[ Financial Results for Fiscal 2021 Performance Briefing ]Consolidated Full Year Projections for FY March 2022

Mr. Shigenao Ishiguro

President & CEO

Hello, I am Shigenao Ishiguro, President and CEO of TDK. I would like to go over our full-year earnings projections for the fiscal year ending March 2022.

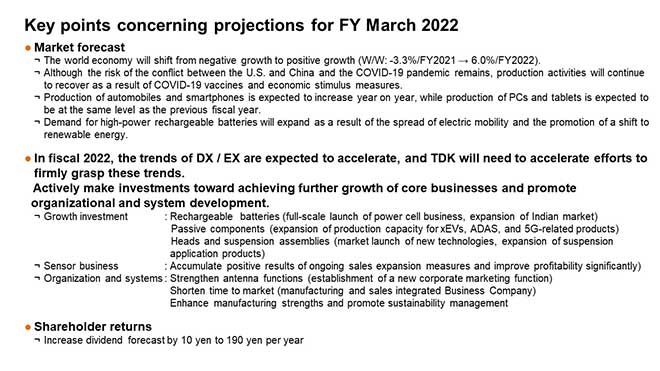

Key points concerning projections for FY March 2022

First, I would like to explain the market forecast that is the basis of our projections. In the fiscal year ended March 2021, the global economy faced negative growth due to the impact of COVID-19, but in the fiscal year ending March 2022, we assume a positive growth level of 6%. While geopolitical risks and risks associated with COVID-19 remain, we expect that production of automobiles and smartphones will increase year on year, and that the production of PCs and tablets, which has surged due to demand generated by remote working and learning, will not decline significantly from the previous fiscal year. We also believe that EX will be further promoted by the spread of electric mobility and the promotion of a shift to renewable energy, which will boost demand for related passive components and rechargeable batteries.

Recognizing that fiscal year ending March 2022 will be a year in which we will firmly grasp these trends of DX and EX and accelerate efforts in order to make a significant contribution to society, we will actively make investments toward achieving the further growth of our core businesses. In our mainstay rechargeable batteries business, we will achieve the full-scale launch of power cell business and the steady launch of the production base in India, which will serve as an important business base for markets outside China. We will make investments to expand production capacity in the passive components business, where 5G and automobile related demand is expected to grow sharply. In the heads and suspension assemblies business, we will invest in technologies and production by taking the technology shift to microwave-assisted recording and heat-assisted recording heads as an opportunity. In the sensor business, the steady expansion of the customer base and growing product lineup have finally produced results. I would like this business to significantly improve profitability in fiscal 2022.

In addition, we will reform and improve the organization and system to achieve growth, shorten “time to market” and “time to volume,” and aim for a system that delivers greater value to society. Specifically, we aim to establish a new corporate marketing function, operate Business Companies with manufacturing and sales integrated, and improve manufacturing capabilities by utilizing digital technology. We will continue to work on sustainability management and strengthening governance as the most important themes to contribute to solving social issues and ensuring corporate transparency.

Regarding shareholder returns, we expect to increase the dividend forecast by 10 yen to 190 yen per year in line with the expansion of earnings.

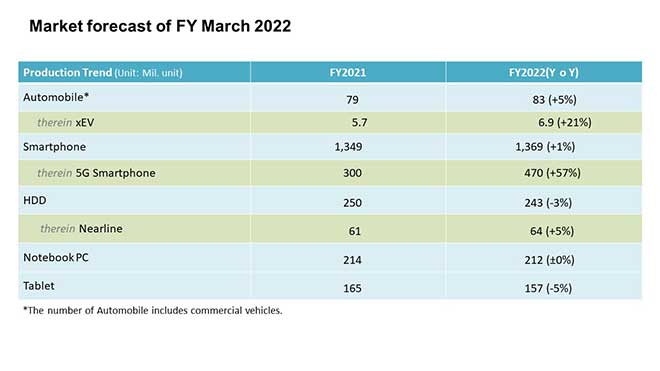

Market forecast of FY March 2022

Next, I will explain the demand assumptions for the major devices related to TDK. We have assumed that the fiscal 2022 market size for automobiles, including commercial vehicles, will be 83 million units, an increase of 5% year on year. Demand has recovered rapidly since the second quarter of the previous fiscal year, and has recently recovered to the level before the outbreak of COVID-19, but automobile production adjustments have also occurred due to a shortage of semiconductors for automobiles, so it is important to continue to assess demand trends. The shift to environmentally friendly vehicles by automakers around the world is accelerating, and the xEV market is expected to grow by 21% year on year.

On the other hand, the number of smartphones that represent the ICT market is assumed to be 1,369 million units, up 1% year on year. High-level production by Chinese smartphone manufacturers is expected, but we feel that it is necessary to monitor the order status while paying close attention to sales trends in the Chinese market. The number of 5G smartphones will continue to grow, reaching 470 million units.

In addition, we assume that nearline HDDs used in data centers will continue to expand while the entire HDD market shrinks, and that PCs and tablets, which will be widely used for remote working and learning, are expected to continue to grow steadily.

Although a solid recovery is expected on the whole, there are some uncertainties about the impact of the COVID-19 pandemic and the actual demand situation in the future, so we think it is necessary to carefully monitor the sales trends for the finished products and determine the production system.

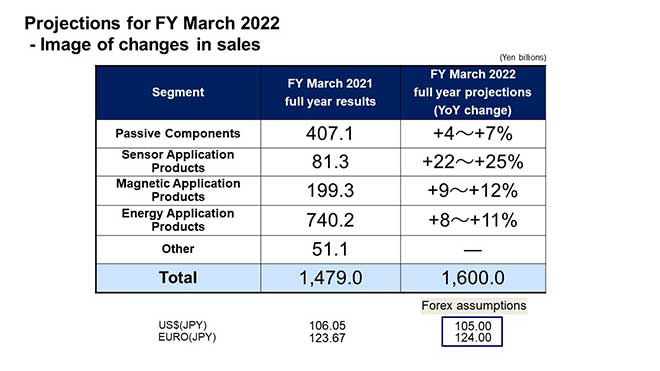

Projections for FY March 2022 - Image of changes in sales

Based on the above assumptions, we forecast overall net sales of 1.6 trillion yen, up about 8% from the full-year results for the fiscal year ended March 2021.

The Passive Components segment is expected to grow by 4–7%, given increased demand for the automotive market, especially for xEVs and 5G-related markets.

The Sensor Application Products segment is expected to grow by 22–25% due to the expansion of the customer base of TMR sensors and MEMS sensors, the expansion of the product lineup, and the increase in demand in the automotive market. Sales of conventional products such as temperature and pressure sensors as well as hall sensors for automobiles are expected to increase as demand recovers. Meanwhile, sales of TMR magnetic sensors, MEMS microphones, and MEMS motion sensors, which are expected to grow, will likely achieve significant growth as a result of successful development of new customers and applications. We achieved the highest sales level on a quarterly basis for the fourth quarter of the fiscal year ended March 2021. We believe that high sales growth can still be achieved by expanding new product sales and boosting sales based on higher demand.

In the Magnetic Application Products segment, the total demand for HDDs will decrease by about 3% due to the further contraction of the market for 2.5-inch and 3.5-inch drives in HDD heads, and consignment production of HDD heads for PCs and 3.5-inch drives will also decrease subsequently. However, due to the increase in demand for nearline HDDs, the production volume of heads on the whole is expected to grow and sales are expected to increase accordingly. Sales of magnets are also expected to increase due to the expansion of new projects for xEV, and the overall segment is expected to see positive growth by 9–12%.

In the Energy Application Products segment, sales of rechargeable batteries will remain firm for the smartphone market as well as for PCs and tablets, and power cell sales will double. In the power supplies business, demand for semiconductor manufacturing equipment and in infrastructure markets will increase. Sales of EV power supplies are also expected to increase due to the start of mass production for approved new projects. As a result, overall sales in this segment are projected to increase by 8–11%.

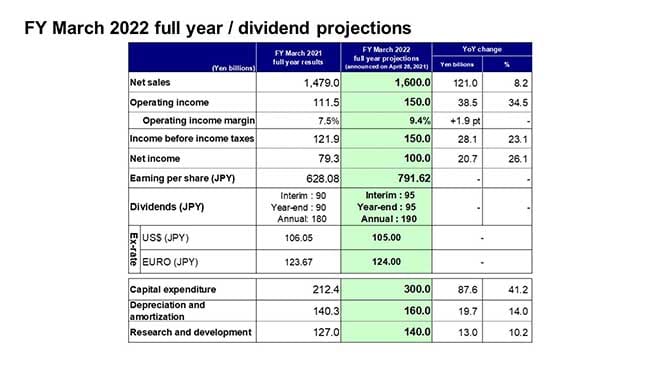

FY March 2022 full year / dividend projections

Based on the global economic trends and the demand forecasts for the major finished products that I just explained, we project that the consolidated financial results for the fiscal year ending March 2022 will be as shown on this page.

Based on the exchange rate assumptions of 105 yen against the U.S. dollar and 124 yen against the euro, net sales are forecast to be 1.6 trillion yen, an increase of about 8% year on year. We expect operating income and income before income taxes to be 150 billion yen, net income to be 100 billion yen, and earnings per share to be 791.62 yen.

As previously announced, the year-end dividend for the fiscal year ended March 2021 will be 90 yen, and the annual dividend is projected to be 180 yen. Dividends for the fiscal year ending March 2022 will be 95 yen for both the interim and year-end dividends, and the annual dividend is projected to be 190 yen.

We expect capital expenditures to be 300 billion yen, depreciation and amortization to be 160 billion yen, and research and development expenses to be 140 billion yen.

That concludes my presentation. Thank you very much for your attention.