Corporate GovernanceCharacteristics of Corporate Governance

Characteristics of Corporate Governance at the TDK Group

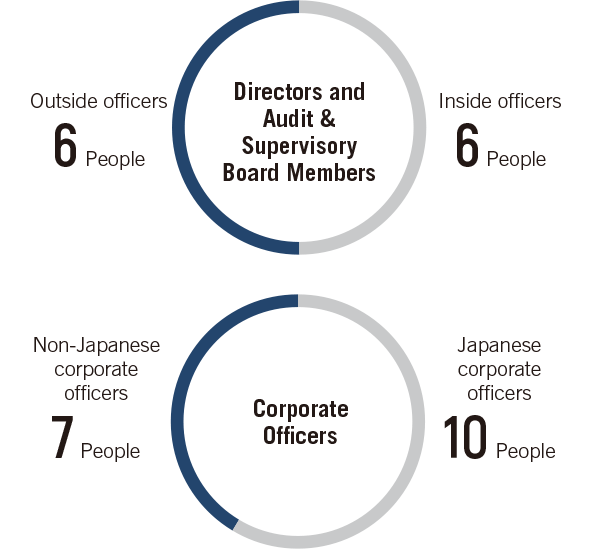

Proactive Invitation of Outside Officers and Aggressive Promotion of Non-Japanese Corporate Officers

Having recognized the importance of supervisory functions for management at an early stage, TDK has actively endeavored to invite outside directors and outside Audit & Supervisory Board Members into its organization. Also, the overseas sales ratio exceeds 90%. As such, the Company aggressively promotes capable personnel in its organization regardless of their nationality.

Strengthening of Supervisory Functions Performed by Outside Directors

Three out of seven directors are outside directors.

The post of chairman of the Board is filled by an outside director.

The posts of chairman of the Nomination Advisory Committee and the Compensation Advisory Committee are

each filled by an outside director.

This helps ensure the transparency of HR and compensation

processes and the validity of officer appointments and compensation.

Initiatives to

Reinforce Corporate Governance

Role of the Nomination Advisory Committee

and Appointment of the CEO

TDK established the Nomination Advisory Committee as an advisory body to the Board of Directors. The Committee is chaired by an outside director, and a majority of its members are also outside directors. It deliberates on expected qualifications of candidates for director, Audit & Supervisory Board Member, and corporate officer and recommends candidates so as to contribute to ensuring the appropriateness of the nomination process and transparency of the decision-making process. The Committee also deliberates on the independence of outside directors.

When nominating the CEO, the Committee formed an image of the ideal person suitable for the role of top executive and conducted repeated deliberations that also covered such issues as systems and the term of office. An outside expert organization was also utilized, and emphasis was placed on ensuring objectivity. (See pages 64–66 for further details.)

Prerequisites for Ensuring

the Effectiveness of the Board of Directors and Audit & Supervisory Board

One of TDK's fundamental policies is to keep the number of members on the Board of Directors low in order to achieve timely management decision making. The Articles of Incorporation specify that the number of Board members shall be no more than 10; the Board currently has seven members. The Articles also specify that the Audit & Supervisory Board shall have no more than five members; it currently has five members. The current composition of the Board of Directors, including both directors and Audit & Supervisory Board Members, is seven directors, of whom three are outside directors, and five Audit & Supervisory Board Members, of whom three are outside members, for a total of six outside officers. Thus, the ratio of inside officers to outside officers is 5:5.

Measures to

Reinforce Management Diversity

Approximately 90% of the TDK Group's sales are from overseas, and non-Japanese employees account for approximately 90% of the workforce, giving the Group a considerable global character. In order to respond to this global management environment, the Group is actively hiring non-Japanese managers, including corporate officers and business division heads, and 41% of corporate officers are non-Japanese nationals. Some 72% of overseas Group subsidiaries have a non-Japanese president, and structures that enable local human resources to exercise leadership are taking root as they become more effective. The TDK Group has a culture of continuously innovating through active discussions regardless of nationality, race, employer, or other factors.

Global Management Meeting shows

strengths of integration

The Global Management Meeting (GMM) is a TDK Group body that meets at least once each month to discuss important issues, including business strategies, operations, and management. Membership includes corporate officers at the senior vice president level and higher, business division heads, and regional managers from Europe, the Americas, and China. Non-Japanese heads of business divisions and managers from regional headquarters participate to encourage discussion from a broader range of perspectives amid a rapidly changing business environment.

Examples of GMM Topics

- Establishment of joint venture

with Company X - Acquisition of business company

in Europe - Investment in

Chinese manufacturing site

to increase production - Establishment of overseas

R&D center

Examples of GMM Members

- President

- CEO of each Business Company

- COO of each Business Company

- Head of each regional headquarters

- CTO

- Officers responsible

for head office functions

View the full text of “Corporate Governance” on the PDF version.

Corporate Governance