[ Financial Results for Fiscal 2014 Performance Briefing ]Consolidated Full Year Results for FY March 2014

Mr. Takakazu Momozuka

Corporate Officer

Hello and thank you all for taking the time to attend TDK’s results presentation for the year ended March 2014 (fiscal 2014). My name is Takakazu Momozuka.

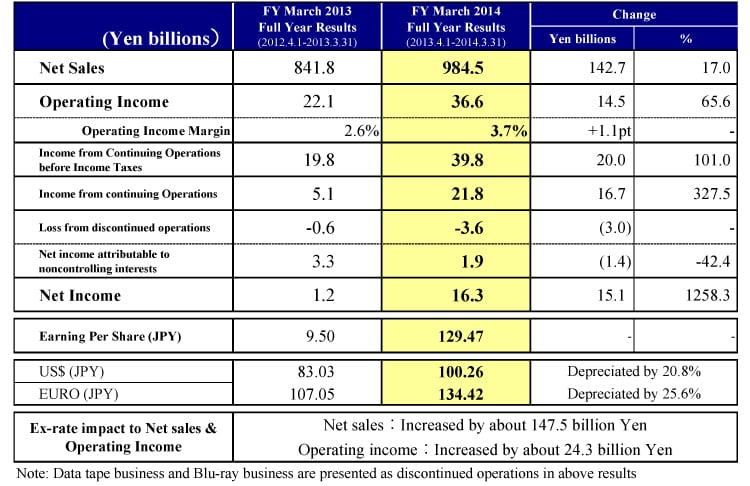

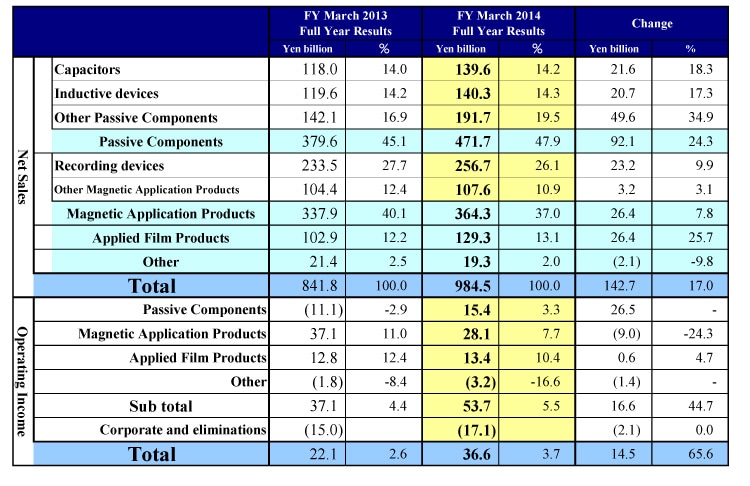

Consolidated Full Year Results for FY March 2014

I will be presenting the full-year consolidated results. As explained previously, the data tape and Blu-ray businesses are shown as discontinued operations in the consolidated financial statements following our moves to exit these two sectors. Prior-year figures for fiscal 2013 have been adjusted accordingly.

Excluding these businesses, net sales for the continuing operations were ¥984.5 billion, increasing by ¥142.7 billion, or 17%, over the previous year. This marked a new record for TDK. Operating income grew by ¥14.5 billion, or 65.6%, to ¥36.6 billion. The income from continuing operations was ¥39.8 billion on a pretax basis and ¥21.8 billion in net terms. We posted a net loss on the discontinued data tape and Blu-ray operations of ¥3.6 billion. After a deduction of ¥1.9 billion for the net income attributable to non-controlling interests, net income for the year was ¥16.3 billion, a gain of ¥15.1 billion in year-on-year terms. Net income per share was ¥129.47. In terms of the average exchange rates, the yen depreciated by 20.8% against the dollar to ¥100.26, and by 25.6% to ¥134.42 against the euro. The net forex impact was an increase of about ¥147.5 billion in sales and ¥24.3 billion in operating income. To date, we estimated our US dollar forex sensitivity at about ¥1.5 billion per ¥1 movement for annual operating income. For the year ending March 2015, we estimate this figure will shift to a gain of about ¥1.4 billion in operating income per ¥1 movement, due to changes in product mix and increased dollar-denominated purchases. Our euro forex sensitivity remains minimal.

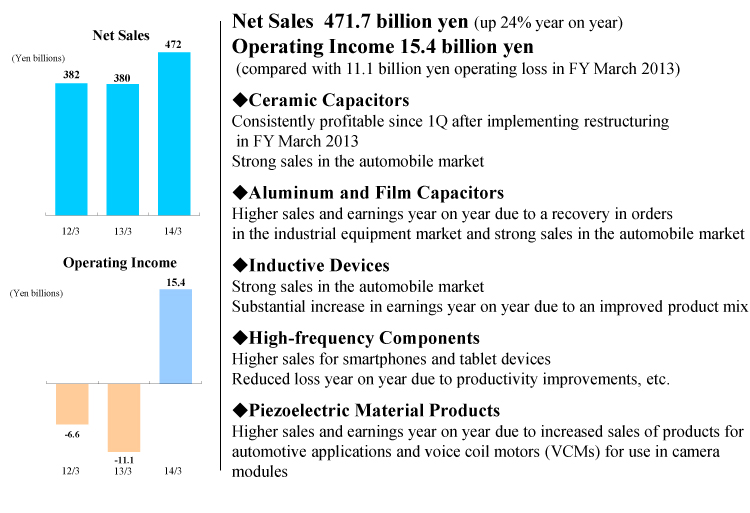

FY March 2014 Results - Passive Components Segment

Moving on to business segment performance, net sales for the passive components segment increased 24% year on year to ¥471.7 billion.

Operating income of ¥15.4 billion marked the first profit in three years and a major turnaround from the prior year’s ¥11.1 billion operating loss. The depreciated yen’s effects were helpful, but the key contributing factors were successful restructuring measures and solid growth in sales in the automotive and smartphone markets. Ceramic capacitors began generating profits again from the first quarter after the earlier restructuring, with strong sales in the automotive market. Aluminum and film capacitors also generated higher sales and profits due to a recovery in orders in industrial equipment and good sales in the automotive market. Inductive devices posted a substantial increase in profits due to automotive demand and an improved product mix. High-frequency components posted higher sales for smartphone and tablet applications, with improvements in productivity helping to suppress losses. Sales of piezoelectric material products increased in the automotive sector and in voice coil motors for camera modules, leading to higher profits on a year-on-year basis. Restructuring charges for passive components totaled ¥2.7 billion, ¥1.5 billion less than the figure of ¥4.2 billion in the previous year. Goodwill amortization costs for EPCOS declined by ¥0.2 billion to ¥3.4 billion.

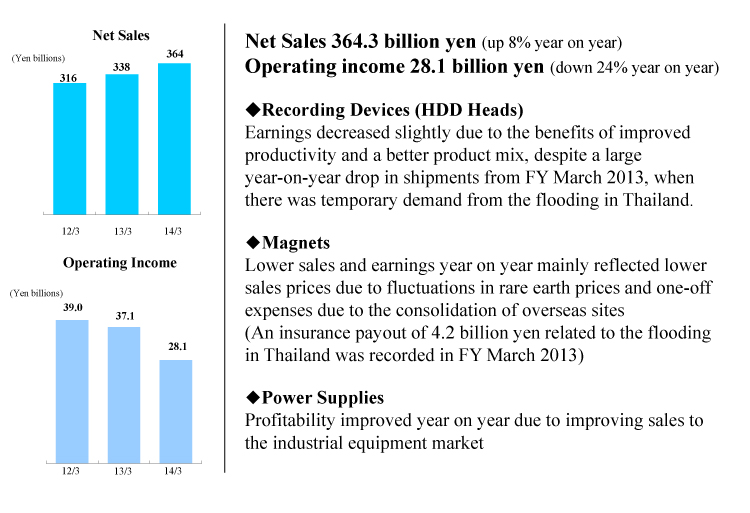

FY March 2014 Results - Magnetic Application Segment

The magnetic application segment recorded an 8% increase in net sales to ¥364.3 billion and a 24% fall in operating income to ¥28.1 billion. In the recording devices business, shipments of HDD heads dropped in year-on-year terms due to a surge in demand during fiscal 2013 associated with the major floods in Thailand. Operating income was only slightly lower due to offsetting productivity gains and product mix improvements. Magnets operations recorded a loss as sales and profits both declined, reflecting price erosion caused by changes in rare earths prices and non-recurring expenses for the integration of overseas sites. This business reported a ¥4.2 billion insurance payout in the previous year relating to the Thai floods. In power supplies, a recovery in sales in the industrial equipment market helped to lift profitability. Restructuring costs for the magnetic application segment totaled ¥1.9 billion, a decline of ¥1.3 billion.

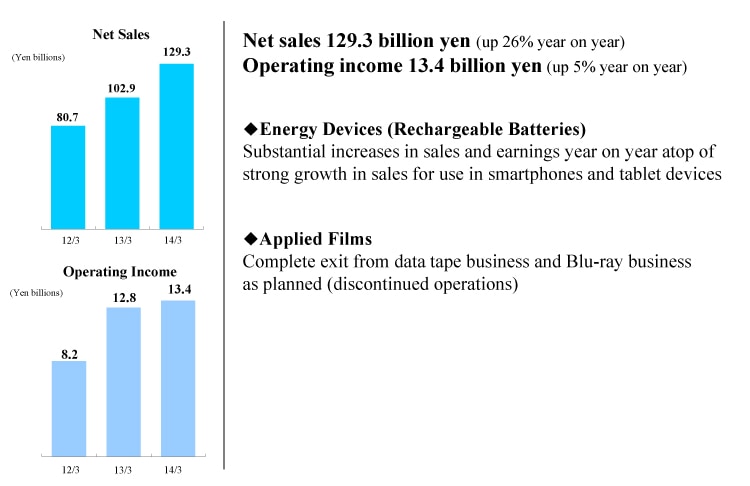

FY March 2014 Results - Film Application Segment

Next is the film application segment. Net sales increased 26% to ¥129.3 billion, and operating income rose 5% to ¥13.4 billion. In the energy devices (rechargeable batteries) business, we recorded strong sales for smartphone and tablet applications. Besides growing sales with existing customers, we secured new customers to grow the overall business, resulting in significantly higher sales and profits than in the prior year. In the applied films business, we completed the exit from data tape and Blu-ray operations as planned. This business still contains TDK’s functional films operations, but the sales were low and the business made a loss. We posted restructuring costs of ¥2.3 billion for the continuing businesses in the film application segment.

FY March 2014 results by Segment

In addition to the three main business segments that I have just reviewed, this slide shows net sales for other products, which declined 9.8% year on year to ¥19.3 billion. This segment saw operating losses grow to ¥3.2 billion, compared with ¥1.8 billion in the previous year. This was due to higher new business development costs.

In corporate and eliminations, operating losses widened from ¥15.0 billion to ¥17.1 billion. This mainly reflected one-off expenses and increased investments in IT systems.

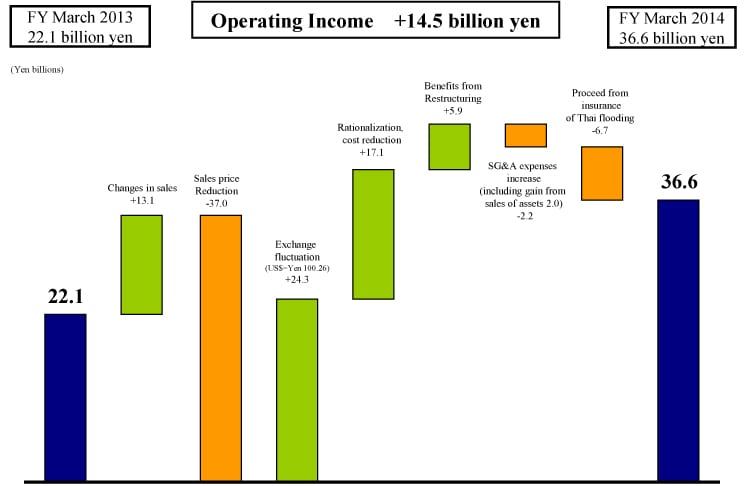

Breakdown of Operating Income Changes

This next slide analyzes the year-on-year increase of ¥14.5 billion in operating income. Changes in sales relating to capacity utilization and product mix factors inflated earnings by ¥13.1 billion. Sales of passive components rose significantly, and this segment benefited from higher capacity utilization as well. Sales of batteries also rose substantially. The impact of price erosion was around minus ¥37.0 billion in year-on-year terms. Exchange rate fluctuations inflated earnings by about ¥24.3 billion. Our rationalization and cost-reduction efforts, combined with lower material prices, yielded a net gain of ¥17.1 billion, although our hourly wage costs in China increased. The benefits from restructuring affecting operating income were ¥5.9 billion, mainly reflecting cost savings from facility integration and workforce reductions overseas. This figure consisted of about ¥4.6 billion from the passive components segment and ¥1.3 billion from the magnetic application segment. Higher SG&A expenses resulted in an earnings drag of ¥2.2 billion, after deducting ¥2.0 billion from the proceeds of asset sales. There was also a drag of ¥6.7 billion as no insurance payouts relating to the Thai floods were received this year. Overall, operating income rose to ¥36.6 billion.

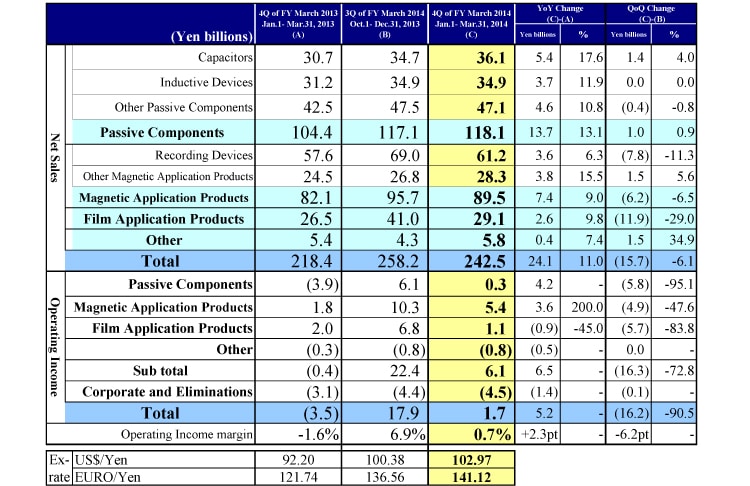

Quarterly Results by Segment

This next slide analyzes the 4Q results of fiscal 2014 by business segment compared with the previous quarter and the fourth quarter of the previous year. Restructuring costs for continuing operations totaled about ¥6.0 billion in the 4Q. The charge for discontinued operations was about ¥0.1 billion, relating to the costs of exiting the Blu-ray and other businesses. The total sales for the passive components business were ¥118.1 billion, 0.9% higher than in the 3Q. Capacitor sales rose 4% to ¥36.1 billion. Although automotive sector sales were strong in the 3Q and 4Q, seasonal demand peaked in the 3Q for gaming equipment. Capacitor sales were strong in Europe to the industrial equipment and automotive sectors. Inductive device sales in the 4Q were flat at ¥34.9 billion. Higher sales in the automotive market were offset by lower sales in the markets for communications and information equipment. Sales of other passive components edged 0.8% lower in the 4Q to ¥47.1 billion. High-frequency component sales also declined in the 4Q due to a drop-off in orders from major smartphone and tablet makers as production entered a seasonal output correction. In contrast, having experienced a similar correction in the 3Q, orders for voice coil motors used in camera modules recovered in the 4Q, helping sales to grow strongly compared with the previous quarter. Together with strong sales in the automotive markets, this supported a healthy overall sales performance.

Operating income in the passive components segment was ¥0.3 billion in the 4Q, declining by ¥5.8 billion from the 3Q figure of ¥6.1 billion. This was the result of seasonal factors such as output corrections at major smartphone and tablet makers and a reduction in capacity utilization in China due to the Lunar New Year holidays, as well as lower profits from high-frequency components and inductive devices. Charges for restructuring increased from about ¥0.2 billion in the 3Q to around ¥1.5 billion in the 4Q.

In the magnetic application products business, sales of ¥89.5 billion in the 4Q were down 6.5% in quarter-on-quarter terms. Sales of recording devices benefited in the 3Q from surging demand linked to the replacement of Windows XP and new gaming console launches. This led to reduced shipments of HDD heads in the 4Q, with quarterly sales slipping 11.3% to ¥61.2 billion. Sales of other magnetic application products rose 5.6% to ¥28.3 billion. This result reflected good sales of magnets for automotive applications, as well as strong sales of power supplies in the industrial equipment markets. Operating income for this segment declined by ¥4.9 billion, from ¥10.3 billion in the 3Q to ¥5.4 billion in the 4Q, reflecting the drop in HDD head shipments and seasonal factors such as lower capacity utilization. The segment booked restructuring charges of about ¥1.9 billion for the 4Q.

Sales of film application products were ¥29.1 billion in the 4Q, down 29% in quarter-on-quarter terms. Sales of batteries fell in the 4Q as leading customers adjusted production levels. Segment operating income of ¥1.1 billion represented a decline of ¥5.7 billion from the 3Q figure of ¥6.8 billion. This also reflected a reduction in sales caused by the output correction at major customers. The segment booked restructuring costs of about ¥2.3 billion for the 4Q.

Sales in the other products segment increased by ¥1.5 billion in the 4Q relative to the 3Q. Segment operating income was flat.

Losses incurred in corporate and eliminations were ¥4.5 billion in the 4Q, an increase of ¥0.1 billion compared with ¥4.4 billion in the 3Q.

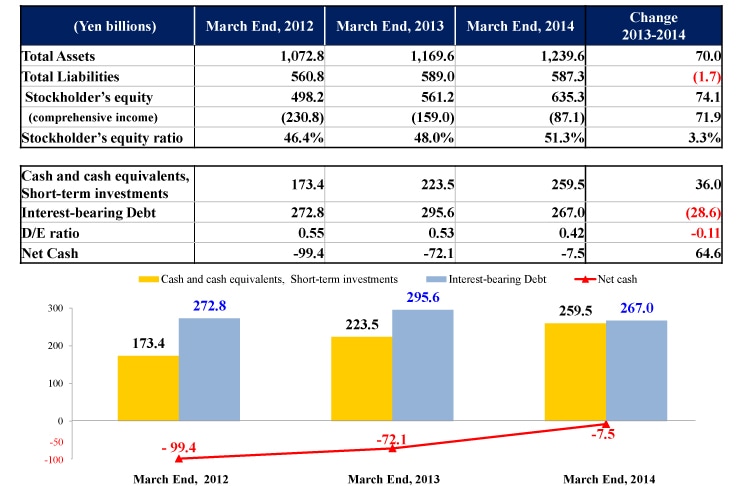

Financial Position

Turning to the consolidated financial position as of the end of March 2014, this slide displays the changes compared with the end of March 2013. Total assets increased by ¥70.0 billion to ¥1,239.6 billion. Total liabilities were ¥587.3 billion. Stockholders’ equity was ¥635.3 billion, an increase of ¥74.1 billion, helping the stockholders’ equity ratio to surpass the 50% mark to reach 51.3%. Cash and cash equivalents and short-term investments were ¥259.5 billion at the end of March, up ¥36.0 billion from the previous year-end. Interest-bearing debt shrank by ¥28.6 billion to ¥267.0 billion. This helped the net cash position improve by ¥64.6 billion, to minus ¥7.5 billion at the year-end. TDK has thus nearly achieved the target of eliminating net debt by the end of March 2015 ahead of schedule. We have achieved steady improvement in our net cash position by reducing capital expenditures and cutting inventories.

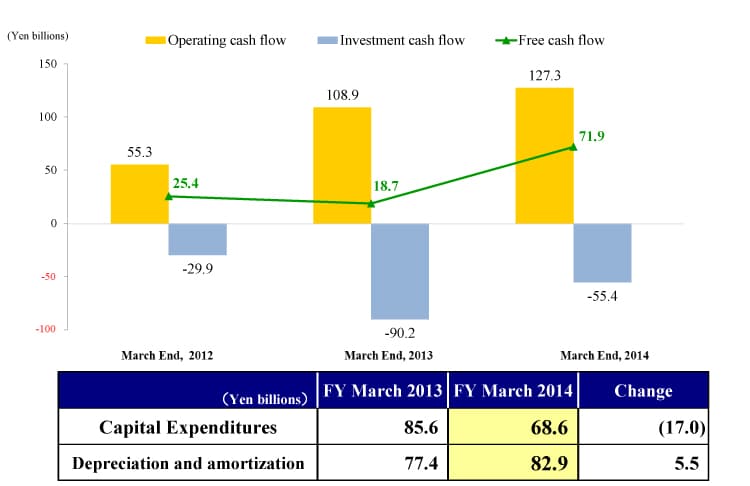

Free Cash Flow

Free cash flow increased to ¥71.9 billion in fiscal 2014, reflecting the growth in operating cash flows to ¥127.3 billion coupled with a reduction in investment cash flows to minus ¥55.4 billion.

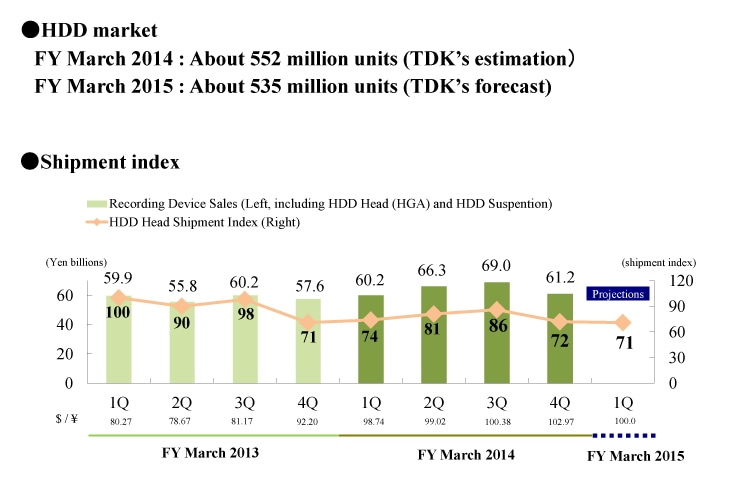

Recording Device Business

I would now like to talk briefly about the HDD heads situation within the recording devices business. We estimated the HDD market at 552 million units in fiscal 2014, and forecast it will decline to 535 million units in fiscal 2015. Based on these market assumptions, our shipment index for HDD heads was 72 in the 4Q of fiscal 2014, down from 100 in the 1Q of fiscal 2013. We expect the index to fall to 71 in the 1Q of the current fiscal year.

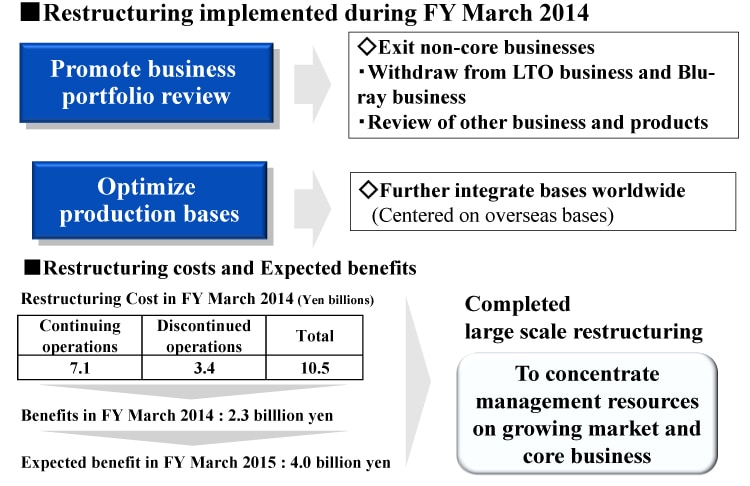

Restructuring Progress

My final slide looks at the progress that TDK has made with restructuring over the past year. Having reviewed our business portfolio, we have exited non-core operations. As of the end of March, we had stopped production of all data tape and Blu-ray products. With the aim of optimizing production bases and reinforcing our manufacturing capabilities, we have been integrating facilities, especially outside Japan. We initially budgeted ¥10 billion for related restructuring costs, but in the end we spent a total of ¥10.5 billion, split between ¥7.1 billion for continuing operations and ¥3.4 billion for discontinued operations. Benefits accrued in fiscal 2014 from restructuring amounted to ¥2.3 billion. In line with earlier projections, we expect restructuring benefits in fiscal 2015 of around ¥4.0 billion. As we explained before, TDK has finished all of the large-scale restructuring measures. Our aim going forward is to concentrate our management resources on growth areas and focus on our core businesses. That concludes my part of the presentation for the fiscal 2014 results. Thank you for your attention today.