[ 1st Quarter of fiscal 2021 Performance Briefing ]Consolidated Results for 1Q of FY March 2021

Mr. Tetsuji Yamanishi

Executive Vice President

Hello, I'm Tetsuji Yamanishi, Senior Vice President of TDK. Thank you for taking the time to attend TDK's performance briefing for the first quarter (April to June) of the fiscal year ending March 2021. I will be presenting an overview of our consolidated results.

Key points concerning earnings for 1Q of FY March 2021

First, let’s take a look at the key points concerning the earnings for the first quarter. With an increasing impact on the real economy from the global spread of COVID-19, the Company’s businesses in the first quarter experienced various changes from initial expectations in terms of levels of demand. In the automotive market and the HDD market, suspension of plant operations by a major customer had a significant impact, and sales to these markets were significantly lower than the initially expected levels. In the ICT market, smartphone demand decreased sharply year on year, as anticipated, while an increase in people working at home and taking classes online caused a sudden acceleration in digital transformation (DX), with mobile device- and 5G-related demand increasing more than initially anticipated.

With demand trends changing from initial expectations in the Company’s core markets, inconsistencies have emerged in the performance for each segment. However, looking at year on year comparisons, overall net sales decreased by 8.1% while operating income decreased by 26.4%.

Despite the adverse market environment, sales and profits from Rechargeable Batteries grew by steadily capturing demand. The acceleration of DX drove expansion in demand for PCs, tablets, and 5G base stations, resulting in higher sales of Rechargeable Batteries, MLCCs, and High Frequency Components, which exceeded initially expected levels by a large margin. This provided a significant boost to first-quarter performance, which was expected to reflect harsh earnings conditions. On the other hand, due to lackluster demand in the automotive market, sales of Passive Components and conventional sensors, for which the automotive market account for a large share of sales, fell below initial expectations. Meanwhile, in HDD Heads, suspension of plant operations by a major customer had a significant impact, causing a fall in sales volumes below initial expectations. Earnings decreased sharply as a result.

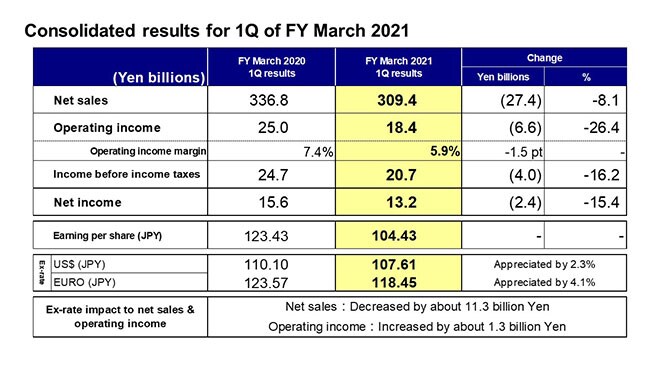

Consolidated results for 1Q of FY March 2021

Moving along, I would like to present an overview of our results. The yen's appreciation against the U.S. dollar and other currencies caused net sales to contract by around 11.3 billion yen and operating income to increase by around 1.3 billion yen. Including this impact, net sales were 309.4 billion yen, a decrease of 27.4 billion yen, or 8.1%, year on year.

Operating income was 18.4 billion yen, down 6.6 billion yen, or 26.4%, year on year. Income before income taxes was 20.7 billion yen, net income was 13.2 billion yen, and earnings per share were 104.43 yen.

With regard to exchange rate sensitivity, we maintain our estimate that a change of 1 yen against the U.S. dollar will affect annual operating income by about 1.2 billion yen, while a change against the euro will have an impact of about 0.2 billion yen.

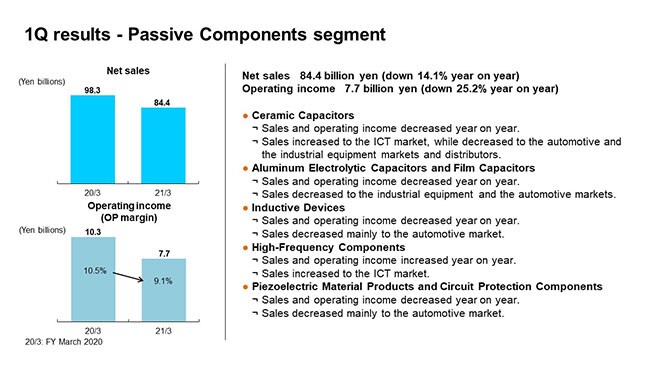

1Q results - Passive Components segment

Next, I would like to explain our business segment performance.

In the Passive Components segment, net sales declined 14.1% year on year to 84.4 billion yen, operating income decreased 25.2% to 7.7 billion yen, and the operating income margin was 9.1%.

Weak demand in the automotive and the industrial equipment markets continued from the previous fiscal year, while orders in the automotive market in particular were lower than initial expectations, reflecting the suspension of plant operations by a major customer due to the impact of COVID-19. On the other hand, in the ICT market, sales exceeded initial expectations. Demand increased significantly for 5G handsets and base stations, particularly in China, along with demand to secure component inventories in advance. As a result, despite a year on year decrease in sales and profits for Aluminum Electrolytic Capacitors and Film Capacitors, as well as Capacitors, Inductors, Piezoelectric Material Products, and Circuit Protection Components, for which the automotive and the industrial equipment markets account for a large share of sales, and for, a significant increase in demand for use in 5G base stations drove a significant increase in sales of Capacitors for base stations, so that profitability remained level year on year. In addition, in High Frequency Components, for which the ICT market accounts for a large share of sales, favorable 5G-related sales enabled growth in sales and profits for a marked increase in profitability.

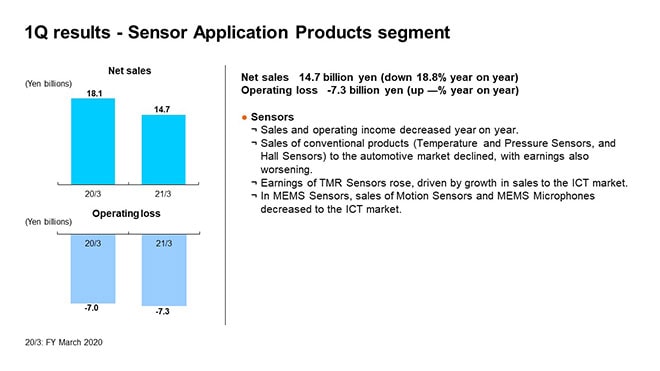

1Q results - Sensor Application Products segment

In the Sensor Application Products segment, net sales declined 18.8% year on year to 14.7 billion yen, and operating loss remained at the same level year on year.

With a business structure in which sales of mainly conventional sensors to the automotive market currently account for around 50% of net sales, the segment is strongly impacted by the slump in demand in the automotive market. This was compounded by the impact of suspension of plant operations at automotive-related customers mainly in Europe and the U.S. during the first quarter, as sales of Temperature and Pressure Sensors and Hall Sensors fell sharply with an attendant deterioration in profits. On the other hand, sales of TMR Sensors were brisk, mainly due to growth in share of sales for use in smartphones, and this TMR Sensors finished by turning a profit. MEMS Sensors were impacted by a decrease in consumer confidence amid the COVID-19 crisis, resulting in declining demand for Microphones used in IoT devices as well as a decrease in smartphone models fitted with Motion Sensors. As a result of these and other factors, sales decreased and MEMS Sensors continued to make a loss due to insufficient sales growth, although the loss is narrowing.

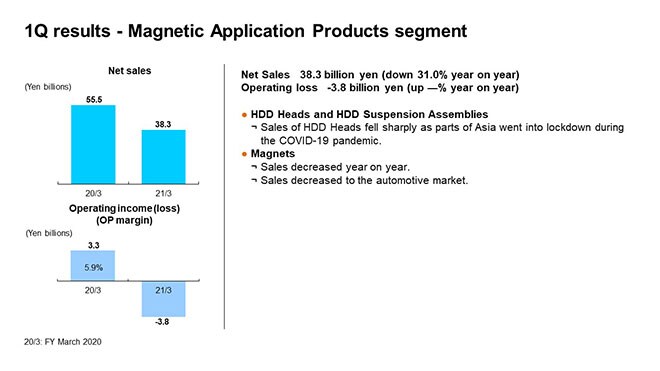

1Q results - Magnetic Application Products segment

In the Magnetic Application Products segment, net sales declined 31.0% year on year to 38.3 billion yen, and an operating loss of 3.8 billion yen was recorded.

Total HDD demand in the first quarter declined by about 20% year on year, but demand for HDD Heads remained about level year on year due to the increase in Nearline HDDs. In the first quarter, a major customer suspended plant operations due to COVID-19, causing HDD Head shipment volumes to fall even further below the initially expected level, dropping by around 45% year on year. As a result, HDD Heads and HDD Suspension Assemblies overall recorded a significant decrease in sales and profits, despite a year on year improvement in earnings of HDD Suspension Assemblies. In Magnets, since almost all sales are to the automotive and the industrial equipment markets, the slump in demand had a heavy impact, resulting in a sharp decrease in sales while operating loss continued at the same level year on year.

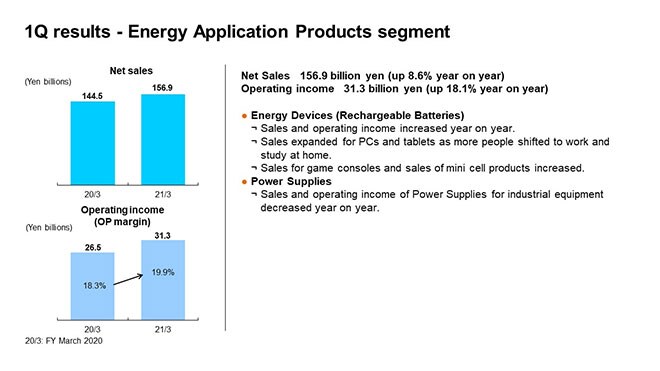

1Q results - Energy Application Products segment

In the Energy Application Products segment, net sales rose 8.6% year on year to 156.9 billion yen, and operating income surged 18.1% to 31.3 billion yen. Profitability also improved, with the operating income margin at 19.9%.

In Rechargeable Batteries, although sales for smartphone applications were slightly higher than initially expected, they were lower year on year due to the impact of a decrease in production volume of smartphones. On the other hand, demand for use in tablets and laptop applications expanded sharply atop an increase in people working at home and taking classes online, and sales volumes grew significantly higher than initially expected levels. Sales for game consoles and sales of mini cells used in wearable products such as wireless earphones also increased steadily. Overall, Rechargeable Battery sales exceeded initial expectations to secure marked increases in sales and profits year on year.

In Power Supplies for industrial equipment, sales and profits both decreased year on year as sales to the industrial equipment market declined due to the impact of a drop in demand.

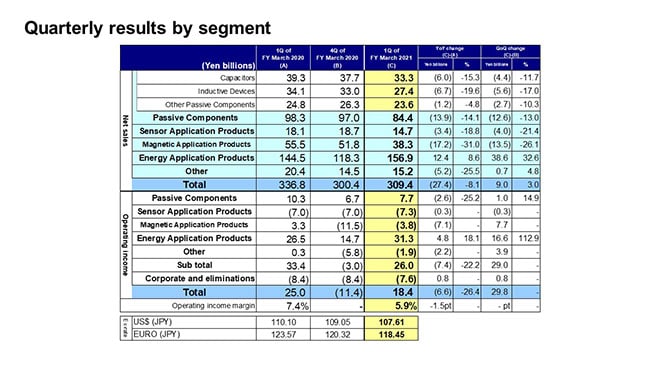

Quarterly results by segment

Next, I would like to explain the factors behind the changes in segment net sales and operating income from the fourth quarter of the fiscal year ended March 2020 to the first quarter of the fiscal year ending March 2021.

Let’s begin with net sales in the Passive Components segment. Net sales in this segment decreased by 12.6 billion yen, or 13.0%, from the fourth quarter; while operating income increased by 1.0 billion yen, or 14.9%. Net sales declined overall, as the impact of suspended plant operations at European and U.S. customers in the automotive market outweighed an increase in sales to the ICT market and distributors, mainly due to growth in 5G-related demand. Compared to the fourth quarter, sales decreased, with the exception of High Frequency Components, which remained about level. Operating income decreased by 1.1 billion yen in real terms, excluding impairment loss of 2.1 billion yen occurring in the fourth quarter. High Frequency Components, which saw brisk sales to the ICT market, also achieved a significant increase in profit, partly due to an increase in profitability. In Capacitors, growth in sales for base station applications absorbed the impact of a decrease in sales to the automotive market, with profitability increasing despite a slight decrease in profits. Operating income from other Passive Components products was heavily impacted by lower sales.

In the Sensor Application Products segment, net sales fell by 4.0 billion yen, or 21.4%, from the fourth quarter; while the operating loss widened by 0.3 billion yen. The segment was heavily impacted by the suspension of plant operations at European and U.S. automotive-related customers. Sales of Temperature and Pressure Sensors and Hall Sensors decreased, while MEMS Motion Sensor sales remained about level from the fourth quarter, as growth in sales for game consoles absorbed a decline in sales for smartphones. In operating income, Temperature and Pressure Sensors saw lower profits on lower sales, operating losses from Magnetic Sensors narrowed slightly with a solid contribution to earnings from TMR Sensors, and operating losses from MEMS Sensors narrowed due to improvements in costs, despite the impact of lower sales.

In the Magnetic Application Products segment, net sales decreased by 13.5 billion yen, or 26.1%, from the fourth quarter; while operating income decreased by 6.7 billion yen in real terms, excluding impairment loss of 14.4 billion yen occurring in the fourth quarter. In HDD Heads, a major impact from a decrease in sales volume of around 44% from the fourth quarter resulted in overall sales of HDD Head and HDD Suspension Assemblies decreasing by around 28%; while sales of Magnets decreased by around 12%. In operating income, HDD Heads reported an operating loss due to the impact of lower sales volume, while Magnets narrowed the operating loss due to cost reductions, impairment effects, and other factors, despite the decrease in sales.

In the Energy Application Products segment, net sales increased by 38.6 billion yen, or 32.6%, from the fourth quarter; while operating income increased significantly by 16.6 billion yen, almost two-fold. In Rechargeable Batteries, demand for smartphone applications began to increase in the first quarter after a seasonal decline in the fourth quarter, and sales for tablet and PC applications increased significantly. Sales of Power Supplies for industrial equipment decreased slightly.

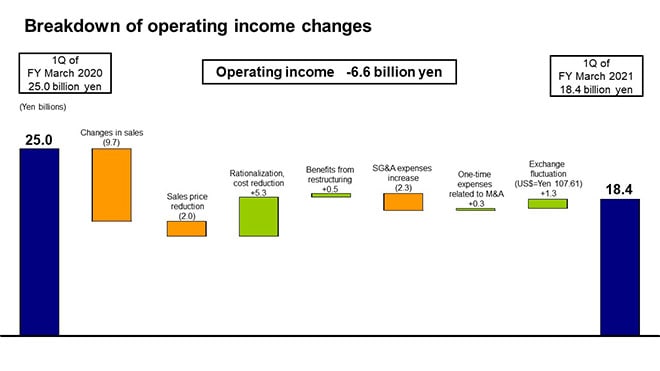

Breakdown of operating income changes

Next is the breakdown of the change in operating income. Let’s take a look at the main factors behind the 6.6 billion yen decrease in operating income. First, there was a decrease in profits of about 9.7 billion yen due to a decrease in sales volume mainly for Passive Components and HDD Heads. Reductions in sales prices had a negative impact of about 2.0 billion yen. On the other hand, there was a positive impact of about 5.3 billion yen from cost reductions undertaken to counteract profit deterioration due to the impact of COVID-19, which combined with benefits of about 0.5 billion yen from restructuring to strengthen our constitution. Expenses related to the InvenSense acquisition decreased by about 0.3 billion yen, while selling, general and administrative expenses increased by about 2.3 billion yen with an increase in development expenses in connection with business expansion in Rechargeable Batteries and the cessation of a filter fee that TDK had been receiving up to the previous fiscal year. Exchange rate fluctuations had a positive impact of 1.3 billion yen. As a result, the overall decrease in operating income was 6.6 billion yen.

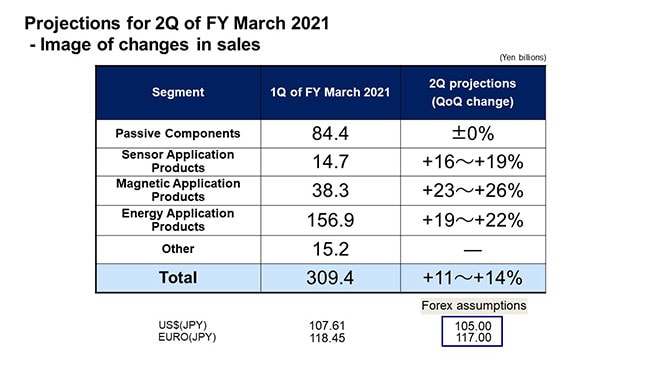

Projections for 2Q of FY March 2021 - Image of changes in sales

Let me now discuss our image of changes in net sales for the second quarter of the fiscal year ending March 2021.

In the first quarter, the automotive market was strongly impacted by the suspension of plant operations mainly in Europe and the U.S. In the second quarter, we expect the market to recover to slightly below the level of our initial expectation, albeit with some variation between regions. In the ICT market, the number of smartphones products will reach a level slightly above our initial expectations, while demand for PCs and tablets will continue to move briskly.

Now let’s look at changes in net sales from the first quarter to the second quarter by segment in light of these demand trends in TDK’s priority markets. In the Passive Components segment, we are projecting that overall net sales will remain level with the first quarter. Sales for the automotive market are projected to increase, while sales for smartphone applications are projected to decrease after a move to secure component inventories in the first quarter, sales for base stations are projected to decline gradually toward the second half, and sales to distributors are also projected to decrease due to inventory adjustments.

In the Sensor Application Products segment, we are projecting an increase in sales of Temperature and Pressure Sensors as orders received have increased with the restart of plant operations at European and U.S. automotive-related customers. We are also projecting increases in sales of TMR Sensors and MEMS Microphones.

In the Magnetic Application Products segment, we are projecting sales volumes of HDD Heads to recover to initially expected levels as a major customer fully restart plant operations. In HDD Suspension Assemblies, we are projecting an increase in sales volume for application in Nearline HDDs. In Magnets, we are also projecting an increase in sales following growth in automobile demand.

In the Energy Application Products segment, we are projecting an increase in demand for smartphone applications as well as further growth in demand for PCs and tablet applications from the first quarter, as well as further increases in demand for mini cells for wearable products from the first quarter.

In light of the above, we are projecting net sales growth of 11% to 14% in the second quarter compared to the first quarter.

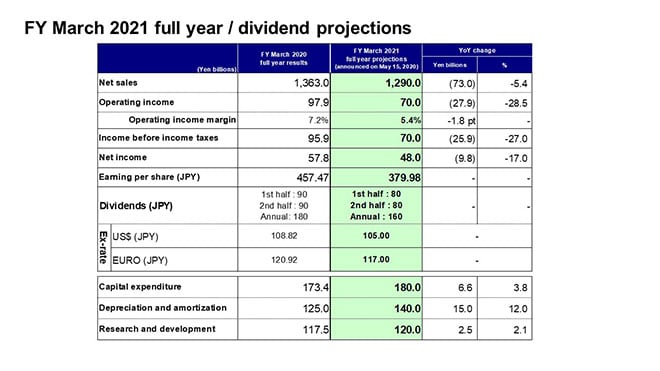

FY March 2021 full year / dividend projections

Finally, I would like to discuss our consolidated full-year projections for the fiscal year ending March 2021. We have maintained the full-year projections announced previously in May.

During the first quarter, our performance exceeds the level of our initial expectations by a significant margin, mainly due to growth in demand driven by DX acceleration and moves to secure inventory based on supply chain concerns. However, the impact of COVID-19 on the real economy remains unclear for now. In our three priority markets: automotive, ICT, and industrial equipment, there has been some variation from the initially expected trends in demand, and our sales projections have also changed by market and segment. Nevertheless, at this point, based on the assumption that there will not be a major change from our initially expected levels for the full year overall, we have maintained our full-year projection figures as initially announced.

That concludes my presentation. Thank you very much for your attention.