Issue of Stock Acquisition Rights as Stock Options for a Stock-Linked Compensation Plan for Directors

Information contained in the news releases are current as of the date of the press announcement, but may be subject to change without prior notice.

Issue of Stock Acquisition Rights as Stock Options for a Stock-Linked Compensation Plan for Directors

May 15, 2007

TDK Corporation's (the "Company") Board of Directors today passed a resolution to issue stock acquisition rights as stock options to Company directors for a stock-linked compensation plan, as detailed below. This resolution is subject to approval of the election of directors at the Company's Ordinary Annual General Meeting of Stockholders scheduled for June 28, 2007.

Ⅰ Reason for issuance of stock acquisition rights as stock options for a stock-linked compensation plan

The purpose of this stock-linked compensation is to provide the Company's directors with further incentive for improving the Company's operating results and share price. This is accomplished by structuring the compensation so that directors share with the Company's stockholders the benefits of an increase in the Company's share price as well as the risk of a decrease.

Ⅱ Details of the stock acquisition rights to be granted

- Name of stock acquisition rights

TDK Corporation 2007 Stock-linked Compensation Stock Acquisition Rights (for Directors. Issued at fair value) - Number of stock acquisition rights

176

The above number of stock acquisition rights is the number scheduled to be allotted. Where there is a decrease in the total number of stock acquisition rights allotted due to non-subscription by eligible individuals and for other reasons, the total number of stock acquisition rights to be issued shall be the total number of stock acquisition rights allotted. - Class and number of shares to be issued upon the exercise of the stock acquisition rights

The class of share to be issued upon the exercise of stock acquisition rights shall be the Company's common stock, and the number of shares for each stock acquisition right (hereinafter the "number of shares granted") shall be 100.

However, in the event that the Company conducts a stock split, distributes shares free of charge, or consolidates its common stock after the determination date of this proposal to shareholders, the "number of shares granted" shall be adjusted according to the following method of calculation. This adjustment will apply to the "number of shares granted" for those stock acquisition rights that have not already been exercised prior to the relevant date. Moreover, fractions of less than one share arising out of the above adjustments shall be discarded.

Post-adjustment "number of shares granted" =

Pre-adjustment "number of shares granted" × stock split or stock consolidation ratio

Moreover, in other cases where circumstances arise requiring the "number of shares granted" to be adjusted after the determination date, the "number of shares granted" shall be adjusted appropriately. - Method for calculating the amount to be invested when exercising stock acquisition rights

The amount to be invested when exercising each stock acquisition right shall be the amount to be paid for each share that can be granted due to the exercise of stock acquisition rights, which shall be ¥1, multiplied by the "number of shares granted." - Exercise period for stock acquisition rights

The exercise period shall be the period beginning July 8, 2007 and ending July 7, 2027. - Other conditions for exercising stock acquisition rights

(1) Stock acquisition rights holders, excluding (2) below, shall not be able to exercise stock acquisition rights in the period from July 8, 2007 to July 7, 2010, but are able to exercise stock acquisition rights on or after July 8, 2010.

(2) Stock acquisition rights holders shall be permitted to exercise stock acquisition rights until July 7, 2010 in cases specified in 1. and 2. below, as long as it is within the time frame stipulated. - In the event that a stock acquisition rights holder loses his or her position as either director or employee of the Company (including full-time consultants and contract employees, but excluding part-time consultants and part-time contract employees. * This definition is applicable throughout this resolution.)

Three years from the day after losing the position - In the event that a proposal for approval of a merger agreement, under which the Company is to be dissolved, or a proposal for approval of a stock exchange agreement or a proposal for share transfer that makes the Company a wholly owned subsidiary, is approved at a meeting of stockholders of the Company.

A period of 15 days from the day following the approval date

(3) On or after July 8, 2010, in the event that a stock acquisition rights holder loses his or her position as either a director or employee of the Company, the individual may exercise his or her rights up to three years from the day after losing the position as long as it is within the exercise period for stock acquisition rights.

(4) In the event that a stock acquisition rights holder relinquishes his or her stock acquisition rights, such stock acquisition rights cannot be exercised. - In the event that a stock acquisition rights holder loses his or her position as either director or employee of the Company (including full-time consultants and contract employees, but excluding part-time consultants and part-time contract employees. * This definition is applicable throughout this resolution.)

- Items concerning increases in common stock and additional paid-in capital if shares are issued due to the exercise of stock acquisition rights

(1) In the event that shares are issued due to the exercise of stock acquisition rights, common stock shall increase by half the limit for increase in common stock calculated in accordance with Article 40-1 of the Japanese generally accepted accounting principles. Any amount less than one yen arising shall be rounded up to the nearest yen.

(2) In the event that shares are issued due to the exercise of stock acquisition rights, additional paid-in capital shall increase by the amount remaining after deducting the increase in common stock prescribed in (1) above from the limit for increase in common stock in (1) above. - Restrictions on the acquisition of stock acquisition rights due to transfers

Regarding the acquisition of stock acquisition rights due to transfers, approval is required by resolution of the Company's Board of Directors. - Provisions for the acquisition of stock acquisition rights

No provisions for the acquisition of stock acquisition rights are specified. - Method of calculation for amount to be paid for stock acquisition rights

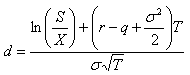

The amount to be paid for stock acquisition rights shall be the option price per share computed based on the following formula and base numbers multiplied by the "number of shares granted."In this formula,1) C = option price per share 2) S = share price: the closing price (regular way) of the Company's common stock on the Tokyo Stock Exchange on July 7, 2007 (or the closing price on the nearest preceding trading day if there is no closing price on that date) 3) X = Exercise price: ¥1 4) T = Expected life: 5.5 years 5) σ = Volatility: for 5.5 years (the variation rate computed based on the closing price (regular way) on each trading day of the Company's common stock from January 8, 2002 through July 7, 2007) 6) r = risk-free interest rate (the interest rate on Japanese government bonds for the remaining years corresponding to the expected life) 7) q = dividend yield: for 5.5 years (the annual average dividend yield from January 8, 2002 through July 7, 2007)

(Dividend per share/closing price on the trading day before the dividend record date)8) = cumulative distribution function of the standard normal distribution Note: The amount calculated in accordance with the above formula is the fair value of the stock acquisition rights. It is not applicable to the issue of stock acquisition rights with specially favorable terms.

Note: The Company shall pay monetary compensation equivalent to the amount to be paid for stock acquisition rights to eligible persons, and the right to claim this compensation shall be offset with the obligation to pay the amount to be paid for stock acquisition rights. - Allotment date of stock acquisition rights

July 7, 2007 - Payment date for stock acquisition rights

The payment date shall be July 7, 2007. - Number of stock acquisition rights allotted and number of eligible persons

176 stock acquisition rights will be allotted to 7 Company directors.

For further information, contact the Corporate Communications Dept.

Tel.: 81-3-6778-1055

E-mail: TDK.PR@tdk.com