SustainabilityMessage from the President and CEO

In these turbulent times, we will enhance our own capabilities and strengthen the collective efforts of TDK United.

Noboru Saito

Representative Director, President and

CEO

Q1. What is your overall impression of performance from the previous fiscal year (FY March 2025)?

A1. We achieved initial targets for all the financial KPIs outlined in the Medium-term Plan. In particular, free cash flow (FCF) significantly outperformed initial assumptions.

In May 2024, we published the “TDK Transformation” as our Long-term Vision and the position we aim to establish for the TDK Group in 10 years. Furthermore, we released a Mediumterm Plan that represents our three-year action plan (FY March 2025 to FY March 2027) for achieving that vision. This Medium-term Plan was formulated based on backcasting from our Long-term Vision. (See page 21)

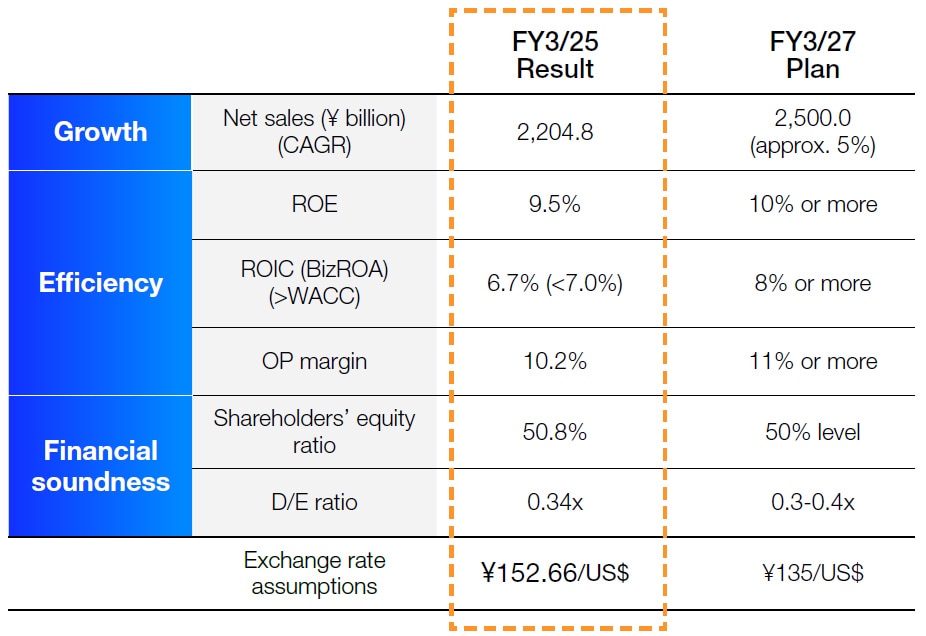

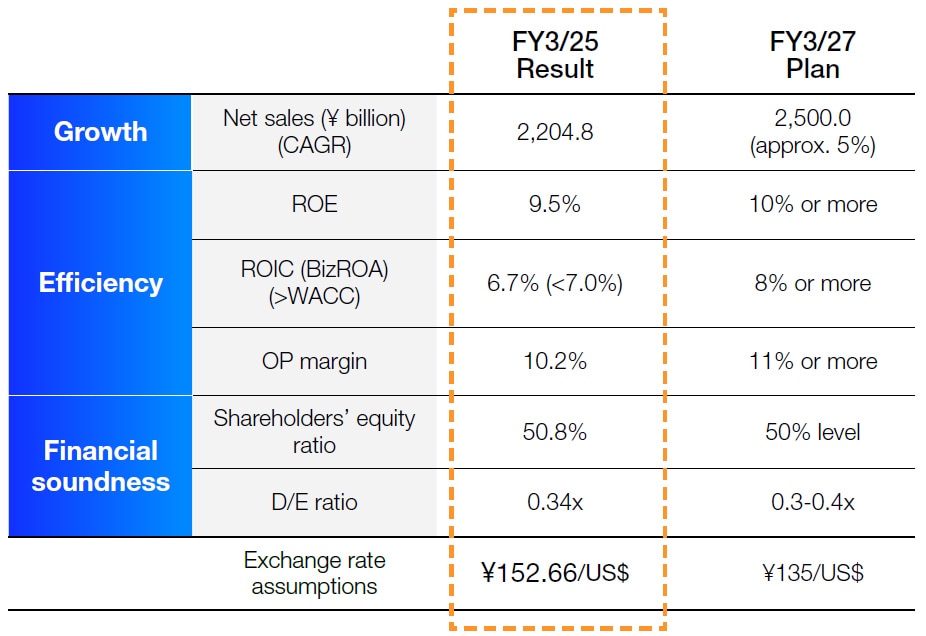

During the previous fiscal year, the initial year of the Medium-term Plan, we achieved record high performance with consolidated net sales improving by 4.8% year on year to ¥2,204.8 billion and operating profit increasing by 29.7% year on year to ¥224.2 billion. We also achieved initial assumptions for all financial KPIs, including ROE of 9.5%, ROIC of 6.7%, and operating profit margin of 10.2%.

Looking at free cashflow (FCF), which we position as an important management indicator, year-end FCF was ¥201.0 billion, which was significantly higher than initial assumptions (¥15.0 billion). This is the result of increased profit as well as benefits of reductions to capital expenditures (CAPEX) and working capital. To put it another way, I view this performance as the result of our capability to recognize that there are elements of our external environment that we cannot change. Thus, while we do pay close attention to external factors, we focused on capitalizing on our own capabilities in areas that we can control, such as CAPEX and inventory management.

Financial KPI progress

Since assuming the role of CEO three years ago, I have continuously promoted the importance of enhancing our own capabilities by focusing on the things we can do ourselves and the things we should do ourselves. Just in the past year, the environment influencing our business has seen incredible uncertainty and dynamic change. Amid such an environment, I believe that being able to achieve that performance was the result of our global team members (employees) identifying changes in our external environment while steadily working to enhance their own capabilities in their respective roles.

Looking at our current environment, there is great uncertainty concerning the outlook for the global economy. While we cannot change our external environment, we do have significant room to improve our quality, productivity, and technological capabilities; our fundamental capability as a manufacturing business. This is why I challenge our team members around the world to “Control the Controllable”; the idea that we should focus our efforts on grasping our current situation and using our own capabilities to control what we can. For our manufacturing sites as well, we promote the concept of “China plus,” through which we address geopolitical risks by dispersing manufacturing to sites in India and countries in Southeast Asia.

To strengthen our dialogue with investors, this year’s Integrated Report is configured based on our formula for enhancing corporate value. The current Medium-term Plan outlines three key points –“Strengthen management focusing on cash flows,” “Enhance business portfolio management (Emphasizing ROIC),” and “Evolve the Ferrite Tree (pre-financial capital)” – regarding which we are proactively implementing measures. The key points reflect our approach that maximizing FCF generation, reducing costs of capital, and increasing expected growth rate are critical to enhancing corporate value. In relation to first point, strengthening management focusing on cash flows, as previously noted, the first year of the Medium-term Plan was successful to our assumption at the beginning of the FY March 2024 outlining three-year cumulative FCF of ¥260.0 billion. We are also making steady progress on the remaining two key points.

Q2. You promote proactive business portfolio management but did you make progress on measures directed at businesses to be intensively monitored?

A2. Of the 27 CBUs to be intensively monitored, we successfully turned around one CBU and decided to sell or terminate operations for seven CBUs. We will continue to strengthen activities with our primary focus on advancing our growth strategy.

We also made progress on the second key point of our Medium-term Plan, enhancing business portfolio management, during FY March 2025. Based on our approach that the most important element of business portfolio management is promoting growth strategy, we hold discussions with the heads of each of the nearly 80 cashflow business units (CBUs) to determine what each unit needs to do for the TDK Group to achieve growth.

To address the 27 CBUs to be intensively monitored with low BizROA (ROIC) and business potential, since May 2024 we conducted discussions on 27 CBUs and examined and implemented measures for early turnaround. As a result, during FY March 2025 we successfully turned around one CBU, HDD suspensions, and profits are also improving for HDD heads.

On the other hand, as of the end of April 2025 we decided on the sale or termination of business for seven CBUs. Among these, we decided that the continuation of business under new ownership was the optimal course for magnet application products (mag rolls), which were a part of the magnets business, and camera module micro actuators, and reached an agreement of business transfer. We also decided on the termination of business for a total of three CBUs: photovoltaic (PV) and Semiconductor Embedded in SUBstrate (SESUB) for high-frequency (HF) components, which fall under the Passive Components segment, and Electric Double-layer Capacitors (EDLC) in the Other segment.

For the remaining 19 CBUs, we will continue to implement measures internally towards achieving a turnaround while also advancing discussions on strategic options from various perspectives. For the magnets business, we are working to reduce quality costs, which has been an ongoing issue. In addition to conventional products for the automotive market, we are also reevaluating our product composition to capture demand related to renewable energy as we work to improve our revenue structure.

Q3. How will you strengthen the businesses you position as growth areas?

A3. We are proactively investing in the AI ecosystem market, which we position as our highest-priority growth driver.

As proactive business portfolio management, we will work to turn around businesses to be intensively monitored while also aggressively implementing measures for businesses in the key growth areas with strong growth potential.

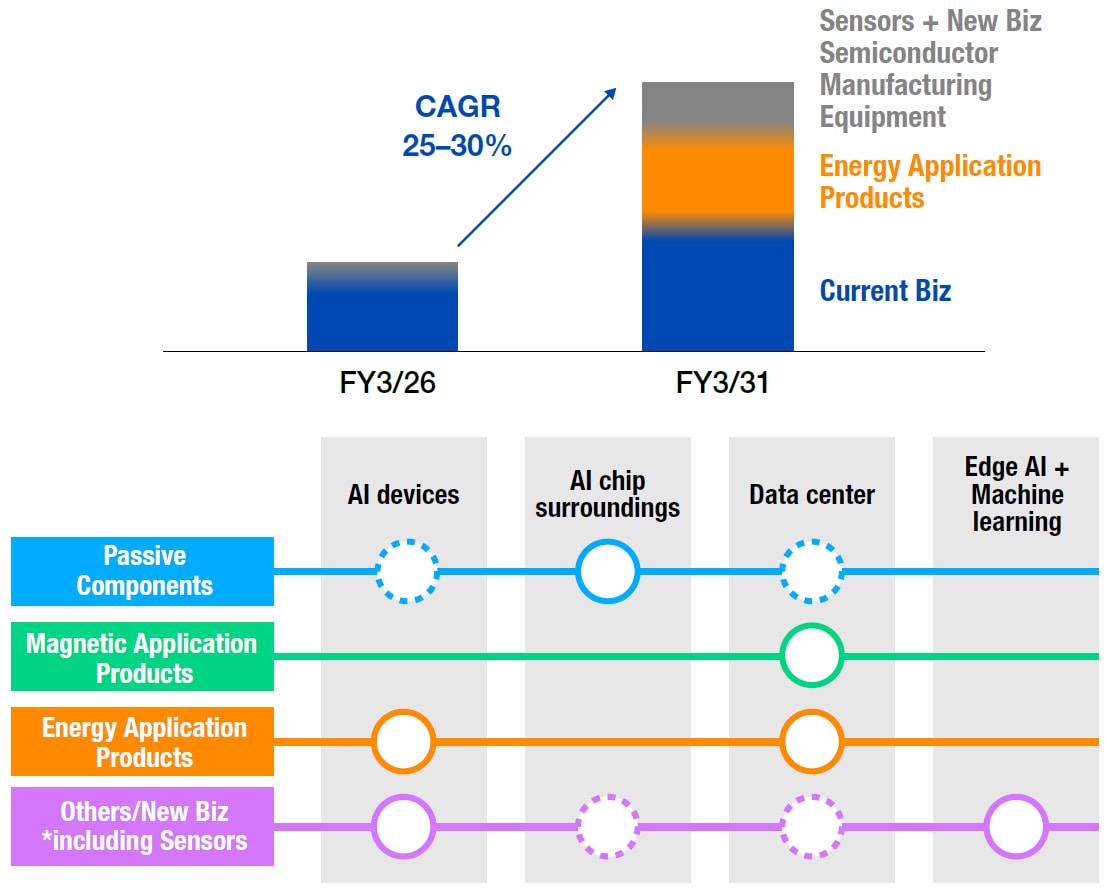

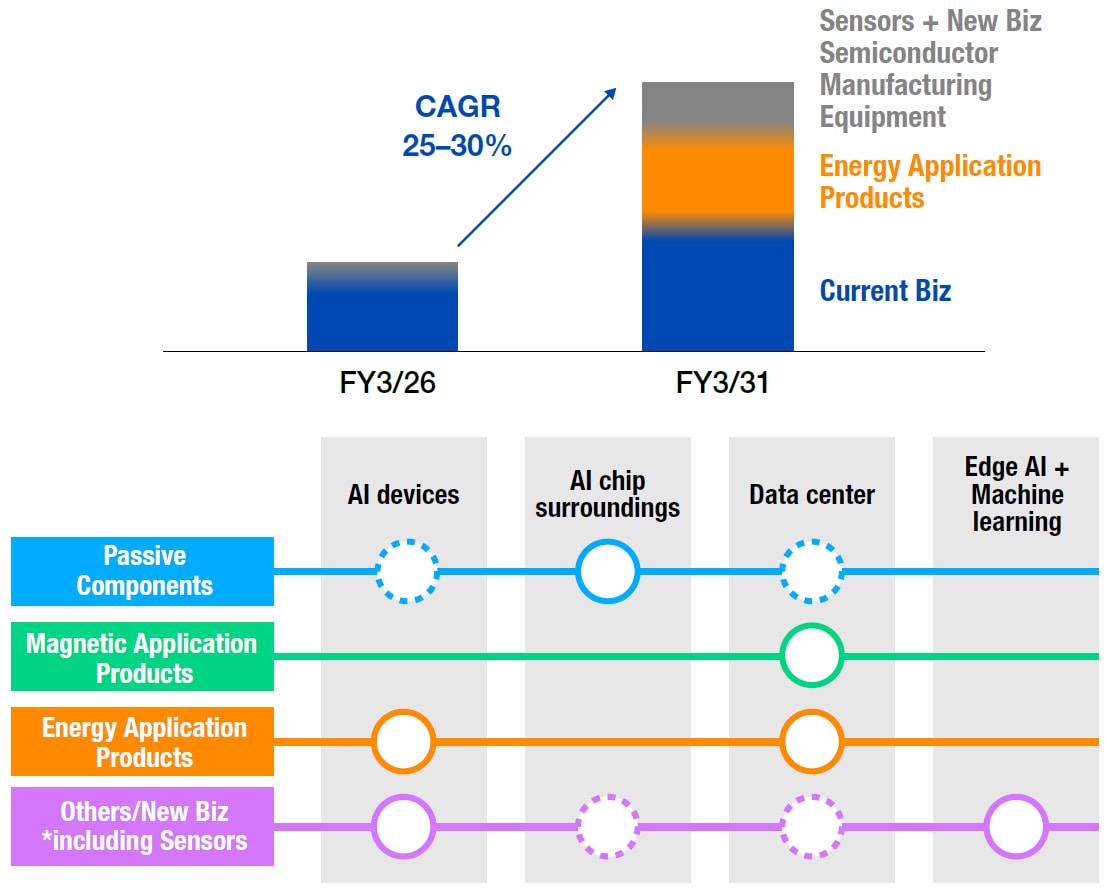

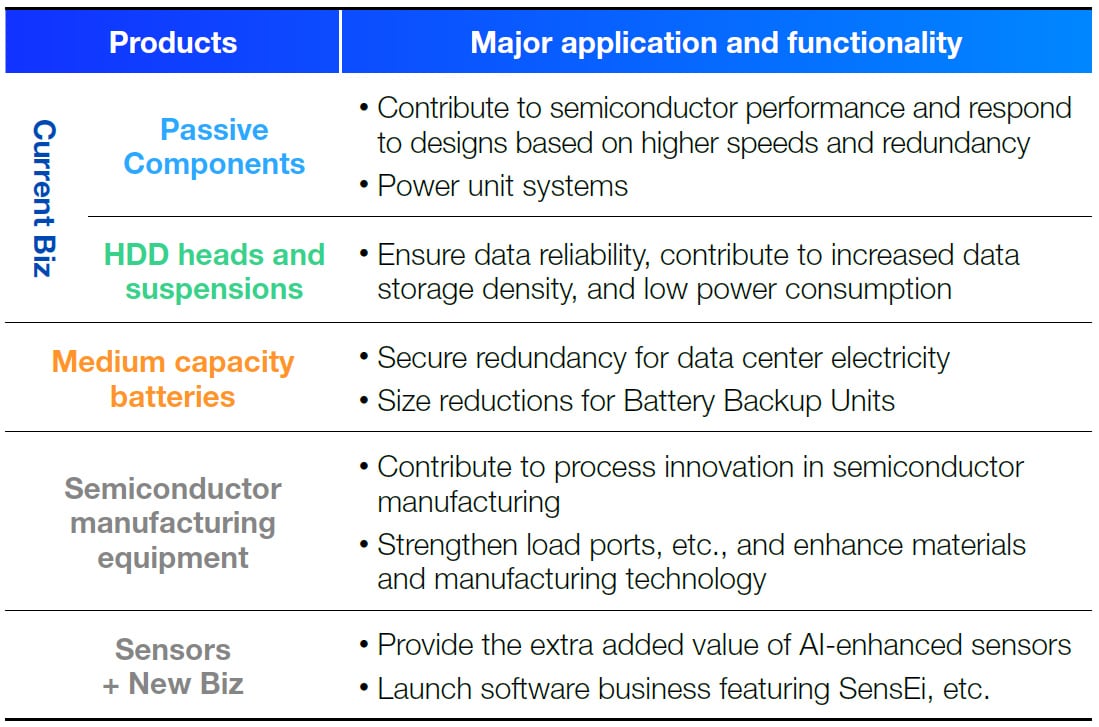

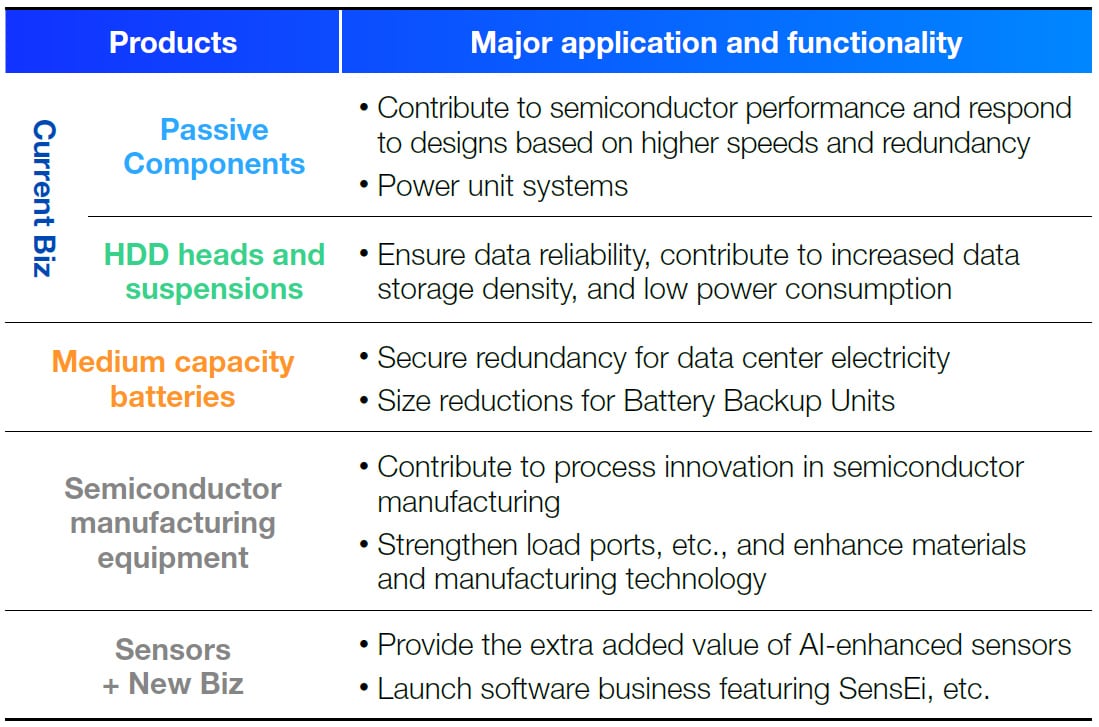

We view AI-related markets as incredibly powerful growth drivers towards realizing our Long-term Vision, TDK Transformation. Currently, the macro-trend of transformation driven by AI is developing rapidly in various domains. Looking at this trend from our perspective, we anticipate that the permeation and expansion of AI will have a positive influence on numerous business domains in which the TDK Group is involved.

For example, our electronic components are expected to contribute power savings and address increasing power consumption by data centers. Increasing data accumulation at data centers is also expected to serve as a tailwind for HDD heads and suspensions. Additionally, the silicon anode batteries we launched to market roughly two years ago provided higher energy density compared to existing products and demand is increasing with the growth of AI smartphones, which require batteries with high energy density. The expanding adoption of AI will also lead to increased data utilization, which is expected to lead to increased demand for sensors as well.

In this sense, we expect to see significant growth not only for data centers and servers, but also for edge AI devices, AI-powered vehicles and infrastructure, and domains such as semiconductor manufacturing equipment. The permeation and expanded adoption of AI in society will serve as a growth driver for various TDK businesses. As such, we define this broad range of AI-related markets as “AI ecosystem market.” In our business portfolio management, we already position many of the businesses related to this AI ecosystem market as key growth areas. Moving forward, we will also utilize our strategic investment budget towards aggressively investing in such businesses.

In addition to current businesses, we also plan to invest proactively in various new domains that will contribute to the development of the AI ecosystem, including M&A as described below.

One such domain is predictive maintenance for the industrial equipment market. In March 2025, we released “edgeRX,” a new product targeting this domain. Offered by TDK SensEI, a new company established in July 2024, “edgeRX” provides real-time monitoring of machinery and equipment malfunctions in manufacturing and logistics operations.

TDK contributes to the entire AI ecosystem

We will also strengthen our technology development for AR glasses, a market that is projected to see medium- and long-term growth. We will offer diverse solutions targeting this market that will contribute to the size and weight reductions for and the increased efficacy of AR glasses. Planned solutions include ‘ultra-compact full color laser modules’, which are one-tenth the size of conventional modules, Piezo Haptics for bone conduction speakers, lithium-ion batteries, and all-solid-state batteries.

In addition to these current products, to further strengthen the AR glasses-related technology, we acquired SoftEye, Inc., based in US, as announced in June 2025. SoftEye brings expertise in algorithms, camera, and low-power chip design, and it enables low-power eye tracking and object recognition.

We also have high expectations for the semiconductor manufacturing equipment domain. While we have not particularly highlighted our efforts thus far, we are building a strong position in this domain based on the factory automation (FA) technology which we have cultivated through our work on automatic mounting machines for electronic components and clean technology. Moving forward, we plan to increase strategic investments, particularly for post-process products such as flip-chip bonding, a domain that is expected to increase in importance with further advancements in AI.

At present (as of April 2025), net sales from the AI ecosystem market only represent a little over 10% of total net sales. However, we project that we can achieve an annual growth rate of 25% to 30% over the medium- to long-term. Offering a diverse range of products, services, and solutions that contribute to the development of the AI ecosystem market will contribute to social transformation and drive sustainable growth for TDK. In that sense, I believe these efforts are directly linked to the realization of the TDK Transformation outlined in our Long-term Vision.

Sales for AI Market (FY3/26 Forecast·FY3/31Target)

Q4. What initiatives are you implementing to strengthen pre-financial capital?

A4. To strengthen pre-financial capital, we created a new CHRO position to focus on human capital. We also established a new Sustainability Committee to implement Group-wide initiatives in the various sustainability fields as a core corporate undertaking.

Borrowing from the growth process of a single tree, TDK uses the term “Ferrite Tree” to refer network of technology that started with the magnetic material ferrite and has expanded since our founding. I view non-financial capital, our technological capabilities, human capital, organizational capabilities, and customer base, as representing the roots of this Ferrite Tree, roots that grow into thick trunks above ground and enable the branches and leaves to expand. This non-financial capital goes on to support the growth of financial capital, which leads to the creation of new value. Based on this thinking, we define them as ‘pre-financial capital’.

Among all pre-financial capital, I focus most on people. Since assuming the role of CEO, I have consistently stressed, both internally and externally, that people are at the root of TDK’s sustainable growth. TDK’s strength is not simply that we have diverse human resources. I believe our true strength lies in our capability to maximize the potential of that diversity. 80% of TDK’s nearly 100,000 employees joined the Group through M&A and nearly 90% are of a nationality other than Japan. Showing mutual respect for culture, proactively incorporating good ideas, and learning from each other is a mentality that has permeated throughout the entire Group.

As a measure related to people, we repositioned the HR Division as a core function for promoting Group-wide corporate strategy and in April 2025 we created a new Chief Human Resource Officer (CHRO). We appointed Andreas Keller to the position of CHRO. Keller, who up to the previous fiscal year was in charge of HR and sustainability, has a broad perspective and vast experience. I expect that fully incorporating his talents into corporate strategy will enable us to further enhance the human resource management of our global enterprise.

In addition to people (human capital), we are looking to overall enhance the strength of our core pre-financial capital. To this end, we redefined TDK sustainability as the pursuit of achieving long-term enhancements in corporate value by providing value to customers and society through our business operations. From the perspective of long-term enhancements in corporate value, we positioned initiatives related to the various sustainability fields (human capital, climate change, human rights, etc.) that influence our Group, both internally and externally, as key issues. To identify the impact of risks and opportunities of each fields and formulate appropriate strategy and business model capable of responding to those impacts, we developmentally dissolved the Sustainability Promotion HQ, which previously operated separately from the Corporate Strategy HQ. In April 2025, we established Sustainability Promotion Group as an entity that operates within the Corporate Strategy HQ. Furthermore, to address the need for a Group-wide approach to engaging in a wide range of sustainability fields, in April 2025 we also established a Sustainability Committee comprised of members from multiple organizations.

Q5. You embrace TDK United as TDK’s ideal organizational culture but what type of value is created through this culture?

A5. There is the benefit of being able to take an approach through which we provide value as a package across all our businesses and products. Instead of striving for uniform to our diverse members, we incorporate the beneficial elements of each other to form connections. Through this mentality, we work together on corporate activities towards the realization of TDK Transformation.

The term TDK United represents an organizational culture that aims for a unique fusion that creates value through teamwork by promoting mutual understanding while developing the strengths of each individual and company. Instead of striving for conformity from our diverse members, we incorporate the beneficial elements of each other to form connections through which we engage in corporate activities.

Under a governance policy of “Empowerment & Transparency” we have established basic rules that we apply worldwide as “Global Common Regulations (KITEI)” to enforce governance. At the same time, we actively promote the empowerment to regional headquarters and core subsidiaries to enable members to maximize their individuality and capabilities on the front lines of business. I believe that the interaction and fusion of different cultures and personalities under such an organizational structure and corporate culture is what leads to the creation of innovative technologies and products.

I myself worked overseas for nearly 20 years in countries such as Germany, Hungary, and the USA. Having been involved in business expansion and organizational development in each location, I had many opportunities to experience the strengths of TDK first-hand from a perspective other than the Global HQ. From my current position in the Global HQ, I continue to communicate oneon- one with executive members around the world on a monthly basis.

The realization of TDK United will not only change how we develop technologies and products, but also how we approach customers. For example, the AR glasses in the AI ecosystem I mentioned earlier incorporate a variety of our products. By offering them as a package rather than as individual components, we should be able to create more value. Moving forward, we hope to create new approaches like this that leverage the strengths of TDK United for more customers.

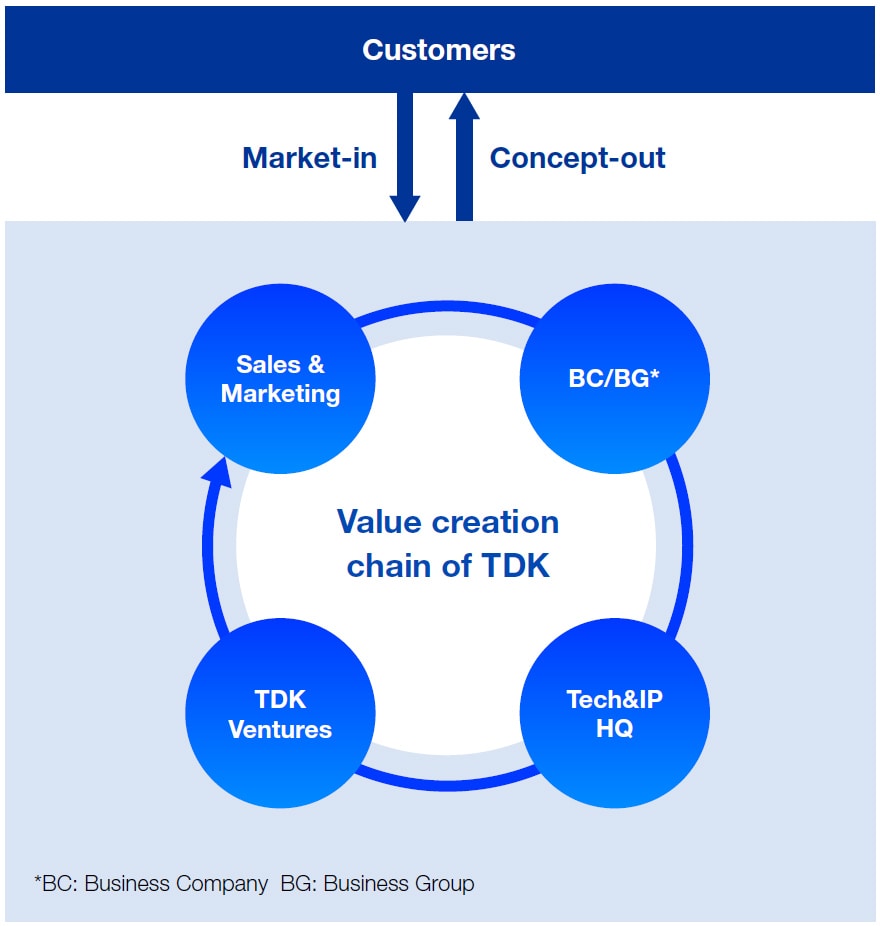

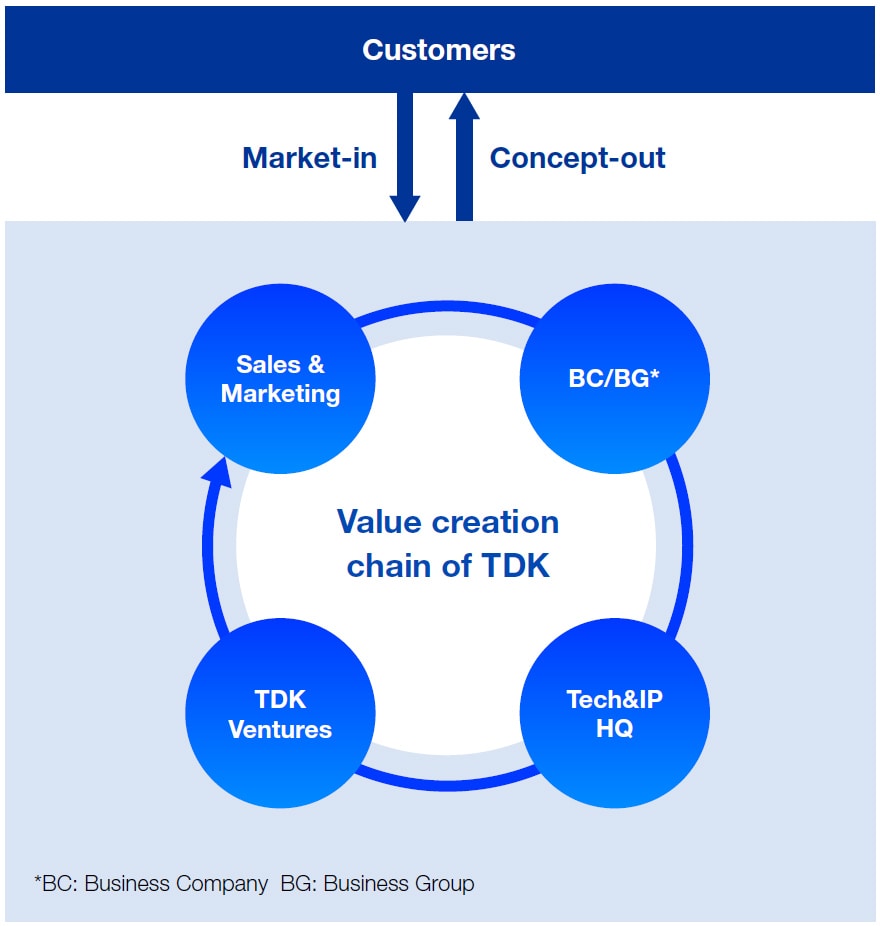

TDK Ventures, which serves as a corporate venture capital (CVC,) makes strategic investments and collects information in a timely manner on technologies that expected to see long-term growth. Both the Corporate Marketing & Incubation (CM&I) HQ and Corporate R&D continuously evaluate how technology trends will affect our business.

When we identify information that could benefit our business, we work with business companies (BCs) towards achieving rapid commercialization. We refer to such dynamic Groupwide and cross-border initiatives as our “value creation chain”. In cases where initiatives transcend the boundaries of a current business division, then we may create a new organization to move the project forward, like we did with TDK SensEI.

Responding to market potential/needs in a cross-sectional manner

Q6. Lastly, please discuss your commitment to stakeholders.

A6. As the lead manager of TDK United, I will support TDK team members in enhancing our own capabilities through “the endless pursuit of something better” to realize TDK Transformation. We hope you will continue to hold high expectations for TDK’s growth potential.

This December (2025), TDK will celebrate our 90th anniversary. Even after 90 years, our Corporate Motto of “Contribute to culture and industry through creativity” and our Corporate Principles of “Vision, Courage, Trust” remain unchanged. We also strive to pass down the corporate culture rooted in this motto and principles. One aspect of this corporate culture is the “TDK Venture Spirit.” The spirit of boldly taking on new challenges and learning from failure has been shared and passed down through the Group since our founding, and is something we hope to pass on to the future. We also strive to pass on the importance of “diversity” as a driving force for TDK. To maximize the strengths of diversity, it is important that we embrace a culture of “functional equality.” This means that although there are hierarchical positions, there are no hierarchical roles or functions; everyone is on an equal footing and able to speak freely about what they think is right, regardless of their position. I want to ensure that this open organizational culture is valued and passed to future generations.

At the same time, there are many things we must change as a corporation aiming for sustainable growth. The “TDK Transformation” outlined in our Long-term Vision also refers to a transformation for TDK itself. Our operating environment is continuously subject to dynamic change. However, if we carefully analyze the conditions we are facing, we should be able to identify many things that can be changed by tapping into our own capabilities. My own transformation is centered on communication. We have increased the amount of dialogue with shareholders and investors by 30% and the number of people with whom we meet by 60% compared to the previous fiscal year.

Internally, we proactively hold town hall meetings and group meetings in various locations to convey our Long-term Vision, the “TDK Transformation,” to team members around the world. This promotes team members embracing our vision as something that applies to them on a personal level. I see my role not as an orchestra conductor, but as the lead manager of a jazz band called TDK United who has gathered an ensemble of players with a wide variety of talents, techniques and personalities. My mission is to achieve our Long-term Vision by creating an environment in which all members, who are full of diversity and embrace the TDK Venture Spirit, are highly motivated to pursue the TDK Transformation as if it were their own goal.

We also want to transform the strength of the TDK corporate brand. Since withdrawing from the cassette tape business more than 10 years ago and fully becoming a B2B enterprise, we have recognized the need to increase recognition of the TDK brand among the general public. We are a global company that supplies essential parts in various domains that support the development of society, so addressing how we increase our brand recognition and elevate our presence within society is a core corporate issue for TDK. To this end, we have begun Group-wide branding activities to revamp TDK’s brand identity and foster a new brand image. Rather than pursuing this as a standalone project, we are linking this initiative with other corporate activities such as recruitment, investor relations, and sales and marketing. As my own project, I launched a task force that included leaders from not only public relations but also various other functional departments.

To put it another way, one could say that unresolved issues are challenges that we can change by applying our own capabilities. In other words, those challenges represent potential. TDK still has room to improve its own capabilities. Evolution stops the moment you think you have achieved the best. More than ever, I intend to convey this message to our 100,000 TDK United team members around the world and encourage them to engage in “the endless pursuit of something better” rather than simply aiming for the best. I would also like to ask all stakeholders for their understanding of the great growth potential that TDK holds, and I look forward to your continued long-term support and expectations.