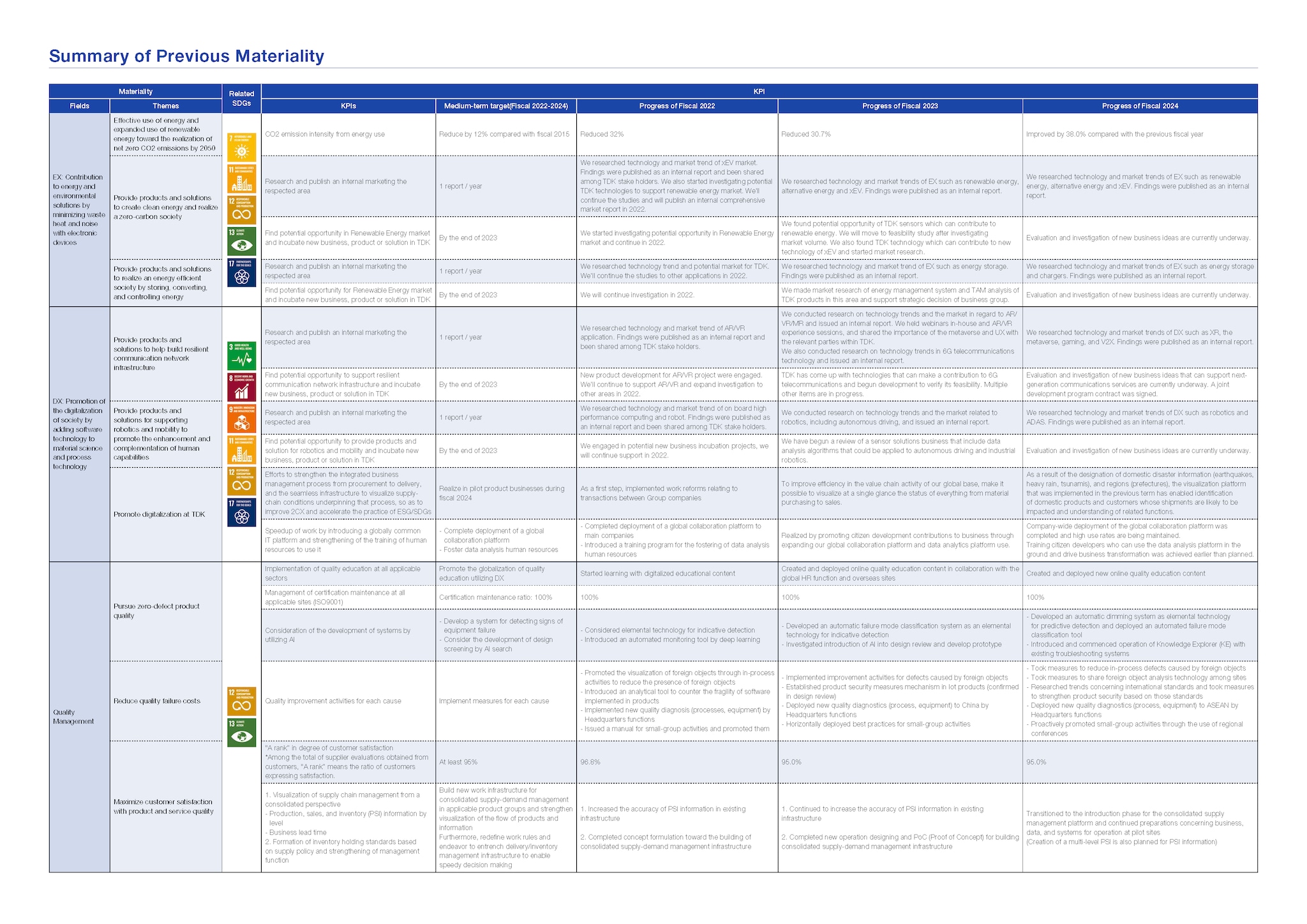

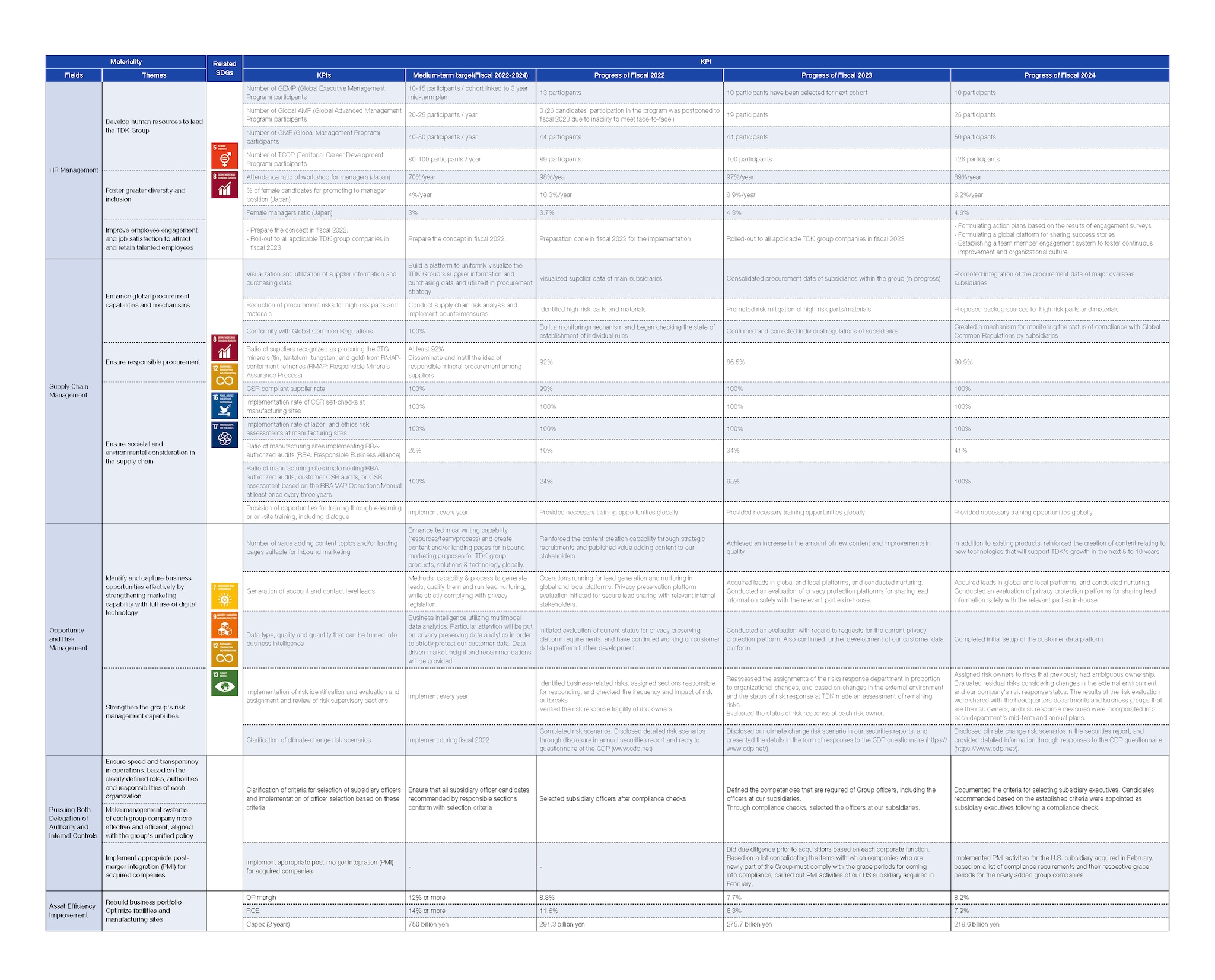

Sustainability | Sustainability Management | TDK Group's MaterialitySummary of Previous Materiality

During the three years from fiscal 2022 to fiscal 2024, we made steady progress toward achieving the medium-term targets set for each topic. As a result, there were no targets that were not achieved, but we are aware that in order to solve global sustainability issues, it will be important for us to set even higher targets and continue to tackle challenges. Starting in fiscal 2025, we will accelerate our efforts even further based on the new materiality.