[ 1st Quarter of fiscal 2016 Performance Briefing ]Consolidated Results for 1Q of FY March 2016

Mr. Tetsuji Yamanishi

Corporate Officer

Hello. My name is Tetsuji Yamanishi. I am a corporate officer at TDK. Thank you for taking the time to attend TDK’s performance briefing for the first quarter of the March 2016 fiscal year in such large numbers. I will be presenting a summary of our consolidated operating results.

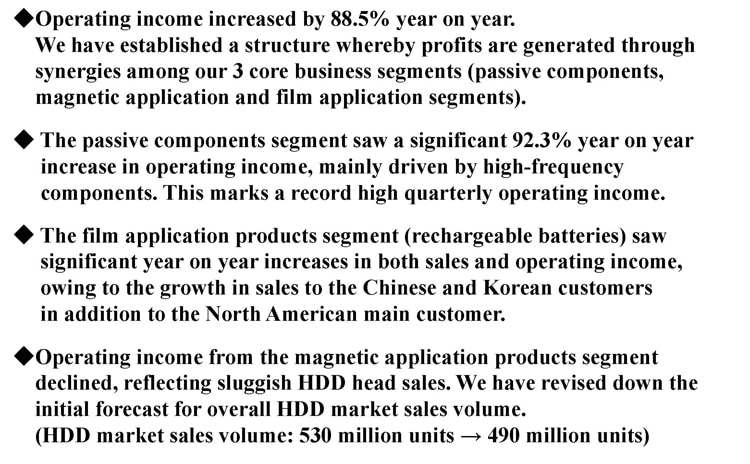

Key points concerning earnings for 1Q of FY March 2016

Let’s begin with a look at the key points of our earnings for the first quarter of the March 2016 fiscal year. The first thing to note is that operating income has nearly doubled, increasing approximately 1.9-fold (88.5%) year on year. This result shows that we have established a structure whereby profits are generated through synergies among our three core business segments (passive components, magnetic application and film application segments).

Against the backdrop of buoyant demand for passive components in the ICT market, earnings from high-frequency components improved dramatically, and other products also performed well, leading to a big jump in operating income. The passive components segment posted record high net sales and operating income on a quarterly basis.

In the film application products segment, overall earnings were driven by higher earnings atop growth in sales to Chinese and South Korean customers in addition to existing main customers.

Meanwhile, in the magnetic application products segment, operating income plummeted by half as HDD head shipments were much lower than initially anticipated. This reflected additional inventory and production adjustments at hard disk manufacturers due to the negative impact of worsening PC market conditions.

Overall HDD head shipment volume represents this segment’s source of earnings in aggregate. Initially, the HDD market sales volume was forecasted at 530 million units. However, in light of trends in demand in the first quarter, we have reduced the forecast to 490 million units.

Earnings growth in the passive components segment and the film application products segment pushed up overall earnings by compensating for the large drop in earnings in the magnetic application products segment caused by plummeting HDD head shipments. As a result, operating income was 18.1 billion yen in the first quarter of the March 2016 fiscal year.

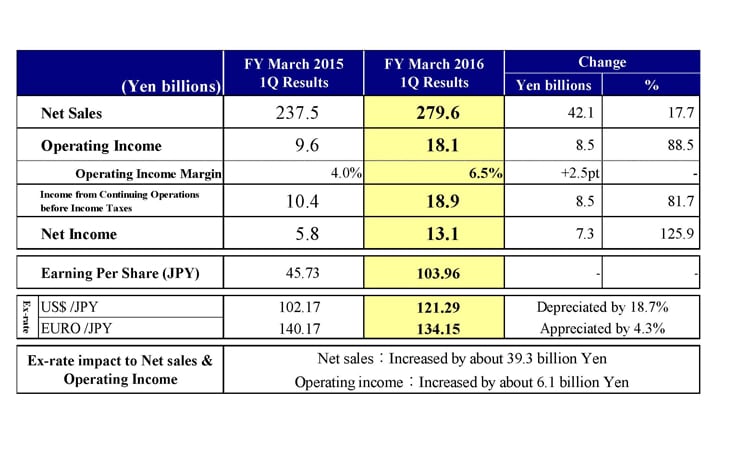

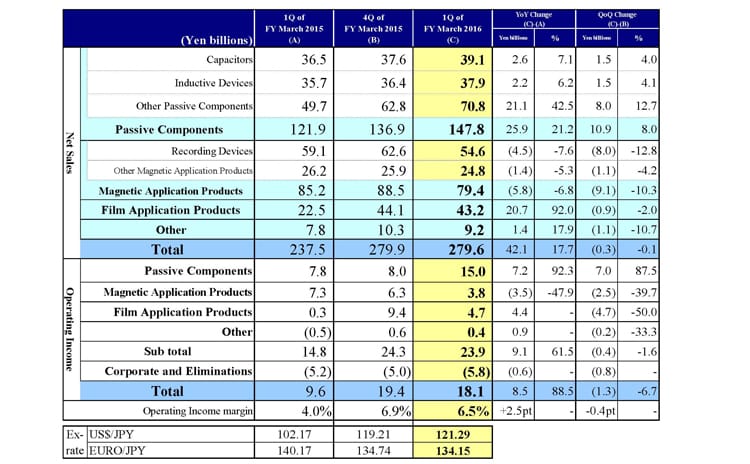

Consolidated Results for 1Q of FY March 2016

Next, I’d like to give you an overview of our consolidated operating results for the first quarter. Net sales amounted to ¥279.6 billion, an increase of ¥42.1 billion, or 17.7%, year on year. Operating income was ¥18.1 billion, up ¥8.5 billion year on year. This result represented an approximate 1.9-fold increase from the same period a year earlier.

The operating income margin improved 2.5 percentage points to 6.5%. Income before income taxes amounted to ¥18.9 billion, up ¥8.5 billion. Net income rose ¥7.3 billion to ¥13.1 billion. As a result, earning per share was ¥103.96. Turning to average exchange rates in the first quarter of the March 2016 fiscal year, the yen depreciated by 18.7% against the U.S. dollar to ¥121.29 compared with the first quarter of the March 2015 fiscal year. The yen appreciated by 4.3% to ¥134.15 against the euro compared with the same period last year. The net forex impact was an increase of approximately ¥39.3 billion in net sales and an increase of approximately ¥6.1 billion in operating income. Regarding exchange rate sensitivities, as we have explained in the past, in terms of the relationship between the yen and the U.S. dollar, a ¥1 appreciation against the U.S. dollar lowers operating income by approximately ¥1.4 billion.

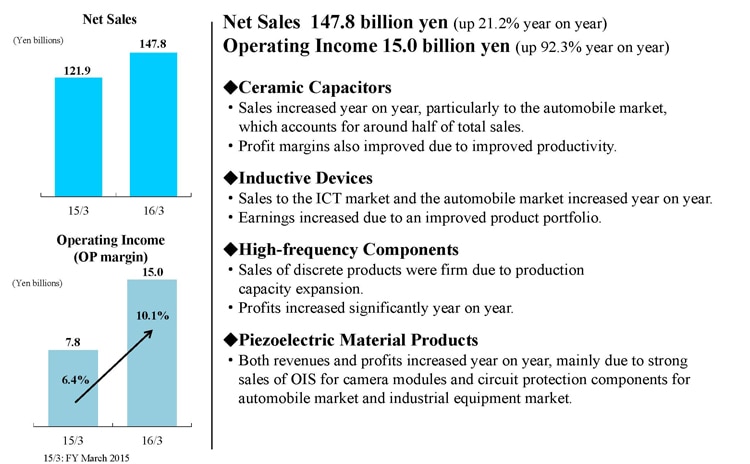

1Q Results - Passive Components Segment

Next, let’s take a look at first-quarter operating results for each segment. Let’s begin with the passive components segment. In this segment, net sales were ¥147.8 billion, up 21.2% year on year. Operating income rose 92.3% year on year to ¥15.0 billion. The operating income margin was 10.2%, marking a sharp improvement in profitability. Overall, sales of passive components for the Chinese smartphone market increased dramatically, along with steady growth in sales to the automotive market.

In ceramic capacitors, sales increased year on year, particularly to the automotive market, which represents about half of overall segment sales. In addition to the higher sales, profit margins improved due to enhanced productivity.

In inductive devices, sales grew steadily to the automotive market, which accounts for about 40% of segment sales. Sales to the ICT market were also up by around 6% year on year. These higher sales, coupled with an improved product mix, helped to push up earnings.

In high-frequency components, sales increased sharply year on year atop substantial growth in sales of discrete products. This was because we had increased our production capacity in response to buoyant demand in the ICT market. Profits benefited from these higher sales, as well as enhanced productivity. High-frequency components were a major driving force behind the passive components segment as a whole, as well as the profits of the entire Company.

Piezoelectric material products saw higher sales of OIS for camera modules for use in high-end models in the Chinese smartphone market, along with higher sales of circuit protection components for the industrial equipment market. This pushed up overall sales of piezoelectric material products compared with the same period last year.

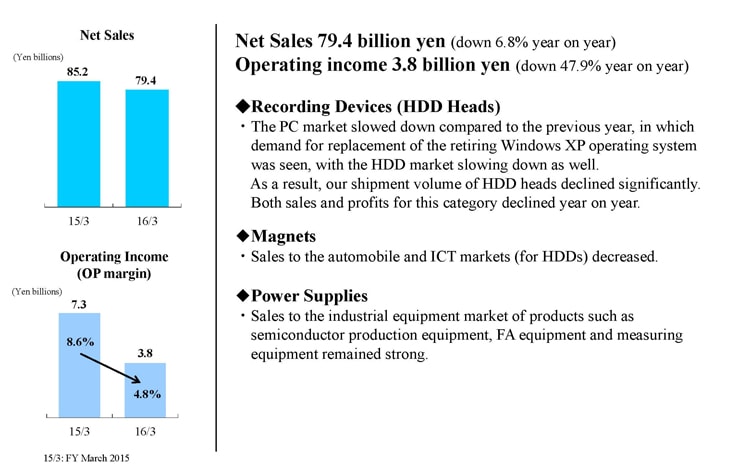

1Q Results - Magnetic Application Products Segment

Next is the magnetic application products segment. In this segment, net sales were ¥79.4 billion, down 6.8% year on year. Operating income decreased by around half to ¥3.8 billion. The operating income margin was down sharply at 4.8%. The PC market slowed down from the same period last year, in which there was demand for replacing PCs upon the end of support for the Windows XP operating system. The HDD market was also lackluster, mainly reflecting the negative impact of additional inventory and production adjustments at HDD manufacturers. Consequently, the actual HDD heads shipment volume index for the first quarter was 72, compared with the initial forecast of 85. This led to a sharp decline in recording device sales from the same period a year earlier. This precipitous decline in HDD head shipment volume had a large negative impact on profitability. In response, we are striving to improve profitability by optimally adjusting our production system so as to generate adequate earnings even at current production levels.

In magnets, products for the automotive and ICT markets faced an uphill battle, with sales declining year on year. As with HDD heads, earnings have been slow to recover partly because of the impact of deteriorating market conditions. However, we are expediting efforts to turn around our performance by strengthening our management system and concentrating resources in this field, with a view to increasing sales to the automotive and the industrial equipment sectors.

In power supplies, sales of products increased year on year to the markets for semiconductor production equipment, FA equipment, and measuring equipment. As a result, sales of power supplies were higher year on year. We have also put in place a structure that generates steady earnings.

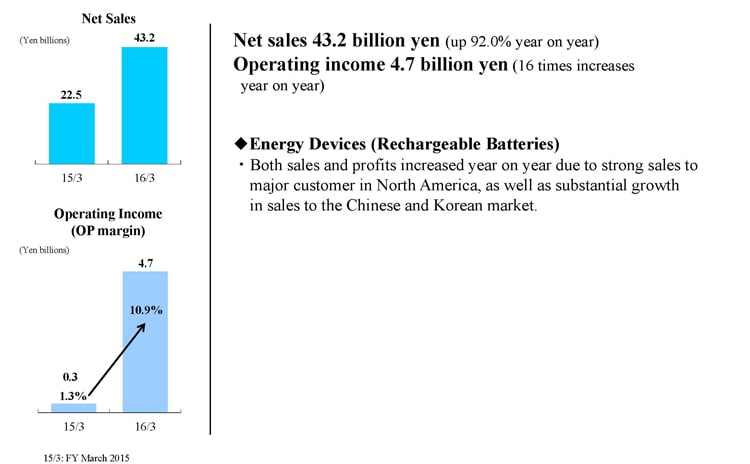

1Q Results - Film Application Products Segment

Next is the film application products segment. Net sales increased dramatically, roughly doubling to ¥43.2 billion. Operating income was ¥4.7 billion, roughly 16 times higher year on year. The operating income margin recovered to more than 10%.

In rechargeable batteries, both sales and profits increased substantially, due to continued strong sales to major customer in North America, as well as the positive impact of having expanded our customer portfolio mainly in the Chinese and South Korean markets.

Quarterly Results by Segment

Next, I’d like to explain the factors behind the changes in net sales and operating income from the fourth quarter of the March 2015 fiscal year to the first quarter of the March 2016 fiscal year. First, certain products that were previously classified in the passive components and magnet application products segments have been reclassified to the Other segment from the March 2016 fiscal year. This reclassification had the impact of increasing sales by ¥2.1 billion in the first quarter and ¥2.2 billion in the fourth quarter of the March 2015 fiscal year. There was virtually no impact on operating income.

Looking at the changes by segment, sales of passive components increased ¥10.9 billion, or 8%, from the fourth quarter of the March 2015 fiscal year. In capacitors, sales of MLCCs were strong to the automotive and industrial equipment markets. Sales of inductive devices rose 4.1% year on year to ¥1.5 billion, mainly due to higher sales of products to ICT markets, such as the Chinese smartphone market. Turning to other passive components, net sales were up sharply by ¥8.0 billion, or 12.7%, from the fourth quarter. This mainly reflected a sharp increase in sales to the ICT market, which was due to two factors. First, owing to an increase in production capacity, our high-frequency components were able to capture buoyant demand mainly in the Chinese smartphone market. Second, sales of OIS for camera modules increased. Operating income in the passive components segment rose ¥7.0 billion from ¥8.0 billion in the fourth quarter to ¥15.0 billion in the first quarter. Operating income in the fourth quarter includes restructuring costs of ¥2.1 billion. Profitability has improved. The operating income margin was more than 10%, reflecting steady sales to the automotive market and a large increase in sales to the smartphone market. Notably, high-frequency components have seen a dramatic improvement in profits driven by growth in sales of high-margin discrete products.

Next is the magnetic application products segment. For the segment as a whole, net sales declined ¥9.1 billion, or 10.3%, from the fourth quarter. Sales of recording devices decreased ¥8.0 billion, or 12.8%, from the fourth quarter, to ¥54.6 billion. HDD head shipments declined sharply as HDD market conditions deteriorated much faster than initially anticipated, due to worsening PC market conditions. Meanwhile, HDD head shipments to the market for nearline HDDs for data centers remained mostly unchanged from the fourth quarter. As a result, the HDD head shipment index was 76, assuming an index of 100 for shipment volume in the first quarter of the March 2015 fiscal year. Under the previous index level, the HDD head shipment index was 72, roughly 15 percentage points below the initially projected index of 85. That said, the HDD head shipment volume is expected to gradually recover. The HDD head shipment index is projected to improve from 76 in the first quarter of the March 2016 fiscal year to around 90 in the second quarter. Sales of other magnetic application products declined ¥1.1 billion, or 4.2%, from ¥25.9 billion in the fourth quarter to ¥24.8 billion. Sales of magnets to the HDD and other markets declined. Operating income in the magnetic application products segment decreased ¥2.5 billion, or 39.7%, from ¥6.3 billion in the fourth quarter to ¥3.8 billion, as the drop in HDD head sales volume weighed heavily on earnings.

Let’s now take a look at the film application products segment. Net sales edged down by 2% from the fourth quarter. Sales of products for use in PCs and tablets decreased, despite an increase in sales of products to the Chinese smartphone market. Operating income decreased by around half to ¥4.7 billion, from ¥9.4 billion in the fourth quarter. Fourth-quarter operating income included a one-time gain of ¥2.2 billion. Therefore, operating income effectively declined by ¥2.5 billion, or 35%. The main reasons were a decline in the share of sales of large batteries, as well as sales price reductions on products sold for use in smartphones.

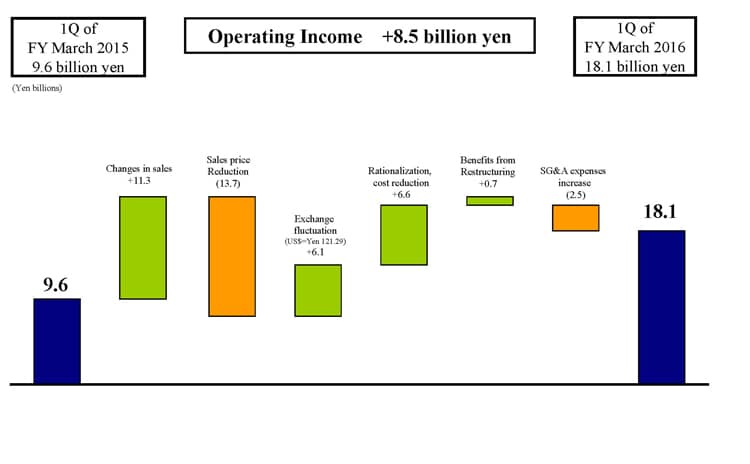

Breakdown of Operating Income Changes

Next is a breakdown of changes in operating income. Let’s take a look at the factors behind the year-on-year increase of ¥8.5 billion in operating income. Changes in sales relating to capacity utilization, product mix and other such factors pushed up earnings by approximately ¥11.3 billion. Despite the negative impact on sales of the drop in HDD head sales volume, sales of passive components centered on high-frequency components and rechargeable batteries for smartphones increased sharply, helping to increase earnings. Earnings also benefited from a higher share of high-margin products.

Next, the impact of sales price reductions was minus ¥13.7 billion in year-on-year terms. Exchange rate fluctuations caused by the yen’s depreciation inflated earnings by around ¥6.1 billion. Looking at rationalization and cost reduction efforts, we improved production processes and pushed ahead with rationalization through automation and other means to mitigate factors pushing up costs such as increases in labor and hourly wage costs. As a result, rationalization and cost reduction efforts lifted earnings by around ¥6.6 billion. The benefits from restructuring boosted earnings by around ¥0.7 billion. Higher SG&A expenses pushed down earnings by ¥2.5 billion. This mainly reflected higher R&D expenses incurred primarily to advance new product development and manufacturing process innovation.

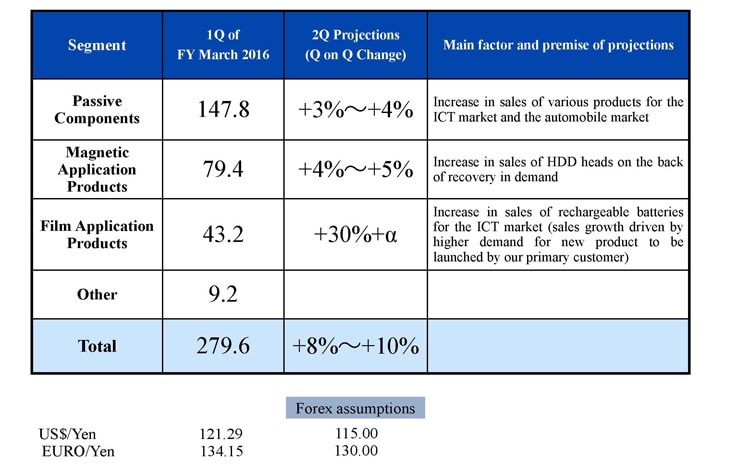

Projections for 2Q of FY March 2016 -Image of change in sales

Let me now discuss our outlook for changes in sales for the second quarter of the March 2016 fiscal year. Looking first at passive components, we expect steady growth in sales of capacitors and inductive devices. This outlook is mainly based on expectations of solid sales growth in the North American automotive market, despite concerns about a downturn in automobile sales in China due to slowing economic growth in that country. Another factor is an anticipated increase in the number of electronic components fitted to automobiles for use in ECUs and ADASs. In the smartphone market, we expect sales of products centered on high frequency components and inductive devices to remain strong, despite a slight slowing trend in smartphone production and sales volume primarily in the Chinese market. This outlook for continued strong sales is mainly based on an anticipated increase in the number of components fitted to smartphones in as the number of communication bands, such as 4G, increase. Higher sales should also be driven by sales expansion leveraging TDK’s expansive customer base. Overall, net sales in the passive components segment are expected to increase by 3% to 4%.

In magnetic application products, we expect HDD demand to gradually recover. The HDD head shipment index is projected to increase from 76 in the first quarter to around 90 in the second quarter. As a result, net sales in the magnetic application products segment are expected to increase by around 4% to 5% on the whole.

In film application products, we expect sales of products to the Chinese market to continue growing steadily, in addition to higher sales from a new product to be launched by our primary customer. Net sales in the film application products segment are projected to increase by just over 30% on the whole. Based on these factors, we expect total net sales in the second quarter of the March 2016 fiscal year to increase by around 8% to 10% compared with net sales of ¥279.6 billion in the first quarter.

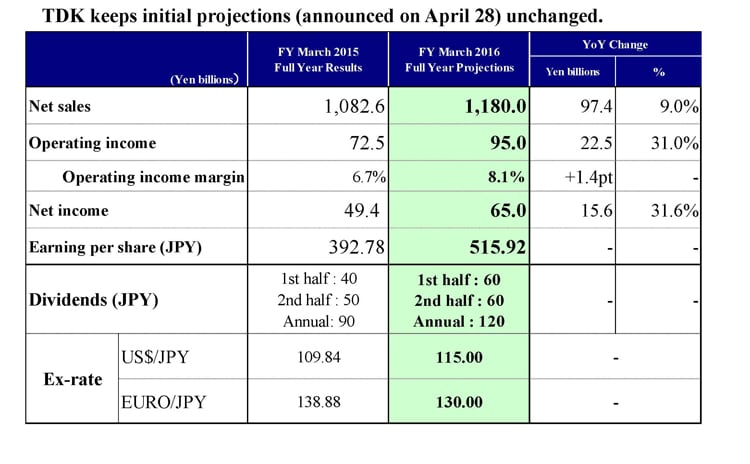

FY March 2016 Full Year / Dividend Projections

Finally, our consolidated full-year forecasts for the March 2016 fiscal year are unchanged from what we announced in April 2015. We are projecting net sales of ¥1,180.0 billion, and operating income of ¥95.0 billion. Net income is projected at ¥65.0 billion. I have just outlined our outlook for changes in sales in the second quarter. In the second half and beyond, we expect sales of products to the automotive market to remain solid in step with the growing use of electronics in automobiles. We also expect steady growth in sales of products for smartphones. This is based on our outlook for strong sales in the Chinese market leveraging our expanded customer portfolio in high-frequency components, rechargeable batteries and other products. Another contributing factor will be the full-scale launch of new models by a core customer in North America. We also expect higher sales of products to the renewable energy market, including wind and solar power.

For the second quarter of the March 2016 fiscal year onward, we are assuming an average exchange rate of ¥115 against the U.S. dollar, and ¥130 against the euro.

That concludes my presentation. Thank you for your attention today.