[ 3rd Quarter of fiscal 2019 Performance Briefing ]Consolidated Results for 3Q of FY March 2019

Consolidated Full Year Projections for FY March 2019

Mr. Tetsuji Yamanishi

Senior Vice President

Hello, I’m Tetsuji Yamanishi, Senior Vice President of TDK. Thank you for taking the time to attend TDK’s performance briefing for the third quarter of the fiscal year ending March 2019. I will be presenting an overview of our consolidated results.

Key points concerning earnings for 3Q of FY March 2019

First, let’s take a look at the key points concerning earnings for the third quarter. Net sales rose slightly 2.8% year on year, and operating income decreased slightly by 2.1%. For the nine-month period, net sales and operating income both continued the momentum from the first half, as did income before income taxes and net income, all achieving new records.

Year on year, Capacitors achieved significant growth in sales, mainly of application products with high reliability and redundancy characteristics for automotive use, leading to continuous expansion in profits with increases in profitability, raising the earnings base of the Passive Components segment as a whole. In the Energy Application Products segment, Rechargeable Batteries experienced a significant expansion in sales to major Chinese customers, and sales for use in tablets, laptops, and others were also firm. With the added effect of a lower cost ratio due to continuous cost saving efforts, we maintained high profitability, lifting the level of earnings for the whole Company.

However, macroeconomic changes have set off by the trade friction between the U.S. and China, with an economic slowdown in China particularly starting to exert a major impact on the global economy. TDK is also feeling the effects, with a sharp slowdown in orders in its main market segments of automotive, ICT, and industrial equipment from around the middle of the third quarter. At the announcement of the first half financial results on October 31, 2018, we revised our full-year earnings forecast upward, but the order status has changed significantly from our assumptions at that time, and recognizing that this situation is likely to continue for some time, we have now revised our consolidated full-year earnings forecast downward. I will explain in detail at the end.

The market environment, which had been trending favorably, has now changed and the short-term outlook has become unclear. However, the medium-term trends in the markets where TDK operates have not changed. The digital transformation powered by digital technologies such as the IoT and AI and the transformation trend in the energy field such as the spread of EVs and electric power in automobiles are still on course, and we are certain that the demand for electronic components supplied by TDK will expand steadily. Rather than becoming fixated on short-term changes, we will keep our focus firmly on the medium-term business environment, and execute our medium-term business strategy to achieve our management targets.

Consolidated results for 3Q of FY March 2019

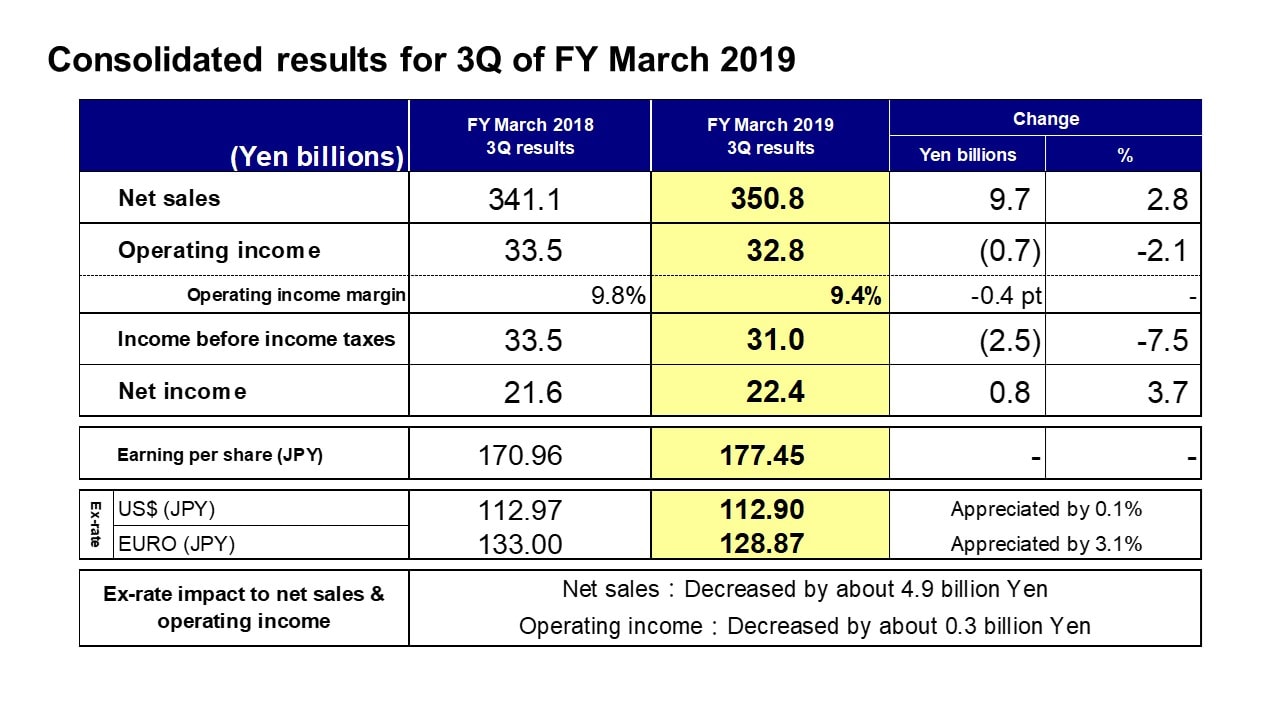

Moving along, I would like to present an overview of our results. Net sales were 350.8 billion yen, an increase of 9.7 billion yen, or 2.8%, year on year. Operating income was 32.8 billion yen, down 0.7 billion yen, or 2.1%, year on year. Income before income taxes was 31.0 billion yen, net income was 22.4 billion yen, and earnings per share were 177.45 yen. In accordance with changes in U.S. accounting standards related to retirement benefit cost, an approximate 1.0-billion-yen portion of the net benefit cost included in operating expense in profit/loss in the previous fiscal year was reclassified to other deductions. From the first quarter of the fiscal year ending March 2019, the amounts pertaining to the change in accounting standards have been recorded as other deductions.

The average exchange rates for the third quarter of the fiscal year ending March 2019 were 112.90 yen against the U.S. dollar, an appreciation of 0.1%, and 128.87 yen against the euro, an appreciation of 3.1%. In terms of the impact of these exchange rate movements, net sales and operating income decreased by around 4.9 billion yen and around 0.3 billion yen, respectively.

With regard to exchange rate sensitivity, as with our previous estimate, we estimate that a change of 1 yen against the U.S. dollar would have an impact of around 1.2 billion yen on full-year operating income, while a change against the euro would have an impact of around 0.2 billion yen.

3Q results - Passive Components segment

Next, I would like to explain our business segment performance.

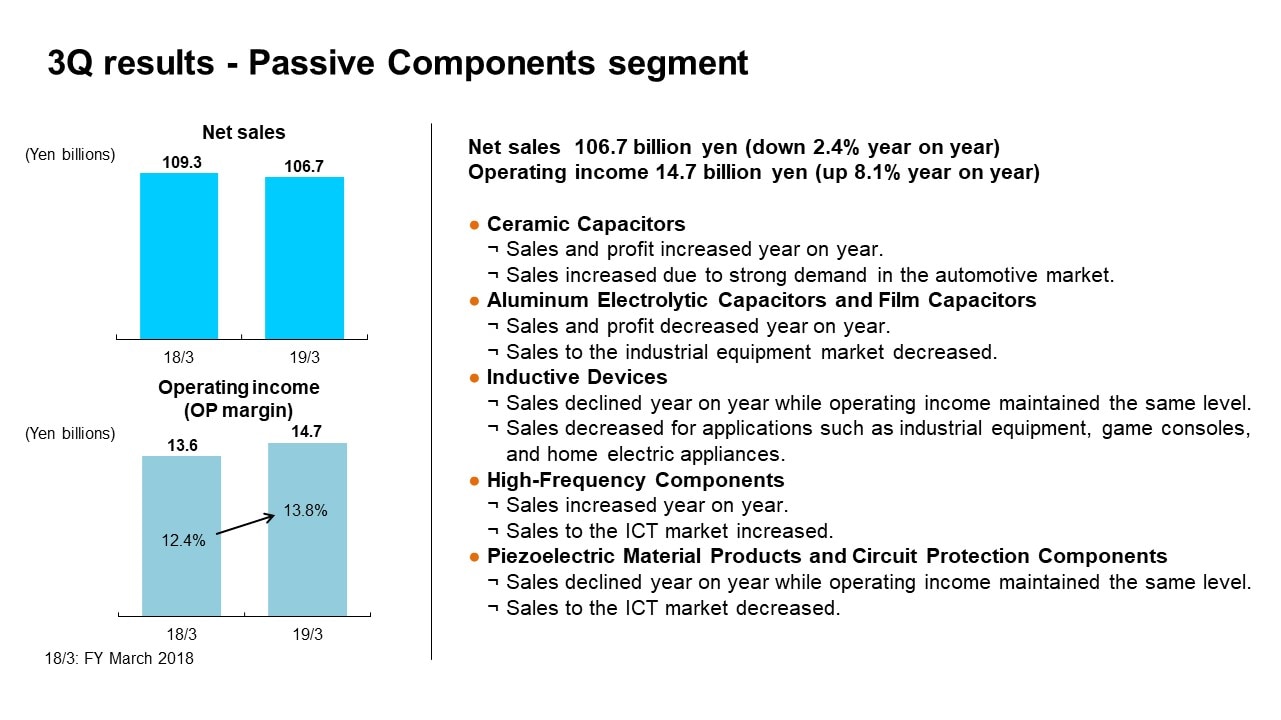

From the fiscal year ending March 2019, we reclassified certain products such as Camera Module Actuators and therefore we have regrouped results for the previous fiscal year. In the Passive Components segment, this change reduced net sales for the same period of the previous fiscal year by 3.5 billion yen and increased operating income by 0.5 billion yen.

In the third quarter of the fiscal year ending March 2019, net sales were 106.7 billion yen, a decrease of 2.4% year on year, and operating income was 14.7 billion yen, an increase of 8.1% year on year. The operating income margin was 13.8%. Despite the decline in sales, we made progress on improving profitability and achieved an increase in profit. In Ceramic Capacitors, sales increased atop strong sales of products with high reliability and redundancy characteristics for the automotive market. The earnings base for the Passive Components segment increased overall due to marked improvements in profitability driven by contributions from an improved product mix and productivity enhancements. In Aluminum Electrolytic Capacitors and Film Capacitors, sales and earnings decreased year on year in China, mainly in sales for the renewable energy market. In Inductive Devices, sales to the automotive market continued to increase firmly, along with an increase in sales for the ICT market. On the other hand, sales decreased for home electric appliances and industrial equipment, mainly in China, and sales for game consoles decreased with a fall in demand. Nevertheless, operating income remained level with the previous fiscal year as the decline in revenues was covered by an improvement in the product mix. In High-Frequency Components, sales of Ceramic Filters increased year on year atop favorable sales for the ICT market. In Piezoelectric Material Products and Circuit Protection Components, sales to the ICT market decreased, but progress on cost improvements kept profits on par with the same period of the previous fiscal year.

3Q results - Sensor Application Products segment

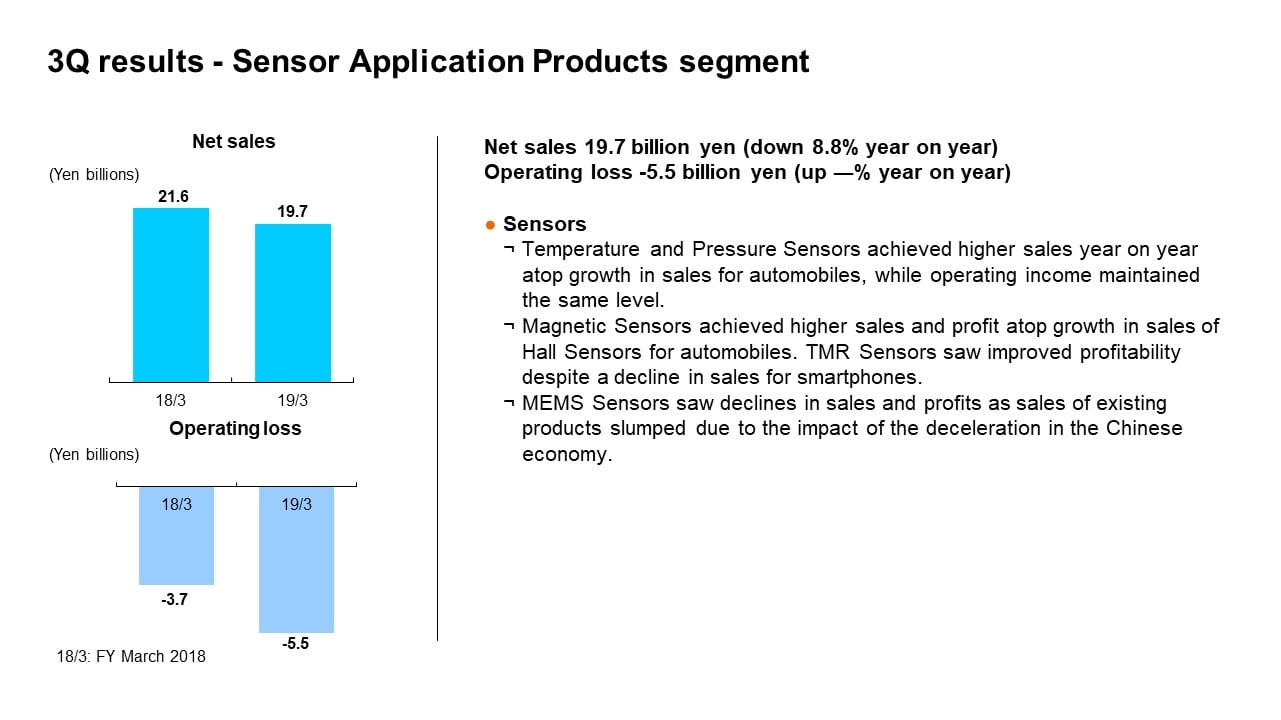

In the Senor Application Products segment, the reclassification of certain products increased operating income for the third quarter of the fiscal year ended March 2018 by around 0.1 billion yen.

In the third quarter of the fiscal year ending March 2019, net sales were 19.7 billion yen, down 8.8% year on year. Operating loss was 5.5 billion yen, including 1.6 billion yen in acquisition-related costs for InvenSense.

Temperature and Pressure Sensors achieved higher sales after a strong performance for automobiles, despite a decline in demand for home electric appliances in China. Meanwhile, operating income remained level year on year due to increases in development expenses and sales promotion expenses for new Pressure Sensor products. Magnetic Sensors achieved higher sales and profit atop growth in sales of Hall Sensors for the automotive market. TMR Sensors recorded lower sales due to a sharp decline in sales for smartphones, but achieved a profit due to increased productivity and improved costs. MEMS Sensors saw a larger operating loss, reflecting a sharp decline in sales due to the impact of the deceleration in the Chinese economy, with decreases in sales for use in smartphones and drones, and lower sales for game consoles, in addition to cost burdens such as for development resources to accelerate commercialization of new models and initiatives to expand the customer base, which outweighed a 0.6 billion yen decrease in acquisition-related costs.

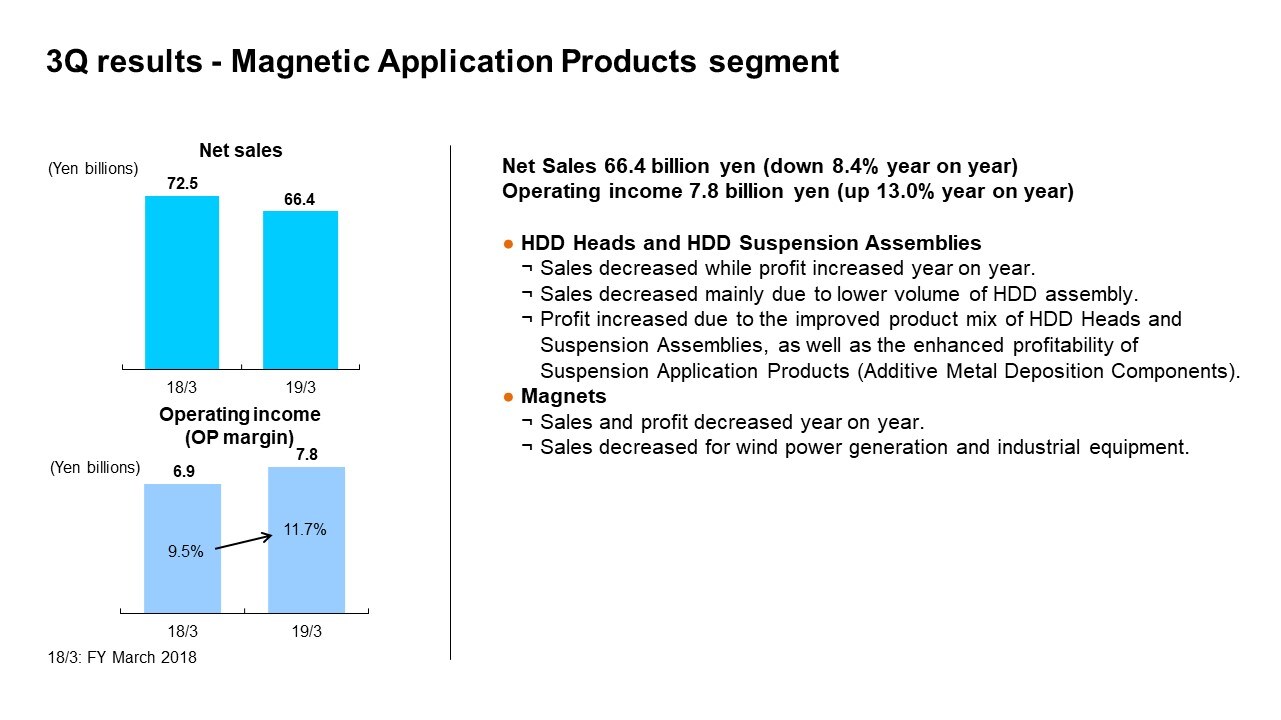

3Q results - Magnetic Application Products segment

In the Magnetic Application Products segment, the reclassification of businesses in connection with a reorganization reduced net sales and operating income for the third quarter of the fiscal year ended March 2018 by 14.4 billion yen and 1.5 billion yen, respectively.

For the third quarter of the fiscal year ending March 2019, net sales decreased 8.4% year on year to 66.4 billion yen, operating income increased 13.0% to 7.8 billion yen, and the operating income margin was 11.7%.

Sales volume of HDD Heads decreased by around 9% year on year. However, sales value was level year on year as sales of Nearline HDD Heads for data centers increased, improving the product mix and raising the average sales price. Moreover, HDD Suspension Assemblies also saw sales volume decrease while sales value remained level due to an increase in the average sales price reflecting a larger share of sales for μDSA type. On the other hand, due to lower volume of HDD assembly, overall sales for HDD Heads and Suspension Assemblies decreased. Operating income increased year on year, assisted by an increase in the average sales prices and earnings contribution from Suspension Application Products.

In Magnets, sales and profit decreased year on year, partly reflecting a worsening product mix due to decreased sales for industrial equipment such as wind power generation.

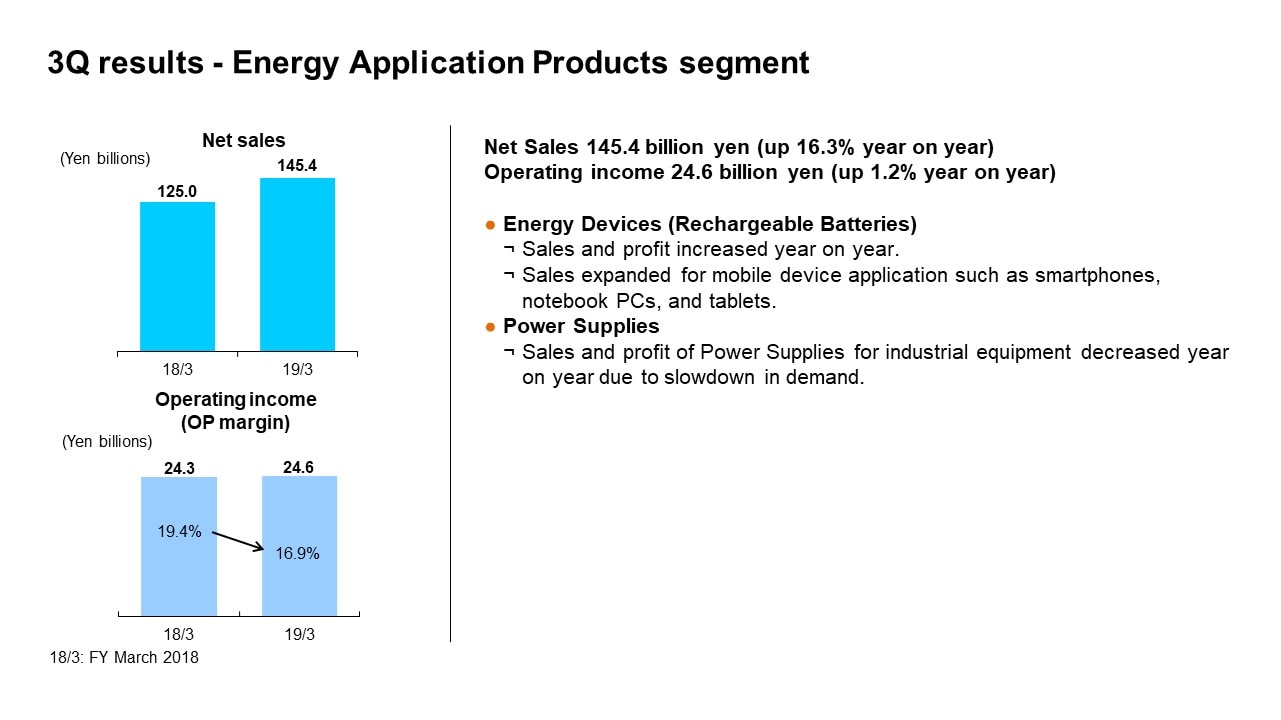

3Q results - Energy Application Products segment

In the Energy Application Products segment, the reclassification of businesses in connection with a reorganization increased net sales and operating income for the third quarter of the fiscal year ended March 2018 by 19.1 billion yen and 0.7 billion yen, respectively.

In the third quarter of the fiscal year ending March 2019, net sales rose 16.3% year on year to 145.4 billion yen and operating income rose 1.2% to 24.6 billion yen.

In Rechargeable Batteries, sales to the Chinese smartphone market increased sharply for major customers, while sales also increased steadily for mobile device applications such as laptops and tablets, resulting in higher sales and profits. However, profit growth slowed due to a downturn in demand for the smartphone market overall that emerged in the middle of the third quarter, leading to production adjustments that resulted in loss on reduced capacity utilization. Meanwhile, with the market price for cobalt materials in a declining phase, we suffered an impact due a time lag between reflecting the lower market price in our sales prices and experiencing the effect of the lower market prices.

Power Supplies for industrial equipment saw lower sales and profits due to a decrease in demand, mainly from the Chinese market.

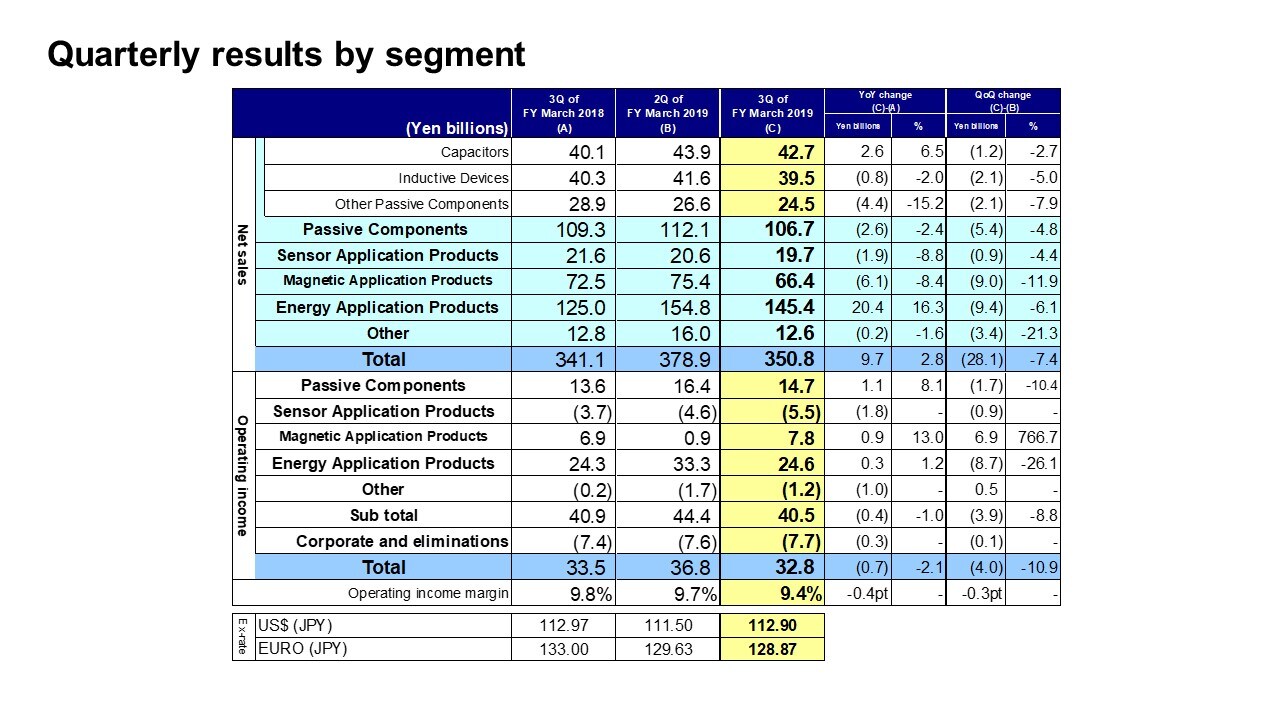

Quarterly results by segment

Next, I would like to explain the factors behind the changes in segment net sales and operating income from the second quarter to the third quarter of the fiscal year ending March 2019.

Let’s begin with net sales in the Passive Components segment. Net sales in this segment decreased by 5.4 billion yen, or 4.8%, from the second quarter. Ceramic Capacitor sales experienced a slowdown in demand in the automotive market, but saw strong sales for products with high reliability and redundancy characteristics. On the other hand, Capacitor sales slipped by 1.2 billion yen, or 2.7%, from the second quarter as sales of Aluminum Electrolytic Capacitors and Film Capacitors for use in automobiles and renewable energy in China declined. Sales of Inductive Devices decreased by 2.1 billion yen, or 5.0%, from the second quarter. As the deceleration of the Chinese economy becomes more apparent, sales have declined for the automotive market, smartphones, industrial equipment, and home electric appliance. In Other Passive Components, net sales declined by 2.1 billion yen, or 7.9%. In High-Frequency Components, sales of Ceramic Filters dropped sharply, mainly for Chinese smartphones. Sales of Piezoelectric Material Products and Circuit Protection Components declined for industrial equipment. Operating income in the Passive Components segment decreased by 1.7 billion yen, or 10.4%, from the second quarter. The main factors were lower sales and profits from Inductors and High-Frequency Components, despite maintaining a high level of profitability in Ceramic Capacitors.

In the Sensor Application Products segment, net sales fell by 0.9 billion yen, or 4.4%, from the second quarter. Sales of Temperature and Pressure Sensors were mainly level from the second quarter, and sales of Magnetic Sensors for smartphones decreased sharply. Sales of MEMS Sensors increased for smartphones but decreased for drones and game consoles. Operating income remained in profit due to level sales of Temperature and Pressure Sensors, despite a drop in sales of Magnetic Sensors. In MEMS Sensors, operating loss expanded as the acquisition-related costs for InvenSense increased by approximately 0.2 billion yen from 1.4 billion yen in the second quarter, reflecting an increase in PPA amortization costs, along with the further impact of a decline in sales. Overall operating loss for the Sensor Application Products segment increased by about 0.9 billion yen.

In the Magnetic Application Products segment, net sales decreased by 9.0 billion yen, or 11.9%, from the second quarter. HDD Heads sales fell by 15% as the shipment index decreased by around 16% from the second quarter, from 97 to 81. In HDD Suspension Assemblies, sales volume of Suspension Assemblies decreased by around 13%. Sales of Magnets decreased, reflecting a drop in demand for the industrial equipment market. Operating income in the Magnetic Application Products segment increased by 6.9 billion yen from the second quarter, but increased by 2.2 billion yen on a real basis excluding impairment losses of 4.7 billion yen recorded in the second quarter. Both HDD Heads and HDD Suspension Assemblies saw growth in profit despite lower sales, reflecting higher average sales prices due to a favorable shift in the product mix, while Magnets saw losses narrow, mainly reflecting a decrease in amortization costs due to impairment losses.

In the Energy Application Products segment, net sales decreased by 9.4 billion yen, or 6.1%, from the second quarter. In Rechargeable Batteries, sales decreased as sales for mobile device applications such as smartphones declined due to the deceleration of the Chinese economy, while sales for game consoles also decreased. Sales of Power Supplies for industrial equipment remained level. Operating income in the Energy Application Products segment was 24.6 billion yen, a decrease of 8.7 billion yen from 33.3 billion yen in the second quarter. In Rechargeable Batteries, profit deteriorated as earnings were weighed down by a decrease in marginal profit due to a drop in sales volume, as well as the impact of a time lag between reflecting the lower market price for cobalt materials in our sales prices and experiencing the effect of the lower market prices in a declining phase for cobalt material market prices. Profit was also affected by a loss on reduced capacity utilization due to the start of production adjustments in response to falling demand for smartphones from November.

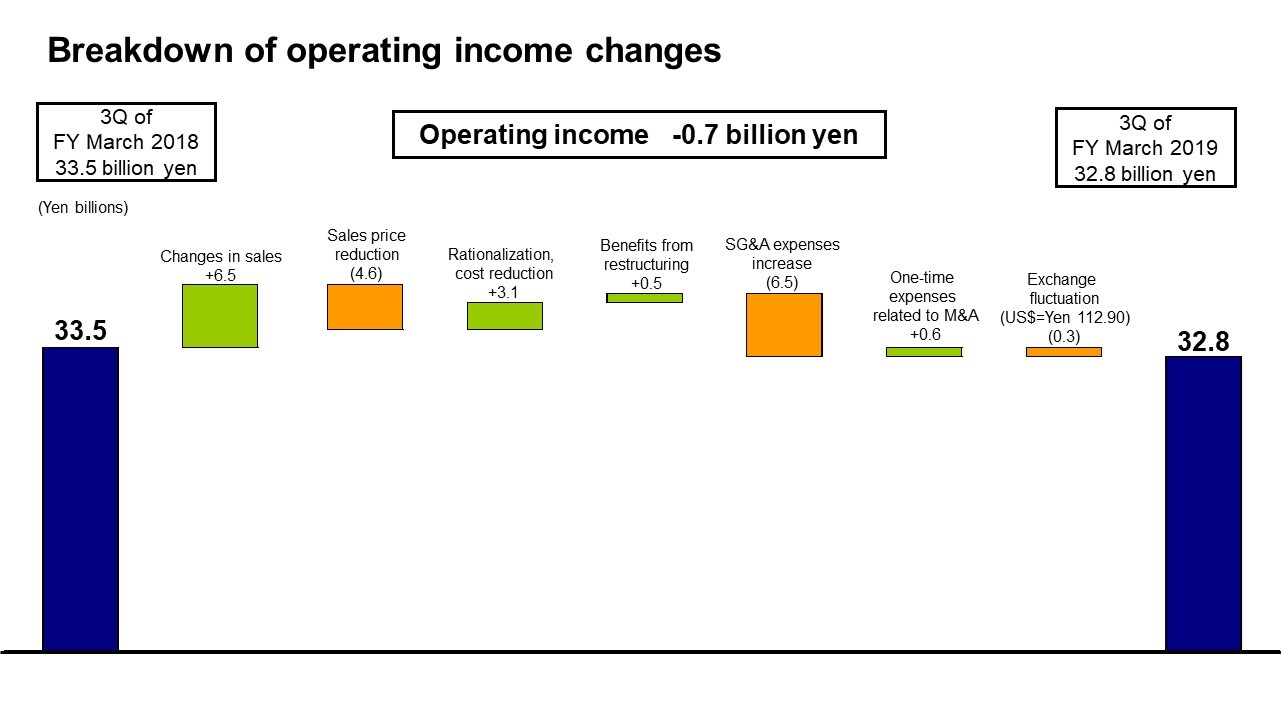

Breakdown of operating income changes

Next is the breakdown of the 0.7 billion yen year-on-year decrease in operating income. First, there was an increase in profits of approximately 6.5 billion yen due to an increase in net sales centered on Capacitors and Rechargeable Batteries, as well as an improvement in the product mix for HDD Heads and Suspension Assemblies. Then there was a negative impact of around 4.6 billion yen due to a drop in sales prices. However, the impact was absorbed for the most part by a saving of about 3.1 billion yen due to rationalization and cost reduction, as well as an impact of approximately 0.5 billion yen due to restructuring carried out in the fourth quarter of the previous fiscal year and impairment of Magnets. SG&A expenses increased by 6.5 billion yen due to increases in administration and development expenses in connection with business expansion in Rechargeable Batteries, as well as higher costs arising from strengthening the development framework in the Sensor business. The overall decrease of 0.7 billion yen includes a decrease of 0.6 billion in one-time M&A related expenses and a decrease of 0.3 billion yen from exchange rate fluctuations.

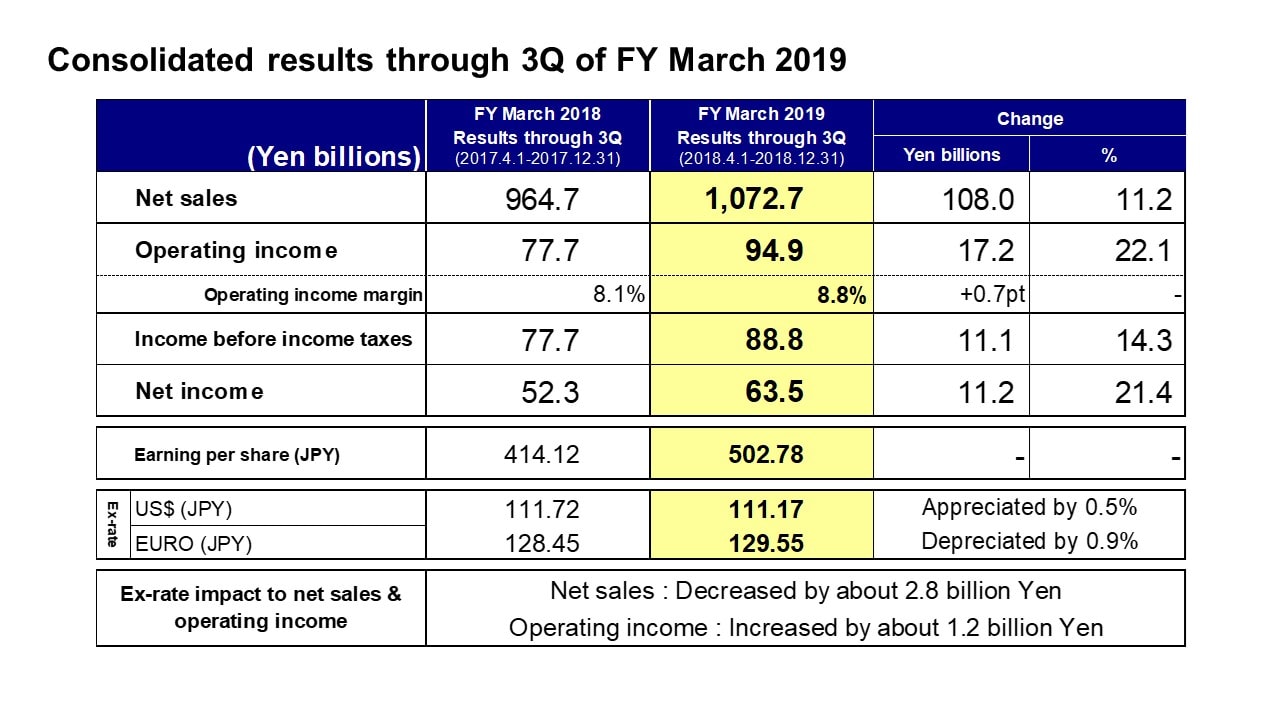

Consolidated results through 3Q of FY March 2019

Next, let's look at consolidated results for the first three quarters of the fiscal year ending March 2019.

For the first three quarters, net sales were 1,072.7 billion yen, up 11.2% year on year, and operating income was 94.9 billion yen, up 17.2 billion, or 22.1% year on year. Income before income taxes was 88.8 billion yen, and net income was 63.5 billion yen, up 21.4% year on year. Net sales, operating income, income before income taxes, and net income all reached new record highs.

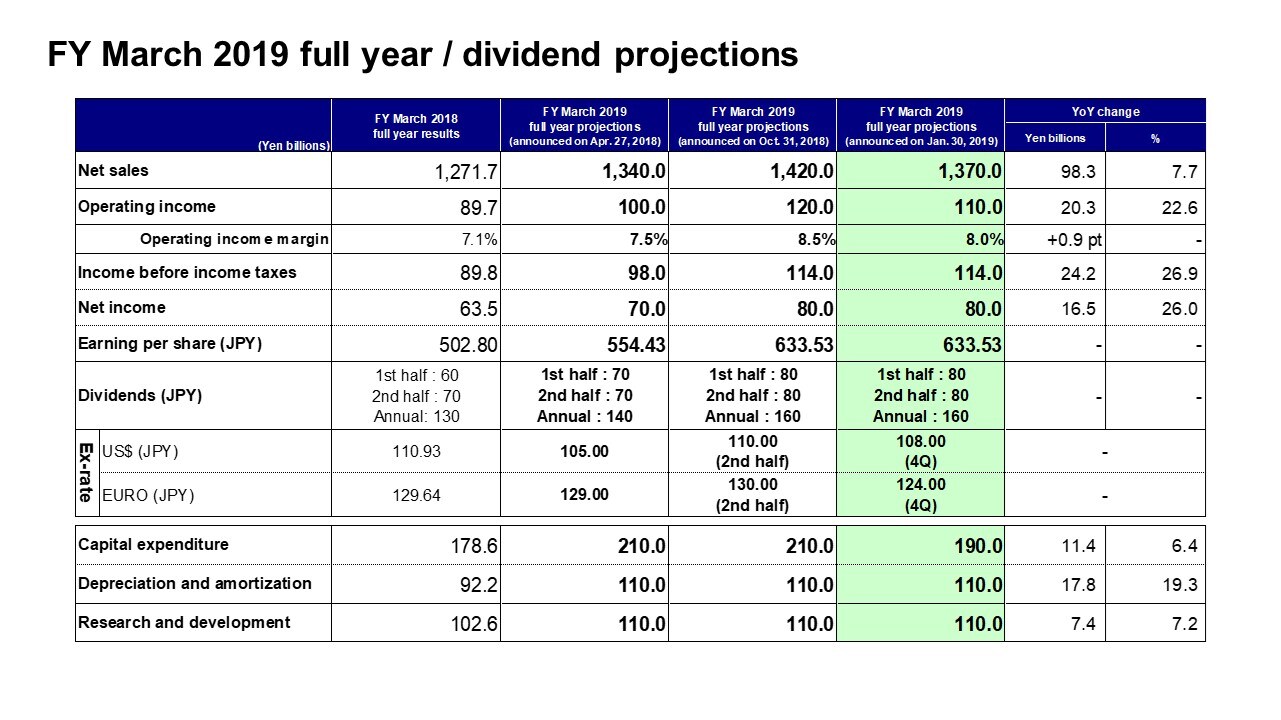

FY March 2019 full year / dividend projections

Finally, we come to our consolidated full-year earnings projections for the fiscal year ending March 2019.

As I mentioned at the start, we have experienced a rapid deterioration in orders across all our main market segments since the middle of the third quarter. Given the significant changes in order status for the second half of the fical year compared with our assumptions in the full-year earnings projections announced on October 31, 2018, we have revised the projections downward.

In net sales, there has been a general decline from the previously assumed level in sales for smartphones, automobiles, and industrial equipment, and the projection is revised down 50.0 billion yen from 1,420.0 billion yen to 1,370.0 billion yen. The operating income projection is revised down 10.0 billion yen from 120.0 billion yen to 110.0 billion yen, in line with the decrease in net sales. Projections for income before income taxes and net income have not changed.

The planned dividend is unchanged from the previous announcement, with an interim dividend of 80 yen and a year-end dividend of 80 yen for an annual dividend of 160 yen.

For the fourth quarter we have revised our exchange rate assumptions for a stronger yen, with 108 yen against the U.S. dollar and 124 yen against the euro.

With regard to capital expenditure, after carefully reviewing the execution timing and details of investments in light of the status of orders received, we have revised our planned expenditure amount downward by 20.0 billion yen from the previous announcement to 190.0 billion yen. However, there are no changes to the Medium-Term Plan, or to the medium-term capital expenditure plan. There are also no changes to our planned depreciation and amortization or research and development expenses.

That concludes my presentation. Thank you very much for your attention.