[ Financial Results for Fiscal 2020 Performance Briefing ]Consolidated Full Year Projections for FY March 2021

Mr. Shigenao Ishiguro

President & CEO

My name is Shigenao Ishiguro, President & CEO of TDK.

First, I’d like to thank all of you for attending our performance briefing in great numbers, despite the irregular circumstances. Today, I’d like to go over our consolidated full year earnings projections for the fiscal year ending March 2021. I will start by discussing their underlying assumptions in terms of demand for major devices and economic trends.

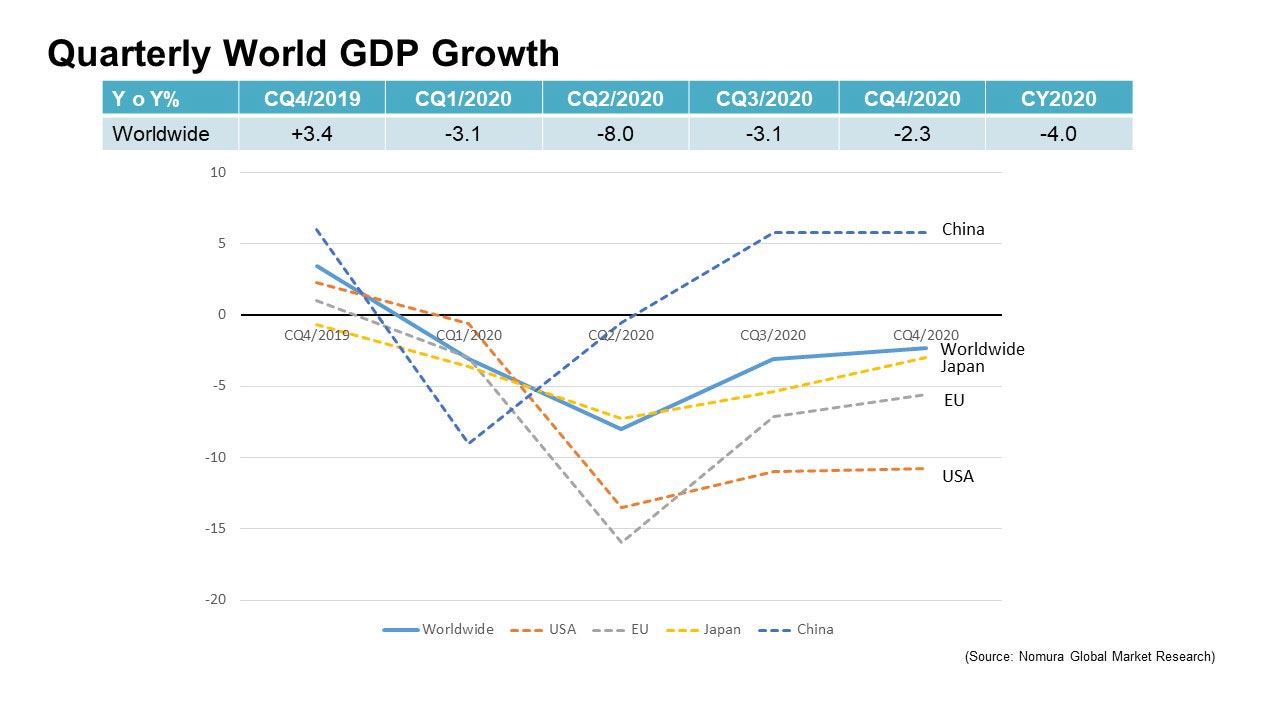

Quarterly World GDP Growth

This graph shows the GDP growth outlook on which our current projections are based. Worldwide GDP is forecast to decline 4% in calendar year 2020. Looking at the outlook by region, China where COVID-19 spread first but was also contained first is expected to see recovery in the latter half of 2020 to the economic environment in late 2019, in other words prior to the spread of COVID-19. Nevertheless, while we expect economic cooling in other regions including Japan to bottom in the second quarter and recover in stages heading into the second half of the year, we assume that recovery to levels prior to the spread of COVID-19 will not be feasible. As for the impact on TDK’s earnings, we feel that it is reasonable to expect the effects to emerge two to three months following the GDP movements due mainly to the relationship with market inventories.

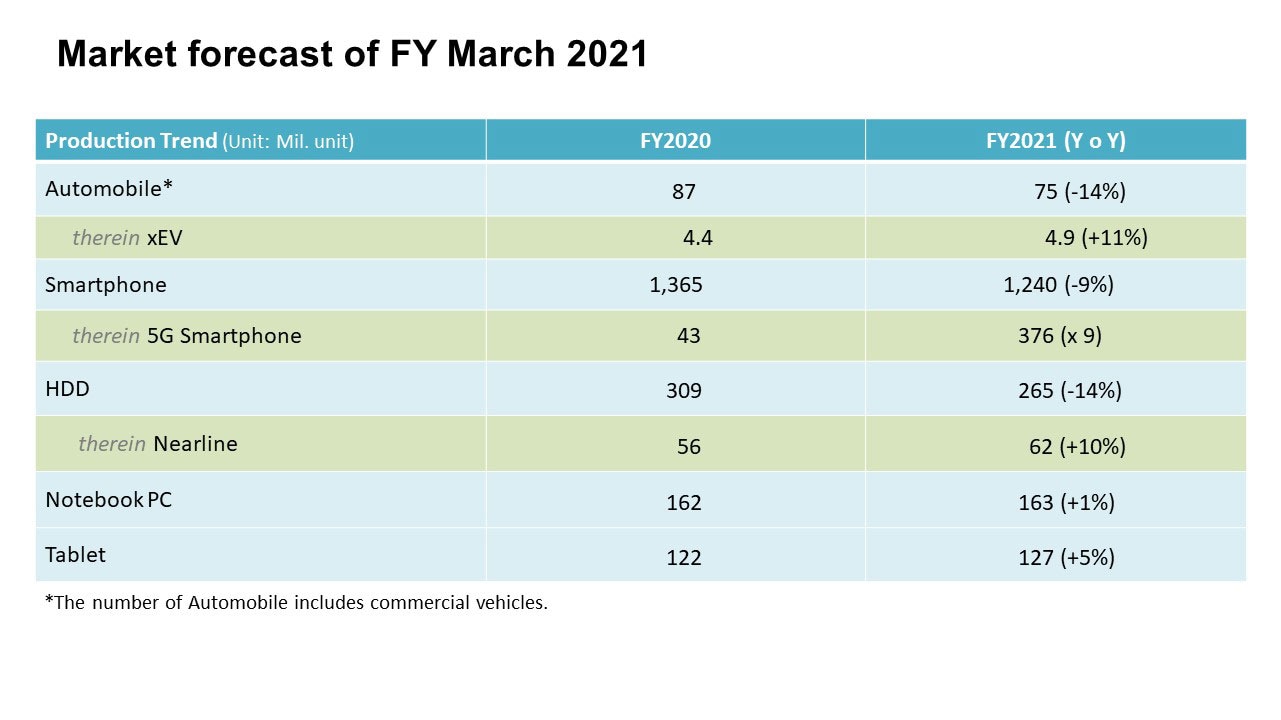

Market forecast of FY March 2021

Next, I will discuss demand assumptions for key devices concerning TDK. Regarding automobiles, TDK assumes the market scale, including commercial vehicles, will decline 14% year on year to 75 million vehicles in the fiscal year ending March 2021. While some are of the opinion that larger declines are likely in some parts of the market, there are also reports in the China market that volumes turned to YoY growth as early as April. We believe it will be important to continue to ascertain trends going forward. Within automobiles, we assume the xEV market will grow 11%.

For smartphones, which exemplify the ICT market, we envision a decrease of 9% year on year in volumes to 1.24 billion units. Within that, we are projecting 5G smartphone volume at 376 million units. That represents a slight downward revision to the 5G smartphone demand level of 400 million units in 2020 anticipated at the end of 2019.

Besides that, we assume that only Nearline HDDs used by data centers will continue to expand amid overall HDD market contraction. In addition, we envision flat to modest growth for PCs and tablets, which are likely to be widely used for telecommuting and home-based learning.

The spread of COVID-19 will not just affect market demand. Over the short term, we must also consider the direct effects on TDK’s supply chains. In other words, the impact on our factories’ operations and so forth.

While TDK presently has some sites in India and Southeast Asia where capacity utilization is not at 100%, it is business as usual at nearly all of our sites in other regions. Our current outlook is based on the assumption that production operations will be able to return to normal going forward.

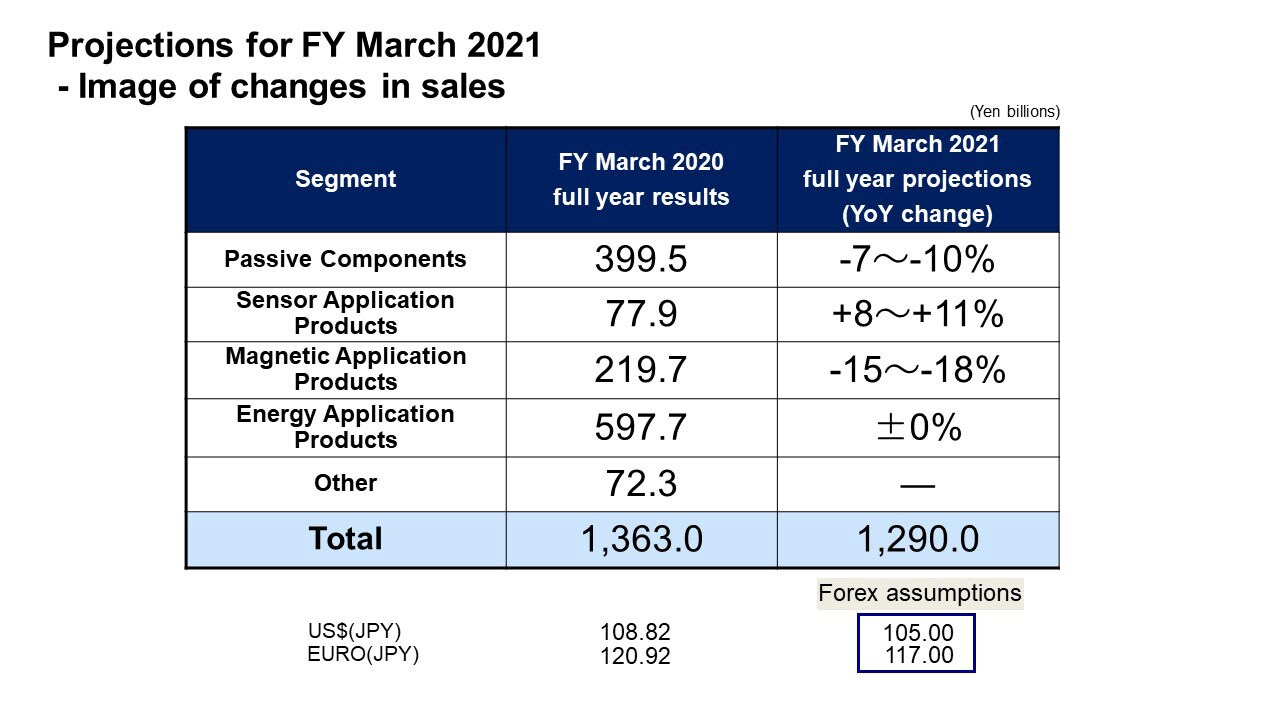

Projections for FY March 2021 - Image of changes in sales

Based on the above assumptions, we are projecting total sales of 1,290 billion yen, a roughly 5% decline from the fiscal year ended March 2020.

For the Passive Components segment, we are projecting a net sales decrease of 7–10%, with the automotive and the industrial equipment markets accounting for a certain level of sales. Within the Passive Components segment, strong growth is expected for the High-Frequency Components business, primarily for markets related to 5G.

In the Sensor Application Products segment, we are projecting net sales growth of 8–11%, even including impact from COVID-19, as a result of expansion of the customer base and enhancement of the product lineup.

Temperature and Pressure Sensors as well as Hall IC for automotive applications have been directly affected by the market up to now and cannot be expected to grow substantially. However, TMR Magnetic Sensors, Microphones, and MEMS Sensors are anticipated to grow moving ahead. For those products, we expect cultivation of new customers and applications to contribute to growth.

In the Magnetic Application Products segment, we are projecting a net sales decline of 15–18%. For HDD Heads, we expect sales to decrease as the market for 2.5-inch and 3.5-inch drives gradually loses steam and is accompanied by a decline in contract manufacturing volumes for 3.5-inch drives. Also, sales of magnetic products are likely to grow for a new project for xEV applications but not for the automotive market due to its downturn.

In the Energy Application Products segment, we are projecting broadly flat growth in net sales. This is based on the assumption that the home market will be strong, mainly for PCs, tablets, and game consoles, and sales of mini cells and power cells will gradually contribute, although the smartphone market will shrink and the infrastructure market pertaining to the Power Supplies business will contract.

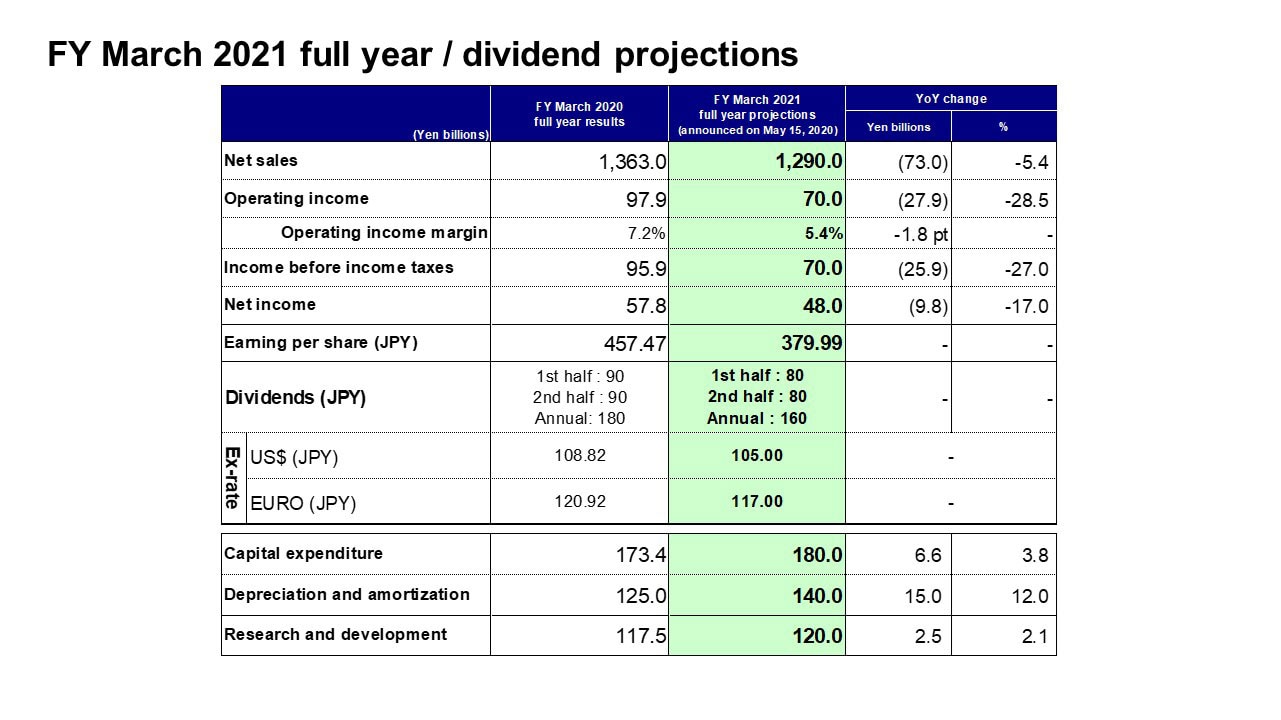

FY March 2021 full year / dividend projections

As you can see, these are our consolidated full year earnings projections for the fiscal year ending March 2021 based on the demand forecasts for major sets and global economic trends I just discussed.

Our earnings projections assume an average exchange rate of 105 yen against the U.S. dollar and 117 yen against the euro. We are projecting net sales will decline about 5% to 1,290.0 billion yen. We estimate the spread of COVID-19 will have a negative impact of about 180 billion yen on annual net sales based on the demand environment before the outbreak. Including that impact, we are targeting operating income of 70.0 billion yen, income before income taxes of 70.0 billion yen, net income of 48.0 billion yen, and earnings per share of around 380 yen.

As announced, we are planning a dividend of 90 yen per share for the second half of the fiscal year ended March 2020 for an annual dividend of 180 yen per share. For the fiscal year ending March 2021, we are planning an interim dividend of 80 yen per share in both the first half and the second half for an annual dividend of 160 per share, taking into account the current Medium-Term Plan’s shareholder returns targets for levels of profits per share and a dividend payout ratio of 30%.

We are projecting capital expenditure of 180.0 billion yen, depreciation and amortization of 140.0 billion yen and research and development expenses of 120.0 billion yen.

In light of the extraordinary environment, Tetsuji Yamanishi will discuss our view on financial strategy.

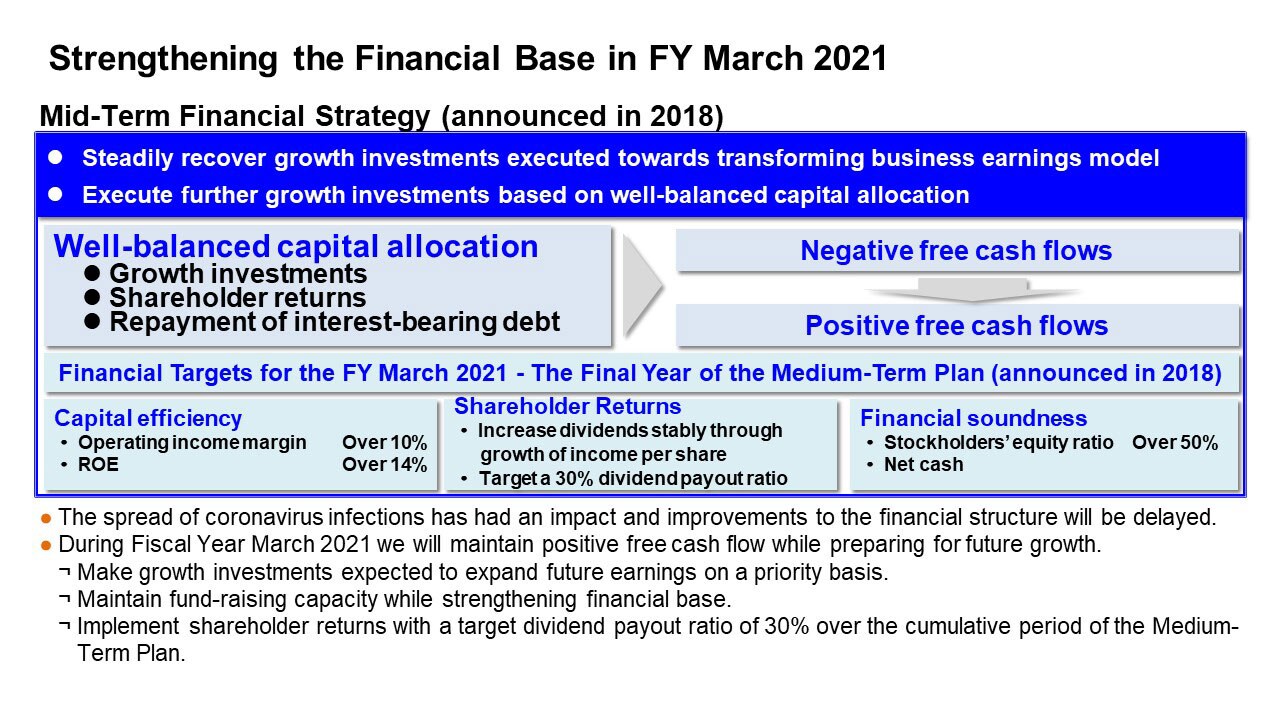

Strengthening the Financial Base in FY March 2021

As President Ishiguro previously discussed, our consolidated full year earnings projections for the fiscal year ending March 2021 call for both net sales and operating income below levels in the previous fiscal year, owing mainly to impact from the spread of COVID-19. As a result, meeting the financial targets for the final year of the current Medium-Term Plan announced in 2018 has become difficult. We project that positive free cash flows will be attainable in each fiscal year during the current Medium-Term Plan, but not reach sufficient levels due to the outlook for earnings to decline in the fiscal year ending March 2021, and improvement in the financial structure will be delayed.

In the fiscal year ending March 2021, we will continue to prioritize growth investments in areas where future earnings expansion is expected, while striving to ensure that growth investments to date are recovered, steadily realizing expansion of free cash flows, and aiming to achieve our financial targets at an early date. Meanwhile, we are securing sufficient fund-raising capacity, including establishing a commitment line, to prepare for sudden changes in the demand climate from what we envision. In addition, we are raising liquidity on hand and strengthening the financial base enabling support of business activities, even in an uncertain demand environment. As for shareholder returns for the fiscal year ending March 2021, we are planning on no growth in earnings per share and reducing dividends per share by 20 yen from the 180 yen per share implemented for the fiscal year ended March 2020. However, we are planning on realizing levels equating to a dividend payout ratio of 30% targeted over the cumulative period of the Medium-Term Plan, based on our dividend policy and taking into account free cash flow levels over the cumulative period of the Medium-Term Plan.

Lastly, President Ishiguro will present TDK’s views looking to the post-COVID-19 era.

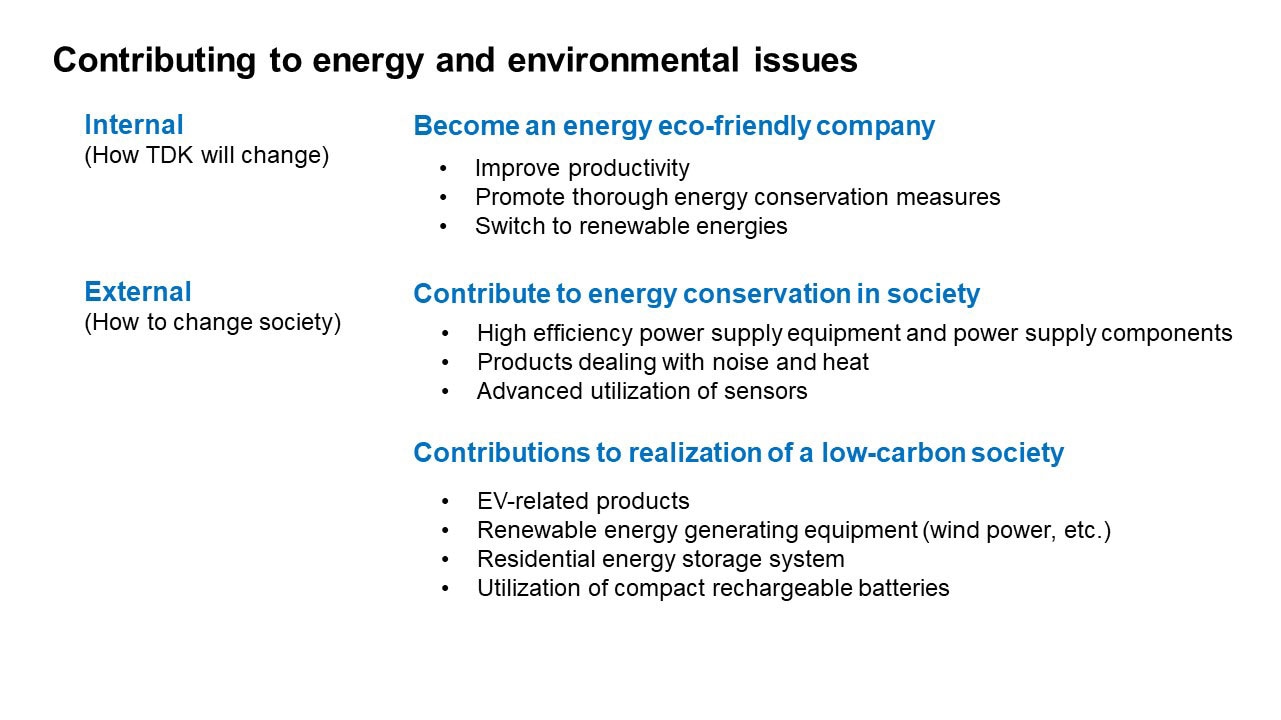

Contributing to energy and environmental issues

The spread of COVID-19 is having a tremendous long-term impact on the consumer market, in part by causing supply chain problems. However, TDK is engaged in the electronics market, which is fortunately expected to grow in the future. As I mentioned at TDK Investor Meeting 2019 last year as well, I believe the major trends of energy transformation (“EX”) and digital transformation (“DX”) will further expand the realms where TDK can greatly contribute to society.

In the EX realm, we will first thoroughly establish TDK as “Eco-TDK.” While applying digital technology, we will enable TDK to maximize output with less input, and actively switch to renewable energy. At the same time, we will contribute significantly to the shift to a low-carbon, energy efficient society.

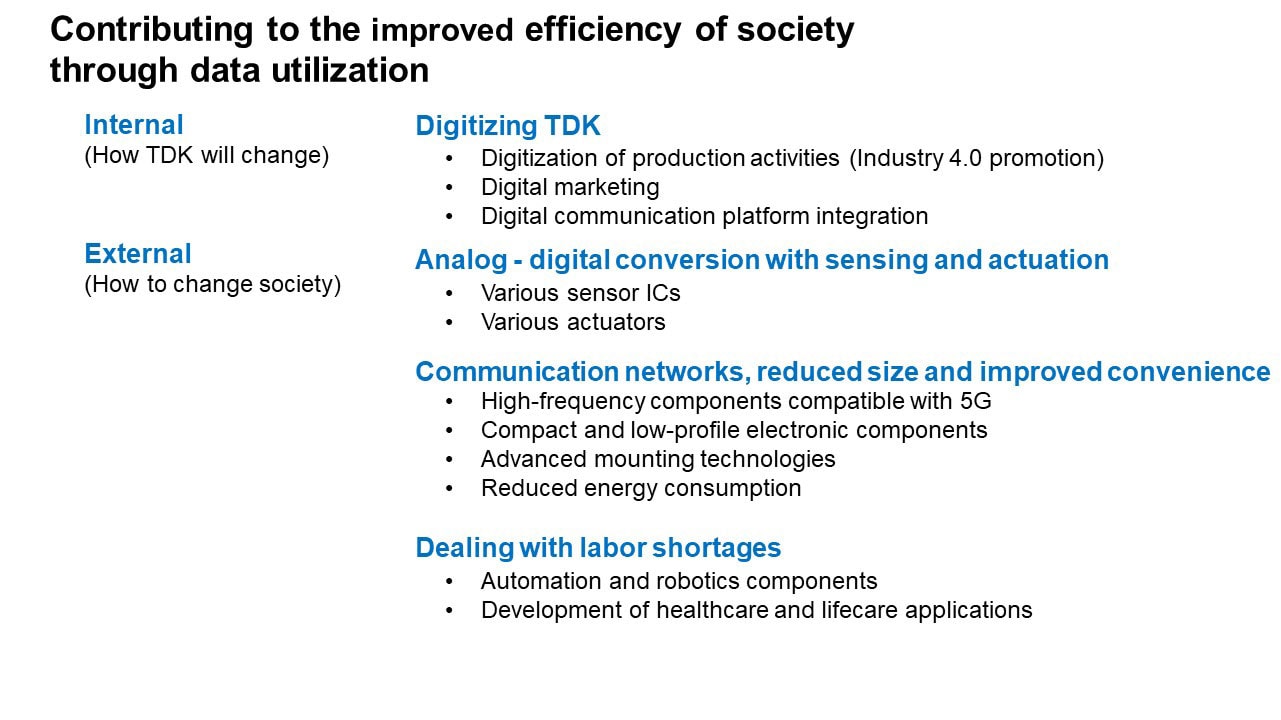

Contributing to the improved efficiency of society through data utilization

As for the DX realm, we will start by digitalizing TDK as much as possible. The pandemic is spurring big changes in what is regarded as common sense around the world, how we work, and more. While I do not in any way intend to dismiss connections between people or humanity, I have come to realize that digital technology can be used to create value that transcends time and space. I have come to understand that it is possible to communicate without taking time to physically travel. As we advance digitalization on an array of fronts—from design and development to manufacturing, marketing, and staff work, we look to play a role in the digitization of society and solution of social issues.

That concludes my lengthy presentation. Thank you very much for your attention.