[ 3rd Quarter of fiscal 2015 Performance Briefing ]Consolidated Results for 3Q of FY March 2015

Consolidated Full Year Projections for FY March 2015

Mr. Takakazu Momozuka

Corporate Officer

Hello and thank you for taking the time to attend TDK’s performance briefing for the first three quarters of the year ending March 2015 (fiscal 2015). My name is Takakazu Momozuka. Today, I will be going over our results for the first three quarters of fiscal 2015.

Highlights of the Operating Results

Let’s begin with a look at the highlights of operating results for the period. We posted our highest ever net sales in both the third quarter and the nine-month period. Notably, in the third quarter, we posted robust sales of products particularly for smartphones in the ICT (Information and Communications Technology) market. Consequently, we delivered record-high sales across all of our major business segments, namely passive components, magnetic application products and film application products.

Operating income was ¥53.1 billion for the nine-month period, a year-on-year increase of 52%. We have maintained a well-balanced earnings structure across all three major business segments, by focusing on the three priority fields of automobiles, ICT and industrial equipment. As a result, we have upwardly revised our full-year operating results projections. We also plan to increase the year-end dividend by ¥10 per share. Furthermore, in the third quarter, we recorded impairment losses mainly on metal magnet-related facilities in the magnet business. We also recorded an impairment loss on goodwill in the power supply business. Altogether, we recorded impairment losses of ¥5.3 billion.

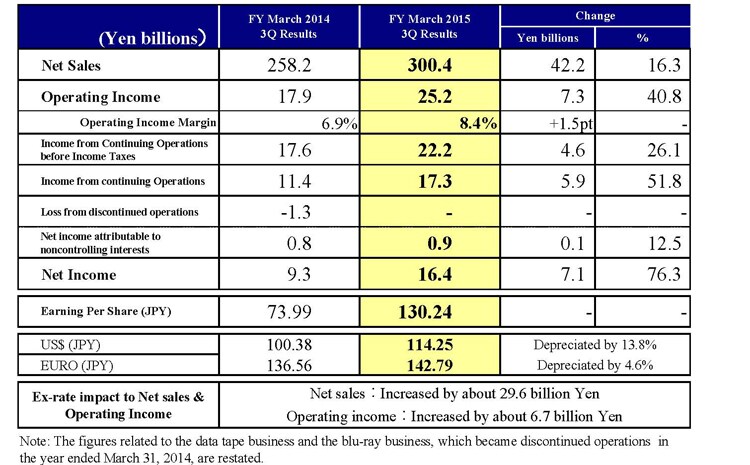

Consolidated Results for 3Q of FY March 2015

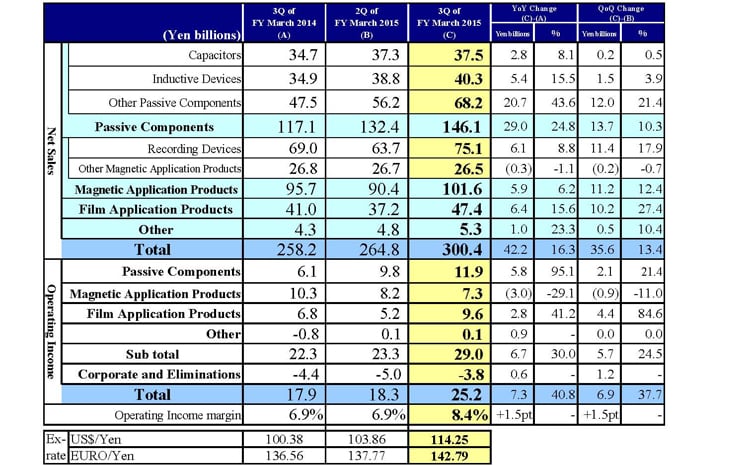

Next, let’s look at our consolidated results for the third quarter (Oct.-Dec.) of fiscal 2015. Net sales were ¥300.4 billion, up ¥42.2 billion, or 16.3%, year on year. Operating income rose ¥7.3 billion, or 40.8%, to ¥25.2 billion. The operating income margin was 8.4%, up 1.5 percentage points. Income from continuing operations was ¥22.2 billion, and net income was ¥16.4 billion. Earnings per share were ¥130.24. Turning to average exchange rates in the third quarter, the yen depreciated by 13.8% against the dollar to ¥114.25 compared with the third quarter of fiscal 2014. The yen depreciated by 4.6% to ¥142.79 against the euro compared with the same period last year. The net forex impact was an increase of approximately ¥29.6 billion in net sales and an increase of approximately ¥6.7 billion in operating income. Regarding exchange rate sensitivities, as we have explained in the past, in terms of the relationship between the yen and the U.S. dollar, a ¥1 appreciation against the U.S. dollar lowers operating income by approximately ¥1.4 billion.

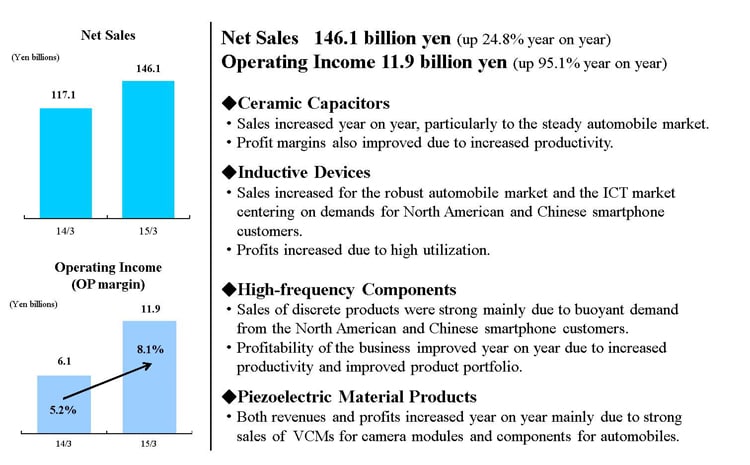

3Q Results - Passive Components Segment

My next topic is the third-quarter results of each business segment. Let’s begin with the passive components segment. In this segment, net sales were ¥146.1 billion, up 24.8% year on year. Operating income rose 95.1% year on year to ¥11.9 billion. The passive components segment posted its highest ever net sales and operating income in third quarter, following record highs in the first and second quarters.

In terms of individual products, ceramic capacitors posted higher sales supported by steady growth in the automotive market, with profit margins improving due to greater productivity. Sales of inductive devices increased owing to solid sales growth in the automotive and the ICT markets. Sales were driven primarily by demand from North American and Chinese smartphone customers. Together with higher capacity utilization, profits from inductive devices rose year on year. In high-frequency components, sales of discrete products were strong mainly due to buoyant demand from North American and Chinese smartphone customers. Profits improved dramatically year on year due to increased productivity and an improved product mix. In piezoelectric material products, both sales and profits increased year on year mainly due to strong sales of VCMs for camera modules and components for automobiles.

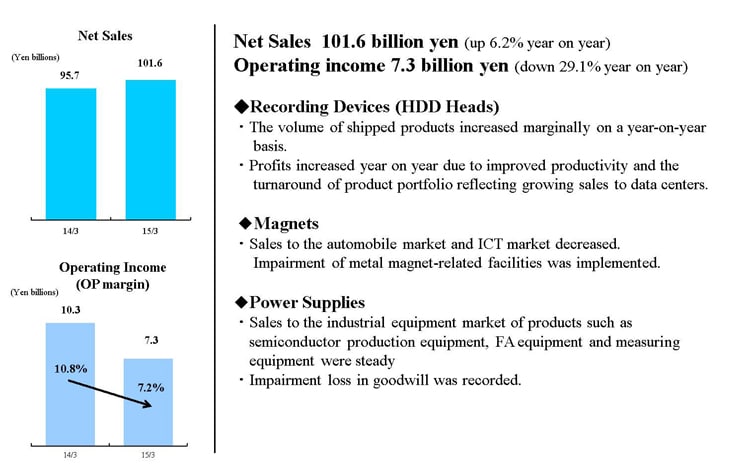

3Q Results - Magnetic Application Segment

Next is the magnetic application products segment. In this segment, net sales increased 6.2% year on year to ¥101.6 billion. Operating income decreased 29.1% year on year to ¥7.3 billion. Earnings of this segment include the impairment losses of ¥5.3 billion I discussed earlier. In recording devices, i.e. HDD heads, although shipment volume increased only marginally year on year, productivity was higher and the product mix improved reflecting growing sales to data centers. As a result, profits increased year on year. In magnets, sales of products to the automotive and ICT markets decreased. Notably, in metal magnets, the business environment was pressured primarily by HDD manufacturers seeking to reduce the number of suppliers in response to a contraction in the HDD market. Taking into account this environment, we decided to record impairment losses on metal magnet-related facilities. The monetary amount of the impairment losses was ¥3.1 billion. Following this action, we will work to turn around this business by concentrating business resources on the automotive and industrial equipment fields.

Looking next at power supplies, we continued to record steady sales of products such as semiconductor production equipment to the industrial equipment market. Although this business is profitable, we can no longer expect the high levels of profitability we anticipated previously. For this reason, we reassessed the value of goodwill and decided to book an impairment loss on certain goodwill. The monetary amount of the impairment loss was ¥2.2 billion.

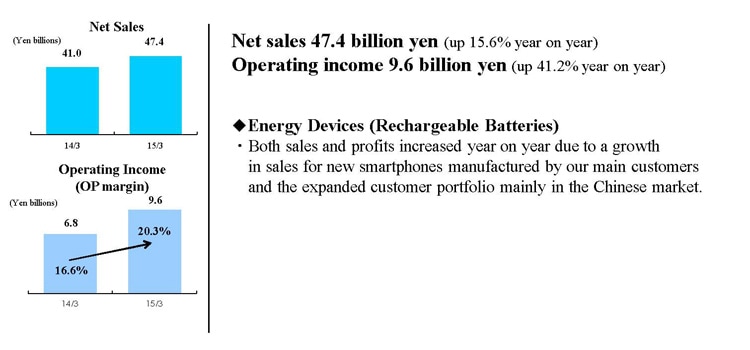

3Q Results - Film Application Segment

Next is the film application products segment. Net sales increased 15.6% year on year to ¥47.4 billion. Operating income rose 41.2% to ¥9.6 billion. Both sales and profits increased year on year particularly due to sales of products for new smartphones manufactured by our main customers and the expanded customer portfolio mainly in the Chinese market. The main products in this segment are energy devices, i.e., rechargeable batteries.

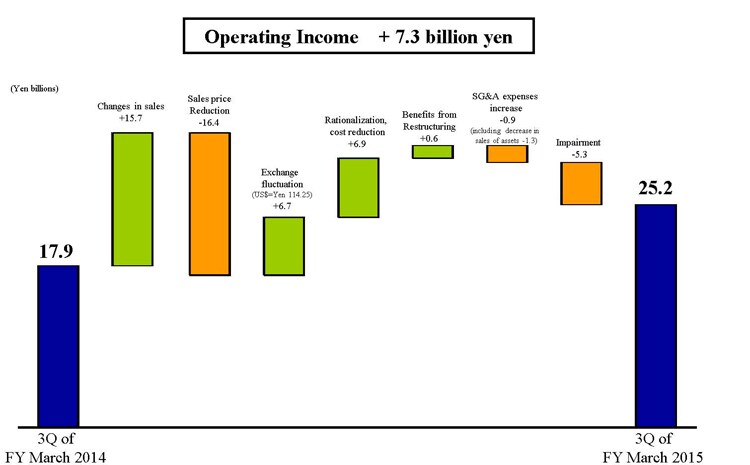

Breakdown of Operating Income Changes (3Q)

Next, let’s take a closer look at the factors behind the year-on-year increase of ¥7.3 billion in operating income from the third quarter of fiscal 2014. Changes in sales relating to capacity utilization, product mix and other such factors pushed up earnings by approximately ¥15.7 billion. As in the first half of fiscal 2015, sales of passive components continued to increase across all product lines to the automotive and ICT markets, helping to increase earnings. Earnings also benefited from higher sales of rechargeable batteries for smartphones. Moreover, the increase of HDD heads to data centers was a contributing factor in increased earnings. Meanwhile, the impact of sales price reductions was minus ¥16.4 billion in year-on-year terms. Exchange rate fluctuations caused by the yen’s depreciation inflated earnings by around ¥6.7 billion. Looking at rationalization and cost reduction efforts, we achieved higher productivity in HDD heads, passive components, and rechargeable batteries while progressing with rationalization. Combined with lower raw materials costs, rationalization and cost reduction efforts pushed up earnings by around ¥6.9 billion on the whole, although factors such as ongoing increases in hourly wage costs, particularly in China, weighed on earnings. The benefits from restructuring boosted earnings by around ¥0.6 billion. Higher SG&A expenses resulted in an earnings drag of about ¥0.9 billion, including a decrease in sales of assets of ¥1.3 billion from the previous year. Impairment losses in the magnet and power supply business pulled down earnings by ¥5.3 billion.

Quarterly Results by Segment

Next, I would like to go over the factors behind the changes in net sales and operating income in each segment from the second quarter to the third quarter. In the passive components segment, net sales rose ¥13.7 billion, or 10.3%, from ¥132.4 billion in the second quarter to ¥146.1 billion in the third quarter. Sales of capacitors were ¥37.5 billion in the third quarter, up ¥0.2 billion, or 0.5%, from the second quarter. Sales of capacitors to the automotive market continued to increase steadily. Moving along, sales of inductive devices were ¥40.3 billion in the third quarter, an increase of ¥1.5 billion, or 3.9%, from the second quarter. Sales of inductive devices to the ICT market increased in line with the peak production of Chinese and North American smartphone customers. Turning to other passive components, net sales were ¥68.2 billion in the third quarter, up ¥12.0 billion, or 21.4%, from the second quarter. As with inductive devices, sales of high-frequency components increased on the back of buoyant demand from Chinese and North American smartphone customers.

Operating income in the passive components segment rose ¥2.1 billion from ¥9.8 billion in the second quarter to ¥11.9 billion in the third quarter. Sales of products to the ICT market increased sharply due to buoyant demand primarily from Chinese and North American smartphone customers. Another factor was firm sales of products to the automotive market. The yen’s depreciation also helped to push up profits. High-frequency components saw an increase in profits driven by growth in sales of highly profitable discrete products in the third quarter, continuing on from the second and first quarters.

Let’s now move on to sales in the magnetic application products segment. For the segment as a whole, net sales were ¥101.6 billion in the third quarter, up ¥11.2 billion, or 12.4%, from ¥90.4 billion in the second quarter. Sales of recording devices rose ¥11.4 billion, or 17.9%, to ¥75.1 billion. HDD head shipment volume was higher than initially forecast owing to firm HDD head production for 2.5-inch external HDDs, increased HDD head shipments to the market for nearline HDDs for data centers and HDD head shipments brought forward from the fourth quarter. Sales of other magnetic application products decreased ¥0.2 billion, or 0.7%, from the second quarter to ¥26.5 billion in the third quarter. Sales of magnets and power supply products to the industrial equipment market were mostly unchanged from the second quarter, but sales of magnets for automobiles declined.

Operating income in the magnetic application products segment decreased ¥0.9 billion, or 11%, from the second quarter to ¥7.3 billion in the third quarter. Profits from recording devices were up sharply due to the higher HDD head shipment volume. However, as I explained initially, we recorded impairment losses of ¥5.3 billion in the magnet and power supply businesses. Consequently, operating income for the magnetic application products segment as a whole decreased from the second quarter.

Let’s now look at sales in the film application products segment. In this segment, net sales were ¥47.4 billion in the third quarter, an increase of ¥10.2 billion, or 27%, from ¥37.2 billion in the second quarter. Operating income was ¥9.6 billion in the third quarter, up ¥4.4 billion, or 84.6%, from ¥5.2 billion in the second quarter. Both the higher net sales and operating income were driven by continued growth in sales of rechargeable batteries for the new models of major customers from the second quarter, along with an increase in customers primarily in the Chinese market.

In the other segment, net sales increased ¥0.5 billion in the third quarter, but operating income was mostly unchanged from the second quarter.

Corporate and eliminations was negative ¥3.8 billion in the third quarter, an improvement of ¥1.2 billion from negative ¥5.0 billion in the second quarter. The third-quarter result included a gain of ¥0.7 billion on the sale of land.

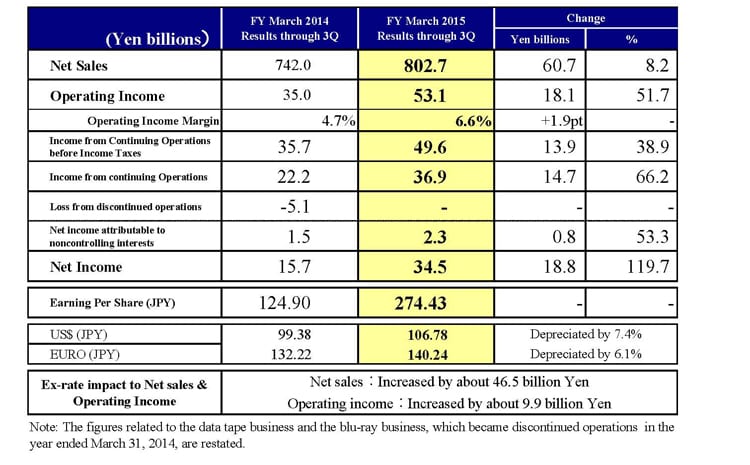

Consolidated Results through 3Q of FY March 2015

Next, let’s take a look at consolidated results for the first three quarters of fiscal 2015. For the nine-month period, net sales were ¥820.7 billion, an increase of 8.2% year on year. Operating income was ¥53.1 billion, up 51.7% year on year. Net income rose approximately 2.2-fold to ¥34.5 billion.

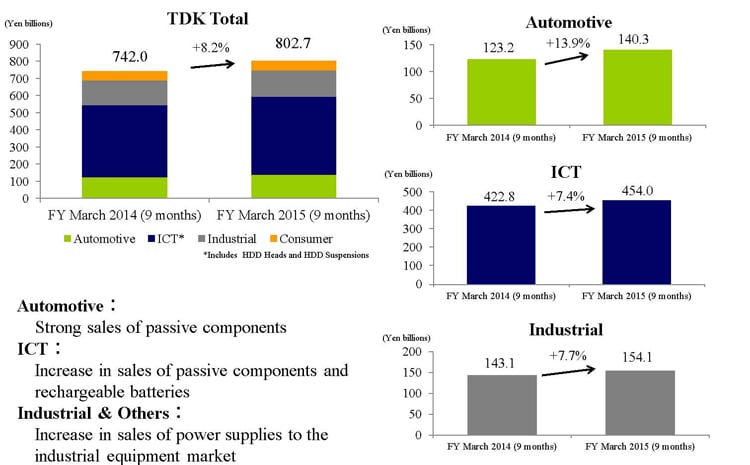

Sales Results by Priority Markets (through 3Q)

Next we look at sales results by priority market for the nine-month period through the third quarter. In sales to the automotive market, sales of passive components increased atop steady growth in the North American market. Sales to the automotive market rose 13.9% year on year, with higher sales recorded across all passive component products, notably inductive devices, ceramic capacitors and other products. In the ICT market, there was a large increase in sales of passive components and rechargeable batteries to North American and Chinese smartphone customers. HDD head sales also rose primarily in the third quarter. Consequently, sales to the ICT market increased 7.4% year on year. Sales to industrial and other markets were up 7.7% year on year.

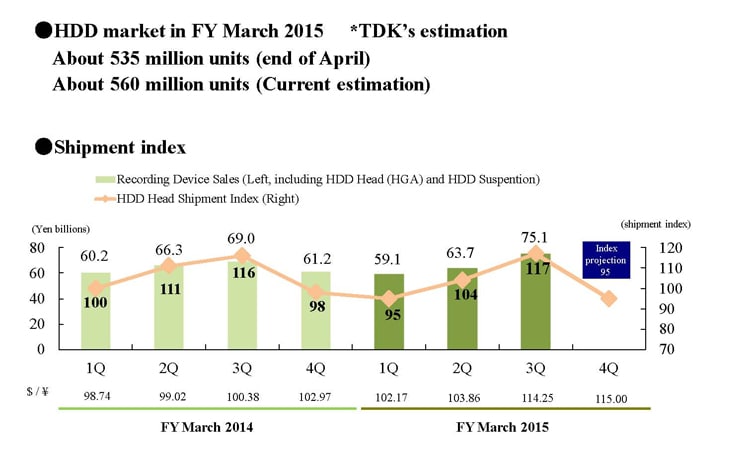

Recording Device Business

I would now like to take a closer look at the recording device business. In fiscal 2015, the HDD market is projected at approximately 560 million units, based on TDK’s initial estimation. Let’s now examine HDD head shipments in terms of our HDD head shipment index, which assumes HDD head shipments in the first quarter of fiscal 2014 to be 100. By this measure, the HDD head shipment index was 117 in the third quarter, coming in much higher than our initial forecast of 106. We are projecting an HDD head shipment index of 95 for the fourth quarter of fiscal 2015.

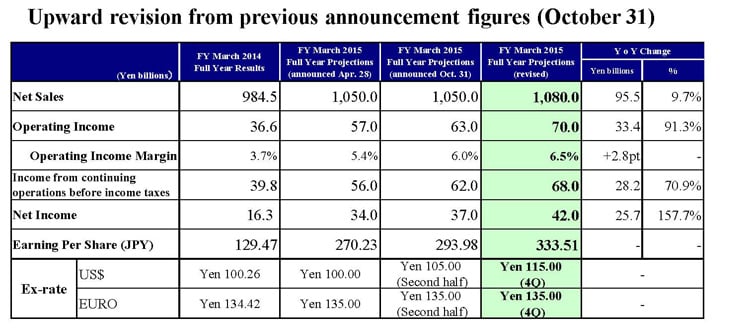

FY March 2015 Full Year Projections

Let me now talk about our operating results projections for fiscal 2015. As with our previous performance briefing, we have upwardly revised our projections. We are now projecting net sales of ¥1,080.0 billion, operating income of ¥70.0 billion, income from continuing operations before income taxes of ¥68.0 billion, net income of ¥42.0 billion and earnings per share of ¥333.51. We are assuming an average exchange rate for the fourth quarter of ¥115 against the U.S. dollar, and ¥135 against the euro. In terms of the market outlook, we expect sales to the automotive market to remain firm. In addition, we anticipate sales of passive components and rechargeable batteries to the ICT market to be stronger than initially anticipated, based primarily on buoyant demand from North American and Chinese smartphone customers. Moreover, we expect sales of HDD heads for data centers to grow steadily. Another factor that should push up operating results is the foreign exchange impact of the yen’s continuing depreciation. Taking these factors into consideration, we have decided to revise our full-year operating result projections. Our three major business segments will continue to drive well-balanced earnings growth centered on our five priority businesses.

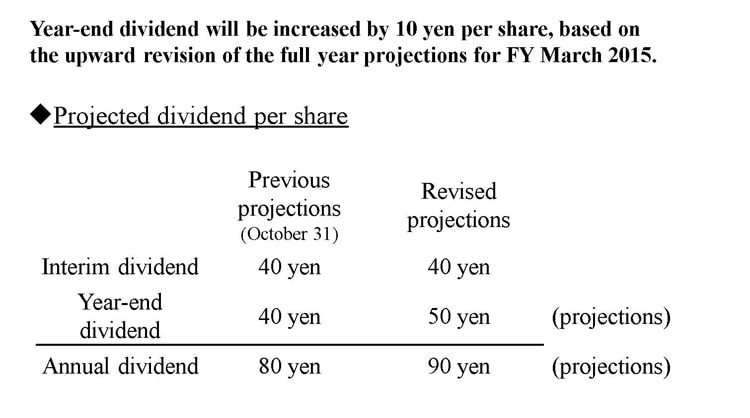

FY March 2015 Dividend Projections

Turning to our dividend projections for fiscal 2015, we plan to increase the year-end dividend by ¥10 to ¥50 per share, compared with the previous year-end dividend projection of ¥40 per share.

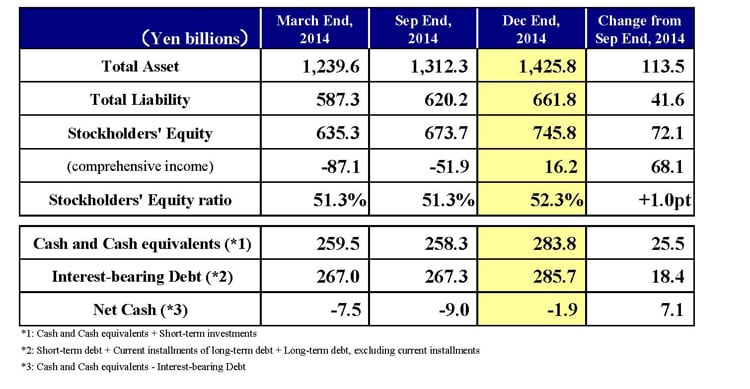

Financial Position

My next topic is our financial position. With the yen’s ongoing depreciation, assets stood at ¥1,425.8 billion, an increase of ¥113.5 billion from September 30, 2014. Stockholders’ equity was ¥745.8 billion, an increase of ¥72.1 billion from the end of September 2014. Accumulated other comprehensive income (loss), a component of stockholders’ equity, gradually improved to a positive value. Accumulated other comprehensive income was ¥16.2 billion at December 31, 2014, compared with an accumulated other comprehensive loss of ¥51.9 billion at September 30, 2014. This marked an improvement of ¥68.1 billion in accumulated other comprehensive income (loss) from the end of September 2014. The improvement was mainly a reflection of foreign currencies translation adjustments. As a result, the stockholders’ equity ratio was 52.3%, up 1 percentage point from September 30, 2014. Net cash, which is cash and cash equivalents less interest-bearing debt, was negative ¥1.9 billion, indicating a virtually debt-free position. On that note, I would like to bring my presentation to a close. Thank you for your attention.