[ Financial Results for Fiscal 2021 Performance Briefing ]Consolidated Results for FY March 2021

Mr. Tetsuji Yamanishi

Executive Vice President

Hello, I am Tetsuji Yamanishi, Executive Vice President of TDK. Thank you for taking the time to attend TDK’s performance briefing for the fiscal year ended March 2021. I will be presenting an overview of our consolidated results.

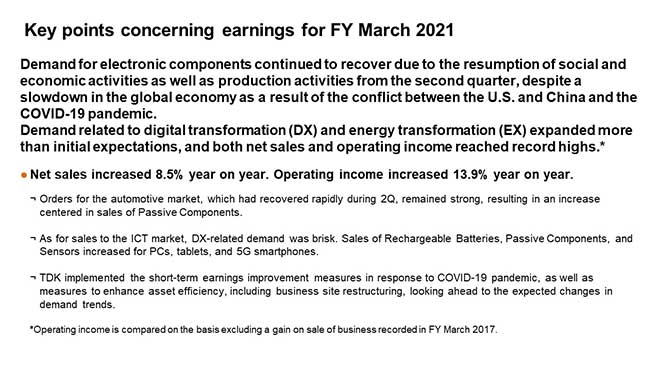

Key points concerning earnings for FY March 2021

First, let me explain the key points of earnings. The global economy during the fiscal year ended March 2021 was greatly affected by the resurgence of COVID-19 and the worsening conflict between the United States and China, but demand for electronic components continued to recover due to the gradual resumption of social and economic activities as well as production activities in each country from the second quarter. In particular, demand related to digital transformation (DX) and energy transformation (EX) grew more than initially expected, and we responded by handling surging orders in a timely manner. As a result, net sales increased 8.5% year on year and operating income increased 13.9% year on year, setting record highs in both sales and operating income.

Orders remained strong for the automotive market, which recovered rapidly during the second quarter. This resulted in an increase particularly in sales of passive components, coupled with the acceleration of the electrification of automobiles, such as xEV and ADAS. As for sales to the ICT market, DX-related demand remained brisk from the beginning of the fiscal year, and sales of rechargeable batteries, passive components, and sensors increased for PCs, tablets, and 5G smartphones. In the industrial equipment market, demand for renewable energy has increased, and the recovery in EX-related demand has become clear.

The environment surrounding electronic components has entered a period of major transformation, and it is expected that the trends of DX and EX will continue to accelerate in the future. In order to seize such growth opportunities and carry out more efficient and competitive business operations, we implemented structural reforms in the fourth quarter to enhance asset efficiency, including business site restructuring and impairment of equipment, looking ahead to expected changes in demand trends.

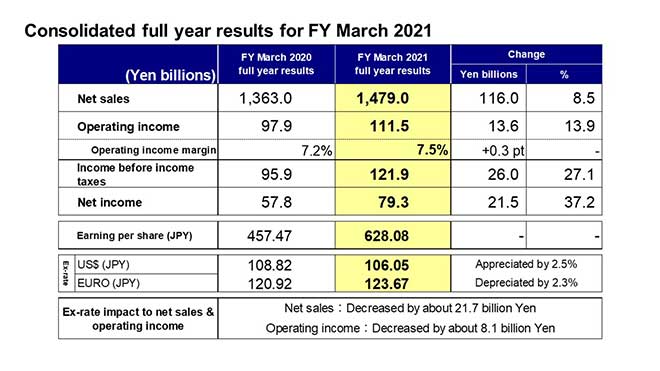

Consolidated full year results for FY March 2021

Next, I would like to present an overview of our results. There was a decrease of about 21.7 billion yen in net sales and a decrease of about 8.1 billion yen in operating income due to exchange rate fluctuations against the U.S. dollar and other currencies. Including this impact, net sales were 1,479.0 billion yen, an increase of 116.0 billion yen, or 8.5%, year on year. Operating income was 111.5 billion yen, up 13.6 billion yen, or 13.9%, year on year, including the effect of one-time expenses such as restructuring of 17.6 billion yen. Income before income taxes was 121.9 billion yen, net income was 79.3 billion yen, and earnings per share were 628.08 yen.

With regard to exchange rate sensitivity, we maintain our estimate that a change of 1 yen against the U.S. dollar will affect annual operating income by about 1.2 billion yen, while a change against the euro will have an impact of about 0.2 billion yen.

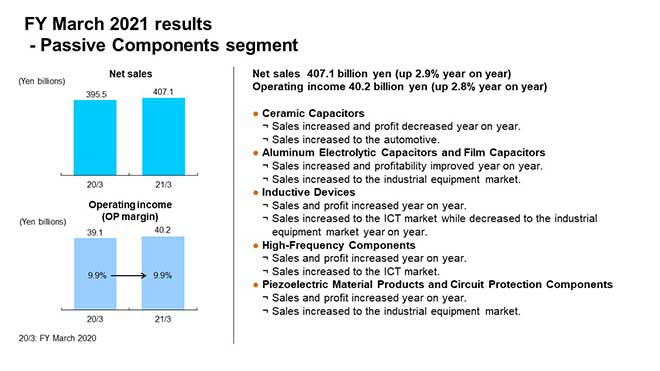

FY March 2021 results - Passive Components segment

Next, I would like to explain our business segment performance for the full-year.

Net sales in the Passive Components segment were 407.1 billion yen, an increase of 2.9% year on year. Demand from the automotive market has been recovering rapidly since the second quarter, 5G-related demand remained robust in the ICT market, and demand related to renewable energy increased in the industrial equipment market, resulting in increased sales in all our priority markets. Operating income was 40.2 billion yen, an increase of 2.8% year on year, and the recording of one-time expenses including business site restructuring of about 3.7 billion yen in the fourth quarter resulted in an operating margin of 9.9%, the same level as the previous fiscal year.

By business, sales of ceramic capacitors increased, but profit decreased due to the impact of declining demand in the automotive market, reflecting the effects of the lockdown in the first quarter. In aluminum electrolytic capacitors and film capacitors, sales to the industrial equipment market surged mainly in renewable energy-related sales, which also resulted in improvement in profitability. In inductive devices, sales increased to the automotive market due to a recovery in demand, as well as to the ICT market, such as smartphone applications. Consequently, both sales and profit increased year on year. Sales and profit of high-frequency components increased year on year due to strong 5G-related demand. Sales of piezoelectric material products and circuit protection components increased for industrial equipment such as renewable energy-related products, as well as for game consoles and home appliances due to increased demand resulting from people staying home, which led to an increase in profit.

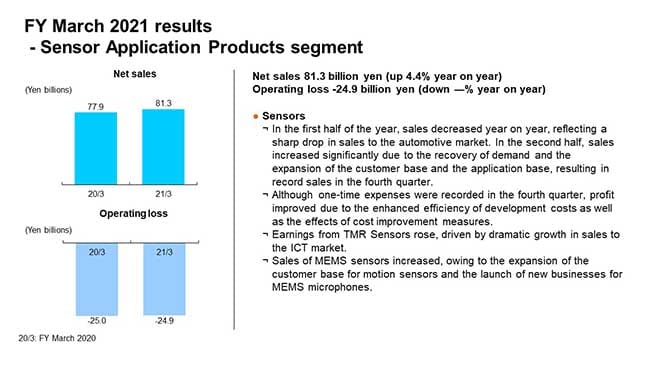

FY March 2021 results - Sensor Application Products segment

In the Sensor Application Products segment, net sales increased 4.4% year on year to 81.3 billion yen, while operating loss remained virtually unchanged from the previous fiscal year.

Although sales to the automotive market fell sharply in the first half, sales recovered significantly in the second half due to the recovery in demand from the automotive market and the effect of expansion in customer base and applications of strategic products. As a result, sales in the fourth quarter reached the highest level on a quarterly basis.

In the fourth quarter, we posted about 4.1 billion yen in restructuring expenses, including business site restructuring and asset disposal. Despite the recording of a loss, overall earnings improved due to the effects of enhanced development efficiency and cost improvement measures. Earnings from TMR sensors rose substantially, driven by dramatic growth in sales to the ICT market. Sales of MEMS sensors increased, owing to the expansion of the customer base for motion sensors and the launch of new businesses for MEMS microphones.

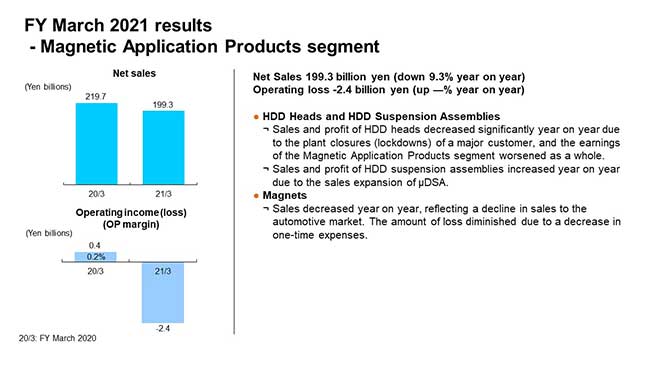

FY March 2021 results - Magnetic Application Products segment

In the Magnetic Application Products segment, net sales decreased 9.3% year on year to 199.3 billion yen, with an operating loss of 2.4 billion yen.

As for HDD heads, sales volume decreased significantly due to the plant closures (lockdowns) of a major customer in the first quarter, and the selling price of existing products fell amid the absence of a new product launch. Consequently, earnings deteriorated significantly. Meanwhile, HDD suspension assemblies saw increases in both sales and profit due to a rise driven by robust sales of nearline HDDs for the data centers of a major customer and the sales expansion of μDSA products. Sales of magnets decreased year on year, reflecting a decline in demand from the automotive market in the first half, despite an increase in sales to the industrial equipment market such as renewable energy-related applications. Meanwhile, the amount of loss diminished due to the decrease in the impairment loss recorded in the previous fiscal year.

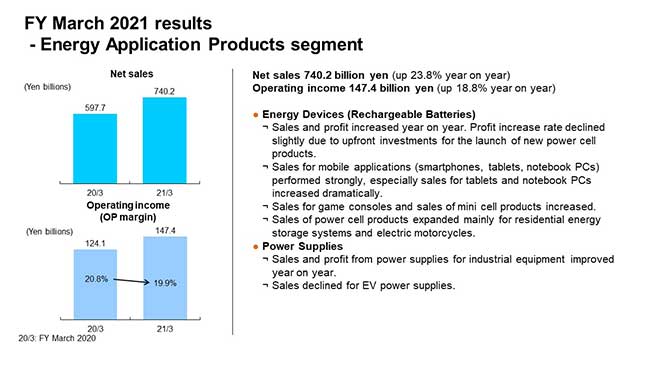

FY March 2021 results - Energy Application Products segment

In the Energy Application Products segment, net sales were 740.2 billion yen, an increase of 23.8% year on year, and operating income was 147.4 billion yen, an increase of 18.8% year on year. As for rechargeable batteries, since we made upfront investments prior to the launch of new power cell products, the profit increase rate declined slightly compared to the increase in sales.

Sales of rechargeable batteries for mobile applications such as smartphones, tablets and notebook PCs have been strong since the beginning of the fiscal year, and sales for tablets and notebook PCs in particular increased significantly, reflecting increased demand related to remote work and education. In addition, sales for game consoles and sales of mini cell products expanded, and sales of power cell products mainly for residential energy storage systems and electric motorcycles, which are expected to grow in the future, began in earnest, with sales increasing significantly from the previous fiscal year.

In power supplies, sales and profit increased, driven by a recovery in demand for use in industrial equipment such as semiconductor manufacturing equipment. Sales of EV power supplies decreased due to a decline in sales of inverters, despite steady growth in sales of DC-DC converters.

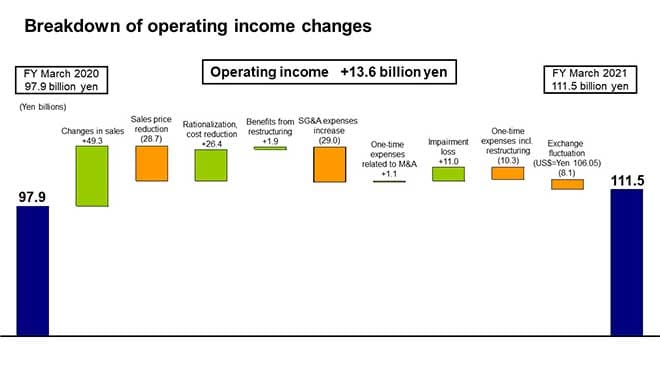

Breakdown of operating income changes

Next is the breakdown of the change in operating income. Let’s take a look at the main factors behind the 13.6 billion yen increase in operating income. There was an increase in income of about 49.3 billion yen due to an increase in sales volumes reflecting the expansion of sales of rechargeable batteries and other products. The negative impact of sales price reductions of about 28.7 billion yen was counteracted by the effects of cost reductions from rationalizing about 26.4 billion yen as well as benefits from restructuring of about 1.9 billion yen. Expenses related to the InvenSense acquisition decreased by about 1.1 billion yen, while selling, general and administrative expenses (SG&A) increased by about 29.0 billion yen due to increases in connection with the business expansion in rechargeable batteries and development expenses reflecting the acceleration of power cell development, as well as the cessation of a filter fee that TDK had been receiving up to the previous fiscal year.Operating income increased by 13.6 billion yen in total, as an impairment loss of about 18.3 billion yen in the previous fiscal year decreased by about 11.0 billion yen year on year to about 7.3 billion yen in the fiscal 2021, profit decreased by about 10.3 billion yen due to one-time expenses for business site restructuring and asset disposal, and profit decreased by about 8.1 billion yen due to exchange rate fluctuations.

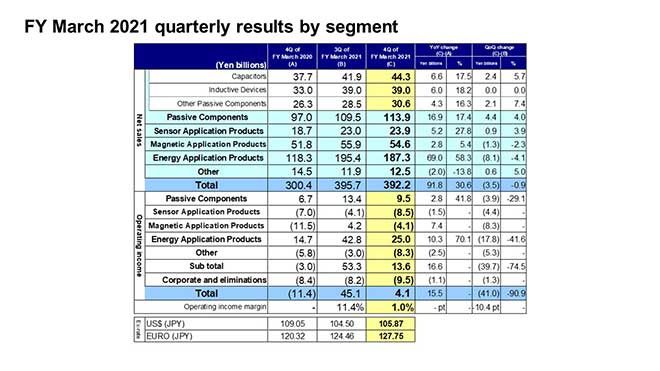

FY March 2021 quarterly results by segment

Next, I will explain some of the factors behind the changes in net sales and operating income by segment from the third quarter to the fourth quarter of the fiscal year ended March 2021.

In the Passive Components segment, net sales increased by 4.4 billion yen, or 4.0%, from the third quarter, and operating income decreased by 29.1% from the third quarter to an operating loss of 3.9 billion yen. While sales to the automotive and the industrial equipment markets increased, sales related to smartphones decreased due to seasonality in the ICT market from the peak season in the third quarter. As a result, while sales of inductive devices and high-frequency components remained virtually flat, sales increased in other businesses with higher sales to the automotive and the industrial equipment markets. Operating income remained virtually unchanged, excluding the effect of one-time expenses of about 3.7 billion yen for business site restructuring and other purposes recorded in the fourth quarter.

Net sales in the Sensor Application Products segment increased by 900 million yen, or 3.9%, and operating loss increased by 4.4 billion yen, which included restructuring expenses of 4.1 billion yen for business site restructuring and asset disposal recorded in the fourth quarter. With the recovery of demand from the automotive market, sales of temperature and pressure sensors and hall sensors increased. Among MEMS sensors, sales of motion sensors increased for Chinese smartphones, and sales from new projects for MEMS microphones also increased. Meanwhile, sales of TMR sensors for smartphones decreased due to seasonality from the peak season in the third quarter. Comparing operating income on a real basis excluding restructuring expenses, temperature and pressure sensors increased, magnetic sensors decreased due to a decline in sales of TMR sensors, and the amount of loss from motion sensors diminished among MEMS sensors, while new product development costs for MEMS microphones increased. As a result, MEMS sensors on the whole saw a slight increase in loss.

In the Magnetic Application Products segment, net sales decreased by 1.3 billion yen, or 2.3% year on year, and operating income decreased by 8.3 billion yen year on year. Impairment loss and business site restructuring expenses of about 5.0 billion yen were recorded in the fourth quarter, while the medical precision components business included in the HDD suspension assemblies business was sold in the third quarter, which resulted in a gain on sales of about 2.4 billion yen. On a net basis, one-time expenses increased by about 7.4 billion yen, and operating income in the fourth quarter decreased by about 900 million yen from the third quarter. Net sales remained virtually flat due to a decline in selling prices and a decrease in HDD assembly sales, despite an increase in the sales volume of HDD heads by about 8% from the third quarter. Net sales of HDD suspension assemblies decreased as sales for use in nearline HDDs decreased slightly and sales of suspension application products for use in smartphones decreased. Net sales of magnets remained virtually flat. Operating income on a real basis, excluding one-time expenses, declined slightly for the segment on the whole, due to an increase in development costs for new head technology for HDD heads.

In the Energy Application Products segment, net sales decreased by 8.1 billion yen, or 4.1% year on year, and operating income decreased by 17.8 billion yen, or 41.6% year on year. Sales of rechargeable batteries for smartphones decreased due to seasonality, while sales of power supplies for industrial equipment increased to reflect rising demand. Sales of EV power supplies also increased. Operating income fell sharply due to a decrease in sales volume of rechargeable batteries, an increase in costs associated with operation during the Chinese New Year holidays, and the impact of rising material prices. Profit for power supplies for industrial equipment increased slightly, while the amount of loss from EV power supplies diminished.

The business of camera module micro actuators for smartphones, which is included in “Other,” continued to post a loss due to the significant decline in sales to a major Chinese customer, and recorded an impairment loss on dedicated line equipment in the fourth quarter that caused the loss to increase by 5.3 billion yen.

That concludes my presentation. Thank you very much for your attention.