[ Financial Results for Fiscal 2015 Performance Briefing ]Consolidated Full Year Projections for FY March 2016 and Mid-Term Policy

Mr. Takehiro Kamigama

President & CEO

Good Afternoon. I’m Takehiro Kamigama. It’s nice to see so many of you in attendance today. I will be picking up the presentation from here to go over our consolidated projections for the fiscal year ending March 31, 2016, as well as our mid-term business policy.

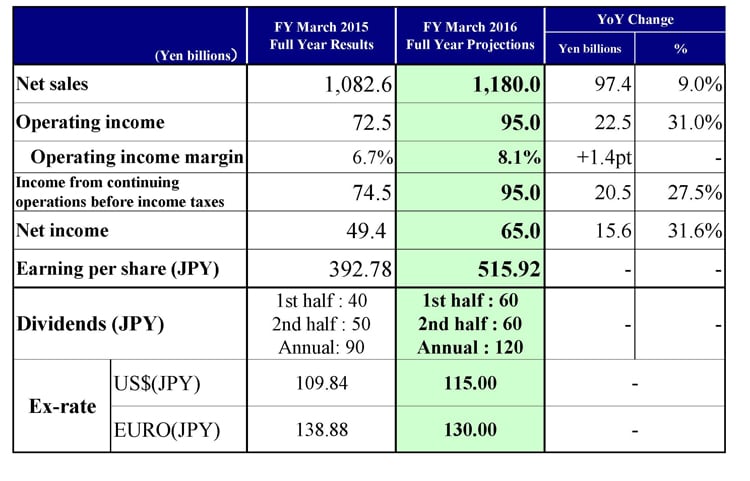

FY March 2016 Full Year / Dividend Projections

Let’s begin with a look at the projections and our dividend outlook. We are projecting net sales of ¥1,180 billion, operating income of ¥95 billion, for an 8.1% operating income margin, and a pretax income from continuing operations of ¥95 billion. That works out to a net income of ¥65 billion, or earnings per share of ¥515.92. We plan to increase our dividend by ¥10 per share in comparison to the second half of the March 2015 fiscal year, and expect to pay interim and final dividends of ¥60 per share, for an annual dividend of ¥120 per share. Our forecasts this term assume an exchange rate of ¥115 to the U.S. dollar and ¥130 to the euro.

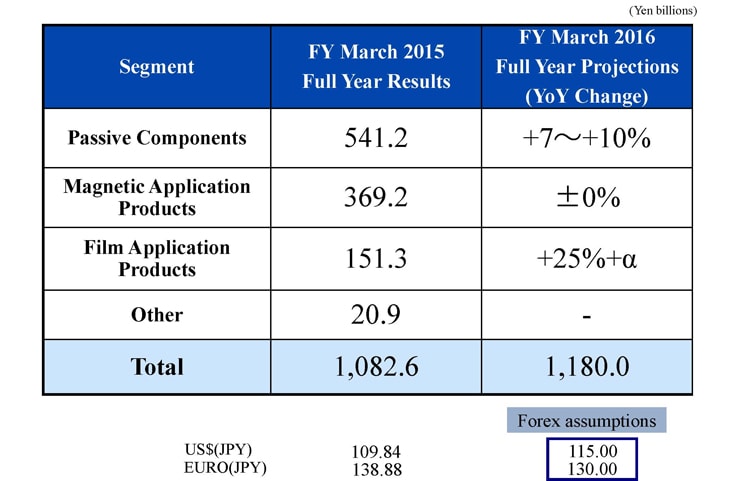

Projections for FY March 2016 -Image of change in sales

This next slide shows the sales projections by segment for the year ending March 2016. We see passive components sales rising roughly 7 to 10% on the back of continued strong performance in high-frequency components and inductive devices. We forecast a marginal decline in HDD heads, but sales in the magnetic application products segment should remain flat for the most part. We project sales in our film application products segment to increase by more than 25%. In summation, this would bring TDK’s consolidated net sales to ¥1,180 billion.

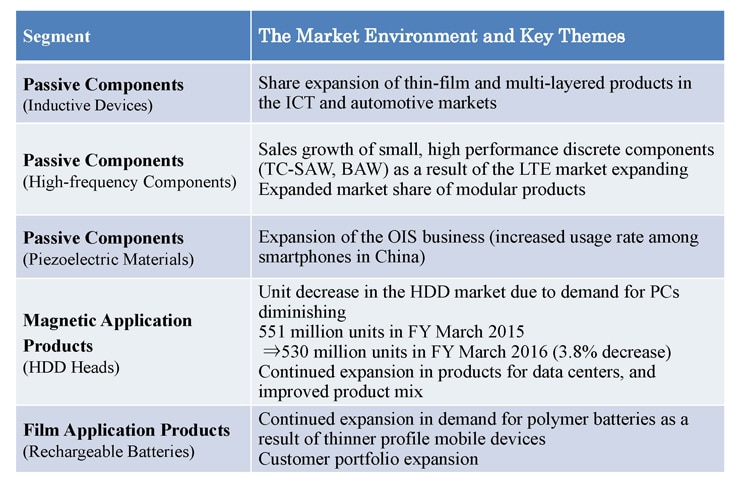

Points of FY March 2016

The points we want to emphasize in the March 2016 fiscal year have to do with our five priority businesses. Let me explain. In inductive devices, TDK expects to expand its share of thin-film and multi-layered products in the ICT and automotive markets. As for high-frequency components, the LTE market is expanding. And we expect the sales of our SAW, TC-SAW and BAW filters and other discrete components, as well as our share of modular products among major customers to grow as we ride the trend in this segment for smaller and higher-performance components. In piezoelectric material products, we expect the usage of our OIS camera module actuators for stabilizing video and photographic images to expand among smartphones sold in China.

As for magnetic application products and HDD heads in particular, as you know, forecasts say sales volumes are about to decline in the PC market. In line with this, we are also projecting sales volume in the HDD market to decline by around 20 million units, from 551 million in the March 2015 fiscal year to 530 million in the March 2016 fiscal year. Then again, we are expecting our segment product mix to improve by contrast to this, as sales of our magnetic application products for data centers have been picking up gradually.

Last but not least, let’s take a look at film application products; and at rechargeable batteries in particular. The point here is that we are expecting the take-up of lithium polymer batteries to accelerate as mobile device profiles become even slimmer. In other words, we are expecting further changeover from square slabs of lithium-ion batteries to thinner lithium polymer batteries. In tandem, we are also foreseeing an expansion in the market for rapidly rechargeable batteries.

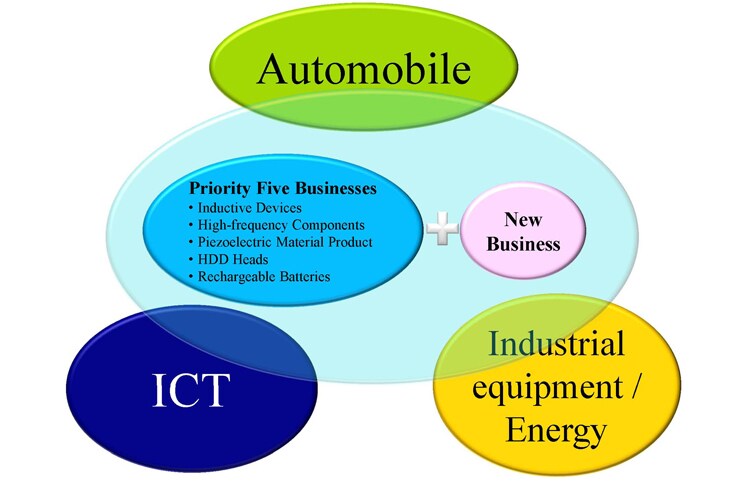

Priority Markets, Priority Businesses and New Business

Next, I would like to provide an overview of TDK’s mid-term policy. This is as it pertains to our three-year plan from the March 2016 fiscal year through the March 2018 fiscal year. As they were previously, TDK’s three priority markets are the automobile, ICT, and industrial equipment/energy markets. In these markets, our five priority businesses have been inductive devices, high-frequency components, piezoelectric material products, HDD heads, and rechargeable batteries. TDK’s policy is to continue expanding in these five businesses as a matter of course, but in addition the Company would like to put an effort into new businesses in growth fields.

Sales Growth Projections by Priority Markets

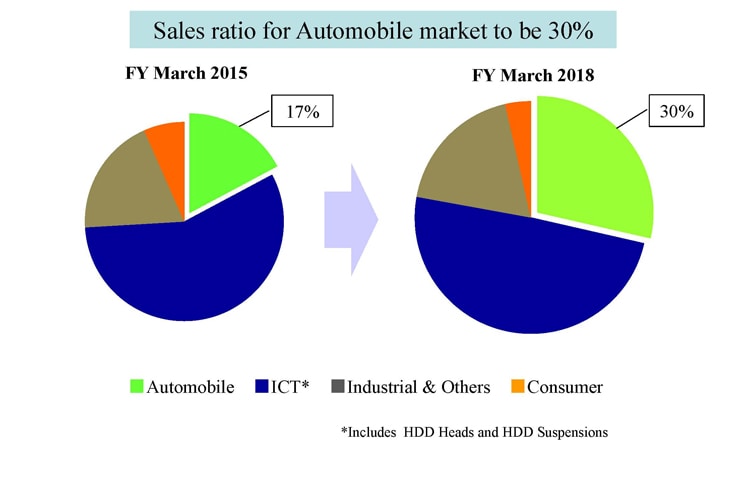

In terms of a sales breakdown of the three priority markets, we want to aim at increasing our sales exposure to the automobile market from 17% at present to 30% by the March 2018 fiscal year.

New businesses in growth fields

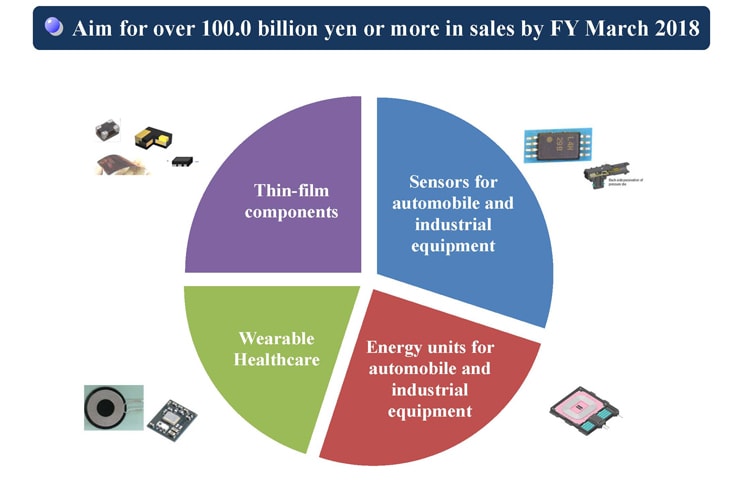

Let’s now turn to taking a look at the new businesses in growth fields I just mentioned. As a headline target, we are aiming for more than ¥100 billion in sales in such new businesses by the March 2018 fiscal year. I think this pie chart will give you a better idea. First, we have the field of sensors for automobiles and industrial equipment. Among the new businesses we envision in this field are TMR magnetic sensors and angle sensors, as well as pressure sensors and barometric pressure sensors. In the field of energy units, we are forecasting business opportunities in industrial equipment to present themselves first, but will also look to expanding them into the automobile market. New businesses we would like to expand in this field include wireless power transfer devices and chargers, DC-DC converters, and batteries. In the field of wearable devices, we would like to concentrate on the healthcare domain in particular. Here, too, we see opportunities for sales expansion of wireless power transfer devices and chargers, miniature modules equipped with TDK’s semiconductor-embedded substrate (SESUB), batteries, and the like. The field of thin-film components will be a matter of applying our accumulated thin-film technologies in new products, which we aim to concentrate on selling in the ICT, automobile and other core markets.

Sales Growth of Priority Five Businesses & New Business

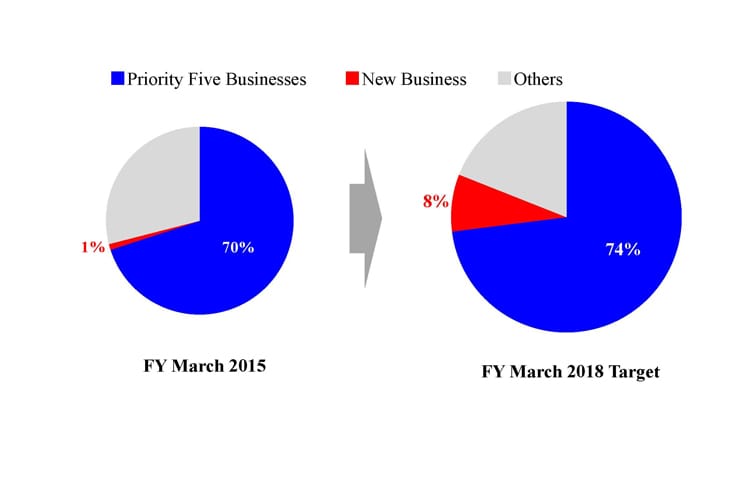

The next pie charts illustrate how we foresee new business as a mix of TDK’s sales. The pie chart for the fiscal year ended March 2015 shows new business was 1% of TDK’s sales. As shown in the pie chart to the right, our goal is to increase the mix of new business to around 8% of total sales by the March 2018 fiscal year.

Operating results and mid-term projections

The next slide is a prospective trend diagram of the mid-term financial performance we envision. The bar to the far right approximates the performance TDK is targeting for the March 2018 fiscal year. The purple bars represent operating income. If you notice, the bars for sales and operating income are about the same height in the March 2018 fiscal year. What we mean to convey by this image is that we are aiming to boost our operating income margin to 10%.

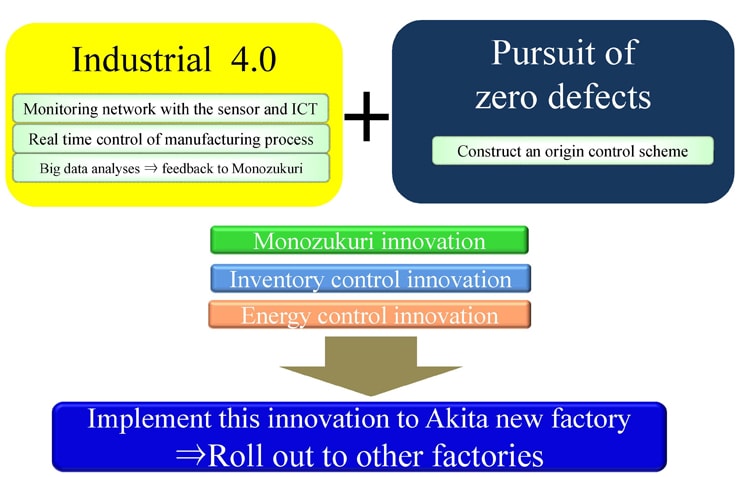

Monozukuri innovation (Zero defect quality)

Next, I would like you to take a look at a block diagram of TDK’s Monozukuri Innovation, which we announced the other day in a press release. This plan calls for investing ¥25 billion in the construction of two new factories in Akita going forward. TDK sees a need to innovate monozukuri (our manufacturing approach) in pursuit of zero defects, based on the Industrial 4.0 concept in the news these days. We are now making steady progress designing the production lines and engineering their flow and organization of procedures for the new monozukuri framework and system we will be introducing to the two factories in Akita. The breakthroughs we conceive will be rolled out not only in Akita, but also to the core products and new products we manufacture in our existing factories. The monozukuri we want to achieve is the capability to manufacture a product of the same quality and performance anywhere in the world. Once they are introduced to our new factories in Akita, we will be rolling out our new monozukuri breakthroughs globally to all of our production sites.

Growth Investment

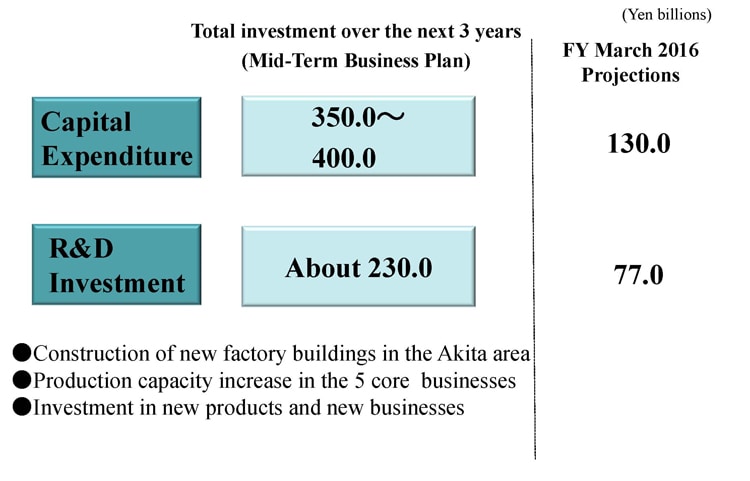

Let’s now turn to examine the growth investments in store at TDK. As shown in this slide, our budget for capital expenditure is ¥350 billion to ¥400 billion over the next three years, from FY March 2016 through FY March 2018. Included in this is the construction of the factories in Akita I just mentioned, as well as expenditure to streamline and increase output at our five priority businesses. Growth investment in new products and new businesses is also part of the plan. As you can see, we are planning to allocate ¥130 billion in capital expenditure for the March 2016 fiscal year.

As for R&D, we plan to invest approximately ¥230 billion over the next three years. Of that, ¥77 billion is earmarked for investment in the March 2016 fiscal year.

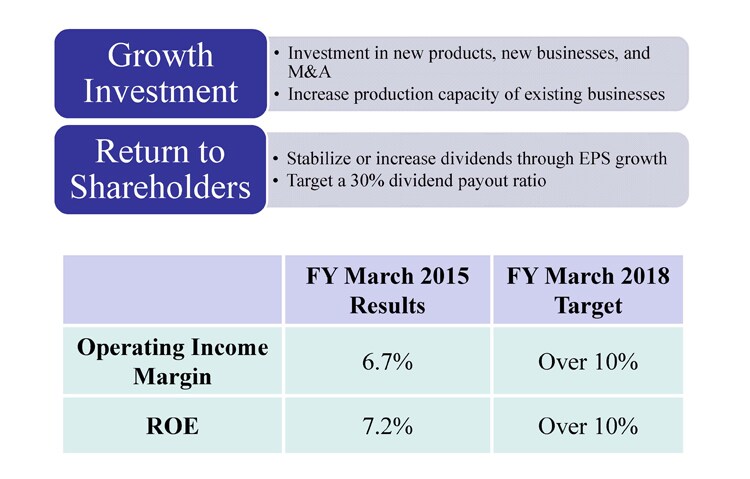

Management Target in Mid-Term

Lastly, I would like to go over TDK’s mid-term management target with you. In business, we will realize growth by building out the five priority businesses mentioned throughout this presentation, and by leveraging means that include growth investments, new business expansion, and M&As. As for return to shareholders, we will maintain a policy of stable dividends backed by growth in EPS, and have set a 30% dividend payout ratio as our target. We will probably fall short of that target this fiscal year, but we ask for your understanding as we shift some of that cash flow priority to growth investments. As an outcome, our target by the fiscal year ending March 2018 is to make progress achieving both an operating income margin and ROE exceeding 10%. That concludes my presentation. Thanks for listening.