[ 2nd Quarter of fiscal 2015 Performance Briefing ]Consolidated Full Year Projections for FY March 2015

Mr. Takehiro Kamigama

President & CEO

My name is Kamigama. Thank you very much for joining us today.

Let me take you through the consolidated full-year projections for the fiscal year ending March 2015.

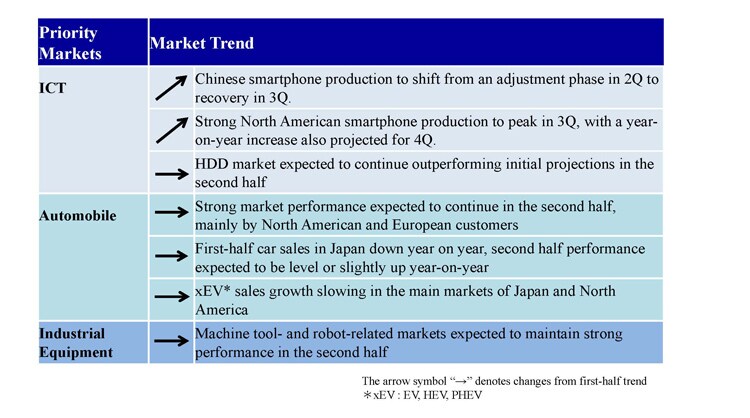

Market trend in the second half

Let me start by reviewing market trends for the second half of fiscal 2015. In the ICT segment, the Chinese smartphone market was quite strong in the first quarter, but shifted into a mild adjustment phase in the second quarter. However, the market is once again picking up in the third quarter. The North American smartphone market is also robust, and we expect that production will peak in the third quarter. We generally experience a fairly significant drop in the fourth quarter every year, but we expect that the decline in the fourth quarter will not be that significant this fiscal year.

We expect the HDD market to outperform our initial projections in the second half. We are seeing signs of growth in the nearline market. And we expect the automotive market, mainly European and North American manufacturers, to also remain robust in the second half. Vehicle sales volumes in Japan dropped from the previous year in the first half of this fiscal year and we think it will be level or slightly up in the second half. In the EV, HEV, and PHEV markets, sales growth in the main markets of Japan and North America is slowing down. Lastly, we expect the machine tool and robotics markets in the industrial equipment segment to maintain a strong performance in the second half.

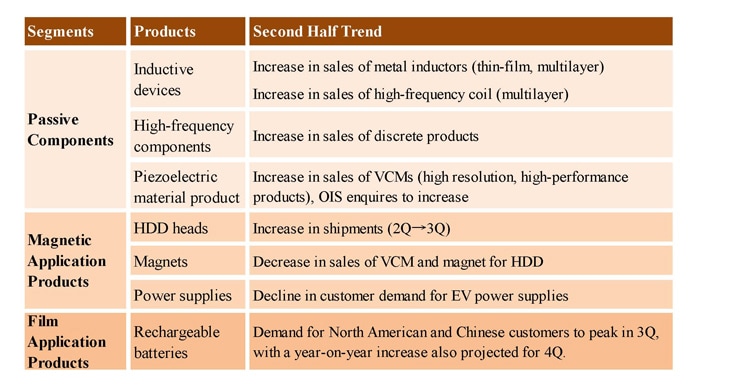

Second half trend of main products

Now, I would like to briefly touch upon the second half trends for our main products. First, in passive components, we are seeing an increase in sales of multilayer thin-film metal inductors. The demand for multilayer high-frequency coils is also rising. In high-frequency components, sales of discrete products, including SAW and BAW products, are expected to grow. In piezoelectric material products, we are also expecting an increase in sales of VCMs used in camera modules. In particular, we are receiving many enquiries on image stabilization actuators for OIS.

Moving on to magnetic application products, as I mentioned earlier, we expect the shipments of HDD heads to increase in the third quarter from the second quarter. Sales of magnets, mainly sales of VCMs for HDDs are unfortunately expected to decline. In power supplies, we anticipate sales of EV power supplies to decline due to a slip in customer demand. Finally, in rechargeable batteries, we are seeing the demand for rechargeable batteries from North American and Chinese customers peak in the third quarter and are projecting a year-on-year increase for the fourth quarter without any significant drop.

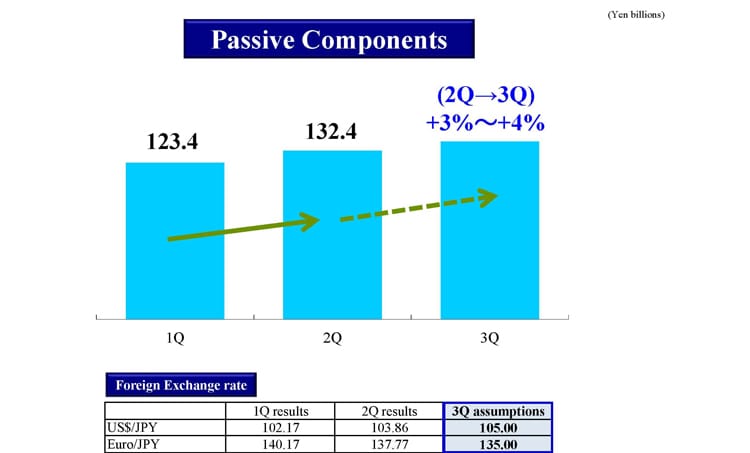

Projections for 3Q of FY March 2015 -Image of change in sales

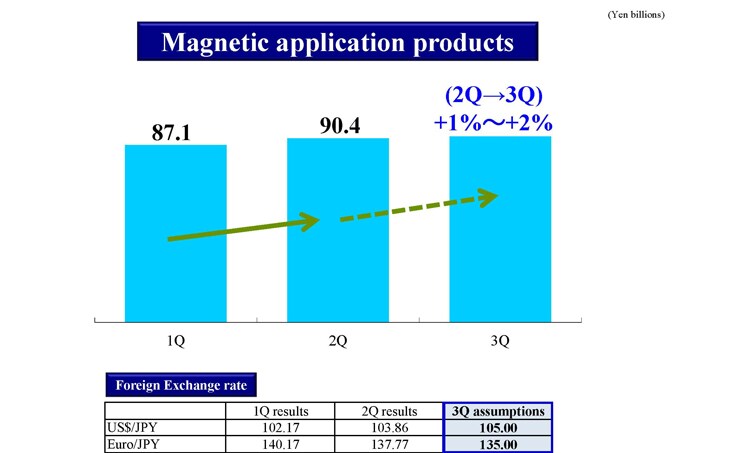

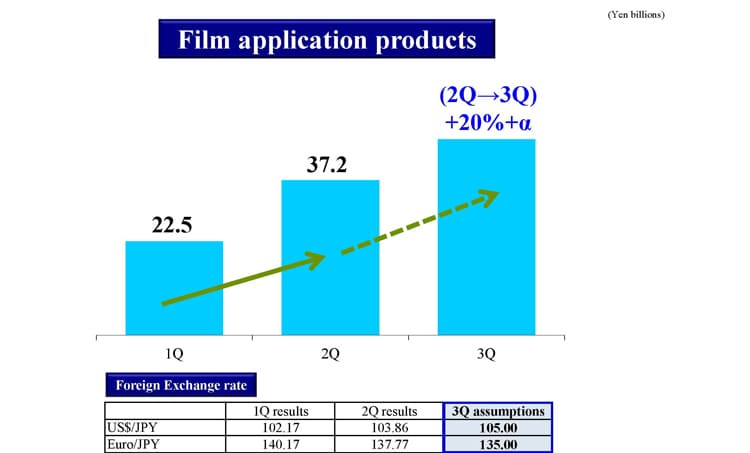

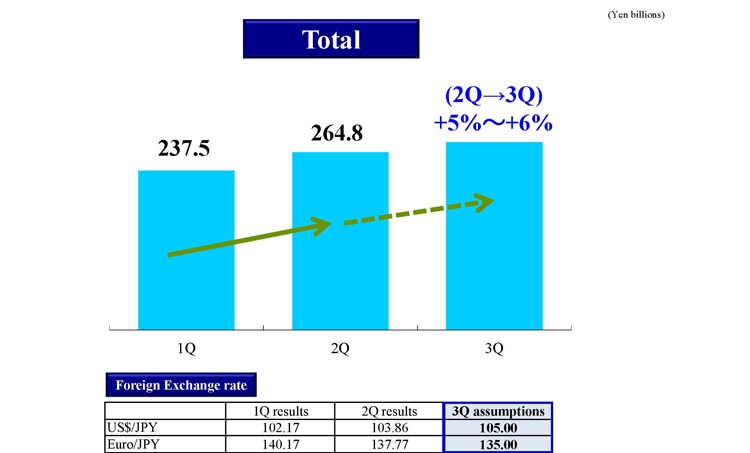

Next, I will talk about the sales projections for the third quarter by segment. The graphs in the slides show changes in sales for the passive components, magnetic application products, and film application products segments, and total company-wide sales. First, we are expecting a 3 to 4% increase in sales of passive components from the second quarter to the third quarter. We expect a 1 to 2% growth in sales of magnetic application products since we expect to have a volume increase in HDD heads, while sales of magnetic application products remain sluggish. For film application products, we are projecting a more than 20% increase in sales in the third quarter on top of the 65.3% growth in sales recorded from the first to the second quarter. Overall, we expect a company-wide sales growth of from 5 to 6%.

FY March 2015 Full Year / Dividend Projections

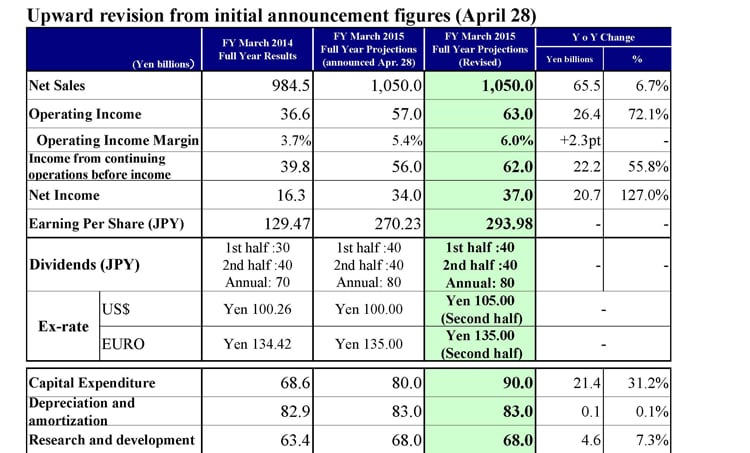

Finally, I would like to talk about the projected consolidated financial results for the fiscal year ending March 2015 as well as our forecast for dividend payments. Our projected net sales are 1,050 billion yen and operating income is 63 billion yen, revised upward somewhat from the previous projection of 57 billion yen. The projected income before tax is 62 billion yen, with a net income of 37 billion yen, and earnings per share of 293.98 yen. As we reported earlier, we expect our interim dividend to be 40 yen per share and the term-end dividend to be 40 yen per share, and so the annual dividend would be 80 yen per share.

We assume foreign exchange rates for the second half to be 105 yen to the dollar and 135 yen to the euro. In the previous announcement, we stated that our capital expenditure would be 80 billion yen but we have now decided to push forward our investment for a production increase and accordingly, the revised capital expenditure will be 90 billion yen. There are no revisions to the previous forecasts for depreciation and amortization of 83 billion yen, and research and development costs of 68 billion yen.

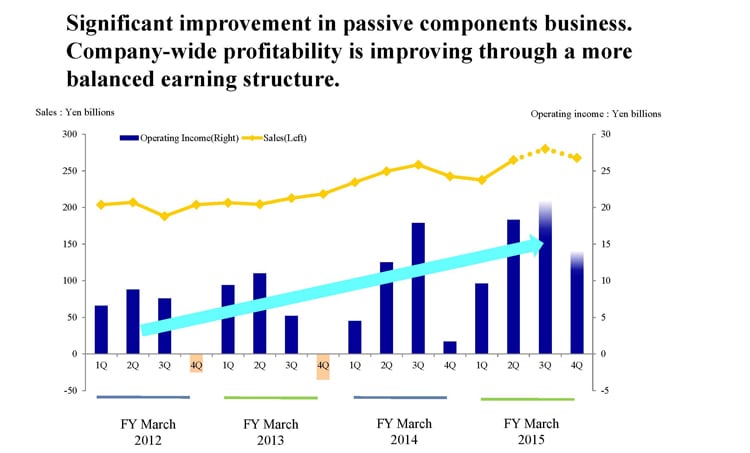

Sales and operating income trend

In closing, I would like to point out that company-wide profitability is improving through a more balanced earnings structure due to significant improvements in the passive components business. All of our business segments have now become profitable although we can further push up our profitability going forward. The graph in the slide shows our operating results since the fiscal year ending March 2012. As you can see, we have previously experienced drops in profits in the fourth quarter. However, as I stated earlier, we do not expect to experience such a significant decrease as in previous fiscal years.

This concludes my briefing.

Thank you all very much for your attention.