[ 1st Quarter of fiscal 2018 Performance Briefing ]Consolidated Results for 1Q of FY March 2018

Mr. Tetsuji Yamanishi

Corporate Officer

I'm Tetsuji Yamanishi, Corporate Officer at TDK. Thank you for taking the time to attend TDK's performance briefing for the first quarter (April to June) of the fiscal year ending March 2018. I will be presenting an overview of our consolidated results.

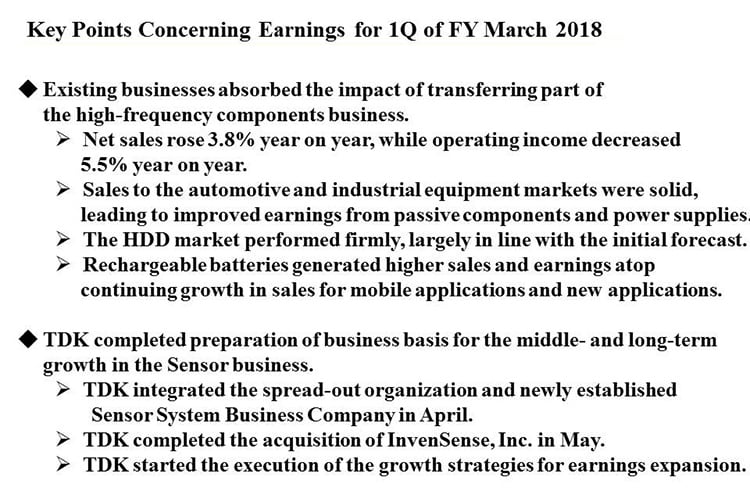

Key Points Concerning Earnings for 1Q of FY March 2018

First, let’s take a look at the key points concerning earnings for the first quarter. This was the first quarter since the major change in earnings structure from the transfer of part of the High-Frequency Components business in the fourth quarter of the previous fiscal year. Nevertheless, net sales rose 3.8% year on year, while operating income only declined about 5.5%, including the one-time expenses of roughly 3.5 billion yen associated with the acquisition of InvenSense, Inc. as earnings expansion in existing businesses offset negative impact on profit from the business transfer.

In the automotive market, sales were brisk, mainly for Passive Components as momentum seemed to slow a bit in North America but stayed strong in Europe, China, and Japan. Also, we achieved growth in sales to the industrial equipment market in all segments, led by Passive Components and Power Supplies, reflecting greater demand for semiconductor equipment and industrial robots, and a recovery in demand related to renewable energy and home electric appliances such as air conditioners.

Total HDD market demand was basically in line with our initial projection. Strong sales of HDD Heads to a major Japanese customer coupled with growth in HDD Suspension Assembly sales volumes from the acquisition of Hutchinson absorbed lower HDD assembly sales to major U.S. customers.

In Rechargeable Batteries, sales and profits grew. Sales to amajor North American customer were brisk, volumes rose from use in a wide range of equipment at major Chinese customers, and sales for new applications such as drones and game consoles kept expanding.

We have been executing M&As in line with our growth strategy since the previous fiscal year, aiming to shift to a new business portfolio with an eye to transferring the High-Frequency Components business. In May of the quarter under review, TDK completed the acquisition of InvenSense to strengthen the Sensor business, which is also a key pillar of the growth strategy. Under the Sensor Systems Business Company established in April, we have nearly finished laying the foundation for medium- to long-term growth in the Sensor business. Moving ahead, we will build a robust earnings foundation by integrating the Sensor business and quickly getting it up and running, fusing materials technology and core technology in sensing with IC technology and packaging technology, and providing sophisticated, high added-value sensing solutions.

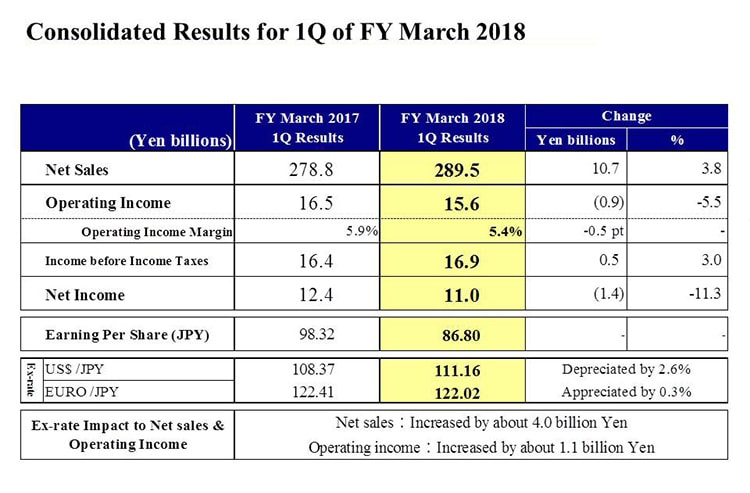

Consolidated Results for 1Q of FY March 2018

Next, let's take a look at our results for the first quarter. Net sales were 289.5 billion yen, up 10.7 billion yen, or 3.8% year on year. Operating income decreased 0.9 billion yen, or 5.5%, to 15.6 billion yen, including one-time expenses of roughly 3.5 billion yen associated with an acquisition. The operating income margin was 5.4%, down 0.5 of a percentage point.

Income before income taxes was 16.9 billion, up 0.5 billion yen. Net income declined by 1.4 billion yen, or 11.3%, to 11.0 billion yen. Consequently, earnings per share was 86.80 yen.

The average exchange rate for the first quarter of fiscal 2018 was 111.16 yen against the US dollar, a depreciation of 2.6%, and 122.02 yen against the euro, an appreciation of 0.3%. In terms of the impact of these exchange rate movements, exchange rates pushed up net sales and operating income by around 4.0 billion yen and 1.1 billion yen, respectively.

With regard to exchange rate sensitivity, we maintain our estimate that a change of 1 yen against the U.S. dollar will affect annual operating income by about 1.2 billion yen. However, we estimate the impact for each 1 yen change against the euro will decline to roughly 0.2 billion yen from our previous estimate of about 0.7 billion yen, owing to a change in the composition of profits denominated in foreign currencies from the transfer of a part of the High-Frequency Components business.

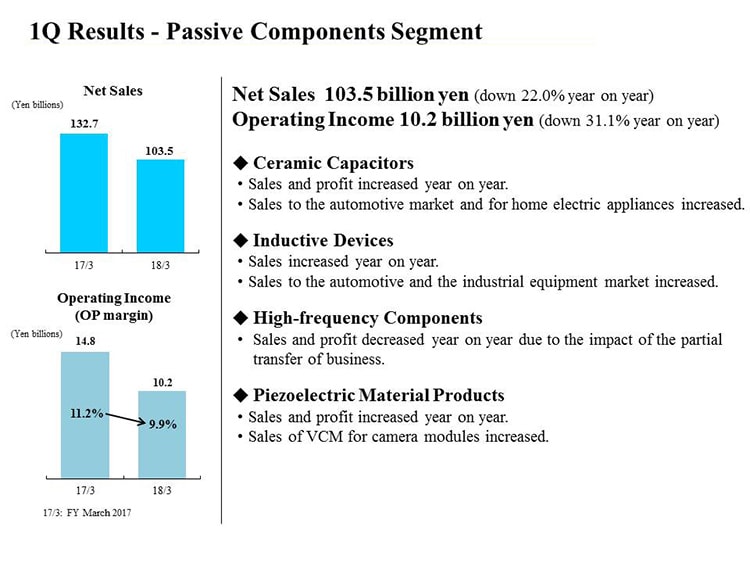

1Q Results - Passive Components Segment

Next, I would like to explain our business segment performance.

We newly established Sensor Application Products as a reporting segment from the fiscal year ending March 2018. As that resulted in certain products being reclassified, we have regrouped results for the fiscal year ended March 2017 into the new reporting segment framework.

First, in the Passive Components segment, the product reclassifications reduced net sales for the first quarter of the previous fiscal year by 5.0 billion yen and operating income by 1.2 billion yen. In the first quarter of the fiscal year ending March 2018, net sales declined 22.0% year on year to 103.5 billion yen, operating income decreased 31.1% to 10.2 billion yen, and the operating income margin was 9.9%.

For Ceramic Capacitors, sales and profits grew on strong sales to the automotive market, which accounts for over half of the sales, and higher sales for air conditioners and other home electric appliances. In Inductive Devices, sales continued to grow and profitability remained high. While sales for the ICT sector declined year on year due to the impact from inventory adjustments at major Chinese smartphone manufacturers, sales were solid to the automotive market, which accounts for a large share of sales as for Ceramic Capacitors. Sales also expanded overall to the industrial equipment market, which includes applications for industrial robots, measuring equipment, medicine, and renewable energy. In High-Frequency Components, sales and profits declined substantially due to the transfer of a part of the business. In the existing business, sales fell sharply due to the absence of sales of Wi-Fi modules recorded in the previous fiscal year. However, profitability remains strong, mainly for Ceramic Filters. For Piezoelectric Material Products, sales and profits rose on a strong performance from VCM for camera modules.

While the Passive Components segment overall could not absorb all of the negative impact from the partial transfer of High-Frequency Components business, which caused net sales to decline by just over 30.0 billion yen and the operating income margin to decline by 20% from the first quarter of the previous fiscal year, earnings are steadily heading up in existing businesses.

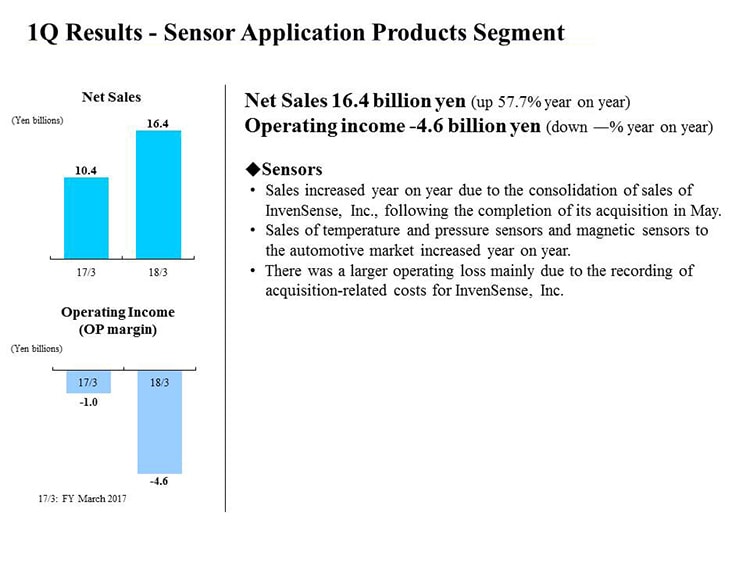

1Q Results - Sensor Application Products Segment

The Sensor Application Products segment includes Temperature and Pressure Sensors, Magnetic Sensors, and MEMS Sensors. Due to the reclassification of products into the new segment, net sales in the first quarter of the fiscal year ended March 2017 were 10.4 billion yen and operating losses totaled 1.0 billion yen.

In the first quarter of the fiscal year ending March 2018, net sales rose 57.7% year on year to 16.4 billion yen, while operating losses totaled 4.6 billion yen.

Completion of the acquisition of InvenSense lifted overall sales by 6.0 billion yen. We are currently calculating goodwill from the acquisition, but figures for the first quarter include one-time expenses totaling about 3.5 billion yen from the recording of amortization costs related to reevaluation of inventories as well as payments such as employee compensation and retention-related costs.

The automotive market accounts for a large share of sales for both Temperature and Pressure Sensors and Magnetic Sensors, which rose about 13% driven by the European and Japanese markets. In addition, shipments of TMR Sensors to the ICT market began. With the consolidation of InvenSense, sales of MEMS Sensors accounted for about 30% of total sales in the Sensor Application Products segment. Of that, roughly just over 70% of sales were to the ICT market and just under 30% for drones and other industrial equipment applications.

Excluding the roughly 3.5 billion yen in acquisition-related costs, operating income in the Sensor Application Products segment was flat year on year.

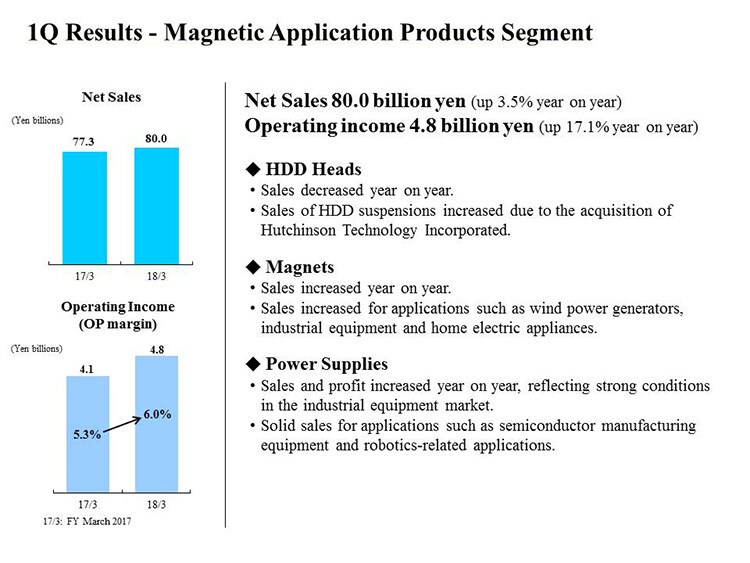

1Q Results - Magnetic Application Products Segment

In the Magnetic Application Products segment, the reclassification of certain products reduced net sales for the first quarter of previous fiscal year by 5.1 billion yen and lift operating income by 2.4 billion yen.

In the first quarter of the fiscal year ending March 2018, net sales rose 3.5% year on year to 80 billion yen, operating income increased 17.1% to 4.8 billion yen, and the operating income margin was 6.0%.

Sales of HDD Heads decreased despite basically flat volumes year on year, reflecting the absence of HDD assembly sales to North American customers recorded in the first quarter of the previous fiscal year. However, profitability increased, reflecting benefits from wafer site integration and cost improvements focusing on HDD full-turnkey products. HDD Suspension Assembly sales rose on volume growth from the acquisition of Hutchinson.

Sales of Magnets rose sharply as higher sales for air conditioners and for industrial equipment applications such as wind power generation and industrial robots offset lower sales of Magnets for HDDs due to a decline in HDD demand. While losses remain, earnings are steadily improving.

In Power Supplies, sales and profits grew and profitability rose markedly on brisk sales related to robotics as well as the semiconductor manufacturing equipment and measuring equipment markets.

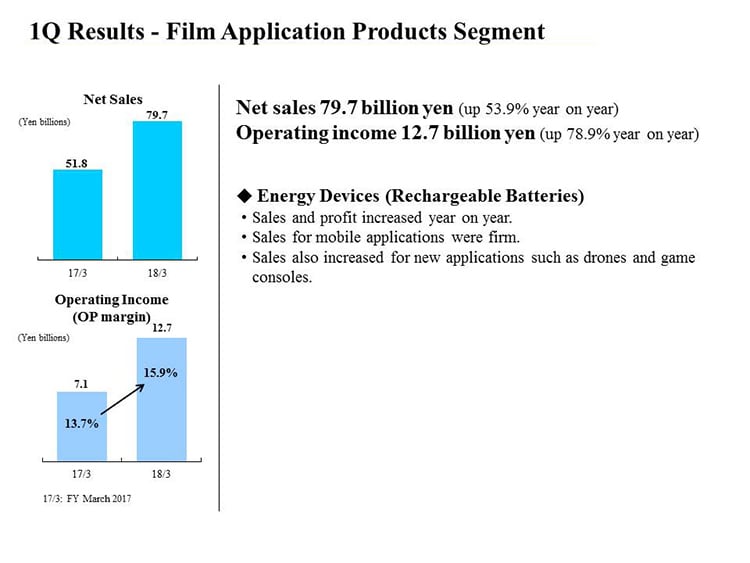

1Q Results - Film Application Products Segment

In the Film Application Products segment, net sales rose 53.9% year on year to 79.7 billion yen and operating income surged 78.9% to 12.7 billion yen. Profitability also stayed strong, with the operating income margin at 15.9%.

In Rechargeable Batteries, sales and profits were much higher. Sales to a major North American customer were stronger than we initially anticipated including for tablets. There were also contributions from growth in sales for a wide array of equipment to major Chinese customers, and expansion of sales for drones and game consoles.

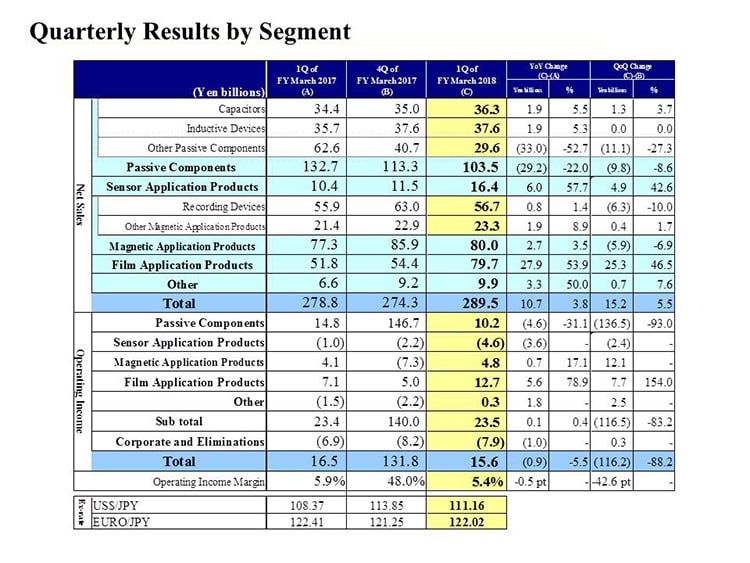

Quarterly Results by Segment

Next, I would like to explain the factors behind the changes in segment net sales and operating income from the fourth quarter of the fiscal year ended March 2017 to the first quarter of the fiscal year ending March 2018. As I previously noted, we have reclassified net sales and operating income for the previous fourth quarter into the new reporting segment framework arising from the establishment of the new segment.

First, net sales in the Passive Components segment decreased by 9.8 billion yen, or 8.6%, from the fourth quarter. Ceramic Capacitor sales were strong to the automotive market. Also, Aluminum Electrolytic Capacitors and Film Capacitors drove sales for use in the renewable energy market and industrial robots.

Inductive Device sales were flat from the fourth quarter, but rose about 3% if impact from yen appreciation is excluded. As with Ceramic Capacitors, sales to the automotive market were strong and sales to the industrial equipment market rose sharply, but sales for ICT applications declined, partially due to inventory adjustments at major Chinese customers. As a result, overall sales were flat.

Other Passive Component sales declined a substantial 11.1 billion yen, or 27.3%. However, the figure for the fourth quarter includes about 14 billion yen in sales from the High-Frequency Components business, which has been partially transferred.

Excluding that, sales were up about 11%. Sales of VCM for camera modules were strong to major Chinese customers.

Operating income in the Passive Components segment decreased by 136.5 billion yen, or 93%, from the fourth quarter.

However, the figure for the fourth quarter includes a net 134.6 billion yen boost from one-off factors, primarily a gain on the sale of business and impairment losses. Excluding that, operating income on a real basis declined by 1.9 billion yen from 12.1 billion yen in the fourth quarter. If we also exclude the just over 2.0 billion yen in operating income posted in the fourth quarter from the High-Frequency Components business that was subsequently transferred and the impact from yen appreciation, operating income grew about 12%.

Turning to the Sensor Application Products segment, net sales rose by 4.9 billion yen, or 42.6%, from the fourth quarter. The growth mainly reflects consolidation of InvenSense. Operating income declined by 2.4 billion yen. However, as I explained before, that is primarily because one-time expenses of approximately 3.5 billion yen related to the acquisition of InvenSense arose in the first quarter.

In the Magnetic Application Products segment, net sales decreased by 5.9 billion yen, or 6.9%, from the fourth quarter. Sales of recording devices declined by 6.3 billion yen, or 10%, owing to slightly lower HDD Head shipments and a decline in HDD full-turnkey shipments. Sales of Other Magnetic Application Products increased by 0.4 billion yen, or 1.7%, from the fourth quarter. Sales to the industrial equipment market including for industrial robots and measuring equipment were brisk for both Magnetic Products and Power Supplies.

Operating income in the Magnetic Application Products segment increased by 12.1 billion yen from the fourth quarter. If we exclude impairment and other restructuring costs totaling about 10.0 billion yen in the fourth quarter, operating income was up by roughly 2.0 billion yen to 1.7 times the figure in the fourth quarter. Profit growth was driven by improvement in the HDD Head product mix from volume growth for heads for nearline HDDs, a decline in goodwill amortization associated with the acquisition of Hutchinson, better Ferrite Magnet earnings in Magnetic Products, and volume growth in Power Supplies.

Moving on to the Film Application Products segment, net sales grew by 25.3 billion yen, or 46.5%, from the fourth quarter. Sales rose sharply on stronger-than-expected sales to major North American customers, including for tablets, and major Chinese customers adopting products for use in a wide range of equipment. Operating income was 12.7 billion yen, up 7.7 billion yen from 5,0 billion yen in the fourth quarter. Profit grew sharply due to a rise in marginal profit from higher sales volumes and cost improvements.

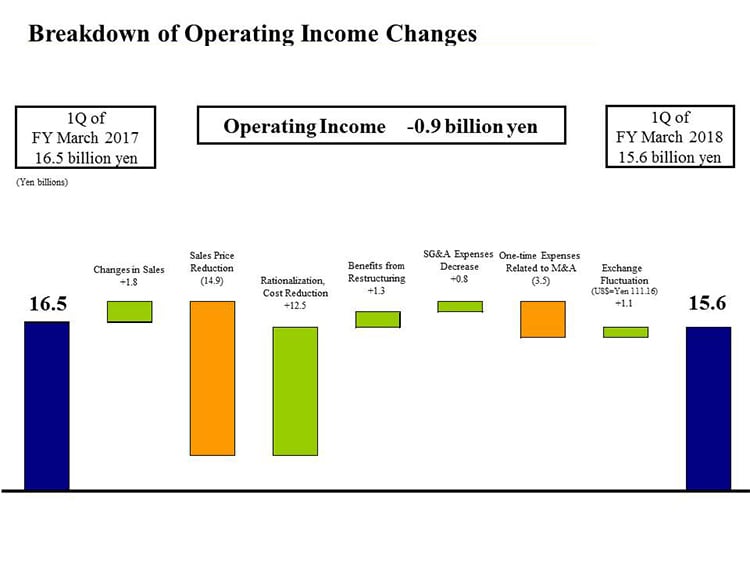

Breakdown of Operating Income Changes

Next is the breakdown of the 0.9 billion yen year-on-year decrease in operating income. First, there was positive impact of roughly 1.8 billion yen from an increase in net sales, including capacity utilization and the product mix. Sales growth in existing businesses absorbed the negative impact from the transfer of part of the High-Frequency Components business, and profit growth was attained.

Sales price reduction had a negative impact of about 14.9 billion yen. However, that was offset by positive impact of roughly 12.5 billion yen from rationalization and cost reductions, approximately 1.3 billion yen from benefits from restructuring, and 0.8 billion yen from a decrease in SG&A expenses.

Excluding one-time expenses related to M&A and impact from the yen’s depreciation against the U.S. dollar, operating income was 18.0 billion yen, up 1.5 billion yen from 16.5 billion yen in the first quarter of previous fiscal year. Including the positive impact of about 1.1 billion yen from the yen’s depreciation against the U.S. dollar and the 3.5 billion yen in one-time expenses related to the acquisition of InvenSense, operating income declined 0.9 billion yen year on year. The one-time expenses related to M&A mainly comprised amortization for the portion of inventories reevaluated as a result of the acquisition, compensation for employees and retention-related expenses, and advisory costs.

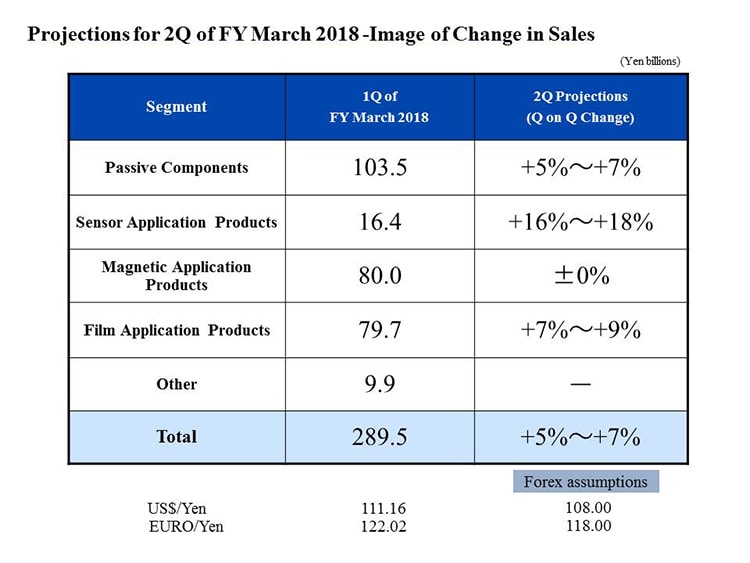

Projections for 2Q of FY March 2018 - Image of Change in Sales

Let me now discuss our image of changes in sales for the second quarter of the fiscal year ending March 2018.

Looking first at the Passive Components segment, we expect net sales to grow 5-7%. We anticipate ongoing strong sales to the automotive markets in Europe, China, and Japan, and solid sales to the industrial equipment market with momentum driven by Capacitors and Inductive Devices. Regarding smartphones, we expect shipments to really take off for a major North American customer’s new smartphone models and inventory adjustments at major Chinese customers wind up.

In the Sensor Application Products segment, we expect net sales growth of 16-18%. This outlook is based on solid sales of Temperature and Pressure Sensors as well as Magnetic Sensors to the automotive market, sales of TMR Sensors gaining momentum for the ICT market, and sales of MEMS Sensors rising on higher sales at InvenSense.

In the Magnetic Application Products segment, we project the HDD head shipment index will increase slightly from 100 in the first quarter to 102 in the second quarter. We expect sales of HDD Suspension Assemblies to increase as volumes grow while sales of Microelectronic Components for the ICT market move into full swing. Meanwhile sales of Magnetic Products and Power Supplies to the industrial equipment market are projected to stay strong. Nevertheless, we anticipate broadly flat net sales for the segment when impact from yen appreciation is included.

In the Film Application Products segment, we expect net sales growth of 7-9% as shipments of Rechargeable Batteries for a major North American customers’ new devices come into full play.

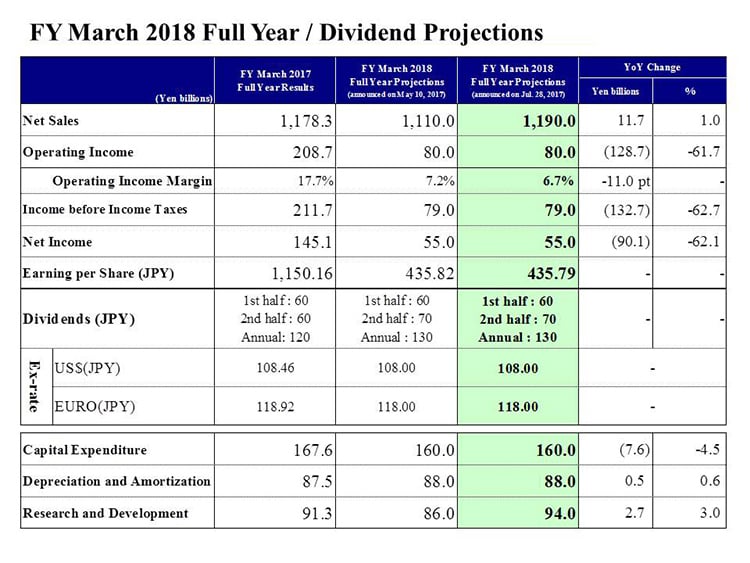

FY March 2018 Full Year / Dividend Projections

Finally, we come to our consolidated full-year projections for the fiscal year ending March 2018. We have raised our projection for net sales by 80.0 billion yen from our previous forecast announced in May, reflecting our latest revisions including InvenSense earnings. Our projections for operating income of 80.0 billion yen and net income of 55.0 billion are unchanged.

Regarding the details of net sales growth, I will explain based on our image of changes in sales from the fiscal year ended March 2017 announced in May 2017. For the Passive Components segment, we previously projected net sales growth of 8-11%, excluding impact from the transfer of a part of High-Frequency Components business, but we now expect 12-15% growth. For the Sensor Application Products segment, we previously forecast growth of 27-30%, but we now expect net sales including InvenSense to be 1.7-2 times the figure for the fiscal year ended March 2017. For the Magnetic Application Products segment, we previously projected a net sales decline of 6-9%, but we now expect a decline of 3-6%. For the Film Application Products segment, we previously expected net sales growth of 8-11%, but we now project growth of 25-28%.

For operating income, we have maintained our forecasts announced at the start of the current fiscal year. While we factored in roughly 9.0 billion yen for costs associated with the acquisition of InvenSense as we expect such expenses to temporarily balloon in the first fiscal year after the acquisition, we expect that to be absorbed by profit growth from higher sales in existing businesses.

For the second quarter of the fiscal year ending March 2018 onward, we maintain our exchange rate assumptions announced in May 2017 of 108 yen against the U.S. dollar and 118 yen against the euro.

Regarding various expenses, we have revised research and development expenses to 94.0 billion yen, including InvenSense.

That concludes my presentation. Thank you very much for your attention.