TDK at a Glance for Investors

What's TDK?

A global electronics technology company and a world leader in electronic solutions for the smart society

TDK in Numbers

-

Year of Establishment

1935

With the objective of commercializing the world’s first ferrite core, Kenzo Saito, TDK’s first president, established Tokyo Denki Kagaku Kogyo(TDK).

-

Overseas sales ratio

Approx.90%

TDK conducts business activities globally. Indeed, approximately 90% of consolidated net sales are accounted for by overseas sales.

-

Overseas employees ratio

Approx.90%

The overseas employees ratio is approximately 90% of our nearly 100,000 employees through M&A.

-

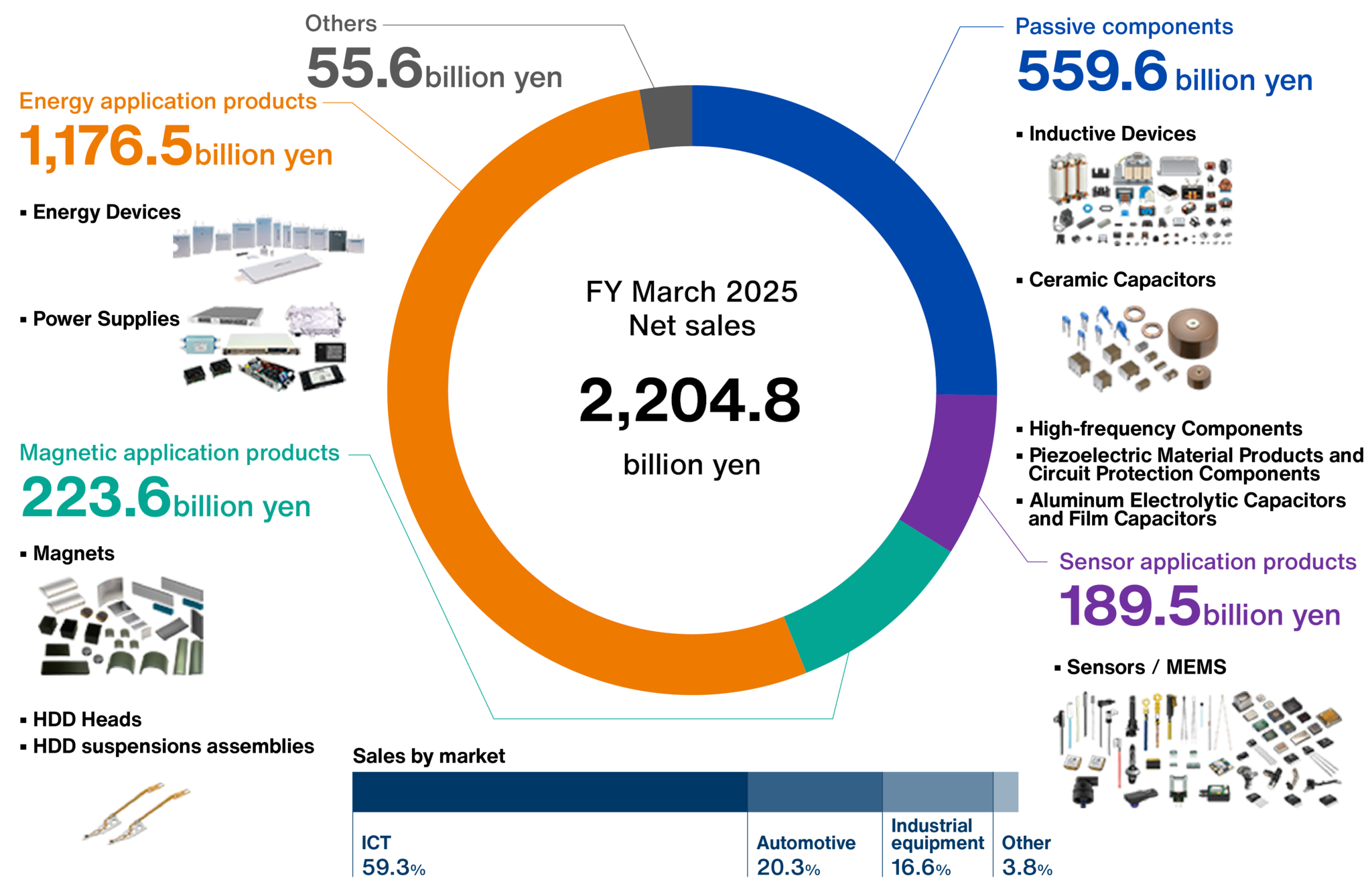

Net sales (Results for FY March 2025)

2,204.8billion yen

[Reference]

Results for FY March 2024: 2,103.9 billion yen -

Operating profit (Results for FY March 2025)

224.2billion yen

(operating profit margin: 10.2%)

[Reference]

Results for FY March 2024: 172.9billion yen

(operating profit margin: 8.2%) -

TDK in video

-

TDK Venture Spirit

The stories of the products that made TDK, which is an university-derived venture company, grow into a global innovation company.

-

TDK Company Introduction Video

TDK's Vision for a Sustainable Future: Pioneering Green Technology

Four Great World-Class Innovations by TDK

-

Ferrite

-

Music cassette tapes

-

Fine multilayering technology

-

Thin-film head technology

Financial Information

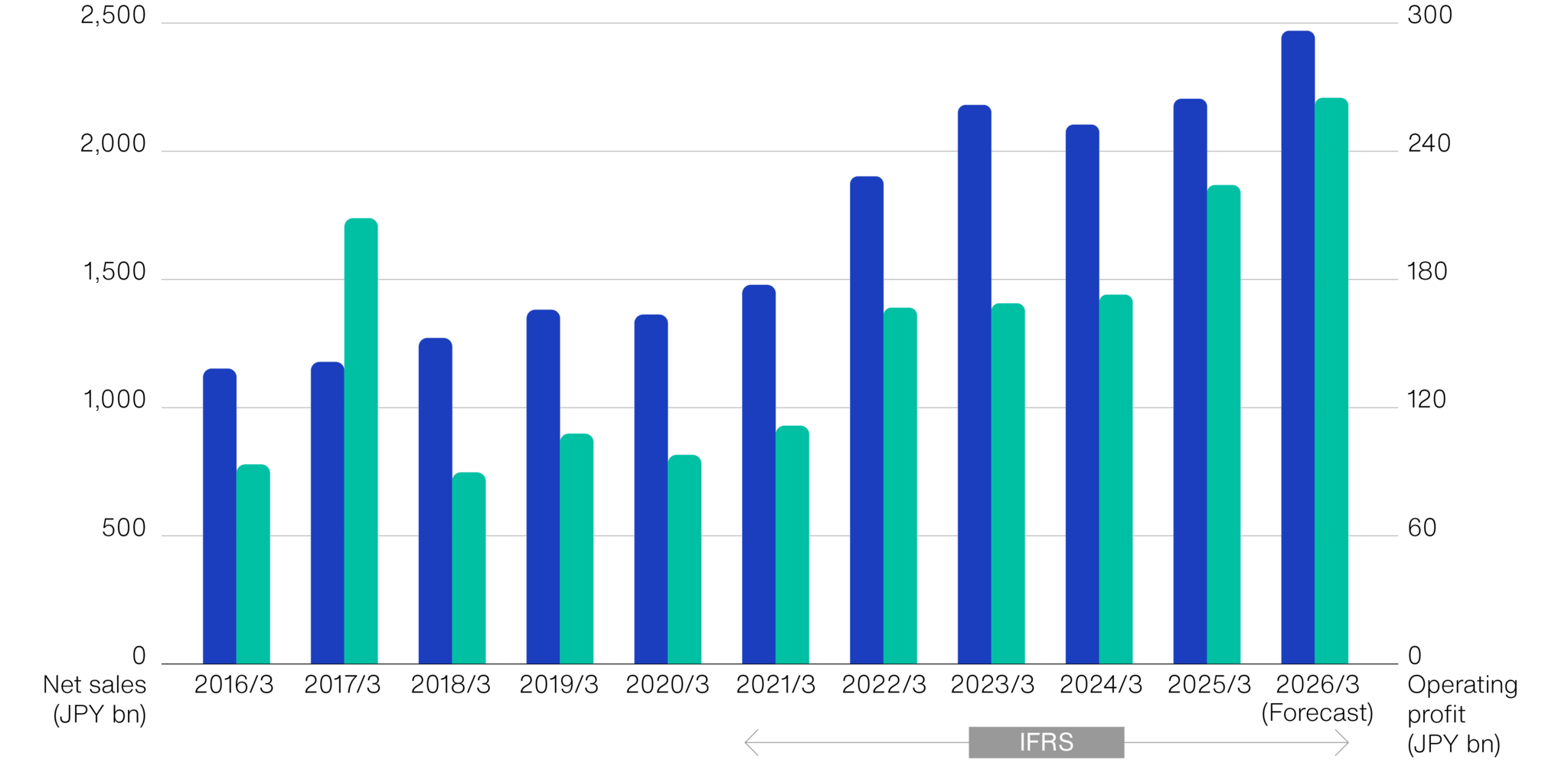

Change in Business Results

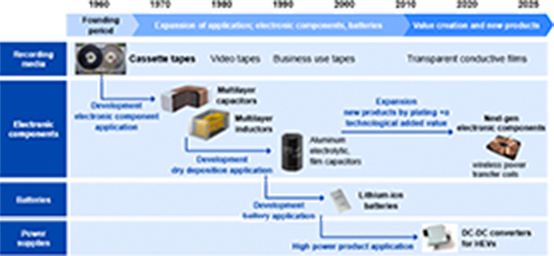

Through proactive transformation of our main business portfolio, TDK has made efforts to expand new technologies for 90 years. These developements have been the driving force to grow. TDK will continue to supply valuable products and grow in changing markets.

FY March 2025

Net sales

0 , 0 0 0 . 0

billion yen

Operating profit

0 0 0 . 0

billion yen

| FY3/26 Forecast | FY3/25 Actual | YoY | |

|---|---|---|---|

| Net sales | 2,470.0 billion yen | 2,204.8 billion yen | +12.0% |

| Operating profit | 265.0 billion yen | 224.2 billion yen | +18.2% |

-

Change in Net sales and Operating profit

- Net sales

- Operating profit

※TDK has adopted the IFRS in place of the US-GAAP from the FY March 2022. The figures for the FY March 2021 are also presented in accordance with IFRS.

(Please check Chart Generator for details)

Financial Summary (by Segment)

(Please check Chart Generator for details)

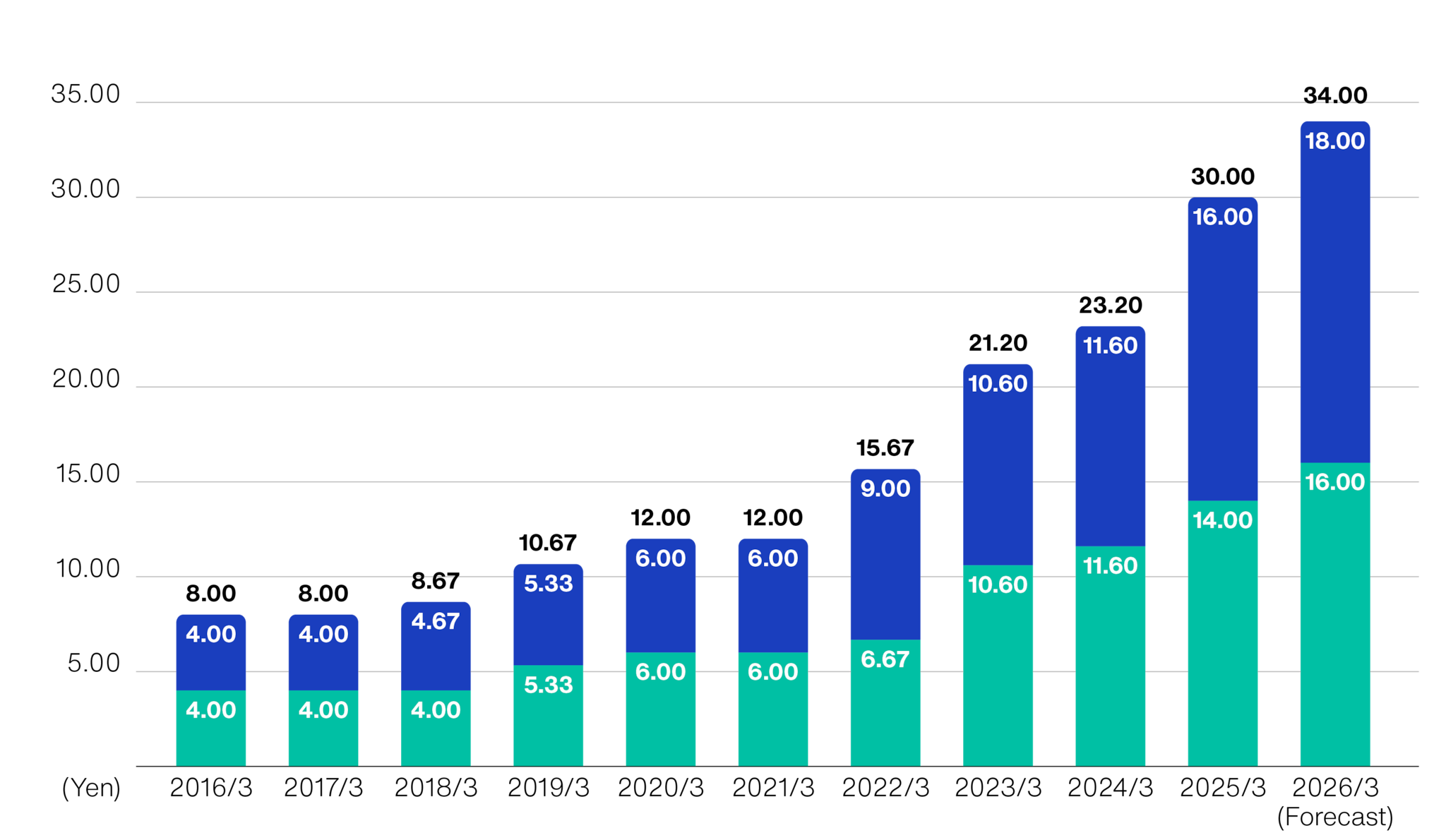

Shareholder return

Strengthen shareholder returns still more

- Strengthening shareholder returns by raising dividend payout ratio from 30% to 35% during the new Medium-term Plan(FY3/25 - FY3/27)

- Considering further return measures such as the share buybacks while taking the stock market situation and other factors into consideration.

Annual dividends per common share

2026/3 Forecast

0.00yen

2025/3 Result

0.00yen

- Interim dividends

- Year-end dividends

※TDK split one share of its common stock into five shares with the effective date of October 1, 2024. Dividends per share are calculated assuming that the share split was implemented at the beginning of the FY March 2016

※TDK has adopted the IFRS in place of the US-GAAP from the FY March 2022. The figures for the FY March 2021 are also presented in accordance with IFRS.

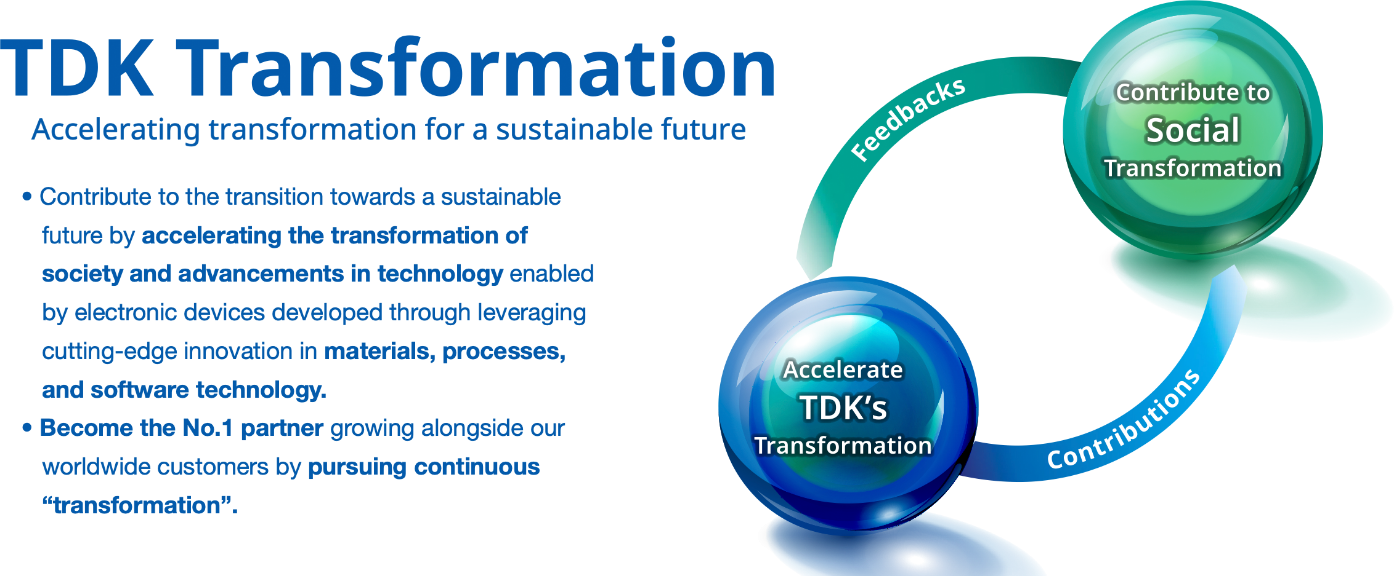

Four Advantages

(TDK’s core competencies)

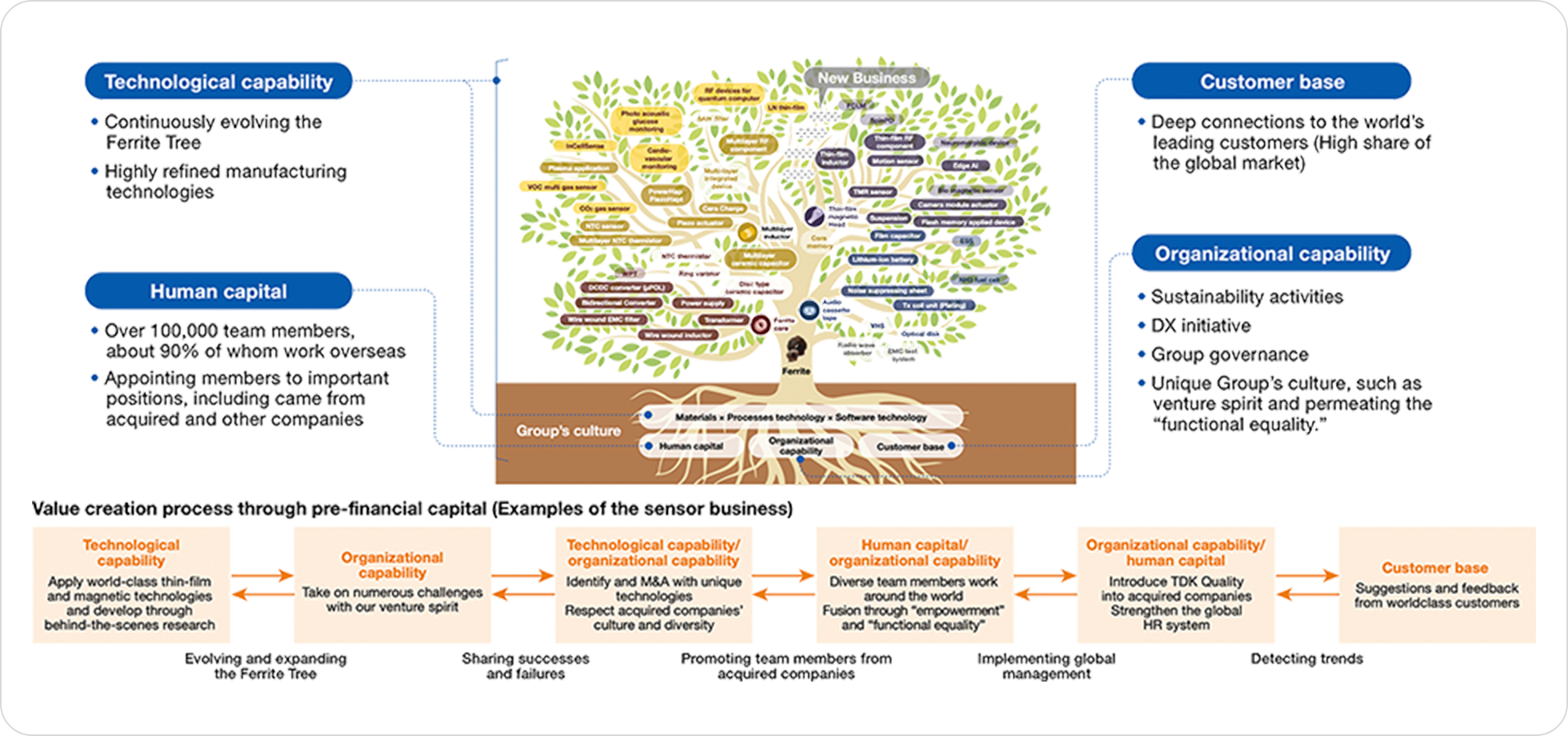

TDK has been realizing its sustainable growth by refining four core competencies.

From its founding to the present day, the source of TDK’s growth has been “new designs from material science” and “manufacturing capabilities that will continue to evolve.” In addition, we can cite “sales and marketing to strike at the center of the world,” proposing original products derived from the fusion of the above two factors to the market. And then, supporting these activities from the roots, there is our “unique employee culture for value creation.” By continuing to polish these four core competencies, we will realize sustained growth going forward.

-

1New designs

from material science

-

2Manufacturing capabilities

that will continue to evolve

-

3 Sales and marketing to strike

at the center of the world

4Unique employee culture

value creation

Empowerment & Transparency

Pre-financial Capital that backs TDK’s Value Creation

TDK considers the following as capital capable of generating future cash flows and refers to them as “pre-financial capital” rather than “non-financial capital”.

What is the Ferrite Tree ?

The Ferrite Tree is a concept that expresses the history and transitions that TDK’s business has continuously undergone since its establishment with ferrite as its founding business, in other words, the Ferrite Tree represents TDK’s growth trajectory. TDK’s generations of products are shown linked by the technology connections of its four major innovations—ferrite, audio cassette tapes, fine multilayering technology, and thin-film head technology. Since the commercialization of ferrite, TDK’s founding business, the Ferrite Tree has grown technology branches and leaves through the development of materials, processes, and derivative technologies and the expansion of TDK’s business portfolio through M&A.

Future Ferrite Tree

Four Great World-Class Innovations by TDK

- Ferrite

- Music cassette tapes

- Fine multilayering technology

- Thin-film head technology

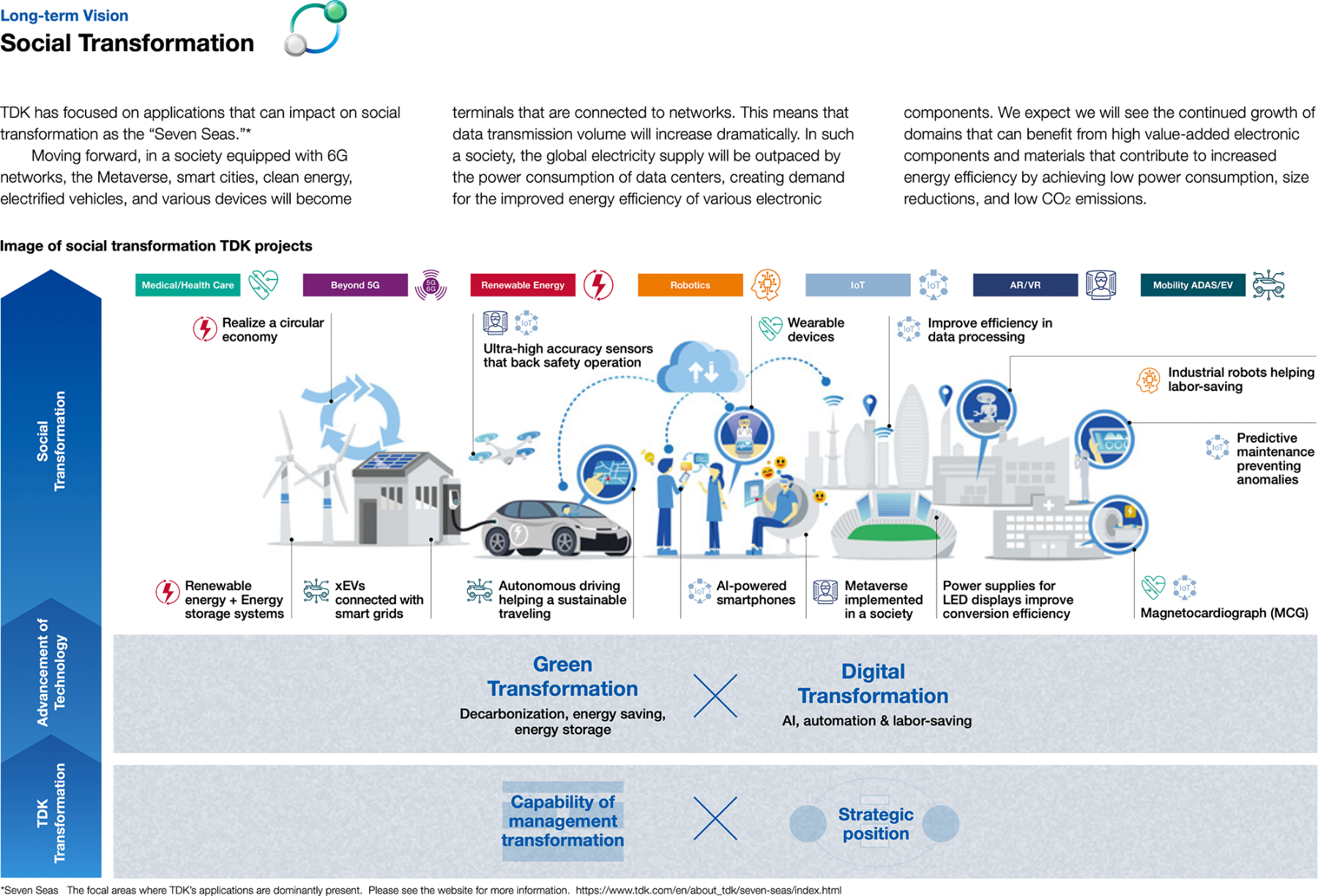

Long-term Vision

KPIs in the new Medium-term Plan(FY3/27)

-

ROIC

0%

or more -

ROE

0%

or more -

Operating profit margin(OPM)

0%

or more