In the past fiscal year (ended March 2013), TDK endeavored to build a solid operating base and, continuing from the previous term, to take measures regarding unprofitable businesses and optimize our business locations and personnel system. Through such measures, we were aggressively implementing our business structure reform plan. In spite of these efforts, however, I regret to say that it was necessary to again significantly correct our financial forecast downwards.

One of the major reasons for this correction is the fact that sales of passive components for the communications sector fell far short of projections, as the smartphone market underwent an adjustment of supply and demand. The second reason can be seen in the stagnation of the industrial equipment market, which led to reduced demand for passive components, magnets, power supplies and similar products. As a result, net sales were down in the area of industrial equipment and some other categories. A third reason is an appraisal loss due to the fall in rare earth prices which is the main raw material for metallic magnets. In addition, the spread of smartphones and tablet devices has led to reduced sales of PCs, resulting in significantly lower demand for hard disk drives (HDDs). Consequently, business results in this market were also much lower than initially projected.

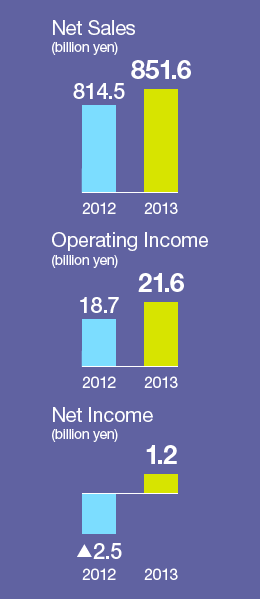

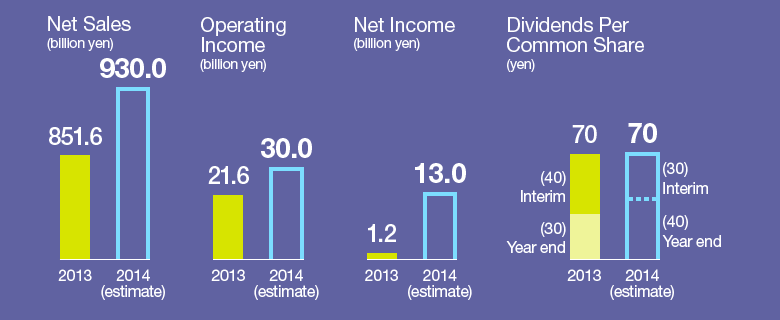

As a result, our consolidated net sales for the year ended March 2013 were 851,575 million yen, with operating income of 21,648 million yen, income from continuing operations before income taxes of 18,858 million yen, and current term net income of 1,195 million yen. Average exchange rates for the U.S. dollar and euro during fiscal 2013 were 83.03 yen and 107.05 yen, respectively, as the yen depreciated 5.0% against the U.S. dollar and appreciated 1.8% against the euro year on year. This increased net sales by approximately 32,400 million yen and operating income by approximately 4,100 million yen.