[ 1st Quarter of fiscal 2023 Performance Briefing ]Consolidated Results for 1Q of FY March 2023

Consolidated Full Year Projections for FY March 2023

Mr. Tetsuji Yamanishi

Executive Vice President

Hello, I’m Tetsuji Yamanishi, Executive Vice President of TDK. Thank you for taking the time to attend TDK’s performance briefing for the first quarter (April to June) of the fiscal year ending March 2023. I will be presenting an overview of our consolidated results.

Key points concerning earnings for 1Q of FY March 2023

First, let’s take a look at the key points concerning the earnings for the first quarter. During the first quarter of the fiscal year ending March 2023, the Chinese economy was significantly affected by the downturns in production activities and social and economic activities as the Chinese government, which promotes a zero-COVID policy, implemented large-scale lockdowns due to the resurgence of the COVID-19 pandemic. In addition, heightened geopolitical risks in line with Russia’s invasion of Ukraine significantly impacted the global economy. Amid such situation, demand for electronic components slowed due to the ongoing supply chain constraints. Despite this business environment, on the back of an expansion of customer and application bases, which has been promoted by each business segment, on top of the positive effect of the rapid depreciation of the yen, net sales increased 21.5% year on year, setting a record high on a quarterly basis, and operating profit increased 42.4% year on year.

In the automotive market, while supply chain constraints such as semiconductor shortage continued, and automobile production volume remained at a level lower than in the previous year, component demand remained brisk thanks to an increase in the xEV ratio. As a result, sales of Passive Components and Sensors increased.

In the ICT market, demand related to PCs and tablets, which had been strong amid the COVID-19 pandemic, started to decline, and demand related to smartphones significantly declined, mainly in China. Reflecting sluggish component demand, sales volume of Rechargeable Batteries decreased. In addition, HDD shipment volume decreased year on year due to the significant decline in demand related to PCs, despite strong demand related to servers for data centers. As a result, sales of HDD Heads and HDD Suspension Assemblies decreased considerably.

On the other hand, demand related to residential energy storage systems rapidly expanded due to concerns over energy supply and soaring energy prices reflecting heightened geopolitical risks. Against such background, sales of medium-sized rechargeable batteries have been accelerating.

In summary, net sales and operating profit remained firm as a result of the expansion of business foundations, while component demand varied among products amid increasing uncertainties surrounding the global economy.

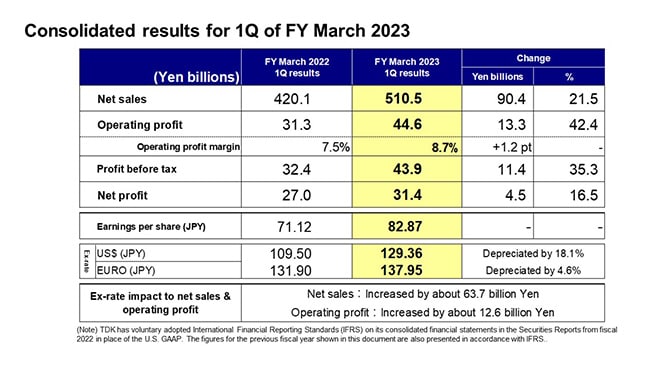

Consolidated results for 1Q of FY March 2023

Next, I would like to present an overview of our results. There was an increase of about 63.7 billion yen in net sales and an increase of about 12.6 billion yen in operating profit due to exchange rate fluctuations against the U.S. dollar and other currencies. Including this impact, net sales were 510.5 billion yen, an increase of 90.4 billion yen, or 21.5% year on year. Operating profit was 44.6 billion yen, an increase of 13.3 billion yen, or 42.4% year on year. Profit before tax was 43.9 billion yen, net profit was 31.4 billion yen, and earnings per share were 82.87 yen.

With regard to exchange rate sensitivity, we estimate that a change of 1 yen against the U.S. dollar will affect actual operating profit by about 1.6 billion yen, while a 1-yen change against the euro will have an impact of about 0.6 billion yen, in light of the rapid depreciation of the yen and euro against the U.S. dollar. The exchange rate sensitivity has risen compared to the past.

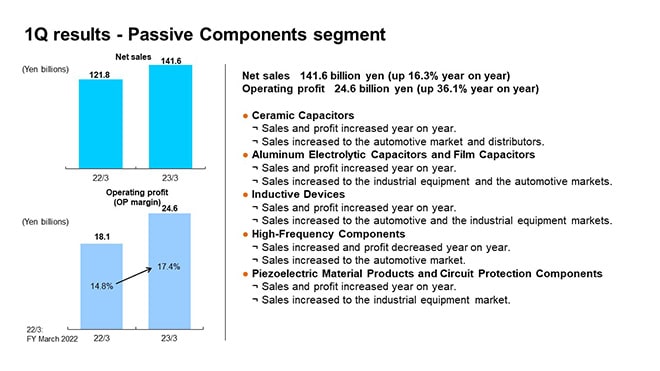

1Q results - Passive Components segment

Next, I would like to explain our business segment performance for the first quarter.

Certain products reclassified into different segments in accordance with the reorganization for the three months ended June 30, 2022. Consequently, the prior year’s results have also been reclassified to conform to the new segmentation. In the Passive Components segment, the prior year’s net sales increased by 0.6 billion yen and operating profit decreased by 0.1 billion yen as a result of the reclassification of certain products which had been included in the Others segment.

Net sales in the Passive Components segment were 141.6 billion yen, an increase of 16.3% year on year. Component demand from the automotive market has remained brisk. Demand from the industrial equipment market has also been firm, particularly for renewable energy and production equipment. On the other hand, as a result of a decline in smartphone demand in the ICT market, sales and profit of High-Frequency Components, which have a high ratio of smartphone-related sales, decreased year on year on an actual basis excluding the effect of fluctuations in foreign exchange rates. Sales and profit of products other than High-Frequency Components, which have a high ratio of sales from the automotive market and the industrial equipment market, increased year on year.

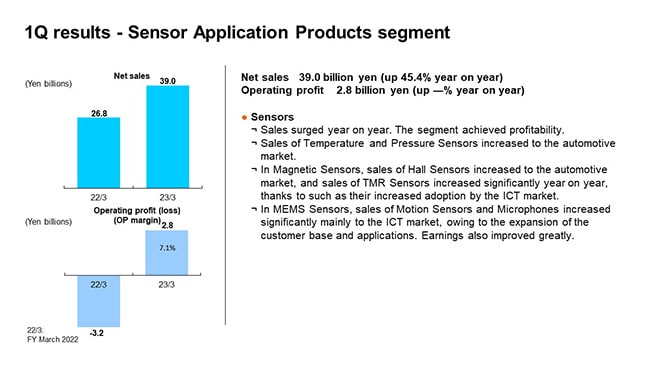

1Q results - Sensor Application Products segment

In the Sensor Application Products segment, the prior year’s results have also been reclassified to conform to the new segmentation, as in the case of the Passive Components segment. Consequently, while there was no change in the prior year’s net sales, operating profit decreased by 1.2 billion yen as a result of the reclassification of certain products which had been included in the Others segment.

Net sales amounted to 39.0 billion yen, up 45.4% year on year, recording a significant increase. Operating profit was 2.8 billion yen, a substantial improvement reflecting increased sales, compared with the same period of the previous fiscal year when an operating loss was recorded.

Due to automotive components supply chain constraints, exacerbated by the conflict between Russia and Ukraine, sales and profit of Temperature and Pressure Sensors decreased year on year on an actual basis excluding the effect of fluctuations in foreign exchange rates, reflecting mainly a decline in orders related to automobiles in Europe. On the other hand, sales of Magnetic Sensors and MEMS Sensors expanded mainly to the ICT market, which boosted earnings and greatly contributed to achieving profitability.

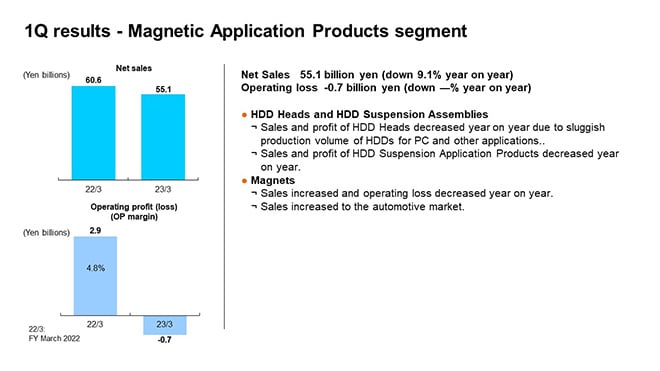

1Q results - Magnetic Application Products segment

In the Magnetic Application Products segment, net sales decreased 9.1% year on year to 55.1 billion yen, and an operating loss of 0.7 billion yen was posted.

In HDD Heads, while demand for Nearline HDD Heads for data centers remained robust, the sales volume of HDD Heads decreased about 20% from the level of initial expectations due to a rapid decline in demand for HDDs for PCs. As a result, both sales and profit of HDD Heads decreased significantly year on year. In HDD Suspension Assemblies, sales and profit of HDD Suspension Application Products decreased year on year due to a decline in volume. On the other hand, sales of HDD Suspension Assemblies increased year on year thanks to a rise in the sales ratio of μDSA-type products for Nearline HDDs with higher added value, despite a decline in overall volume reflecting sluggish PC-related demand. Sales and profit of HDD Suspension Assemblies on the whole increased year on year.

In Magnets, operating loss diminished on the back of increased sales reflecting a rise in sales related to xEVs.

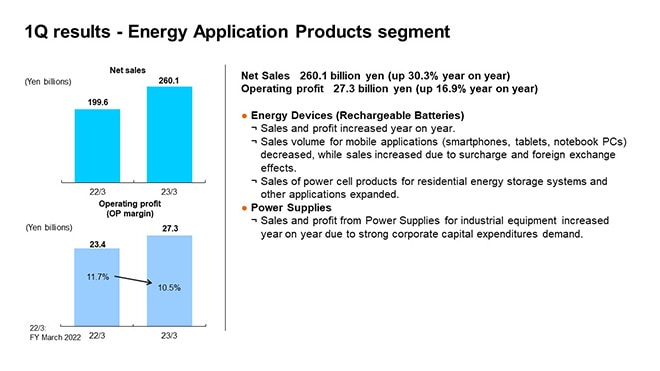

1Q results - Energy Application Products segment

In the Energy Application Products segment, net sales surged 30.3% year on year to 260.1 billion yen and operating profit increased 16.9% year on year to 27.3 billion yen.

In Rechargeable Batteries, sales volume decreased for mobile applications, such as smartphones, tablets, and notebook PCs. However, sales and profit of Rechargeable Batteries on the whole increased year on year on the back of the steady expansion in sales of power cell products for residential energy storage systems and other applications, on which TDK has been focused, as well as the effects of surcharges and fluctuations in foreign exchange rates, in addition to ongoing efforts to improve profitability through cost reductions.

In Power Supplies for Industrial Equipment, demand for semiconductor manufacturing equipment and other industrial equipment remained robust, resulting in year-on-year increases in both sales and profit.

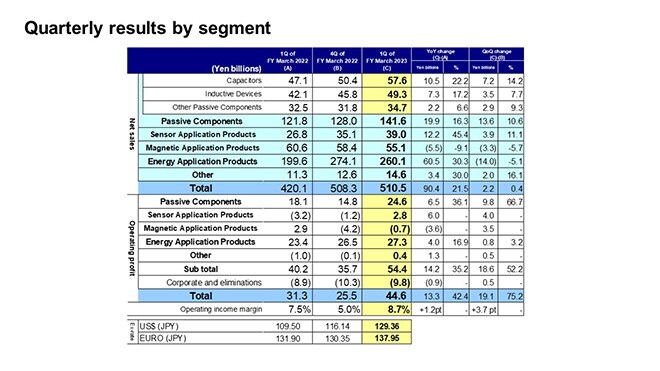

Quarterly results by segment

Now, I would like to explain the factors behind the changes in segment net sales and operating profit from the fourth quarter of the fiscal year ended March 2022 to the first quarter of the fiscal year ending March 2023.

Firstly, in the Passive Components segment, net sales of the fourth quarter of the previous fiscal year increased by 0.8 billion yen and operating profit decreased by 0.1 billion yen as a result of segment reclassification in accordance with the reorganization. Net sales increased by 13.6 billion yen, or 10.6%, from the fourth quarter, and operating profit increased by 7.7 billion yen, or about 46%, excluding one-time expenses of 2.1 billion yen recorded in the fourth quarter. Net sales increased from the fourth quarter across all markets, including the automotive market, ICT market, industrial equipment market, and distributors. As all businesses posted increased sales, operating profit has also remained strong.

In the Sensor Application Products segment, while there was no change in the prior year’s net sales, operating profit decreased by 0.9 billion yen as a result of segment reclassification in accordance with the reorganization. Net sales increased by 3.9 billion yen, or 11.1%, from the fourth quarter, and operating profit increased by 2.0 billion yen excluding one-time expenses of 2.0 billion yen recorded in the fourth quarter. Sales and profit of Temperature and Pressure Sensors decreased from the fourth quarter on an actual basis, excluding the effect of fluctuations in foreign exchange rates, due to supply chain constraints in automotive components. Sales and profit of Magnetic Sensors, on the other hand, increased from the fourth quarter as sales for automotive and smartphone applications remained brisk. The profitability of MEMS Sensors improved from the fourth quarter as sales related to game machines and VR increased, despite a decline in sales of Motion Sensors for smartphone applications in China.

In the Magnetic Application Products segment, net sales decreased by 3.3 billion yen, or 5.7%, from the fourth quarter, while operating profit increased by 0.6 billion yen excluding one-time expenses of 2.9 billion yen recorded in the fourth quarter. Sales of HDD Heads declined significantly from the fourth quarter as the sales volume of HDD Heads plunged by about 23% and sales of HDD assembling also declined. Sales of HDD Suspension Assemblies also decreased from the fourth quarter due to a decline in the sales volume of suspensions for PCs. Sales of Magnets increased slightly from the fourth quarter. While the operating profit of HDD Heads decreased from the fourth quarter due to a decline in sales volume, the profitability of Magnets improved from the fourth quarter, although still in the red, as sales for automotive applications increased.

In the Energy Application Products segment, net sales decreased by 14.0 billion yen, or 5.1%, from the fourth quarter, while operating profit increased by 0.8 billion yen, or 3.2%, from the fourth quarter. Sales of Rechargeable Batteries decreased from the fourth quarter due to a significant decline in the sales volume to the ICT market, while operating profit remained virtually flat from the fourth quarter as a result of our efforts to reduce costs including SG&A expenses, in addition to the absorption of the impact of soaring prices through surcharges. Sales and profit of Power Supplies for Industrial Equipment remained virtually unchanged from the fourth quarter.

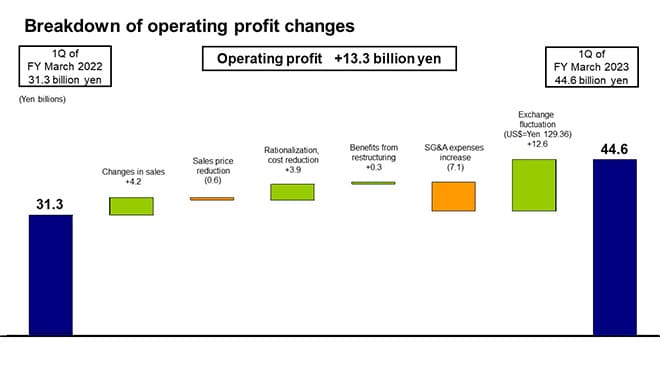

Breakdown of operating profit changes

Next is a breakdown of changes in operating profit. Let’s take a look at the main factors behind the 13.3 billion yen increase in operating profit. First, operating profit increased by 0.7 billion yen on an actual basis, excluding an increase in profit of 12.6 billion yen attributable to the depreciation of the yen resulting from exchange rate fluctuations. Next, there was an increase in profit of 4.2 billion yen on the whole due to changes in sales, including an increase in the sales volume of Sensors and the effect of surcharges for Rechargeable Batteries, despite the significant negative impact of the decline in the sales volume of HDD Heads. While the negative impact of sales price reduction amid soaring raw material prices was limited to 0.6 billion yen, the positive effects of rationalization, cost reduction, and benefits from restructuring in the fourth quarter of the previous fiscal year amounted to 4.2 billion yen. While SG&A expenses increased by 7.1 billion yen, about 4.1 billion yen of this was attributable to the fact that royalty fees to CATL had not been recorded in the first quarter of the previous fiscal year. In addition, the impact of soaring transportation costs was among the main factors behind this increase.

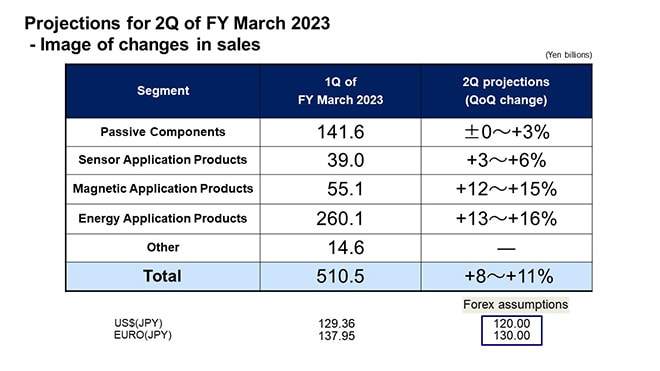

Projections for 2Q of FY March 2023 - Image of changes in sales

I would now like to discuss our projection regarding changes in net sales for the second quarter of the fiscal year ending March 2023.

In terms of sales to the automotive market, component demand is expected to remain robust on the assumption that the negative effects of China’s lockdowns during the first quarter will be alleviated and automobile production will increase in the second quarter. In the ICT market, demand for PCs and tablets is anticipated to remain sluggish. In addition, smartphone production in China is expected to remain significantly below the level of initial expectations. On the other hand, sales to the ICT market will likely increase on the assumption that smartphone production will increase from the first quarter as a new product is scheduled to be launched by a major customer. As for sales to the industrial equipment market, demand is forecast to remain robust.

In light of these demand trends in TDK’s priority markets, we are projecting that overall net sales of the Passive Components segment will increase between ±0% and 3% (6-9% excluding the effect of fluctuations in foreign exchange rates) from the first quarter. Sales for automotive and smartphone applications are expected to increase from the first quarter, while sales to the industrial equipment market are anticipated to remain virtually unchanged from the first quarter and sales to distributors are projected to decrease from the first quarter.

In the Sensor Application Products segment, we are projecting an increase in net sales by 3-6% (11-14% excluding the effect of fluctuations in foreign exchange rates) from the first quarter. This is based on the assumption that sales of Magnetic Sensors for smartphone applications will significantly increase as a new product is scheduled to be launched by a major customer.

In the Magnetic Application Products segment, we are projecting an increase in overall net sales by 12-15% (21-24% excluding the effect of fluctuations in foreign exchange rates) from the first quarter. This is based on the assumption that while demand for HDD Heads for PCs will remain sluggish, demand for Nearline HDDs for data centers will increase significantly from the first quarter as the shipment of the products for main models begins in earnest. Sales of Magnets are also expected to increase from the first quarter in line with a rise in demand for automotive applications.

In the Energy Application Products segment, we are projecting an increase in overall net sales by 13-16% (20-23% excluding the effect of fluctuations in foreign exchange rates) from the first quarter. This is based on the assumption that demand related to residential energy storage systems and electric motorcycles will expand, in addition to an increase in sales volume due to the launch of a new smartphone product.

In light of the above, we are projecting net sales growth of 8-11% (15-18% excluding the effect of fluctuations in foreign exchange rates) overall in the second quarter compared to the first quarter.

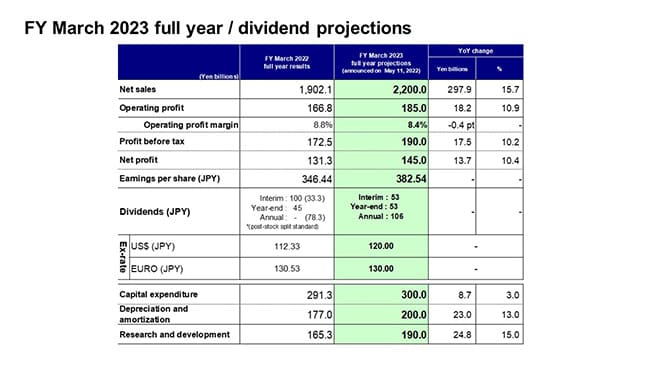

FY March 2023 full year / dividend projections

Finally, I would like to discuss our consolidated full-year projections for the fiscal year ending March 2023. We have maintained the full-year projections announced previously in May 2022.

During the first quarter, while demand from the ICT market remained below the level of initial expectations and sales of relevant products decreased, sales of high value-added Passive Components and Sensor products increased, boosting earnings. While raw material prices remained at the level of initial expectations, the amount of surcharges increased. In addition, as a result of our efforts to reduce costs including SG&A expenses, we delivered sales and profit exceeding the level of initial expectations, even excluding the effect of the depreciation of the yen.

As for the outlook for demand trends for the second quarter, demand from the automotive market and the smartphone market is expected to increase, and both net sales and operating profit are projected to remain at the level of initial expectations. However, since the future outlook is expected to remain unclear, such as the demand trends of major markets toward the end of the current fiscal year, normalization of supply chains, and trends of raw material prices and foreign exchange rates, we have maintained the projections, including those of foreign exchange rates, as initially announced. There are no changes in the projections of capital expenditure, depreciation and amortization, and research and development expenses.

That concludes my presentation. Thank you very much for your attention.