[ 3rd Quarter of fiscal 2020 Performance Briefing ]Consolidated Results for 3Q of FY March 2020

Consolidated Full Year Projections for FY March 2020

Mr. Tetsuji Yamanishi

Senior Vice President

Hello, I’m Tetsuji Yamanishi, Senior Vice President of TDK. Thank you for taking the time to attend TDK’s performance briefing for the third quarter of the fiscal year ending March 2020. I will be presenting an overview of our consolidated results.

Key points concerning earnings for 3Q of FY March 2020

First let’s take a look at key points concerning earnings. From the second quarter, trade tensions between the U.S. and China began to take full effect, and the impact on the global economy grew more serious, notable in China. Since this time, there

has been an ongoing sense of uncertainty in the global economy. In our priority markets, there were no major changes in the demand environment and the Company achieved year on year increases in sales and profit for the third quarter amid a continuing

adverse business environment. Net sales for the third quarter increased by 1.4% year on year, and operating income increased significantly by 23.2%.

For the nine-month period, net sales were down year on year, while operating income, income

before income taxes, and net income reached record highs, with operating income for the nine-month period surpassing 100.0 billion yen for the first time.

Demand trends overall continued along the same trends as the previous quarter, with full-scale

demand for 5G starting in the ICT market and growth in sales of Rechargeable Batteries, High-Frequency Components, MLCCs, and Inductors for use in 5G smartphones and base stations contributing significantly to an overall increase in earnings.

With regard to Rechargeable Batteries in particular, we leveraged our expansive customer base to secure high earnings even after the peak demand for smartphones in the second quarter had passed and driving Companywide earnings.

On the other

hand, sales to the automotive and the industrial equipment markets decreased year on year as demand continued to decelerate globally, notable in China, and continue to trend at a level below our initial projection. As a result, with the exception

of increased sales and profit for High-Frequency Components, other Passive Components recorded lower sales and profit year on year. In Sensor Application Products, there was an overall delay in earnings improvement, mainly reflecting a slump in

sales of conventional sensors such as Temperature Sensors and Hall Sensors to the automotive market, despite steady growth in sales of our strategic growth products, TMR Sensors and MEMS Sensors.

Based on the assumption that there is little

probability of a rapid recovery in the global economy over the short term, the development of the DX (Digital Transformation) with the startup of 5G and so forth and the development of the EX (Energy Transformation) through the acceleration of

responses to environmental issues are set to generate new market needs. We will continue various preparations to anticipate these needs and firmly grasp further growth opportunities.

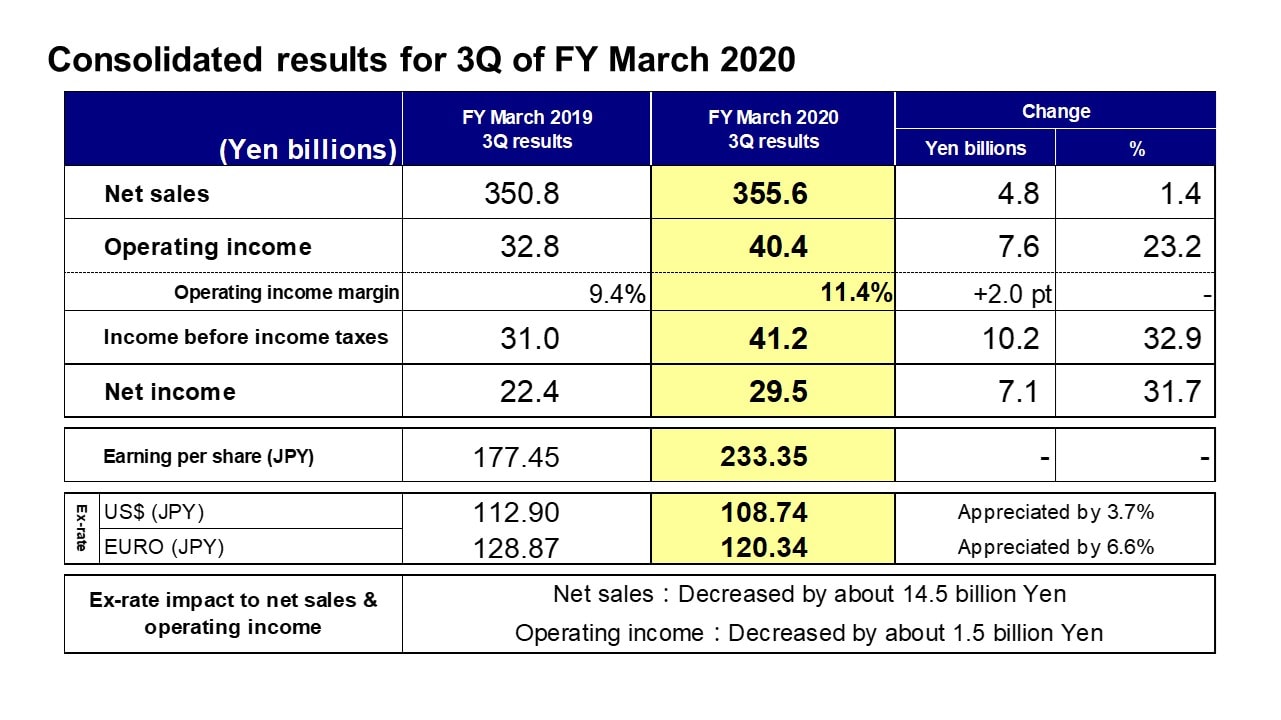

Consolidated results for 3Q of FY March 2020

Moving along, I would like to present an overview of our results. The impact of the yen’s appreciation against the U.S. dollar and the euro caused net sales to contract by around 14.5 billion yen and operating income by around 1.5 billion yen. Nevertheless,

both sales and income increased. Net sales were 355.6 billion yen, an increase of 4.8 billion yen, or 1.4%, year on year. Operating income was 40.4 billion yen, up 7.6 billion yen, or 23.2%, year on year. Income before income taxes was 41.2 billion

yen, net income was 29.5 billion yen, and earnings per share were 233.35 yen.

With regard to exchange rate sensitivity, we maintain our estimate that a change of 1 yen against the U.S. dollar will affect annual operating income by about 1.2

billion yen, while a change against the euro will have an impact of about 0.2 billion yen.

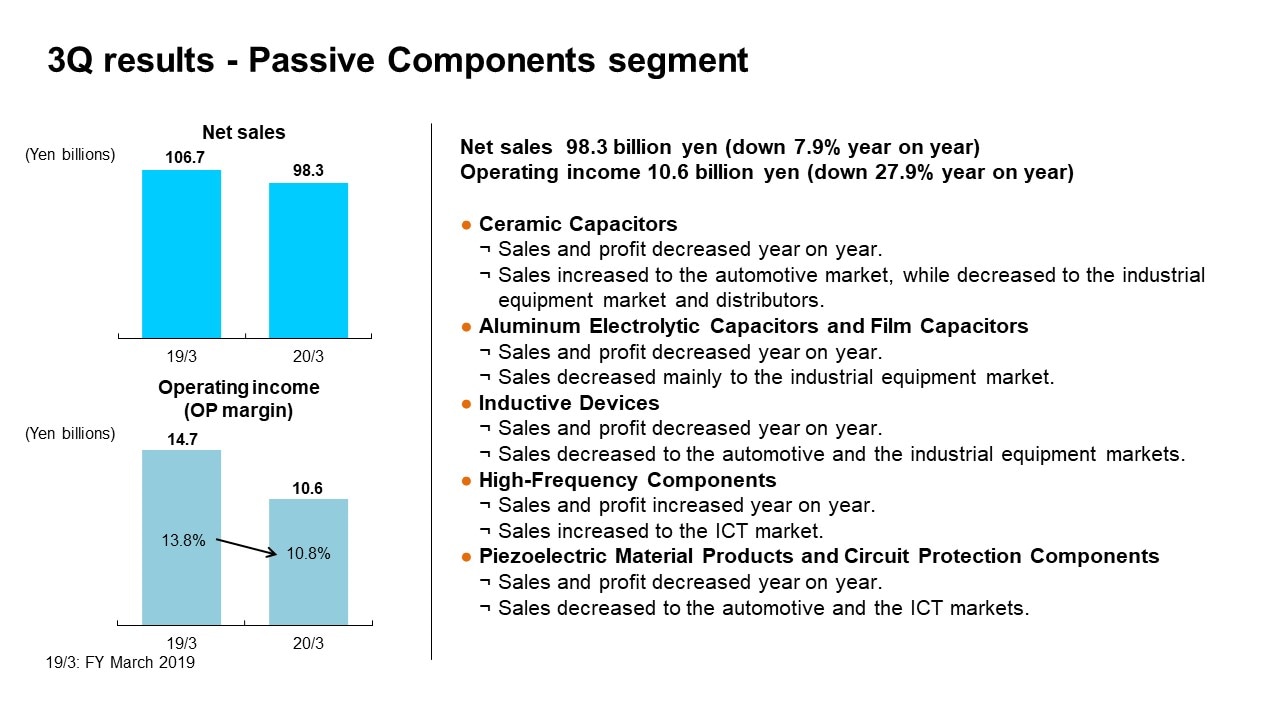

3Q results - Passive Components segment

Next, I would like to explain our business segment performance.

From the fiscal year ending March 2020, we reclassified some Inductive Devices as Other Passive Components, which reduced sales of Inductive Devices for the third quarter of the fiscal

year ended March 2019 by 2.2 billion yen and reduced operating income by 0.4 billion yen.

In the Passive Components segment, net sales were 98.3 billion yen, a decrease of 7.9% year on year, and operating income was 10.6 billion yen, a decrease

of 27.9%. The operating income margin was 10.8%. Looking at overall market conditions affecting Passive Components, a slump in demand from the automotive and the industrial equipment markets continued along with the impact of an inventory adjustment

phase among major distributors in Europe and the U.S. Meanwhile the full-scale awakening of 5G demand, mainly in China, is stimulating movement in products for 5G. Sales of Ceramic Capacitors are increasing steadily to the automotive market, despite

the sluggish demand for automobiles. Meanwhile, sales for the ICT market have been level overall, while sales for 5G base stations increased. On the other hand, sales to distributors decreased sharply, for an overall decrease of 12.6%. Profit

decreased due to the decrease in sales, however, profitability remained at a high level, mainly due to a higher average sales price driven by growth in the share of high value-added products within sales. In Aluminum Electrolytic Capacitors and

Film Capacitors, sales and profit decreased as sales declined to the automotive market and the industrial equipment market, including for renewable energy applications, as in the previous quarter.

Inductive Devices saw lower sales and profit

due to a slump in sales for the automotive and the industrial equipment markets, despite growth in sales for the ICT market driven by an increase in products for 5G. High-Frequency Components saw increases in sales and profit, with sales for 5G

devices and base stations increasing significantly in line with growth in demand for 5G. Piezoelectric Material Products and Circuit Protection Components saw lower sales and profit due to a decline in demand for automobiles and a decrease in

sales for the ICT market.

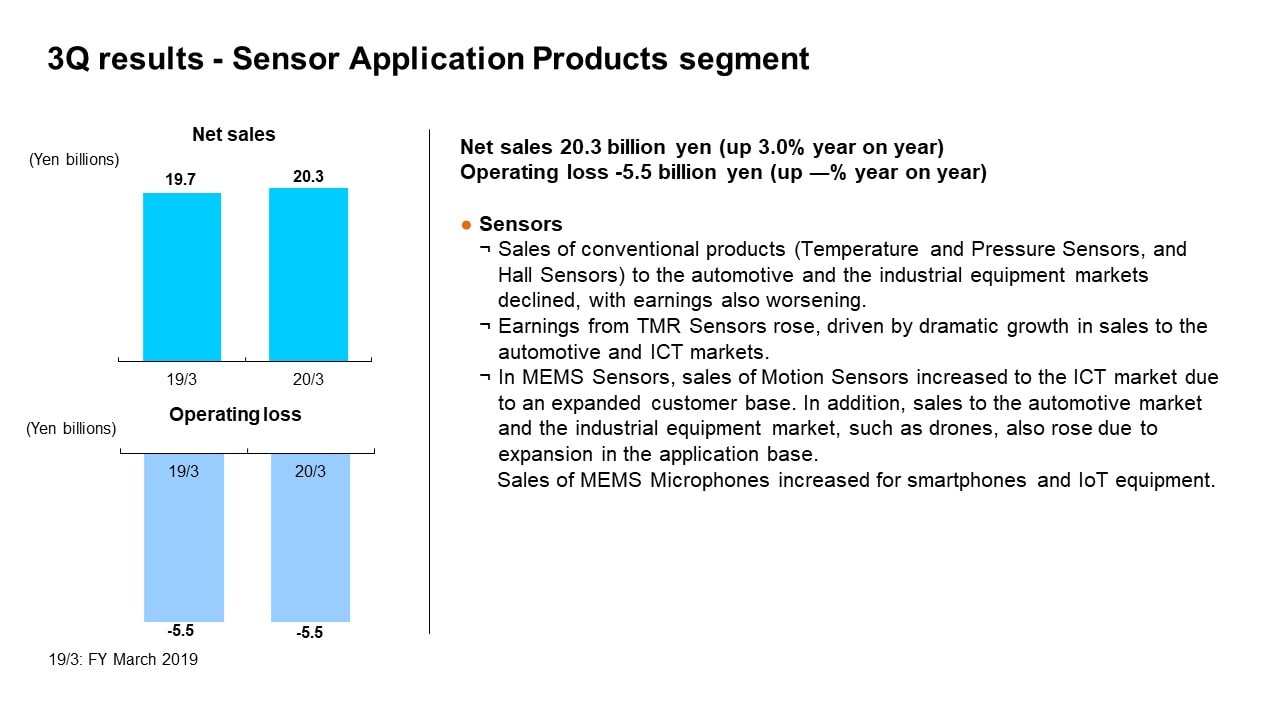

3Q results - Sensor Application Products segment

In the Sensor Application Products segment, net sales increased 3.0% year on year to 20.3 billion yen, while operating loss was 5.5 billion yen, maintaining the same level as the same period of the previous fiscal year. This includes about 1.4 billion

yen in acquisition-related costs for InvenSense, a decrease of 0.2 billion yen year on year. With no sign of a recovery in demand in the global automotive and industrial equipment markets, sales of conventional sensors, such as Temperature Sensors

and Hall Sensors continued from the previous quarter to lack vigor, with sales decreasing sharply year on year and profit also deteriorating, exerting a significant effect on the overall earnings for the segment.

Meanwhile, in strategic products,

which are expected to deliver strong growth, TMR Sensors saw further adoption for new applications in the automotive market and sales expanded steadily with increased volume, while in sales for smartphones, progress in adoption for new smartphone

models also made a significant contribution to sales expansion. Moreover, in MEMS Sensors, sales of motion sensors to new customers increased steadily, while sales of MEMs Microphones also grew for smartphones, the IoT, and other applications.

The impact of the macroeconomic slump and other factors has seen a continued one-step-forward, one-step-back pattern in sales overall, leading to a delay in earnings improvement. In a structural sense, however, we are making progress on consolidating

a foundation for earnings growth.

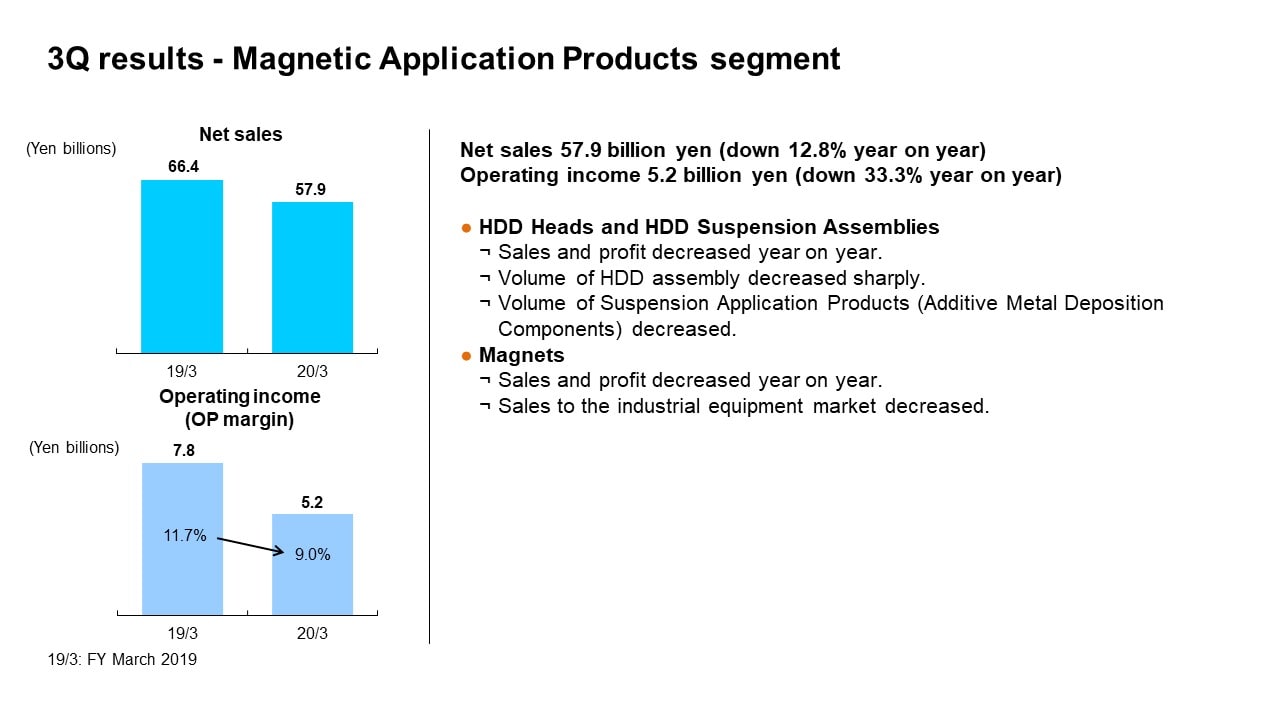

3Q results - Magnetic Application Products segment

In the Magnetic Application Products segment, net sales declined 12.8% year on year to 57.9 billion yen, operating income declined by 33.3% to 5.2 billion yen, and operating income margin was 9.0%.

The demand trend for HDD Heads and HDD Suspension

Assemblies has changed dramatically since the previous fiscal year. While recording densities have increased for 2.5-inch HDDs for PCs, sales volumes decreased and demand for HDD heads for PCs has slowed sharply. On the other hand, demand for

Nearline HDD Heads has gradually increased atop a recovery in demand for HDDs for data centers, while recording densities for Nearline HDDs have also been increasing in stages. In this situation, while the sales volume of HDD heads overall has

increased 6% year on year, sales of HDD Assemblies have decreased by around 40% from the previous fiscal year with the end of certain HDD Assembly products, and HDD Heads overall have seen sales decrease by around 15%. HDD Suspension Assemblies

recorded an approximate 6% decrease in overall sales, with Suspension sales trending about the same level in both volume and amount, while sales of Suspension Application Products to the ICT market decreased. As a result, overall operating income

for HDD Heads and HDD Suspension Assemblies decreased, mainly reflecting lower sales and profit for both Suspension Application Products and HDD Heads, as well as a decline in average sales prices due to a changeover period in the product mix.

In

Magnets, sales declined by around 14%, mainly reflecting our withdrawal from Magnets for HDDs and the impact of slumps in demand for the industrial equipment and the automotive markets, such as industrial robots and machine tools. Operating loss,

however, remained at around the same level as the previous fiscal year, mainly due to the effect of measures to improve production efficiency of products for the automotive market.

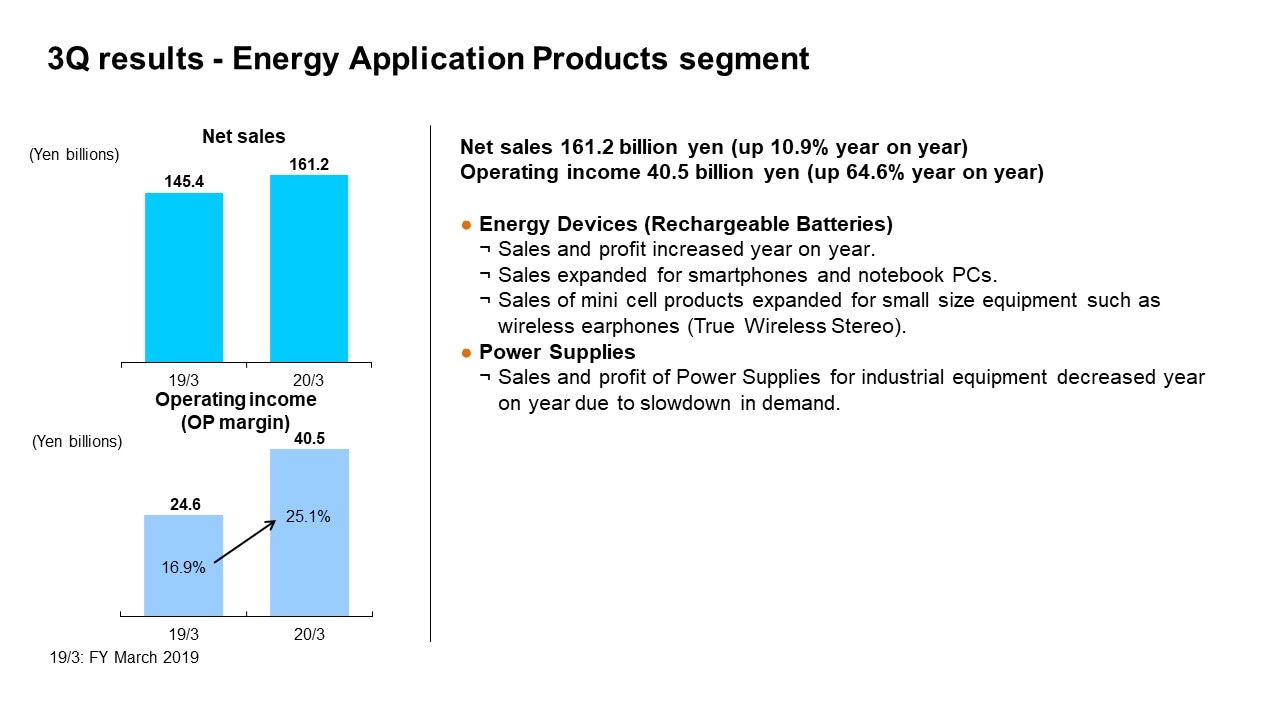

3Q results - Energy Application Products segment

In the Energy Application Products segment, net sales rose 10.9% year on year to 161.2 billion yen, and operating income surged 64.6% to 40.5 billion yen. Profitability also improved dramatically, with the operating income margin at 25.1%.

In Rechargeable

Batteries, sales increased by around 15% year on year. Sales to the China smartphone market increased sharply year on year due to increased 5G demand and other factors, while in other areas sales for major customers also trended briskly, leading

to a significant increase in overall sales for smartphone applications. In addition, sales were strong for tablets and laptop PC applications, along with a steady increase in sales of minicells for wearable products such as wireless earphones.

Earnings also increased significantly due to the effect of higher sales, a favorable change in the product mix, and the synergistic effect of further production efficiency improvements in step with volume expansion.

Power Supplies for industrial

equipment saw sales and profit decrease due to the strong influence of economic deceleration, including a decline in sales for industrial equipment market.

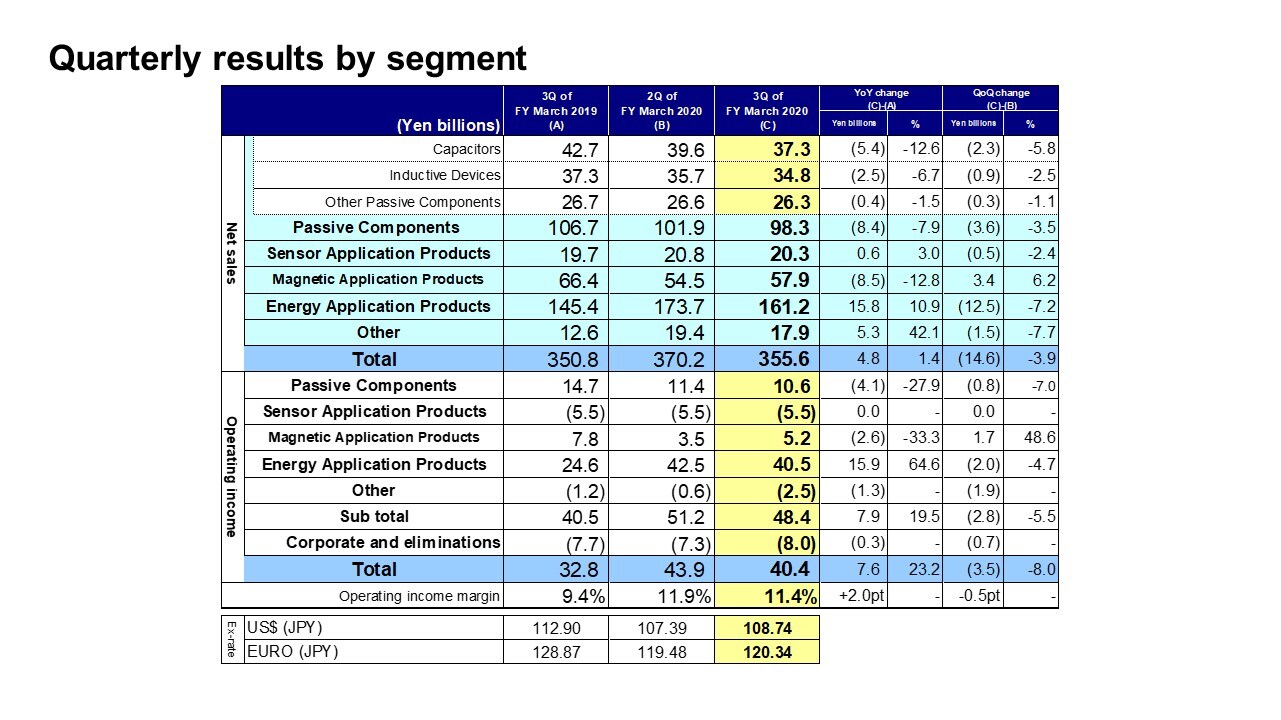

Quarterly results by segment

Next, I would like to explain the factors behind the changes in segment net sales and operating income from the second quarter to the third quarter of the fiscal year ending March 2020.

Let’s begin with net sales in the Passive Components segment.

Net sales in this segment decreased by 3.6 billion yen or 3.5%, from the second quarter. Sales of Capacitors decreased overall by around 2.3 billion yen, or 5.8%, from the second quarter. Ceramic Capacitor sales decreased, reflecting a sharp drop

in sales to distributors and an overall declining trend, despite increasing for 5G base stations. Sales of Aluminum Electrolytic Capacitors and Film Capacitors decreased overall to the industrial equipment market, despite showing an increasing

trend for renewable energy, while sales to the automotive market also decreased. Sales of Inductive Devices decreased by 0.9 billion yen, or 2.5%, from the second quarter. While sales for the 5G devices increased, sales remained flat overall for

the ICT market, with sales for the automotive market also level from the second quarter. Meanwhile, sales for the industrial equipment market continued flagging, leading to an overall decrease. In Other Passive Components, net sales decreased

slightly by 0.3 billion yen, or 1.1%, from the second quarter. Growth in sales of High-Frequency Components for 5G devices and base stations absorbed a decline in sales of Piezoelectric Material Products and Circuit Protection Components due to

flagging sales to the industrial equipment and the automotive markets.

Operating income in the Passive Components segment decreased by 0.8 billion yen, or 7.0%, from the second quarter. Profit from Ceramic Capacitors, Aluminum Electrolytic

Capacitors, Film Capacitors, and Inductive Devices decreased on lower sales. High-Frequency Components achieved significant earnings growth atop increases in sales and profit along with production efficiency gains, among other factors. Profit

from Piezoelectric Material Products and Circuit Protection Components remained about level from the second quarter as the impact of a decrease in sales was absorbed by cost improvements.

In the Sensor Application Products segment, net sales

decreased by 0.5 billion yen, or 2.4%, from the second quarter. Sales of Temperature and Pressure Sensors decreased overall as Temperature Sensors were affected by a slump in demand for automobiles. Sales of Magnetic Sensors were level overall,

as a slight upturn in sales of Hall Sensors for the automotive market from the second quarter was offset by a decrease in sales of TMR Sensors to the ICT market after peaking in the second quarter. Sales of MEMS sensors decreased slightly from

the second quarter, with sales for microphones remaining mostly flat, while sales of motion sensors were affected by a decline in demand from small- and medium-sized smartphone manufacturers in China.

The Sensor Application Products segment

continued to report an operating loss at about the same level as the second quarter of about 5.5 billion yen. Temperature and Pressure Sensors reported a slight loss due to lower sales. Magnetic Sensors saw losses narrow on higher sales of Hall

Sensors, but maintained a loss in line with the second quarter overall. MEMS Sensors continued to report a loss, but made progress in reducing it through changes to the product mix and improvement in costs, among other initiatives.

In the Magnetic

Application Products segment, net sales increased by 3.4 billion yen, or 6.2%, from the second quarter. The shipment index for HDD Heads increased by about 3% from 89 in the second quarter to 92 in the third quarter. HDD Assembly sales also increased,

growing by about 5% overall. In HDD Suspension Assemblies, sales of Nearline HDD Suspension Assemblies increased sharply, outweighing a decrease in Suspension Application Product sales for an overall increase of 14%. Magnet sales decreased by

about 3% from the second quarter.

Operating income in the Magnetic Application Products segment increase by 1.7 billion, or 48.6%, from the second quarter. HDD Heads and HDD Suspension Assemblies both saw increases in sales and profit, while

Magnets narrowed its loss by improving costs, despite a decrease in sales.

In the Energy Application Products segment, net sales decreased by 12.5 billion yen, or 7.2%, from the second quarter. While Rechargeable Batteries saw sales to China

increase due to an increase in sales for 5G smartphone handsets, sales to North America and South Korea decreased overall as demand retreated from a peak in the second quarter. Sales of Power Supplies for industrial equipment remained about level

with the second quarter.

Operating income in the Energy Application Products segment was 40.5 billion yen, a decrease of 2.0 billion yen from the second quarter. The main contributing factor was lower sales and profit from Rechargeable Batteries.

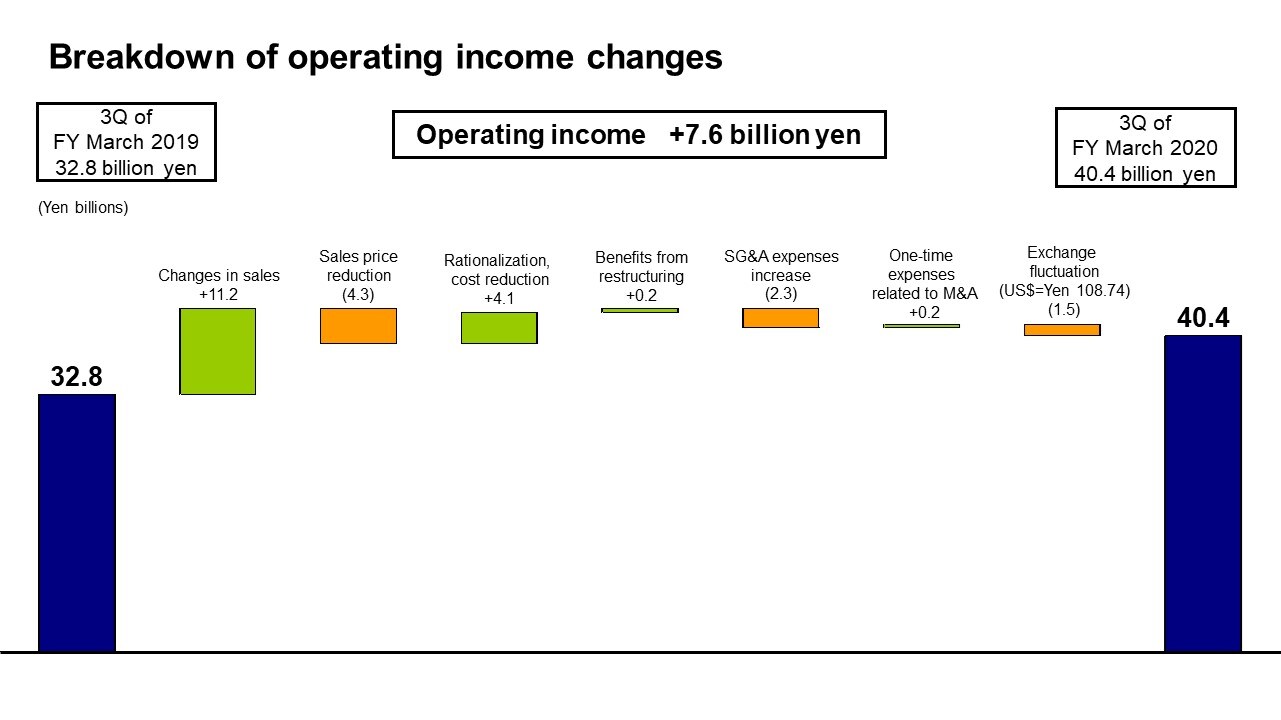

Breakdown of operating income changes

Next is the breakdown of the change in operating income. Let's take a look at the main factors behind the increase of 7.6 billion yen in operating income. First, while there was a reduction in income due to a decrease in sales of Passive Components, there was a positive impact of about 11.2 billion yen from an increase in sales, mainly for Rechargeable Batteries. Sales price reductions had a negative impact of around 4.3 billion yen; however, this was absorbed by the effect of rationalization and cost improvements including measures to improve manufacturing capability for Passive Components and further productivity improvements in Rechargeable Batteries, which had a positive impact of roughly 4.1 billion yen. Benefits from structural reforms had a positive impact of about \0.2 billion yen, along with a positive impact of around 0.2 billion yen due to a decrease in expenses related to the InvenSense acquisition. Administration and development expenses in connection with business expansion in Rechargeable Batteries increased by around 2.3 billion yen, and the increase of 7.6 billion yen in operating income included a negative impact of about 1.5 billion yen from exchange rate fluctuations.

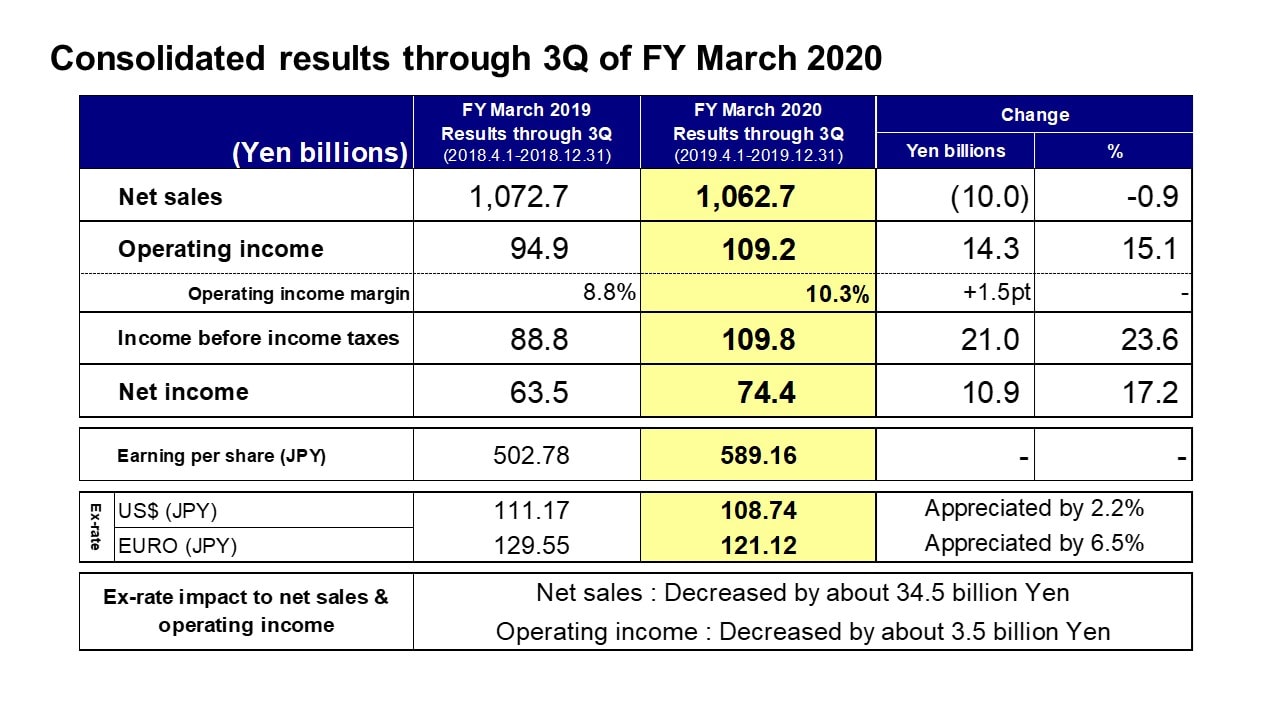

Consolidated results through 3Q of FY March 2020

Next, let's look at consolidated results for the nine months ended December 2019.

For the first three quarters, net sales were 1,062.7 billion yen, down 0.9% year on year, and operating income was 109.2 billion yen, up 14.3 billion, or 15.1% year

on year. Income before income taxes was 109.8 billion yen, and net income was 74.4 billion yen, up 17.2% year on year. Although net sales decreased, operating income, income before income taxes, and net income all reached new record highs.

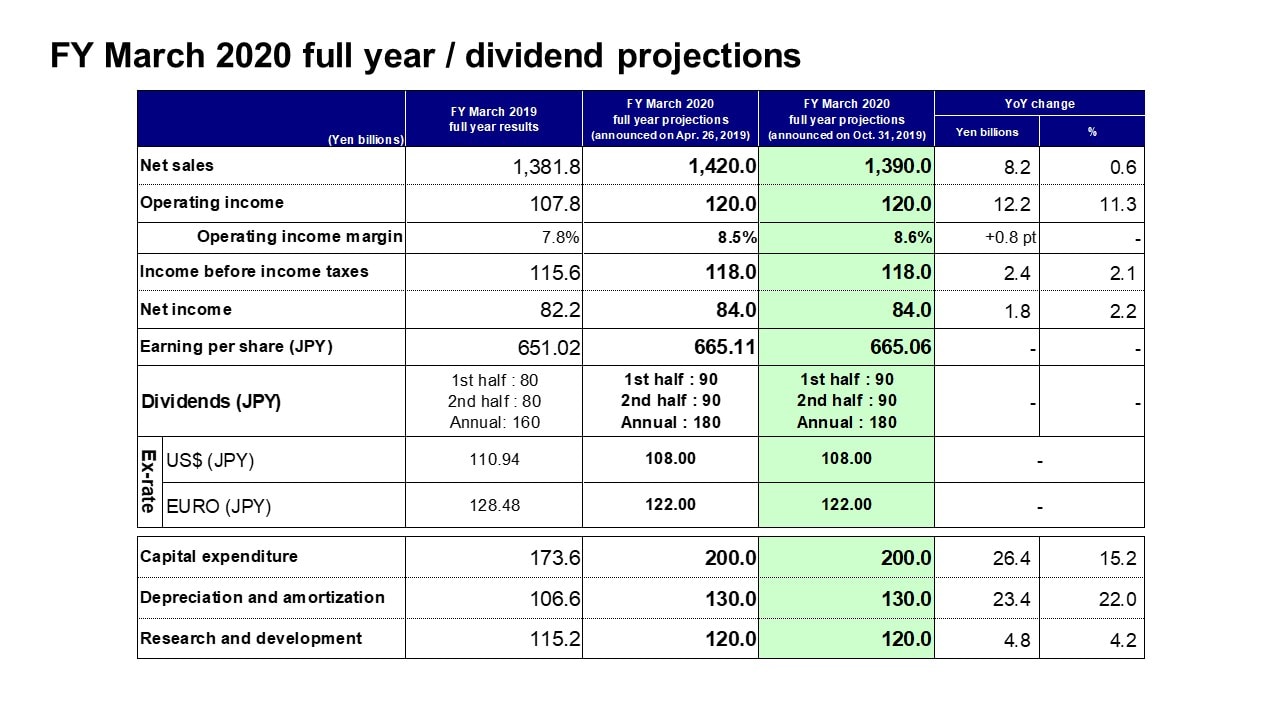

FY March 2020 full year / dividend projections

Next, I would like to discuss our consolidated full-year projections for the fiscal year ending March 2020. We have maintained the full-year projections announced previously in October.

In our October announcement, we reflected significant changes

in demand trends in our target markets, and making a downward revision only to net sales. Subsequently, some improvements were seen in the demand environment, including the start of full-scale demand for 5G and a recovery in semiconductor-related

demand. However, the impact of the U.S.-China trade dispute on the Chinese ICT market is unclear. Moreover, demand trends in the automotive and the industrial equipment markets and inventory adjustments at major distributors in Europe and the

U.S. are not expected to cause major changes in the overall demand trend for the short term, and we have therefore left the previously announced forecast unchanged.

Our forecasts for operating income, income before income taxes, and net income

remain unchanged. Our assumed exchange rates for the fourth quarter, capital expenditure, depreciation and amortization, and R&D expenses have not changed from our initial plan.

Dividends are to be 90 yen per share for the second half, as initially

planned, for an annual dividend of 180 yen per share.

Amid an uncertain future in the global economy, we will aim to achieve profits as initially announced. We will firmly capture growth opportunities while focusing on changes in demand trends

as we steadily promote measures to improve earnings at troubled businesses. In this way, we aim to achieve further growth from the fiscal year ending March 31, 2021 and onward.

That concludes my presentation. Thank you very much for your attention.