[ Performance Briefing Fiscal Year March 2022 ]

Consolidated Full Year Projections

for FY March 2023

Progress of Medium-Term Plan

Mr. Noboru Saito

President & CEO

Hello, I am Noboru Saito. I assumed the position of President and CEO on April 1, 2022. Thank you for joining us today. I would like to go over our full-year earnings projections for the fiscal year ending March 2023 and the progress of our medium-term plan.

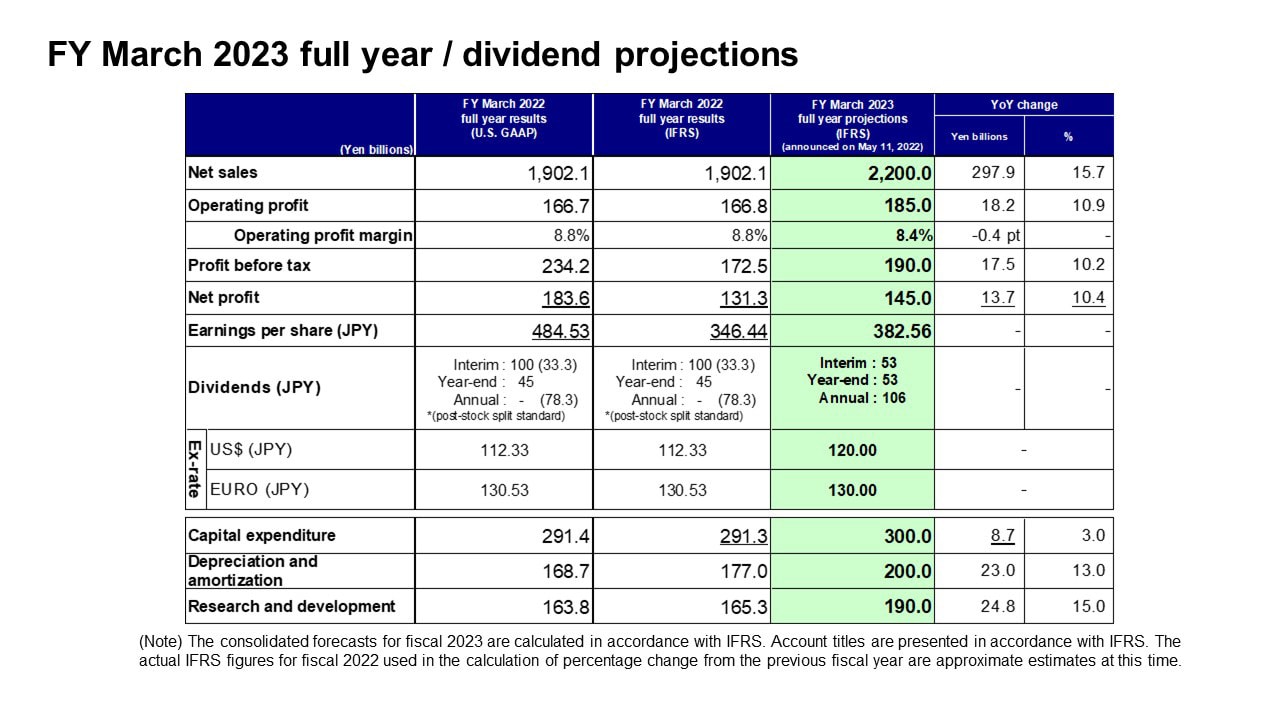

FY March 2023 full year / dividend projections

First, I would like to discuss our projections for consolidated financial results and dividends for the fiscal year ending March 2023 and the underlying market conditions.

The global economic growth rate for the fiscal year ended March 2022 was 6.1% in line with the recovery from the COVID-19 pandemic, but the forecast for the fiscal year ending March 2023 was revised downward from the initial forecast of 4.4% to 3.6% in April 2022. Although recovery from the pandemic and the movement toward economic normalization will accelerate and production activities will be on a recovery track, there are still concerns that the macroeconomy will further deteriorate in the future due to the impact of the risks associated with higher-than-expected interest rate hikes, the conflict between Russia and Ukraine, lockdowns in some regions due to the resurgence of COVID-19, and other factors.

We predict that production volume for automobiles will increase year on year while that for smartphones will remain flat year on year. However, production volume for PCs and tablets, which had been at a high level reflecting demand related to remote working until the previous year, will likely decrease on a year-on-year basis. In addition, we expect the impact of rising energy and material prices to continue for some time due to heightened geopolitical risks.

Our full-year projections in light of production volume and order status for our major markets are as follows: net sales of 2,200.0 billion yen; operating income of 185.0 billion yen; income before income taxes of 190.0 billion yen; and net income of 145.0 billion yen. Our exchange rate assumptions are 120 yen against the U.S. dollar and 130 yen against the euro.

In light of an increase in earnings per share, the annual dividend is projected to increase from 78.3 yen (conversion after stock split) for the fiscal year ended March 2022 to 106 yen for the fiscal year ending March 2023. We expect capital expenditures to be 300.0 billion yen, depreciation and amortization to be 200.0 billion yen, and research and development expenses to be 190.0 billion yen.

As announced earlier, TDK has voluntarily adopted the International Financial Reporting Standards (IFRS), instead of U.S. GAAP, starting from the Annual Securities Report for the fiscal year ended March 2022. The full-year projections for the fiscal year ending March 2023 have been calculated based on IFRS, and the figures converted based on IFRS standards are presented as reference values for the fiscal year ended March 2022 as the basis for comparison. Gain on valuation of investment securities of 60.2 billion yen recorded in the fiscal year ended March 2022 is included in “Other income (deductions)” based on U.S. GAAP. However, based on the IFRS standards, it will be reported under “Net change in fair value of equity instruments measured at fair value through other comprehensive income” on the balance sheet, not under “Other income (deductions).”

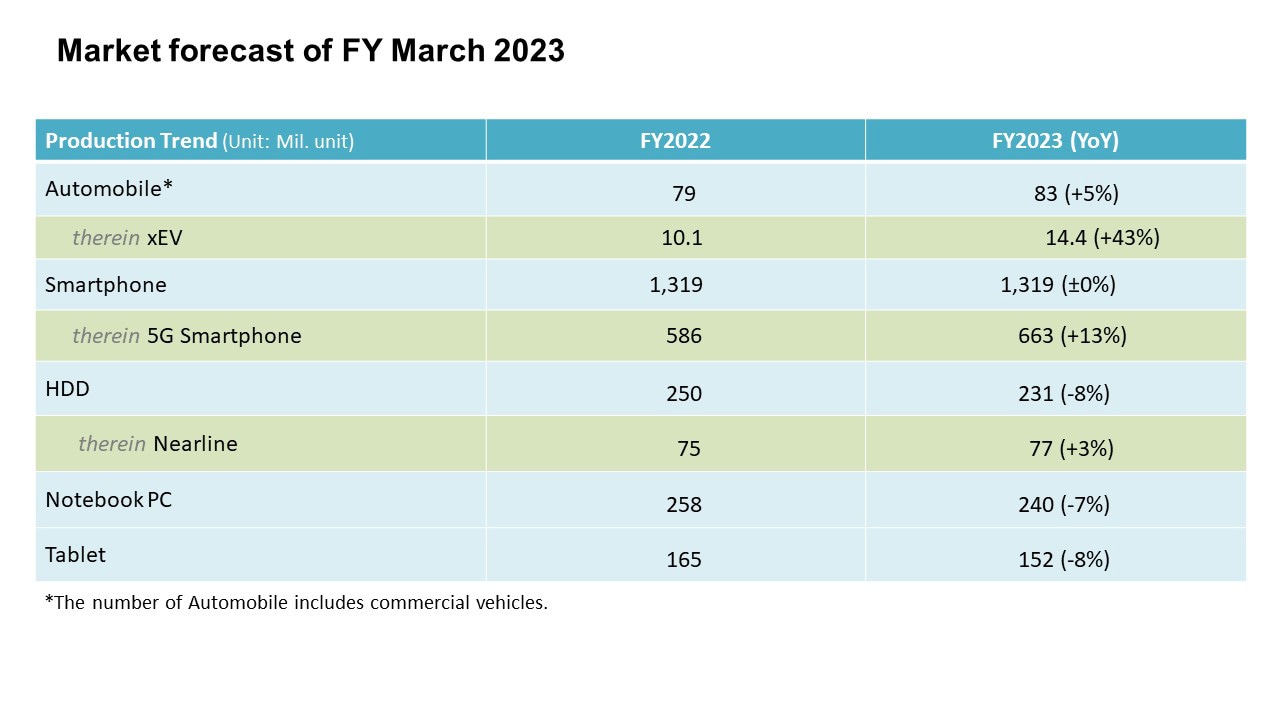

Market forecast of FY March 2023

Next, I will explain demand and production volume in the major markets related to TDK.

We have assumed that automobile production volume, including commercial vehicles, for the fiscal year ending March 2023 will be 83 million units, an increase of 5% year on year. However, since actual production volume has been slightly less than this assumption, we believe that close attention must be paid to the future trends.

Among automobiles, investment in EVs and environmentally friendly vehicles, which have a significant impact on TDK’s earnings, has been accelerating. Therefore, we have assumed that xEV production volume will increase by 43% year on year to 14.4 million units.

Production volume for smartphones, which represent the ICT market, is assumed to be 1,319 million units, the same level as the previous fiscal year. Meanwhile, production volume for 5G smartphones is expected to continue to grow, reaching 663 million units.

While the overall HDD market shrinks, production volume for Nearline HDDs for data centers is assumed to increase by 3% year on year to 77 million units. Production volume for PCs and tablets, whose demand had been robust thanks to the spread of remote working and learning, is expected to decrease year on year.

As there have been uncertainties surrounding the macroeconomy in general, we think that it is necessary to carefully monitor the sales trends for finished products and determine the trends for component demand.

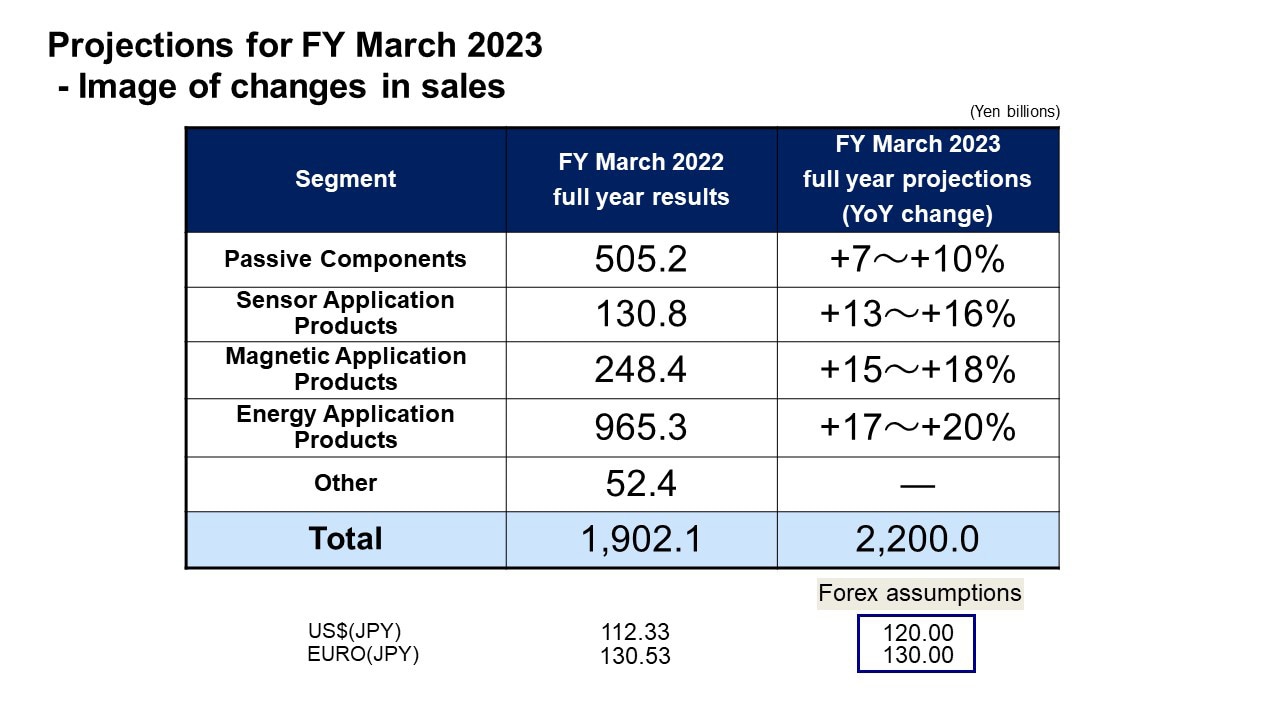

Projections for FY March 2023 - Image of changes in sales

Now, I would like to explain the image of changes in sales by segment for the fiscal year ending March 2023.

Sales of the Passive Components segment are expected to grow by 7-10% year on year overall. Sales to the automotive market are forecast to increase at a rate exceeding the growth in automobile production volume. Sales to the industrial equipment market are also projected to increase. As demand is expected to expand over the medium to long term, we will aggressively invest in the reinforcement of development and production capacity in order to capture business opportunities.

Sales of the Sensor Application Products segment are expected to grow by 13-16% year on year. We expect an increase in adoption of Magnetic Sensors, mainly TMR Sensors, and MEMS Microphones, whose demand has been brisk for ICT applications. As for Temperature and Pressure Sensors as well as Hall Sensors, sales of the products for the automotive market will likely increase as robust growth in sales is expected in line with electrification.

Sales of the Magnetic Application Products segment are expected to grow by 15-18% year on year. Despite sluggish production volume for HDDs, demand for Nearline HDDs is expected to remain brisk reflecting active investment in data centers. As a result, production volume for HDD Heads on the whole will likely increase. Sales of Magnets are also expected to grow on the back of an expansion of sales of products for xEV applications.

Sales of the Energy Application Products segment are expected to grow by 17-20% year on year. While production volume for smartphones is anticipated to remain unchanged from the previous year, sales of medium-sized batteries for residential energy storage systems and electric motorcycles will likely grow. In the standard power supply business, demand related to semiconductor manufacturing equipment and the infrastructure market is forecast to increase.

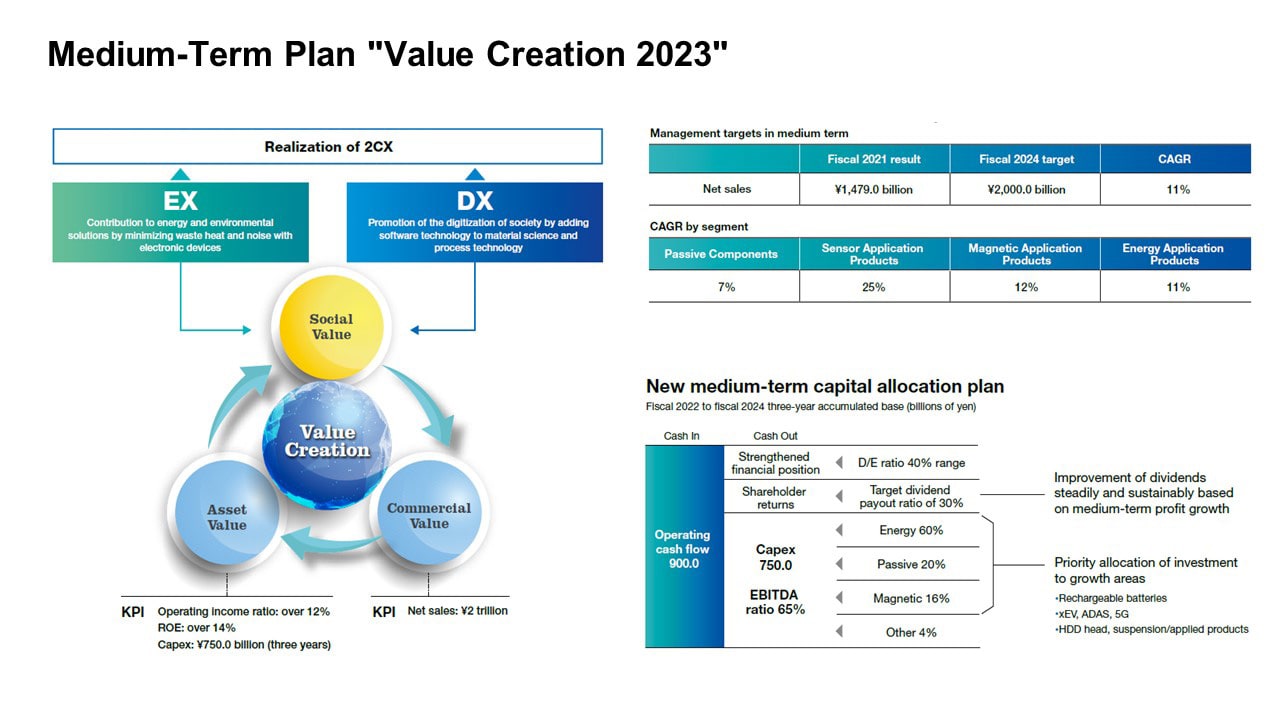

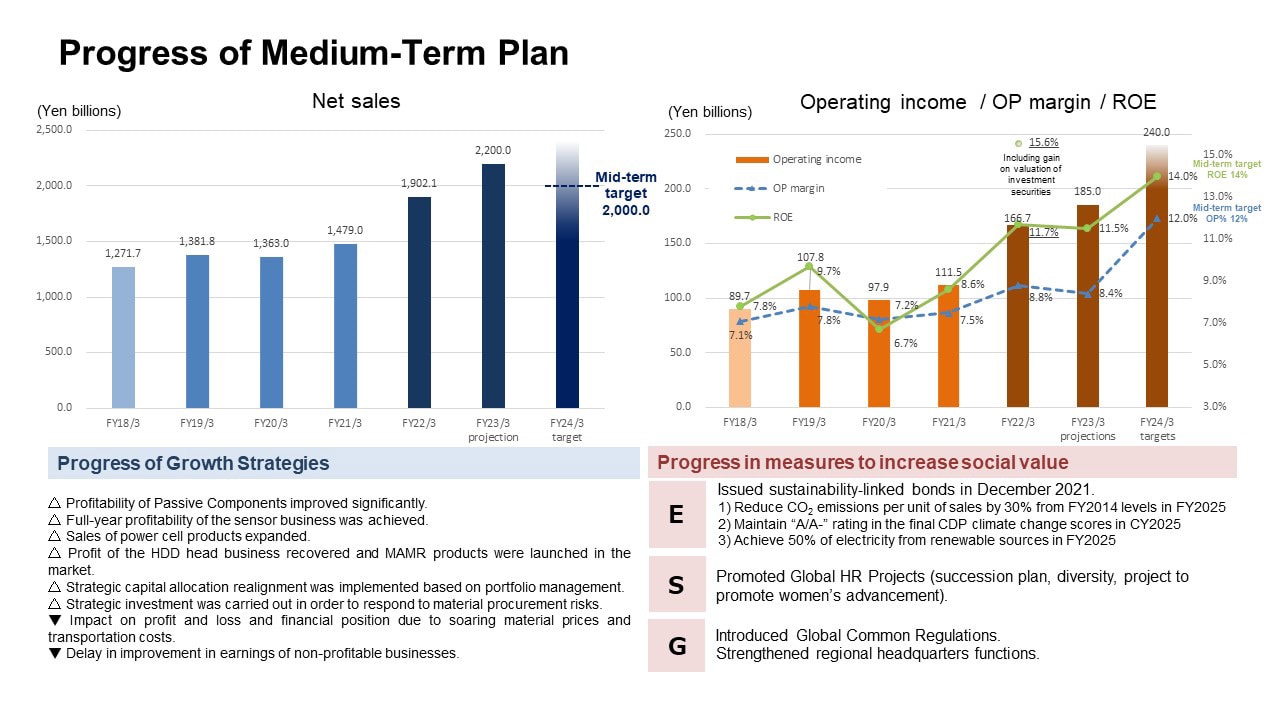

Next, I would like to talk about the progress of our medium-term plan, “Value Creation 2023,” which started from the previous fiscal year.

Medium-Term Plan "Value Creation 2023"

The TDK Group endeavors to increase its corporate value by contributing to social trends such as energy transformation (EX) and digital transformation (DX) through its businesses.

Our KPIs for net sales and operating income and our capital allocation plans are as shown on this slide.

Next, I would like to explain the key points for progress of our medium-term plan.

Progress of Medium-Term Plan

First, let me explain the progress of growth strategies. Both sales and profitability of Passive Components exceeded our plan. Full-year profitability of the Sensor business was achieved as earnings improved at a pace slightly faster than initially anticipated. In Rechargeable Batteries, the power cell business expanded as planned. Profit of the HDD Head business also recovered and MAMR products featuring next-generation technology were launched in the market.

In the capital allocation plan, we initially planned to allocate about 60% of our capital expenditures of 750.0 billion yen in total for three years to Energy Application Products, but we will reduce it to about 40% taking into consideration the medium- to long-term business environment and the changes in business strategy. On the other hand, we plan to increase the allocation to Passive Components from about 20% to 30% with the aim of boosting production capacity. In addition, we will change the allocation significantly in order to ensure that growth opportunities in growth areas such as next-generation HDD Heads and TMR Sensors will be captured.

In terms of our financial position and cash flows, we implemented strategic measures toward stable procurement of battery-related materials over the medium to long term by investing about 100.0 billion yen. As a result, it has become difficult to achieve our medium-term target of generating positive free cash flow after shareholder returns during the medium-term period. However, we regard this as advance investment in order to gain sustainable competitiveness from a long-term perspective.

Meanwhile, there has been an impact on our financial position due to higher-than-expected rises in material prices and transportation costs, among other factors. We will strive to minimize such impact by cost pass-through measures and cost reduction. In addition, as there has been a delay in improvement in earnings of non-profitable businesses, we will take priority measures.

Next, I will explain the progress in measures to increase social value from the ESG perspective.

In terms of “E (Environment),” we issued TDK’s first sustainability bonds of 40.0 billion yen in December 2021. Toward achieving the targets through fiscal 2025, we have started initiatives to reduce CO2 emissions by focusing on both Lower Energy and Renewable Energy.

In terms of “S (Social),” we established the Global Human Resources HQ in Munich, Germany in the fiscal year ended March 2018 and have been engaging in full-fledged operations. In addition to the activities aimed at promoting succession plans and diversity, we have been promoting a project to promote women’s advancement in order to achieve a female manager ratio of 15% in Japan in 2035.

In terms of “G (Governance),” we have established the Global Common Regulations, which set out basic rules to be observed by TDK Group companies around the world, while encouraging each Group company and region to develop an autonomous decentralized organization based on the concept of “Empowerment & Transparency.” We will further strengthen regional headquarters functions in order to facilitate prompt and adequate decision-making by frontline workers.

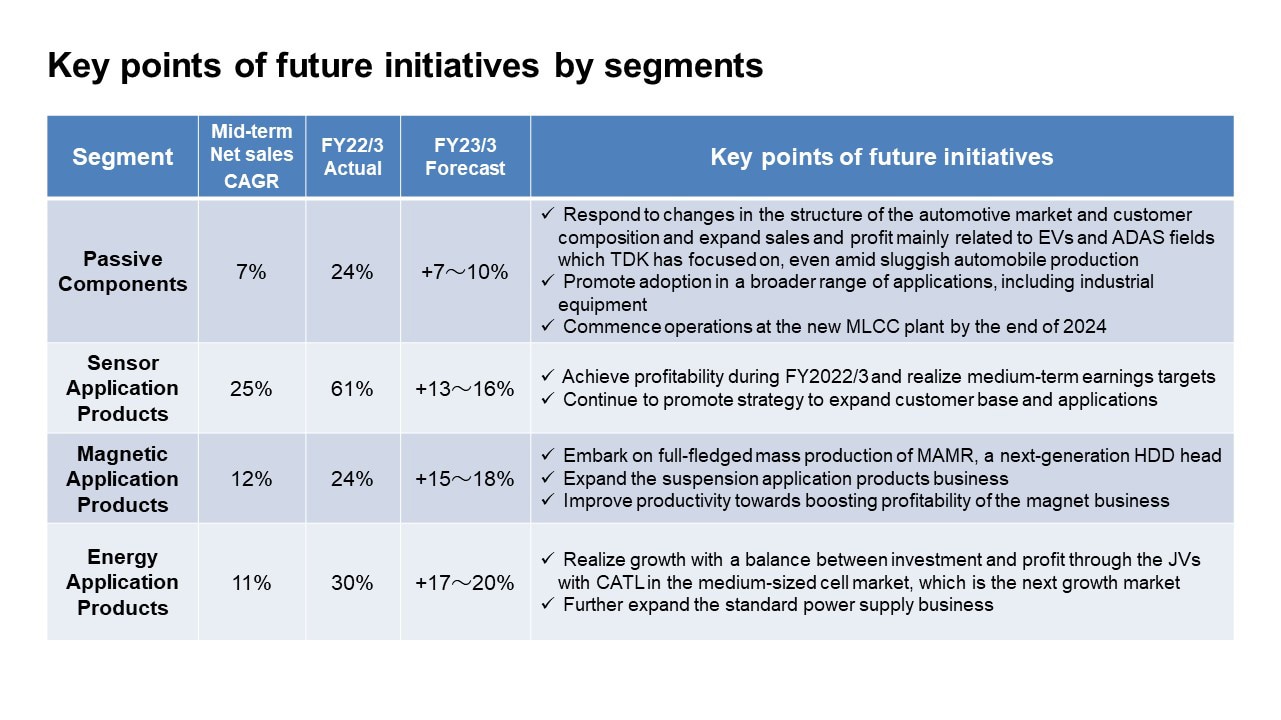

Key points of future initiatives by segments

Now, I would like to talk about key points of future initiatives by segment.

In the Passive Components segment, by flexibly responding to changes in the industrial structure and customer composition of the automotive market, which accounts for about 40% of net sales, we will aim to expand sales and profit by continuing to increase sales mainly related to the EV and ADAS fields which TDK has focused on, even amid sluggish automobile production. We will also boost sales of products for a broader range of applications, including renewable energy and industrial equipment, in addition to sales to the automotive market.

In addition, as announced by a press release, we have decided to construct a new MLCC factory. The outline of the plan is provided on the next slide.

In the Sensor Application Products segment, while profitability was achieved during the fiscal year ended March 2022, we will continue to promote a strategy to further expand the customer base and applications as planned in order to realize medium-term earnings targets. Steady growth in sales is anticipated for Temperature and Pressure Sensors as well as Hall Sensors for automobiles. We believe that sales growth can be realized by further increasing the adoption of Magnetic Sensors, mainly TMR Sensors, MEMS Microphones, and DX applications, whose demand is expected to grow in the future.

In the Magnetic Application Products segment, we expect robust demand for Nearline HDDs as investment in data centers has been brisk, despite sluggish production volume for HDDs. Sales of HDD Heads are expected to increase reflecting a rise in production volume for heads overall. We will embark on full-fledged mass production of next-generation HDD Heads using MAMR technology and aim to further expand the suspension application products business other than HDD products. We will also improve productivity toward boosting the profitability of the magnet business.

In the Energy Application Products segment, we will aim to realize growth with a balance between investment and profit through the joint ventures(JVs) with CATL in the medium-sized battery market with growth prospects such as residential energy storage system and electric motorcycle applications, as production volume of smartphones is expected to remain flat from the previous fiscal year.

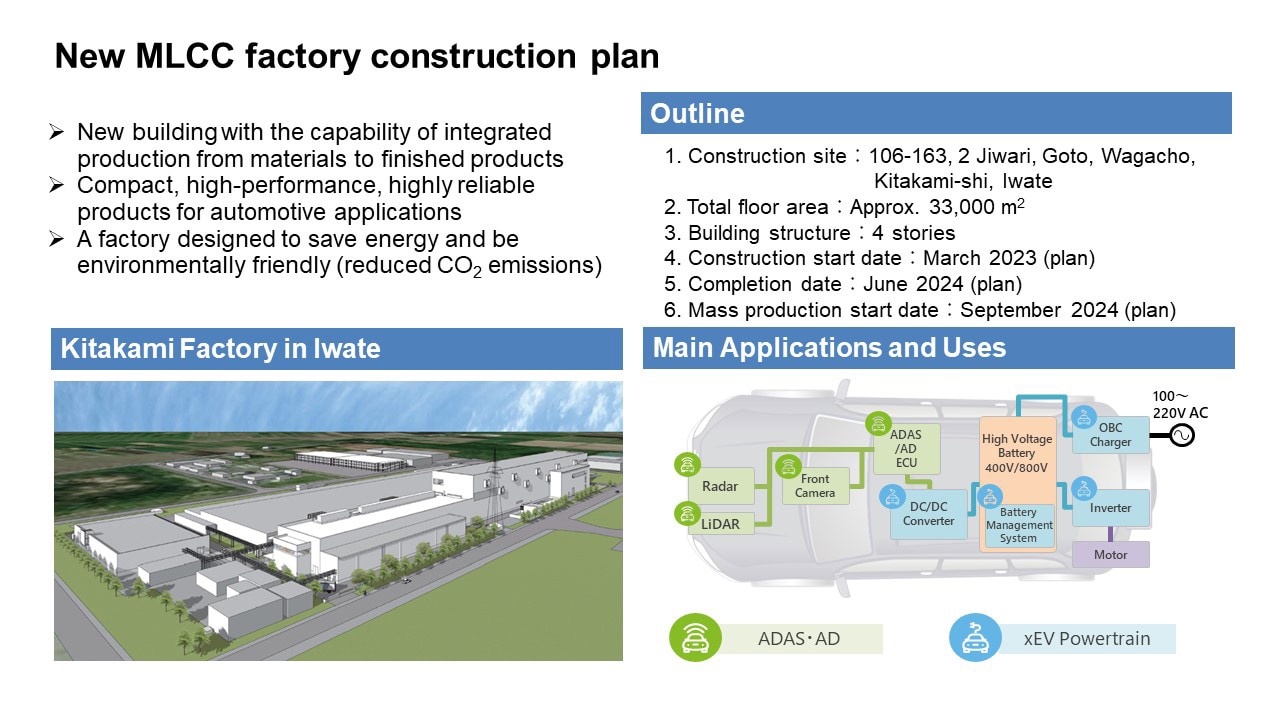

New MLCC factory construction plan

We have decided to construct a new plant on the site of the Kitakami Factory (Kitakami-shi, Iwate Prefecture), one of TDK’s main MLCC production bases, by investing about 50.0 billion yen. The construction is scheduled to complete in June 2024 and full-fledged mass production will start in September of the same year. The new plant, with the capability of integrated production from materials to finished products, is designed to save energy and reduce CO2 emissions.

The new plant will mainly manufacture products for automobile applications, whose demand is expected to grow significantly in the future. Specifically, it will manufacture compact, high-performance, highly reliable products to be installed in high voltage conversion units for ADAS and xEV applications.

By combining the new plant and the production expansion plan that has already been commenced, our production capacity is expected to increase to 190% as of the end of 2024 compared with the fiscal year ended March 2021.

Mr. Fumio Sashida

Corporate Officer

I am Fumio Sashida, Corporate Officer of TDK. I will explain about the JVs with CATL in the Energy Applied Products business.

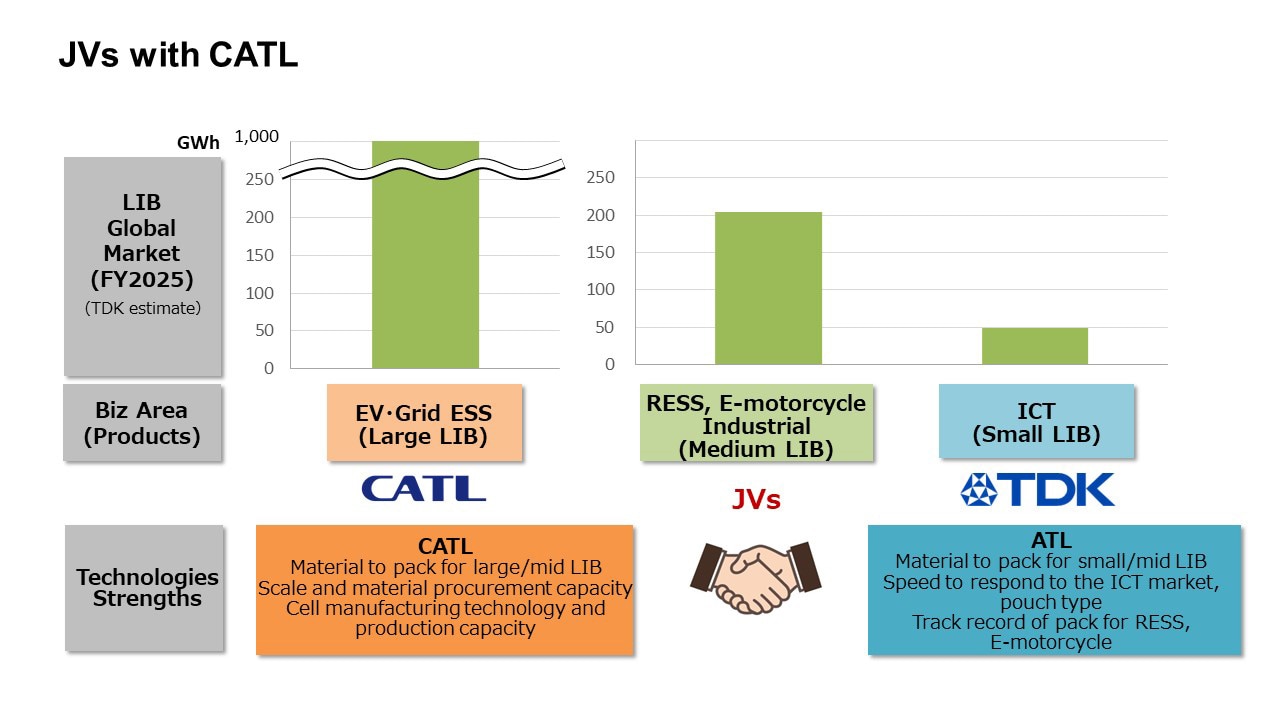

JVs with CATL

Now, let me explain the progress and direction of the establishment of the joint ventures with CATL announced in April 2022.

First, I would like to go over the background behind our entry into the medium-sized battery market and the alliance with CATL once again.

TDK has achieved high growth by focusing on the small-sized battery business for ICT applications. While growth of the ICT market is anticipated to slow down in the future, significant growth is projected for large-sized batteries for EV applications and medium-sized batteries for residential energy storage systems and electric motorcycles. We estimate that the medium-sized battery market will grow to 200 GWh by 2025, becoming four times as large as the small-sized battery market. We think that the key to success in rapidly growing markets is to acquire the necessary technical and management resources on a timely basis (Time to Market, Time to Volume) as we did in the small-sized battery market.

TDK’s battery business has grown to the current size over the past 20 years or so since the establishment of ATL. The size of the medium-sized battery market is expected to grow further at a faster pace than that of the small-sized battery market. In order to succeed in such circumstances, enormous technical and management resources will be required. Although TDK has already entered the medium-sized battery market on its own, we have decided to form an alliance with CATL, taking into account the need to efficiently expand the business quickly in light of market potential in the future as well as long-term raw material procurement and technical advancement.

We have a similar corporate culture to CATL and have collaborated with them in some development areas before. Therefore, we believe that we will be able to generate synergy effects through our partnership in a speedy manner.

The cross-licensing agreement concluded last year is indispensable for the future growth of our battery business as it will not only provide us with access to technical resources related to medium-sized batteries but also enable application and utilization for small-sized battery products.

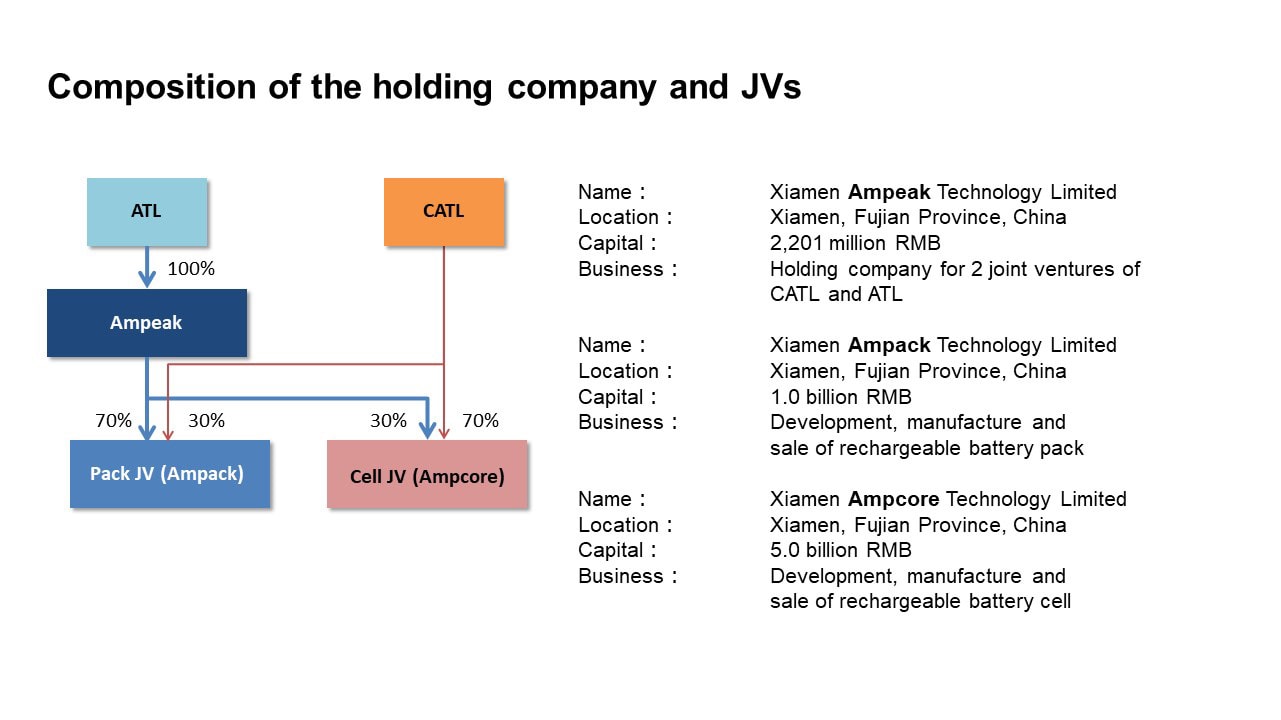

Composition of the holding company and JVs

Now, I would like to explain the capital composition of the holding company, whose establishment has been announced, and joint ventures.

We announced the establishment of a new company on April 27, 2022. The name of the new company is Xiamen Ampeak Technology Limited. We will establish this company as a holding company of the two joint ventures in order to implement more flexible management. It will be located in Xiamen, Fujian Province, China.

The name of the joint venture for rechargeable battery packs, in which TDK will have a 70% stake, is Xiamen Ampack Technology Limited. The name of the joint venture for rechargeable battery cells, in which TDK will have a 30% stake, is Xiamen Ampcore Technology Limited. Both companies will be located in Xiamen, Fujian Province, China. While Ampcore will be in charge of manufacturing cells and Ampack will be in charge of manufacturing packs, the cell company Ampcore will act as the sales contact for customers.

Medium- to long-term directions

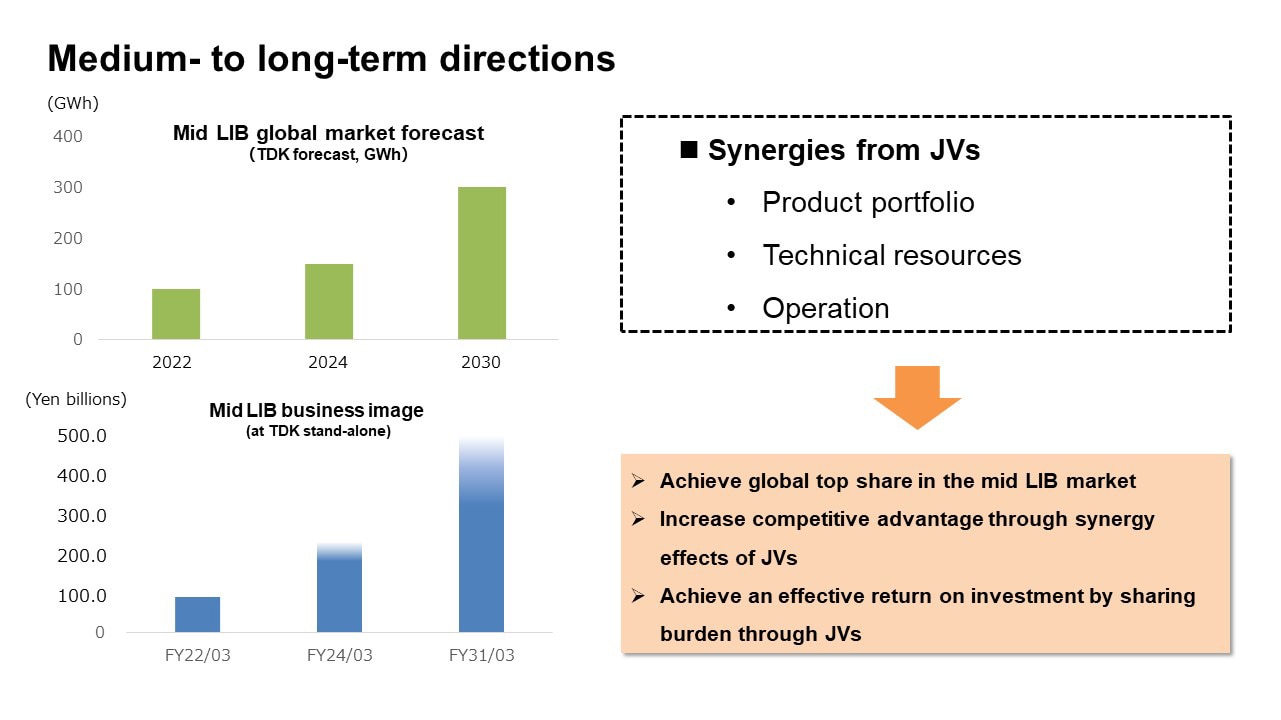

Next, I would like to talk about the medium- to long-term direction of our joint ventures.

The forecast of the medium-sized battery market is presented at the left top of this slide. The current market size is about 100 GWh. We estimate that the market will grow to around three times as large by 2030.

First, I will explain the scenario in which TDK engages in the medium-sized battery business on its own, based on the assumption of a rapidly expanding market. Medium-sized batteries accounted for about 10% of the battery business sales overall in the fiscal year ended March 2022 and have grown to about 90.0 billion yen in value. Our long-term target is to gain a market share of 10% or higher and grow the business as large as the current ICT business in terms of capacity by 2030. The expected sales of medium-sized batteries at that point will be between 400.0 billion yen and 500.0 billion yen.

The biggest benefit of the joint venture scenario, in comparison with the aforementioned scenario in which TDK engages in the business on its own, is the ability to harness synergy effects while complementing each other's insufficiencies.

In terms of products, the addition of CATL's prismatic and cylindrical cells to TDK’s specialty, pouch-type cells, will make it possible to meet a wide range of customer needs and to rapidly expand market share in fast-growing markets. In terms of technology, the two companies will work together to secure human resources to support the business, and we believe that by complementing each other in terms of intellectual property, we can create highly competitive products. In terms of operations, we believe that we can achieve a high level of cost competitiveness through economies of scale in material procurement and production, and manufacturing by leveraging each other's production technologies.

Through these synergies, we will aim to achieve a global top share of 30-40% over the medium to long term. We expect that net sales to be reflected in TDK’s consolidated financial results will reach the level we initially anticipated based on the scenario in which TDK engages in the business on its own. On the profit front, we believe that higher profitability will be realized on the back of synergy effects compared to the TDK’s stand-alone scenario. Investment burden will be borne according to the joint venture ratio. More effective returns can be expected, and we believe that we will be able to achieve growth that balances investment and earnings. By promoting the medium-sized battery business through our joint ventures, we hope to achieve faster and greater growth.

That concludes my presentation. Thank you very much for your attention.