[ 3rd Quarter of fiscal 2020 Performance Briefing ]Consolidated Results for 3Q of FY March 2021

Consolidated Full Year Projections for FY March 2021

Mr. Tetsuji Yamanishi

Executive Vice President

Hello, I am Tetsuji Yamanishi, Executive Vice President of TDK. Thank you for taking the time to attend TDK’s performance briefing for the third quarter of the fiscal year ending March 2021. I will be presenting an overview of our consolidated results.

Key points concerning earnings for 3Q of FY March 2021

First, let's take a look at key points concerning earnings. Amid the ongoing social effects of the COVID-19 pandemic as many countries around the world face a third wave of COVID-19, a recovery trend in electronics demand has become clearer since the second quarter in social and economic activities as well as corporate production activities that had resumed already. In the ICT market, DX-related demand for mobile devices, among others, remained strong, while overall demand in the automotive market increased in line with the acceleration of the electrification of automobiles such as xEVs and ADAS. In addition, in the industrial equipment market, demand related to renewable energy has increased and, the recovery in demand for EX-related products has become clear. Amid such a demand environment, net sales and operating income for the third quarter increased by 11.3% and 11.6%, respectively, year on year, achieving record levels of quarterly net sales and operating income.

Orders for the automotive market, which had recovered rapidly during the second quarter, remained strong in the third quarter, resulting in an increase in sales of Passive Components and Sensors. Meanwhile, as for sales to the ICT market, demand for DX-related products remained brisk and sales of Rechargeable Batteries and Passive Components increased. These contributed significantly to the overall earnings of the Company.

In light of the latest brisk order levels related to DX and EX and strong operating results up to the third quarter, full-year projections were revised upward again from the previous announcement.

Not being complacent about the recovery in demand, we will continue to implement the additional earnings improvement measures, such as rationalization and efficiency enhancement, formulated at the beginning of the fiscal year looking ahead to a possible worsening of the COVID-19 pandemic. In addition, we will promote measures to enhance asset efficiency, including business site restructuring in light of demand trends related to DX and EX, thereby further accelerating efforts toward earnings improvement.

Consolidated results for 3Q of FY March 2021

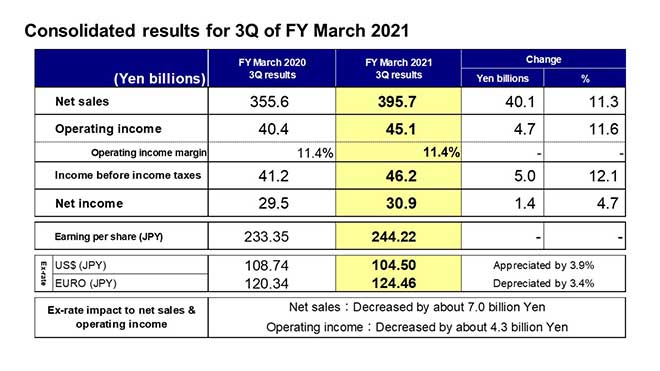

Moving along, I would like to present an overview of our results. The yen's appreciation against the U.S. dollar and other currencies caused net sales to contract by around 7.0 billion yen and operating income to decrease by around 4.3 billion yen. Including this impact, net sales were 395.7 billion yen, an increase of 40.1 billion yen, or 11.3%, year on year. Operating income was 45.1 billion yen, up 4.7 billion yen, or 11.6%, year on year. Income before income taxes was 46.2 billion yen, net income was 30.9 billion yen, and earnings per share were 244.22 yen.

With regard to exchange rate sensitivity, we maintain our estimate that a change of 1 yen against the U.S. dollar will affect annual operating income by about 1.2 billion yen, while a change against the euro will have an impact of about 0.2 billion yen.

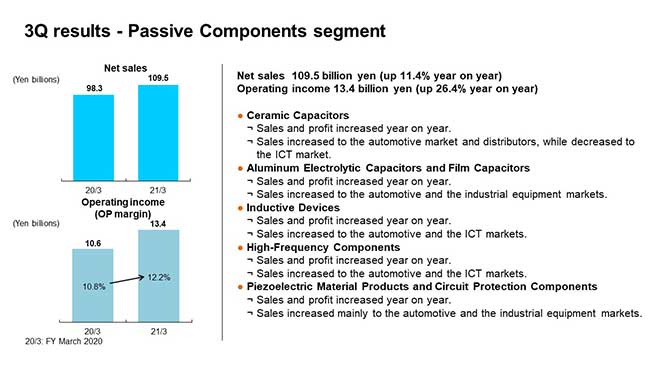

3Q results - Passive Components segment

Next, I would like to explain our business segment performance for the third quarter.

In the Passive Components segment, net sales were 109.5 billion yen, an increase of 11.4% year on year, and operating income was 13.4 billion yen, an increase of 26.4%. The operating income margin was 12.2%. Demand in the automotive market has been recovering rapidly since the second quarter, 5G-related demand remained robust in the ICT market, and demand related to renewable energy increased in the industrial equipment market, resulting in increased sales and profit in all businesses.

In Ceramic Capacitors, while sales decreased for 5G base stations, sales increased to the automotive market and distributors. In Aluminum Electrolytic Capacitors and Film Capacitors, sales increased to the industrial equipment market such as renewable energy-related products, in addition those to the automotive market. In Inductive Devices, sales increased to the automotive market due to a recovery in demand, as well as to the ICT market on the back of the strong launch of a new smartphone product. In High-Frequency Components, 5G-related demand remained strong, In Piezoelectric Material Products and Circuit Protection Components, sales increased in the overall automotive, ICT and industrial equipment markets.

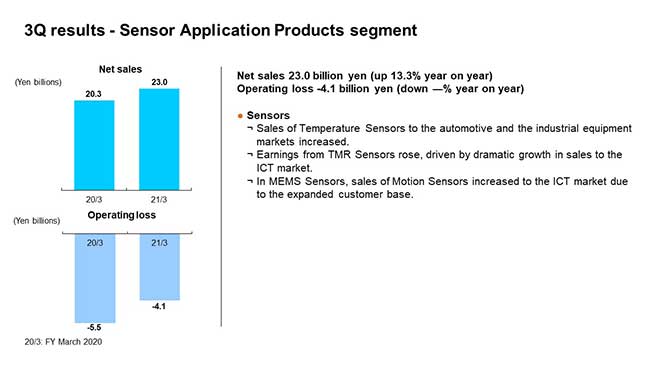

3Q results - Sensor Application Products segment

In the Sensor Application Products segment, net sales increased 13.3% year on year to 23.0 billion yen, while operating loss decreased.

As in the case of the Passive Components segment, all of the three businesses achieved increased sales and profit, reflecting a recovery in demand in the automotive market and significant rise in sales to the ICT market, especially those related to smartphones.

Temperature and Pressure Sensors saw an increase in sales to the automotive market and for home appliances, recovering to the level where the business can contribute to earnings. While the recovery in orders for Hall Sensors had been delayed due to the long supply chain for the automotive market, sales started to increase finally. Sales and operating income of TMR Sensors grew considerably as the production of the new smartphones entered the peak season. In MEMS Sensors, sales increased to the ICT market reflecting an expansion in the customer base for motion sensors, and operating loss was diminished due to enhanced cost efficiency as a result of the review of development resources.

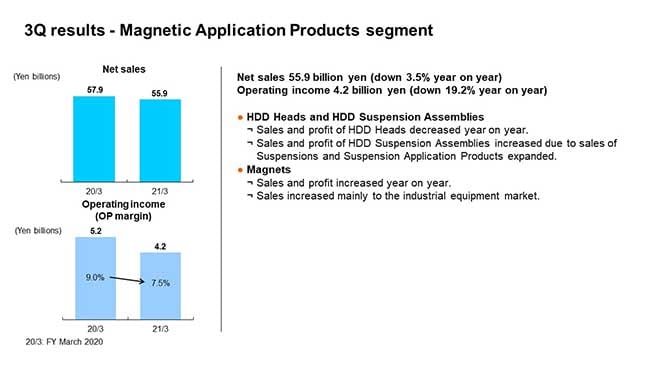

3Q results - Magnetic Application Products segment

In the Magnetic Application Products segment, net sales decreased 3.5% year on year to 55.9 billion yen and operating income decreased 19.2% to 4.2 billion yen.

In HDD Heads, sales and profit decreased as HDD Head shipment volumes fell due to a decline in overall demand for HDDs, despite an increase in sales in the HDD assembly business reflecting a rise in demand for PCs. HDD Suspension Assemblies saw increases in both sales and profit due to a rise in shipment volumes on the back of robust sales of Nearline HDDs for data centers of a major customer. In Magnets, operating loss decreased as demand from the automotive market recovered and sales increased for use in industrial equipment such as renewable energy-related products.

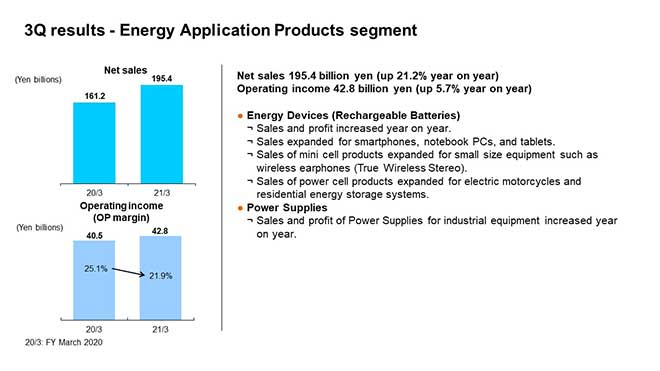

3Q results - Energy Application Products segment

In the Energy Application Products segment, net sales were 195.4 billion yen, an increase of 21.2% year on year, and operating income was 42.8 billion yen, an increase of 5.7% year on year.

In Rechargeable Batteries, sales increased slightly for use in smartphones on the back of an increase in smartphone production, while sales remained at a high level for use in PCs and tablets. Sales of mini cell products remained robust for small size equipment such as wireless earphones, and sales of power cell products have been expanding for residential energy storage systems and electric motorcycles since the first quarter. As a result, both sales and profit of Rechargeable Batteries increased overall. In Power Supplies, sales and profit increased on the back of a recovery in demand for use in industrial equipment such as semiconductor manufacturing equipment.

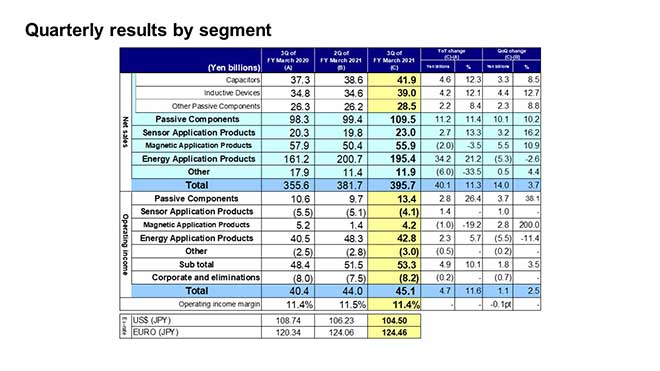

Quarterly results by segment

Next, I will explain some of the factors behind the changes in net sales and operating income by segment from the second quarter to the third quarter of the fiscal year ending March 2021.

In the Passive Components segment, net sales increased by 10.1 billion yen, or 10.2%, from the second quarter, and operating income was 13.4 billion yen, an increase of 38.1% from the second quarter. While sales to the automotive and the industrial equipment markets increased, sales to the ICT market have remained virtually flat from the second quarter reflecting a decline in demand for 5G base stations, despite an increase in demand for smartphones in their peak season. As a result, while sales of High-Frequency Components remained virtually flat, both sales and profit increased in other businesses with higher sales to the automotive and the industrial equipment markets.

In the Sensor Application Products segment, net sales increased by 3.2 billion yen, or 16.2%, from the second quarter, and operating loss was reduced by 1.0 billion yen from the second quarter. As demand from the automotive market recovered, sales of Temperature and Pressure Sensors as well as Hall Sensors increased. Sales of TMR Sensors surged due to the peak season for smartphones. In addition, sales of MEMS Sensors increased for use in Chinese smartphones and drones. As a result, sales increased across all the businesses. In terms of operating income, Temperature and Pressure Sensors as well as Magnetic Sensors posted a profit, while the operating loss of MEMS Sensors narrowed due to the effect of enhanced efficiency in development expenses in addition to improved profitability as a result of increased sales.

In the Magnetic Application Products segment, net sales increased by 5.5 billion yen, or 10.9%, from the second quarter, and operating income increased by 2.8 billion yen from the second quarter. While HDD Head sales volumes decreased by about 2% from the second quarter, sales of HDD Heads increased as a whole due to a rise in average sales prices and an increase in 3.5-inch HDD assembly sales as demand for use in PCs grew. Sales of HDD Suspension Assemblies increased as sales for use in Nearline HDDs for data centers surged and sales of Suspension Application Products for use in smartphones increased. Sales of Magnets increased due to a recovery in demand from the automotive and the industrial equipment markets. In terms of operating income, HDD Heads and HDD Suspension Assemblies posted a profit due to increased sales, while the operating loss of Magnets narrowed on the back of increased sales. Meanwhile, the HDD Suspension Assemblies business sold its medical precision components business, which had been positioned as a non-core business, during the third quarter and the proceeds from the sale have been included.

In the Energy Application Products segment, net sales were 195.4 billion yen, a decrease of 2.6% from the second quarter, and operating income was 42.8 billion yen, a decrease of 11.4% from the second quarter. Sales of Rechargeable Batteries for use in smartphones fell far short of expectations because of the shift of a substantial portion of sales from the third quarter to the fourth quarter due to inventory adjustments by a customer. As a result, sales of Rechargeable Batteries decreased from the second quarter as a whole. In addition, sales of Power Supplies for industrial equipment decreased slightly. Operating income declined as sales of Rechargeable Batteries decreased and expenses related to the reinforcement of the power cell production system and the acceleration of development efforts increased, although Power Supplies for industrial equipment posted a profit despite decreased sales.

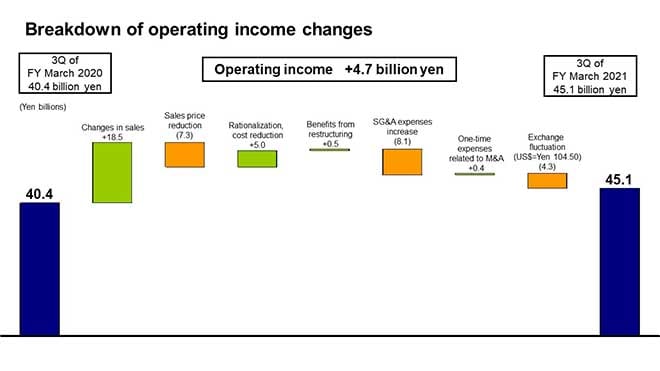

Breakdown of operating income changes

Next is the breakdown of the change in operating income. Let’s take a look at the main factors behind the 4.7 billion yen increase in operating income. There was an increase in income of about 18.5 billion yen due to an increase in sales volumes reflecting the expansion of sales of Rechargeable Batteries and Passive Components. The negative impact of sales price reductions of 7.3 billion yen was counteracted by the effects of cost reductions from rationalization of about 5.0 billion yen and benefits from restructuring of about 0.5 billion yen. Expenses related to the InvenSense acquisition decreased by about 0.4 billion yen, while selling, general and administrative (SG&A) expenses increased by about 8.1 billion yen due to an increase in SG&A in connection with the business expansion in Rechargeable Batteries, an increase in development expenses due to the acceleration of power cell development, and the cessation of a filter fee that TDK had been receiving up to the previous fiscal year. Exchange rate fluctuations had a negative impact of 4.3 billion yen. These resulted in an overall increase in operating income of 4.7 billion yen.

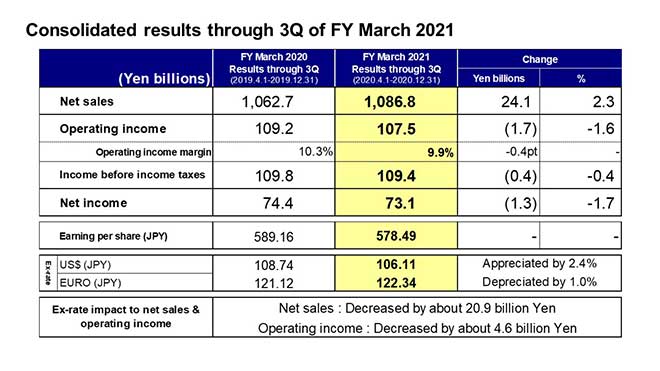

Consolidated results through 3Q of FY March 2021

Next, let’s look at the consolidated results for the nine months of the fiscal year ending March 2021.

Net sales were 1,086.8 billion yen, an increase of 2.3% year on year. Operating income was 107.5 billion yen, down 1.7 billion yen, or 1.6%, year on year. Income before income taxes was 109.4 billion yen, and net income was 73.1 billion yen, down 1.7% year on year. Net sales achieved a record high level for the nine-month period.

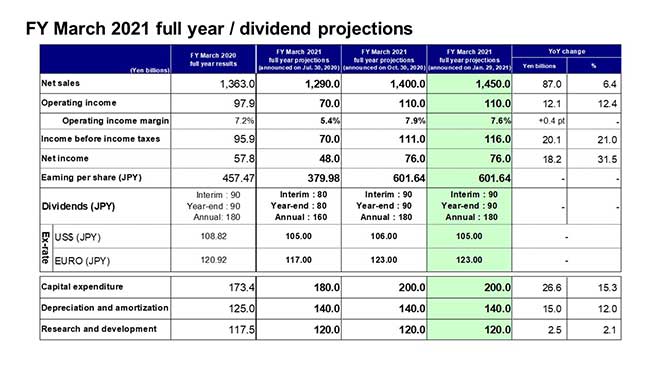

FY March 2021 full year / dividend projections

Finally, we come to our consolidated full-year earnings projections for the fiscal year ending March 2021.

In light of the operating results up to the third quarter and the latest order levels for the fourth quarter, we have revised our previous projections announced in October 2020. Our consolidated full-year earnings projections have been revised upward to net sales of 1,450.0 billion yen, and income before income taxes of 116.0 billion yen. The projections for operating income of 110.0 billion yen, and net income of 76.0 billion yen remain unchanged from the previous announcement.

Projections for net sales have been revised upward on the assumption that demand from the automotive and the industrial equipment markets will remain brisk. Projections for income before income taxes are based on the assumption of an increase in non-operating income.

Amid the COVID-19 pandemic, demand levels related to DX and EX have changed significantly from the initial projections, and we have been promoting asset optimization in line with demand trends and restructuring toward the reinforcement of competitiveness. Therefore, our projections for operating income are based on the assumption that one-time expenses of about 12.0 billion yen will be recorded in the fourth quarter.

There are no revisions to the projections for year-end dividends, capital expenditure, depreciation and amortization, and research and development expenses from the previous announcement.

That concludes my presentation. Thank you very much for your attention.