[ 2nd Quarter of fiscal 2015 Performance Briefing ]

Mr. Takakazu Momozuka

Corporate Officer

My name is Momozuka. Thank you very much for joining us today for our performance briefing for the first half of the fiscal year ending March 2015, despite your busy schedule. We are honored to have a large audience today.

I will walk you through the outline of our operating results.

Key points concerning earnings for First Half of FY March 2015

First, the key points in our earnings results for the first half of the fiscal year ending March 2015. Sales were 502.3 billion yen, the highest ever recorded. Operating income was 27.9 billion yen, an increase of 64% year-on-year. In particular, passive components marked record highs in both sales and operating income in a six-month comparison. Operating income has doubled year-on-year. There were strong sales in the automobile market as well as smartphone markets in China and North America. These robust sales of passive components are behind the strong overall earnings results for the first half of this fiscal year. The first half operating income for film application products was at the same level as the previous fiscal year despite a slow start in the first half of this fiscal year. Rechargeable batteries, which are the main products in this segment, saw strong sales to smartphone customers from the second quarter.

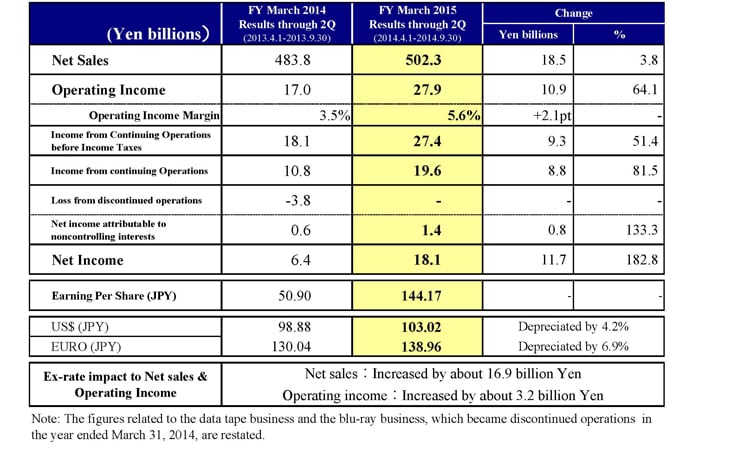

Consolidated Results for First Half of FY March 2015

Now, I would like to talk more about the operating results for the first half of the fiscal year ending March 2015. There are no discontinued operations in the first half.

Net sales grew by 3.8% or 18.5 billion yen year-on-year to 502.3 billion yen. Operating income was up 64.1% or 10.9 billion yen to 27.9 billion yen. The operating income margin was up 2.1 percentage points to 5.6%. Income before taxes was up 51.4% or 9.3 billion yen to 27.4 billion yen. Net income rose 182.8% or 11.7 billion yen to 18.1 billion yen. Earnings per share were 144.17 yen.

The average exchange rates for the first half were 103.2 yen to the dollar, a depreciation of 4.2% in the yen, and 138.96 yen to the euro, a depreciation of 6.9% in the yen. The impacts of these exchange rates translate into an increase of 16.9 billion yen in sales and an increase of 3.2 billion yen in operating income. In terms of the foreign exchange sensitivity, we estimate that we would receive an impact of approximately 1.4 billion yen in operating income annually for a change of one yen to the dollar.

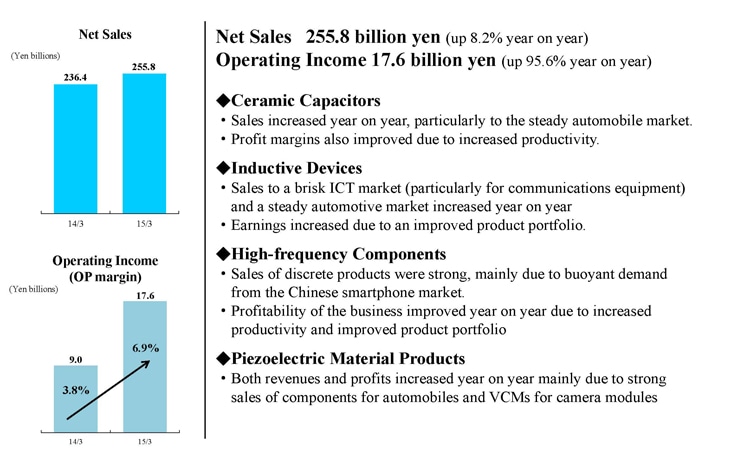

First Half Results - Passive Components Segment

Now, let’s turn to the operating results by business segment for the first half of fiscal 2015. Net sales of passive components were up 8.2% year-on-year to 255.8 billion yen, and the operating income rose 95.6% to 17.6 billion yen. All passive component products recorded increases in sales and income year-on-year. Sales of ceramic capacitors increased year-on-year, particularly to the steady automobile markets. Profit margins also improved due to increased productivity. Sales of inductive devices to the brisk ICT market, particularly for communications equipment, and to the steady automotive market increased year-on-year. Earnings increased significantly due to an improved product portfolio.

In high-frequency components, sales of discrete products were strong, mainly due to buoyant demand from the Chinese smartphone market. The profitability of the business improved significantly due to increased productivity and an improved product portfolio, now ensuring stable income streams. Both sales and profits for piezoelectric material products increased year-on-year mainly due to strong sales of the components for automobiles and VCMs for camera modules.

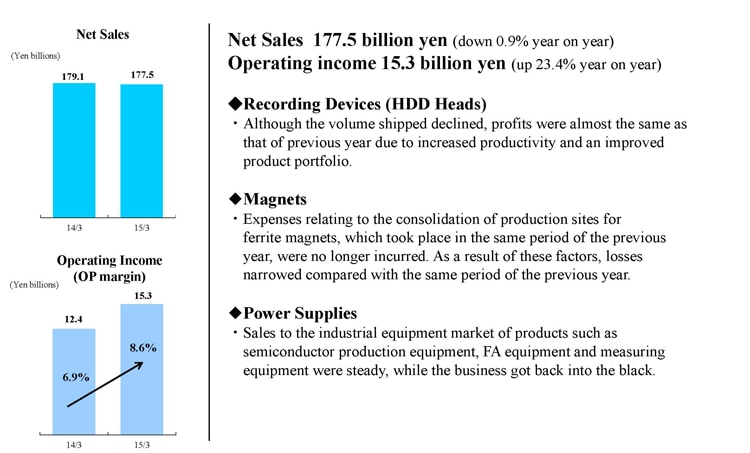

First Half Results - Magnetic Application Segment

Moving on to the magnetic applications segment, net sales were down 0.9% year-on-year to 177.5 billion yen and operating income was up 23.4% to 15.3 billion yen. Although the shipment volume declined for recording devices (HDD heads), profits were almost the same as for the previous year due to increased productivity, an improved product portfolio and reductions in fixed costs. The losses narrowed for magnetic products compared with the same period in the previous year. This is mainly due to the fact that expenses related to the consolidation of production sites for ferrite magnets, which took place in the same period of the previous year, were no longer incurred, resulting in a recovery of the operating rate. In power supplies, sales of semiconductor production equipment, etc. to the industrial equipment market were solid. As a result, the business moved back into the black.

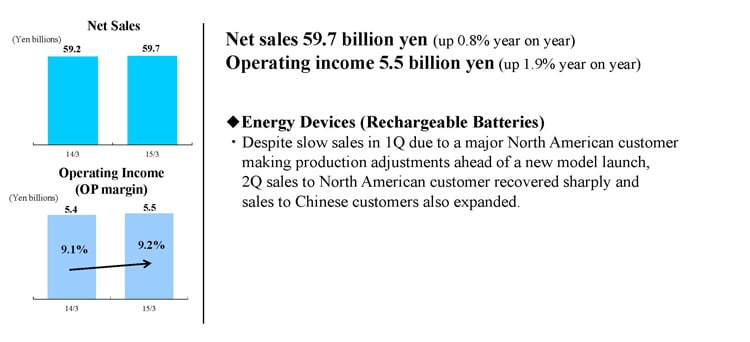

First Half Results - Film Application Segment

Let’s look at the film applications segment. Sales increased 0.8% year-on-year to 59.7 billion yen. Operating income was up 1.9% to 5.5 billion yen. Despite slow sales of rechargeable batteries―the main product in this business segment―in the first quarter due to a major North American customer making production adjustments ahead of a new model launch, sales to this customer recovered sharply in the second quarter as scheduled. Sales to Chinese customers also expanded in the second quarter. As a result, in the first half of fiscal 2015 we generated profits which are about the same level compared with the previous year.

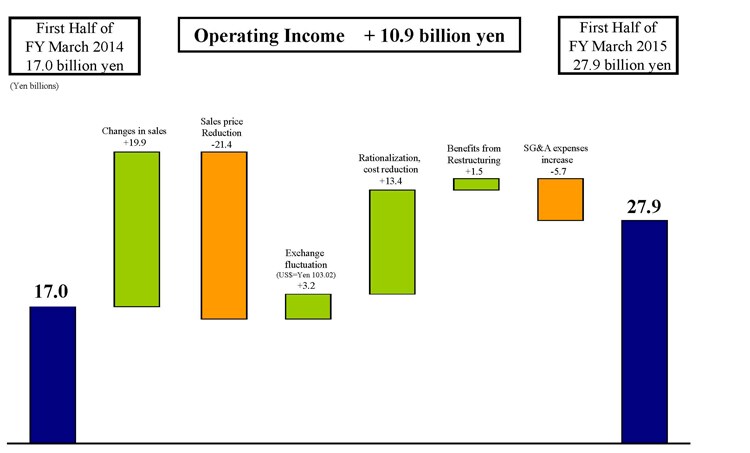

Breakdown of Operating Income Changes (First Half)

We now turn to the breakdown of operating income changes for the first half of fiscal 2015 versus the previous year. We had an increase in operating income of approximately 19.9 billion yen due to an increase in sales which include the benefits from the improved operating rate and product portfolio. Sales of passive components for the automotive and ICT markets for all product lineups increased year-on-year. Improvements to the product mix also contributed to the increase in sales, and for the magnetic products business, recovery of the operating rate, which was down during the previous fiscal year due to consolidation of the Chinese production sites, contributed positively.

Sales price reductions pushed down operating income by 21.4 billion yen. The favorable foreign exchange rate due to the cheaper yen contributed approximately 3.2 billion yen to the increase. Rationalization and cost reductions pushed up operating income by approximately 13.4 billion yen. This includes improved productivity and rationalization efforts in HDD heads and passive components, as well as reductions in material costs. The benefits from restructuring contributed to an increase of approximately 1.5 billion yen. Increases in SG&A expenses resulted in a decrease of approximately 5.7 billion yen.

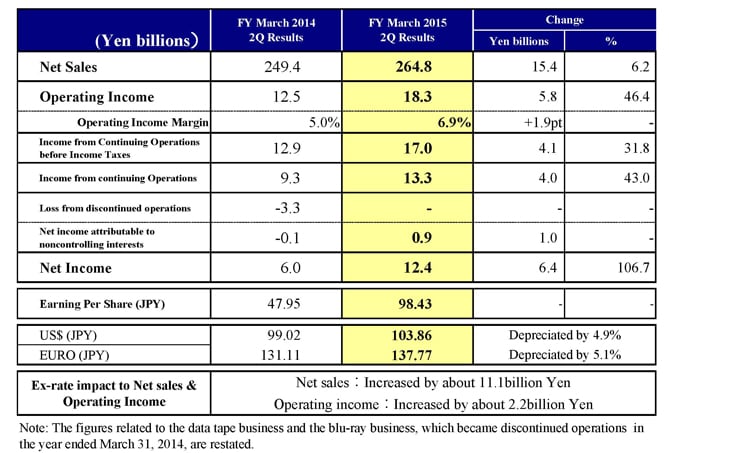

Consolidated Results for 2Q of FY March 2015

Now let me turn to the consolidated operating results for the second quarter of fiscal 2015. Net sales increased 6.2% year-on-year to 264.8 billion yen. Operating income was up 46.4% to 18.3 billion yen. Net income rose by 106.7% to 12.4 billion yen.

Quarterly Results by Segment

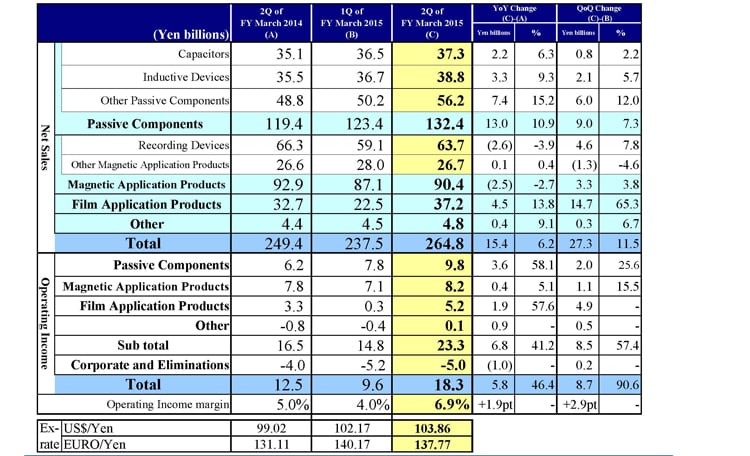

Next, I will go over the factors contributing to the changes in sales and operating income by segment from the first quarter to the second quarter of fiscal 2015. Net sales of passive components for the second quarter increased to 132.4 billion yen from 123.4 billion yen in the first quarter, an increase of 7.3% or 9 billion yen. Of the total, sales of capacitors rose 2.2% or 800 million yen to 37.3 billion yen. Sales to automotive and industrial equipment markets were robust. Next, sales of inductive devices were up 5.7% or 2.1 billion yen to 38.8 billion yen. Sales to ICT communications equipment markets including sales to the North American smartphone customer who launched a new model in the second quarter grew significantly in addition to continued robust sales to Chinese smartphone customers following the first quarter.

Next, sales of other passive components were up 12.0% or 6 billion yen to 56.2 billion yen in the second quarter. As with inductive devices, we saw strong sales of high-frequency components on the back of robust demand from Chinese smartphone customers and the launch of the new smartphone model by our North American smartphone customer. Operating income for passive components was up 25.6% or 2 billion yen to 9.8 billion yen from 7.8 billion yen in the first quarter. Sales to automotive markets have been strong and coupled with strong demand from Chinese smartphone customers and the new model launch by the North American smartphone customer, operating rates for respective products also remained high. In high-frequency components, sales of highly profitable discrete products have been growing from the first quarter and productivity has also improved. As a result, profitability has continued to rise.

Let’s turn now to magnetic application products. Net sales were up 3.8% or 3.3 billion yen, from 87.1 billion yen to 90.4 billion yen in the second quarter. Sales of recording devices increased 7.8% or 4.6 billion yen to 63.7 billion yen in the second quarter. The shipment volume of HDD heads was higher than the previous projection due to solid production of HDDs for gaming consoles and personal computers, as well as increased shipments of nearline storage to data centers.

Sales of other magnetic application products were down 4.6% or 1.3 billion yen to 26.7 billion yen. While sales of other magnetic products to the industrial equipment market, which include magnetic products and power supplies remained almost flat, sales to ICT and the automotive market decreased. Operating income for magnetic application products increased by 15.5% or 1.1 billion yen, from 7.1 billion yen in the first quarter to 8.2 billion yen in the second quarter. Although operating income for recording devices increased due to the rise in the shipment volume of HDD heads, operating income for other magnetic application products was slightly down due to a drop in sales.

Turning now to film application products, net sales in the second quarter increased 65.3% or 14.7 billion yen to 37.2 billion yen from 22.5 billion yen in the first quarter. Operating income rose 4.9 billion yen to 5.2 billion yen from 0.3 billion yen in the first quarter. In the first quarter, sales of rechargeable batteries to our major customer remained low, but it picked up from the second quarter with the new shipments starting for the new model. Business with the Chinese market also expanded. As a result, in the second quarter, both sales and income have recovered. Sales of other products increased by 0.3 billion yen to 4.8 billion yen and operating income improved by 0.5 billion yen to 0.1 billion yen, from an operating loss of 0.4 billion yen in the first quarter. This is due to the improved profitability of new business products. Corporate and eliminations was 5 billion yen in the second quarter from 5.2 billion yen in the first quarter; the impact was reduced by 0.2 billion yen.

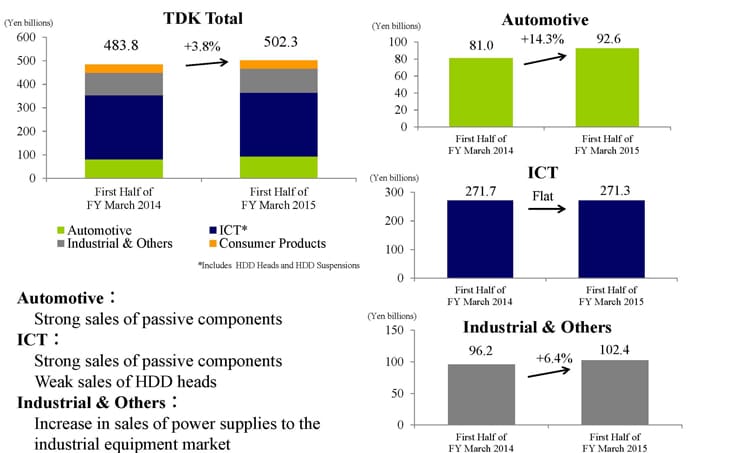

Sales Results by Priority Markets

Let me now talk about sales in three priority markets in the first half of fiscal 2015. In the automotive market, sales of passive components grew significantly on the back of a solid North American market. Sales rose in all product lineups of passive components including inductive devices and ceramic capacitors, and were up 14.3%. For the ICT market, sales to Chinese smartphone customers increased while sales of HDD heads decreased. As a result, overall sales were flat. In industrial equipment and other markets, sales grew 6.4% due to expanded sales of power supplies and passive components for industrial equipment.

Recording Device Business

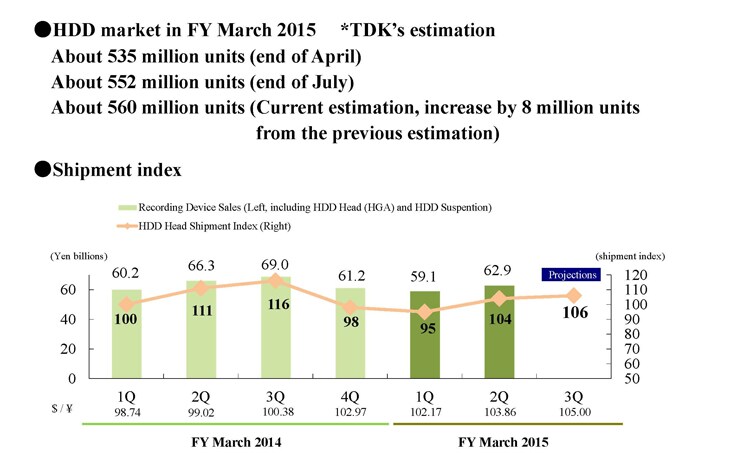

Next, I will talk about the recording device business, specifically, the estimation of the HDD market for the fiscal year ending March 2015. Previously, at the end of July, we raised our estimate to 552 million units from the estimate of 535 million units at the end of April. Now, once again, we are raising our estimate by 8 million units. Accordingly, our current estimate is approximately 560 million units. In line with that we have projected shipment trends for HDD heads. Taking the shipment volume for the first quarter of the fiscal year ended 2014 as 100, we project that it will rise to 104 in the second quarter of fiscal 2015 and to 106 in the third quarter of fiscal 2015.

This concludes my summary of our operating results for the first half of fiscal 2015.

Thank you very much for listening.