[ Financial Results for Fiscal 2020 Performance Briefing ]Consolidated Results for FY March 2020

Mr. Tetsuji Yamanishi

Executive Vice President

Hello, I'm Tetsuji Yamanishi, Executive Vice President of TDK.

Thank you for taking the time to attend TDK’s

performance briefing for the fiscal year ended March 2020. I will be presenting an overview of our consolidated

full year earnings.

Key points concerning earnings for FY March 2020

First, let’s take a look at key points concerning earnings for the fiscal year ended March 2020. Impact from worsening ties between the U.S. and China intensified with each passing day heading into the end of 2019, and economic deceleration in China and the rest of the world became clear. In the fourth quarter, economic activity stalled in each country due to the spread of COVID-19, and production of electronics and demand for electronic components were affected more than initially anticipated. As a result, net sales declined 1.4% year on year, and operating income decreased 9.2% year on year.

Despite a tough global demand climate throughout the year, sales of Rechargeable Batteries continued to grow by capturing demand in the ICT market from the start of the fiscal year and expanding applications. As a result, Energy Application Products segment sales and profits grew, and both net sales and operating income reached new record highs.

In the automotive and the industrial equipment markets, which were significantly affected by trade tensions between the U.S. and China, demand was weak and sharply trailed expectations from the start of the fiscal year. This had a substantial impact on sales of many products in the Passive Components segment, as well as conventional sensors in the Sensor Application Products segment in particular. On the other hand, demand was strong in the ICT market and sales to the ICT market increased year on year. Amid growth in demand for 5G applications, sales of Rechargeable Batteries and High-Frequency Components for smartphones and base stations increased to secure higher sales and profits and driving Companywide earnings.

In the fourth quarter, we determined that significant earnings recovery over a short period of time would be difficult due to prolonged sluggish demand in the automotive and the industrial equipment markets. Accordingly, we recorded an impairment loss of about 16.5 billion yen on manufacturing and related facilities for Magnets and Aluminum Electrolytic Capacitors. Additionally, we posted an impairment loss of about 1.8 billion yen on surplus facilities, owing to improvement of the development system.

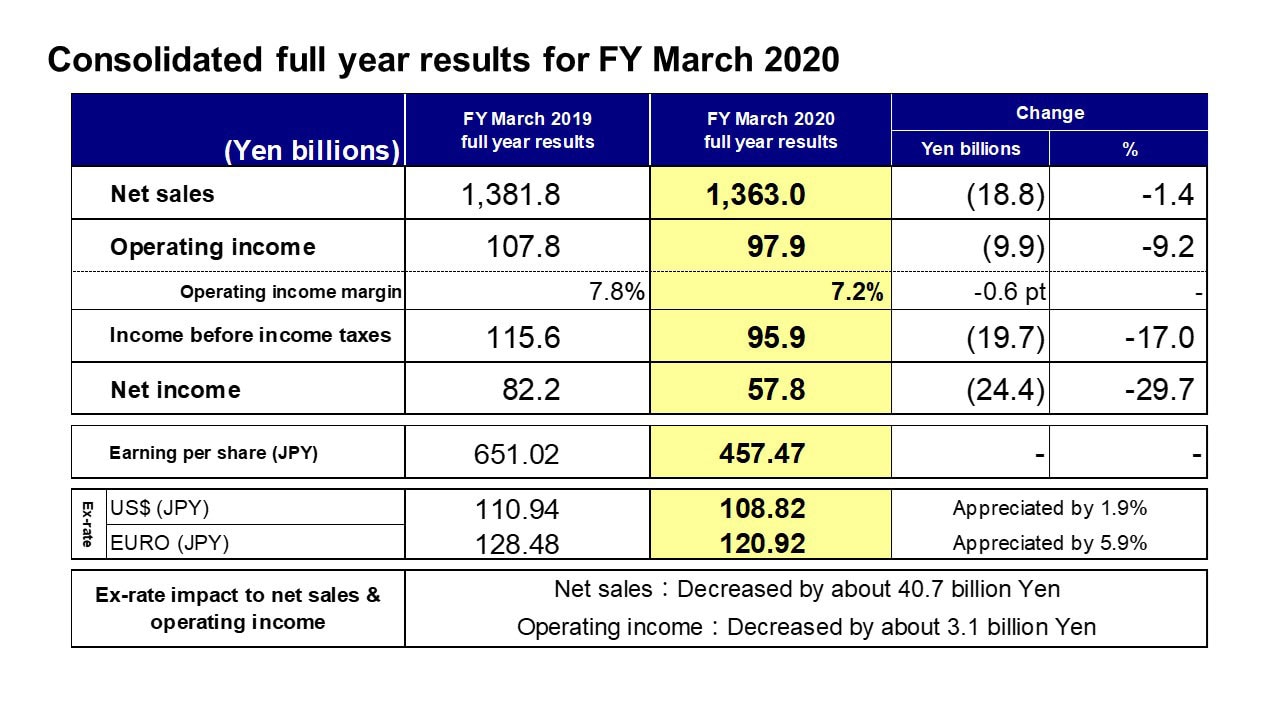

Consolidated full year results for FY March 2020

Moving along, I would like to present an overview of our results. The impact of the yen’s appreciation against the U.S. dollar and the euro caused net sales to contract by around 40.7 billion yen and operating income by around 3.1 billion yen. Net sales were 1,363.0 billion yen, a decrease of 18.8 billion yen, or 1.4%, year on year. Operating income was 97.9 billion yen, down 9.9 billion yen, or 9.2%. This includes impairment losses of 18.3 billion yen. Income before income taxes was 95.9 billion yen, net income was 57.8 billion yen, and earnings per share were 457.47 yen. We estimate that suspensions of shipments and plant operations in the fourth quarter due to the spread of COVID-19 depressed net sales by about 28.0 billion yen and operating income by around 12.0 billion yen.

With regard to exchange rate sensitivity, we maintain our estimate that a change of 1 yen against the U.S. dollar affected annual operating income by about 1.2 billion yen, while a change against the euro had an impact of about 0.2 billion yen.

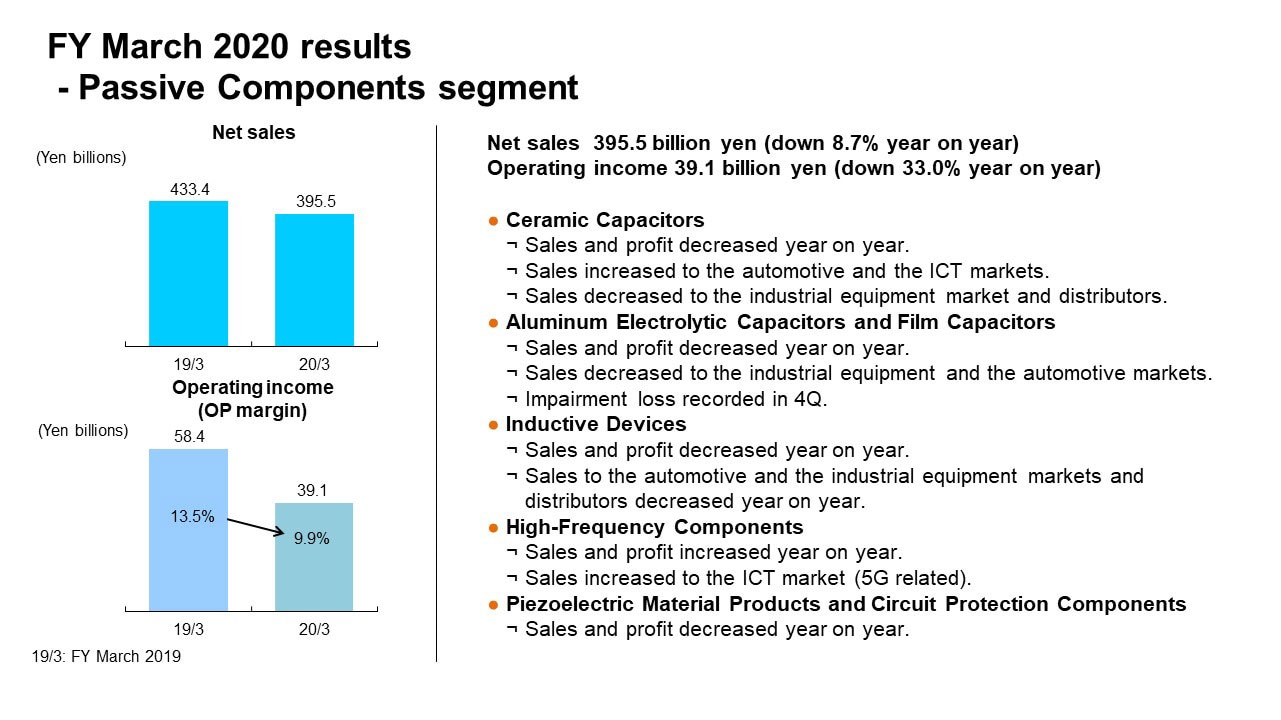

FY March 2020 results - Passive Components segment

Next, I would like to explain our business segment performance.

In the Passive Components segment, net sales were 395.5 billion yen, a decrease of 8.7% year on year, and operating income was 39.1 billion yen, a decrease of 33.0%. The operating income margin was 9.9%. Weak demand in the automotive and the industrial equipment markets due to impact from ongoing trade friction between the U.S. and China since the start of the fiscal year was compounded by impact from inventory adjustments at major distributors in the U.S. and Europe. Subsequently, sales slumped and profit declined for Aluminum Electrolytic Capacitors and Film Capacitors as well as Capacitors, Inductors, and Piezoelectric Material Products and Circuit Protection Components, for which the automotive and the industrial equipment markets account for a large share of sales. For Aluminum Electrolytic Capacitors, excess production capacity due to weaker demand resulted in the recording of an impairment loss of about 2.1 billion yen in the fourth quarter.

On the other hand, demand in the ICT market was strong from the beginning of the fiscal year. The startup of 5G came into full swing, mainly in China, and, though there was impact from the spread of COVID-19 in the fourth quarter, High-Frequency Components secured growth in sales and profit.

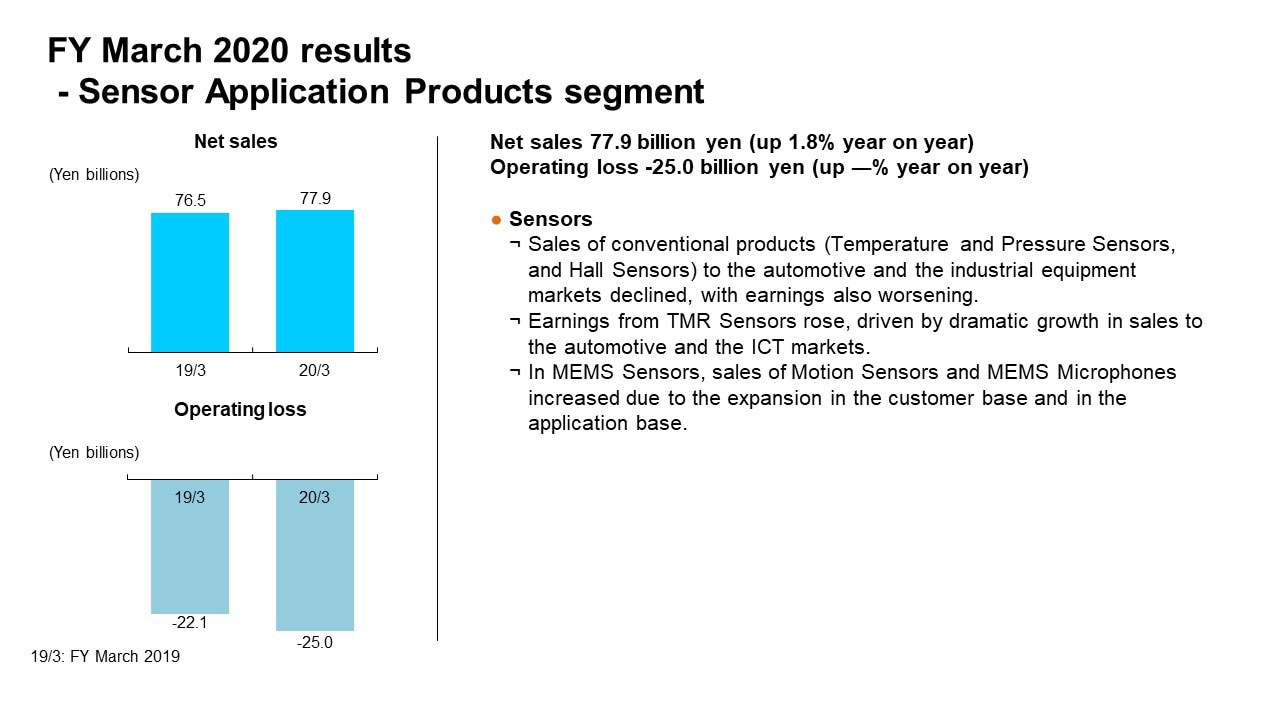

FY March 2020 results - Sensor Application Products segment

In the Sensor Application Products segment, we aimed to expand sales as a growth strategy business, but overall sales only increased 1.8% year on year and losses widened.

The segment’s products were sharply divided into two groups. Products that were significantly affected by the economy and saw sales decline, and products that got on board with the growth strategy and saw sales rise.

Sales of conventional sensors such as Temperature Sensors and Hall Sensors were lackluster, owing to impact from weak global demand in the automotive and the industrial equipment markets. Their sales declined markedly from the previous fiscal year and their profits deteriorated, which had a major impact on overall business earnings. In contrast, TMR Sensors, a strategic product expected to see growth, made progress on adoption for automotive applications, volumes grew, and sales rose. For smartphone applications as well, TMR Sensors made headway on adoption for new smartphone models, sales expanded, and profits have taken hold. In MEMS Sensors, sales of Motion Sensors steadily rose to new customers and sales of MEMS Microphones grew for smartphone and IoT applications, but sufficient sales growth and earnings contributions were not attained.

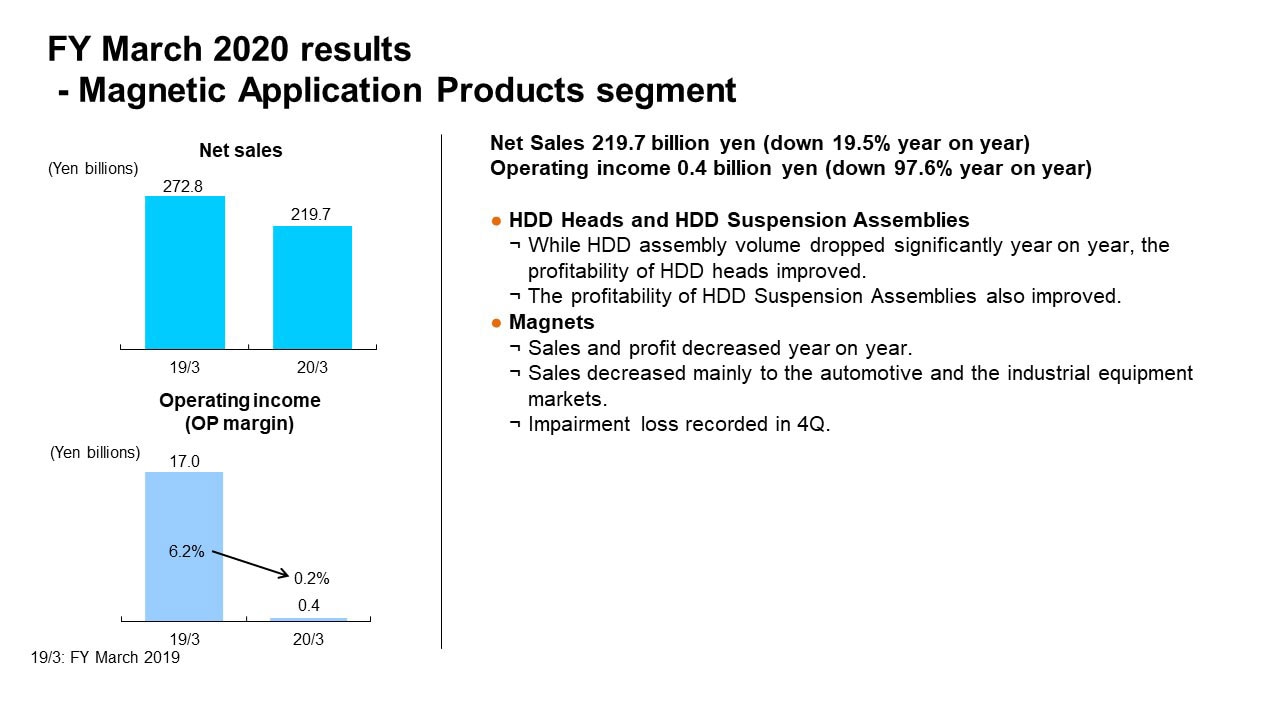

FY March 2020 results - Magnetic Application Products segment

In the Magnetic Application Products segment, net sales declined 19.5% year on year to 219.7 billion yen, and operating income decreased substantially to 0.4 billion yen.

For HDD Heads and HDD Suspension Assemblies, overall sales declined about 18% and profit decreased as less total HDD demand led to roughly 4% lower volumes for HDD Heads and some products reached end of life in HDD assemblies, but growth in high-value-added products contributed to a rise in profitability from the previous fiscal year.

In Magnets, sales decreased due to our withdrawal from Magnets for HDDs and impact from sluggish demand for the industrial equipment and the automotive markets, such as industrial robots and machine tools, and ongoing harsh business conditions led to the recording of an impairment loss of 14.4 billion yen in the fourth quarter.

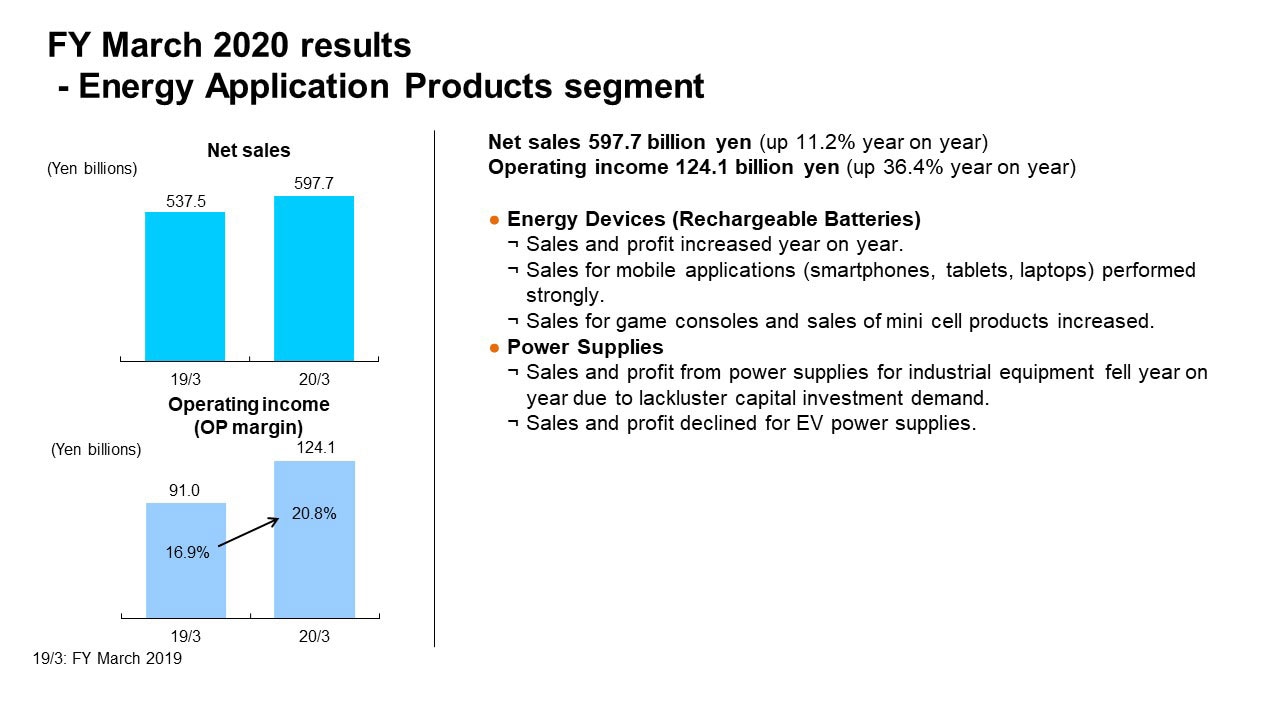

FY March 2020 results - Energy Application Products segment

In the Energy Application Products segment, net sales rose 11.2% year on year to 597.7 billion yen, and operating income surged 36.4% to 124.1 billion yen. Profitability also improved dramatically, with the operating income margin at 20.8%.

In Rechargeable Batteries, sales increased about 15% year on year and profitability rose. This reflects a sharp rise in sales for smartphone applications and strong sales for tablet and laptop applications, along with a steady increase in sales of minicells for wearable products such as wireless earphones.

Power Supplies for industrial equipment saw profit decrease as sales declined to the industrial equipment market, owing to significant impact from less demand for capital expenditures due to economic slowdown.

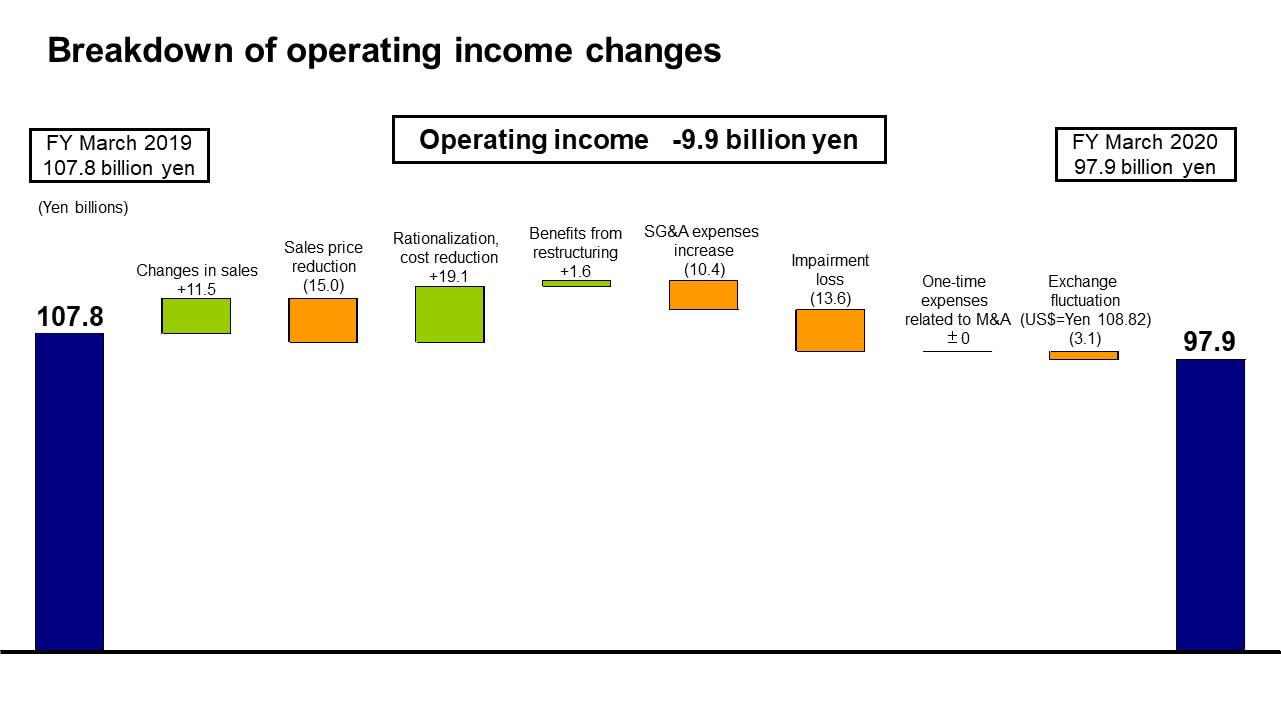

Breakdown of operating income changes

Next is the breakdown of the change in operating income. Let’s take a look at the main factors behind the 9.9 billion yen decrease in operating income. First, there was an increase in profits of about 11.5 billion yen due to sales volume growth, despite including negative impact of about 12.0 billion yen from the spread of COVID-19.

Next, negative impact of around 15.0 billion yen from reduction in sales prices was absorbed by positive impact of about 19.1 billion yen from rationalization and cost reductions, which, along with benefits of about 1.6 billion yen from restructuring, contributed to increased earnings by strengthening our constitution. Expenses related to the InvenSense acquisition were about 5.4 billion yen for the fiscal year, unchanged from the previous fiscal year.

Administration and development expenses in connection with business expansion in Rechargeable Batteries increased by 10.4 billion yen, exchange rate fluctuations had a negative impact of around 3.1 billion yen, and there was an increase of 13.6 billion yen in impairment losses. As a result, the overall decrease in operating income was 9.9 billion yen.

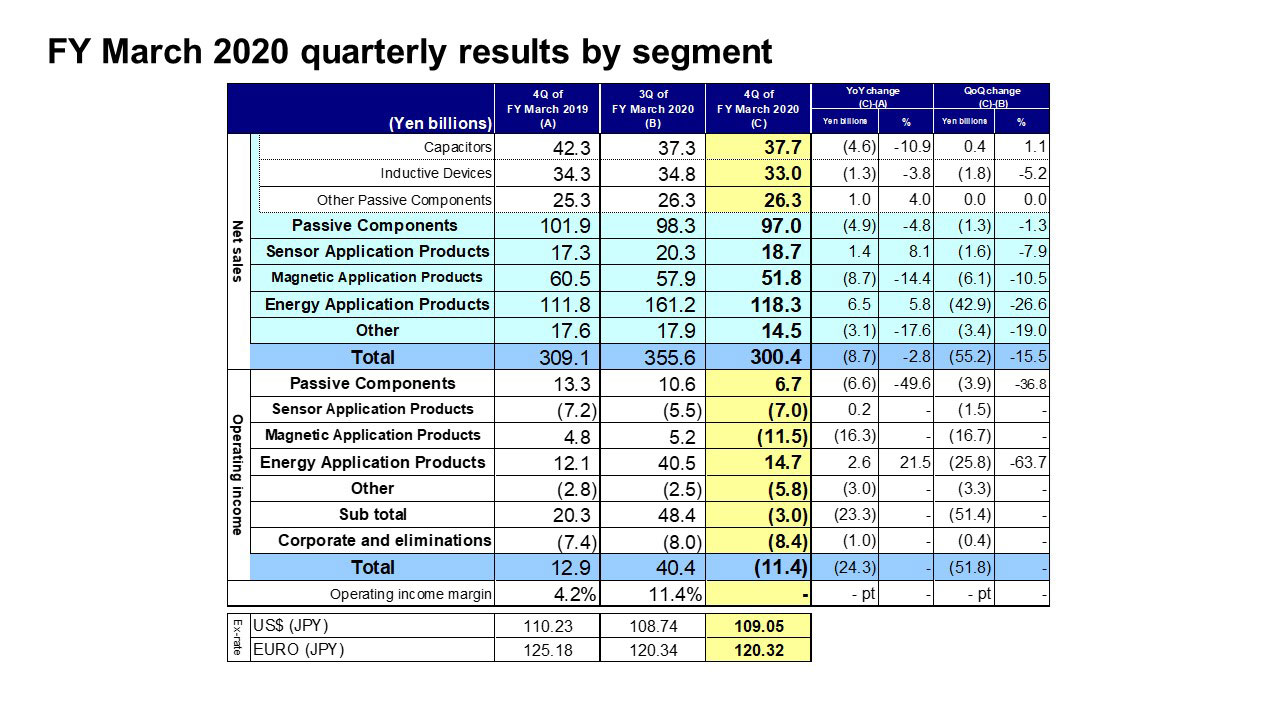

FY March 2020 quarterly results by segment

Next, I would like to explain the factors behind the changes in segment net sales and operating income from the third quarter to the fourth quarter of the fiscal year ended March 2020.

Let’s begin with net sales in the Passive Components segment. Net sales in this segment decreased by 1.3% from the third quarter, but we estimate they grew about 2% excluding impact from the spread of COVID-19.

Overall, sales for both the ICT and the industrial equipment markets declined, whereas sales of Ceramic Capacitors for 5G base station applications and High-Frequency Components grew. Operating income decreased about 37%, but we estimate that it grew roughly 9% excluding impact from COVID-19 and an impairment loss posted for Aluminum Electrolytic Capacitors.

In the Sensor Application Products segment, net sales fell 7.9% from the third quarter, and operating losses widened by 1.5 billion yen. Although sales for the automotive market increased on a seasonal recovery following the Christmas holidays, overall sales declined due to lower volumes for smartphones. Excluding impact from the suspension of production lines due to the spread of COVID-19, we estimate operating income declined about 14% due to lower sales.

In the Magnetic Application Products segment, sales fell about 6% on a decrease in volumes for HDD Heads from the third quarter, which along with lower HDD assembly sales and lower HDD suspension sales volumes led to an overall sales decline of 10.5%. Sales of Magnets decreased roughly 5%. Excluding an impairment loss of 14.4 billion yen and impact from COVID-19, we estimate operating income in the Magnetic Application Products segment declined by about 35% due to lower sales volumes.

In the Energy Application Products segment, net sales decreased by 26.6% from the third quarter but we estimate that the decline was about 15% excluding impact from COVID-19. Rechargeable Batteries were affected by a seasonal decline in demand, but Power Supplies for industrial equipment were basically steady. Operating income declined 63.7%, but we estimate that the decline was about 49% excluding impact from COVID-19.