a decrease of about ¥2.1 billion in operating profit due to exchange rate fluctuations against the U.S. dollar and other currencies. Including this impact, net sales were ¥647.6 billion, an increase of ¥76.9 billion, or 13.5 %, year on year, and operating profit was ¥91.2 billion, an increase of ¥15.8 billion, or 20.9%, year on year. Profit before tax was ¥89.8 billion, an increase of ¥22.1billion, or 32.6%, year on year. Net profit attributable to owners of parent was ¥69.9 billion, a significant increase of ¥23.9 billion, or 51.8%, year on year. As a result, TDK set record highs in net sales and all profit items on a quarter basis as well.

Earnings per share turned out to be ¥36.86.

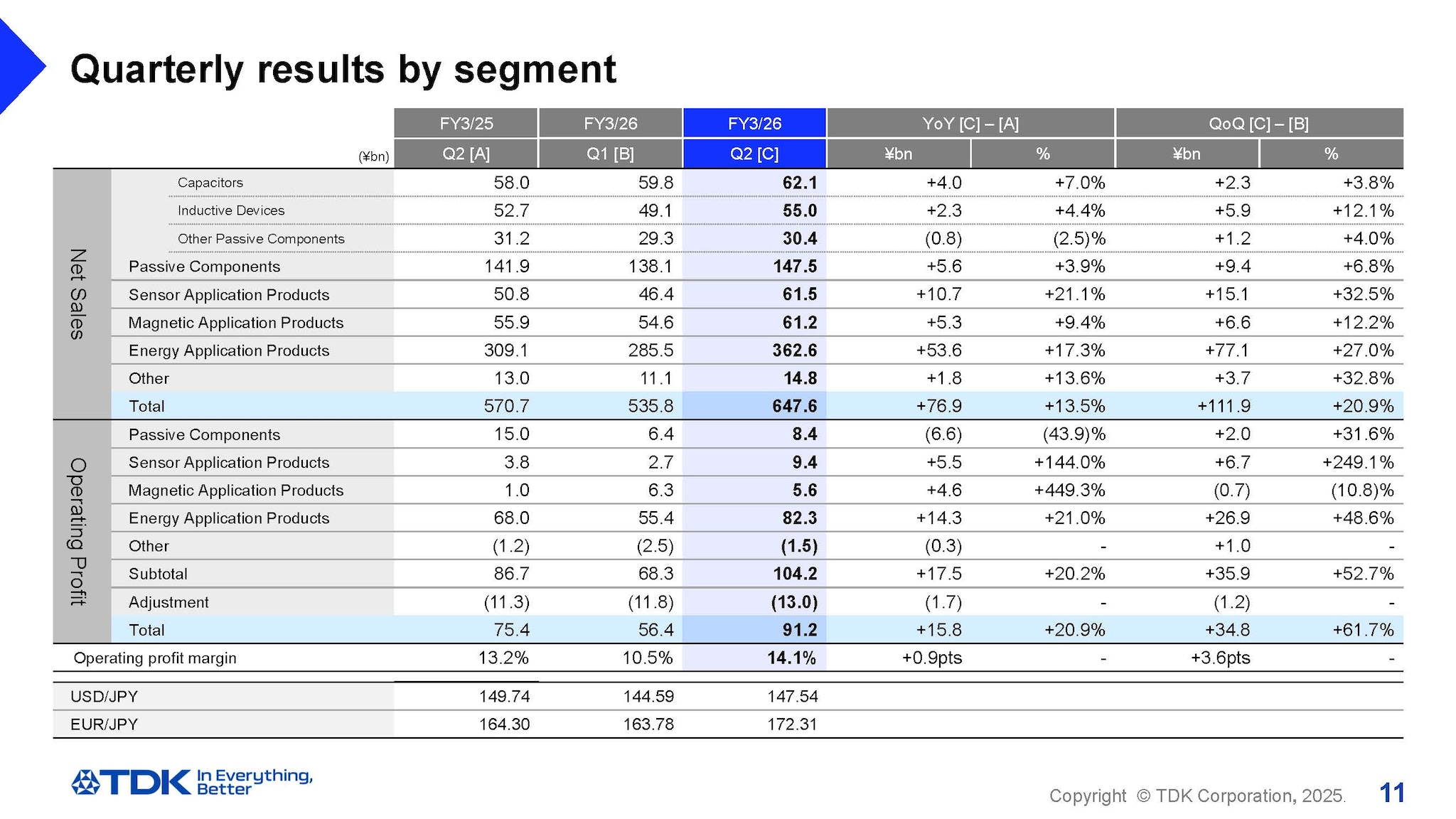

Quarterly results by segment

I will now explain some of the factors behind the changes in segment sales and operating profit from Q1 to Q2 of FY March 2026.

In the Passive Components segment, net sales increased by ¥9.4 billion, or 6.8%, from Q1, and operating profit increased by ¥5.7 billion from Q1, when excluding one-time expenses of ¥3.7 billion recorded in Q2. Sales and profit of ceramic capacitors increased reflecting a rise in sales to the automotive market, despite a loss of about ¥1.0 billion due to the suspension of production as a result of the floods in Akita prefecture in August. Sales of aluminum electrolytic capacitors and film capacitors increased due to growth in sales to the automotive and industrial equipment markets. While a slight loss was recorded as ¥2.7 billion of restructuring costs was posted as part of business portfolio management to improve financial position toward boosting earnings in the future, the business was profitable in real terms. Sales and profit of inductive devices increased on the back of a rise in sales to the ICT market due to seasonality, on top of an increase in sales to the automotive and industrial equipment markets. Sales of high-frequency components increased as sales to the ICT market grew due to seasonality. Sales of piezoelectric material products and circuit protection components increased driven by higher sales to the industrial equipment market. Operating profit increased overall, despite the recording of one-time expenses of ¥3.7 billion.

In the Sensor Application Products segment, net sales rose significantly by ¥15.1 billion, or 32.5%, from Q1, and operating profit increased by ¥6.7 billion from Q1. Sales and profit of temperature and pressure sensors grew reflecting a rise in sales to the automotive and industrial equipment markets. Magnetic sensors saw an increase in sales and a significant growth in profit reflecting seasonal demand for Hall sensors and TMR sensors from the ICT market. MEMS sensors saw an increase in sales on the back of brisk sales of microphones, achieving a break-even point in H1 reflecting a significant improvement in profitability. Sale and profit of motion sensors also increased mainly for Chinese smartphones and game console applications. As a result, MEMS sensors on the whole returned to profitability in Q2 and secured profits for H1.

In the Magnetic Application Products segment, net sales increased by ¥6.6 billion, or 12.2%, from Q1, while operating profit declined slightly by ¥0.7 billion from Q1. Overall sales volume of HDD heads increased about 14% due mainly to a rise in sales of new nearline HDD head products, and profit also increased reflecting a favorable change in product mix in addition to increased sales. Sales and profit of HDD suspension assemblies increased as the sales volume rose about 4% reflecting an increase in growth in demand for nearline HDDs. As for magnets, sales remained virtually unchanged, while profit declined as proceeds from the sale of employee welfare facilities of ¥1.0 billion had been included in Q1. As a result, profit of Magnetic Application Products on the whole fell slightly.

In the Energy Application Products segment, net sales increased by ¥77.1 billion, or 27%, from Q1, and operating profit grew significantly by ¥26.9 billion, or 48.6%, from Q1. Rechargeable batteries saw a considerable rise in sales and profit reflecting a growth in the sales volume of small capacity batteries to the ICT market due to seasonality, a favorable change in product mix as a result of an increase of new products in composition, and spot orders received. Power supplies for industrial equipment saw an increase in terms of both sales and profit due to moderate demand recovery. Power supplies for EVs continued to post a loss reflecting lower demand for BEVs.

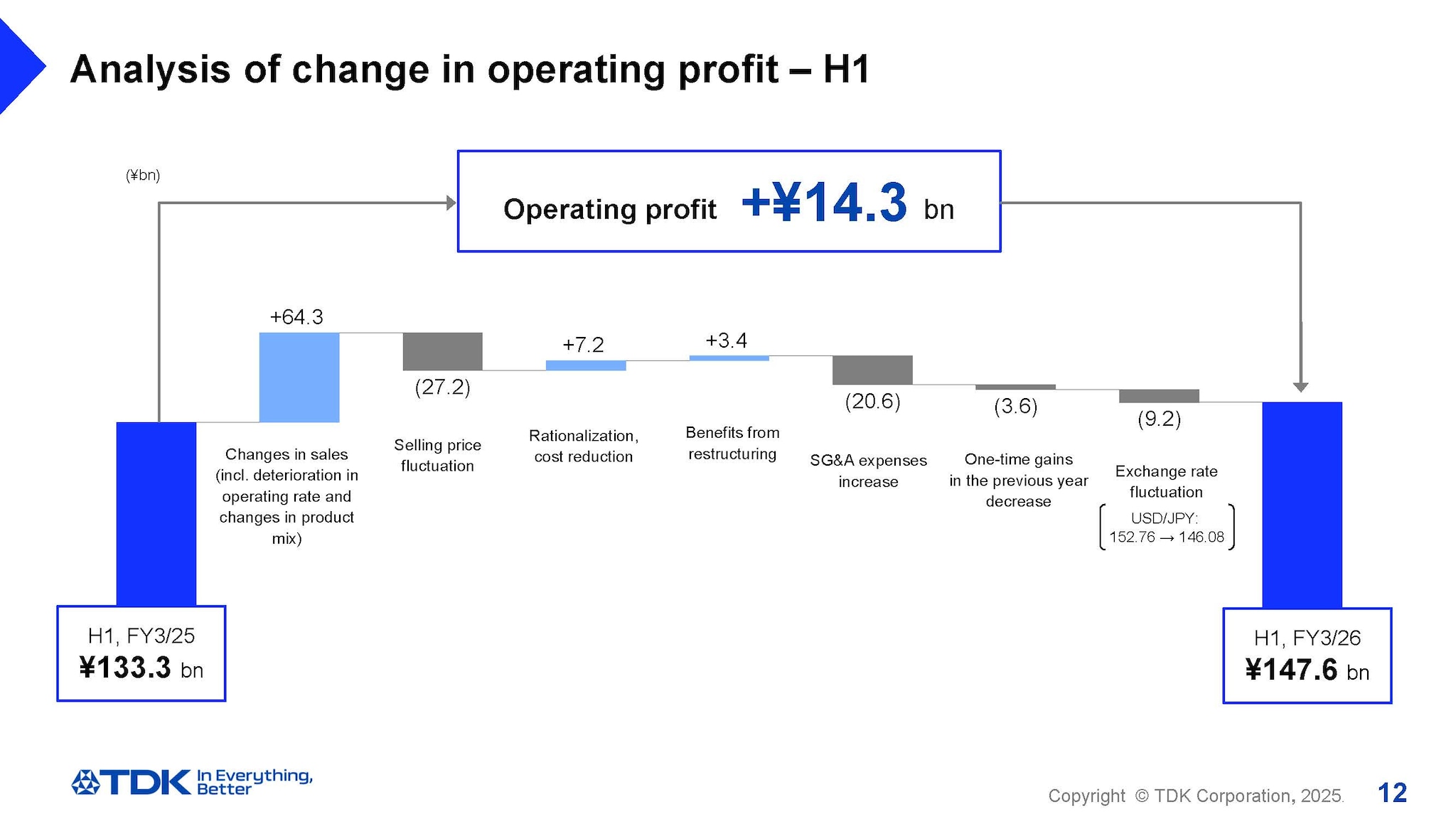

Analysis of change in operating profit – H1

Next is an analysis of the ¥14.3 billion year-on-year increase in operating profit for H1.

Changes in sales increased by ¥64.3 billion due to an increase in the sales volume of rechargeable batteries, HDD heads and HDD suspension assemblies, and sensors. While there were positive effects on operating profit including rationalization and cost reduction of ¥7.2 billion and benefits from restructuring carried out in the previous fiscal year of ¥3.4 billion, operating profit declined by ¥27.2 billion due to selling price fluctuation reflecting intensifying pressure to discount selling prices. SG&A expenses increased by ¥20.6 billion reflecting an increase in R&D expenses related to rechargeable batteries, for which TDK has been accelerating the development of new technologies and products. There was also ¥3.6 billion decrease in one-time gains recorded in the previous fiscal year. These factors, along with the positive effect of an increase in sales volume, contributed to the ¥14.3 billion increase in operating profit on the whole, despite the negative effect of the stronger yen amounting to ¥9.2 billion.

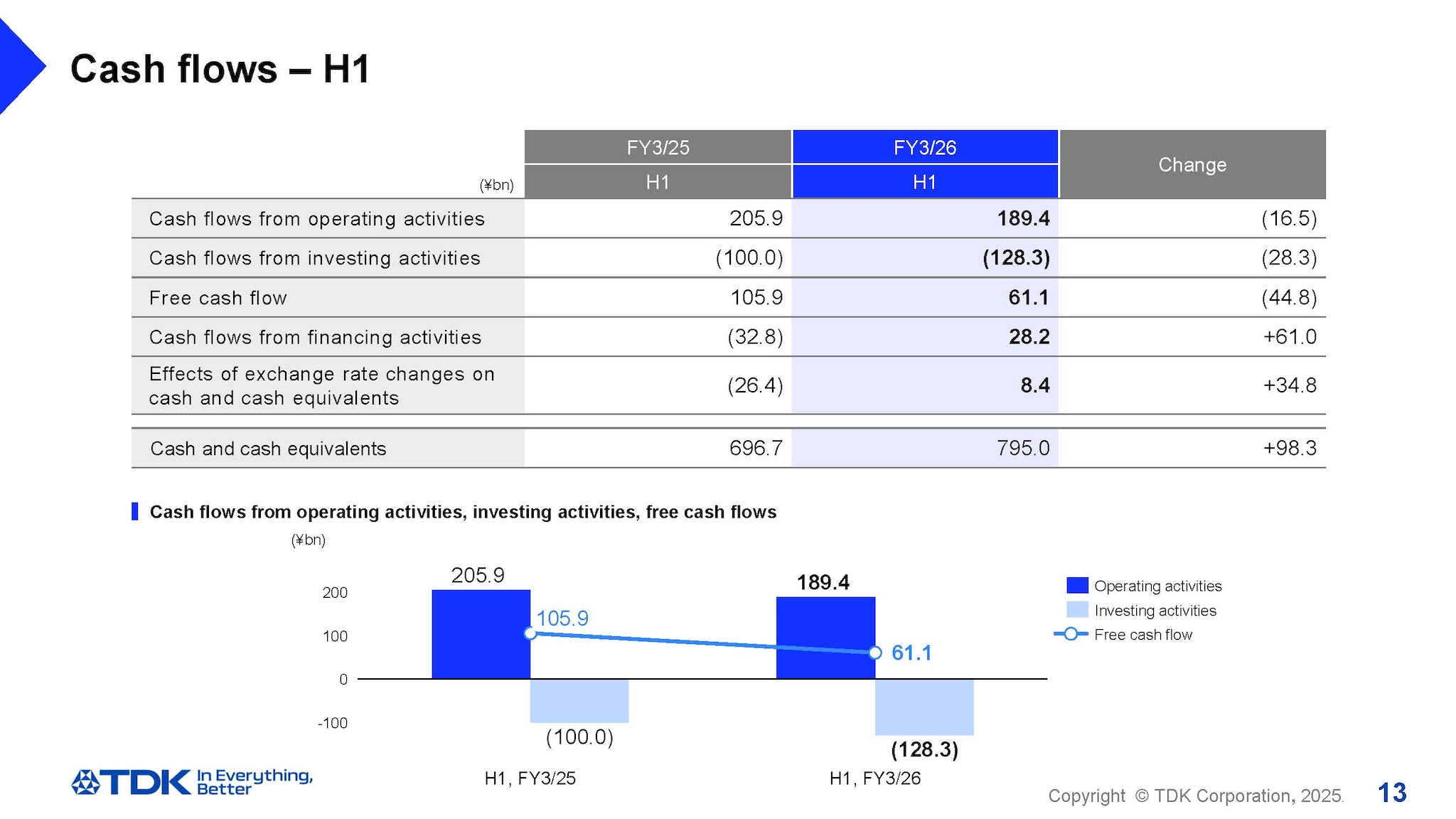

Cash flows – H1

I would like to present an overview of cash flows.

In H1, operating cash flow amounted to ¥189.4 billion and investing cash flow amounted to ¥128.3 billion including the acquisition of companies related to AI ecosystem, resulting in free cash flow of ¥61.1 billion, exceeding the levels forecasted for the first-half period.

This concludes my presentation. Thank you very much for your attention.

FY March 2026 Projections

Noboru Saito

President & CEO

Hello, I am Noboru Saito.

Thank you for your attendance today. I would like to explain our FY March 2026 projections.

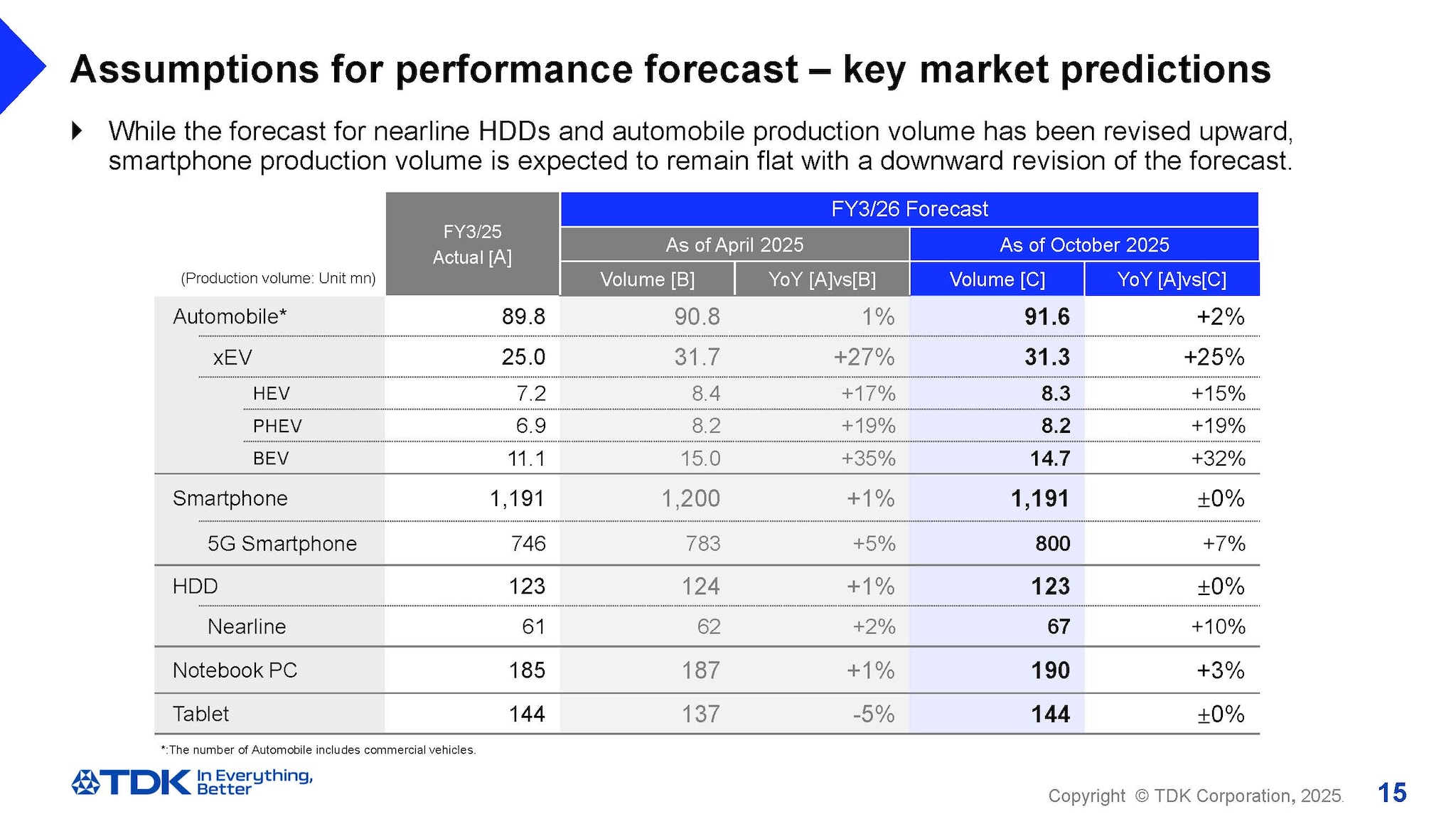

Assumptions for performance forecast – key market predictions

I would like to begin with the revision of the production volume forecast for key devices as the basis of our performance forecast.

In the automotive market, we have revised our forecast for total automobile production volume upward compared to the forecast in April 2025. However, we have revised downward our forecast for xEVs, as a result of the review of the production volume of BEVs.

As for the production volume of smartphones, which represent the ICT market, we have revised the April forecast of 1,200 million units in April to 1,191 million units.

In the HDD market, given the ongoing trend of robust demand, we have revised upward the April production volume forecast for nearline HDDs for data centers to 67 million units.

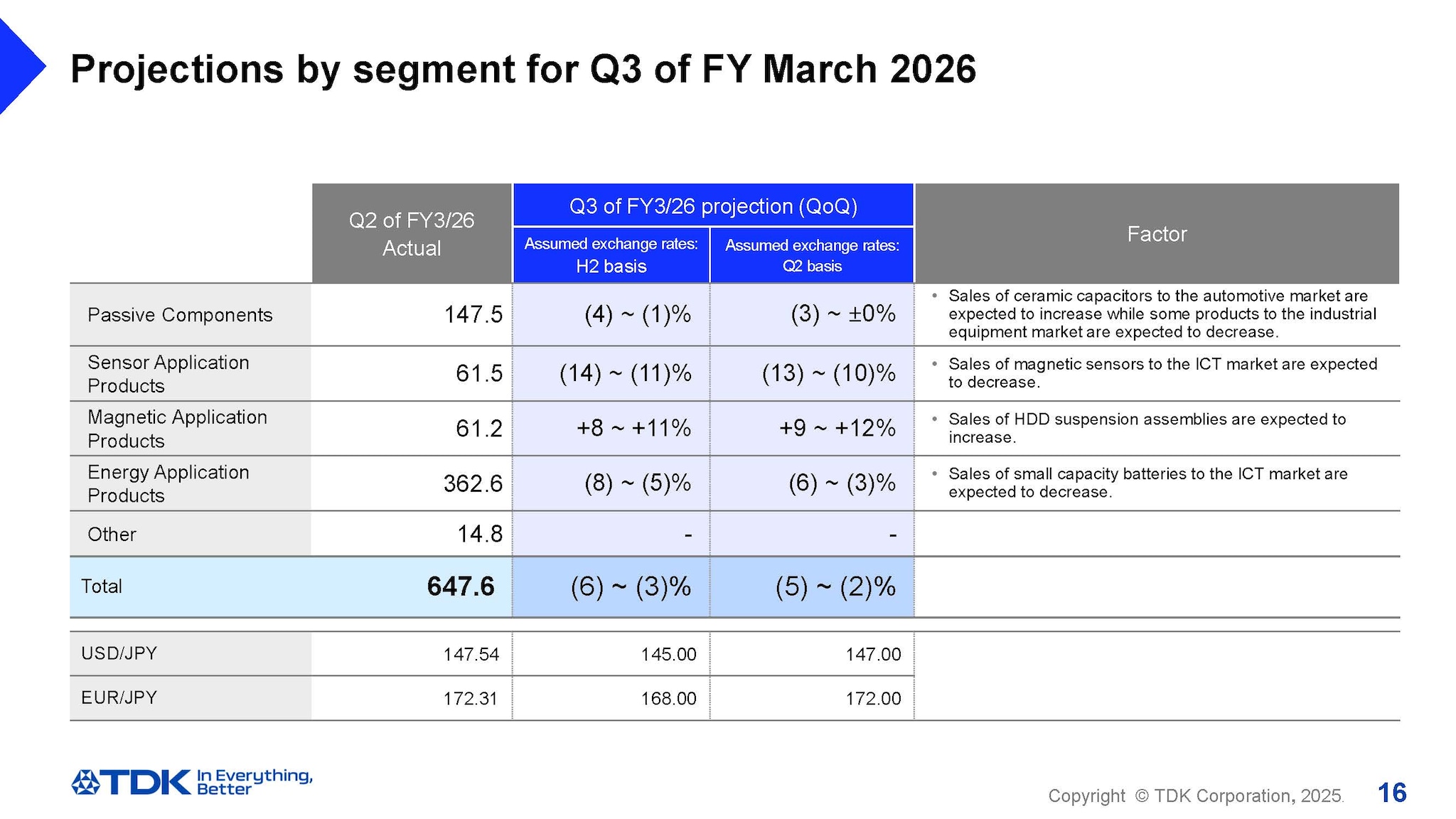

Projections by segment for Q3 of FY March 2026

I would now like to discuss our projections regarding changes in segment net sales for Q3.

We have revised our exchange rate assumption for Q3 onward from ¥140 to the U.S. dollar to ¥145 to the U.S. dollar. However, for the sake of easier comparison, I will provide explanations by adjusting this to the actual exchange rate for Q2.

In the Passive Components segment, we expect overall sales growth between -3% and ±0% on a quarter-on-quarter basis. This is attributable mainly to a decrease in sales to the industrial equipment market, despite an increase in sales to the automotive market.

In the Sensor Application Products segment, we expect overall sales growth between -13% and -10% on a quarter-on-quarter basis. This is attributable mainly to the end of the seasonal peak sales of magnetic sensors and MEMS sensors for smartphone applications and a reactionary decline following front-loaded demand due to tariffs, despite an increase in sales of temperature and pressure sensors to the automotive market.

In the Magnetic Application Products segment, we expect overall sales growth between +9% and +12% on a quarter-on-quarter basis. This is attributable mainly to the fact that the sales volume of HDD heads is expected to increase by approximately 3% and that of HDD suspension assemblies is expected to increase by approximately 15% on the back of capacity expansion among other factors.

In the Energy Application Products segment, we expect overall sales growth between -6% and -3% on a quarter-on-quarter basis. This is attributable mainly to a decline in sales of small capacity batteries for smartphone applications due to seasonality and a reactionary decline following front-loaded demand due to tariffs.

FY March 2026 projections

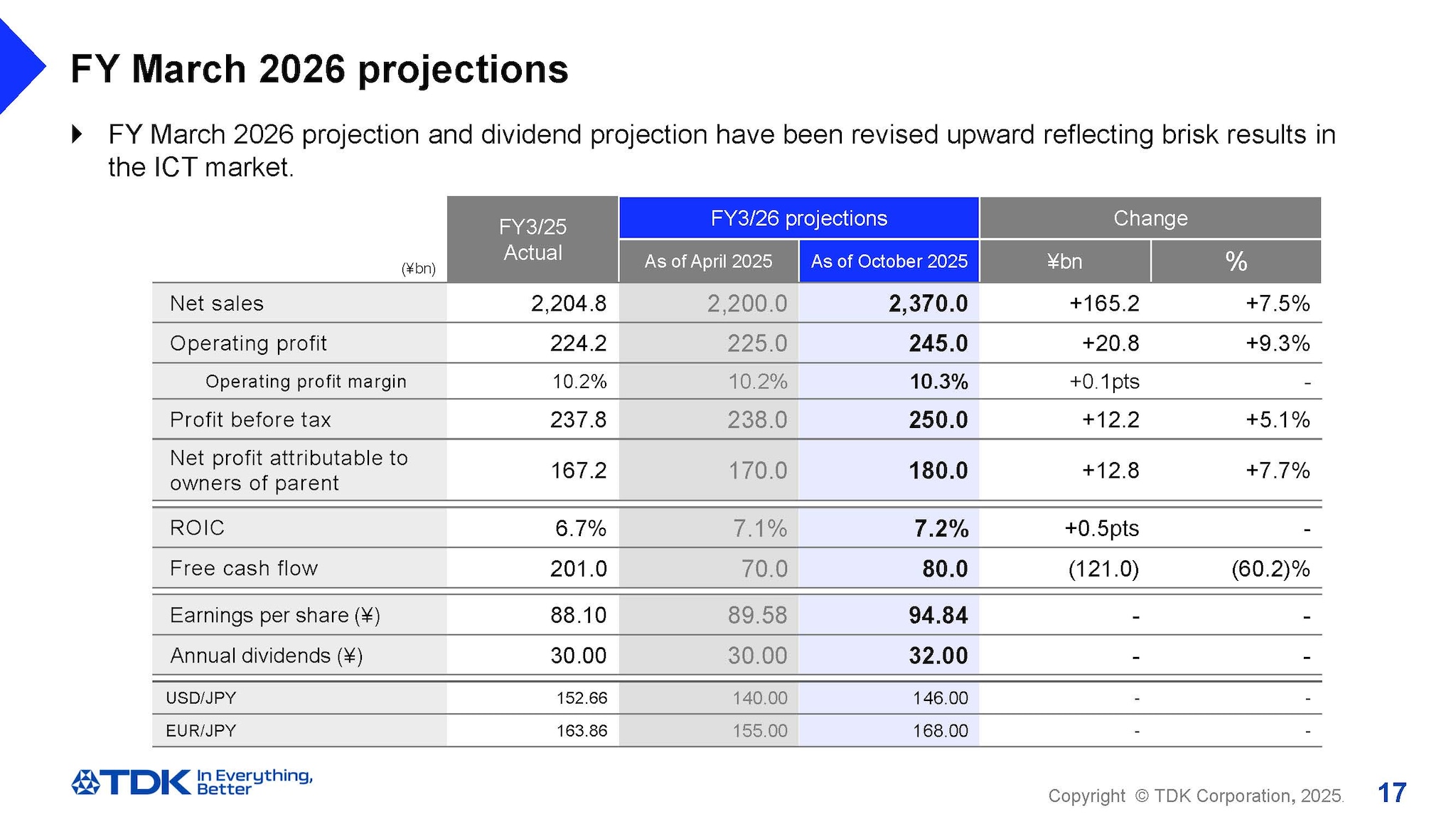

I would now like to go over our full-year projections for FY March 2026.

TDK has changed its consolidated projections for FY March 2026 using both a base scenario and a risk scenario to the projections using a base scenario only because the impact of the U.S. tariffs is expected to be limited.

As explained earlier, in the electronics market during H1, while demand from the automotive market remained sluggish, production in the ICT market, including that of smartphones and HDDs, remained robust, surpassing the level of the same period of the previous fiscal year. Under such circumstances, TDK’s performance for H1 exceeded the projections announced on April 28, 2025.

In the ICT market, sales of rechargeable batteries and sensors expanded due primarily to the launch of new models and front-loaded demand due to tariffs. In addition, sales of HDD suspension assemblies remained robustas demand related to data centers continued to show strength.

As a result of a review of full-year projections in light of the above conditions, TDK has revised upward its consolidated projections for FY March 2025 from the projections announced on April 28, 2025 as follows: net sales of ¥2,370.0 billion, operating profit of ¥245.0 billion, and net profit attributable to owners of parent of ¥180.0 billion. Our exchange rate assumption for the second half of FY March 2026 remains has been revised from our initial projection to ¥145 against the U.S. dollar.

In addition, to proactively drive our business portfolio management and address the turnaround businesses, TDK will recognize one-time expenses including restructuring costs of approximately ¥10.0 billion in total for FY March 2026, with an increase of approximately ¥5.0 billion from its beginning-of-year forecast.

As for our projections for dividend per share, we expect to pay annual dividend of ¥32, including an interim dividend of ¥16 and a year-end dividend of ¥16, up from the initial annual dividend projection of ¥30.

Notice of TDK Investor Day

Lastly, I would like to make an announcement.

On November 28, we will hold TDK Investor Day. We will explain the path toward achieving the Long-term Vision and the progress of the Medium-term Plan and business portfolio management. In addition, four Outside Directors will join the discussion and have dialogue with investors on the effectiveness of governance among other topics.

The event will be held in a hybrid format, combining both on-site and online participation. I hope you will be able to join us.

Link to the archived video (to be posted):

https://www.tdk.com/en/ir/ir_events/strategy/index.html

This concludes my presentation today. Thank you for your attention.