[ Performance Briefing Fiscal Year March 2022 ]Consolidated Results for FY March 2022

Mr. Tetsuji Yamanishi

Executive Vice President

Hello, I am Tetsuji Yamanishi, Executive Vice President of TDK. Thank you for taking the time to attend TDK’s performance briefing for the fiscal year ended March 2022. I will be presenting an overview of our consolidated results.

Key points concerning earnings for FY March 2022

First, let me explain the key points of our earnings. During the fiscal year ended March 2022, the supply chain constrains in components procurement continued and the production volume of automobiles and smartphones remained sluggish due to the resurgence of the COVID-19 pandemic and concerns over political conflicts such as the tensions between the U.S. and China. On the other hand, as a result of the normalization of social and economic activities and the recovery of production activities, demand for electronic components remained robust. Consequently, net sales increased in all segments. Our earnings structure became more balanced and profitability increased as profit of the Passive Components business expanded and the Sensors business achieved profitability. Net sales increased 28.6% year on year and operating income increased 49.4% year on year, with both net sales and operating income achieving record highs.

In the automotive market, although production volume remained unchanged from the previous fiscal year due to the supply chain constraints in procurement of components, demand remained brisk on the back of an increase in the number of components installed per vehicle and stockpiling by customers, reflecting the further evolvement of xEVs and the acceleration of electrification such as ADAS. Against such backdrop, sales of Passive Components and Sensors expanded.

In the ICT market, demand for PCs and tablet devices remained brisk for the fiscal year ended March 2022. As demand related to data centers picked up and production of HDDs for servers remained strong, sales related to PCs, tablets and HDDs increased. Smartphone production volume for the fiscal year ended March 2022 fell below that of the previous fiscal year as the resurgence of COVID-19 and other factors negatively affected components procurement and smartphone demand. However, sales related to smartphones rose on the back of increased adoption of products for smartphone applications. Consequently, sales of Rechargeable Batteries, Sensors, and HDD Heads increased.

In the industrial equipment market, corporate capital expenditures remained strong. As a result, sales related to semiconductor manufacturing equipment and renewable energy increased, and sales of Passive Components and Power Supplies for Industrial Equipment also expanded. In addition, in Rechargeable Batteries, sales of medium-sized batteries grew, particularly for residential energy storage systems and other applications.

TDK recorded gain on valuation of investment securities of 60.2 billion yen in other income for the fiscal year ended March 2022, which boosted net income. Since net income on an actual business performance basis, excluding the impact of valuation gain, increased from the full-year forecast announced on January 31, 2022, we increased the year-end dividend forecast by 9 yen, considering the growth in earnings per share.

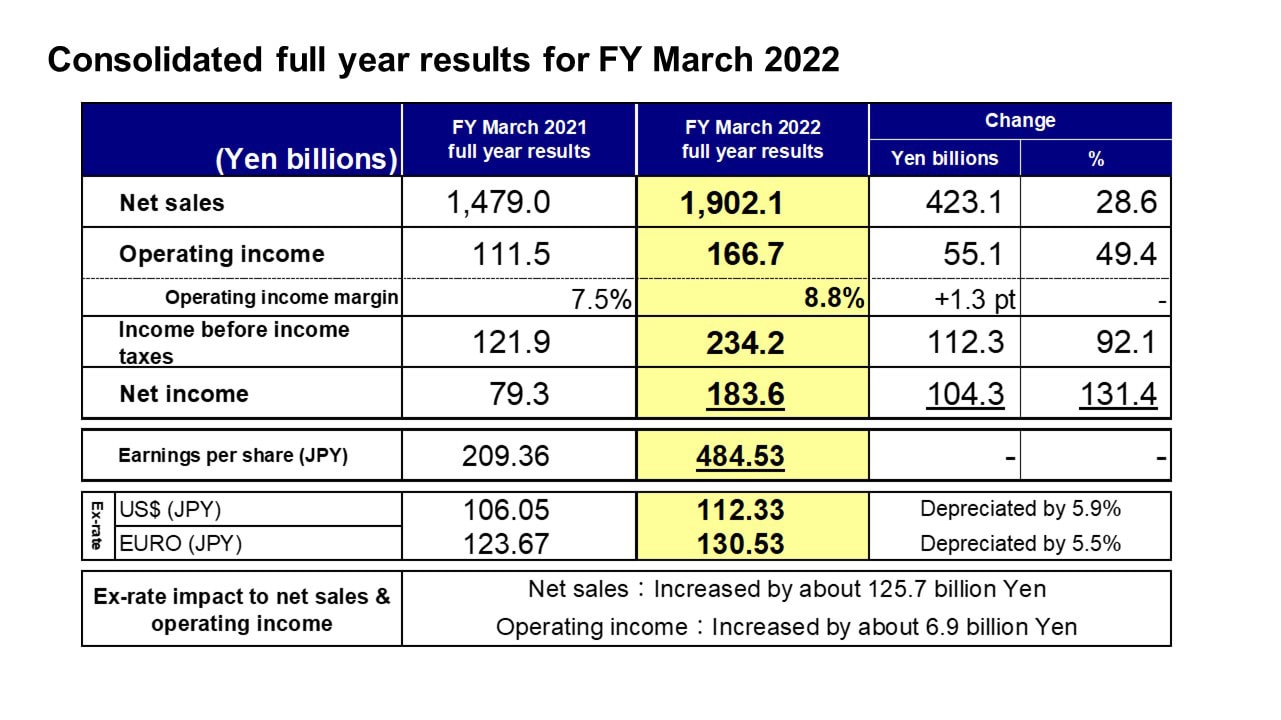

Consolidated full year results for FY March 2022

Next, I would like to present an overview of our results. There was an increase of about 125.7 billion yen in net sales and an increase of about 6.9 billion yen in operating income due to exchange rate fluctuations against the U.S. dollar and other currencies. Including this impact, net sales were 1,902.1 billion yen, an increase of 423.1 billion yen, or 28.6%, year on year. Operating income was 166.7 billion yen, up 55.1 billion yen, or 49.4%, year on year. As explained earlier, as a result of the recording of gain on valuation of investment securities of 60.2 billion yen in other income, income before income taxes and net income surged by 234.2 billion yen and 183.6 billion yen, respectively, setting record highs for all P/L items. Earnings per share were 484.53 yen.

With regard to exchange rate sensitivity, we maintain our estimate that a change of 1 yen against the U.S. dollar will affect annual operating income by about 1.2 billion yen, while a 1-yen change against the euro will have an impact of about 0.2 billion yen.

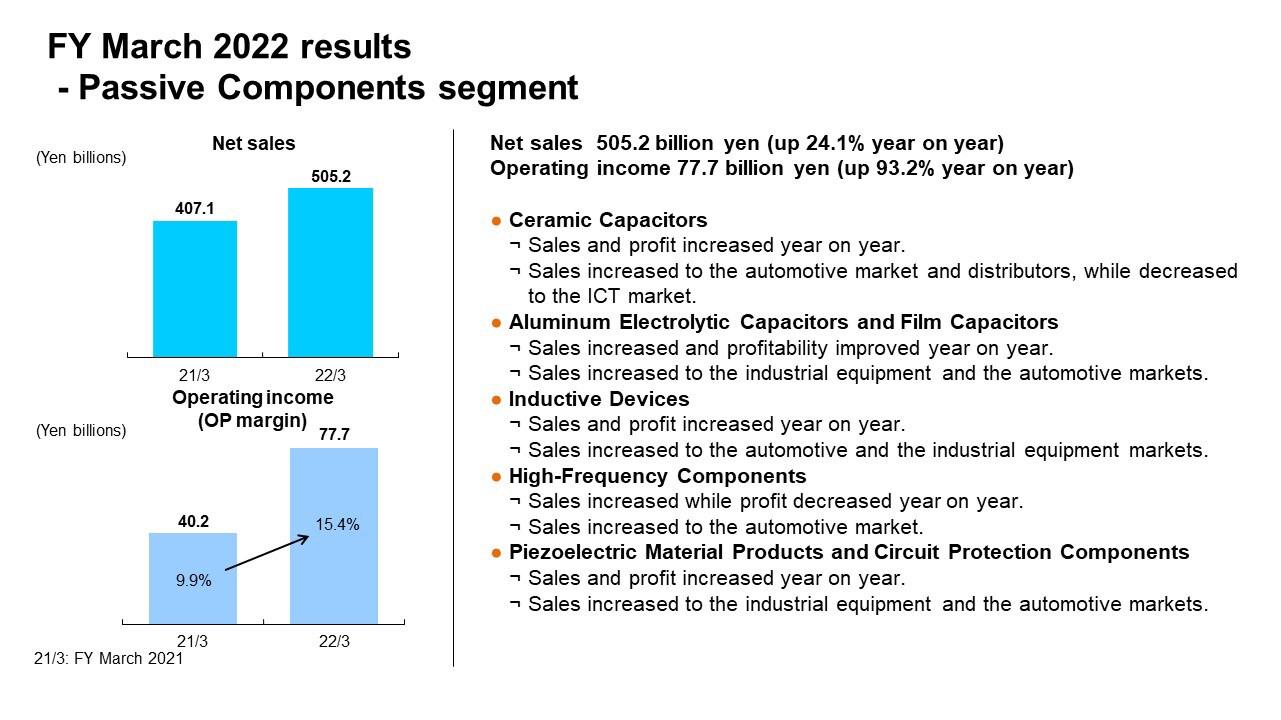

FY March 2022 results - Passive Components segment

Next, I would like to explain our business segment performance for the full year.

Net sales in the Passive Components segment were 505.2 billion yen, an increase of 24.1% year on year. While automobile production volume remained flat year on year, sales to the automobile sector remained robust on the back of an increase in the number of components installed per vehicle. Demand from the industrial equipment market has also been brisk, particularly for applications related to renewable energy and production equipment. Demand from the ICT market increased only slightly reflecting a decline in smartphone production volume. Operating income increased about 1.9 times year on year to 77.7 billion yen, and the operating margin was 15.4%, indicating a significant improvement in profitability.

By business, both net sales and operating income increased year on year in businesses with a high ratio of sales to the automotive market, except for the High-Frequency Components business. In particular, improvement in the profitability of Capacitors and Inductive Devices contributed to the expansion of earnings as a whole.

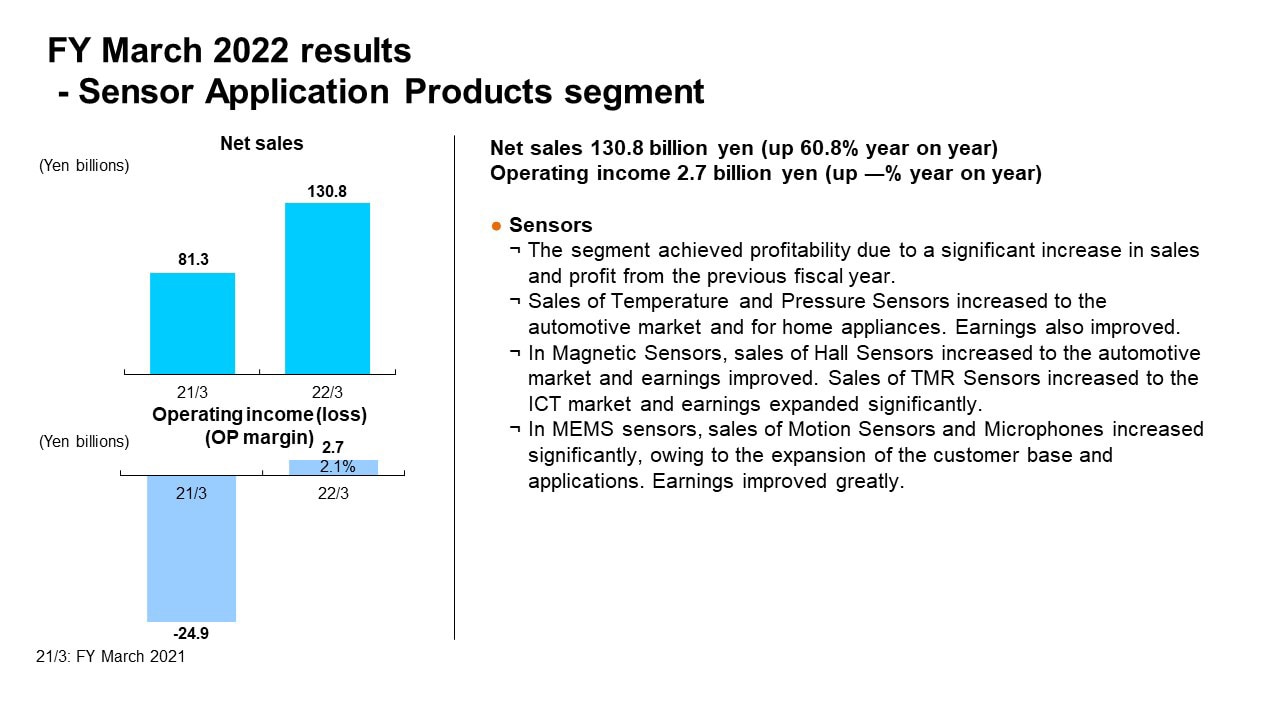

FY March 2022 results - Sensor Application Products segment

In the Sensor Application Products segment, net sales increased 60.8% year on year to 130.8 billion yen, setting a record high. The segment also posted 2.7 billion yen in operating income for the full year on the back of increased sales and positive changes in the product mix, despite one-time expenses of 2.0 billion yen recorded in the fourth quarter.

As demand for Temperature and Pressure Sensors from the industrial equipment and home appliances markets, in addition to the automotive market, remained firm, net sales increased year on year. Sales of Hall Sensors to the automotive market surged, with earnings also improving greatly.

Sales and profit from TMR Sensors rose substantially, driven by their increased adoption in addition to an increase in demand from the ICT market. In MEMS Sensors, sales of Motion Sensors and MEMS Microphones surged, reflecting steady growth on the back of the expansion of the customer base and applications. As a result, earnings further improved and operating loss diminished significantly.

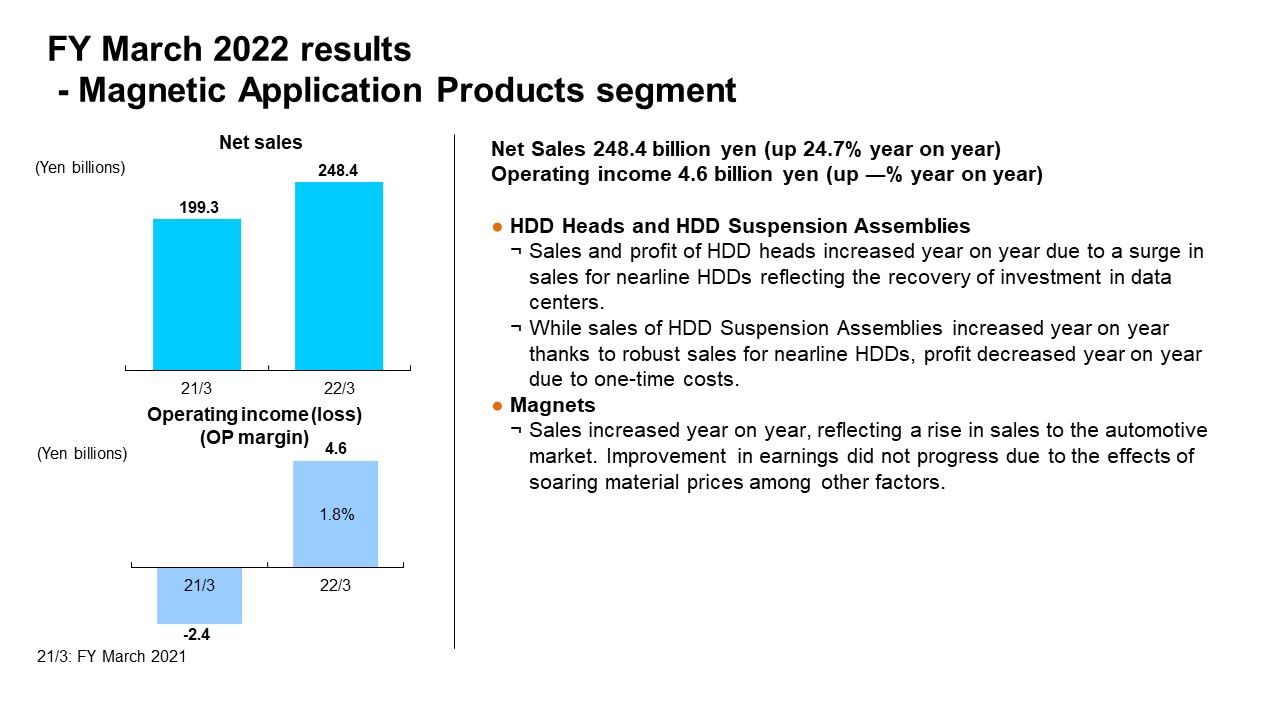

FY March 2022 results - Magnetic Application Products segment

In the Magnetic Application Products segment, net sales increased 24.7% year on year to 248.4 billion yen, and operating income amounted to 4.6 billion yen, compared with a loss recorded in the previous fiscal year.

In terms of HDD Heads, as demand for servers for data centers continued to recover from the beginning of the fiscal year, the sales volume of Nearline HDD Heads increased 1.9 times year on year. The sales volume of HDD Heads as a whole also increased 33% year on year, resulting in increases in both sales and profit.

HDD Suspension Assemblies also saw an increase in net sales as well as an increase in operating income on an actual basis, excluding one-time expenses, as sales of Nearline HDDs remained brisk.

In Magnets, while net sales increased as sales to the automotive market remained robust, operating loss remained at the same level as in the previous fiscal year due to the effects of soaring raw material prices.

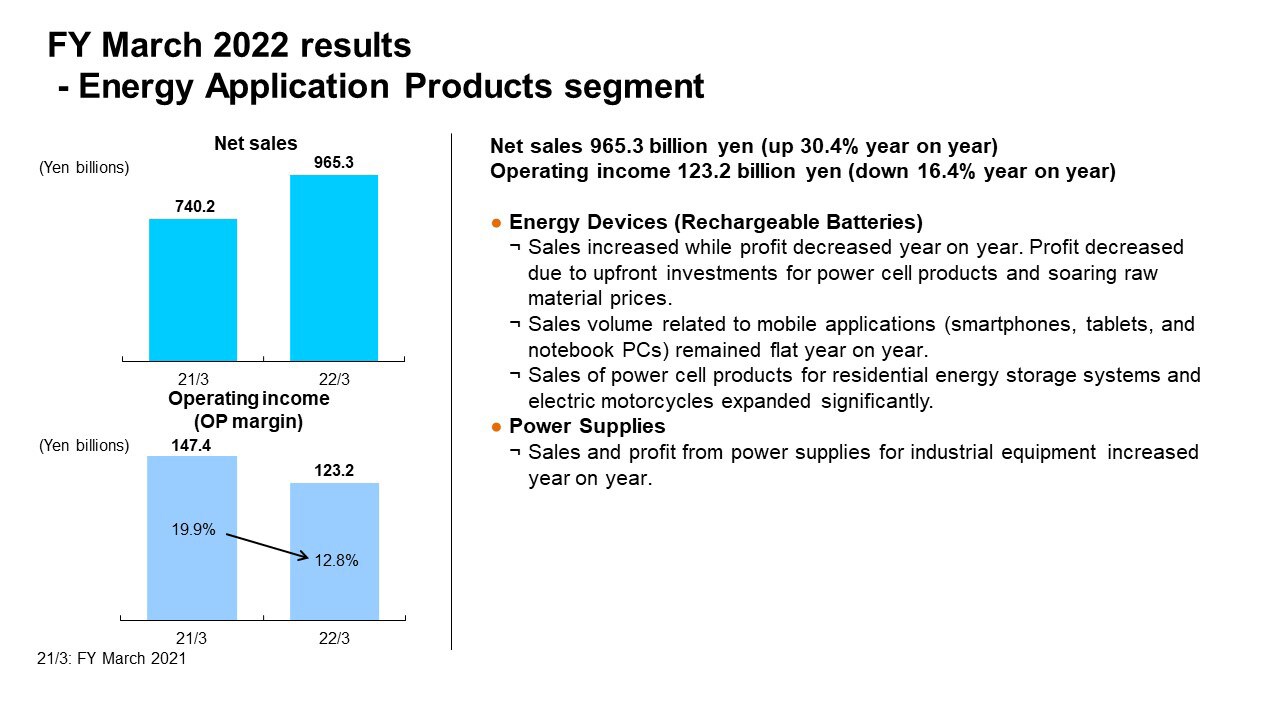

FY March 2022 results - Energy Application Products segment

In the Energy Application Products segment, net sales increased by 30.4% year on year to 965.3 billion yen, while operating income decreased 16.4% year on year to 123.2 billion yen.

In Rechargeable Batteries, sales to the ICT market increased only slightly as smartphone production volume decreased year on year, when excluding the effects of exchange rate fluctuations and an increase in sales as a result of cost pass-through measures to cope with soaring material prices. On the other hand, sales of power cell products for electric motorcycles and residential energy storage systems expanded steadily, and overall sales increased by over 10% year on year. Amid the situation where actual sales to the ICT market remained sluggish, operating income decreased on a year-on-year basis, as negative effects on profit remained due to the resurgence of steep rises in raw material prices from the third quarter of the fiscal year ended March 2022 as well as royalty fees of about 15.0 billion yen. In Power Supplies for Industrial Equipment, demand for semiconductor manufacturing equipment and other industrial equipment remained robust, resulting in increases in both sales and profit.

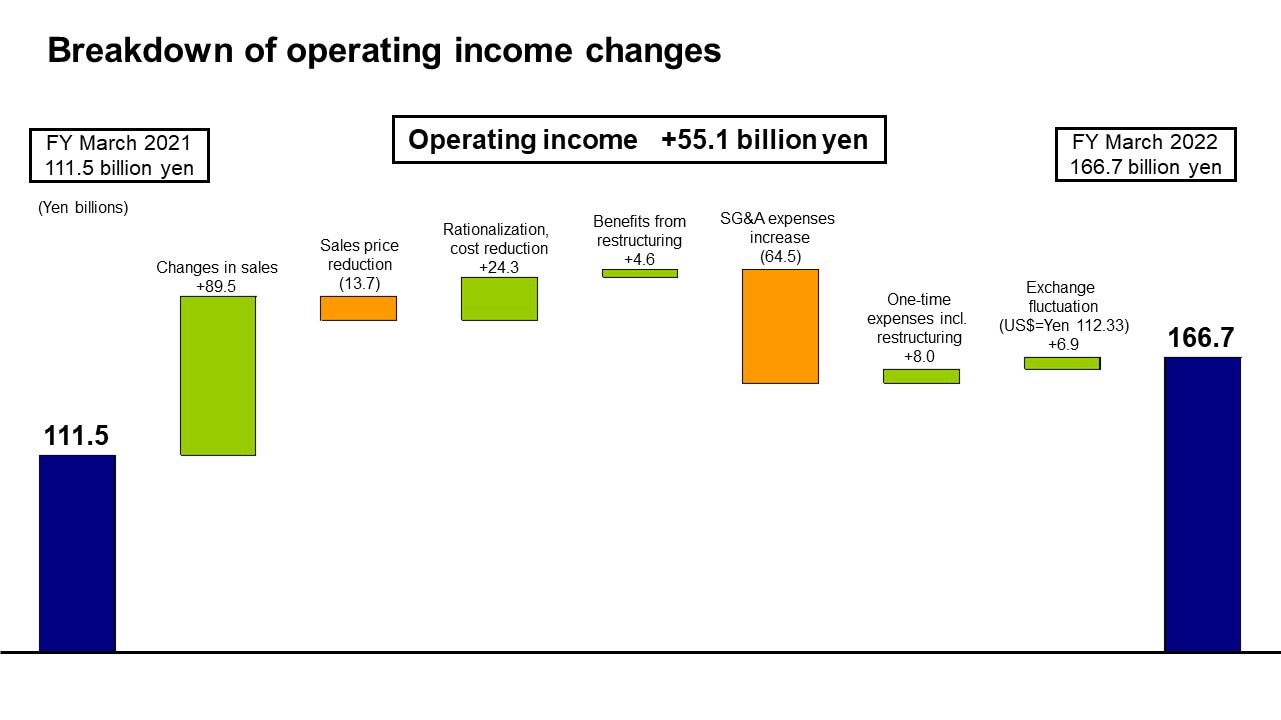

Breakdown of operating income changes

Next is the breakdown of the change in operating income. Let’s take a look at the main factors behind the 55.1-billion-yen increase in operating income. First, there was an increase in profit of 89.5 billion yen attributable to an increase in sales, reflecting increased sales and profit of Passive Components, profitability achieved by Sensors, and a recovery in profit of HDDs, despite the negative effects of soaring material prices for Rechargeable Batteries and other products. While the negative impact of the reductions in sales prices remained minimal, there was an increase in profit of 28.9 billion yen in total as a result of rationalization and cost reduction as well as the benefits from restructuring during the fourth quarter of the previous fiscal year, which boosted profitability.

On the other hand, SG&A expenses increased by 64.5 billion yen. This was owing primarily to the impact of an increase in royalty fees related to Rechargeable Batteries of about 15.0 billion yen, an increase in sales expenses in line with the expansion of sales of Passive Components, an increase in global logistics costs due to COVID-19, and an increase in expenses due to the expansion of the power cell pack business in Rechargeable Batteries. One-time expenses including restructuring recorded in the fourth quarter decreased by 8.0 billion yen from 17.6 billion yen of the previous fiscal year to 9.6 billion yen, and exchange rate fluctuations had a positive impact of 6.9 billion yen due to the depreciation of the yen. As a result, the overall increase in operating income came to 55.1 billion yen.

FY March 2022 quarterly results by segment

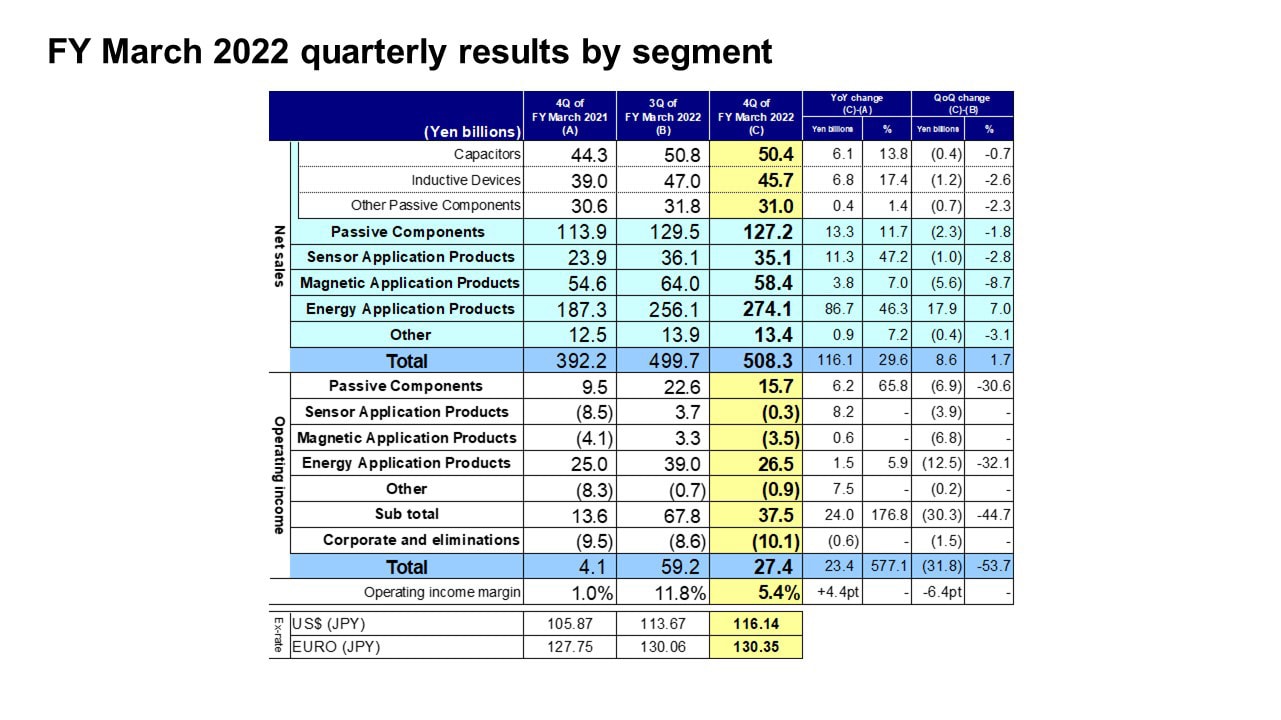

Now, I will explain some of the factors behind the change in segment net sales and operating income from the third quarter to the fourth quarter of the fiscal year ended March 2022.

First, in the Passive Components segment, net sales decreased by 2.3 billion yen, or 1.8%, from the third quarter, and operating income dropped by 6.9 billion yen, or 30.6%, from the third quarter. As for net sales, sales to the automotive market remained brisk, while sales for smartphone applications decreased in the ICT market and sales of High-Frequency Components declined significantly. Operating income in this segment decreased from the third quarter due to one-time expenses of 2.1 billion yen recorded in the fourth quarter and the decline in operations during the Chinese New Year holiday.

In the Sensor Application Products segment, net sales decreased by 1.0 billion yen, or 2.8%, from the third quarter, and operating income dropped by 2.0 billion yen from the third quarter, excluding one-time expenses of 2.0 billion yen recorded in the fourth quarter. Sales of Temperature and Pressure Sensors rose slightly from the third quarter due to an increase in sales to the automotive market. In Magnetic Sensors, sales of Hall Sensors for automobile applications remained robust. Meanwhile, in TMR Sensors, sales volume of new products sold to major smartphone manufacturers decreased significantly from the third quarter due to seasonal factors, while sales of Motion Sensors remained flat from the third quarter. As for operating income, earnings from TMR Sensors declined from the third quarter due to a decrease in sales, earnings from MEMS Sensors decreased slightly from the third quarter reflecting an increase in development costs, and earnings from Hall Sensors dropped from the third quarter due to the effects of soaring energy costs, among other factors.

In the Magnetic Application Products segment, net sales decreased by 5.6 billion yen, or 8.7%, from the third quarter, and operating income dropped by 3.9 billion yen from the third quarter, excluding one-time expenses of 2.9 billion yen recorded in the fourth quarter. As for net sales, the sales volume of HDD Heads for Nearline HDD and PC applications decreased by about 19% from the third quarter, due to the decline in demand related to data centers, among other factors. Sales of assembled HDDs also declined significantly from the third quarter due to a decrease in the sales volume by about 17%, while sales of HDD Suspension Assemblies dropped slightly from the third quarter. Sales of Magnets increased slightly from the third quarter reflecting robust demand for automobile applications. As for operating income, earnings of HDD Heads decreased significantly from the third quarter due to the decline in operations during the Chinese New Year holiday, on top of a decline in sales volume. Earnings of HDD Suspension Assemblies increased slightly from the third quarter, excluding the impact of one-time expenses. Operating loss of Magnets increased from the third quarter owing to the lingering effects of soaring raw material prices, even without the effects of one-time expenses of 1.7 billion yen.

In the Energy Application Products segment, net sales increased by 17.9 billion yen, or 7.0%, from the third quarter, and operating income dropped by 12.5 billion yen, or 32.1%, from the third quarter. Sales of Rechargeable Batteries increased slightly from the third quarter on the basis of excluding the effects of exchange rate fluctuations and an increase in sales as a result of cost pass-through measures to cope with soaring material prices, despite a decrease in smartphone production volume. Sales of Power Supplies for Industrial Equipment rose slightly from the third quarter. As for operating income, earnings of Rechargeable Batteries decreased from the third quarter as a result of the lingering effects of the further rise in material prices in the fourth quarter. Earnings of Power Supplies for Industrial Equipment rose from the third quarter on the back of increased sales.

That concludes my presentation. Thank you very much for your attention.