[ 2nd Quarter of fiscal 2016 Performance Briefing ]Consolidated Full Year Projections for FY March 2016

Takehiro Kamigama

President and CEO

I would like to briefly explain our full-year projections for the fiscal year ending March 2016.

Market trend in the second half

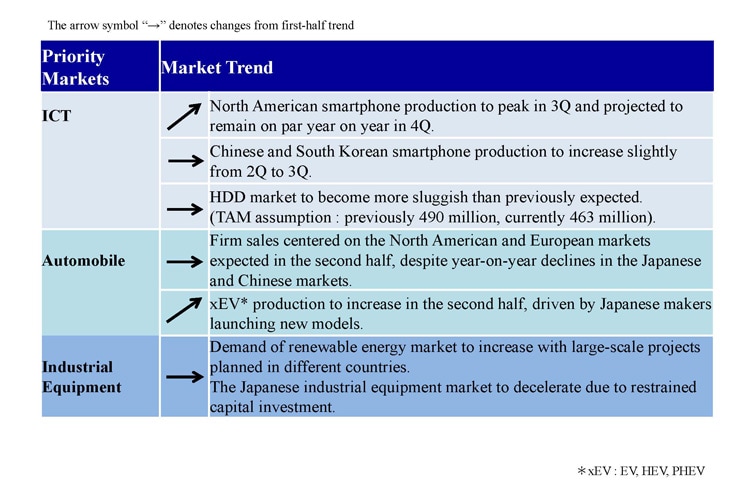

First, I will go over related market trends for the second half of the year. In view of the slowing Chinese economy, there are increasing uncertainties and concerns over the direction of demand for electronic components. I would like to outline the company’s priority markets and major products.

-

(i) ICT market

Major North American smartphone maker projects their smartphone production to peak in the third quarter, then to remain flat year on year for the fourth quarter. In view of minor model changes, there are some concerns that the annual production for the year may fall below that of the previous year. However, we expect the full-year production to be similar to the previous year.

We monitor the status of eight major makers as a benchmark in the Chinese smartphone market. It is our view that the level of production will increase slightly from the second quarter to the third quarter. Despite the clearer distinction between “winner” and “loser” companies in the market, the overall volume of order receipts remains strong.

In the South Korean smartphone market, the production of high-end devices is below the initially planned level.

However, the production of mid- to low-end models has been increasing, and so the initially planned units for the full year should be achievable.

Due to the deterioration of the PC market, we have revised our HDD TAM assumption downward from 490 million units to 463 million units. Demand from data centers is expected to remain strong for the second half of the year. -

(ii) Automotive market

Although automobile sales to Japanese and Chinese markets declined year on year, we expect the overall demand to remain solid, primarily driven by the U.S. and European markets.

Due to lower gasoline prices, xEV production has been weaker than initially planned. In the second half, however,major Japanese automakers will release new models, and we expect auto production to increase substantially over the fourth quarter. -

(iii) Industrial equipment market

With large-scale projects under way in many countries, demand in the renewable energy market is expected to grow further.

On the other hand, Japan’s industrial equipment market has been slowing down due to restrained capital expenditure. However, we expect this market to remain strong overall.

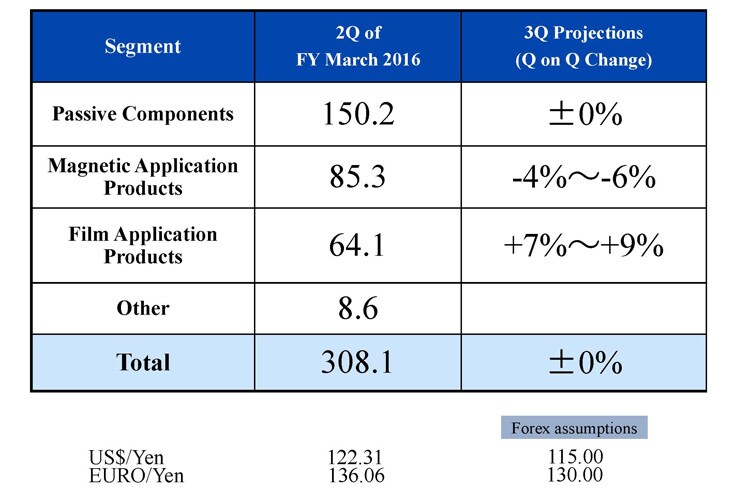

Projections for 3Q of FY March 2016 -Image of change in sales

Next, I would like to explain our projections for third quarter sales for each segment.

Sales are projected assuming foreign exchange rates set at the beginning of the year at 115 yen to the U.S. dollar and 130 yen to the Euro.

Firstly, sales of passive components are projected to remain flat between the second quarter and the third quarter. The flat sales projection for this segment is based on, as I mentioned earlier, overall sales to ICT and automotive markets that are likely to remain strong, which is expected to be offset by adverse effects of some products already in full production since the second quarter, and others facing a possible reduction from the second quarter to the third quarter.

We expect sales of magnetic application products to fall by 4-6%. As Mr. Yamanishi mentioned earlier, the shipment volume of HDD heads is projected to remain flat year on year. Additionally, a reduction in prices is incorporated into the projected sales in view of the latest market condition.

Sales of film application products grew significantly in the second quarter, reaching 1.5 times the first quarter sales.

We expect further growth of 7-9% in the third quarter. Sales of rechargeable batteries, mainly products for main customers that will reach peak production in the third quarter, are projected to perform well.

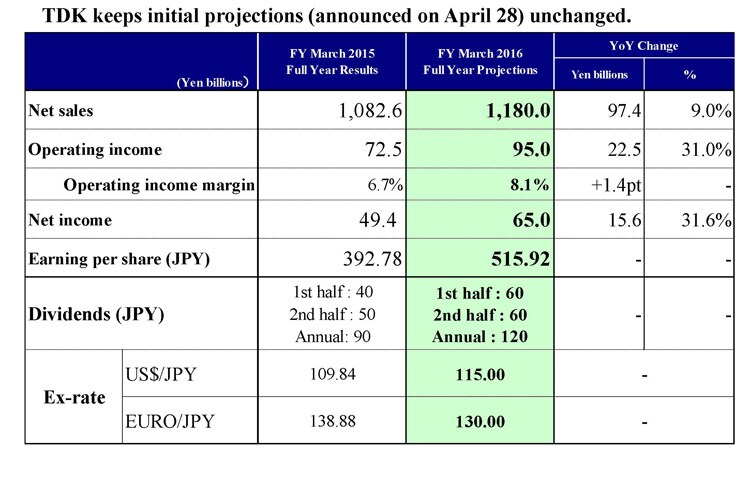

FY March 2016 Full Year / Dividend Projections

We keep initial full-year projections and dividend projections for the fiscal year ending March 2016 announced on April 28th unchanged.

That’s all for my presentation. Thank you for listening.