Fiscal Year March 2025 Full Year Performance Briefing

Mr. Noboru Saito

President & CEO

Hello, I am Noboru Sato. Thank you for joining us today.

First, I would like to talk about the key points for today.

In FY March 2025, both sales and profit increased year on year, setting new record highs for the fiscal year. Our free cash flows also exceeded our expectations, and we conducted an upward revision for shareholder returns from our initial plans to increase dividends.

Since the outlook for economic environment is highly uncertain due to the impact of additional tariffs since the inauguration of the new U.S. administration, we projected our consolidated operating results for FY March 2026 using a base scenario and a risk scenario. In terms of shareholder returns, however, we will maintain dividends of ¥30 per share even in our risk scenario.

As we have entered the second year of our current Medium-term Plan, we would like to explain its progress, especially the progress in enhancement of portfolio management or our growth strategy. Along with the progress in our review of the businesses to be intensively monitored, we will talk about our investment and growth strategy related to the AI ecosystem, which poses a great potential for TDK in a medium to long term.

We are also intensifying our engagement with investors and analysts. As for the strengthening of pre-financial capital, which is another pillar of our current Medium-term Plan, we will provide the details of progress on September 1.

These are the key points for today.

Now, I would like to hand over to Mr. Yamanishi.

FY March 2025 Results Highlights

Mr. Tetsuji Yamanishi

Executive Vice President

Hello, I am Tetsuji Yamanishi. Thank you for taking the time to attend TDK’s performance briefing for FY March 2025. I would like to explain the highlights of our consolidated results and FY March 2026 projections.

FY March 2025 key points

Looking at the electronics market, which has a large bearing on TDK’s consolidated business results, the production of products related ICT grew on a year-on-year basis. Demand for smartphones, notebook PCs and tablets was robust. Demand for nearline HDDs for data centers also recovered sharply.

On the other hand, in the industrial equipment market, capital investment demand remained weak in general. In the automotive market, demand for battery electronic vehicles (BEVs) remained sluggish, resulting in lower component demand than we had expected at the beginning of the period.

In this business environment, during FY March 2025, sales of passive components and sensors decreased year on year due mainly to a decline in demand from the automotive market. Sales of power supplies for industrial equipment, passive components and sensors also dropped year on year primarily reflecting delayed demand recovery in the industrial equipment market.

On the other hand, sales of sensors, HDD heads, HDD suspension assemblies and small capacity batteries increased significantly on the back of a recovery in demand for components in the ICT market and new product sales among other factors, resulting in a 4.8% year-on-year increase in net sales.

Reflecting the sharp depreciation of the yen and an increase in shipments of products for the ICT market, as well as rationalization and the benefits from restructuring implemented in the previous fiscal year, operating profit increased 29.7 % year on year, setting new record highs for both sales and profit.

FY March 2025 results

Next, I would like to present an overview of our results for FY March 2025.

There was an increase of about ¥95.7 billion in net sales and an increase of about ¥19.7 billion in operating profit due to exchange rate fluctuations against the U.S. dollar and other currencies. Including this impact, net sales were ¥2,204.8 billion, an increase of ¥100.9 billion, or 4.8%, year on year, and operating profit was ¥224.2 billion, an increase of ¥51.3 billion, or 29.7%, year on year, including one-time expenses of ¥20.2 billion. Profit before tax was ¥237.8 billion, an increase of ¥58.6 billion, or 32.7%, year on year. Net profit attributable to owners of parent was ¥167.2 billion, an increase of 34.1% year on year. In summary, TDK set record highs in all items. Earnings per share amounted to ¥88.10. In terms of exchange rate sensitivity, we estimate that a change of ¥1 against the U.S. dollar will affect operating profit by about ¥2 billion a year, the same as our previous estimate, while a ¥1 change against the euro will have an impact of about ¥0.3 billion a year.

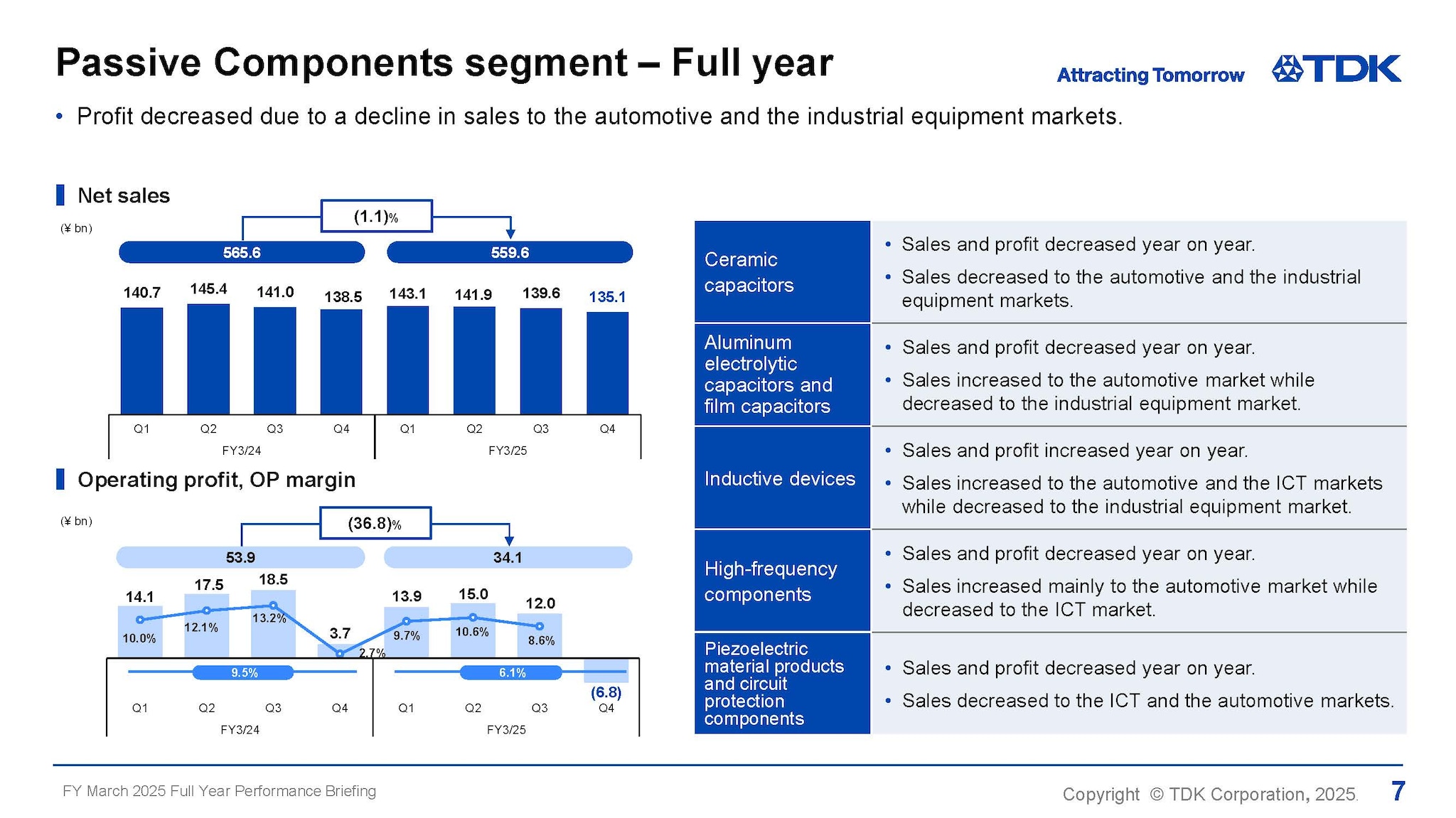

Passive Components segment – Full year

I will now move on to full-year segment results.

First, in the Passive Components segment, as sales to the automotive market and the industrial equipment market declined, net sales decreased by 1.1% year on year to ¥559.6 billion and operating profit dropped by 36.8% year on year to ¥34.1 billion.

Sales and profit decreased year on year for ceramic capacitors and aluminum electrolytic capacitors and film capacitors, which have a high ratio of sales to the automotive and industrial equipment markets. Sales and profit of inductive devices increased year on year on the back of a rise of sales to the ICT and automotive markets, among other factors, despite a decline in sales to the industrial equipment market. A significant loss was recorded for high-frequency components due to a decline in sales to the ICT market and the posting of impairment losses amounting to ¥10.6 billion. Sales and profit of piezoelectric material products and circuit protection components decreased year on year reflecting a decline in sales to the ICT and automotive markets.

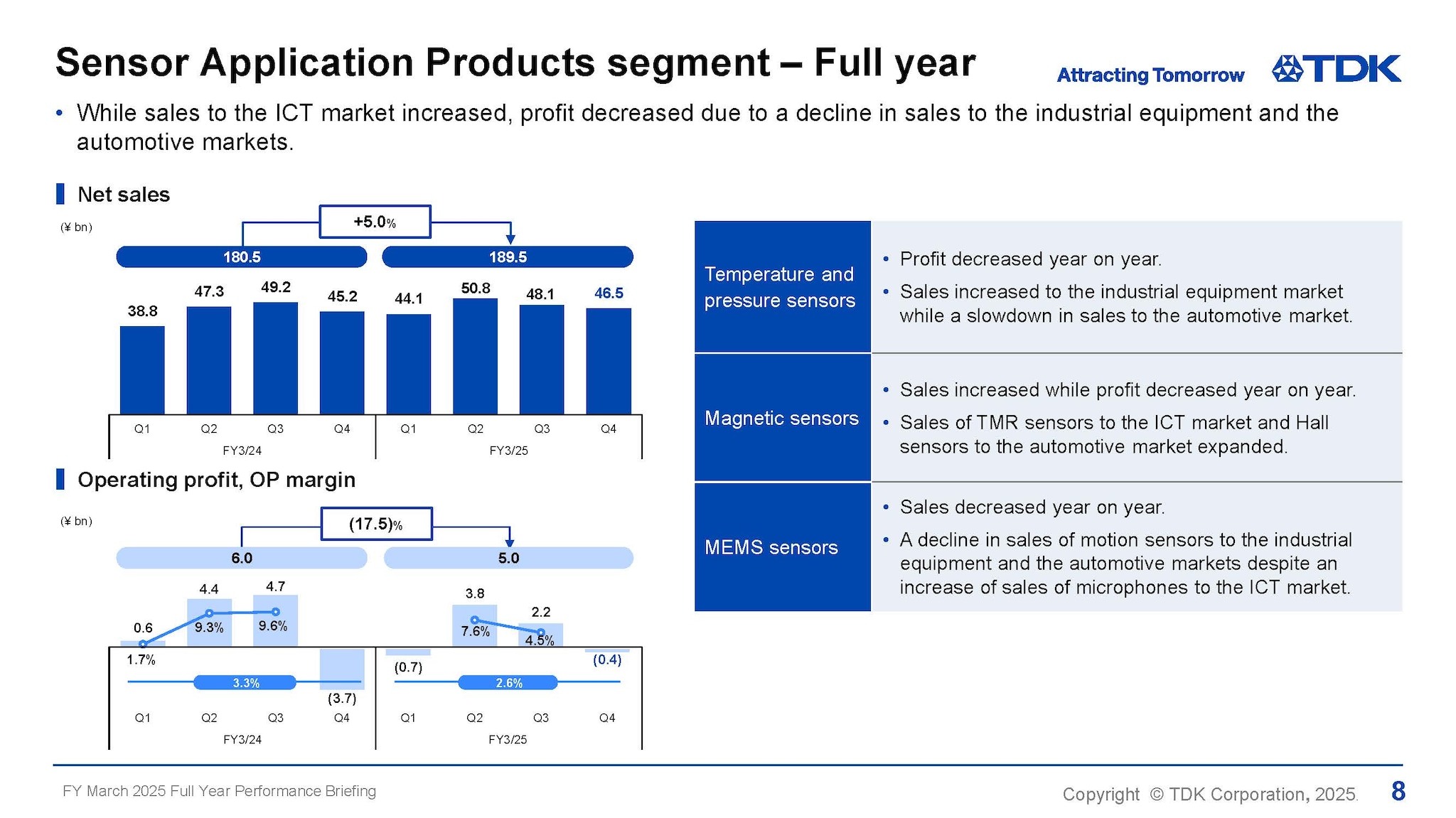

Sensor Application Products segment – Full year

Next, in the Sensor Application Products segment, net sales increased 5.0% year on year to ¥189.5 billion, while operating profit decreased 17.5% year on year to ¥5.0 billion.

Sales of temperature and pressure sensors increased year on year reflecting a rise in sales to the industrial equipment and automotive markets, while profit decreased year on year as a one-time gain from the sale of assets had been included in profit for the previous year.

In magnetic sensors, sales increased year on year due to a rise in sales of TMR sensors for smartphone applications as well as an expansion of sales of Hall sensors to the automotive market, while profit decreased year on year mainly reflecting a rise in expenses due to capital expenditure to increase production capacity. In MEMS sensors, sales of microphones increased to the ICT market, while sales of motion sensors decreased to the automotive and industrial equipment markets. This resulted in a year-on-year decrease in sales of MEMS sensors on the whole.

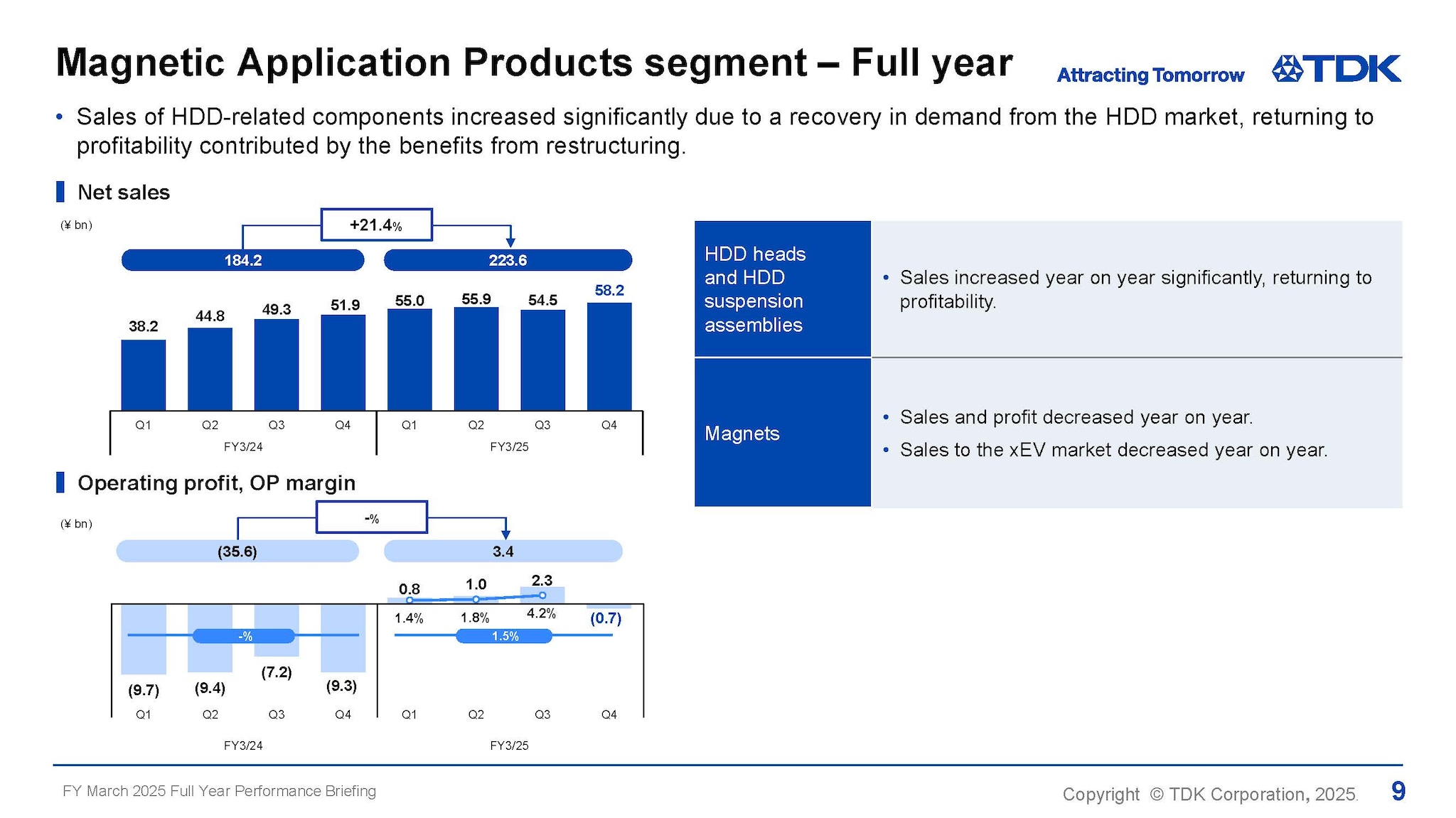

Magnetic Application Products segment – Full year

Next, in the Magnetic Application Products segment, net sales rose sharply by 21.4% year on year to ¥223.6 billion, and operating profit returned to the black.

In HDD heads and HDD suspension assemblies, demand for nearline HDDs for data centers increased about 1.5 times year on year, resulting in a return to profitability for both HDD heads and HDD suspension assemblies.

The sales volume of HDD heads increased about 30% year on year, and the sales volume of nearline HDD heads, in particular, nearly doubled on a year-on-year basis. While still slightly below the break-even point after the restructuring, HDD heads returned to profitability due to an improved product mix and in utilization rate. The sales volume of HDD suspension assemblies exceeded the break-even point, remaining in the black with high profitability.

Both sales and profit of magnets decreased year on year due to lower sales to the automotive market.

Energy Application Products segment – Full year

Next, in the Energy Application Products segment, net sales amounted to ¥1,176.5 billion, up by 4.9% year on year, and operating profit rose strongly by 19.8% year on year to ¥234.4 billion.

Profit of rechargeable batteries jumped significantly with increased profitability due to a rise in sales volume on the back of the launch of new smartphone models as well as an improved product mix, despite the impact of a decline in selling prices resulting from lower material prices.

Power supplies for industrial equipment saw a year-on-year decline in terms of both sales and profit as demand for industrial equipment applications failed to recover, and sales of power supplies for EVs also decreased year on year due to a slowdown in BEV sales.

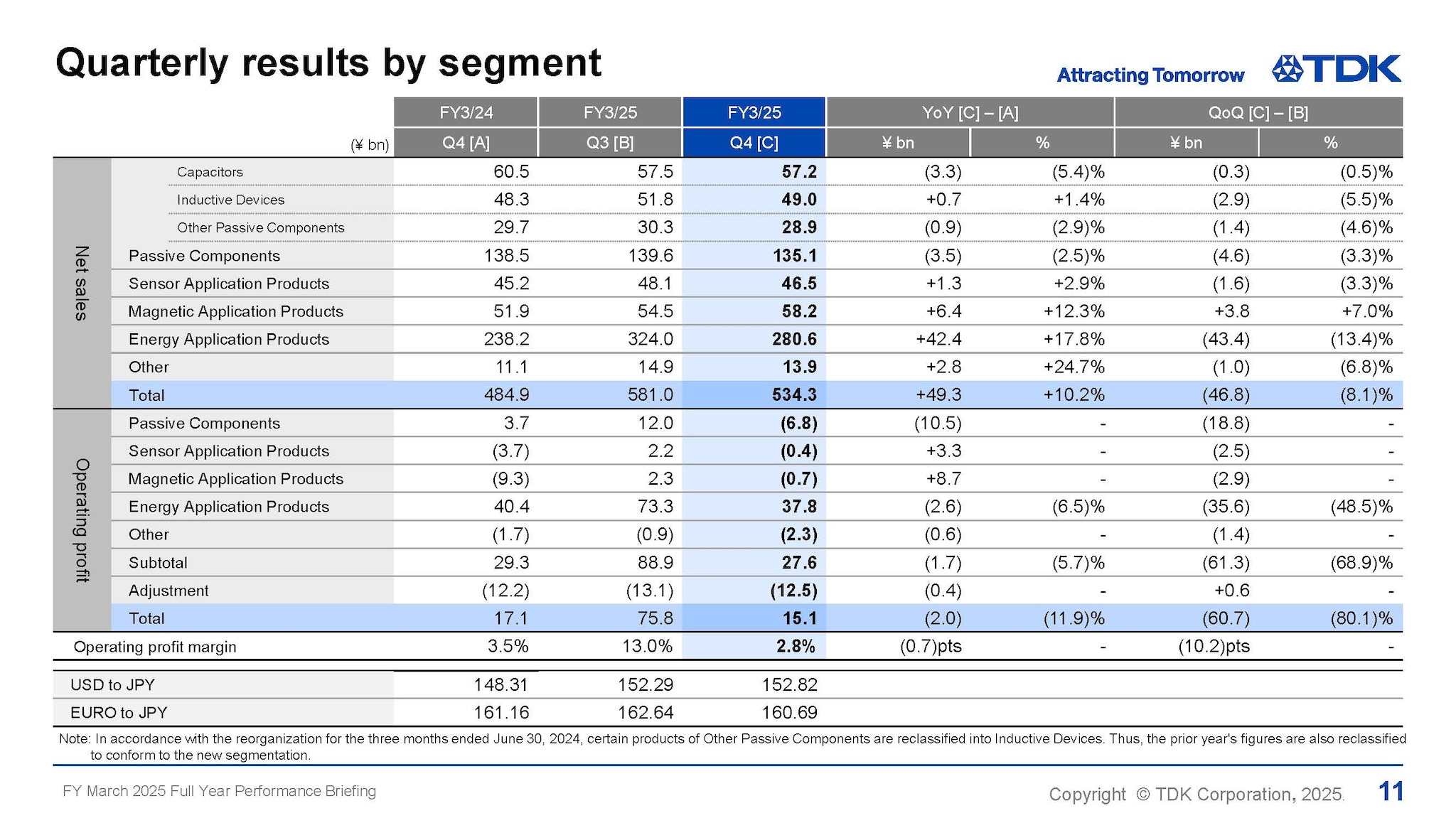

Quarterly results by segment

Now, I will explain some of the factors behind the changes in segment sales and operating profit from the third quarter to the fourth quarter of FY March 2025.

In the Passive Components segment, net sales decreased by ¥4.6 billion, or 3.3% from the third quarter, and operating profit decreased by ¥18.8 billion from the third quarter. While demand related to the industrial equipment market increased slightly, demand related to the automotive market remained stagnant. In the ICT market, as demand related to smartphones declined due to seasonal factors, sales of ceramic capacitors, inductive devices, and high-frequency components decreased year on year, while sales of aluminum electrolytic capacitors and film capacitors increased year on year reflecting the growth in sales related to industrial equipment. In terms of operating profit, a significant loss was posted due to the year-on-year decline in sales and profit related to ceramic capacitors and inductive devices as well as the impairment loss related to high-frequency components amounting to ¥10.6 billion recorded in the fourth quarter.

In the Sensor Application Products segment, net sales decreased by ¥1.6 billion, or 3.3%, from the third quarter, and operating profit decreased by ¥2.5 billion from the third quarter. Temperature and pressure sensors remained virtually flat in terms of both sales and profit, while magnetic sensors saw a decrease in sales and profit reflecting a decline in sales of TMR sensors for smartphone applications due to seasonal factors. MEMS sensors saw an increase in operating loss due partly to the recording of restructuring costs amounting to ¥0.6 billion.

In the Magnetic Application Products segment, net sales increased by ¥3.8 billion, or 7.0 %, from the third quarter, while operating profit dropped by ¥2.9 billion from the third quarter. Sales of HDD heads increased from the third quarter as the sales volume of nearline HDD heads grew by about 30%. Although operating loss was posted for HDD heads due to the payment of property taxes, profit increased from the third quarter in real terms. HDD suspension assemblies saw a decline in both sales and profit in the fourth quarter in reaction to the front-loaded shipment in the third quarter. As for magnets, both sales and profit decreased from the third quarter.

Next, in the Energy Application Products segment, net sales decreased by ¥43.4 billion, or 13.4%, from the third quarter, and operating profit dropped by ¥37.8 billion, or 48.5%, from the third quarter. Rechargeable batteries saw a decline in both sales and profit from the third quarter due to the recording of one-time expenses related to a write-off amounting to ¥2.3 billion, despite the fact that the sales volume of small capacity batteries to the ICT market was in line with our expectations. Power supplies for industrial equipment saw an increase in terms of both sales and profit from the third quarter reflecting a slight recovery trend in demand. While sales of power supplies for EVs increased from the third quarter, the business continued to post a loss.

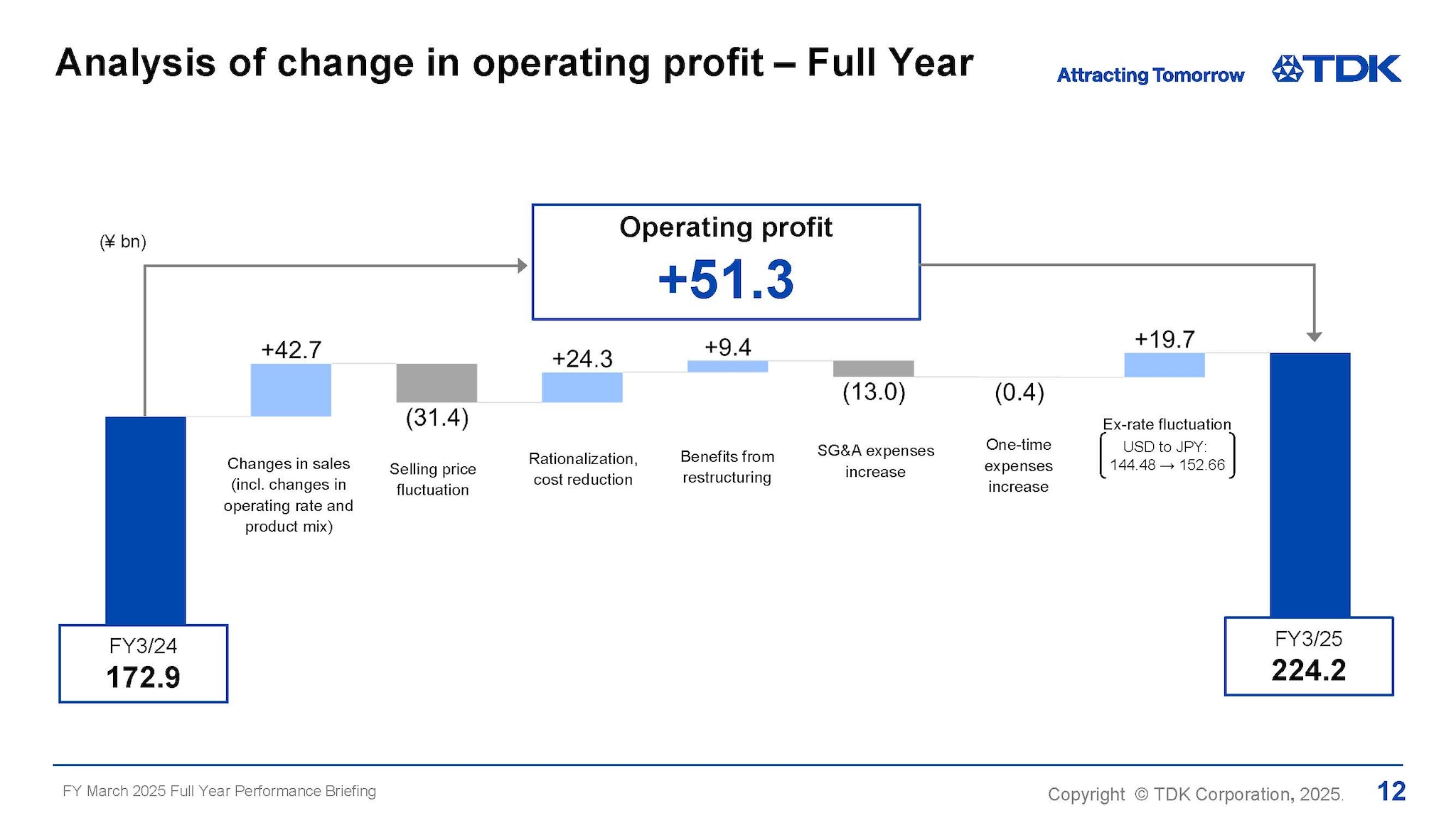

Analysis of change in operating profit – Full Year

Next is an analysis of the ¥51.3 billion year-on-year increase in operating profit for FY March 2025. Operating profit increased by ¥42.7 billion due to an increase in the sales volume of rechargeable batteries, HDD heads and HDD suspension assemblies. The effects of rationalization and cost reduction of ¥24.3 billion and benefits from restructuring of ¥9.4 billion absorbed the ¥31.4 billion decline in profit caused by selling price fluctuation. SG&A expenses increased by ¥13.0 billion reflecting an increase in R&D expenses related to rechargeable batteries for which TDK has been accelerating the development of new products. These factors, including the positive effect of the lower yen amounting to ¥19.7 billion, contributed to the ¥51.3 billion increase in operating profit.

Cash flows – Full Year

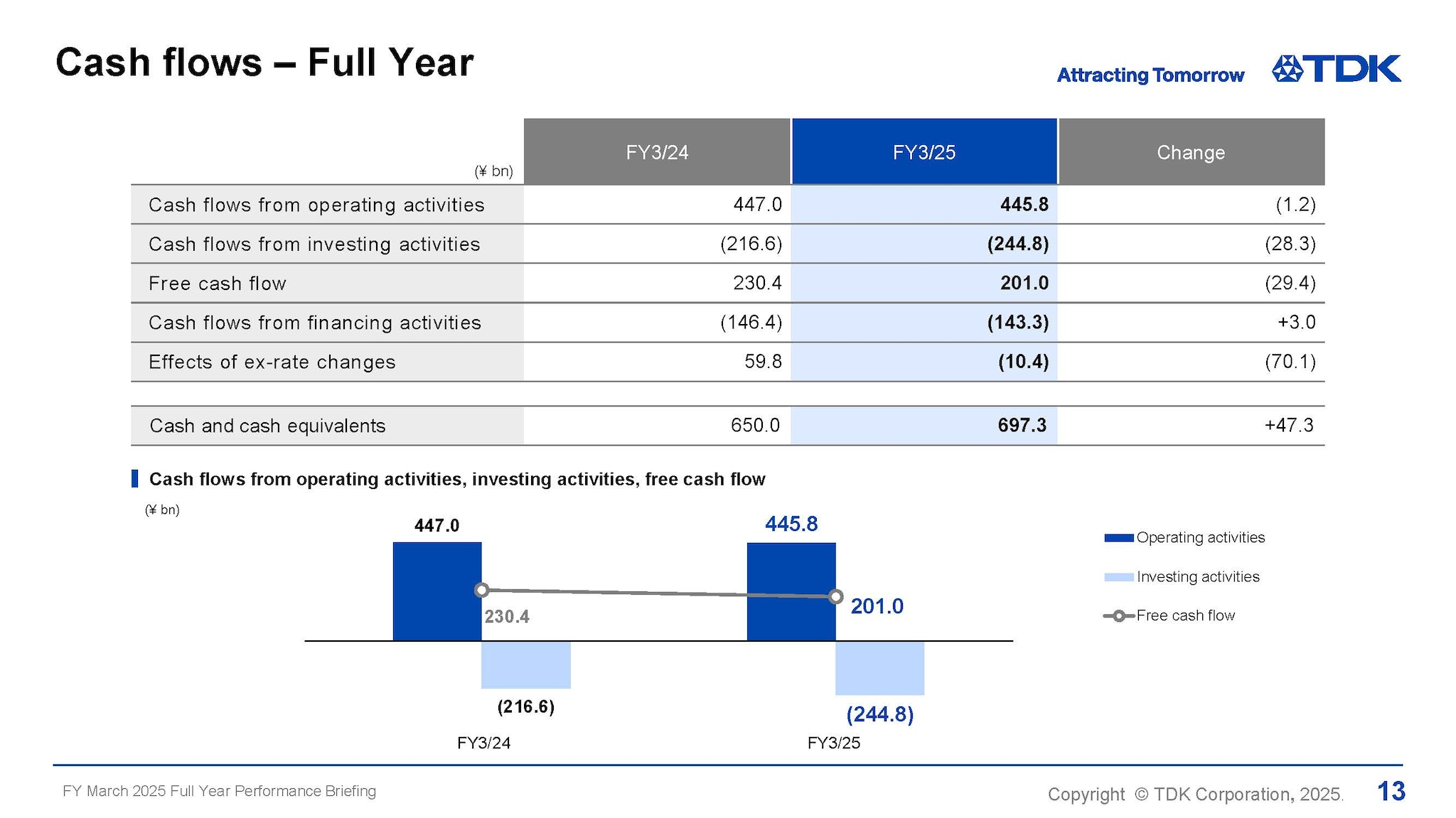

Next, I would like to present an overview of cash flows.

In FY March 2025, operating cash flow amounted to ¥445.8 billion, investing cash flow amounted to ¥244.8 billion, and free cash flow amounted to ¥201.0 billion, mostly achieving the levels projected at the time of the announcement of the third quarter results at the end of January.

Free cash flow was significantly above the initial forecast level due to a decline in CAPEX and a reduction in working capital on top of an increase in profit.

FY March 2026 Projections

Now, I would like to explain the FY March 2026 projections.

Assumptions for performance forecast - key market predictions -

Now, I would like to talk about production volume forecasts for key devices related to TDK as the basis for our projections of operating results for FY March 2026.

The outlook for the global economy in FY March 2026 is highly uncertain due to the repeated changes in tariffs by the new U.S. administration. Under such circumstances, with regard to the production volume for key devices as the basis for our projections, we have formulated a risk scenario in which demand for key devices will decline in the U.S. due to tariffs, along with a base scenario based on initial expectations. Our projections based on these scenarios have a range.

The risk scenario has been formulated based on the base scenario by predicting how much the anticipated demand in the U.S. will decline as a result of an increase in selling prices due to tariffs.

First, in the automotive market, we expect that the total automobile production will be in the range between a 1% year-on-year slight increase and a 3% year-on-year decrease.

We expect that the production of smartphones, which represent the ICT market, will be in the range between 1,200 million units and 1,164 million units, down about 3% year on year.

Next, in the HDD market, while we initially anticipated that the production of nearline HDDs for data centers will increase by 2% year on year given the recovery trend in the market, we have incorporated a downside risk of about 5%.

FY March 2026 projections

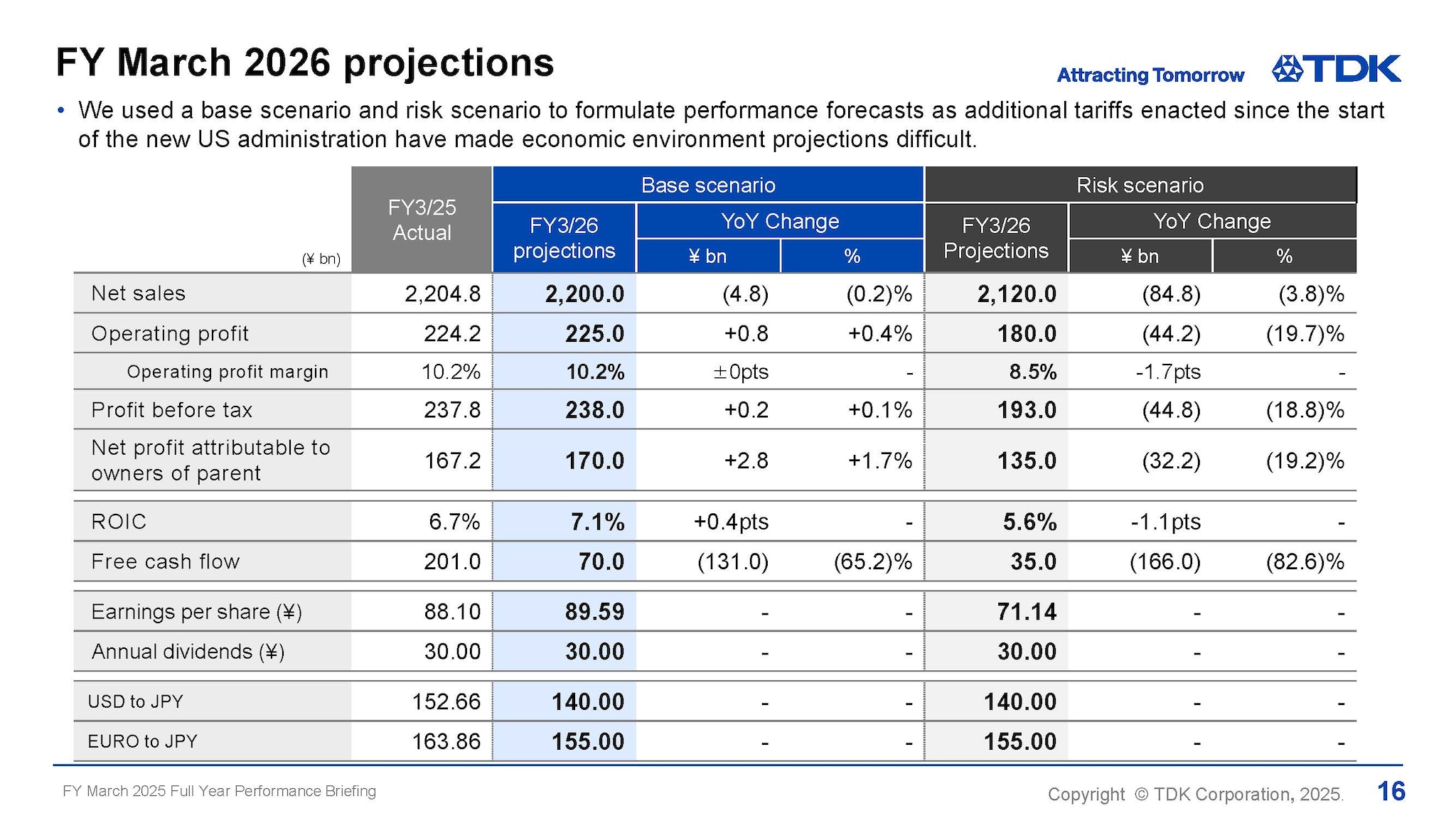

Based on the production volume for key devices, we have also used the base scenario and risk scenario to formulate our projections of operating results for FY March 2026.

Our exchange rate assumptions are ¥140 to the dollar, a sharp appreciation of the yen from ¥153 yen to the dollar in FY March 2025. In the base scenario, net sales, operating profit and all other items are expected to be at virtually the same levels as in FY March 2025. Even under the situation in which the impact of the tariffs on our earnings projections is unclear, we have set the base scenario as the minimum level to be achieved. We expect ROIC to improve slightly to 7.1% and free cash flow to amount to ¥70.0 billion as CAPEX is anticipated to increase and working capital will likely remain unchanged.

Meanwhile, the risk scenario indicates the possibility that net sales will decrease by ¥80.0 billion, or about 4%, and operating profit will drop by ¥45.0 billion from the projections under the base scenario. It is predicted that ROIC and free cash flow will also deteriorate due to the effect of lower profit.

We expect to maintain an annual dividend of ¥30 per share in FY March 2025 even in the risk scenario.

Projections by segment for FY March 2025

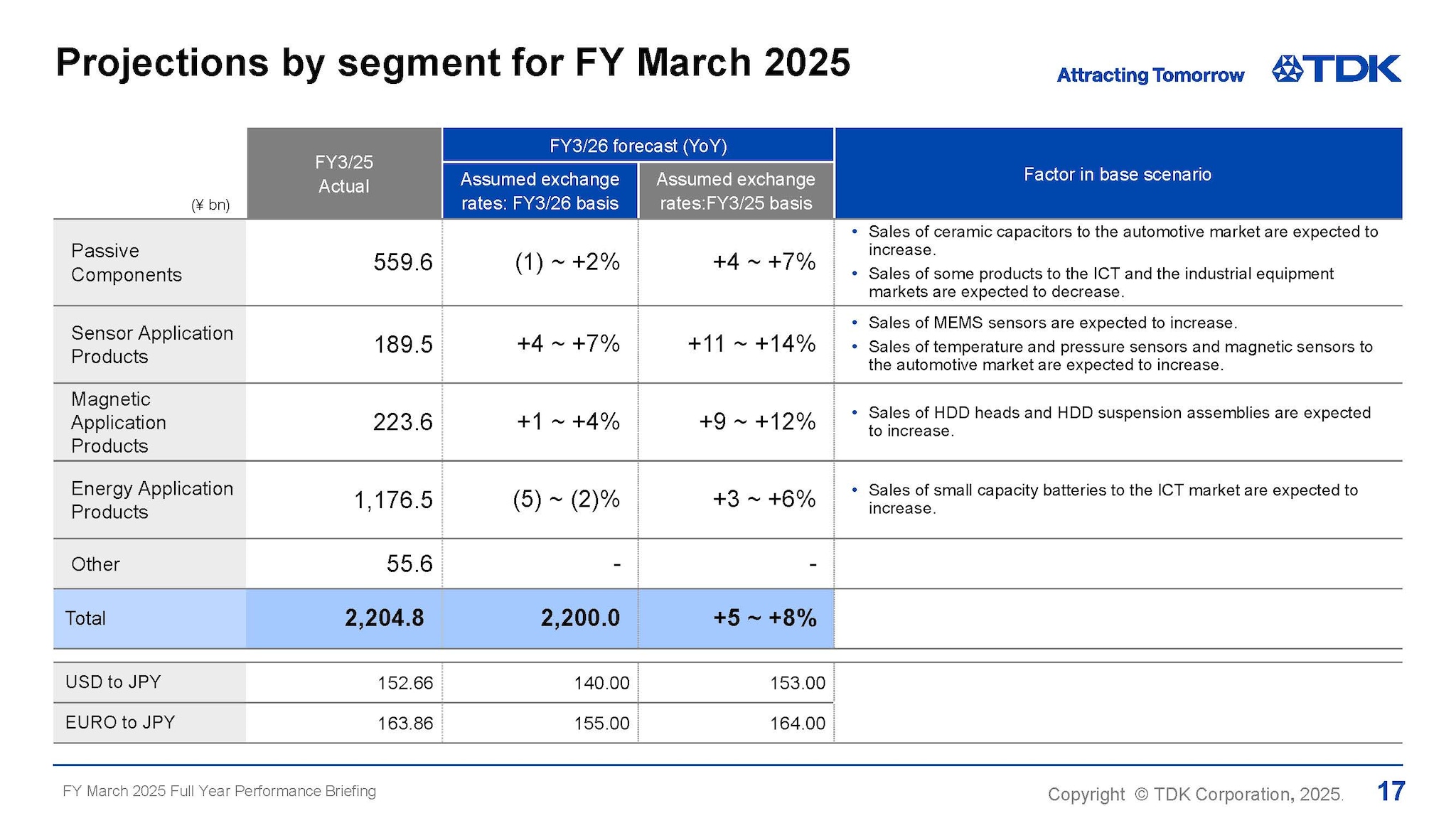

I will now explain our projections by segment for FY March 2026.

While the impact of yen appreciation reflected in exchange rate assumption changes from ¥153 to the dollar to ¥140 to the dollar has been incorporated in the base scenario, I will provide explanations here by excluding the impact of exchange rate fluctuation for comparison purposes.

In the Passive Components segment, we predict that sales for automobile applications, primarily MLCC sales, will grow year on year on the back of a rise in demand related to the automotive market, such as xEVs, but that sales related to the ICT and industrial equipment markets will decrease year on year. We expect overall sales growth of 4-7% year on year on the back of an expected sales increase in all businesses.

In the Sensor Application Products segment, we expect overall sales growth of 11-14% year on year, driven by expected increases in sales of temperature and pressure sensors and magnetic sensors for automobile applications as well as a rise in sales of MEMS sensors for ICT and game console applications.

In the Magnetic Application Products segment, we expect overall sales growth of 9-12% year on year. While the production volume of HDDs is anticipated to decline by about 2%, the production volume of nearline HDDs will likely increase by about 2%. Based on such premise, we forecast that the sales volume of HDD heads will increase by about 16% and that the sales of HDD suspension assemblies will increase by about 25%.

In the Energy Application Products segment, we expect overall sales growth of 3-6% year on year as demand related to smartphones is projected to remain robust.

Operating profit projections for FY March 2026

Now I would like to explain our operating profit projections for FY March 2026.

In real terms excluding the effects of the stronger yen and the decrease in one-time expenses, operating profit is expected to increase by ¥20.8 billion year on year.

We project profit to increase by ¥70.0 billion year on year due to an increase in sales in all businesses. On the other hand, we expect that there will be an impact of selling price fluctuation amounting to ¥65.0 billion on the assumption of stronger pressure to discount selling prices amid uncertain economic environment. Cost reduction and benefit from restructuring will likely contribute to an increase in operating profit of ¥40.0 billion, while SG&A expenses is projected to increase by ¥24.2 billion due to the plan to strengthen new products and new technology development mainly for rechargeable batteries.

In the base scenario, including the impact of a decrease in one-time expenses and the appreciation of the yen, we expect operating profit to remain at virtually the same level as the previous year.

In the risk scenario, an impact of a decline in demand due to tariffs amounting to ¥45.0 billion has been included.

Capex, Depreciation, and R&D expenses – Projections

I will now turn to our projections for capex, depreciation, and R&D expenses.

Our forecast for capital expenditures is ¥280 billion, depreciation and amortization ¥205 billion, and R&D expenses ¥260 billion.

Shareholder returns

Lastly, I will explain shareholder returns.

In our current Medium-term Plan, we plan to return profits to shareholders with a target dividend payout ratio of 35% taking into account comprehensive factors, including changes in the business environment, investment in growth businesses, and ROE. While we have a policy to push forward with strengthening of shareholder returns based on our free cash flow level, given the uncertain economic environment, our current plan is to pay an annual dividend of ¥30 per share, the same amount as in FY March 2025.

Although we expect our profit level to decline considerably in the risk scenario, it is our policy to maintain an annual dividend of ¥30 per share. The dividend payout ratio will be about 42% in that case.

Progress on Medium-term Plan

Mr. Noboru Saito

President & CEO

Now, Noboru Sato will explain the progress of the Medium-term Plan.

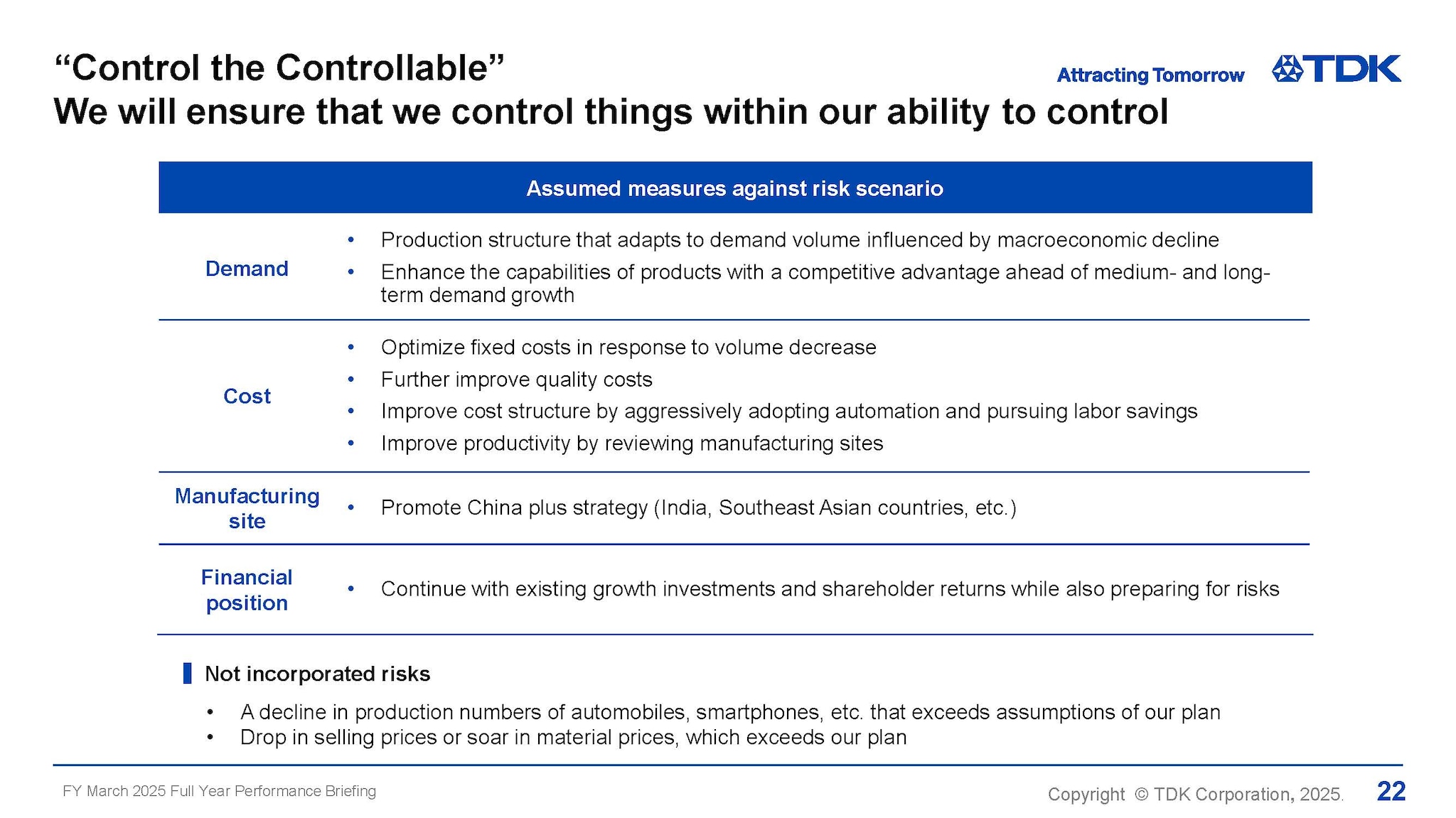

First, I would like to explain our measures against the risk scenario.

It is very difficult to predict the future, leading to the slowdown of the global economy.

We will continue to prepare as much as possible for this macro environment, but we cannot change it.

Therefore, what we need to do now is focus on what we can control. In other words, we need to improve and strengthen our own capabilities.

These capabilities include quality, productivity, and technological capabilities, as described here, and we will thoroughly strengthen these capabilities.

In addition, we will strengthen our financial position as a measure against the risk scenario, and even in that scenario, we will steadily implement growth investments, strategic investments, and shareholder returns while keeping a balance.

Financial KPI progress

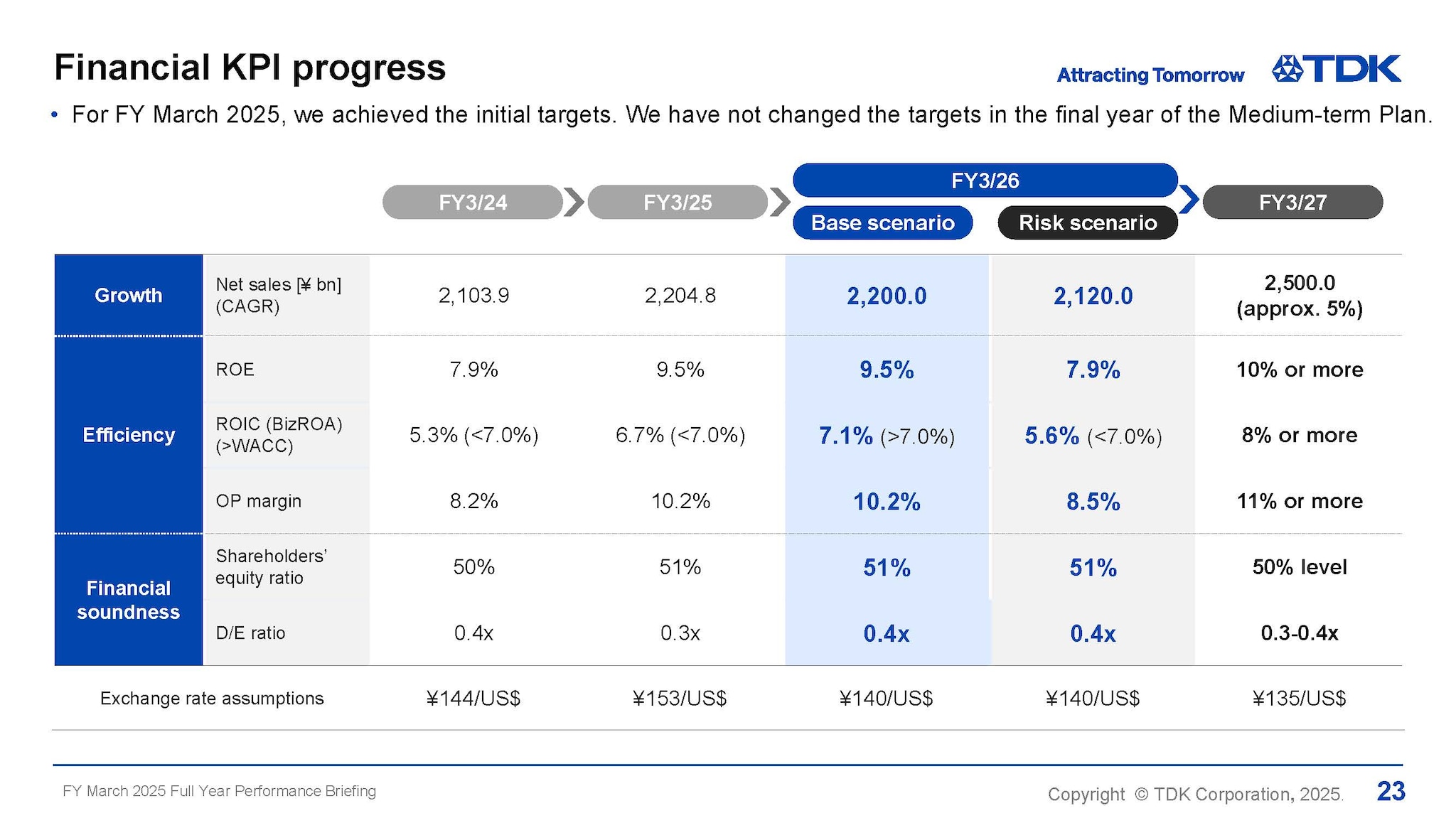

Next, let me move on to the results and projections of financial KPIs in the current Medium-term Plan.

We achieved all KPI targets for FY March 2025.

While the risk scenario was added for FY March 2026 on top of the base scenario, we have not changed the targets in the final year of the Medium-term Plan.

Toward achieving the targets for FY March 2027, we will focus on asset efficiency by enhancing our own capabilities.

Change of capital allocation plan

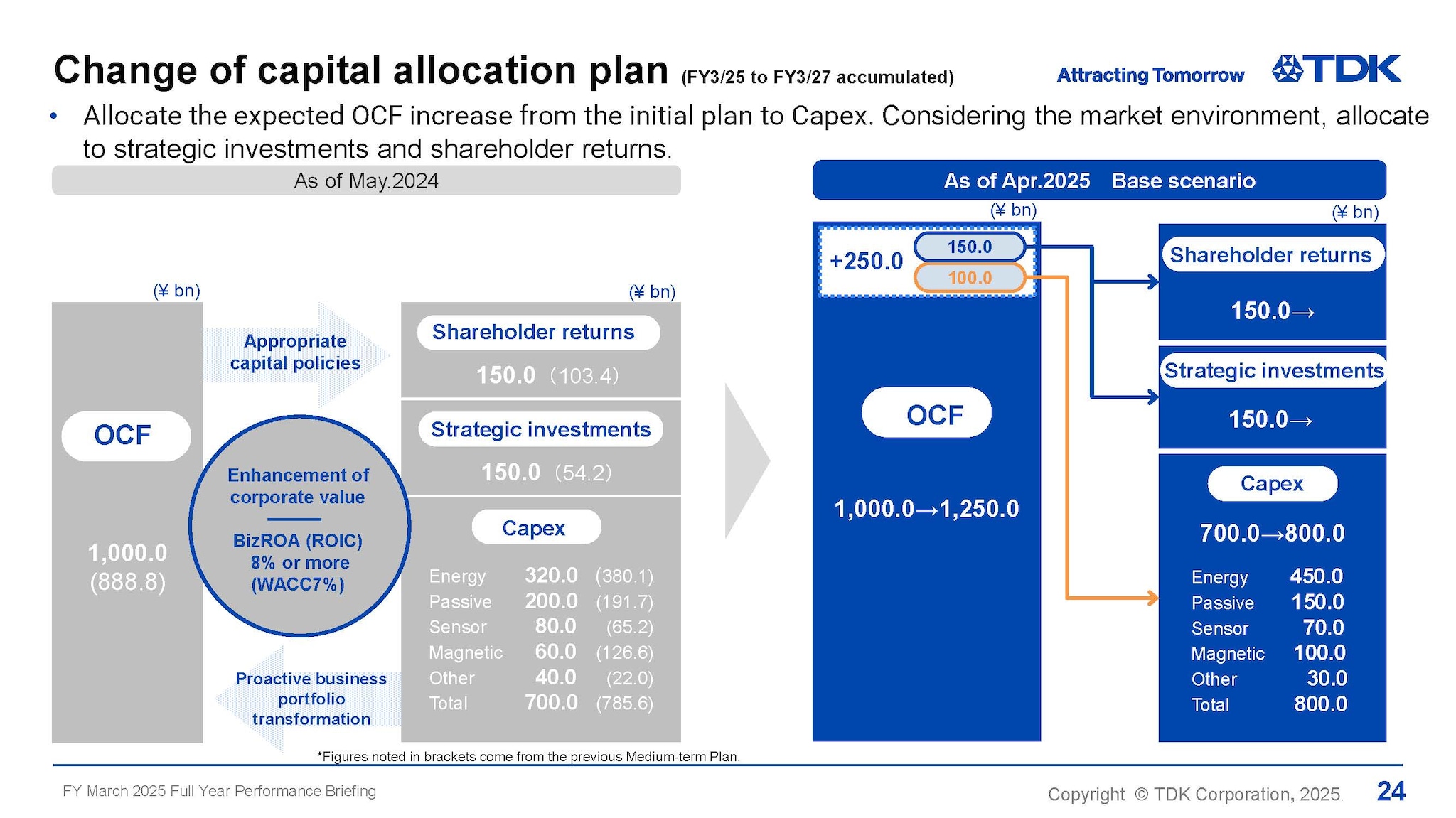

I will now talk about the progress of our capital allocation plan.

While we had expected operating cash flow to amount to about ¥1,000 billion for the three-year period, we now project that it will increase by about ¥250 billion in total from the initial plan for the same period, reflecting free cash flow for the initial year exceeding the target.

About ¥150 billion of this increase in operating cash flow will be allocated to shareholder returns and strategic investments in a flexible manner while paying close attention to the market environment.

We will also increase CAPEX by about ¥100 billion, majority of which will be allocated to energy. Given robust demand for innovative technologies related to small capacity batteries, we plan to boost investments aimed at relevant technologies and equipment.

While we will provide an overview of strategic investments later in this presentation, it is our plan to actively invest in AI ecosystem.

Progress on Key points of the Medium-term Plan

I will now explain the progress on three key points of the current Medium-term Plan.

As explained earlier, we have exceeded the targets for the first point of strengthening management focusing on cash flows.

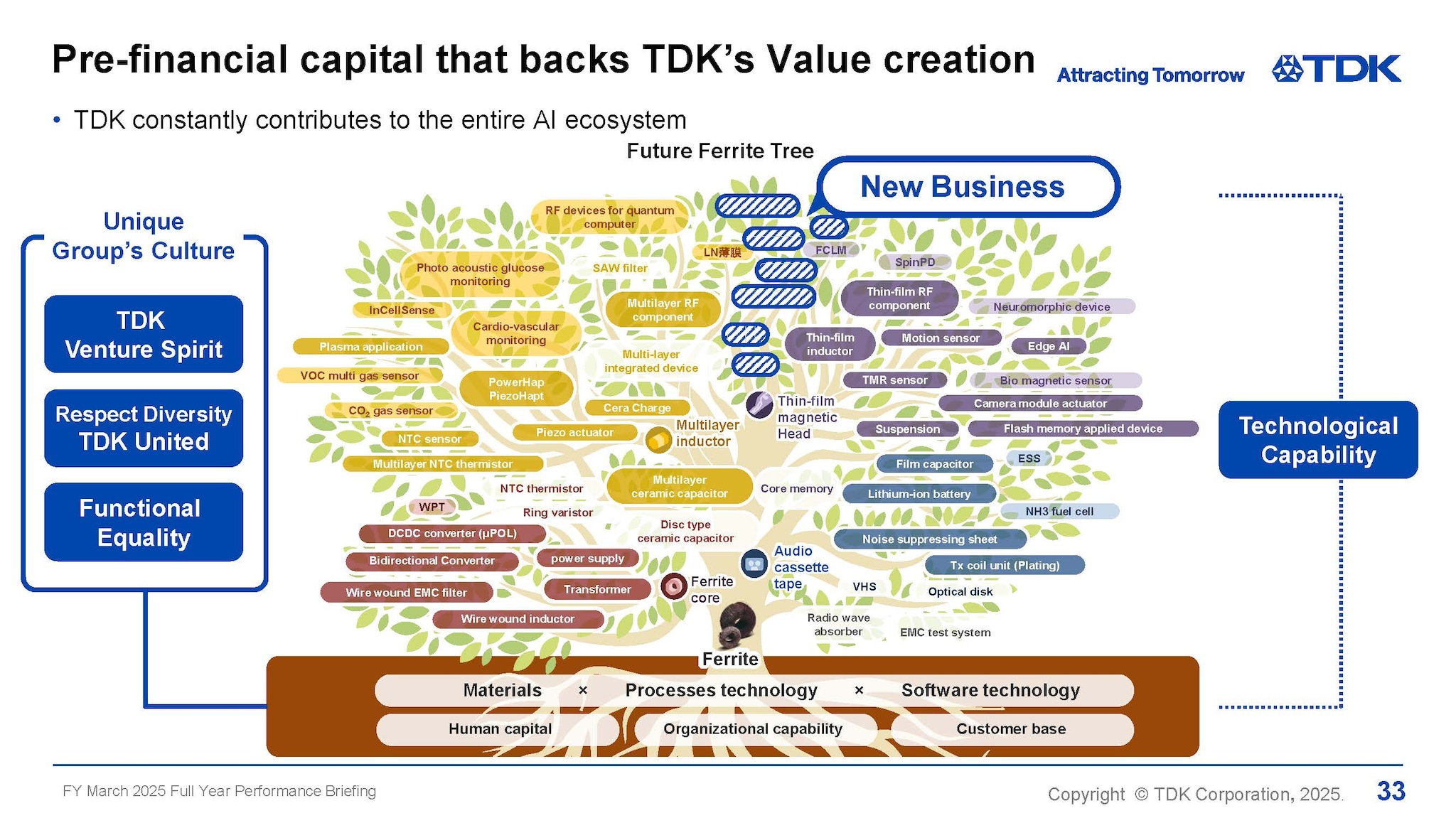

As you can see on this slide, there have been a progress in various fields related to the third points of evolving the Ferrite Tree, or strengthening pre-financial capital.

We have appointed the CHRO to further enhance human capital. In terms of enhancing our technological capabilities, we have successfully demonstrated the spin photo detectors for the first time in the world for the future development of the AI ecosystem. Using TDK‘s spintronics technology, we have achieved a reaction speed more than 10 times faster than that of conventional semiconductor-based photo detectors. By continuing to reinforce initiatives related to sustainability and DX on top of the above, we will evolve the Ferrite Tree significantly.

In the following slides, I will explain the details of the second point of proactive business portfolio management.

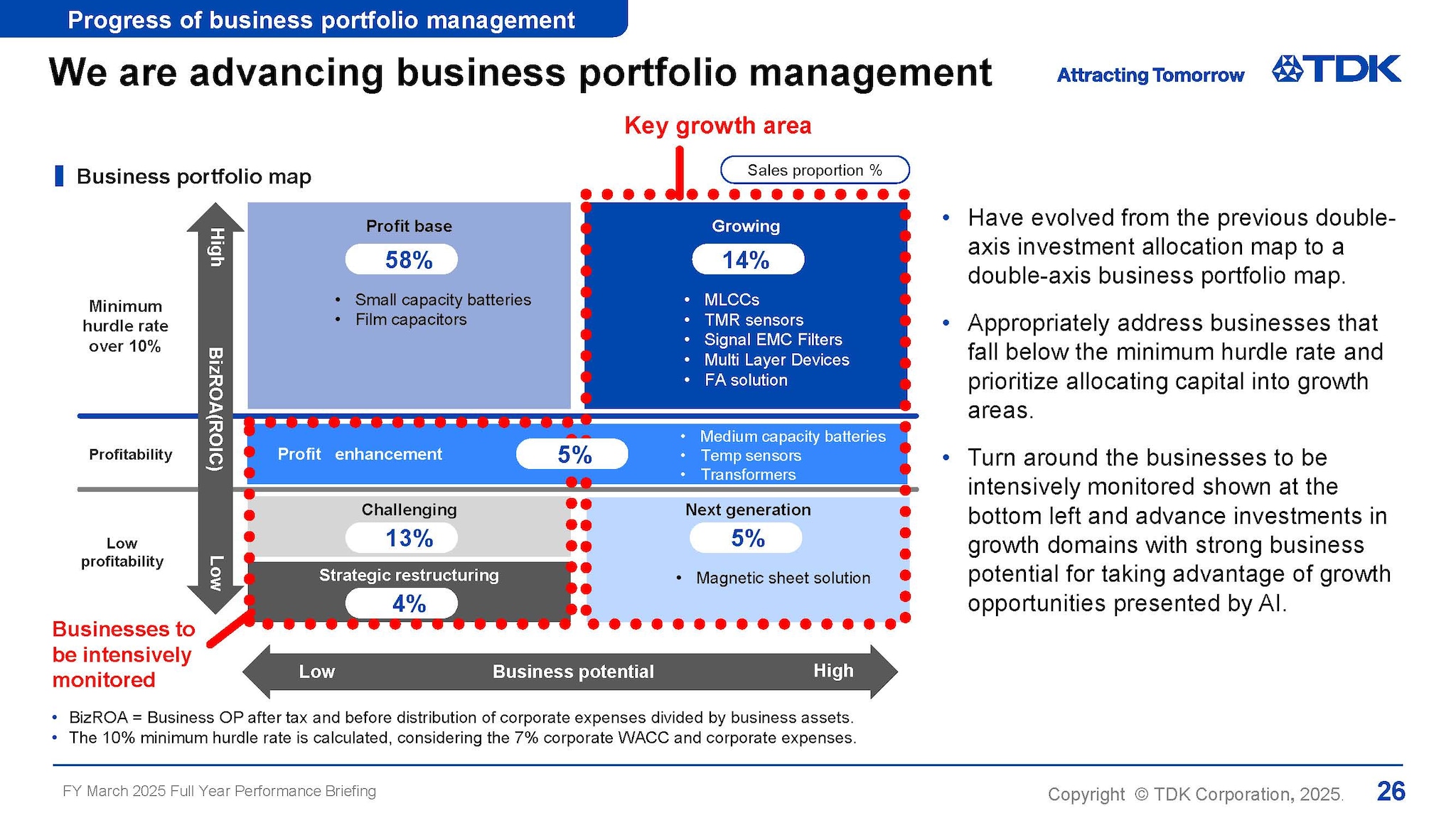

We are advancing business portfolio management

As we have repeatedly emphasized since the Medium-term Plan announcement last year, the first priority for proactive business portfolio management is to promote growth strategies.

Today, I will explain the details of the progress related to the businesses to be intensively monitored shown at the bottom left and the key growth area with strong business potential for taking advantage of growth opportunities presented by AI on the right.

Improve profitability of Business to be intensively monitored

Let me start with the businesses to be intensively monitored shown at the bottom left.

Since May 2024, we conducted discussions on 27 CBUs and examined and implemented measures for early turnaround. As a result, we have already turned around the HDD suspensions business. We are also working toward turning around the HDD heads business.

With regard to 19 CBUs, we are in the progress of implementing internal measures for turnaround and advancing discussions on strategic options from various viewpoints.

As for 7 CBUs, for which announcement is possible as of April 28, we have already made decisions for business termination or business transfer.

Business transfer agreements have been concluded for magnet application products in the magnet business and the micro actuators business. In the Passive Components segment, we have decided to terminate the photovoltaic (PV) and Semiconductor Embedded in SUBstrate (SESUB) under the high-frequency components business. We have also decided to terminate the Electric Double Layer Capacitor (EDLC) business in the Other segment.

This is the progress up to date.

We will continue to accelerate proactive business portfolio management and advance growth strategies.

TDK constantly contributes to the entire AI ecosystem

I will now explain the key growth areas on the right.

The AI market will be a major driver in realizing our Long-term Vision: TDK Transformation. We define the AI market as the AI ecosystem market, not just servers and data centers.

We see significant growth in the entire AI ecosystem in the future, from Edge AI devices, and AI-powered vehicles and infrastructures, to manufacturing processes and equipment including AI semiconductors.

Our competitive product portfolio based on core technologies will contribute to the social transformation by making indispensable contributions to applications that are expected to grow significantly in the future.

We will help boost sales for the entire AI ecosystem

The specific growth prospects in the AI ecosystem market are outlined on this slide.

As I explained earlier, our major businesses and new businesses will make indispensable contributions to the growth of the AI ecosystem.

Specifically, the relevant businesses currently account for just over 10% of our total sales, but we expect to achieve significant growth of 25-30% per year in the medium to long term. As listed on the right, medium capacity batteries, HDD heads and HDD suspension assemblies, and passive components are some of specific examples.

Today, in addition to these current businesses, I will explain three new business fields and applications that we will focus on and actively invest in.

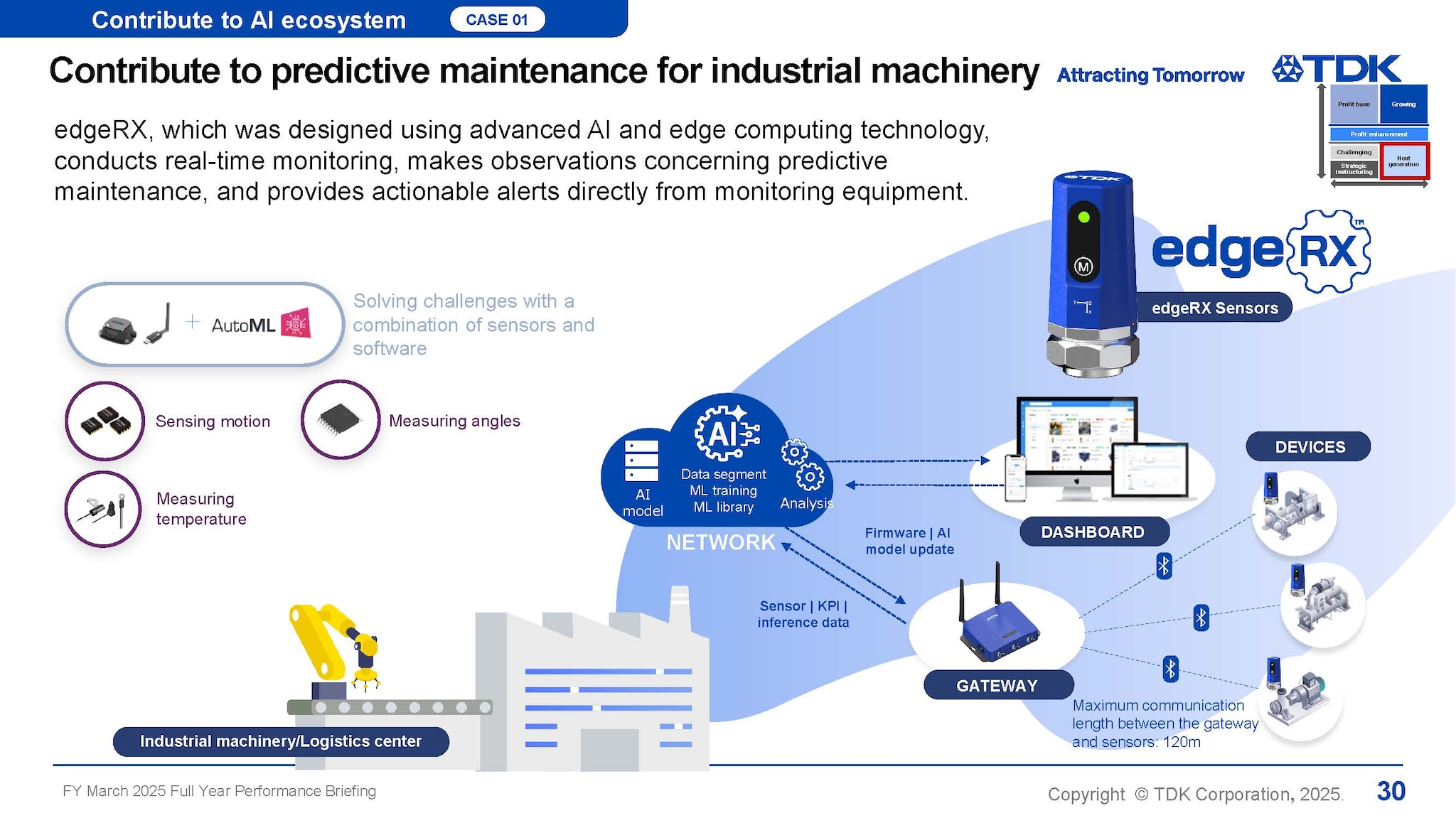

Contribute to predictive maintenance for industrial machinery

The first example is predictive maintenance in the industrial machinery market.

In anticipation of medium- to long-term growth for sensors and software, we established SensEI in July 2024 and launched a new product edgeRX in March 2025.

Equipped with a variety of TDK’s sensors and state-of-the-art AI and edge computing, edgeRX can monitor machinery and equipment malfunctions at production and logistics sites in real time and provide predictive maintenance information directly from monitoring equipment.

We will contribute to transformation of AI ecosystem by providing our unique values.

Contribute to AI devices

Next, we will also make strategic investments in AR glasses, which are also expected to become growth applications in the medium to long term.

As we explained in May 2024, we are making a steady progress in the development of ultra-compact full-color laser modules that are 1/10 the size of our conventional laser modules.

In addition, we expect to provide various solutions to reduce the size and weight of glasses and increase efficiency, including Piezo Haptics for bone conduction speakers, lithium-ion batteries, and all-solid-state batteries.

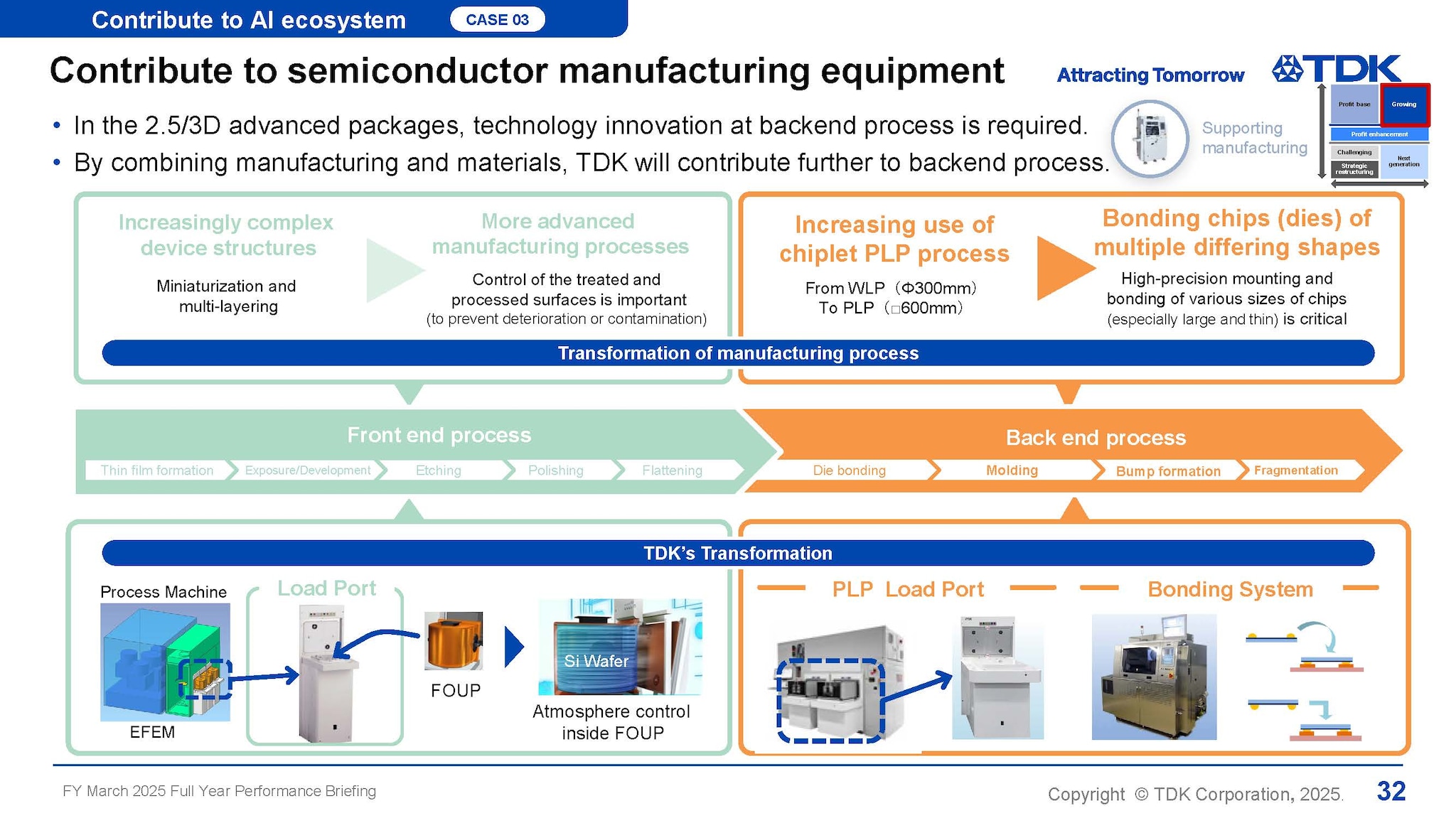

Contribute to semiconductor manufacturing equipment

Finally, although it has not been highlighted, TDK also provides manufacturing equipment in the semiconductor manufacturing field.

We have established a solid position in the industry by transforming FA technology cultivated in such fields as automatic mounting machines for electronic components and cleaning technology essential for manufacturing of DVDs and magnetic heads.

Current key products include Load Ports, which move Front Opening Unified Pods (FOUP) into and out of semiconductor manufacturing equipment, and flip-chip mounting systems, which play a significant role in backend processes whose importance is expected to grow in the future.

These products are positioned at the top right of our portfolio, but in light of the growth of AI semiconductors in the future, we will make strategic investments to achieve a further leap.

We will not only strengthen manufacturing technology, but also combine it with materials technology to provide new solutions not available from other companies and contribute to the entire AI ecosystem.

Pre-financial capital that backs TDK’s Value creation

I have just introduced three applications. Including additional investment in CVC (US$ 150 million) announced separately, we will accelerate strategic investments in AI ecosystem as a main driver of social transformation to continue to grow the Ferrite Tree from a medium- to long-term perspective.

At the root of this growth, which is a major driver to continue to achieve this growth, lies the TDK Group’s unique corporate culture.

Our diverse human resources share the TDK Venture Spirit that continues to take on new challenges, and pave the way for social and our own transformation based on a culture of "functional equality." SensEI, our new Edge AI company, is one such example.

We plan to talk about our efforts to grow pre-financial capital, including human capital, at Investor Day on September 1.

My commitment as President & CEO

In closing, I will continue to realize my commitment, which I mentioned a year ago, without losing the focus.

Last fiscal year, we increased the number of dialogues with investors by 30% and engaged in dialogues with 60% more investors.

We would like to maintain constructive dialogues and collaborative activities with all of you to enhance our corporate value. I would like to ask for your continued support.

This concludes my presentation today. Thank you for your attention.