[ 1st Quarter of fiscal 2020 Performance Briefing ]Consolidated Results for 1Q of FY March 2020

Mr. Tetsuji Yamanishi

Senior Vice President

Hello, I’m Tetsuji Yamanishi, Senior Vice President of TDK. Thank you for taking the time to attend TDK’s performance briefing for the first quarter (April to June) of the fiscal year ending March 2020. I will be presenting an overview of our consolidated results.

Key points concerning earnings for 1Q of FY March 2020

First, let’s take a look at key points concerning earnings. In the first quarter of the fiscal year ending March 2020, trade tensions between the U.S. and China escalated as both countries raised tariffs, and the effects rippled across the world, with global economic deceleration affecting the business climate. However, we delivered roughly steady earnings compared with the first quarter of the previous fiscal year as net sales were only down by 1.8% year on year and operating income by 1.6%.

We are seeing divergence in demand trends in our three priority markets—the automotive, ICT, and industrial equipment and energy markets, and sales to the ICT market surpassed our initial projection. Rechargeable Batteries earnings grew as sales rose to major customers for use in smartphones, driving our overall earnings. However, sales to the automotive and industrial equipment markets decreased year on year and were below our initial projection, mainly due to worsening demand conditions in the China market. As a result, sales declined year on year for almost all businesses in the Passive Components segment. Also, Sensor Application Products segment earnings declined, reflecting weak sales to the automotive market.

We expect demand trends to remain uncertain from the second quarter due to the global economic slowdown. However, we intend to focus on achieving our Medium-Term Plan targets by steadily implementing the various initiatives we initially set out for each business.

Consolidated results for 1Q of FY March 2020

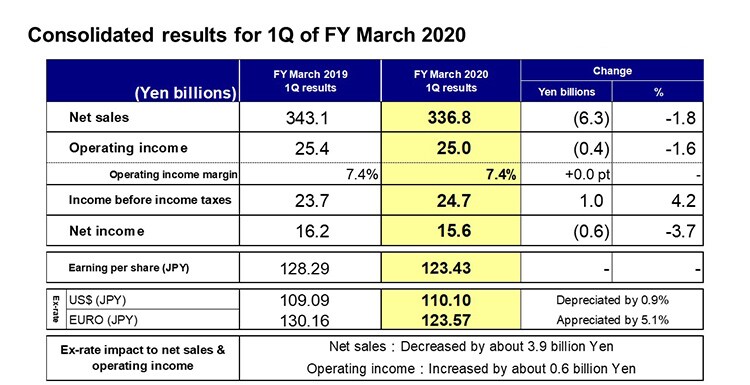

Moving along, I would like to present an overview of our results. Net sales were 336.8 billion yen, a decrease of 6.3 billion yen, or 1.8%, year on year. Operating income was 25.0 billion yen, down 0.4 billion yen, or 1.6% year on year. Income before income taxes was 24.7 billion yen, net income was 15.6 billion yen, and earnings per share were 123.43 yen.

The average exchange rates for the first quarter of the fiscal year ending March 2020 were 110.10 yen against the U.S. dollar, a depreciation of 0.9%, and 123.57 yen against the euro, an appreciation of 5.1%. As a result, in terms of the impact of these exchange rate movements, net sales were down by around 3.9 billion yen and operating income were pushed up by around 0.6 billion yen.

With regard to exchange rate sensitivity, as with our previous estimate, we estimate that a change of 1 yen against the U.S. dollar would have an impact of approximately 1.2 billion yen on operating income, while a change against the euro would have an impact of approximately 0.2 billion yen.

1Q results - Passive Components segment

Next, I would like to explain our business segment performance.

From the fiscal year ending March 2020, we reclassified some Inductive Devices as Other Passive Components, which reduced sales of Inductive Devices for the first quarter of the fiscal year ended March 2019 by 2.4 billion yen and reduced operating income by 0.5 billion yen.

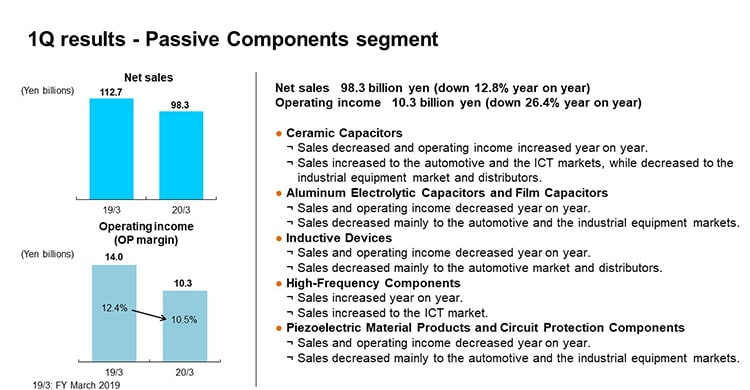

In the first quarter of the fiscal year ending March 2020, net sales in the Passive Components segment were 98.3 billion yen, a decrease of 12.8% year on year, and operating income was 10.3 billion yen, a decrease of 26.4% year on year. The operating income margin was 10.5%.

In Ceramic Capacitors, sales declined as higher sales to the ICT market, including for base stations, were outweighed by lower sales to the industrial equipment market, as well as lower sales to distributors reflecting inventory adjustments due to a decline in automotive market demand. However, operating income rose and profitability improved as growth in sales of high value-added products pushed up average sales prices. In Aluminum Electrolytic Capacitors and Film Capacitors, sales and operating income decreased as sales declined substantially to the industrial equipment market, including for renewable energy applications, and to the automotive market. In Inductive Devices, sales declined on lower sales to the automotive market and distributors, and operating income decreased in part because sales of high-margin products to the automotive market declined. Sales of High-Frequency Components rose on brisk sales for use in base stations. Piezoelectric Material Products and Circuit Protection Components recorded lower sales and operating income as sales declined to the automotive and industrial equipment markets.

1Q results - Sensor Application Products segment

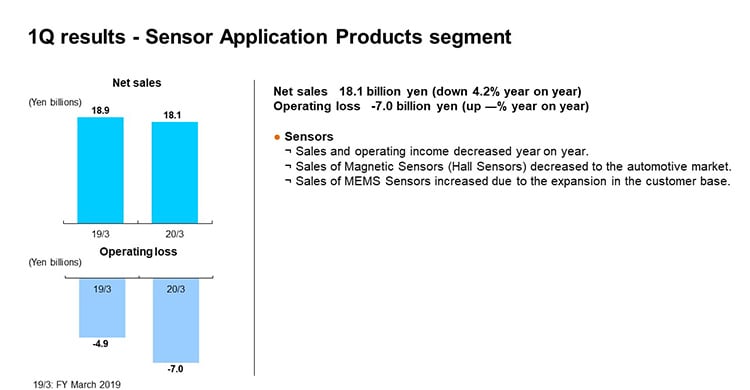

In the Sensor Application Products segment, net sales declined 4.2% year on year to 18.1 billion yen, and the operating loss widened by 2.1 billion yen to 7.0 billion yen. This includes about 1.4 billion yen in acquisition-related costs for InvenSense, the same level year on year.

Let’s look at sales trends by market. Sales declined about 13% to the automotive market, mainly for Temperature Sensors and Hall Sensors, reflecting significant impact from slowing demand in the market. In contrast, sales grew about 12% to the ICT market as sales of TMR Sensors for smartphones increased, and our efforts to expand the customer base in MEMS Sensors paid off with the start of sales to major customers. As a result, overall sales of Temperature and Pressure Sensors were slightly lower as sales grew steadily for Pressure Sensors but declined for Temperature Sensors. Overall sales of Magnetic Sensors decreased sharply due to a significant decline for Hall Sensors. Overall sales of MEMS Sensors grew sharply as sales rose for microphones, and higher sales of new products of Motion Sensors offset lower sales of older products. The operating loss widened year on year, owing mainly to a decline in earnings from the automotive market and a rise in development costs leading up to mass production of MEMS Motion Sensors.

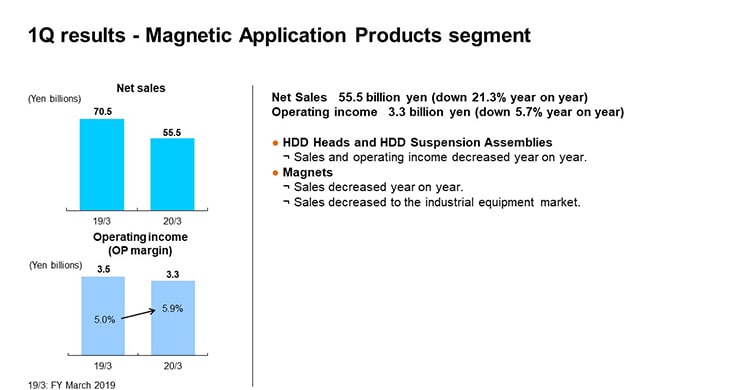

1Q results - Magnetic Application Products segment

In the Magnetic Application Products segment, net sales declined 21.3% year on year to 55.5 billion yen, operating income decreased by 5.7% to 3.3 billion yen, and the operating income margin slightly improved at 5.9%.

In HDD Heads, the shipment index declined by around 12% year on year to 88 in the first quarter and sales of HDD assemblies decreased roughly 43% year on year, resulting in a decrease in sales of about 25% overall. In HDD Suspension Assemblies, high added-value µDSA type products accounted for a larger share of sales and average sales prices rose. Further, sales of Suspension Application Products to the ICT market increased. However, HDD Suspension sales volumes declined by about 27%, resulting in a 17% decrease in overall sales of HDD Suspensions. Overall operating income for HDD Heads and HDD Suspension Assemblies decreased slightly due to impact from lower sales volumes.

In Magnets, operating income was mostly flat year on year, despite a roughly 9% decrease in sales to the industrial equipment market for wind power generation, industrial robot, machine tool, and other applications.

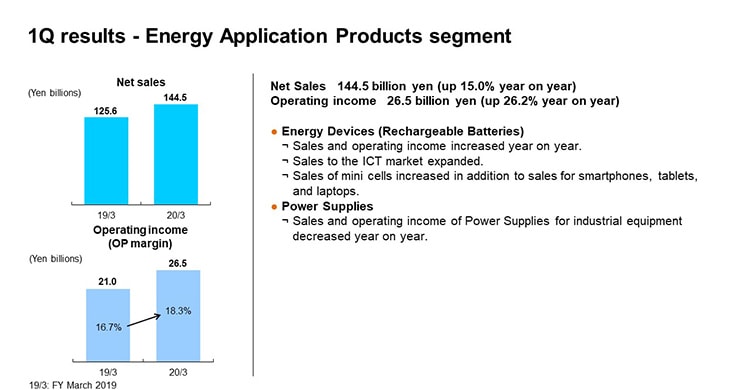

1Q results - Energy Application Products segment

In the Energy Application Products segment, net sales rose 15.0% year on year to 144.5 billion yen and operating income surged 26.2% to 26.5 billion yen. Profitability also improved, with the operating income margin at 18.3%.

In Rechargeable Batteries, sales declined a bit to the China smartphone market. However, sales to major customers came into full swing and market share increased, such that overall sales for smartphone applications grew sharply. In addition, sales increased for tablet and laptop PC applications as well as mini cells, including for wearable products, with the benefits of higher sales volumes and improved productivity generating synergies that efficiently raised earnings.

Power Supplies for industrial equipment saw sales and operating income decline due to the effect of a slowdown in demand for semiconductor manufacturing facilities and measurement instruments for industrial equipment market.

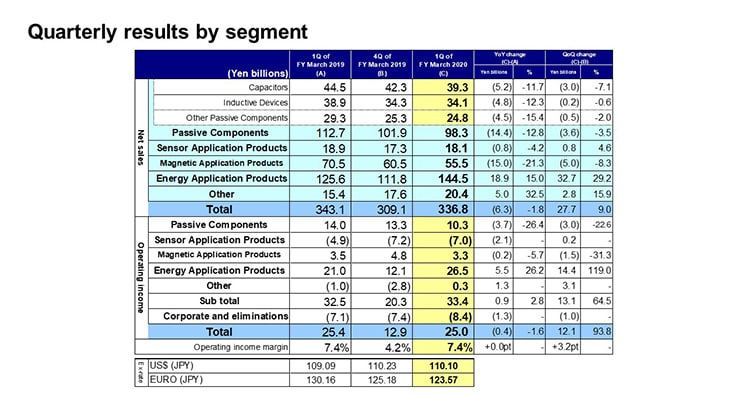

Quarterly results by segment

Next, I would like to explain the factors behind the changes in segment net sales and operating income from the fourth quarter of the fiscal year ended March 2019 to the first quarter of the fiscal year ending March 2020.

Let’s begin with the Passive Components segment. In this segment, net sales in the first quarter decreased by 3.6 billion yen, or 3.5%, from the fourth quarter. Ceramic Capacitor sales declined to distributors. Also, sales of Aluminum Electrolytic Capacitors and Film Capacitors decreased to the automotive and industrial equipment markets. As a result, sales of Capacitors decreased by 3.0 billion yen, or 7.1%, from the fourth quarter. Sales of Inductive Devices declined by 0.2 billion yen, or 0.6%, from the fourth quarter. The overall decrease was minor as lower sales to the automotive market were partly offset by higher sales to the ICT market, including for smartphones. In Other Passive Components, sales decreased by 0.5 billion yen, or 2%, from the fourth quarter. In High-Frequency Components, sales of Ceramic Filters for smartphones increased, whereas sales of Piezoelectric Material Products and Circuit Protection Components decreased to the automotive and industrial equipment markets.

Operating income in the Passive Components segment decreased by 3.0 billion yen, or 22.6%, from the fourth quarter. Operating income declined substantially for Capacitors, owing to lower sales and a loss on a reduction in capacity utilization from reduced production in Aluminum Electrolytic Capacitors and Film Capacitors. In Inductive Devices, profit declined due to lower sales to the highly profitable automotive market. In Other Passive Components, earnings were stable for High-Frequency Components but decreased for Piezoelectric Material Products and Circuit Protection Components.

In the Sensor Application Products segment, net sales increased by 0.8 billion yen, or 4.6%, from the fourth quarter. Temperature and Pressure Sensors sales were flat. Overall sales declined for Magnetic Sensors despite an increase in TMR Sensors sales to the ICT market as Hall Sensors sales to the automotive market decreased markedly. In contrast, sales of MEMS Sensors rose to both the ICT market and the industrial equipment market, and for game consoles, resulting in sales growth for the segment overall.

In the Sensor Application Products segment, the operating loss shrank by 0.6 billion yen in real terms from the fourth quarter as profit increased by 0.2 billion yen and acquisition-related costs for InvenSense rose by 0.4 billion yen. Profit was flat for Temperature and Pressure Sensors and declined for Hall Sensors in Magnetic Sensors. However, losses improved as sales growth increased profits in TMR Sensors and sales growth drove higher profits in MEMS Sensors.

In the Magnetic Application Products segment, net sales decreased by 5.0 billion yen, or 8.3%, from the fourth quarter. Overall sales of HDD Heads declined roughly 13% despite an increase of about 8% in shipment volume. Key factors were lower average sales prices and a significant decline of about 40% in sales of HDD assemblies. Sales of HDD Suspensions were basically flat as lower volumes were offset by higher average sales prices. Sales of magnets were mostly flat.

In the Magnetic Application Products segment, operating income decreased by 1.5 billion yen, or 31.3%, from the fourth quarter. In Magnets and HDD Suspension Assemblies, profit was broadly flat from the fourth quarter. However, profit decreased in HDD Heads due to impact from lower sales and lower average sales prices, as well as a rise in costs for developing next-generation HDD Heads.

In the Energy Application Products segment, net sales increased by 32.7 billion yen, or 29.2%, from the fourth quarter. In Rechargeable Batteries, sales increased to major customers for smartphone applications, and sales grew to the North America and China markets. In addition, sales expansion for mini cell products and tablet and laptop PC applications contributed to the segment’s sharp sales growth. Sales were flat for Industrial Power Supplies.

In the Energy Application Products segment, operating income was 26.5 billion yen, an increase of 14.4 billion yen from 12.1 billion yen in the fourth quarter. In addition to the erasure of impact from a loss on a reduction in capacity utilization due to the Lunar New Year holidays, the sharp profit growth was driven by a rise in marginal profit from higher sales volumes and cost improvements.

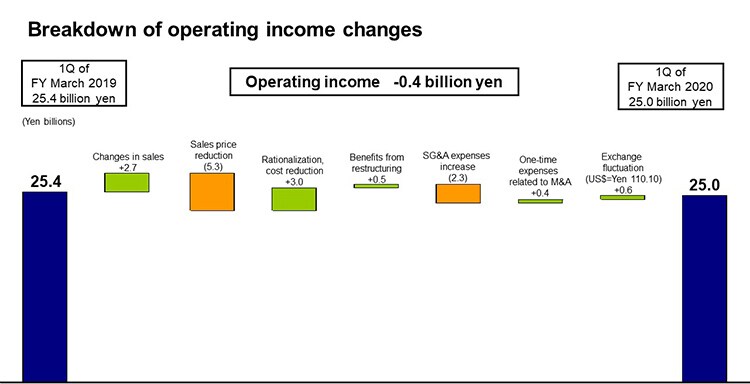

Breakdown of operating income changes

Next is the breakdown of the change in operating income. Let’s take a look at the main factors behind the decrease of 0.4 billion yen in operating income. First, there was a positive impact of about 3.1 billion yen from an increase in sales, mainly for Rechargeable Batteries. Sales price reductions, primarily for HDD Heads and Rechargeable Batteries, had a negative impact of around 5.3 billion yen. Rationalization and cost reductions, including productivity improvements centered on Passive Components, had a positive impact of roughly 3.0 billion yen. Benefits from write-downs posted in the second quarter of the previous fiscal year had a positive impact of about 0.5 billion yen. There was negative impact of about 2.3 billion yen from SG&A expenses due to increases in administration and development expenses in connection with business expansion in Rechargeable Batteries. Lastly, the 0.4 billion decrease in operating income included positive impact of about 0.6 billion from exchange rate fluctuations.

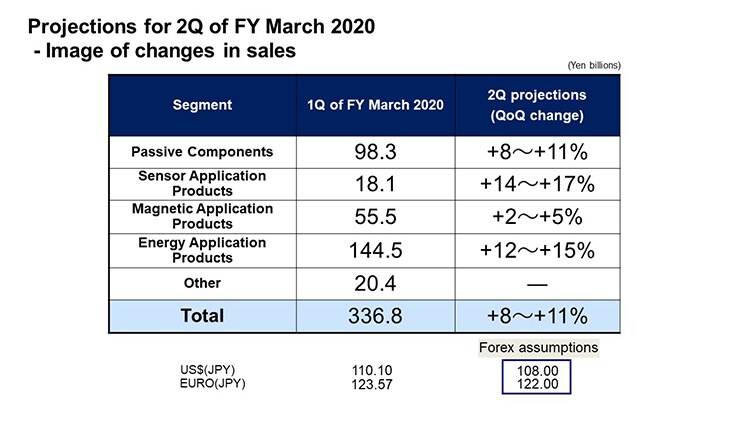

Projections for 2Q of FY March 2020- Image of changes in sales

Let me now discuss our image of changes in sales for the second quarter of the fiscal year ending March 2020.

Starting with the Passive Components segment, we are projecting net sales growth of 8-11% from the first quarter. Assuming demand from the automotive market gradually increases from the latter half of the second quarter, we expect growth in sales of MLCCs, Inductive Devices, and Piezoelectric Material Products and Circuit Protection Components. Also, assuming sales to the ICT market centered on smartphones rise heading into the peak season, we expect Inductive Device and High-Frequency Component sales to grow. As the industrial equipment market is not expected to recover significantly, we anticipate slight increases in sales of Aluminum Electrolytic Capacitors and Film Capacitors.

In the Sensor Application Products segment, we are projecting net sales growth of 14-17% from the first quarter. We expect Temperature and Pressure Sensors sales to increase slightly. In Magnetic Sensors, we anticipate sharp growth in sales of TMR Sensors to the ICT market. In MEMS Sensors, we are projecting sales growth led by Motion Sensors.

In the Magnetic Application Products segment, we expect sales volume to increase by around 6% from the first quarter for HDD Heads but decrease further for HDD assemblies and trend basically flat for HDD Heads. For HDD Suspension Assemblies, we expect volumes to increase by about 24% and sales to rise. We expect Magnets to be mostly flat.

In the Energy Application Products segment, we are projecting net sales growth of 12-15% from the first quarter. In Rechargeable Batteries, sales for major customers are expected to slow down slightly compared to the pace in the first quarter. Meanwhile, overall sales are projected to increase due to the increased sales volume for the peak season and the increase in mini cells. Sales of Power Supplies are forecast to remain mostly unchanged.

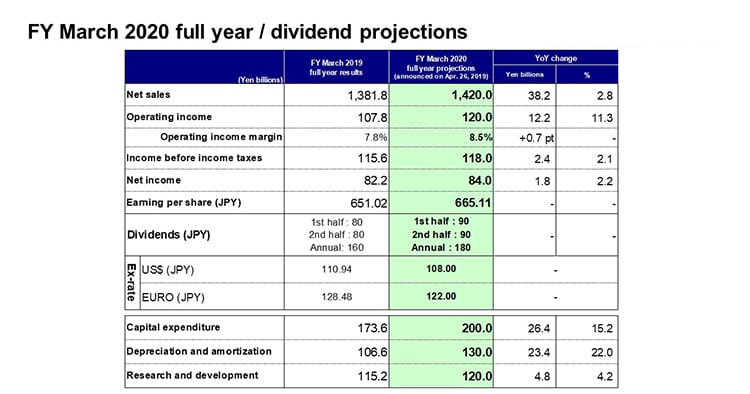

FY March 2020 full year / dividend projections

Finally, I would like to discuss our consolidated full-year projections for the fiscal year ending March 2020. We have maintained the full-year projections announced in April.

Demand trends are diverging from our initial projections in the three priority markets. Also, trade tensions between the U.S. and China and Brexit are expected to further impact the global economy. Nevertheless, we look to seize growth opportunities while keeping an eye on demand trends as we steadily implement steps to improve earnings in businesses that require attention, with the aim of achieving our initial full-year projections.

That concludes my presentation. Thank you very much for your attention.