[ 2nd Quarter of fiscal 2020 Performance Briefing ]Consolidated Full Year Projections for FY October 2020

Mr. Shigenao Ishiguro

President & CEO

Hello, I'm Shigenao Ishiguro, President & CEO of TDK. Today, I'd like to go over our consolidated earnings forecast for the fiscal year ending March 2020.

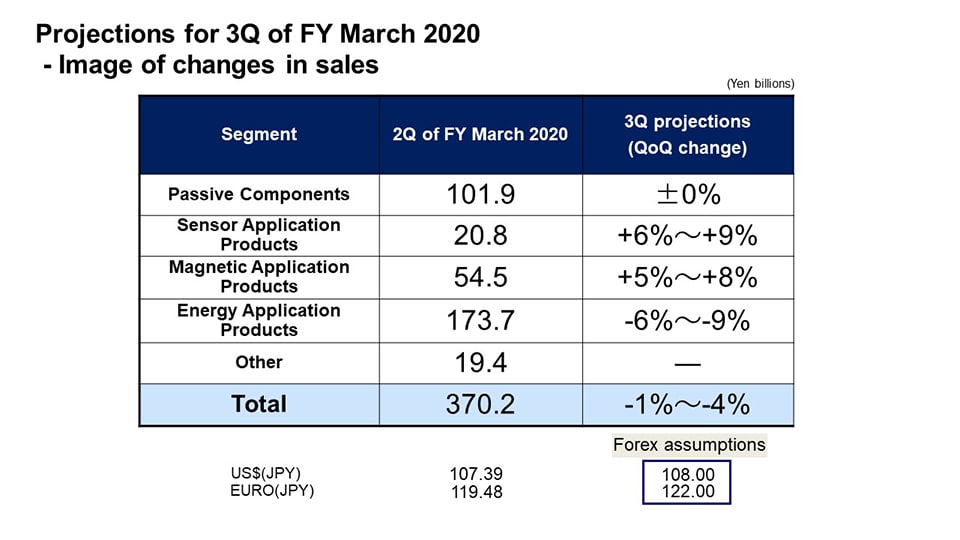

Projections for 3Q of FY March 2020 - Image of changes in sales

Looking at the demand environment for the second half of the fiscal year ending March 2020, the global economic outlook remains uncertain and we do not believe we can expect a recovery in business conditions. In the industrial equipment market, there are signs of recovery in demand for semiconductor manufacturing facilities, but demand in the automotive market has slumped worldwide, and is set to continue at this level. Smartphone demand peaked in the second quarter and is expected to decline gradually towards the fourth quarter.

In this environment, we are expecting adverse conditions to affect sales in the third quarter, and we are forecasting a decline of 1-4% overall from the second quarter.

By segment, first in the Passive Components segment, sales are expected to remain about level with the second quarter. In MLCCs, we expect that demand from the automotive market has not really recovered, and that more time will be needed for inventory adjustments by distributors. We therefore expect sales to decrease slightly from the second quarter. Aluminum Electrolytic Capacitors and Film Capacitors are expected to see a slight increase in sales, while Inductive Devices, Piezoelectric Material Products and Circuit Protection Components, and High Frequency Components are also expected to remain about level with the second quarter.

In the Sensor Application Products segment, we expect sales to increase by 6–9%. Sales for the automotive market are set to remain about level with the second quarter, and TMR Sensor sales are expected to be strong for the ICT market, while for MEMS Sensors we are projecting strong sales of MEMS Motion Sensors for the ICT market and an increase in sales of MEMS Microphones for IoT devices and smartphones.

In the Magnetic Application Sensors segment, sales are predicted to increase by 5–8%. Although HDD assembly sales are set to decrease further, the volume of HDD Head sales is projected to increase by about 1%, with an increase in HDD Heads for nearline systems raising the average price by about 2%. HDD Suspension Assemblies are projected to experience an increase in sales volume, primarily for HDDs used in nearline systems, with sales increasing by around 17%. Magnets are projected to see sales increase for use in HV motors.

In the Energy Application Products segment, we expect to see sales decrease by 6–9%. In Rechargeable Batteries, overall sales are forecast to decline, despite minicell sales trending favorably, as sales for smartphones to major customers in all regions are expected to slow from the second quarter peak. Sales of Power Supplies are expected to increase slightly.

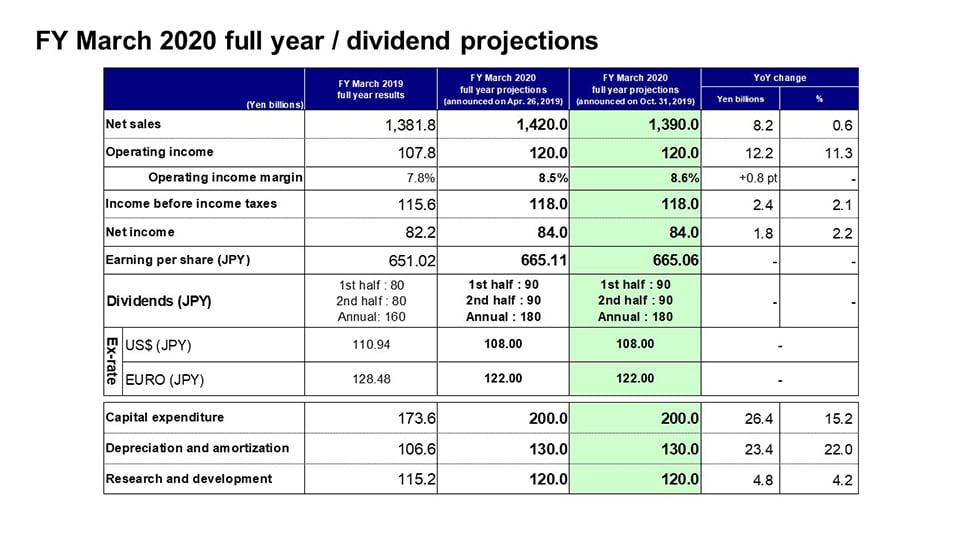

FY March 2020 full year / dividend projections

Next, we come to our consolidated full-year earnings projections for the fiscal year ending March 2020.

We have revised our sales forecasts downward from 1,420.0 billion yen at the start of the fiscal year by 30.0 billion yen to 1,390.0 billion yen.

Demand trends have changed significantly from our initial expectations in our three priority markets. While sales have been trending at a higher level than initially expected for the ICT market, mainly in Rechargeable Batteries, the automotive and the industrial equipment markets have been heavily impacted by the global economic slowdown, and demand in these markets is not expected to recover in the second half of the fiscal year. Mainly, sales of Passive Components and some Sensor products are expected to fall below the envisaged levels, and we have revised our sales forecasts downward.

Our forecasts for operating income, income before income taxes, and net income remain unchanged. Our assumed exchange rates for the second half, capital expenditure, depreciation and amortization cost, and R&D costs have not changed from our initial plan.

Dividends are to be 90 yen per share for the first half, and 90 yen per share for the second half, as initially planned, for an annual dividend of 180 yen per share.

Amid an uncertain future in the global economy, we will focus on demand trends and accelerate measures based on our growth strategy, firmly capturing growth opportunities while steadily promoting measures to improve earnings in troubled businesses as we aim to achieve our full-year earnings targets. That concludes my presentation. Thank you for your attention.