[ 3rd Quarter of fiscal 2016 Performance Briefing ]Consolidated Results for 3Q of FY March 2016

Consolidated Full Year Projections for FY March 2016

Tetsuji Yamanishi

Corporate Officer

My name is Yamanishi. Thank you for taking the time to attend our performance briefing for the third quarter of the fiscal year ending March 2016. I would like to start with the consolidated financial results.

Key points concerning earnings for 3Q of FY March 2016

Firstly, and most importantly, we achieved new records for net sales and operating income, both for the nine-month period and the third quarter.

Our profitability is also increasing. In the third quarter, our companywide operating income margin cleared double digits at 10%. The passive components segment posted historical highs in operating income for both the third quarter and the nine-month period. In the smartphone market, although the slowdown has continued even further, there has been an increase in the number of components mounted per unit as smartphones become more advanced. The sales centered on high-frequency discrete products to a major customer in North America. The segment has also succeeded in making sales to Chinese customers among the so-called “winners” in this market.

Furthermore, the segment managed to securely capture demand from the automotive market for inductors and capacitors, centered on North America. The film application products segment achieved new historical highs in both segment sales and operating income, for both the third quarter and the nine-month period. The result was partly due to a major increase in sales of rechargeable batteries after increasing market share in the peak season for a North American customer. The segment also expanded sales for customers in China and South Korea, and has seen an increase in new applications, such as drones. On the other hand, in the magnetic application products segment, both sales and operating income declined considerably year on year for heads and magnets. This reflects the further contraction of demand for HDD heads. Our previous estimation for the HDD market was 463 million units, but we have now revised this to 452 million units based on recent demand trends. The company has successfully established a flexible earnings structure, whereby the adverse effects of the weak demand in the PC market on earnings of the magnetic application products segment were offset by the strong growth in the passive components and film application product segments. Consequently, the company’s overall earnings grew further and operating income for the third quarter amounted to 30.3 billion yen.

To ensure sustainable growth in the dynamic and volatile market in which we operate, it is vitally important to execute growth strategies with the correct timing. Part of this is the important strategies that we have been executing from November last year up to this month. These have already been made public, but I will recap them here. We acquired Hutchinson Technology Incorporated to strengthen the HDD suspension business. We acquired Micronas Semiconductor Holding AG to bolster the sensor business. We acquired the Tsuruoka Factory of Renesas Semiconductor Manufacturing Co., Ltd. to extend thin-film technology into electronic components. We took a stake in Trigence Semiconductor, Inc. to form a business alliance aimed at expanding the market for semiconductor-embedded substrates utilizing SESUB technology. And this month, we announced the formation of a business alliance and joint venture with Qualcomm Incorporated in the high-frequency components business.

These strategies are designed to achieve tremendous synergies between our existing businesses and our new growth-oriented businesses. Through them, we aim to achieve sustainable growth going forward.

Consolidated Results for 3Q of FY March 2016

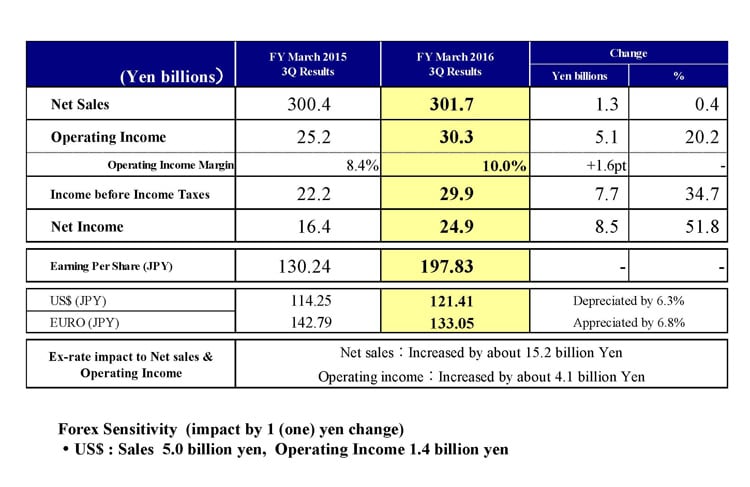

Next, I would like to outline the results for the third quarter of the fiscal year ending March 2016. For the third quarter, the company’s sales remained almost level, increasing by 1.3 billion yen year on year to 301.7 billion yen. Operating income was 30.3 billion yen, marking year-on-year growth of 5.1 billion yen, or 20.0%. The operating income margin increased by 1.6 points to clear double digits at 10.0%.

Income before income taxes grew by 7.7 billion yen, or 34.7% year on year, to 29.9 billion yen. Net income amounted to 24.9 billion yen with year-on-year growth of 51.8%.

As a result, earnings per share amounted to 197.83 yen. Average exchange rates for the period were 121.41 yen to the U.S. dollar and 133.05 yen to the euro, which meant that the yen depreciated by 6.3% against the dollar and appreciated by 6.8% against the euro.

Exchange rate fluctuations contributed to increased Earnings rate fluctuations increased sales by about 15.2 billion yen and operating income by about 4.1 billion yen. The company’s sensitivity to exchange rate fluctuations is calculated to be an increase or decrease in operating income of approximately 1.4 billion yen for every one yen change in the exchange rate of the yen to the U.S. dollar.

3Q Results - Passive Components Segment

Next, I would like to explain each segment’s performance for the third quarter.

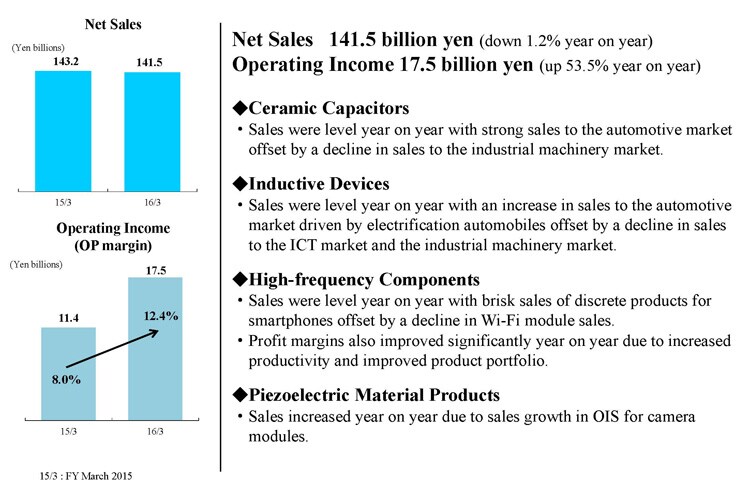

Firstly, the passive components segment posted sales of 141.5 billion yen, a slight decline of 1.2% year on year. Operating income grew 53.5% year on year to 17.5 billion yen. The segment has shown steady double-digit operating income margins, achieving 12.4% for the period atop significant growth in operating income and improved profitability.

The automotive market centered on North America saw strong performance with an increase in sales. However, in the ICT market, which is centered on smartphones, sales declined due to the impact of a sharp decline in Wi-Fi module sales. In the industrial equipment market, sales declined, partly due to the economic slowdown in China.

Sales of ceramic capacitors were level year on year, as strong sales to the automotive market, which represents approximately 50% of total sales of ceramic capacitors, were offset by a decline in sales to a lackluster industrial equipment market.

Sales of inductive devices declined year on year. Strong sales to the automotive market, which accounts for more than 40% of the total sales of inductive devices, were offset by a slight decline in sales for use in smartphones, which were affected in part by a production cut by a customer in North America. Sales in the industrial equipment market also declined, partly due to the economic slowdown in China.

Sales of high-frequency components were level year on year. Brisk sales of discrete products for smartphones were offset by a sharp decline in sales of Wi-Fi modules for a customer in North America.

The impact of increased production of discrete products and significant growth in profit due to improvements in the product mix led the company’s overall operating income growth in high-frequency components. Both sales and operating income of piezoelectric material increased year on year, backed by strong sales of OIS for camera modules to Chinese smartphone makers.

3Q Results - Magnetic Application Segment

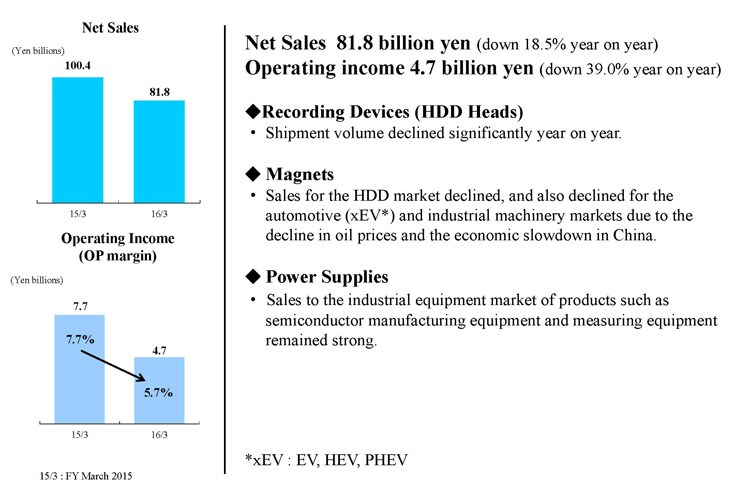

Moving on to the magnetic application products segment, sales declined by 18.5% year on year to 81.8 billion yen. Operating income for the segment declined roughly by 39.0% year on year to 4.7 billion yen. The segment’s operating margin declined substantially to 5.7%. Business conditions remained harsh, affected by a slowdown in HDD demand and further progress in the changeover to SSDs in the PC market.

The shipment index for HDD heads was 87 for the third quarter, posting a significant year-on-year decline in both sales and profits of HDD heads. Magnet sales also faced continued adversity, including strong impacts from the decline in demand for HDDs and flagging sales of xEV automobiles due to the decline in oil prices. Another factor was a decline in sales for motors used in industrial equipment due to the economic slowdown in China.

Sales of power supplies were level year on year, with strong sales for the semiconductor manufacturing equipment and measuring equipment markets.

3Q Results - Film Application Segment

For the film application products segment, sales and operating income surged by around 1.5 times year on year, with sales of 68.5 billion yen and operating income of 14.6 billion yen. The segment’s operating margin was 21.3%, tracking a further increase in profitability.

In the rechargeable batteries business, sales grew even further year on year, boosted by an increase share with a major customer in North America. In addition, sales expanded to customers in South Korea and China, and increased for new applications such as drones. The benefits of a timely increase in production capacity are steadily being realized.

Breakdown of Operating Income Changes (3Q)

Next I will talk about year on year changes in operating income. One of the main factors contributing to the 5.1 billion yen growth in operating income was about 15.1 billion yen in sales growth, including the effects of capitalization and changes in product mix. Adverse effect of the lower sales volume of HDD heads and magnets that put downward pressure on operating income were more than offset by increased sales of high-frequency components and rechargeable batteries to the smartphone market, as well as an increase in the share of highermargin products.

Lower selling prices reduced operating income by approximately 21.3 billion yen.

Exchange rate fluctuations due to the yen’s depreciation pushed up operating income by 4.1 billion yen. Our efforts to cut costs by rationalization such as reforming production processes for high-frequency components and rechargeable batteries to enhance efficiency and yield ratio, as well as discounts on raw materials, helped to increase the operating income by 10.1 billion yen. And the benefit of structural reform is calculated as 0.7 billion yen.

If we discount an impairment loss incurred in the previous fiscal year of 5.3 billion yen and gain on sale of property of 0.7 billion yen, then selling, general and administration expenses increased by 8.2 billion yen year on year.

This was mainly attributable to an increase in R&D costs to support new product development, and R&D to overhaul manufacturing for high-frequency components and rechargeable batteries, an increase in administration expenses associated with the expansion of the rechargeable battery business, and one-time expenses for executing strategic measures, which have been announced.

Quarterly Results by Segment

Next I would like to explain changes in segment sales and operating income for the second and third quarters.

First of all, as I noted in the briefing for the second quarter, starting this fiscal year, some of the products in the passive components and magnetic application products business are reclassified into the category of “Other”. Because of this reclassification, sales under “Other” for the third quarter for the fiscal year ended March 2015 increased by 2.2 billion yen. The impact of this change on operating income was negligible.

Let me summarize the results for each segment. Firstly, for the passive components segment, sales decreased by 8.7 billion yen or 5.8% in the third quarter compared with the second quarter. The capacitors business saw solid sales of multi-layer ceramic capacitors for automobiles, but sales of aluminum film capacitors for the strong renewable energy market declined due to seasonal factors. Furthermore, sales for industrial equipment fell heavily, dropping by 3.1 billion yen, or 7.8%, mainly because of the impact of the economic slowdown centered on China and the fall in oil prices. Sales of inductive devices in the third quarter declined by 1.2 billion yen or 3.1% from the second quarter. Although sales to the automobile market remained firm, there was a slight impact from production adjustments by a smartphone manufacturing customer in North America in December and sales for use in air conditioners and other items declined with the impact of the economic slowdown in China.

Sales of other passive components in the third quarter declined by 4.4 billion yen or 6.1% from the second quarter. The main factor in the decline was a decline in sales of high-frequency modules such as Wi-Fi modules to customers in North America. Sales of discrete products among high-frequency components, as OIS products for camera modules, continued to gain steadily.

Operating income of the passive components segment recorded a new historical high at 17.5 billion yen on a quarterly basis, while remaining almost level with 17.4 billion yen recorded in the second quarter. There was little profit contribution from high-frequency module products, which were a factor in the significant decline in sales from the second quarter. Consequently, sales declined for the passive components segment overall. At the same time, however, the segment’s operating income margin improved from 11.6% in the second quarter to 12.4% in the third quarter, as profits expanded on the back of higher sales volume for smartphone use centered on high-frequency discrete products and cost reduction efforts through rationalization including better productivity.

For the magnetic application products segment, sales in the third quarter declined by 3.5 billion yen, or 4.1%, from the second quarter. Sales of recording devices in the third quarter declined by 2.2 billion yen, or 3.6%, from the second quarter. Changes in the product mix outweighed third-quarter HDD head shipment volume coming in slightly higher than expected.

The shipment index for HDD heads for the third quarter increased slightly to 87, almost flat with the second-quarter index of 86 as expected. For the fourth quarter, we expect the index to decline significantly from the third quarter to 70. Sales of other magnetic application products in the third quarter declined by 1.3 billion, or 5.3%, from the second quarter.

Sales of magnets declined due to the impact of a contraction in demand for HDD use and weak sales for use in EVs due to the impact of low oil prices. Another factor was a decline in sales for use in industrial equipment due to the impact of the economic slowdown in China. Sales of power supplies were mainly flat compared to the second quarter, with steady sales for measuring equipment and others.

Operating income for the magnetic application products segment declined slightly, reflecting a decline in sales of recording devices due to the impact of the product mix in HDD heads. Nevertheless, in terms of profitability the segment maintained a double-digit operating income margin. Profits on magnet sales continued to come under pressure with sales declining more than expected.

For the film application products segment, sales in the third quarter increased by 4.4 billion yen, or 6.9% from the second quarter. The significant growth in sales was due to an increase in sales during the peak sales season of a major customer in North America, as well as increased use of lithium polymer batteries by Chinese and South Korean smartphone makers.

Operating income for the third quarter increased by 3.0 billion yen to 14.6 billion yen from 11.6 billion yen in the second quarter. On a quarterly basis, both sales and operating income reached new historical highs.

Consolidated Results through 3Q of FY March 2016

Next, let’s take a look at consolidated results for the first three quarters of fiscal 2016.

For the nine-month period, net sales were 889.3 billion yen, an increase of 10.8% year on year. This represents a new historical high for a nine-month period.

Operating income was 75.9 billion yen, up 42.9% year on year. As with net sales, this is also a new historical high for a nine-month period.

Net income rose 63.5% to 56.4 billion yen.

FY March 2016 Full Year Projections

In our full-year operating results projections for fiscal 2016, we have made no changes to the projections announced in April.

Net sales are projected at 1,180.0 billion yen, operating income at 95.0 billion yen, net income at 65.0 billion yen, and earnings per share at 515.92 yen. The projected exchange rates for the fourth quarter are 115 yen against the U.S. dollar and 130 yen against the euro. In terms of the market outlook, we expect sales to the automotive market to remain firm, mainly for North America. In the smartphone market, we expect sales to continue steadily for the fourth quarter in line with initial projections. We expect to be able to achieve fourth quarter sales in line with initial estimates despite production adjustments by our customer in North America, and an increase in sales share to growing customers should offset the overall slowdown in growth for the Chinese smartphone market. In the industrial equipment market, we expect a continuing impact from curbs on infrastructure investment and corporate capital investment due to the effect of the economic slowdown in China and low oil prices.

Next let us look at envisaged changes in sales between the third quarter and fourth quarter by segment. In the passive components segment we expect fourth quarter sales to be roughly flat compared to the third quarter, with steady sales projected for the automotive and Chinese smartphone markets. In magnetic applications products, fourth quarter sales are expected to decline by between 11% and 13% compared to the third quarter. This reflects an anticipated decline in the HDD head shipment volumes by around 20% in terms of the shipment index as well as the impact of declining HDD demand on magnetic products. Other factors are weak sales projected for xEVs due to the impact of low oil prices, and for industrial equipment due to the impact of the economic slowdown in China. In film application products, fourth quarter sales are expected to decline by between 11% and 13% compared to the third quarter. This reflects the start of a new product line at a South Korean customer and growth in sales to Chinese customers, which are expected to cushion the impact of a seasonal decline in sales to a North American customer.

Based on these background factors, we have decided to leave our full-year operating results projections unchanged from our initial announcement.

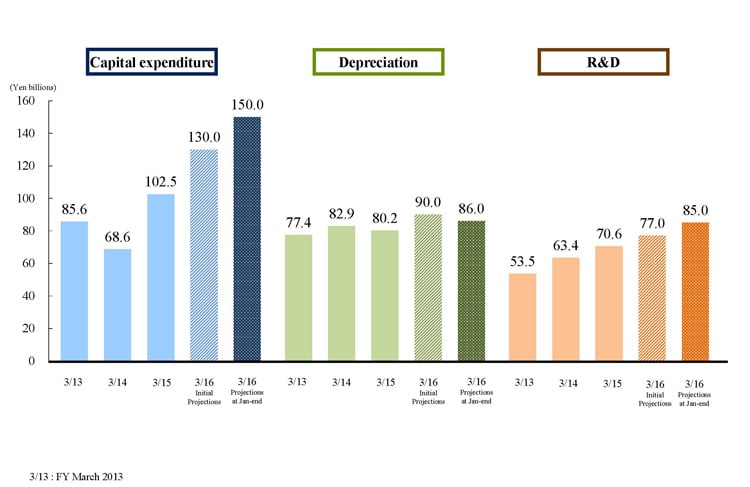

FY March 2015 Projections -Capex, Depreciation, R&D-

Finally, we have changed our cost projections from the initial announcement, in light of trends in the third quarter.

In capital expenditure, we initially planned to spend 130.0 billion yen, but we have revised this figure upward by 20.0 billion yen. This reflects the bringing forward of capital expenditures related to high-frequency components, which are seeing rapid growth, in step with the expansion of sales for the smartphone market. Investment related to acquisitions, which have already been announced, are not included in this.

For depreciation and amortization, we have revised our estimate downward from 90.0 billion by 4.0 billion yen to 86.0 billion.

One main factor was a downward revision in capital expenditure initially planned for HDD heads in light of the decline in demand. The other was a slight delay in executing capital expenditure planned for rechargeable batteries as a result of timing execution closely with market trends.

Finally, with respect to research and development expenses, we have increased our projection by 8.0 billion yen to 85.0 billion yen from the initial projection of 77.0 billion yen. The main factor is an increase in our workforce to accelerate new product development and strengthen process development in the rapidly growing fields of highfrequency components and rechargeable batteries.

That’s all for my presentation. Thank for listening.