Fiscal Year March 2024 Full Year Performance Briefing

FY March 2024 Results Highlights

Mr. Tetsuji Yamanishi

Executive Vice President

Hello, my name is Tetsuji Yamanishi. Thank you for attending our FY March 2024 results presentation today. I would like to explain the highlights of our consolidated results.

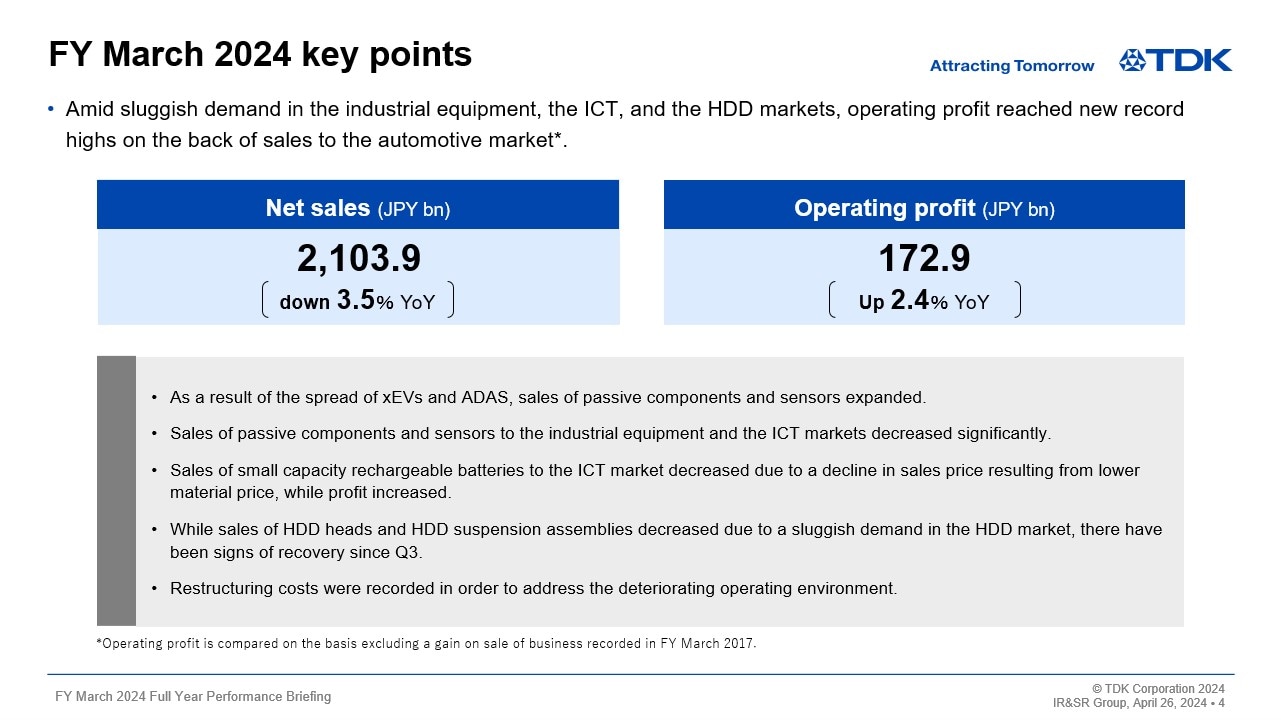

FY March 2024 key points

I will start with the key points of FY March 2024. The global economy showed increasing signs of slowing due to the economic weakness in Europe and China and unrest in the Middle East, although the North American economy remained robust. The yen remained weak against the dollar and the euro.

Under this business environment, in the electronics market, which significantly affects our earnings, we experienced a 3.5% year-on-year decline in sales due to sluggish demand in the ICT and HDD markets caused by prolonged weakness in final demand, as well as low capital investment demand in the industrial equipment market in general. However, operating profit grew by 2.4% year on year to a record high, mainly due to an increase in sales to the automotive market as a result of an increase in xEV production and an increase in profit from small capacity rechargeable batteries for the ICT market.

In terms of sales by business and market, sales of Passive Components and Sensors to the automotive market increased due to the spread of xEVs and ADAS, while sales of these products to the industrial equipment market decreased significantly due to weak demand.

Sales of small capacity rechargeable batteries to the ICT market decreased due to a decline in the sales price resulting from lower material prices, but profit slightly increased.

While sales of HDD Heads and HDD Suspension Assemblies decreased due to sluggish demand in the HDD market, there have been signs of recovery since Q3.

One-time expenses of JPY 19.8 billion were recorded for production capacity optimization and other restructuring undertaken in view of the demand environment.

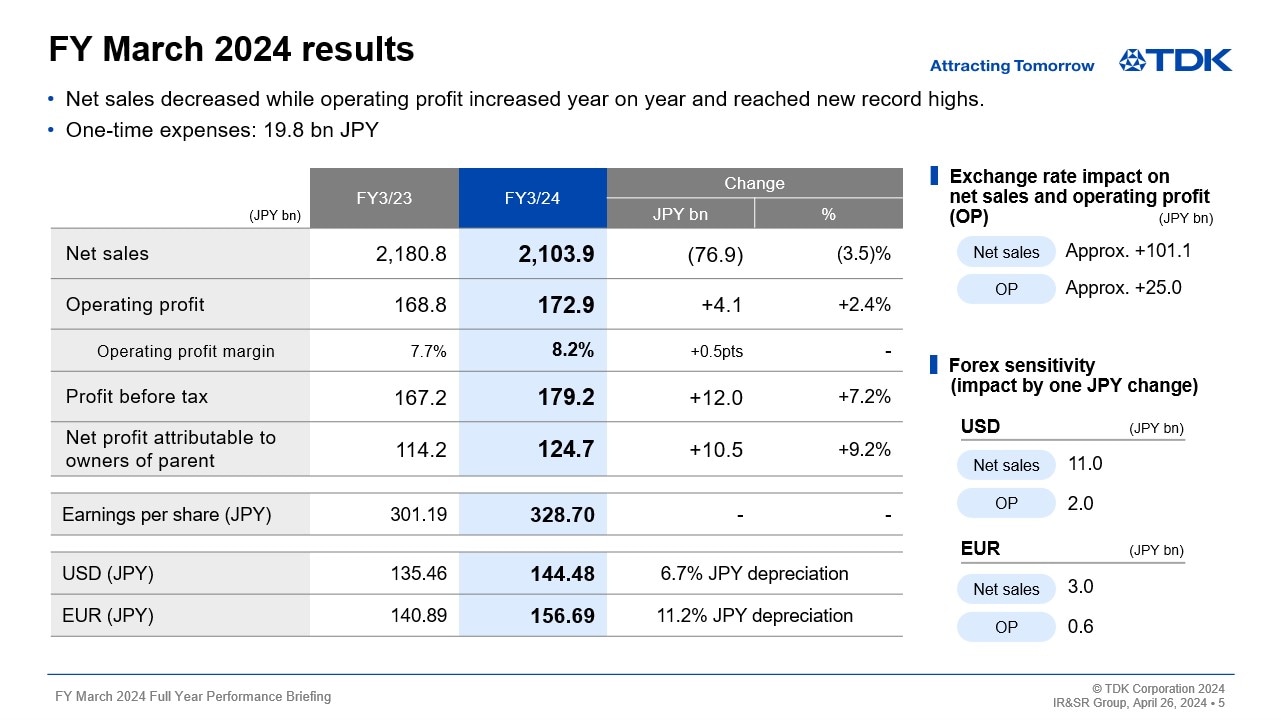

FY March 2024 results

I will now explain our full-year results.

Including the effects of approximately +JPY 101.1 billion and +JPY 25 billion on net sales and operating profit, respectively, due to changes in exchange rates against the dollar, etc., net sales decreased by JPY 76.9 billion, or 3.5%, year on year to JPY 2,103.9 billion, operating profit increased by JPY 4.1 billion, or 2.4%, year on year to JPY 172.9 billion, including one-time expenses of JPY 19.8 billion, profit before tax came to JPY 179.2 billion, and net profit attributable to owners of parent ended at JPY 124.7 billion.

Earnings per share were JPY 328.70.

In terms of foreign exchange rate sensitivity, we estimate the impact of a change of JPY 1 against the dollar to be approximately JPY 2 billion per year and against the euro to be approximately JPY 0.6 billion, unchanged from the previous estimate.

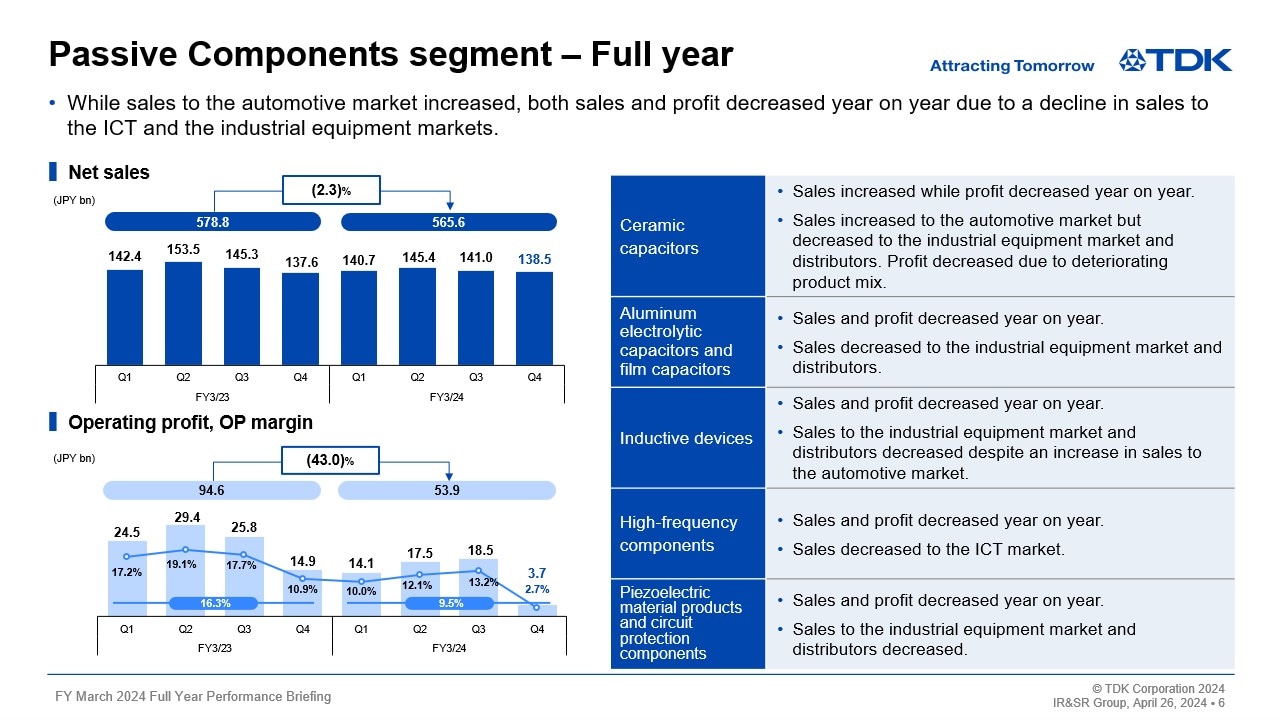

Passive Components segment – Full year

I will now move on to full-year segment results.

In the Passive Components segment, sales to the ICT and the industrial equipment markets decreased, while sales to the automotive market increased, particularly for xEVs. As a result, net sales decreased by 2.3% year on year to JPY 565.6 billion, and operating profit fell by 43.0% to JPY 53.9 billion, severely impacted by the decline in volume.

Ceramic capacitors increased in sales due to growth in sales to the automotive market, but their profits decreased as a result of a deteriorating product mix and a decline in sales volume to the industrial equipment market and distributors. Aluminum electrolytic capacitors and film capacitors decreased in both sales and profit due to a decline in sales to the industrial equipment market and distributors. Inductive devices decreased in both sales and profit as a result of a decline in sales to the industrial equipment market and distributors, although sales to the automotive market increased, and piezoelectric material products and circuit protection components also decreased in both sales and profit as a result of a decline in demand for products for the industrial equipment market as well as distributors. High frequency components decreased in both sales and profit due to a decline in sales to the ICT market.

One-time expenses of JPY 7.4 billion were also recorded this fiscal year.

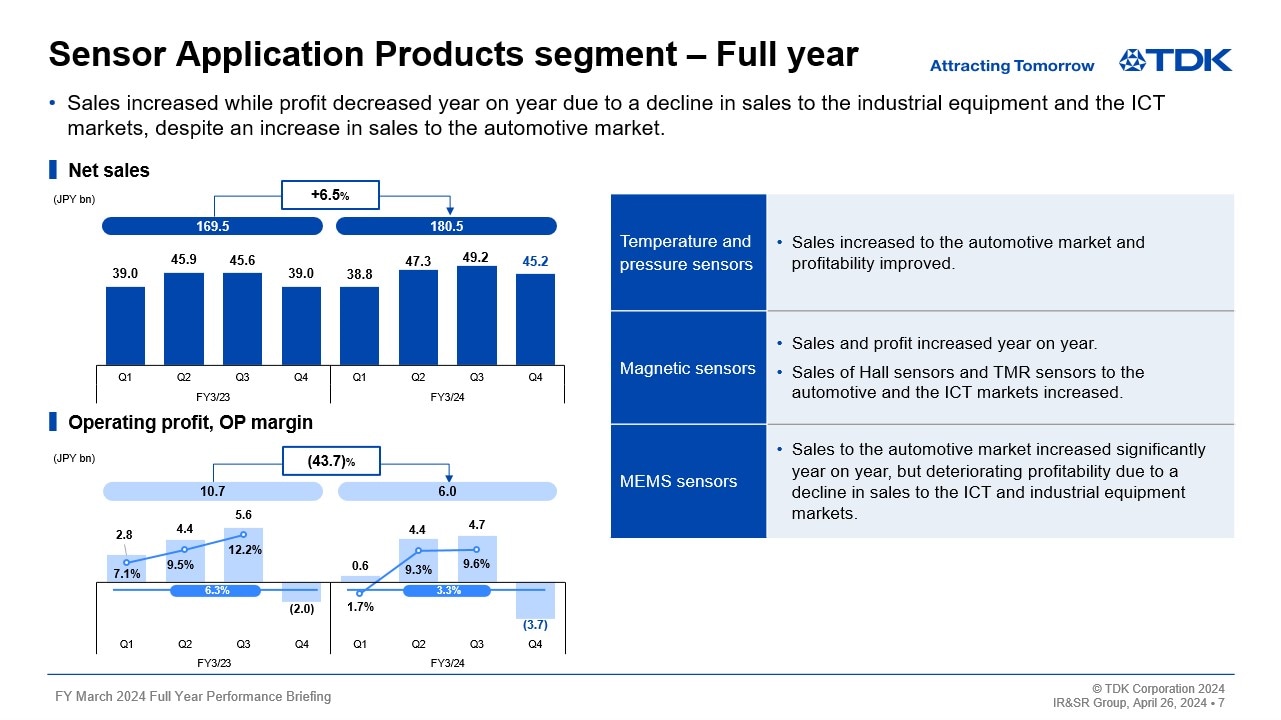

Sensor Application Products segment – Full year

In the Sensor Application Products segment, net sales were JPY 180.5 billion, up 6.5% year on year, and operating profit was JPY 6 billion, down 43.7%, including one-time expenses of JPY 3.3 billion.

Temperature and pressure sensors improved in profitability as sales to the automotive market increased. Magnetic sensors increased in both sales and profit as sales of Hall sensors and TMR sensors to the smartphone and automotive markets increased.

Meanwhile, MEMS sensors decreased in both sales and profit as sales to the smartphone and industrial equipment markets declined, although sales of motion sensors to the automotive market increased.

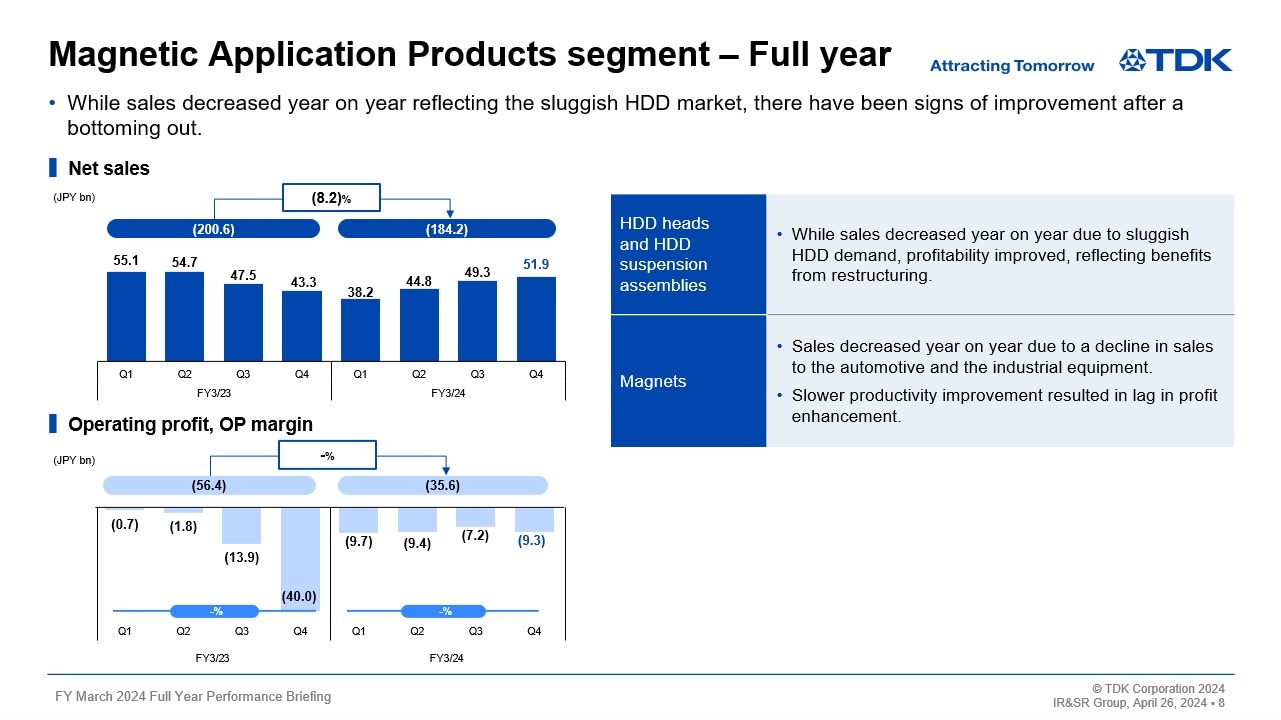

Magnetic Application Products segment – Full year

In the Magnetic Application Products segment, net sales were JPY 184.2 billion, down 8.2% year on year, and operating profit was a loss of JPY 35.6 billion, which included one-time expenses of JPY 6.5 billion.

HDD heads and HDD suspension assemblies continued to experience weakness in demand for HDDs. The sales volume of both products decreased significantly compared to the previous year, with total HDD demand decreasing 23% year on year and total nearline HDD demand decreasing 30%. As a result, sales continued to decline, and the operating loss increased.

Magnets decreased in sales as sales to the automotive and industrial equipment markets declined. Improvement in profitability has also been slow, partly due to a delay in productivity improvements.

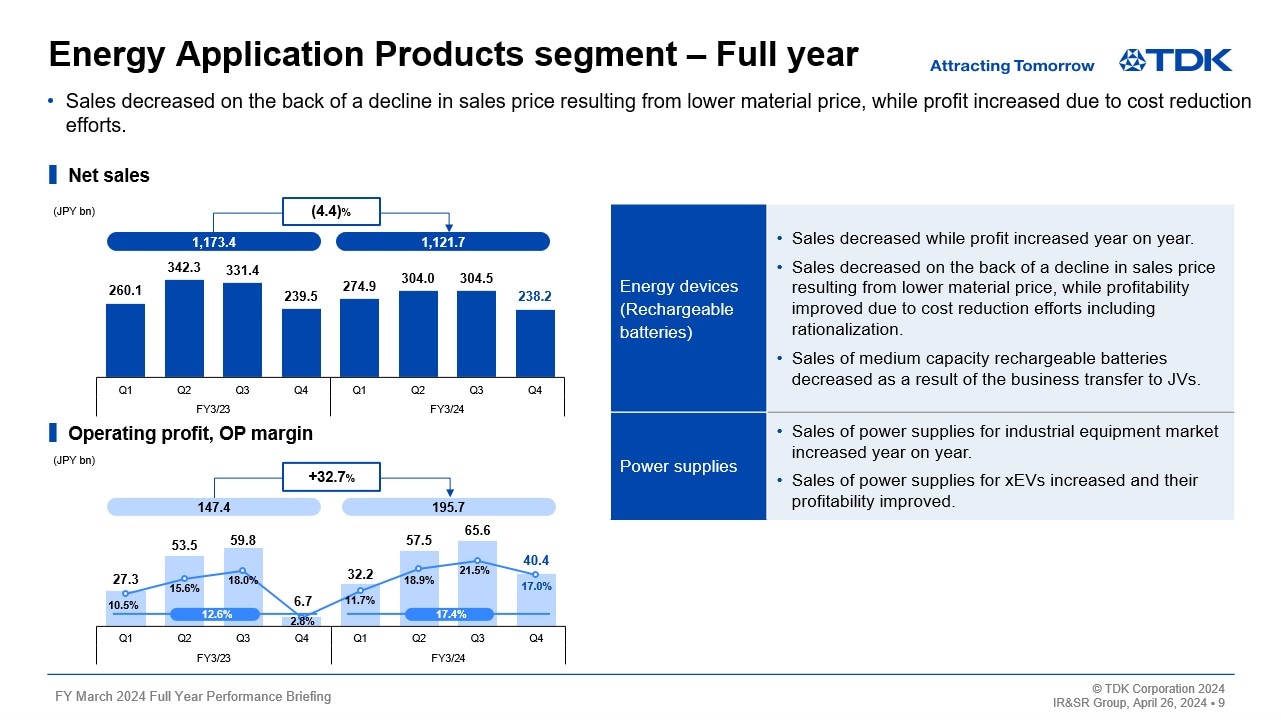

Energy Application Products segment – Full year

In the Energy Application Products segment, net sales were JPY 1,121.7 billion, and operating profit was JPY 195.7 billion, including one-time expenses of JPY 2 billion. Sales were down 4.4% year on year, but operating profit was up 32.7%.

Rechargeable batteries decreased in sales due to a decline in selling prices and price discounts resulting from lower material prices, although the sales volumes of small capacity batteries for smartphones and other applications increased. Sales of medium capacity batteries also decreased due to the transfer of the business to the JVs. As a result, sales for the segment as a whole decreased year on year, but profit increased thanks to sales volume increases, rationalization, and foreign exchange gains.

Power supplies for industrial equipment increased in both sales and profit, with sales for industrial equipment applications, including semiconductor manufacturing equipment, and for medical equipment applications increasing as a result of responding to order backlogs, while power supplies for EVs improved in profitability.

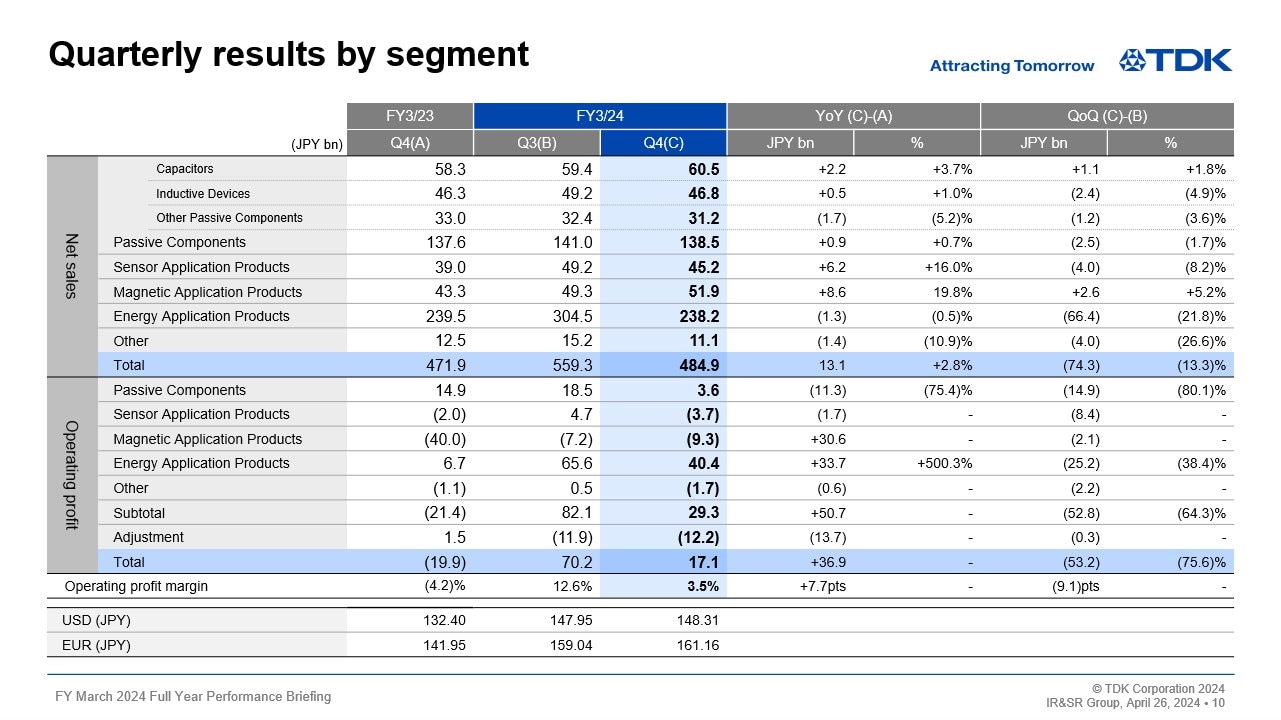

Quarterly results by segment

I will now explain the reasons for the increase or decrease in segment sales and operating profit from Q3 to Q4 of FY March 2024.

In the Passive Components segments, net sales decreased by JPY 2.5 billion, or 1.7%, from Q3, and operating profit decreased by JPY 14.9 billion, or 80.1%. Ceramic capacitors increased in sales as sales to the automotive market increased, but operating profit decreased due in part to an increase in costs related to production increases. Aluminum electrolytic capacitors and film capacitors decreased in both sales and profit on the back of lower demand from the industrial equipment market, and inductive devices also decreased in both sales and profit due to a fall in sales to all markets. High frequency components saw a decline in sales and profit due to lower sales to the ICT and industrial equipment markets, while piezoelectric material products and circuit protection components saw a decline in sales to the industrial equipment and ICT markets but an increase in sales to the automotive market, resulting in sales and profit remaining roughly flat compared to Q3. Restructuring costs of approximately JPY 0.4 billion and JPY 7 billion were recorded in Q3 and Q4, respectively.

In the Sensor Application Products segment, net sales decreased by JPY 4 billion and operating profit by JPY 8.4 billion. Sales of temperature and pressure sensors were roughly unchanged, but sales and profit of magnetic sensors decreased as sales to the ICT market peaked, although sales to the automotive market increased. MEMS sensors decreased in sales and profit due to a significant fall in the sales of motion sensors for game console applications, although sales to the ICT market increased. One-time expenses of JPY 3.3 billion were recorded in Q4.

In the Magnetic Application Products segment, net sales increased by JPY 2.6 billion, or 5.2%, while operating loss increased by JPY 2.1 billion. Due to the recovery of total demand for nearline HDDs, the sales volume of HDD heads increased by approximately 8%, while the sales volumes of HDD suspension assemblies increased by approximately 10%, resulting in an increase in sales and a reduction in operating loss for the head businesses as a whole.

Magnets saw a decrease in sales and an increase in operating loss. One-time expenses of JPY 0.9 billion and JPY 4.7 billion were recorded in Q3 and Q4, respectively.

In the Energy Application Products segment, sales decreased by JPY 66.4 billion, and operating profit decreased by JPY 25.2 billion. Rechargeable batteries saw a decrease in sales and profit as sales of small capacity batteries to the ICT market declined significantly due to seasonal factors. Power supplies for industrial equipment were robust, while Power supplies for EVs decreased in both sales and profit. One-time expenses of JPY 2 billion were recorded in Q4.

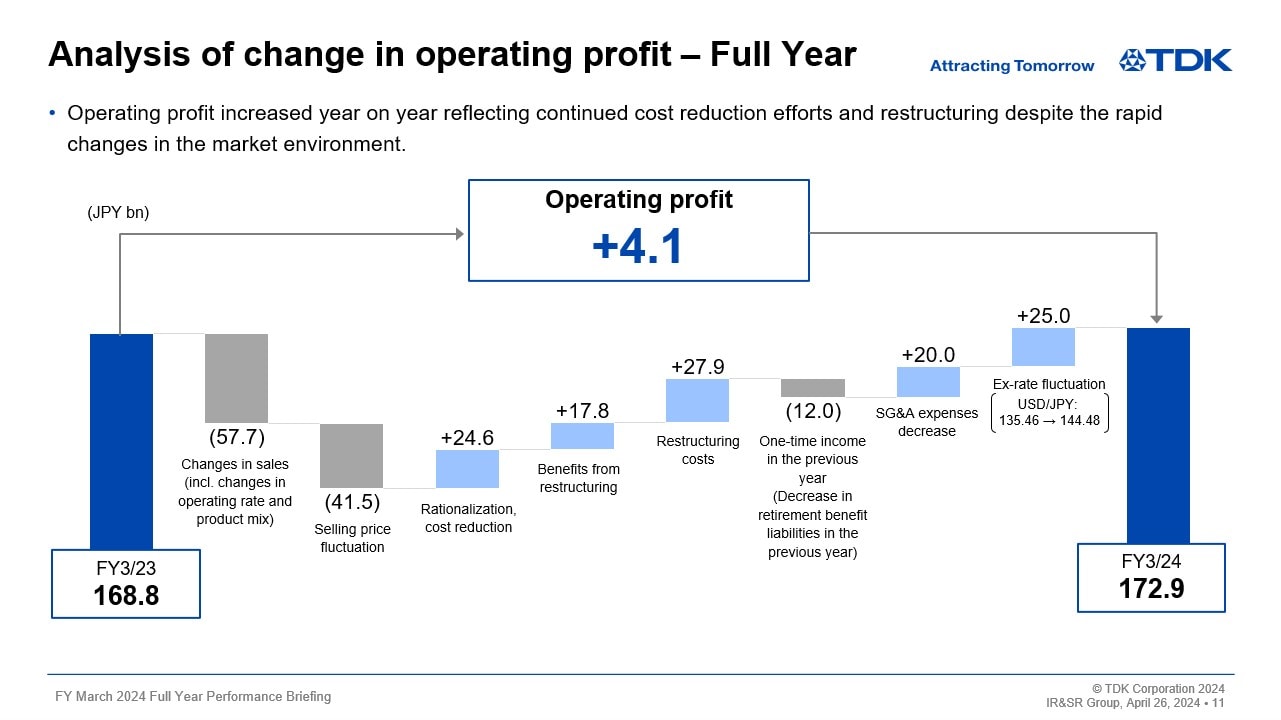

Analysis of change in operating profit – Full Year

I would now like to analyze the change in full-year operating profit, which was an increase of JPY 4.1 billion. Changes in sales caused profit to decrease by JPY 57.7 billion. These included a fall in sales volumes, a deterioration of the product mix, and reduced operating rates in the Passive Components segment and a fall in the sales volume of HDD heads, although the profit for rechargeable batteries increased due to increased sales volume. The JPY 42.4 billion profit increase due to rationalization, cost reductions, and benefits from restructuring absorbed the JPY 41.5 billion profit decrease due to changes in selling prices.

Thorough cost reductions were made in SG&A expenses, especially for rechargeable batteries and HDD heads, resulting in a reduction of JPY 20 billion. Restructuring costs and other one-time expenses fell by JPY 15.9 billion from the previous period, and the weaker yen boosted profit by JPY 25 billion. These contributed to the JPY 4.1 billion increase in operating profit.

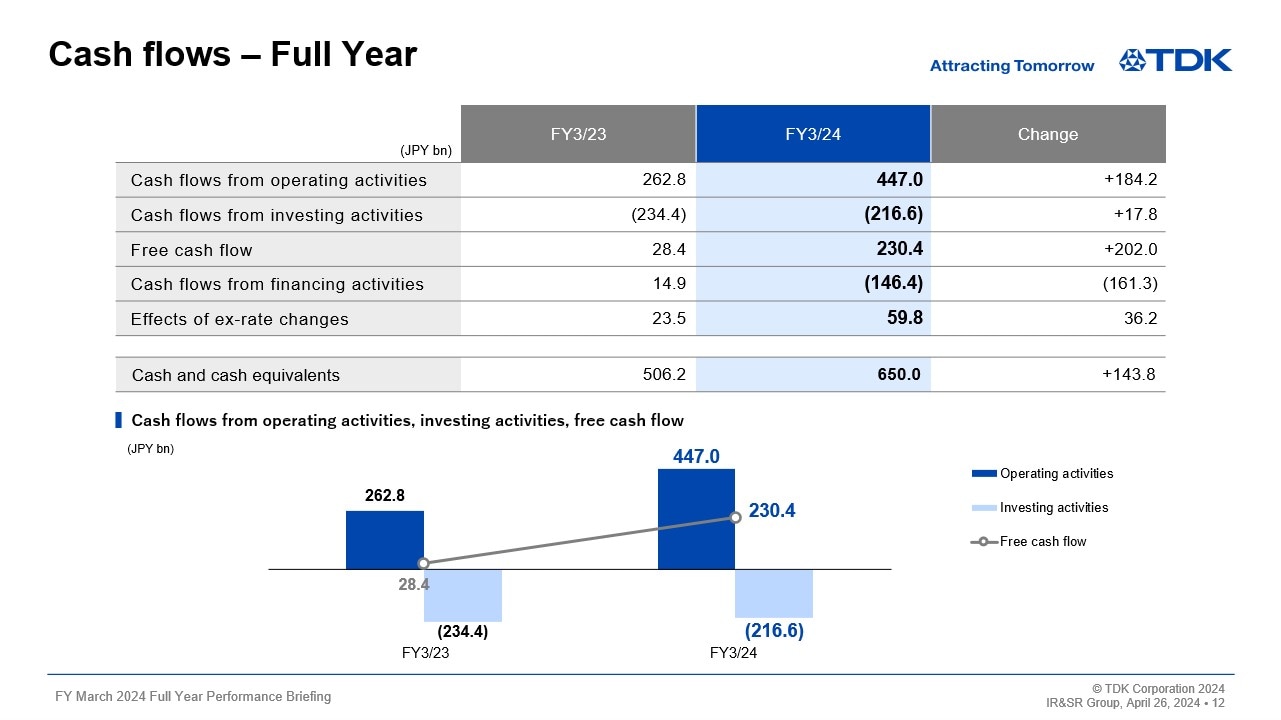

Cash flows – Full Year

These are the cash flows of FY March 2024.

The full-year cumulative cash flows were cash flows from operating activities of JPY 44.7 billion, cash flows from investing activities, including capex, of JPY 216.6 billion, and free cash flow of JPY 230.4 billion, which was a significant increase from JPY 28.4 billion in the previous year. This significant increase in free cash flow to JPY 230.4 billion was achieved as a result of the substantial increase in cash flows from operating activities due to a reduction in working capital, including the continuous optimization of inventories based on market demand, and a reduction in capital expenditures of approximately JPY 40 billion from the JPY 260 billion expected at the beginning of the period, based on a careful assessment of demand trends.

We also achieved the financial target of surplus free cash flow after shareholder returns in our previous medium-term plan, exceeding the original target by approximately JPY 50 billion. We will also aim to increase free cash flow in our new medium-term plan through further improvements in capital efficiency.

This concludes my presentation. Thank you for your attention.

FY March 2025 Projections

Mr. Noboru Saito

President & CEO

Hello, I am Noboru Saito. Thank you for your attendance today. I would like to explain our FY March 2025 projections.

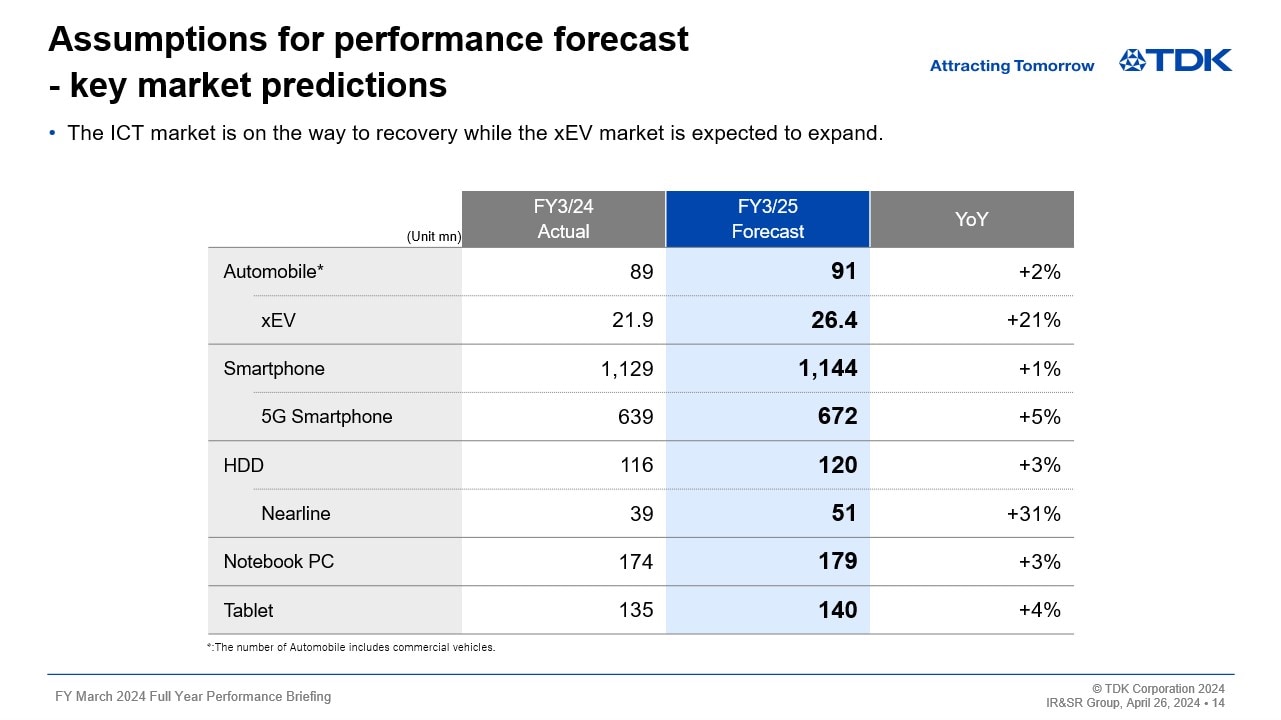

Assumptions for performance forecast - key market predictions -

I would like to begin with our consolidated earnings forecast for FY March 2025, the market background on which it is based, and production volume forecasts for key devices.

For automobiles, we expect the market in FY March 2025, including commercial vehicles, to be 91 million units, up 2% year on year. Based on the continued expansion of EV and eco-friendly car production, which has a significant impact on our earnings, we expect the total xEV market to grow 21% to 26.4 million units.

On the other hand, we expect the production of smartphones, which represent the ICT market, to increase only slightly by around 1% year on year to 1,144 million units.

For the HDD market as a whole, we expect an increase of around 3%. However, we expect the production of nearline HDDs for data centers to increase by 31% year on year to 51 million units, as production is showing a recovery from last year’s sharp decline.

We expect the production of notebook PCs and tablets to increase by around 3–4%.

On the other hand, the production of FA equipment in the industrial equipment market shows no signs of recovery, and we expect it to weaken throughout the year.

The production of key devices, excluding industrial equipment, is expected to increase year on year and is showing signs of bottoming out, but it is necessary to keep a close eye on component demand trends, as the macroeconomic environment is highly uncertain.

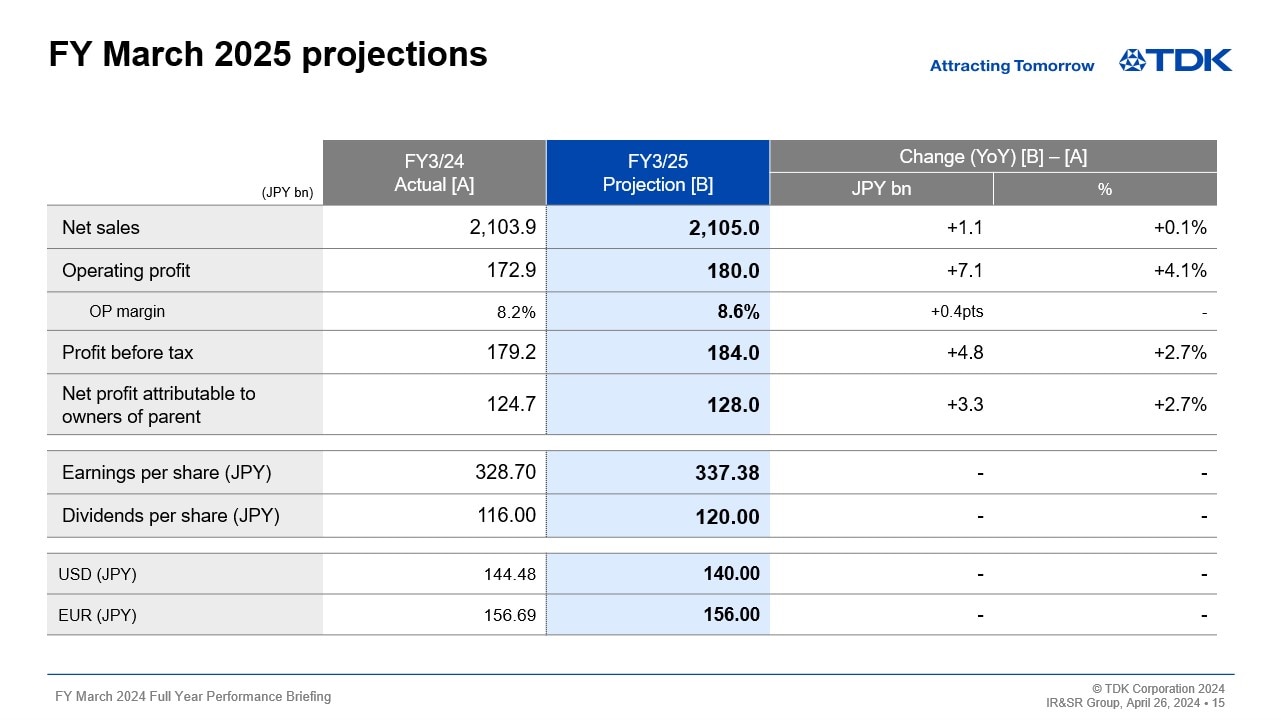

FY March 2025 projections

Based on the production volume and orders received for these key devices, we are forecasting the following consolidated earnings for FY March 2025: net sales of JPY 2,105 billion, operating profit of JPY 180 billion, profit before tax of JPY 184 billion, and net profit attributable owners of parent of JPY 128 billion.

Our exchange rate assumptions are JPY 140 to the dollar and JPY 156 to the euro.

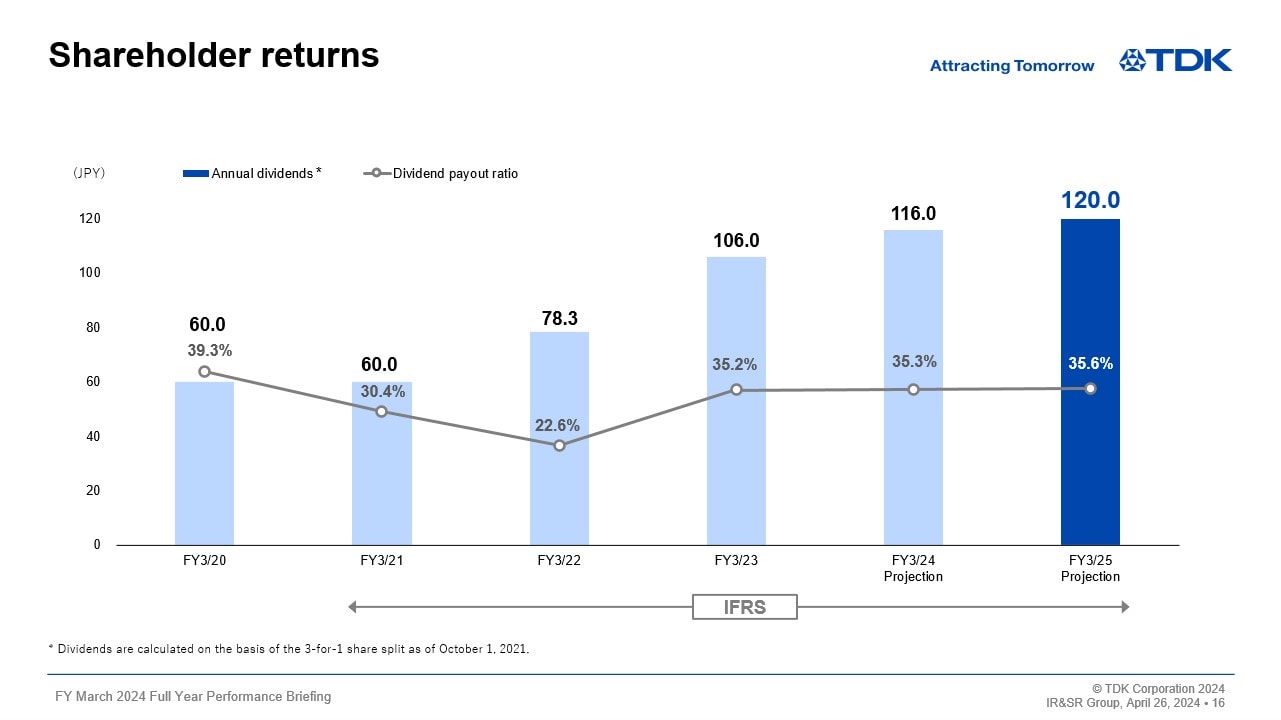

Shareholder returns

I will now explain shareholder returns.

In our new medium-term plan, we plan to return profits to shareholders with a target dividend payout ratio of 35%, up from 30% previously, taking into account issues such as changes in the business environment, investment in growth businesses, and ROE. We expect to pay an annual dividend of JPY 120 per share in FY March 2025, an increase of JPY 4 per share year on year.

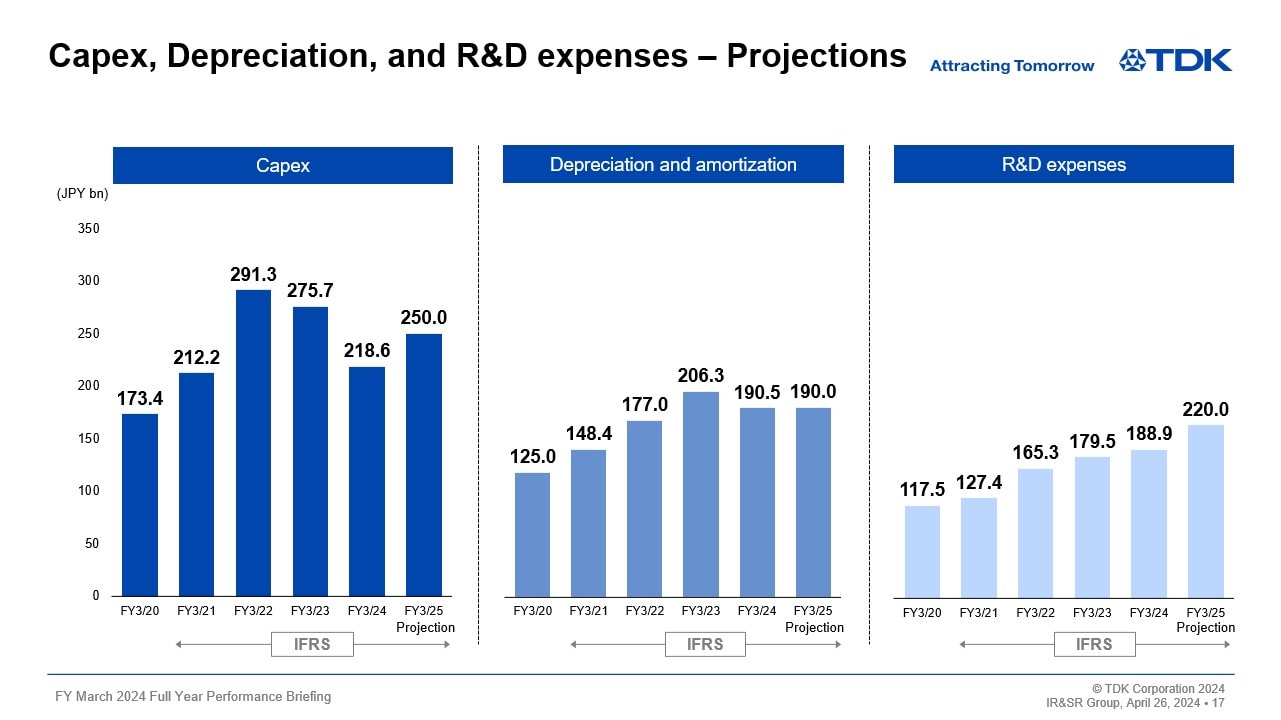

Capex, Depreciation, and R&D expenses – Projections

I will now turn to our projections for capex, depreciation, and R&D expenses.

Our forecast for capital expenditures is JPY 250 billion, depreciation and amortization JPY 190 billion, and R&D expenses JPY 220 billion.

For R&D expenses, we expect an increase of approximately JPY 30 billion in FY March 2025 due to a review of certain categories of SG&A and R&D expenses.

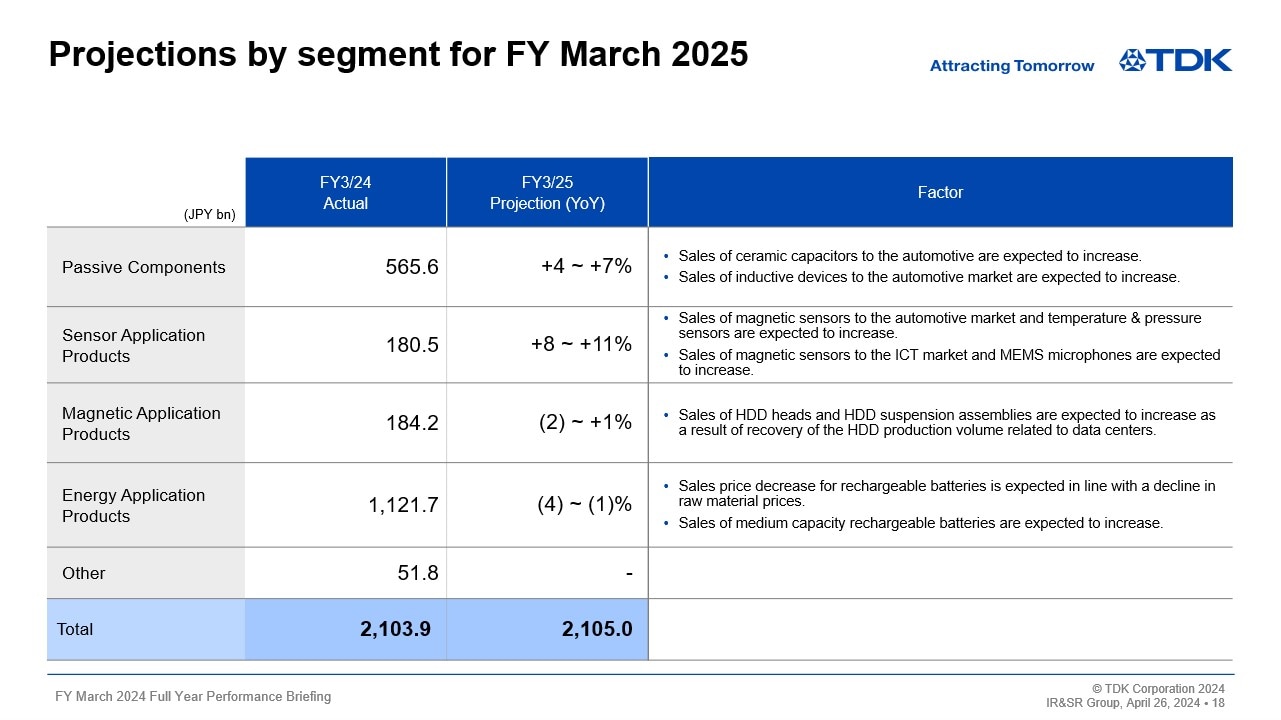

Projections by segment for FY March 2025

I will now explain our projections by segment for FY March 2025.

In the Passive Components segment, we expect sales to grow by 4–7% overall due to an anticipated increase in sales from the further development of xEVs but also an expected decline in selling prices of MLCCs and sluggish sales to the industrial equipment market.

In the Sensor Application Products segment, we expect overall sales growth of 8–11%, driven by expected increases in sales of magnetic sensors such as TMR sensors and Hall sensors, which are selling well in the automotive and ICT markets, temperature and pressure sensors, which are expected to grow due to xEV-related demand, and MEMS microphones.

In the Magnetic Application Products segment, we expect sales to be down 2% to up 1% due to an anticipated decrease in magnet sales, although HDD sales are expected to increase as production of HDDs and nearline HDDs for data centers shows signs of bottoming out.

In the Energy Application Products segment, our sales projection is down 4% to 1% year on year due to an expected fall in selling prices associated with a decline in raw material prices for rechargeable batteries, although demand for smartphones, notebook PCs, and tablets shows signs of bottoming out.

Overview of New Medium Term Plan

I would now like to outline our new medium-term plan, which we plan to announce on May 22.

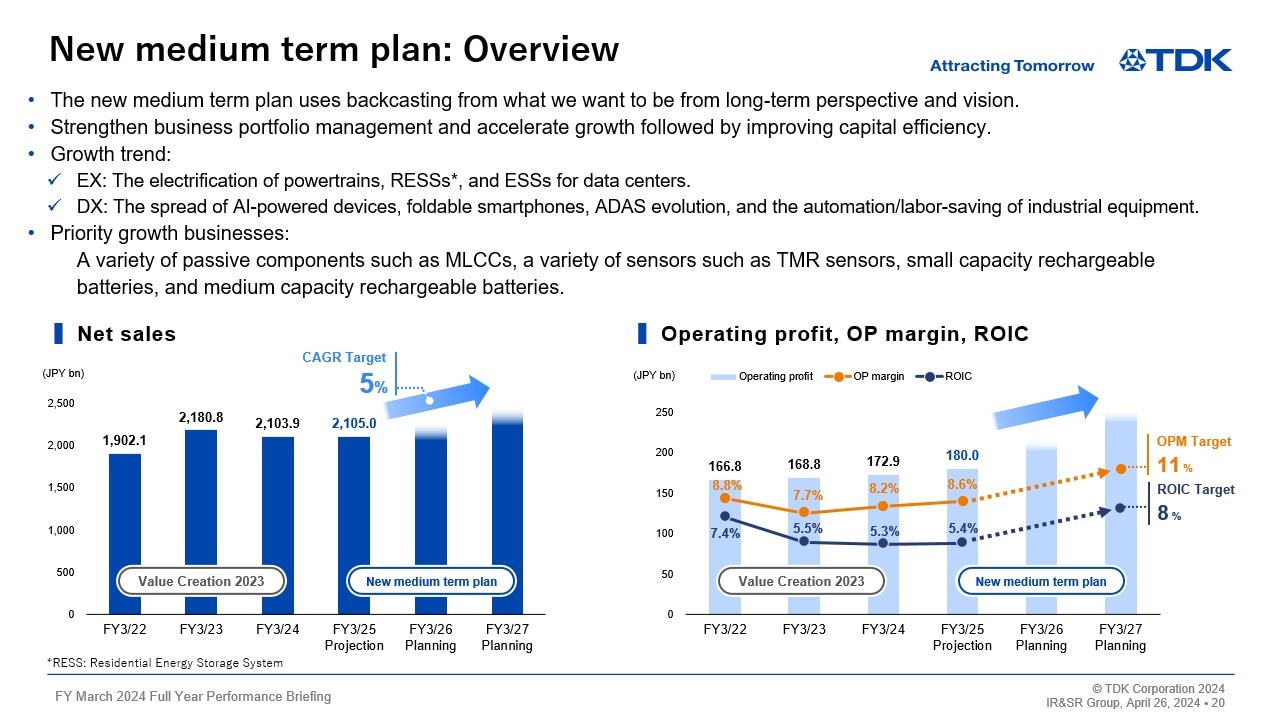

New medium term plan: Overview

The new medium-term plan uses backcasting from what we want to be in the long term, or in other words, our long-term vision. Considering the period of the plan as a period of building a platform for long-term growth, we will work to solidify our foundation and foothold.

Our company-wide performance indicators will be operating profit margin, unchanged from before, and ROIC, replacing ROE, with the aim of improving profitability.

To achieve these targets, we will continue to invest aggressively in priority growth businesses to improve our earning power and accelerate the implementation of appropriate measures for businesses in need of turnaround and reinforcement, thereby improving capital efficiency further and engaging in proactive business portfolio management with a heightened awareness of the cost of capital.

In terms of our main priority growth businesses, we will continue to invest in MLCCs and other high-reliability passive components and TMR sensors, which are expected to see increased demand due to the electrification of automotive powertrains amid the EX trend. By doing so, we will continue to strengthen our competitiveness to ensure that we can capture demand.

We will also maximize synergies with the JVs to expand sales in the medium to long term since demand for medium capacity rechargeable batteries for commercial ESSs , as well as RESSs, and data center UPS is also expected to increase due to the progress of decarbonization and renewable energy.

With regard to the DX trend, we will expand sales of high value-added products such as silicon anode lithium batteries, as well as TMR sensors and MEMS microphones, in response to the spread of AI-powered devices and the increase in demand for high-performance devices such as foldable smartphones.

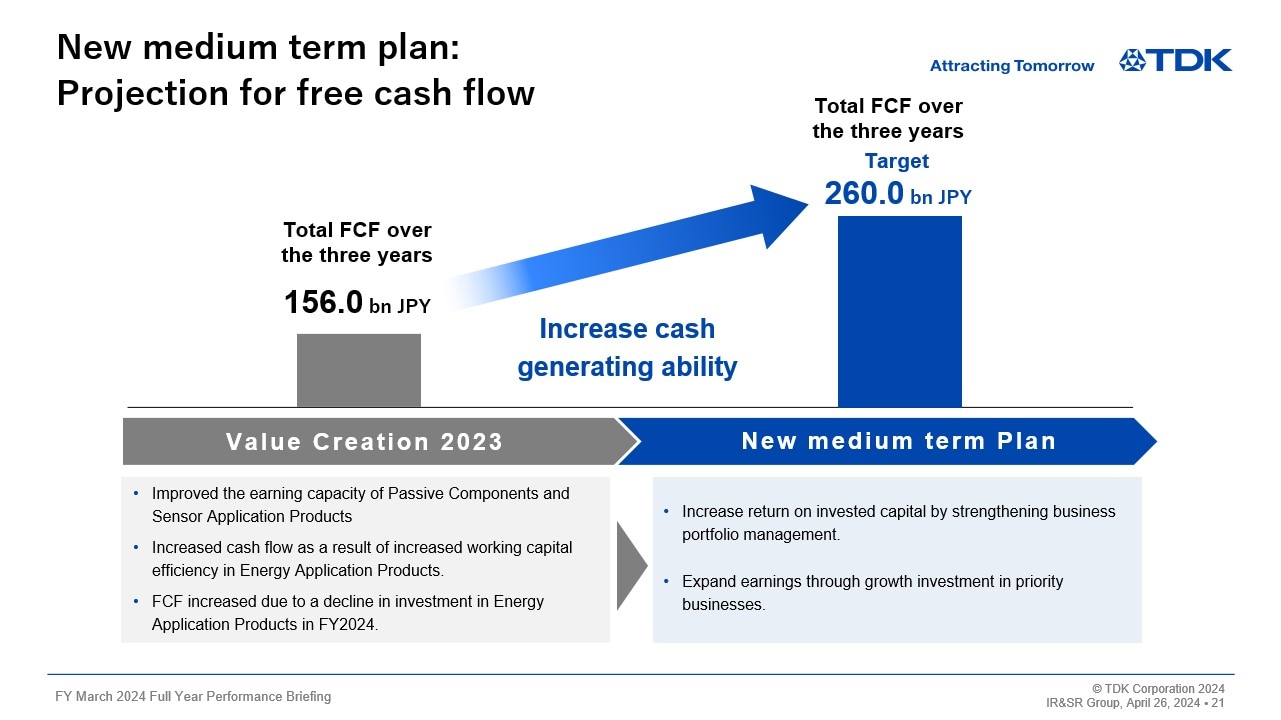

New medium term plan: Projection for free cash flow

I will now explain our projection for free cash flow, which we will continue to focus on in our new medium-term plan.

During the period of the previous medium-term plan, cash flows from operating activities increased due to the improved earning power of the passive components business, which includes MLCCs, and the Sensor Application Products business, which includes TMR sensors, as well as an improvement in working capital.

In the final year, partly as a result of a decline in investment in Energy Application Products, we were able to generate a total of JPY 156 billion in free cash flow over the three years.

Under the new medium-term plan, we will further strengthen our business portfolio management with a focus on increasing the return on invested capital. Also, we expect to generate a higher level of free cash flow through an increase in the profitability of small capacity rechargeable batteries, passive components, and sensor application products, in which we have invested heavily. Free cash flow after return to shareholders is expected to be utilized for strengthening growth investments and shareholder returns. As a result, we believe we can further improve cash generation over the period of the new medium-term plan.

In addition to the details of these financial initiatives, we will also discuss our non-financial activities, including ESG initiatives, at the May 22 briefing.

Although the global economic environment is highly uncertain in the short term, we will make the three years from FY March 2025 a period to solidify our foundation and foothold for the long term and realize sustainable value creation.

This concludes my presentation. Thank you for your attention.