[ Financial Results for Fiscal 2019 Performance Briefing ]Consolidated Full Year Projections for FY March 2020

Mr. Shigenao Ishiguro

President & CEO

Hello, I’m Shigenao Ishiguro, President & CEO of TDK. Today, I’d like to go over our consolidated full-year earnings projections for the fiscal year ending March 2020.

Key points concerning projections for FY March 2020

First, I will discuss our perspectives on the business environment, which underlie our assumptions for the full-year projections for the fiscal year ending March 2020. I will then discuss our outlook for business performance in each segment based on the environment.

Beginning with the medium- to long-term outlook for the markets where TDK operates, we expect demand for the electronic components we supply to grow substantially as the electronics business expands steadily. This expansion is being driven by further acceleration in digital transformation, specifically changes spurred by digital technologies such as IoT and AI, and the transformation trend in energy fields such as the adoption of xEVs (HEV, PHEV, EV, etc.), and electric power. In this business environment, TDK will remain mindful of the “Time to Market” concept as it seeks to capture new business opportunities.

Meanwhile, we expect that events such as China’s economic slowdown, which was set off by trade friction between the U.S. and China, and political instability in Europe caused by events such as Brexit, will likely continue to have an impact on macroeconomic trends in the short term. In this market environment, TDK positions the fiscal year ending March 2020 as a year for devising measures to achieve medium- to long-term growth. Accordingly, we intend to steadily implement measures to achieve our Medium-Term Plan targets. Looking at our projections for the fiscal year ending March 2020 based on these assumptions, we do not expect substantial sales growth in Passive Components, including Ceramic Capacitors, which has continued to perform strongly, and Energy Application Products, which is centered on Rechargeable Batteries, compared with the fiscal year ended March 2019. In HDD Heads and HDD Suspension Assemblies, which are part of the Magnetic Application Products segment, we anticipate a recovery in demand in the market for HDDs for data centers from the second half of the fiscal year ending March 2020 onward. Based on this outlook, we are determined to steadily achieve our earnings targets.

Meanwhile, earnings improvements in the Sensor and Magnet businesses fell behind in the fiscal year ended March 2019. In these businesses, we will work to implement measures based on growth strategies that are already under way, and steadily turn around losses, thereby paving the way for an overall improvement in earnings.

While we are not expecting substantial overall growth in net sales, we plan to continue to execute growth investments in Ceramic Capacitors and Rechargeable Batteries to bolster competitiveness. In Ceramic Capacitors, we have made solid progress on capturing demand in the automotive market through our unique products. In Rechargeable Batteries, we will drive further growth by cultivating the market for applications other than smartphones, leveraging our strong competitiveness in Rechargeable Batteries for smartphones.

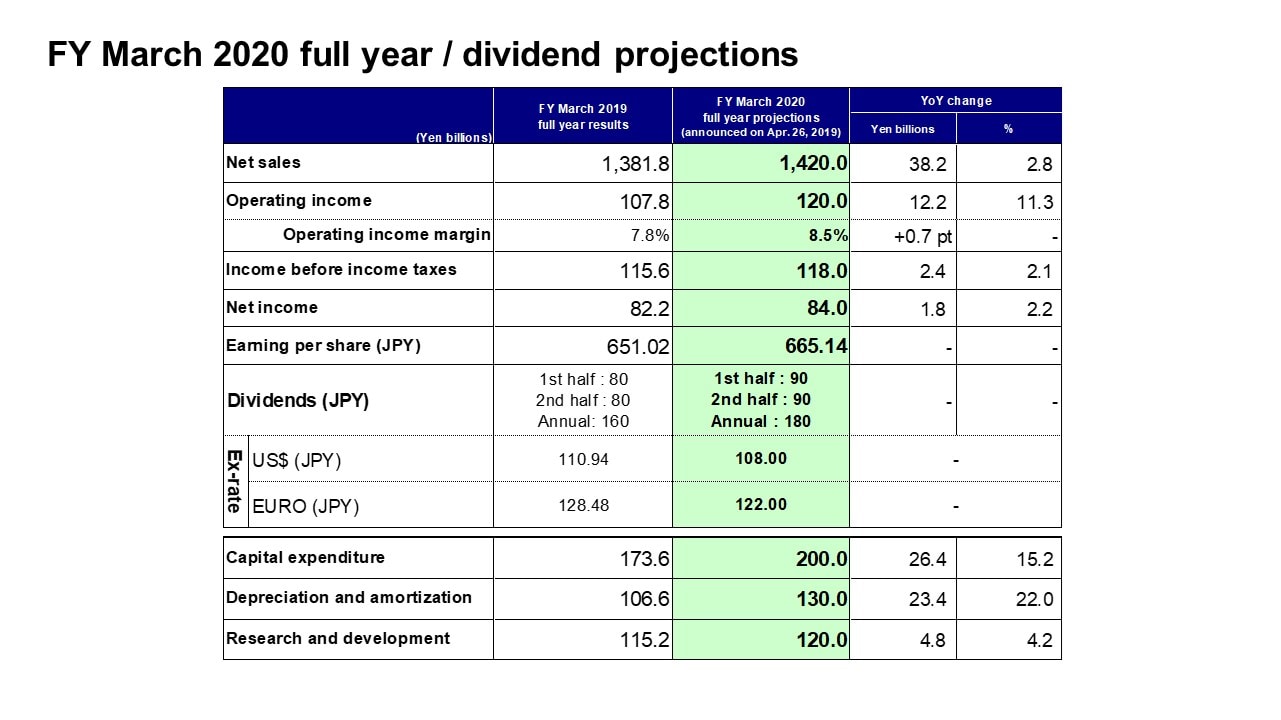

FY March 2020 full year / dividend projections

In accordance with these principles, I will now discuss our full-year consolidated earnings projections.

First, our earnings projections assume an average exchange rate of 108 yen against the U.S. dollar and 122 yen against the euro.

We are targeting net sales of 1,420.0 billion yen. This would be a record-high result for a seventh consecutive year. We are also projecting record-high operating income of 120.0 billion yen. We are projecting income before income taxes of 118.0 billion yen, net income of 84.0 billion yen, and earnings per share of 666 yen. As for dividends, the interim dividend and year-end dividend are both projected at 90 yen per share, bringing the annual dividend to 180 yen per share, an increase of 20 yen from the previous fiscal year.

We are projecting capital expenditure of 200.0 billion yen, depreciation and amortization of 130.0 billion yen, and research and development expenses of 120.0 billion yen.

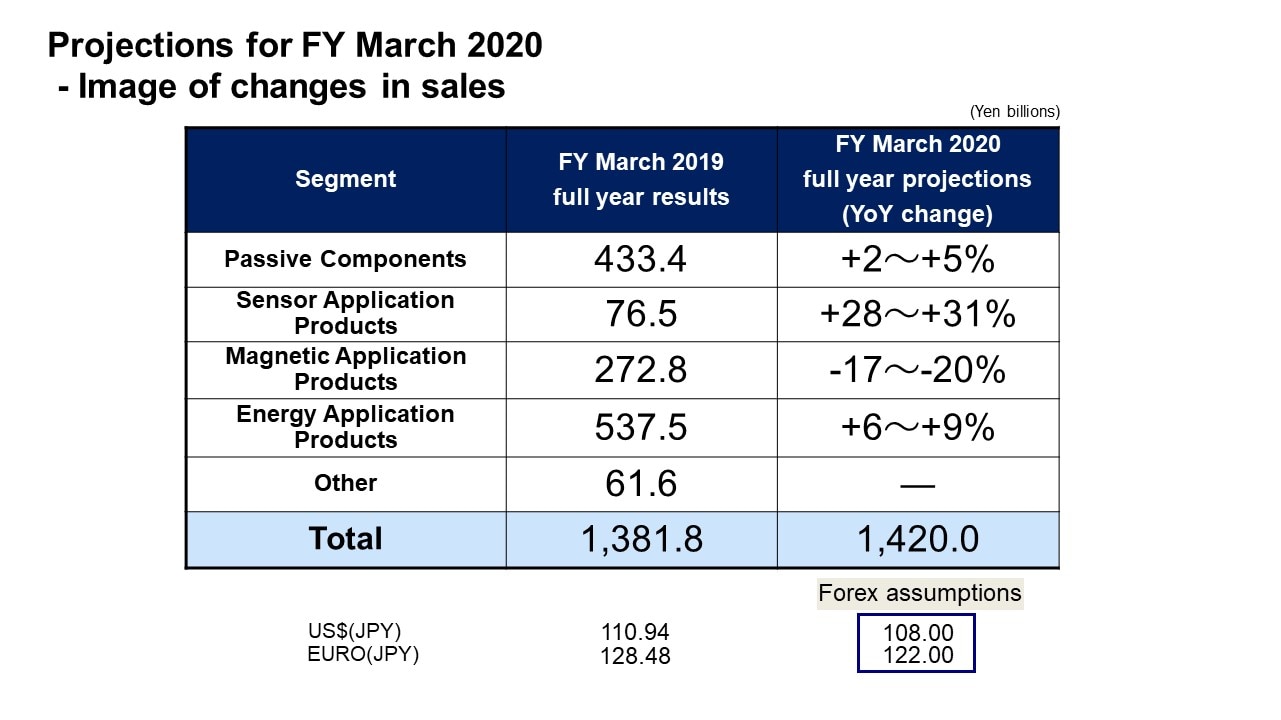

Projections for FY March 2020 - Image of changes in sales

I’d now like to present our expectations for changes in consolidated sales in each segment, which underlie our full-year projections for the fiscal year ending March 2020.

First, for the Passive Components segment, we are projecting a net sales increase of 2-5%. In the automotive market, global automobile sales volume is expected to remain mostly flat year on year. However, we expect demand to increase even further with expansion in the adoption of xEVs, advanced driving assistance systems (ADAS), automated driving, and other developments. Based on this outlook, we anticipate that Capacitors will drive sales growth. We expect hardly any growth in sales to the ICT market and industrial equipment market.

In the Sensor Application Products segment, we are projecting net sales growth of 28-31%. Sales of MEMS Sensors and TMR Sensors for smartphones are expected to increase. In addition, we are forecasting increased sales of Magnetic Sensors and Temperature and Pressure Sensors to the automotive market.

In the Magnetic Application Products segment, we are projecting a net sales decline of 17-20%. HDD Head shipment volumes are forecast to decline overall, despite a higher share of sales of nearline HDD Heads, and sales of HDD assemblies are expected to decrease sharply. Meanwhile, HDD Suspension Assembly sales are expected to remain level. In Magnets, while sales to the automotive market are expected to start increasing, lower sales for HDDs and a delayed recovery in demand for the industrial equipment market are expected to push down overall Magnet sales.

In the Energy Application Products segment, we are projecting net sales growth of 6-9%. We do not anticipate any large increases in sales for smartphones besides an increase in sales to major customers. However, we anticipate an increase in sales for applications other than smartphones, such as mini cells. Sales of Power Supplies for industrial equipment are expected to decrease slightly.

That concludes my presentation. Thank you for your attention.