Notice Regarding the Allotment of Stock Options

- Stock Acquisition Rights -

Information contained in the news releases are current as of the date of the press announcement, but may be subject to change without prior notice.

July 29, 2010

TDK Corporation (the "Company") has announced that the Board of Directors today decided to issue stock acquisition rights as stock options to high-ranking TDK managers and high-ranking managers of group companies, as detailed below. This resolution was based on authority vested in the Board of Directors by the Company's 114th Ordinary General Meeting of Shareholders held on June 29, 2010.

Ⅰ Reason for issuance of stock acquisition rights with specially favorable terms and conditions to individuals other than shareholders

The Company will issue stock acquisition as a further incentive for contributing to the improvement of the Company's consolidated operating results.

Ⅱ Matters pertaining to the issuance of stock acquisition rights

- Name of stock acquisition rights

TDK Corporation 9th Stock Acquisition Rights - Total number of stock acquisition rights

996 - Class and number of shares to be issued upon the exercise of the stock acquisition rights

The class of share to be issued upon the exercise of stock acquisition rights shall be the Company's common stock, and the number of shares for each stock acquisition right (hereinafter the "number of shares granted") shall be 100.

However, in the event that the Company conducts a stock split, distributes shares free of charge, or consolidates its common stock, etc., the number of shares granted shall be adjusted according to the following method of calculation. This adjustment will apply to the "number of shares granted" for those stock acquisition rights that have not already been exercised prior to the relevant date. Moreover, fractions of less than one share arising out of the above adjustments shall be discarded.

Post-adjustment number of shares granted = Pre-adjustment number of shares granted Stock split or stock consolidation ratio

Moreover, in other cases where circumstances arise requiring the number of shares granted to be adjusted, the number of shares granted shall be adjusted appropriately. - Method for calculating the amount to be invested when exercising each stock acquisition right

The amount to be invested when exercising each stock acquisition right shall be the amount to be paid for each share that can be granted due to the exercise of stock acquisition rights (hereinafter the "exercise price") multiplied by the "number of shares granted."

The exercise price shall be an amount which is the average of the closing price (regular way) of the Company's common stock on the Tokyo Stock Exchange on each day (other than any day on which no sale is reported) of the month immediately preceding the date of allotment (hereinafter "allotment date") of stock acquisition rights, multiplied by 1.05. Any amount less than one yen arising from this calculation shall be rounded up to the nearest yen.

However, if the resulting exercise price is less than the closing price as of the day before the allotment date (or the closing price on the nearest preceding day if there is no closing price on that date), then the closing price on the day before the allotment date shall be used instead.

In the event that the Company conducts a stock split, distributes shares free of charge, or consolidates its common stock, etc., after the allotment date, the exercise price shall be adjusted in accordance with the following method of calculation and any amount less than one yen arising out of such adjustment shall be rounded up to the nearest yen:

Exercise price after adjustment = Exercise price before adjustment × 1 / Stock split or stock consolidation ratio

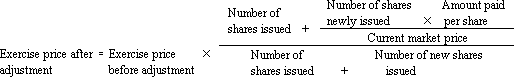

In case the Company issues new shares or disposes of its own shares at a price less than the current market price (except in the case of the conversion of convertible stock or stock with mandatory conversion terms, or in the case of a request by a stockholder for the sale of shares constituting less than one unit or the exercise of stock acquisition rights), the exercise price shall be adjusted in accordance with the following formula and any amount less than one yen arising out of such adjustment shall be rounded up to the nearest yen:

In the above formula, the "number of shares issued" shall be defined as the aggregate number of shares of common stock issued and outstanding less the number of treasury stock. In the event that the Company disposes of treasury stock, the "number of new shares issued" shall be read as "number of treasury stock disposed of".

Moreover, in other cases where circumstances arise requiring the exercise price to be adjusted after the allotment date, the exercise price shall be adjusted appropriately. - Exercise period for stock acquisition rights

The exercise period shall be the period beginning August 1, 2012 and ending on July 31, 2016. - Other conditions for exercising stock acquisition rights

In the event that a stock acquisition rights holder relinquishes his or her stock acquisition rights, such stock acquisition rights cannot be exercised. - Items concerning increases in common stock and additional paid-in capital if shares are issued due to the exercise of stock acquisition rights

(a) In the event that shares are issued due to the exercise of stock acquisition rights, common stock shall increase by half the limit for increase in common stock calculated in accordance with Article 17-1 of the Company Accounting Regulations of Japan. Any amount less than one yen arising shall be rounded up to the nearest yen. (b) In the event that shares are issued due to the exercise of stock acquisition rights, additional paid-in capital shall increase by the amount remaining after deducting the increase in the limit for increase in common stock prescribed in (a). - Restrictions on the acquisition of stock acquisition rights due to transfers

Regarding the acquisition of stock acquisition rights due to transfers, approval is required by resolution of the Company's Board of Directors. - Provisions for the acquisition of stock acquisition rights

If Shareholders Meeting of the Company approves any of the following proposals (or the Company's Board of Directors approves a resolution where approval of the Shareholders Meeting is not required), the Company can acquire the stock acquisition rights without compensation on a date separately specified by the Board of Directors.- a proposal of a merger agreement under which the Company is to be dissolved,

- a proposal for a corporate division agreement or plan under which the Company undergoes a split, or

- a proposal of a share transfer agreement or plan that makes the Company a wholly owned subsidiary

- Amount to be paid for stock acquisition rights

No payment shall be required for the stock acquisition rights. - Allotment date of stock acquisition rights

August 19, 2010 - Number of stock acquisition rights allotted and number of eligible persons

650 stock acquisition rights will be allotted to 124 high-ranking TDK managers, and 346 stock acquisition rights will be allotted to 65 high-ranking managers of group companies.

For further information, contact Mr. Marukawa in the Corporate Communications Dept.

Tel.: 81-3-6778-1055

E-mail: TDK.PR@tdk.com